De-Coding Crypto Market Surge on Bitcoin Cash Fork News

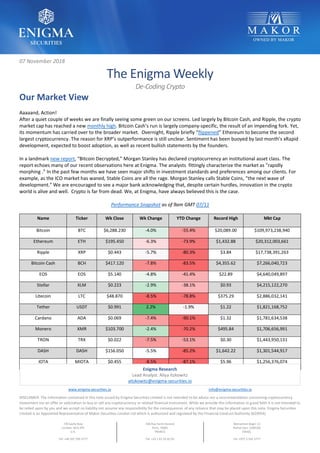

- 1. www.enigma-securities.io info@enigma-securities.io DISCLAMER: The information contained in this note issued by Enigma Securities Limited is not intended to be advice nor a recommendation concerning cryptocurrency investment nor an offer or solicitation to buy or sell any cryptocurrency or related financial instrument. While we provide this information in good faith it is not intended to be relied upon by you and we accept no liability nor assume any responsibility for the consequences of any reliance that may be placed upon this note. Enigma Securities Limited is an Appointed Representative of Makor Securities London Ltd which is authorized and regulated by the Financial Conduct Authority (625054). 7/8 Savile Row London, W1S 3PE U.K. Tel: +44 207 290 5777 336 Rue Saint-Honoré Paris, 75001 FRANCE Tel: +33 1 42 33 02 05 Menachem Begin 11 Ramat Gan, 5268104 ISRAEL Tel: +972 3 545 3777 07 November 2018 The Enigma Weekly De-Coding Crypto Our Market View Aaaaand, Action! After a quiet couple of weeks we are finally seeing some green on our screens. Led largely by Bitcoin Cash, and Ripple, the crypto market cap has reached a new monthly high. Bitcoin Cash’s run is largely company-specific, the result of an impending fork. Yet, its momentum has carried over to the broader market. Overnight, Ripple briefly “flippened” Ethereum to become the second largest cryptocurrency. The reason for XRP’s outperformance is still unclear. Sentiment has been buoyed by last month’s xRapid development, expected to boost adoption, as well as recent bullish statements by the founders. In a landmark new report, “Bitcoin Decrypted,” Morgan Stanley has declared cryptocurrency an institutional asset class. The report echoes many of our recent observations here at Enigma. The analysts fittingly characterize the market as "rapidly morphing .” In the past few months we have seen major shifts in investment standards and preferences among our clients. For example, as the ICO market has waned, Stable Coins are all the rage. Morgan Stanley calls Stable Coins, “the next wave of development." We are encouraged to see a major bank acknowledging that, despite certain hurdles, innovation in the crypto world is alive and well. Crypto is far from dead. We, at Enigma, have always believed this is the case. Performance Snapshot as of 9am GMT 07/11 Name Ticker Wk Close Wk Change YTD Change Record High Mkt Cap Bitcoin BTC $6,288.230 -4.0% -55.4% $20,089.00 $109,973,238,940 Ethereum ETH $195.450 -6.3% -73.9% $1,432.88 $20,312,003,661 Ripple XRP $0.443 -5.7% -80.3% $3.84 $17,738,391,263 Bitcoin Cash BCH $417.120 -7.8% -83.5% $4,355.62 $7,266,040,723 EOS EOS $5.140 -4.8% -41.4% $22.89 $4,640,049,897 Stellar XLM $0.223 -2.9% -38.1% $0.93 $4,215,122,270 Litecoin LTC $48.870 -8.5% -78.8% $375.29 $2,886,032,141 Tether USDT $0.991 2.2% -1.9% $1.22 $1,821,168,752 Cardano ADA $0.069 -7.4% -90.1% $1.32 $1,781,634,538 Monero XMR $103.700 -2.4% -70.2% $495.84 $1,706,656,991 TRON TRX $0.022 -7.5% -53.1% $0.30 $1,443,950,131 DASH DASH $156.050 -5.5% -85.2% $1,642.22 $1,301,544,917 IOTA MIOTA $0.455 -8.5% -87.1% $5.96 $1,256,376,074 Enigma Research Lead Analyst: Aliya Itzkowitz aitzkowitz@enigma-securities.io

- 2. www.enigma-securities.io info@enigma-securities.io DISCLAMER: The information contained in this note issued by Enigma Securities Limited is not intended to be advice nor a recommendation concerning cryptocurrency investment nor an offer or solicitation to buy or sell any cryptocurrency or related financial instrument. While we provide this information in good faith it is not intended to be relied upon by you and we accept no liability nor assume any responsibility for the consequences of any reliance that may be placed upon this note. Enigma Securities Limited is an Appointed Representative of Makor Securities London Ltd which is authorized and regulated by the Financial Conduct Authority (625054). 7/8 Savile Row London, W1S 3PE U.K. Tel: +44 207 290 5777 336 Rue Saint-Honoré Paris, 75001 FRANCE Tel: +33 1 42 33 02 05 Menachem Begin 11 Ramat Gan, 5268104 ISRAEL Tel: +972 3 545 3777 Chart of the Week Crypto AUM The decline in the crypto market has not hindered new money from pouring into the space. In fact, though the crypto market has declined 75 percent in market value, crypto AUM is booming – reaching record highs. According to CryptoFundResearch, there are now over 7 billion dollars of crypto assets under management. A recent Morgan Stanley report breaks these holdings into three categories: 48% hedge fund, 48% venture capital and 3% private equity. Of these funds, half are in the United States, with 9 percent in China and Hong Kong, and the remaining 6 percent in the UK. By year-end, it is expected that 220 cryptocurrency funds will have been created in 2018. That compares with 198 last year, and only 45 in 2015. In July 2016, the crypto fund AUM was $380 million. Two years later, the AUM was over $6 billion This year, impressive fund-raising included a $330 million raise by Grayscale Investments. This followed a 1,200 percent increase in the amount the firm raised over the course of 2017. The surge in AUM is also the result of several high profile investments from Institutional players. For example, recently, Goldman Sachs & Galaxy Digital’s contribution to a $58.5 million dollar round in BitGo. BitGo addresses one of the key sticking points many institutions have had with crypto: lack of a custody solution. The Morgan Stanley report cites three major obstacles to large-scale, institutional investment in crypto. These issues, gleaned from client conversations include: underdeveloped regulation, lack of a custodian solution and lack of large financial institutions currently invested. We, at Enigma, feel that the last of these concerns is fast diminishing. With the arrival of major players like Fidelity on the scene, asset managers will no longer feel they run the risk of being the first big player to enter the market. Likewise, the issue of custody is diminishing. This year we have seen several solutions come into place – including new efforts by Coinbase and Gemini, the Winklevoss brothers’ firm. Regulation remains a key issue which we are tracking closely. We continue to view any regulatory development, regardless of how “crypto-friendly” as a net positive. The market is currently lacking clarity and any certainty could serve as a catalyst for new money, currently on the side-lines, to enter the crypto space. The current ambiguity regarding how governing bodies treat crypto is unsustainable.

- 3. www.enigma-securities.io info@enigma-securities.io DISCLAMER: The information contained in this note issued by Enigma Securities Limited is not intended to be advice nor a recommendation concerning cryptocurrency investment nor an offer or solicitation to buy or sell any cryptocurrency or related financial instrument. While we provide this information in good faith it is not intended to be relied upon by you and we accept no liability nor assume any responsibility for the consequences of any reliance that may be placed upon this note. Enigma Securities Limited is an Appointed Representative of Makor Securities London Ltd which is authorized and regulated by the Financial Conduct Authority (625054). 7/8 Savile Row London, W1S 3PE U.K. Tel: +44 207 290 5777 336 Rue Saint-Honoré Paris, 75001 FRANCE Tel: +33 1 42 33 02 05 Menachem Begin 11 Ramat Gan, 5268104 ISRAEL Tel: +972 3 545 3777 Currency of the Week BCH Bitcoin Cash is up a massive 46 percent in the last week. The catalyst behind this price surge is widely considered to be the imminent hard fork. Why the fork? BCH tends to have planned protocol upgrades twice per year, however, this fork is different. Bitcoin ABC, the largest Bitcoin cash client, has proposed a non-scheduled change to bitcoin cash which it claims will make it more scalable and usable, as well as opening doors for non-cash transactions. ABC is up against nChain which wants to avoid such transactions and increase block size. The Bitcoin Cash fork is set for 15 November. So far, two major excahnges, Binance and Coinbase, have announced they will support the possible new BCH token formed post- fork. Traders typically interpret coin forks in a bullish manner. Trading around a fork is akin to a technical trade in the equity market – such as buying a stock before the “spin-out” of part of the larger business. The result is a “two for one” deal. Coin holders own both the original asset, and the new coin formed post-fork. As one analyst writes, a fork signifies “free coins” on top of existing holdings. Bitcoin cash is itself the product of a fork. Previously, when the Bitcoin blockchain forked to create Bitcoin Cash. BTC holders receiving an equivalent amount of BCH. Those BCH tokens went on to have a $555 value as soon as crypto exchanges began to list the new coins. Bitcoin Cash led the market higher this week with a sudden surge in price Over the course of this week, Bitcoin Cash trading volume has increased seven times - from less than $200 million to $1.4 billion, according to CoinMarketCap data. The added volume is further supporting the price. The last time we saw a comparable volume increase was when Ripple spiked on X-Rapid news in early October. We, at Enigma, view Bitcoin Cash’s run as a largely company- specific, short-lived, phenomenon. That said, BCH’s momentum has carried over to a few other names, including Ripple, which was up as much as 15 percent yesterday.

- 4. www.enigma-securities.io info@enigma-securities.io DISCLAMER: The information contained in this note issued by Enigma Securities Limited is not intended to be advice nor a recommendation concerning cryptocurrency investment nor an offer or solicitation to buy or sell any cryptocurrency or related financial instrument. While we provide this information in good faith it is not intended to be relied upon by you and we accept no liability nor assume any responsibility for the consequences of any reliance that may be placed upon this note. Enigma Securities Limited is an Appointed Representative of Makor Securities London Ltd which is authorized and regulated by the Financial Conduct Authority (625054). 7/8 Savile Row London, W1S 3PE U.K. Tel: +44 207 290 5777 336 Rue Saint-Honoré Paris, 75001 FRANCE Tel: +33 1 42 33 02 05 Menachem Begin 11 Ramat Gan, 5268104 ISRAEL Tel: +972 3 545 3777 ICO of the Week VERIDIUM ***Enigma Securities is pleased to announce exclusive allocations in several private sales*** If you would like more information on our ICO allocations please contact our team – info@enigma-securities.io The Proposal Veridium will create a trading platform and marketplace where companies can buy and sell various eco-friendly assets. The first of these tokens will be CARBON. Each token is backed by one carbon credit. The project caters primarily to the private investor compliance market where institutional investors (such as pension funds) are now requiring companies to purchase carbon credits in order to offset their carbon liabilities. With increased focus on climate change and ESG (Environmental & Social Governance) ratings, the investor compliance market is growing more than twice as fast as the government mandated compliance markets. Large Oil & Gas companies, such as BP and Shell, have also become large purchasers of carbon assets in efforts to hedge future liabilities. Veridium, with the help of partner IBM, will automate the entire carbon accounting process for these companies by integrating a proprietary blockchain-based accounting tool – the ‘EcoSmart-Protocol.’ Enigma Rating: BUY With the recent publication of the U.N. Climate report, and a feeling of mounting urgency around the need to address climate change, Veridium’s launch is timely. Currently, there is no liquid marketplace where such assets can be traded, so Veridiium is filling a need. As more companies feel compelled to reduce their carbon footprint, demand for an automated service and a private sector marketplace for carbon credits will increase. The decision to focus on the private sector market insulates the project from political risk. For example, the decision of the Trump administration to leave the Paris Accord etc, is not as relevant to demand as the decisions of large corporations like Microsoft, Shell and BP, which are already large purchasers of this class of carbon credits. The Team Todd Lemons, Chairman, and team have 25 years of experience incubating environmentally-oriented projects. Todd has founded companies all over the world including Envision Corp, Composite Technologies & Infinite- Earth. Under the leadership of Todd and Jim Procanik, Executive Director, InfiniteEARTH authored the first forest carbon accounting methodology known as REDD+ which is now recognized in the Paris Accord and has set the criteria by which all projects are measured today. Brian Kelly of CNBC is on the project’s board of advisors. IBM is the official technology provider of the project. Currently, IBM is working with a consortium of Fortune 500 companies on the development of a Hyperledger Fabric which will be integrated with Veridium. Transaction Details $5 = 1 CARBON tokens are on the Stellar blockchain, Soft-cap: $5 million (already reached), $25 million hard-cap for this first round. 6-month lockup. There are two tokens: CARBON and VERDE. *CARBON – commodity-backed, stable token = one metric ton of carbon offsets, max supply: 5 million for this round, *VERDE –platform utility token - max supply 1 billion units, exclusive, free distribution to first-round participants. Used to pay for transaction fees on the Veridium trading platform. Users of the Veridium Marketplace trading platform will be charged ~0.2% of the total transaction value in VERDE. VERDE’s value will be derived from prevailing market supply and demand. Roadmap Oct 2018: Private Sale begins ~April 2019: Launch of technology ***Details Subject to Change***

- 5. www.enigma-securities.io info@enigma-securities.io DISCLAMER: The information contained in this note issued by Enigma Securities Limited is not intended to be advice nor a recommendation concerning cryptocurrency investment nor an offer or solicitation to buy or sell any cryptocurrency or related financial instrument. While we provide this information in good faith it is not intended to be relied upon by you and we accept no liability nor assume any responsibility for the consequences of any reliance that may be placed upon this note. Enigma Securities Limited is an Appointed Representative of Makor Securities London Ltd which is authorized and regulated by the Financial Conduct Authority (625054). 7/8 Savile Row London, W1S 3PE U.K. Tel: +44 207 290 5777 336 Rue Saint-Honoré Paris, 75001 FRANCE Tel: +33 1 42 33 02 05 Menachem Begin 11 Ramat Gan, 5268104 ISRAEL Tel: +972 3 545 3777 Regulation Watch Hong Kong’s securities regulator has set out new standards forcrypto funds which, it hinted, could soon become formal regulation for crypto exchanges. Currently, the rules apply to any fund managers investing more than 10 percent of their holdings in cryptocurrency. Initially, professional traders will able to join a sandbox scheme designed to give regulators a chance to refine their approach. “The market for virtual assets is still very young and trading rules may not be transparent and fair,” said chief regulator Ashley Adler. Hong Kong has a significantly different approach from neighbour, mainland China, where cryptocurrency is illegal. Hong Kong’s decision follows an announcement by Taiwan, last week, that it would begin regulating ICOs next June. Key Dates November – What We’re Reading Morgan Stanley Report Says Crypto Now An Institutional Asset Class – Institutional investors are increasingly getting involved in bitcoin and other cryptocurrencies – while the number of retail investors in the space is staying stagnant – according to a new report by Morgan Stanley. In an update to "Bitcoin Decrypted: A Brief Teach-In and Implications," the global banking giant's research division delved into the last six months of bitcoin and highlighted certain trends it noticed. The report is dated October 31. Perhaps most notably, the report emphasized its writers' view of the market's "rapidly morphing thesis," which began by defining bitcoin as "digital cash" and noting that investors had full confidence in it, to a solution for issues in the financial system, to a new payment system to ultimately a new institutional investment class. Strong Demand: Crypto Hedge Funds are Still Raising $100 Million+ – Throughout 2018, the cryptocurrency market has lost 75 percent of its valuation. Yet, crypto hedge funds are raising hundreds of millions of dollars from accredited investors and institutions. Grayscale Investments, a subsidiary company of cryptocurrency venture capital behemoth Digital Currency Group, raised more than $330 million from both existing and new investors. After recording a 1,200 percent increase in the amount the firm had raised across three quarters in 2017, Michael Sonnenshein, managing director of Grayscale Investment stated that the substantial 69 percent drop in the price of Bitcoin had minimal impact on the company’s client base. Over the last several months, other major cryptocurrency hedge funds such as Pantera Capital and former Point72 portfolio manager Travis Kling- founded Ikigai Asset Management have raised over $100 million to invest in the asset class. Is Cryptocurrency Dead for Good? – Since it was created, nearly a decade ago, bitcoin—and the cryptocurrency market it spawned—have faced a constant stream of doomsayers declaring the coin dead or headed for obsolescence. Even so, ten years later, a single bitcoin is worth four figures, and it appears to have found some stability in tandem with its growing maturity. The same can’t be said for the sector which now includes thousands of coins and tokens, each of which exhibits varying degrees of success. Moreover, for all their promise, cryptocurrencies still can't seem to break into the mainstream. There are still very few merchants that accept crypto payments, and most financial services continue to be settled in fiat currencies. Critics say crypto may have been a flash in the pan. For supporters, though, the signs are clear that even with the current culling of the crypto ranks, the sector will emerge stronger. Only 1 in 4 Bitcoins Moved Between Addresses in Past Six Months – While volatility is back in global financial markets, only about one in four Bitcoins that weren’t freshly mined moved between the anonymous online addresses holding them in the last six months. That’s a huge change from late 2017, when about half of all such Bitcoins were active, according to data compiled for Bloomberg News by researcher Coin Metrics. Bitcoin hadn’t hit such low levels of activity since 2015, before the massive influx of investors that flocked to the cryptocurrency during its record price run-up late last year, Coin Metrics said

- 6. www.enigma-securities.io info@enigma-securities.io DISCLAMER: The information contained in this note issued by Enigma Securities Limited is not intended to be advice nor a recommendation concerning cryptocurrency investment nor an offer or solicitation to buy or sell any cryptocurrency or related financial instrument. While we provide this information in good faith it is not intended to be relied upon by you and we accept no liability nor assume any responsibility for the consequences of any reliance that may be placed upon this note. Enigma Securities Limited is an Appointed Representative of Makor Securities London Ltd which is authorized and regulated by the Financial Conduct Authority (625054). 7/8 Savile Row London, W1S 3PE U.K. Tel: +44 207 290 5777 336 Rue Saint-Honoré Paris, 75001 FRANCE Tel: +33 1 42 33 02 05 Menachem Begin 11 Ramat Gan, 5268104 ISRAEL Tel: +972 3 545 3777 Coinbase Now Worth $8 Billion – With its shiny new $8B valuation, Coinbase is now worth more than all but the top three cryptocurrencies that trade on the platform. That’s right, the only cryptocurrency assets that are worth more than the platform that trades them are Bitcoin, Ethereum and Ripple. Coinbase’s Series E is nearly three times as much as its Series D, and the fresh cash brings the company’s total capital-raised-to-date to over $520M. The bet for investors is, and should be, that if cryptocurrencies are indeed the next big idea in the ways that humans determine value, then Coinbase should be worth far more than any of the assets that trade on its exchange. The fact that it’s neither indicates how much farther the company has to grow, or the limits of the thesis that cryptocurrencies will take over the world. Microsoft Partnering with Nasdaq to Implement Blockchain Technology – Global software giant Microsoft have announced they are teaming up with Nasdaq Inc. to offer blockchain software solutions to traders and exchanges. Microsoft intends to integrate their Azure Blockchain technology with Nasdaq’s Financial Framework (NFF. Microsoft Integrating Blockchain Technology The plans to integrate their Azure blockchain with Nasdaq aims to create systems that can bridge the gap in differing technology so Nasdaq’s customers can benefit. They hope to simplify the process of matching together buyers and sellers, while also managing payments, delivery and the settlement of transactions. Hong Kong Issues New Rules to Regulate Cryptocurrency Funds and Exchanges – Hong Kong's securities regulator issued a statement setting out guidelines for funds dealing with cryptocurrency Thursday, Nov. 1, saying it could move to formally regulate exchanges. In what it called “guidance on regulatory standards,” the autonomous Chinese territory’s Securities and Futures Commission (SFC) set in motion a series of steps that chief Ashley Alder hinted would culminate in a formal regulatory environment. Hong Kong differs significantly in its approach to cryptocurrency from mainland China, with cryptoasset exchange and related activities legal, though formal regulation is pending. Closing the Cash Gap With Cryptocurrency – In emerging markets, the shallow reach of traditional money systems means there’s less resistance to new financial technology. Now, Gatina-pesa is going crypto, shifting from multicolored paper notes to a digital token based on blockchain, the recordkeeping technology that makes Bitcoin possible. The pilot program is funded by Bancor, a project based in Switzerland that operates a decentralized cryptocurrency trading platform. Bancor raised $153 million last year selling its own digital token, making it one of the splashiest of 2017’s so-called initial coin offerings, attracting instant skepticism from the many critics of crypto euphoria. It's Bitcoin's 10th Birthday. Here's What People Are Saying – Ten years ago, the pseudonymous creator behind bitcoin, Satoshi Nakamoto, released the currency's whitepaper, Bitcoin: A Peer-to-Peer Electronic Cash System. Back then, those in the know - initially just Hal Finney, a computer scientist, and Nakamoto, who some believe is the same person - were experiencing a new form of currency aiming to give people back the power to control their money, following the 2008 global financial crisis. Until next week - thank you for reading. Please reach out to info@enigma-securities.io with any questions.