CCL Products: Standalone net sales grew by 4.2% y-o-y; Accumulate

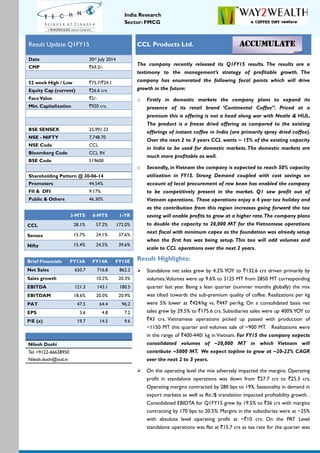

- 1. India Research Sector: FMCG CCL Products Ltd. The company recently released its Q1FY15 results. The results are a testimony to the management’s strategy of profitable growth. The company has enumerated the following focal points which will drive growth in the future: o Firstly in domestic markets the company plans to expand its presence of its retail brand ‘Continental Coffee”. Priced at a premium this is offering is not a head along war with Nestle & HUL. The product is a freeze dried offering as compared to the existing offerings of instant coffee in India (are primarily spray dried coffee). Over the next 2 to 3 years CCL wants ~ 15% of the existing capacity in India to be used for domestic markets.The domestic markets are much more profitable as well. o Secondly, in Vietnam the company is expected to reach 50% capacity utilization in FY15. Strong Demand coupled with cost savings on account of local procurement of raw bean has enabled the company to be competitively present in the market. Q1 saw profit out of Vietnam operations. These operations enjoy a 4 year tax holiday and as the contribution from this region increases going forward the tax saving will enable profits to grow at a higher rate.The company plans to double the capacity to 20,000 MT for the Vietnamese operations next fiscal with minimum capex as the foundation was already setup when the first has was being setup. This too will add volumes and scale to CCL operations over the next 2 years. Result Highlights: Standalone net sales grew by 4.2% YOY to `132.6 crs driven primarily by volumes.Volumes were up 9.6% to 3125 MT from 2850 MT corresponding quarter last year. Being a lean quarter (summer months globally) the mix was tilted towards the sub-premium quality of coffee. Realizations per kg were 5% lower at `424/kg vs. `447 per/kg. On a consolidated basis net sales grew by 29.5% to `175.6 crs. Subsidiaries sales were up 400%YOY to `43 crs. Vietnamese operations picked up passed with production of ~1150 MT this quarter and volumes sale of ~900 MT. Realizations were in the range of `400-440/ kg in Vietnam. For FY15 the company expects consolidated volumes of ~20,000 MT in which Vietnam will contribute ~5000 MT. We expect topline to grow at ~20-22% CAGR over the next 2 to 3 years. On the operating level the mix adversely impacted the margins. Operating profit in standalone operations was down from `27.7 crs to `25.3 crs. Operating margins contracted by 280 bps to 19%. Seasonality in demand in export markets as well as Re./$ translation impacted profitability growth. . Consolidated EBIDTA for Q1FY15 grew by 19.5% to `36 crs with margins contracting by 170 bps to 20.5%. Margins in the subsidiaries were at ~25% with absolute level operating profit at ~`10 crs. On the PAT Level standalone operations was flat at `15.7 crs as tax rate for the quarter was Result Update Q1FY15 Date 30th July 2014 CMP `69.2/- 52 week High / Low `75.7/`24.1 Equity Cap (current) `26.6 crs FaceValue `2/- Mkt. Capitalization `920 crs. BSE SENSEX 25,991.23 NSE - NIFTY 7,748.70 NSE Code CCL Bloomberg Code CCL IN BSE Code 519600 Shareholding Pattern @ 30-06-14 Promoters 44.54% FII & DFI 9.17% Public & Others 46.30% 3-MTS 6-MTS 1-YR CCL 28.1% 57.2% 172.0% Sensex 15.7% 24.1% 37.6% Nifty 15.4% 24.5% 39.6% Brief Financials FY13A FY14A FY15E Net Sales 650.7 716.8 862.2 Sales growth 10.2% 20.3% EBITDA 121.3 143.1 180.5 EBITDAM 18.6% 20.0% 20.9% PAT 47.5 64.4 96.2 EPS 3.6 4.8 7.2 P/E (x) 19.7 14.5 9.6 Nilesh Doshi Tel: +9122-66638950 Nilesh.doshi@tssl.in Accumulate

- 2. CCL Products Ltd. – Q1FY15 2 30th July2014 India Research Sector: FMCG lower. Consolidated PAT grew much faster at 587% to `20 crs. on the ack of Vietnamese operations breaking even on the PAT level. We expect Operating profit margins to remain in range of 19-20%. PAT will grow much faster as Vietnamese operations ramp up and become PAT positive.The tax holiday will further perk up growth. We expect PAT to grow by ~35-40% for the next 2 to 3 years. Outlook &Valuations: We believe the growth levers for CLL products to be well placed. The company’s focus on growing its presence in the domestic market with a strong brand coupled with ramp-up ofVietnamese operations will pave the road to healthy profitable growth for the next 2-3 years. At the CMP of ````69.2/- the stock trades at 9.6x its FY15E estimated EPS of ````7.2/-. We recommend investors to ACCUMULATE the stock. Quarterly Results

- 3. CCL Products Ltd. – Q1FY15 3 30th July2014 India Research Sector: FMCG (` Cr.) (YE March 31) STANDALONE CONSOLIDATED Q1FY 15 Q1FY 14 % Chg. FY14 FY13 % Chg. Q1FY 15 Q1FY 14 % Chg. FY14 FY13 % Chg. Net Sales 132.6 127.2 4.2% 611.1 584.8 4.5% 175.6 135.6 29.5% 716.8 650.7 10.2% Other operational Income Total Oper. Income(TOI) 132.6 127.2 4.2% 611.1 584.8 4.5% 175.6 135.6 29.5% 716.8 650.7 10.2% Raw Materials Cons. 84.1 72.1 16.6% 357.3 353.3 1.1% 114.1 82.1 39.0% 420.0 396.7 5.9% % to TOI 63.4% 56.7% 58.5% 60.4% 65.0% 60.6% 58.6% 61.0% Stock adj. (-)Inc / (+)Dec -2.7 -5.8 -53.6% -2.1 -0.4 445.6% -8.5 -13.5 -37.4% 5.1 -12.2 % to TOI -2.0% -4.5% -0.3% -0.1% -4.8% -10.0% 0.7% -1.9% Net Raw Mat adj. for stock 81.4 66.4 22.7% 355.2 352.9 0.7% 105.7 68.6 54.0% 425.1 384.5 10.5% % to TOI 61.4% 52.2% 58.1% 60.3% 60.2% 50.6% 59.3% 59.1% Personnel 5.1 4.7 7.3% 21.9 17.5 25.2% 6.1 5.5 10.0% 25.8 21.2 21.7% % to TOI 3.8% 3.7% 3.6% 3.0% 3.5% 4.1% 3.6% 3.3% Packing Material Consumed 6.7 7.2 -7.7% 33.0 32.8 0.5% 7.3 7.4 -1.7% 34.6 33.8 2.3% % to TOI 5.0% 5.7% 5.4% 5.6% 4.2% 5.5% 4.8% 5.2% Power & Fuel 7.9 7.6 3.5% 38.7 40.0 -3.1% 10.5 8.6 22.3% 45.6 44.1 3.5% % to TOI 5.9% 6.0% 6.3% 6.8% 6.0% 6.4% 6.4% 6.8% Other expenses 6.4 13.6 -53.4% 34.8 34.5 1.0% 10.1 15.3 -34.4% 42.6 45.8 -7.0% % to TOI 4.8% 10.7% 5.7% 5.9% 5.7% 11.3% 5.9% 7.0% Total expenditure 107.3 99.5 7.9% 483.6 477.6 1.3% 139.7 105.5 32.4% 573.7 529.4 8.4% Operating Profit 25.3 27.7 -8.8% 127.5 107.3 18.9% 36.0 30.1 19.5% 143.1 121.3 18.0% OPM (%) 19.0% 21.8% 20.9% 18.3% 20.5% 22.2% 20.0% 18.6% Non-Operating Income 0.4 0.1 278.1% 0.9 1.4 -35.8% 0.9 0.2 356.5% 2.6 1.9 40.2% Interest 1.9 2.1 -13.5% 7.3 12.0 -39.1% 4.2 3.8 10.0% 17.1 20.7 -17.4% Depreciation 2.4 3.5 -31.1% 13.0 15.9 -18.4% 6.7 6.8 -2.0% 29.1 28.6 1.6% PBT before Extra- ord 21.4 22.2 -3.5% 108.2 80.8 33.9% 25.9 19.6 32.1% 99.6 73.9 34.8% PBT (%) 16.1% 17.4% 17.7% 13.8% 14.7% 14.4% 13.9% 11.4% PBT 21.4 22.2 -3.5% 108.2 80.8 33.9% 25.9 19.6 32.1% 99.6 73.9 34.8% Prov. for Tax- Cur 5.8 6.6 -11.8% 34.5 25.1 37.7% 5.8 6.6 -11.8% 34.7 25.2 37.5% Tax/PBT (%) 27.2% 29.8% 31.9% 31.0% 22.5% 33.7% 34.9% 34.2% Profit after Cur. Tax 15.6 15.6 0.0% 73.7 55.8 32.1% 20.1 13.0 54.4% 64.9 48.6 33.3% Prov. for Tax- Def -0.1 0.3 - 154.7% 0.4 1.2 -62.4% -0.1 0.3 - 154.0% 0.4 1.2 -62.4% Profit after Tax 15.7 15.3 2.6% 73.3 54.6 34.2% 20.2 12.7 58.7% 64.4 47.5 35.7% PAT (%) 11.84% 12.03% 11.99% 9.33% 11.51% 9.39% 8.99% 7.29% Share of Profit/(Loss) of Associates Minority Interest Reported PAT 15.7 15.3 2.6% 73.3 54.6 34.2% 20.2 12.7 58.7% 64.4 47.5 35.7% PAT (adj. For extraord) 15.7 15.3 2.6% 73.3 54.6 34.2% 20.2 12.7 58.7% 64.4 47.5 35.7% Face Value 2.0 2.0 2.0 2.0 2.0 2.0 2.0 2.0 Equity Share capital 26.6 26.6 26.6 26.6 26.6 26.6 26.6 26.6 No. of shares (in crs.) 13.3 13.3 13.3 13.3 13.3 13.3 13.3 13.3 EPS (````) 1.2 1.2 2.6% 5.5 4.1 34.2% 1.5 1.0 58.7% 4.8 3.6 35.7%

- 4. CCL Products Ltd. – Q1FY15 4 30th July2014 India Research Sector: FMCG Team Analyst Designation Sector Email Telephone Nilesh Doshi President (Research) nilesh.doshi@tssl.in +9122-6633 8950 ShivaniV.Vishwanathan Sr. Research Analyst FMCG shivani.mehra@tssl.in +9122-6663 8956 Nisha Harchekar Sr. Research Analyst Chemicals nishaharchekar@way2wealth.com +9122-6146 2952 Institutional Dealing Designation Email Telephone Ajay Prabhudesai AssistantVice President ajay.prabhudesai@tssl.in +9122-4027 8930 Mitul Doshi Senior Executive mitul.doshi@tssl.in +9122-4027 8932 GautamVyas Institutional Sales Trader gautam.vyas@tssl.in +9122-4027 8934 Corporate Office: 3rd Floor, Hincon House,Tower - B, 247 Park, L.B.S. Marg,Vikhroli (W), Mumbai, Maharashtra – 400083, India. Tel No. 91-22 – 6663 8900 Email: research@tssl.in website: www.technoworld.in, www.way2wealth.com Strictly for Private Circulation only.All rights reserved. ©Techno Shares & Stocks Ltd & Way2Wealth Brokers Pvt. Ltd. DISCLAIMER: This information & opinions in this report have been prepared by TECHNO SHARES & STOCKS LTD &WAY2WEALTH BROKERS PVT. LTD.The report & the information contained herein are strictly confidential and meant solely for the authorized recipient and may be restricted by law or regulation in certain countries.This report is for information purposes only for the authorized reader and does not construe to be any investment, legal or taxation advice. This report is based on the information obtained from public sources and sources believed to be reliable, however, no warranty, express or implied, are given for the accuracy or correctness of the same and it should not be construed as such. It is also not intended as an offer or solicitation for the purchase and sale of any financial instrument. Techno Shares & Stocks Ltd &Way2Wealth Brokers Pvt. Ltd. and/or its subsidiaries and/or directors, employees, officers or associates – including the persons involved in the preparation/issuance of this report may have (a) from time to time, any interest or positions (buy/sell etc.) – financial (including in derivatives/commodities market) or otherwise in the companies/securities covered/mentioned in this report and may have acted upon the information &/or (b) been engaged in any other transaction, commercial or otherwise, in respect of the companies/securities covered in this report, like earning brokerage, commission or act as a market maker &/or (c) performed or may seek to perform any merchant/investment banking services for such companies or act as advisor or lender/borrower to such companies &/or (d) have other possible conflict of interest with respect to any recommendation or any information/opinions that could affect the objectivity of this report. As a result, the authorized recipients of this report should rely on their own investigations and analysis & seek professional advice. Any action taken by any one solely on the basis of the information contained herein is their own responsibility alone and Techno Shares & Stocks Ltd,Way2Wealth Brokers Pvt. Ltd. and its subsidiaries or its directors, employees or associates will not be liable in any manner whatsoever for the consequences of such action taken. No data/information contained in this report shall be copied, forwarded, transmitted or distributed, in part or in whole, in any form or in any media, without the previous written consent ofTechno Shares & Stocks Ltd. &Way2Wealth Brokers Pvt. Ltd.