Spotlight on Media & Entertainment: Over The Top TV Trends

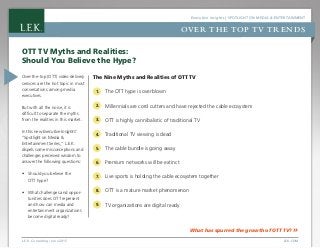

- 1. Executive Insights | SPOTLIGHT ON MEDIA & ENTERTAINMENT Over-the-top (OTT) video delivery services are the hot topic in most conversations among media executives. But with all the noise, it is difficult to separate the myths from the realities in this market. In this new Executive Insights’ “Spotlight on Media & Entertainment Series,” L.E.K. dispels some misconceptions and challenges perceived wisdom to answer the following questions: • Should you believe the OTT hype? • What challenges and oppor- tunities does OTT represent and how can media and entertainment organizations become digital ready? What has spurred the growth of OTT TV? » OTT TV Myths and Realities: Should You Believe the Hype? L.E.K. Consulting / June 2015 LEK.COM The Nine Myths and Realities of OTT TV 1. The OTT hype is overblown 2. Millennials are cord cutters and have rejected the cable ecosystem 3. OTT is highly cannibalistic of traditional TV 4. Traditional TV viewing is dead 5. The cable bundle is going away 6. Premium networks will be extinct 7. Live sports is holding the cable ecosystem together 8. OTT is a mature market phenomenon 9. TV organizations are digital ready OVER THE TOP TV TRENDS

- 2. Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT The increasing ubiquity and speed of broadband connections have facilitated OTT content delivery growth in the U.S., as well as globally. Household broadband penetration is up from ~63% in 2009 to ~75% in 2014 and is expected to reach ~80% by 2017. Other Western economies are likely to achieve a similar penetration, while most emerging economies will exhibit even stronger growth. Given these growth rates, online video services have become increasingly viable options for content delivery. How has this impacted the proliferation of OTT services? » The Fast and the Furious: High Speed Broadband Has Enabled OTT TV Content Delivery Growth L.E.K. Consulting / June 2015 LEK.COM Notes: Weighted based on 2013 population by country; 2 Australia, New Zealand; 3 UK, France, Germany, Spain, Italy; 4 Poland, Russia; 5 United Arab Emirates, Saudi Arabia; 6 Japan, China, Korea; 7 Brazil, Mexico; 8 India, Indonesia Household Broadband Penetration for Select Global Regions (2009-17f) Percent of households 0 10 20 30 40 50 60 70 80 90 100% 2009 2010 2011 2012 2013 2014E 2015F 2016F 2017F ANZ2 Europe3 USA RCEE4 ME5 Asia6 LatAm7 SEA8 OVER THE TOP TV TRENDS

- 3. L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OTT services have proliferated to cater to the growing OTT demand base, and the rate of new entrants is accelerating in 2015. These new services range from standalone entertainment- focused offerings (e.g., CBS All Access, Nickelodeon Noggin, HBO Now), to live and sports- centric content (e.g., WWE Network, NFL Now), to virtual multichannel video programming distributors (MVPDs), providing serious alternatives to traditional cable subscriptions (e.g., Sling TV, Verizon), including offerings from electronics players who have entered the fray (e.g., Apple TV, PlayStation Vue). How is the market valuing these OTT players? » A Game of Thrones: New OTT TV Services Are Battling to Be King Content owner platforms Virtual MVPDs Jan Feb2014 Oct 2015 Mar April Feb Apr Date TBD Date TBD Comedy Date TBD Note: *Selected Examples Source: Company websites, press releases OVER THE TOP TV TRENDS

- 4. L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM As the OTT market matures, we are seeing more proof points — both in terms of subscriber and revenue numbers — which highlight the growth potential of online video services. Increasingly, the market at large is recognizing these new businesses and attaching significant valuations to OTT players. Market cap grew from $6.5B to $27B (~60% CAGR) from January 2013 to 2015; ~54M paying global subscribers (38M U.S.) Generated ~$1B in revenue in 2013; 6M subscribers as of April 2014 Fastest-growing OTT service – in first year signed up 1M paying subscribers representing $120M in revenue (run rate) Projected revenues to hit $1B by end the of 2016; recently closed deal to power HBO’s OTT platform Initial launch leveraged existing ~90M Amazon Prime subscribers; will launch decoupled ad-supported subscription service in 2015 ~45.3M monthly users with valuation between $500-950M Over 800K shows/350K movies purchased per day; 2013 estimated yearly spend of $1.75B on iTunes videos1 But are content providers simply jumping on the OTT bandwagon, or are they responding to an underlying consumer demand? » For a Fistful of Dollars: There Are Tremendous Valuations Attached to OTT Players Note: 1 Apple analyst calculated Apple users spend ~$1.75B a year on iTunes videos Source: Fierce Online Video, company websites, Asymco, CapIQ OVER THE TOP TV TRENDS

- 5. L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM Over-the-top (OTT) is not all hype. There are underlying factors that explain its growing appeal and importance in the media landscape: • Consumers are increasing their consumption of OTT services, driven by better affordability and a broader content offering • Major OTT services have grown subscriptions significantly • OTT has been a catalyst for the “content arms race” to capture new subscriptions What is driving consumer interest in OTT? » OTT TV Myth #1: The OTT TV Hype Is Overblown Myth The OTT TV hype is overblown Reality Not really OVER THE TOP TV TRENDS

- 6. L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM Note: 1 “On average, how many hours of the following types of media do you consume in a typical week?” (n = 1,490); 2 “You indicated that your weekly media consumption has increased / decreased compared to last year. Please select up to three reasons why you currently consume more / less”; (n = 622); 3 Includes free video (3 hours) and paid OTT services (4 hours, mostly streaming) Source: 2015 L.E.K. Media Entertainment Survey Increase in choice / content libraries 15% 14% 14% 11% 11% 10% 10% 9% 5% 3% Online video subscription services are now more affordable I have more free time for entertainment More on-demand content is now available I recently bought a tablet / laptop and want to watch on it I am spending less time consuming other forms of media Now use secondary / additional devices to watch videos I am traveling more and need to watch content on the go Paid and free OTT online video services3 Reduced purchases of online rental Other Time Spent Consuming Various Forms of Media Content1 Percent of total hours Reasons for Increasing Consumption: Paid OTT/Online Video Service, Streamed2 Percent 0 5 10 15% 0 5 10 15% 10% Online video streaming services now comprise ~10% of total media hours consumed. Consumers cite expanding content libraries (15%) and affordability relative to traditional TV subscriptions (14%) as the key drivers behind increased consumption of paid OTT and online video services. The bottom line: OTT is becoming more attractive and is increasingly perceived as a viable alternative for entertainment. The above drivers have driven huge growth. How big is the growth? » I Want It That Way: Better Pricing and More Content Are Driving High Growth for Online Streaming OVER THE TOP TV TRENDS

- 7. L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM Source: Analyst reports, SNL Kagan, Company 10-Ks, The Wrap, L.E.K. analysis Netflix and Hulu Plus Total Paid Streaming Subscribers in the U.S. (2011-19F) Millions 2011 2012 2013 2014 2015F 2016F 2017F 2018F 2019F Netflix base case Netflix low case Netflix high case Netflix Hulu Plus 0 10 20 30 40 50 60 70Netflix’s U.S. paid streaming subscribers are up from 20.2 million in 2011 to 37.7 million in 2014 (~23% growth per year). Hulu Plus has shown even greater growth (~67% per year) albeit from a smaller base, starting at 1.4 million subscribers in 2011 to 6.5 million in 2014. While rapid growth is expected to moderate slightly over the next few years, these services will still expand significantly. Netflix is projected to continue growing at ~6-11% per year through 2019, depending on various analyst views. OTT TV services will likely continue to penetrate the universe of U.S. broadband households. But how are these players driving subscriber acquisition? » To Infinity and Beyond: Leading OTT TV Services Are Growing Rapidly OVER THE TOP TV TRENDS

- 8. Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Source: SNL Kagan, RBC, L.E.K. analysis Total Original Production Spend (2014E-19F) Millions of dollars AmazonHulu Netflix 0 250 500 750 1,000 1,250 1,500 1,750 2,000 2,250 2014E 2015F 2016F 2017F 2018F 2019F So who is opting for OTT services and are they cutting the cord? » Netflix spend on original production is expected to grow at ~38% per year from $267 million in 2014 to $1.3 billion by 2019, dramatically outpacing its rivals. Other OTT players are following suit, with Hulu original content spend likely increasing from $44 million in 2014 to $250 million in 2019 and Amazon going from $92 million to $462 million over the same period. This content “arms race” to attract subscribers and manage churn is having knock-on effects on content spend in the linear TV space as traditional players — primarily in cable and premium TV — look to differentiate themselves and claw back viewers from online. We’re Going to Need a Bigger Boat: The Battle for Subscribers Is Driving a Content Arms Race

- 9. Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS What are the video consumption habits of Millennials? » The cord-cutting tendencies of Millennials are less dramatic than you think: • Millennials do watch more online media relative to other demographics • However, they are still tethered by the multichannel ecosystem OTT TV Myth #2: Millennials Are Cord Cutters and Have Rejected the Cable Ecosystem Myth Millennials are cord cutters and have rejected the cable ecosystem Reality Less than you would think

- 10. Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Are Millennials still connected to the multichannel ecosystem? » While traditional TV viewing remains the primary source of media consumption in the general population, its importance relative to online media varies by consumer group. Within the Millennial group, traditional TV viewing is still popular, but OTT video services are making significant headway and online video consumption is almost three times as prevalent with Millennials as in the non-Millennial group. But does this mean Millennials are abandoning traditional TV viewing and the cable ecosystem entirely? The Times They Are a Changin’: Millennials Watch More Online Media and Less Traditional TV Than the General Population Note: 1 “On average, how many hours of the following types of media do you consume in a typical week?”; 2 Includes in-theater and physical purchase / rental, and includes TV show box sets; 3 Includes free video (3 hours) and paid OTT services (4 hours, mostly streaming); 4 Defined as age 18-34 Source: 2015 L.E.K. Media Entertainment Survey All respondents Millennials4 Non-Millennials Time Spent Consuming Various Forms of Media1 Percent of total hours PublishingMovies2 Games Internet Music Radio Paid and free OTT online video services3 TV (traditional) 0 20 40 60 80 100% 8% 8% 7% 23% 5% 8% 10% 31% 5% 8% 6% 25% 4% 8% 6% 37% 13% 9% 10% 20% 6% 5% 16% 21%

- 11. Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Is OTT TV cannibalistic of traditional TV? » Surprisingly, despite a higher reported propensity to cord cut, Millennials still appear to be connected to the multichannel ecosystem. While this may be due to Millennials sharing their parents’ accounts (without having to actually pay for the service), several other studies indicate that cable is not dead. A March 2014 study by Verizon indicated a similar trend, estimating that 87% of Millennials were multichannel subscribers, compared with 91% of non-Millennials. Experian estimates that ~12% of households inhabited by a Millennial were non-subscribers compared to 6.5% of total households in 2013. The More Things Change, the More They Stay the Same: Millennials Are Still Connected to the Multichannel Ecosystem Source: 2015 L.E.K. Media Entertainment Survey, Verizon Digital Media’s “Millennials Entertainment – March 2014”; Experian’s “Cross Device Video Analysis”, 2014 Media Subscription Rates by Age Cohort (2014E) Percent of respondents OTT viewer BroadcastMultichannel subscriber 0 20 40 60 80 100% All adults 89% 6% 5% 18-24 88% 10% 2% 25-34 87% 9% 4% 35-44 90% 5% 5% 45-54 89% 5% 6% 55-64 90% 4% 6% 65+ 90% 4% 6% L.E.K. Consulting is a registered trademark of L.E.K. Consulting LLC. All other products and brands mentioned in this document are properties of their respective owners. © 2015 L.E.K. Consulting LLC

- 12. OVER THE TOP TV TRENDSOVER THE TOP TV TRENDS Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT What type of OTT content is cannibalizing linear TV? » OTT TV Myth #3: OTT Is Highly Cannibalistic of Traditional TV L.E.K. Consulting / June 2015 LEK.COM Alarmist statements abound regarding the predatory nature of over-the-top (OTT) and how it is poaching traditional TV viewers. While cannibalization does exist, the interplay between linear TV and OTT varies depending on the type of online content offering. For Myths 1-2, please see part one of “Over The Top TV Trends” in our Executive Insights’ “Spotlight on Media Entertainment” series. Myth OTT is highly cannibalistic of traditional TV Reality Only somewhat

- 13. OVER THE TOP TV TRENDS Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT Sports-related OTT services (e.g., UFC.TV, MLB.TV, WWE Network) show the highest cannibalization of traditional TV consumption. Entertainment services such as Netflix, Amazon Prime or Hulu Plus are used as complements to linear TV. While there is no certainty of a causal relationship, recent research from the Cabletelevision Advertising Bureau attributed ~40% of 2014 Q3 and Q4 TV ratings decline to a combined effect of online video services and measurement systems that do not capture digital device viewership. So is traditional TV dead? » Guess Who’s Coming to Dinner: OTT Sports Services Cannibalize Traditional TV, Entertainment Complements TV L.E.K. Consulting / June 2015 LEK.COM Note: 1 How has your online video consumption impacted your viewing of traditional TV over the past year?; 2 Cannibalization indexed on the TV cannibalization from MVPD catch-up services Source: 2015 L.E.K. Media Entertainment Survey, Cabletelevision Advertising Bureau Relative impact on traditional TV consumption indexed to impact of online catch up services2 Percent of respondents stating online service had no impact on traditional linear TV consumption Sports-related services Entertainment services Impact of OTT on Traditional Linear TV Viewing of Similar Content1 (2014) UFC.TV MLB.TV WWE Network Hulu+ Netflix Amazon Prime HBO Go iTunes 1.40 1.39 1.31 1.19 1.02 1.00 0.95 0.94 0.87 TV catch-up services 0.0 0.3 0.6 0.9 1.2 1.5 0 10 20 30 40 50 Base Index OVER THE TOP TV TRENDS

- 14. L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS What is the status of traditional TV consumption? » OTT TV Myth #4: Traditional TV Viewing Is Dead TV has yet to breathe its last breath: • Traditional TV still remains the largest media consumption platform • Consumers prefer free or subscription-based services (including linear TV) over transaction-based offerings Myth Traditional TV viewing is dead Reality Nope

- 15. L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Note: 1 “On average, how many hours of the following types of media do you consume in a typical week?”; 2 Includes in-theater and physical purchase / rental, and includes TV show box sets; 3 Includes free video (3 hours) and paid OTT services (4 hours, mostly streaming) Source: 2015 L.E.K. Media Entertainment Survey Time Spent Consuming Various Forms of Media Content1 Percent of total hours Movies2 Publishing Games Internet Music Radio Paid and Free OTT Online Video Services3 TV (traditional) 0 20 40 60 80 100% 8% 8% 7% 23% 5% 8% 10% 31% Television accounts for ~31% of total hours spent on media per week. Paid and free OTT online video services have been growing but still represent only a 10% share of total hours consumed. So what form of video consumption platforms work best with users? How do consumers prefer to access video content? » TV Is Dead, Long Live…TV (!): Traditional TV Remains the Single Largest Platform of Media Consumption

- 16. L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS People are watching more on free/subscription services and less on pay-per-view services. This chart shows an increase in the net variance in consumption for free or subscription-based media, indicating a consumer preference for “passive” forms of billing, which either do not require a payment or which only require an initial set-up. On the other hand, transaction- based media (which requires users to make a payment decision each time they wish to consume) is struggling. While this is good news for both traditional TV and OTT services, a question remains around the viability of the cable bundle. Is the cable bundle going away? » A Tale of Two Cities: Subscription Platforms Grow, While Transaction-Based Models Decline Note: 1 “Compared to last year, has your weekly consumption (in hours) for different types of media increased, decreased, or remained the same as current?”; 2 General internet net variance was 36% in 2010 and 27% in 2009 Source: 2015 L.E.K. Media Entertainment Survey Change in Consumption of Forms of Media1 Percent Net variance2 Increased somewhat (5-10%) Increased significantly (10%) Decreased significantly (10%) Decreased somewhat (5-10%) Pay Television Paid OTT / online video service, streamed Free online video service Paid OTT / online video service, rented or downloaded TV Series (purchased / rented physical discs – e.g, DVDs) Movies (purchased / rented physical discs – e.g., DVDs) Movies (in-theater) Free / subscription based Transaction based (20) (10) 0 10 20 30% (7%) (7%) 13% 8% (5%) (6%) 11% 8% (5%) (5%) 14% 6% (7%) (5%) 8% 3% (9%) (7%) 6% 4% (10%) (7%) 9% 4% (9%) (6%) 10% 4%

- 17. L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS What is the status of traditional TV consumption? » OTT TV Myth #5: The Cable Bundle Is Going Away Multichannel video programming distributor (MVPD) subscriptions have grown slightly at 1.4% per year from 2011-14. But new virtual MVPD services such as Apple TV or Sling TV are potential substitutes to traditional cable subscriptions. These services could contribute to a drop in the share of households subscribing to traditional MVPDs from ~89% currently to ~70% in 2019. Myth The cable bundle is going away Reality Maybe in the long term but not in the next five years

- 18. L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Source: SEC Filings, L.E.K. analysis Key Provider Subscription Rates (2011 – 2014) Millions of subscribers 0 10 20 30 40 50 60 70 80 2011 76.0 2012 77.4 2013 77.9 2014 79.3 Verizon ATT Time Warner Cable DISH Network Corp. DIRECTV Comcast Corporation Overall cable, satellite and Internet TV subscriptions (MVPD subscriptions) have grown 1.4% per year even as OTT services have proliferated. Newer video operators such as ATT (U-verse) and Verizon (FiOS) are continuing to penetrate the market (growing at 17.4% and 10.6% per year, respectively between 2011-14) and are sustaining overall MVPD expansion compared to the stagnant/declining footprint of more traditional cable and satellite operators. The bottom line: MVPDs are not going away anytime soon. Are virtual MVPDs a disruptive force? » Don’t You Forget About Me: MVPDs Have Continued to Grow Between 2011-14

- 19. Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Note: 1 Take rates are normalized by a 70/30/10 adjustment; 2 Millennial / Gen Z category includes those under 35 as of 2014 Source: 2015 L.E.K. Media Entertainment Survey 0 10 20 30 40 50 60 70 80 90 100% How likely would you be to subscribe to a service (described to be similar to PlayStation Vue) at a price that you would consider reasonable? Take rate1 Current multichannel subscribers Current non-multichannel OTT viewers All Respondents 18% 22% 12% 24% 21% 20% Millennials / Gen Z2 Non-Millennials Surprisingly, non-Millennial current multichannel subscribers reported a higher take rate for the new OTT MVPD service How great is the risk for the traditional multichannel ecosystem? » Several new “virtual MVPD” platforms have been announced, such as Sling TV (Dish), PlayStation Vue (Sony) and Apple TV. These platforms represent direct substitutes for traditional MVPD services as they provide live streaming of linear channels. Our recent survey of U.S. multichannel respondents yielded an ~18% take rate (after overstatement adjustment) for a virtual MVPD service similar to those recently announced. Interestingly, the take rate was greatest among non-Millennials, highlighting the cross- generational appeal of these offerings. Clear and Present Danger: Virtual MVPDs Are Potential Substitutes for Traditional Cable Subscriptions

- 20. Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS But does this mean that even premium bundles are at risk? » Without new virtual MVPDs, not much will change. MVPD share will be comparable (dropping from ~89% to ~86%) if you project demographic shifts to 2019 and apply the current growth rate of subscription video on demand (SVOD). However, virtual MVPD services could deliver a step change in OTT penetration and drop the multichannel share to ~70% by 2019. The predicted share gains for virtual MVPDs assume that the products actually work. They might fail if the services have too many bugs and/or cannot get complete channel lineups. Brave New World: By 2019 Virtual MVPDs Could Drive Multichannel Share of Households Down to About 70% Source: 2015 L.E.K. Media Entertainment Survey New Virtual MVPD offerings Broadcast OTT standalone Multichannel Media Subscription Rates Over Time: Demographic Shift + Existing SVOD Growth + New Offerings (2014E-19F) Percent of adult broadband population 0 20 40 60 80 100% 2014E 88.8% 6.0% 5.2% 2019F dem. shift + existing SVOD growth 85.5% 4.9% 9.7% 2019F dem. shift + existing SVOD growth + new OTT MVPDs 70.4% 7.5% 17.2% 4.9%

- 21. Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS How resilient are premium offerings to OTT? » OTT TV Myth #6: Premium Networks Will Be Extinct Increasingly traditional premium TV networks such as HBO are experimenting with standalone OTT offerings, by-passing their existing operator relationships. The bulk of premium networks’ revenues will continue to be driven through traditional multichannel distribution in the short term. But as the share of the broadband-only population increases, premium networks need to develop alternative platforms, likely through new partnerships with device manufacturers and tech companies such as Microsoft, Google or Apple. This approach should help these networks hedge their bets. Myth Premium networks will be extinct Reality Not yet (but they will need to go on the offensive)

- 22. Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Is live sports the only thing holding the cable system together? » As both an offensive and defensive move, HBO has introduced HBO Now, a standalone OTT offering of HBO, which will target consumers who only receive content via broadband. While HBO executives see the initiative as a means to go after “low hanging fruit,” customers who currently only receive video content through broadband, it may generate pushback from MVPDs. According to our proprietary survey, a premium OTT network analogous to HBO Now could potentially cause ~54% of respondents to modify their TV subscription. Staying Alive: OTT Versions of Premium Networks Could Drive Significant Shifts in MVPD Subscriptions Note: 1 “What impact would such a service have on your existing premium pay TV subscription?” Source: 2015 L.E.K. Media Entertainment Survey Consumer Actions if Premium OTT Network Was Available1 Percentage of responses No change Cancel movie package Cancel full TV subscription Overall 54% would cancel their movie package or full TV subscription 0 20 40 60 80 100% 18% 36% 46%

- 23. Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Can sports content protect the multichannel ecosystem from the threat of cord cutting? » OTT Myth #7: The Cable Ecosystem Is Disintegrating Access to live sports content is a fundamental aspect of the multichannel video programming distributor (MVPD) bundle offering. Sports leagues recognize the value of their content and have been able to extract significant domestic rights fees from operators. Bottom line: live content, and sports in particular, is the glue holding the MVPD ecosystem together and a “killer app” in slowing cord cutting. Myth The cable ecosystem is disintegrating Reality Live sports is holding it together

- 24. Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Is OTT only relevant in mature TV markets like the U.S.? » Live sports is a key driver of consumers’ willingness to subscribe to cable. What’s more, 27% of survey respondents would trim or cancel their TV subscription if the ESPN channels were OTT-only. Third-party studies confirm the role of sports in preserving MVPD subs: • According to a 2013 Harris Interactive poll, 43% of U.S. adults cited live sports as a reason for not cancelling cable • According to a Frank Magid Associates’ 2014 survey,1.4% of ESPN watchers were “very likely” to cut the cord in the next 12 months compared with 2.9% overall The Last of the Mohicans: Live Sports Is a Key Barrier to Cord Cutting Note: 1 “What impact would this have on your existing cable / satellite TV subscription?” Source: 2015 L.E.K. Media Entertainment Survey; Frank Magid Associates, 2014; Harris Interactive, June 2013 0 20 40 60 80 100% Consumer Actions if ESPN Channels Were Only Available in OTT Format1 Percentage of responses No change Cancel sports package Cancel full TV subscription 27% would cancel their sports package or full TV subscription 19% 8% 73% L.E.K. Consulting is a registered trademark of L.E.K. Consulting LLC. All other products and brands mentioned in this document are properties of their respective owners. © 2015 L.E.K. Consulting LLC

- 25. Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Is OTT relevant beyond the U.S. domestic market? » OTT TV Myth #8: OTT TV Is a Mature Market Phenomenon The growing importance and opportunities presented by over-the-top (OTT) TV are not limited to mature media markets. In fact, it is highly relevant to emerging markets, which in many cases have leap-frogged the traditional media evolution cycle to embrace digital content distribution methods. OTT TV represents an intriguing option to roll out content internationally (assuming, that the underlying infrastructure can support video streaming). For Myths 1-2, please see part one of “Over The Top TV trends” in our Executive Insights’ “Spotlight on Media Entertainment” series. Myths 3-7 can be found in part two. Myth OTT is a mature market phenomenon Reality Definitely not

- 26. OVER THE TOP TV TRENDS Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT The rapid growth of China’s broadband infrastructure (~39% penetration, ~168M households in 2014), has fueled the emergence of multiple online video platforms (alternative video platforms or AVPs) with national audience reach. A set of large, well-funded, national digital players, including Tencent, iQiYi (Baidu owned), Youku/Tudou (Alibaba minority ownership) and Sohu are driving demand for content. These players are increasingly considered as a viable monetization alternative to traditional TV, particularly as AVPs recognize the value of exclusive premium content (e.g., Tencent’s exclusive agreements with the NBA and HBO). Can TV organizations take advantage of domestic and international opportunities? » Crouching Tiger, Hidden Dragon: Demand for Online Video in China Is Vibrant L.E.K. Consulting / June 2015 LEK.COM Note: 1 Stats as of September 2013 Source: L.E.K. analysis Users of Major Chinese Online Video Providers1 Millions of users 162 Online video arm of Baidu, leader in mobile video users 168 Diversified digital player ranging from ads and pay-for-click services to gaming 254 Major digital player active in mobile, social (QQ), gaming, online ads and e-commerce Previous share leader in online video, acquired Tudou in 2012 309 0 50 100 150 200 250 300 350 OVER THE TOP TV TRENDS

- 27. L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS What cautionary tales exist for organizations that attempt to get into OTT TV without being digital ready? » OTT TV Myth #9: TV Organizations Are Digital Ready Digital readiness refers to a company’s ability to: 1. Engage with their viewers regardless of channel (traditional Pay-TV, broadcast, VOD, over-the-top (OTT) Internet) 2. Provide a seamless and integrated entertainment experience across platforms, anytime and anywhere 3. Develop a direct connection to the consumer (higher margin and less- intermediated by others) Myth TV organizations are digital ready Reality Not really

- 28. L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS The OTT TV market is littered with failed experiments because organizations are not sufficiently prepared to take on the challenges of OTT. Case in point: Despite large organizational support and deep investment (~$150M), Verizon and Redbox shut down Redbox Instant just 19 months from initial launch after being plagued with issues. While fortunes will be made going forward, the high levels of current investment by incumbents will require new entrants to develop clever strategies, find deep-pocketed partners and carefully leverage existing assets. How can organizations develop the right capabilities to succeed in OTT? » Risky Business: The OTT TV Territory Is Treacherous “… The service was plagued with problems right out of the gate. The library of movies was nowhere near as expansive as Netflix’s, Amazon Instant’s, or even Hulu’s. They also didn’t offer any TV shows …” Fast Company, October 2014 “… Compounding the misery of the service was the security vulnerability – criminals were using Redbox Instant to verify stolen credit cards and Instant was forced to shut down new user sign up for three months .…” Fast Company, October 2014 “… We made the mistake of putting traditional Telco and media guys into the venture instead of bringing in someone who understands digital media and digital subscriptions. It was a disaster .…” Company board member, November 2014 Source: CNET, BGR, Variety, The Desk, Gigaom

- 29. L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS While (OTT) TV is top of mind for network executives, most firms are not digital ready. Studio executives acknowledge OTT is a rising trend in home entertainment. However, traditional TV organizations don’t know how to conduct billing, collections, customer service, app development and other critical tasks. TV networks that switch to an OTT-ready mindset face content acquisition challenges and cannibalization risks. Competing effectively in OTT requires a new approach to content acquisition and creation. There are also inherent risks, especially for networks that rely heavily on traditional revenue streams. What are the required criteria for a successful OTT launch? » The OTT TV Hunger Games: Big Opportunity Poses New Challenges for TV Organizations Source: L.E.K. analysis Level of Preparedness Traditional TV Functions (pre-2014) Time “Digital Ready” Functions (2015+) Viewer / customer data warehousing Platform / app development Data analytics Billing / collections Scheduling Content acquisition Content development Offline marketing Legal / privacy / PII data management Viewer / customer service Subscriber acquisition / retention

- 30. L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS What tips and traps should organizations know about? » Fantastic Four: Here Are the Required Criteria for Successful OTT Launches Successful OTT TV network launches require the following: • Affinity base must be reachable and can be activated to a paying audience • Ongoing pipeline of differentiated or new content to keep the audience interested • Promotion platform to access your affinity base and drive it towards your service • Excellent technology delivery and ubiquitous placement on devices for anytime, anywhere viewing – meeting these criteria are table stakes for OTT TV networks Source: L.E.K. analysis Affinity Base Ongoing Pipeline of Differentiated Content OTT Launch Success Factors Promotion Platform Excellent Technology Delivery and Ubiquitous Placement on Devices

- 31. L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS This installment of our Executive Insights’ “Spotlight on Media Entertainment” series covering “Over the Top TV Trends” aims to highlight a set of tips for launching an online video network and some pitfalls to avoid. Here are our lessons learned on pricing. » How can you deliver a great service? » The Craft: Pricing an OTT TV Service Correctly Requires Research and Flexibility Source: L.E.K. analysis Conduct extensive market research to understand price parameters, benchmark to competing offers, trade-offs and opportunity costs Do Your Homework Low switching costs and comparable features require pricing to be at least comparable to other OTT services to facilitate adoption and steal market share Making Pricing Competitive Test multiple offers to see consumer response beyond the initial launch price Be Flexible

- 32. Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS How should you acquire and retain subscribers? » Fundamentally, no OTT TV service will succeed if it is not intuitive and ergonomic. Here are more lessons learned on pricing. » The OTT Engine That Could: Successful OTT TV Services Deliver a Great User Experience Source: L.E.K. analysis Remove barriers to easy sign-up and payment, ensure availability across devices, facilitate discoverability and develop intuitive navigation tools that empower the consumer (e.g., library queue, recommendations) Simplify the Service Consumers expect OTT networks and platforms to provide a seamless and high-performing viewing experience from any device Have a Leading Edge UI Understand product requirements and partner with vendors that can handle seamless back-end support, including KPI monitoring Partner Strategically

- 33. OVER THE TOP TV TRENDSOVER THE TOP TV TRENDS Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT What pitfalls should be avoided in launching an OTT service? » What To Expect When You’re OTT-ing: Getting Consumers and Investors on Board with Your OTT TV Service L.E.K. Consulting / June 2015 LEK.COM Driving new customer acquisition and return usage is critical to the long-term success of an OTT TV network. Here are our lessons learned on consumer offers and managing expectations. » Source: L.E.K. analysis Ensure the product offering has a rotation of “fresh” and repeat value content; follow up on marketing efforts that work and don’t work to support subscriber base Feed Your OTT Service For content aggregators, consumers will not be motivated to add an additional or replace their existing subscription if the new OTT service does not provide at least the comparable catalog as offered by existing competitors Offer a Comparable Catalog (for aggregator) Building a successful OTT service takes time and requires a different set of measures than are traditionally followed by investors; ensure that this is communicated clearly and do not over-promise on the expected growth Manage Expectations

- 34. Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS So what can TV organizations do to become digital ready? » Hawaii Five-No-Nos: Pitfalls to Avoid When Launching an OTT TV Service These critical mistakes can nip promising OTT TV services in the bud. Here are our pitfalls to avoid. » Shifting to a subscription-based model requires a focus on subscriber care and acquisition, a continuous refinement of the product, and ongoing monitoring of subscriber analytics Not Organizing Appropriately Be prepared for adverse reactions from other content carriers (be they networks, MVPDs or other OTT providers) after you announce a channel that circumvents their service Not Anticipating Partner Reactions Underfunding Marketing Don’t short change the marketing resources needed to generate trials from prospective users (wherever they may be), subsidize trials and support ongoing retention. CACs will be painfully high at outset but will come down over time as the network effect builds Avoid launching before appropriately beta-testing and working out the ”kinks” in the service to limit negative PR at launch from technical issues Launching Too Quickly Global expansion — beyond simply making the domestic service available — necessitates a strong understanding of localization requirements including dubbing/sub-titling costs, billing/payment infrastructure, local regulations, in-country marketing etc. Launching Internationally Without Appropriate Due Diligence Source: L.E.K. analysis

- 35. Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS What have we learned? » Maps To The Stars: TV Organizations Can Chart a Path to Digital Readiness The path to becoming digital ready requires organizations to re-think their strategic positioning and answer some tough questions. Here are our four steps to success and digital readiness. » Source: L.E.K. analysis Digital Readiness Is Where TV Organizations Can and Need to Act Now End State Definition 1. • What is the ideal end state for digital readiness? • How much control do we want over our digital rights? • Which approaches are most attractive? – MVPD subscription – Standalone subscription – Transaction-based platform – Ad-supported platform – Utilize a third party’s platform – Others? Current State Diagnostic 2. • Where are we today? • What is the current status of digital rights / licensing deals? • Do we currently have a touch point with the end consumer? • Where are we distributed today? • Is there sufficient scale / demand for our content? • Where do we have permission to play? • Who owns digital within the organization? Gap Analysis 3. • What are key gaps between current state and end state? – Capabilities – Organizations – Processes – Systems – Content rights – Distribution partnerships – Others? Barrier Identification / Resolution 4. • What are key roadblocks to addressing gaps? • For each, what are our options and pros / cons? • What subscriber numbers are required for each approach to be attractive? • What are the financial implications? – Incremental revenue potential – Cost requirements – Scenario analysis

- 36. Executive Insights | SPOTLIGHT ON MEDIA ENTERTAINMENT L.E.K. Consulting / June 2015 LEK.COM OVER THE TOP TV TRENDS Our Outlook: Digital Ready Is the New Black Our Executive Insights’ “Spotlight on Media Entertainment” series covering “Over the Top TV Trends” presents a case to debunk a few of the key myths around online video services. What Have We Learned About OTT TV? 1. OTT is for real 2. Traditional TV viewing is not dead, but under pressure 3. Millennials do consume OTT disproportionately but have not abandoned cable/satellite 4. Virtual MVPDs will pressure the traditional cable bundle, but it will persist for the time being… 5. …in no small part due to live sports, even if premium networks are at risk 6. OTT is not constrained to mature markets as many emerging markets such as China represent tremendous growth opportunities 7. Despite the opportunity, many TV organizations are not “digital ready” to avoid the risks of and realize the benefit from OTT L.E.K. Consulting is a registered trademark of L.E.K. Consulting LLC. All other products and brands mentioned in this document are properties of their respective owners. © 2015 L.E.K. Consulting LLC