Midem / Informa: How mobile apps bring new business opportunities to the music industry

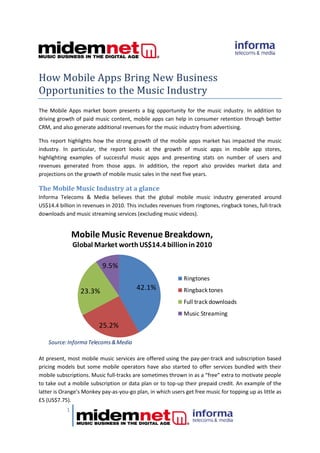

- 1. How Mobile Apps Bring New Business Opportunities to the Music Industry The Mobile Apps market boom presents a big opportunity for the music industry. In addition to driving growth of paid music content, mobile apps can help in consumer retention through better CRM, and also generate additional revenues for the music industry from advertising. This report highlights how the strong growth of the mobile apps market has impacted the music industry. In particular, the report looks at the growth of music apps in mobile app stores, highlighting examples of successful music apps and presenting stats on number of users and revenues generated from those apps. In addition, the report also provides market data and projections on the growth of mobile music sales in the next five years. The Mobile Music Industry at a glance Informa Telecoms & Media believes that the global mobile music industry generated around US$14.4 billion in revenues in 2010. This includes revenues from ringtones, ringback tones, full-track downloads and music streaming services (excluding music videos). Mobile Music Revenue Breakdown, Global Market worth US$14.4 billion in 2010 9.5% Ringtones 23.3% 42.1% Ringback tones Full track downloads Music Streaming 25.2% Source: Informa Telecoms & Media At present, most mobile music services are offered using the pay-per-track and subscription based pricing models but some mobile operators have also started to offer services bundled with their mobile subscriptions. Music full-tracks are sometimes thrown in as a “free” extra to motivate people to take out a mobile subscription or data plan or to top-up their prepaid credit. An example of the latter is Orange’s Monkey pay-as-you-go plan, in which users get free music for topping up as little as £5 (US$7.75). 1

- 2. Mobile operator O2 UK also employs the tactic of using music as a tool to tie customers into new services, but in a different way. It has aligned itself with the live-music scene by sponsoring various high-profile music venues and offering subscribers the ability to pay for tickets to these venues via their monthly phone bills. Key Market Trends Digital-music-sales statistics published in many developed countries show a decline in the number of mobile full tracks being downloaded. The countries affected include France, Italy, Japan, Spain and the US. Some key European markets have recorded sharp declines in mobile full-track sales over the past year or two. In Italy, for example, there was a 40% drop between 1H09 and 1H10. Rather than marking the demise of the full-track music format on mobile phones, the stats betray a shift among mobile users away from the services provided by traditional mobile- music companies such as mobile operators and mobile content merchants, to those provided by online players such as Apple and Spotify. It appears that operators might have inadvertently accelerated this shift by abandoning feature-phone-friendly music-file formats in favour of MP3, which is increasingly focusing full-track consumption on smartphones, where the online brands have greater sway. The low margins of the full-track business are pushing a lot of mobile companies out of the market, reducing supply from their end and further encouraging the shift toward the online brands. Traditional mobile music providers such as Buongiorno, are also migrating to unlimited music-subscription services. And they will be competing against similar services from online players in the app-store environment on smartphones. The biggest blow, however, has been the new world order ushered in by the rise of smartphone apps and the “over the top” players from the online and computer worlds, most notably Apple and Google. It is these mobile outsiders that now dominate the mobile content scene, at least in developed markets. The music-sales stats published in each country often fail to take into account the proportion of full tracks downloaded or streamed via mobile devices from online services such as iTunes and Spotify, even though it is these services that represent the fastest-growing segment of the mobile-full-track market in developed countries. So rather than necessarily reflecting a shrinking mobile-full-track market, the stats point to the shrinking market share of traditional mobile music providers i.e. operators and content aggregators. Mobile Apps Market Boom For many years, mobile operators have tried to drive mobile content sales via their portals but most have had limited success. The launch of the mobile app stores have provided the much-needed impetus to mobile content sales and are making a massive contribution in changing the way people interact with content and value-added services on their devices. Informa Telecoms & Media believes that around US$4 billion in revenues was generated from mobile apps in 2010. A survey conducted in 3Q10 by Informa Telecoms & Media reveals that, globally, about 70 mobile application stores are in operation, 600 if all the localized versions are counted for each country. 2

- 3. These are deployed by the handset/OS makers, mobile operators and application/content aggregators. The majority (about 50%) of these app stores are from the application/content aggregators (many predating the Apple App Store), followed by operators with around 30%, and handset/OS makers accounting for the remaining 20%. Although many of the mobile app stores are global, in the sense that they can be accessed from anywhere in the world where there is mobile Web access, many also tailor themselves to local needs by deploying “localized” versions for different countries. This localization not only involves offering content that is culturally, or at least linguistically, attuned to the country in question, but also payment facilities for paid downloads. The latter requires clearing certain technical and regulatory hurdles, as well as striking commercial deals with billing aggregators or operators in the case of payments transacted via mobile networks. Music in Mobile App-Stores The number of music apps has been growing steadily in the mobile app stores. For example, number of music apps in the Apple App Store have grown from 496 (3.2% share of total apps) in Jan 2009, to 13, 912 (4.1% share of total apps) in Jan 2011. Growth of Music Apps in the Apple App Store 16,000 13,912 14,000 12,000 10,000 10,185 8,000 6,000 5,231 4,000 2,000 2,095 0 496 Source: Informa Telecoms & Media Many music apps in the mobile app stores have become hugely popular among users. Some good examples of successful mobile music apps include Spotify, Shazam, TuneWiki, Midomi, Last.fm, Pandora, LaDiDa, and Turner Internet Radio. Spotify In September 2010, Spotify reported crossing the 10 million user mark of which around 750,000 are paying users. The company claims that 90% of its paying users subscribe to the more expensive €10 per month plan, which allows the use of the Spotify app on mobile phones rather than the €5 per month desktop-only option. This means it is reasonable to assume that Spotify has over 600,000 users paying to access it on their mobile phones, generating around €6 million in revenues for the company, each month. In the UK, Spotify is priced at £9.99 per month for unlimited streaming. 3

- 4. Spotify is also a good example of a service that has benefitted the mobile operator. By entering a long-term, exclusive partnership with Spotify, TeliaSonera managed to achieve outstanding results without needing to build its own music product. TeliaSonera offers Spotify Premium for just SEK29 (around €3) per month – a 71% reduction on the regular price, when a new mobile subscription is taken out. One of the benefits of the partnership is that it encourages customers to sign up for longer contracts. TeliaSonera is only offering Spotify to customers that sign a 24 month contract, making it a very effective way to increase the lifetime value of customers. A survey of TeliaSonera’s subscribers of the Spotify price plan showed that - Spotify has been an acquisition driver for them (over 50%) 44.6% claimed Spotify influenced their choice of mobile phone or subscription 52.6% suggested they are less likely to churn from TeliaSonera because of Spotify Shazam In December 2010, Shazam announced achieving a major milestone of having 100 million users in 200 countries. Using the Shazam app, users can hold their mobile phones near the speakers of a device playing music and get hold of the song and details including album, artist and the song title. In addition to its free music discovery mobile app, Shazam has managed to successfully introduce the paid-for version of the app called Shazam Encore, which has now become its core product. The free Shazam app limits users to 5 tags per month but for US$2.99 users can purchase Shazam Encore and enjoy unlimited tagging and additional features. The Shazam app directs users to various a la carte music stores, largely dependent on which device the application is installed on. In July 2010 it was reported that the Shazam app was referring around 300,000 paying customers every day to retail affiliates like the iTunes Store. The Shazam iPhone app helped the company double its user base to 35 million in just seven months between September 2008 and May 2009. Its revenues increased by 60% to £7.3 million in the 12 months following the debut of its iPhone app in July 2008. The Shazam app is now available in most major mobile app-stores including Android, BlackBerry, Symbian/Nokia, and Windows Phone. Artist branded Mobile Apps Even record labels are seeing the value of mobile applications as a means of encouraging music fans to interact with their artists. Pop star Lady Gaga launched an iPhone app as a means of interacting with her fans in the early stages of her career, which enabled her to build an intensely loyal fan base. This intense support from her fans, many of whom subsequently set up fan Web sites and participated in “word-of-mouth marketing”’ helped propel her to international success with mainstream music audiences. Trent Reznor and 50 Cent are also good examples of artists who have been particularly active in engaging with their fan bases through mobile apps with great success. 4

- 5. Informa Telecoms & Media’s Predictions for Market Growth Informa Telecoms & Media believes that mobile music revenues will grow from an estimated US$14.4 billion in 2010 to US$25.3 billion in 2014. Mobile music full-track downloads are expected to see the strongest growth over the next four years and generate more revenues than ringtones from 2013 onwards. Global Mobile Music Revenues (US$ billion) 30 25 20 15 10 5 0 2010 2011 2012 2013 2014 Ringtones Ringback tones Full track downloads Streaming Source: Informa Telecoms & Media Revenues from Music Apps It is estimated that around US$4 billion in revenues were generated from mobile apps in 2010. Also, market data from Informa Telecoms & Media shows that in January 2011, music apps accounted for 3.9% (average) of the total mobile apps in the leading app stores including Apple App Store, Android Market and BlackBerry App World. % of Music Apps in Mobile App Stores (Jan 2011) Apple App Store 4.1% Android Market 3.5% BlackBerry App World 3.8% Source: Informa Telecoms & Media Therefore, as a rough estimate, based on the proportion of music apps in mobile app stores, it can be argued that around US$156 million (3.9% of US$4 billion) of revenues came from download of music apps in 2010. This is a very conservative estimate, considering that average price for paid-for music apps is higher than the overall average price of paid-for mobile apps. Many music apps direct users to purchase music from various a la carte stores and those revenues are also not included here. Also, this does not include subscription fee for music services such as Spotify, and revenues from music services bundled by the operators with their price plans. 5

- 6. In terms of the likely impact of mobile apps on the music industry, Informa Telecoms & Media predicts the following trends over the next five years. More D2C models for mobile music will emerge driven by the app store phenomenon. The smartphone users that mobile operators are concentrating on are the most likely to defect to the numerous over-the-top music services offered via native apps, or via the mobile app stores on their handsets. Increasingly, mobile users will shift away from music services provided by the operators and traditional mobile-music companies to those provided by online players. More interesting and complex deals and partnerships will emerge as operators face tough competition and feel the need of developing new relationships such as TeliaSonera’s deal with Spotify. Mobile apps will also drive convergence business models i.e. music services that can be accessed on mobile, online, in the car, and on the home stereo system. This special report for MidemNet 2011 is based on forecasts and findings from Informa Telecoms & Media’s published research in the Mobile Content & Applications Intelligence Centre. Further details can be found at www.informatm.com and www.intelligencecentre.net Shailendra Pandey Senior Analyst, Mobile Content & Applications shailendra.pandey@informa.com Guillermo Escofet Senior Analyst, Mobile Content & Applications guillermo.escofet@informa.com 6