HDFC Bank 4QFY15 Results Update Maintains Buy Rating on Healthy Growth Outlook

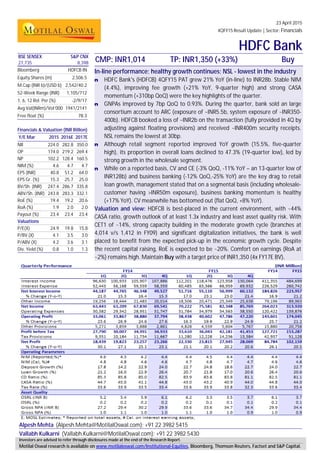

- 1. 23 April 2015 4QFY15 Result Update | Sector: Financials HDFC Bank Alpesh Mehta (Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415 Vallabh Kulkarni (Vallabh.Kulkarni@MotilalOswal.com); +91 22 3982 5430 BSE SENSEX S&P CNX CMP: INR1,014 TP: INR1,350 (+33%) Buy27,735 8,398 Bloomberg HDFCB IN Equity Shares (m) 2,506.5 M.Cap (INR b)/(USD b) 2,542/40.2 52-Week Range (INR) 1,105/712 1, 6, 12 Rel. Per (%) -2/9/17 Avg Val(INRm)/Vol’000 1941/2141 Free float (%) 78.3 Financials & Valuation (INR Billion) Y/E Mar 2015 2016E 2017E NII 224.0 282.8 350.0 OP 174.0 219.2 269.4 NP 102.2 128.4 160.5 NIM (%) 4.6 4.7 4.7 EPS (INR) 40.8 51.2 64.0 EPS Gr. (%) 15.3 25.7 25.0 BV/Sh. (INR) 247.4 286.7 335.8 ABV/Sh. (INR) 243.8 283.3 332.1 RoE (%) 19.4 19.2 20.6 RoA (%) 1.9 2.0 2.0 Payout (%) 23.4 23.4 23.4 Valuations P/E(X) 24.9 19.8 15.8 P/BV (X) 4.1 3.5 3.0 P/ABV (X) 4.2 3.6 3.1 Div. Yield (%) 0.8 1.0 1.3 In-line performance; healthy growth continues; NSL - lowest in the industry n HDFC Bank's (HDFCB) 4QFY15 PAT grew 21% YoY (in-line) to INR28b. Stable NIM (4.4%), improving fee growth (+21% YoY, 9-quarter high) and strong CASA momentum (+310bp QoQ) were the key highlights of the quarter. n GNPAs improved by 7bp QoQ to 0.93%. During the quarter, bank sold an large consortium account to ARC (exposure of ~INR5.5b, system exposure of ~INR350- 400b). HDFCB booked a loss of ~INR2b on the transaction (fully provided in 4Q by adjusting against floating provisions) and received ~INR400m security receipts. NSL remains the lowest at 30bp. n Although retail segment reported improved YoY growth (15.5%, five-quarter high), its proportion in overall loans declined to 47.3% (19-quarter low), led by strong growth in the wholesale segment. n While on a reported basis, CV and CE (-3% QoQ, -11% YoY – an 13-quarter low of INR128b) and business banking (-12% QoQ,-25% YoY) are the key drag to retail loan growth, management stated that on a segmental basis (including wholesale- customer having >INR50m exposure), business banking momentum is healthy (+17% YoY). CV meanwhile has bottomed out (flat QoQ, +8% YoY). Valuation and view: HDFCB is best-placed in the current environment, with ~44% CASA ratio, growth outlook of at least 1.3x industry and least asset quality risk. With CET1 of ~14%, strong capacity building in the moderate growth cycle (branches at 4,014 v/s 1,412 in FY09) and significant digitalization initiatives, the bank is well placed to benefit from the expected pick-up in the economic growth cycle. Despite the recent capital raising, RoE is expected to be ~20%. Comfort on earnings (RoA at ~2%) remains high. Maintain Buy with a target price of INR1,350 (4x FY17E BV). Investors are advised to refer through disclosures made at the end of the Research Report. Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

- 2. 23 April 2015 2 HDFC Bank Exhibit 1: Quarterly Performance: In-line with estimate Y/E March 4QFY15A 4QFY15E V/S our Est Comments Net Interest Income 60,132 60,127 0 Inline performance; NIMs stable QoQ % Change (Y-o-Y) 21 21 Other Income 25,638 24,197 6 Beat on fees led by higher than expected Forex and trading profits Net Income 85,769 84,324 2 Operating Expenses 38,550 37,269 3 Operating Profit 47,220 47,055 0 Operating leverage help boost profitability % Change (Y-o-Y) 25 25 Other Provisions 5,767 4,765 21 Higher than expected NPA provisioning Profit before Tax 41,453 42,290 -2 Tax Provisions 13,384 14,273 -6 Net Profit 28,069 28,017 0 Higher provisioning compensated by beat on fee income leading to inline PAT% Change (Y-o-Y) 21 20 Source: MOSL, Company GNPA improvement led by sale to ARC; OSRL stable QoQ n In absolute terms, GNPA and NNPA declined by 1% QoQ each. HDFCB sold one corporate account (of INR 5.5b) which had slipped into NPA during the quarter. Bank booked a loss of ~INR2b (full provided in 4Q by adjusting against floating provisions). Thus, gross slippages increased to INR16.3b (annualized slippage ratio of ~2.2%) vs. ~INR10b in 3QFY15 (based on basel disclosures). n In percentage terms, GNPA stood at 0.93% (down 7bp QoQ) and NNPA percentage was at 0.2% (down 10bp QoQ). Restructured standard loan portfolio (including pipeline) remained stable QoQ at 0.1% of loans and consequently net stress loans also declined (10bp) QoQ to 30bp. Retail loans proportion at 18 quarter low; Growth driven by wholesale book n Reported loans grew 21% YoY and 5% QoQ mainly driven by strong growth in wholesale segment (+6% QoQ and +26% YoY). As per the management, sequential growth in retail loans (+5% QoQ) in 4Q continues to remain lower than the seasonal trend of +7-8% QoQ growth reported in the previous years (mainly dragged down by CV and CE growth). n Retail loan portfolio growth was led by strong momentum in Home loans (+21% QoQ and 25% YoY; higher buy back from HDFC limited during the quarter), Kissan gold cards (+19% QoQ and 53% YoY) and Loan against shares (+13% QoQ and 21% YoY). n Growth in unsecured segments remained robust as personal loans grew +4% QoQ (+21% YoY) and credit cards (+5% QoQ and 32% YoY). n While on a reported basis, CV and CE (-3% QoQ, -11% YoY – an 13 quarter low of INR128b) and business banking (-12% QoQ,-25% YoY) are key drag to retail loan growth, management mentioned that on segmental basis (including wholesale –customer having >INR50m exposure) business banking momentum (+17% YoY) is healthy whereas, CV has bottomed out (flat QoQ, +8% YoY). n Domestic corporate and international loans grew 6% QoQ and 26% YoY. This segment formed ~53% of loan book. Corporate banking loan growth is largely driven by working capital and trade finance related products; lower focus on term loans. International book formed ~8% of the overall loan book. Lowest Net stress loans in the industry at 30bp Strong growth in Home loans led by higher buyback from HDFC Limited in 4QFY15

- 3. 23 April 2015 3 HDFC Bank NIM stable QoQ; CASA ratio up 310bp n NIM remained stable QoQ at 4.4% as the impact of decline in CD ratio (-270bp QoQ) was compensated by improvement in CASA ratio (+310bp QoQ to 44%). n CASA deposits accounted for ~80% of the incremental growth in deposits during the quarter. CASA deposits grew 21% YoY and 17% QoQ. n NII growth (21.4% YoY and +5.5% QoQ) continues to be marginally higher than loan growth n Bank added 611 branches in FY15; ~60% of these branch additions happened in 4QFY15. Fee income growth tracking loan growth n HDFCB reported continued traction in fee income (+21% YoY vs 15%/13% YoY in 3Q/2QFY15). Management indicated that third party distribution fees had some lumpiness in 4Q, however all other line items witnessed sustained improvement. n Fee income growth was driven by (a) Pickup in third party business especially Mutual Fund distribution (b) continued momentum in forex income (+30% QoQ and YoY each) and (c) healthy growth in Auto and Personal loans (high processing fees). Higher branch expansion lifts opex growth to 8 quarter high n Overall opex especially employee expense growth picked up during the quarter led by focus on capacity building and cost of digitalization initiatives. n Opex grew 21% YoY (+12% QoQ) led by 25% YoY growth in employee expenses. Bank added ~1,750 employees during the quarter taking the overall number of employees to ~78,000. n Cost to Income ratio increased 260bp QoQ to 47.2% in 4QFY15. As the branches mature, management expects cost to Income ratio to stabilize over the medium term. Other highlights n During the quarter bank added 355 (59 in 3QFY15, and 611 in FY15) branches and 133 ATMs (118 in 3QFY15 and 510 in FY15). Additionally, management plans to open ~300 branches per annum going forward. n CAR stood at 16.8% with Tier 1 at 13.7%. Conference Call highlights Balance Sheet related n Retail disbursement growth especially in Auto (incl. CV), PL, HL and Business banking remained strong at average growth of 20% YoY partially due to lower base of 4QFY14. M&HCV growth robust at 40% YoY; LCV growth muted; gaining market share in Auto loans. n Unsecured loans, Auto and home loans to drive near term retail growth. Strong underlying momentum seen from 2HFY16 n Business banking from a segment perspective grew 21% YoY. Decline seen in the retail business banking (-3% QoQ and -20% YoY) is partially due to some of customers moving to wholesale segment NII growth continues to be marginally better than loan growth Strong exchange profits drove fee income growth in 4QFY15 Despite strong expansion, opex growth has lagged revenue growth in the last 10 quarters

- 4. 23 April 2015 4 HDFC Bank n Higher deposit growth due to one-off CA balances in 4Q; SA balance steadily improving due to better cross sell and digital initiatives. HDFC Bank does not offer SA interest rate of more than 4% in any of its products n Quick Turn-around-time (TAT) and better service levels along with competitive pricing with increased customer acquisition through better distribution, brand and product to ensure market share gains going forward n Increase in Investment book due to growth in Commercial Paper from large corporate customers P&L related n Provisions break up (INR5.8b in 4QFY15) – General provisions (INR1.2b), NPA provisions (INR4.3b) and others (INR0.3b). n 2/3rd of loan book is not linked to base rate, while 2/3rd of term deposits are short term in nature (upto 12 months). Hence, change in base rate not going to meaningfully impact NIMs. n No plans to change the 4% rate on SB account. Initiatives on digital and multiple loan products would strengthen market position in low cost deposits. n Higher share of lumpy fees in Third Party Distribution (especially Mutual Funds) in 4Q; however, other fee line items showing a sustainable growth rate. n Base rate calculation is already based on marginal cost of funds Asset Quality n 4QFY15 NPA movement: Additions (INR16.3b), Reductions (INR16.6b); Annualized slippage ratio of 2.2% n Full Year NPA movement: Additions (INR47.9b), Reductions (INR43.4b). Recoveries (INR14b) and Updradations (INR10.8b). n Calculated PCR stands at 73%. However, it stood at 164% adjusted for special, general and floating provisions. Outstanding floating provisions at INR15.2b n Outstanding SRs stood at INR2.6b Data points n Employee strength- 78,000 n Total customers including Jan Dhan – 32m n RWA - INR4,230b

- 5. 23 April 2015 5 HDFC Bank Valuation and view n Structural drivers in place with (1) CASA ratio of ~44%, (2) growth outlook of at- least 1.3x the industry growth, (3) improving operating efficiency, (4) expected traction in income due to strong expansion in branch network, and (5) best in the class asset quality. n Retail loan growth is bottoming out and with the pickup in economic growth we expect its contribution to overall loans to go up. In the near term high ROE retail products like Unsecured retail loans, LAS etc will drive growth in our view. HDFCB has built capacity in downcycle to capture opportunities in the wholesale business and we expect it to play out as the risk aversion will reduce. n Initial signs of core revenue growth pick up: Over the last 2-3 quarters, bank’s core revenue growth has accelerated to 21% YoY (16% in FY14 and 22% in FY13). With the improvement in economic growth and loan growth core revenues are expected to remain 21%+ from hereon. n Despite pricing pressure NIMs are expected to remain at current levels as a) CASA growth will pick up b) benefit of falling rate cycle to occur due to high share of fixed rate retail loans (~70% of book) c) high yielding retail loans contribution to rise and d) capital raise to provide free float benefit (benefit of ~15bp to NIMs) n Biggest risk to earnings for private financials is the implementation of dynamic provisioning by RBI wherein, HDFCB is best placed due to floating provisions created during the last three years. HDFCB carries floating provisions of INR15.2b created to smoothen earnings growth led by better-than-factored credit cost on retail loans. n Earnings CAGR of 25%, best amongst large private banks, with core income growth pick up led by healthy loan growth, stable NIMs and gradual improvement in fee income. Further, opex growth is expected to be lower at 19% CAGR (strong operating leverage) over FY15/18 resulting into core PPP growth of 26%+. n Attractive valuations for strong liability franchise: Over the last 12 years, HDFCB’s market share has increased significantly in (1) retail loans, (2) low cost deposits and (3) higher share in profitability; indicating the strength of its franchisee. Strong fundamentals and near nil stress loans would enable the bank to gain further market share. RoEs are expected to be best amongst private banks at ~20%. Maintain Buy. Exhibit 2: One year forward P/BV Source: Company, MOSL Exhibit 3: One year forward P/E Source: Company, MOSL Buy with a target price of INR1,350 (4x FY17E BV)

- 6. 23 April 2015 6 HDFC Bank Exhibit 4: We largely maintain our estimates INR b Old Estimates New Estimates % Change FY16 FY17 FY16 FY17 FY18 FY16 FY17 Net Interest Income 275.0 339.1 282.8 350.0 437.6 2.8 3.2 Other Income 103.6 121.6 101.4 117.0 135.3 -2.1 -3.8 Total Income 378.6 460.7 384.2 466.9 572.9 1.5 1.4 Operating Expenses 162.6 197.3 165.1 197.5 236.3 1.5 0.1 Operating Profits 216.0 263.4 219.2 269.4 336.5 1.5 2.3 Provisions 24.4 31.4 26.1 28.0 35.5 PBT 191.6 232.0 193.1 241.4 301.0 0.8 4.1 Tax 64.2 76.5 64.7 80.9 100.8 0.8 5.7 PAT 127.4 155.4 128.4 160.5 200.2 0.8 3.3 Loans 4,509 5,636 4,532 5,665 7,081 0.5 0.5 Deposits 5,288 6,610 5,500 6,820 8,456 4.0 3.2 Margins (%) 4.8 4.8 4.7 4.7 4.8 Credit Cost (%) 0.6 0.6 0.6 0.5 0.5 RoA (%) 2.0 2.0 2.0 2.0 2.0 RoE (%) 19.3 20.2 19.2 20.6 21.8 Exhibit 5: DuPont Analysis: Strong improvement in risk adjusted NIMs and operating leverage; RoAs at a decadal high (%) Y/E March FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16E FY17E FY18E Interest Income 9.4 10.5 8.1 8.2 9.1 9.5 9.2 9.0 9.1 9.1 9.2 Interest Expended 4.4 5.6 3.8 3.8 4.9 5.2 5.1 4.8 4.8 4.7 4.7 Net Interest Income 5.0 4.8 4.3 4.4 4.2 4.3 4.1 4.1 4.3 4.4 4.5 Core Fee Income 1.6 1.5 1.5 1.4 1.4 1.3 1.3 1.2 1.2 1.1 1.1 Fee to core Income 23.8 23.1 25.9 24.0 24.6 23.9 23.8 22.7 21.2 20.4 19.5 Core Income 6.6 6.3 5.8 5.8 5.6 5.6 5.4 5.4 5.5 5.5 5.6 Operating Expenses 3.8 3.8 3.2 3.1 3.0 3.0 2.7 2.6 2.5 2.5 2.4 Cost to Core Income 58.2 59.6 55.3 53.8 54.3 54.1 49.6 48.3 46.0 44.9 43.5 Employee cost 1.2 1.4 1.1 1.1 1.1 1.1 0.9 0.9 0.9 0.8 0.8 Others 2.7 2.3 2.1 2.0 1.9 2.0 1.8 1.7 1.7 1.6 1.6 Core operating Profits 2.8 2.5 2.6 2.7 2.5 2.6 2.7 2.8 3.0 3.0 3.1 Trading and others 0.7 0.9 0.8 0.6 0.5 0.5 0.5 0.4 0.4 0.3 0.3 Operating Profits 3.4 3.4 3.3 3.3 3.1 3.1 3.2 3.2 3.4 3.4 3.4 Provisions 1.4 1.3 1.2 0.9 0.6 0.5 0.4 0.4 0.4 0.4 0.4 NPA 1.1 1.2 1.1 0.5 0.4 0.3 0.4 0.3 0.4 0.3 0.3 Others 0.2 0.1 0.1 0.5 0.3 0.1 0.0 0.0 0.0 0.0 0.0 PBT 2.0 2.1 2.1 2.3 2.4 2.6 2.9 2.8 3.0 3.0 3.1 Tax 0.6 0.7 0.7 0.8 0.8 0.8 1.0 0.9 1.0 1.0 1.0 Tax Rate 30.3 32.0 31.3 32.5 31.2 31.0 33.6 33.4 33.5 33.5 33.5 RoA 1.4 1.4 1.5 1.6 1.7 1.8 1.9 1.9 2.0 2.0 2.0 Leverage (x) 12.5 11.9 11.1 10.7 11.1 11.2 11.2 10.3 9.7 10.2 10.6 RoE 17.7 16.9 16.1 16.7 18.7 20.3 21.3 19.4 19.2 20.6 21.8 Source: Company, MOSL

- 7. 23 April 2015 7 HDFC Bank Exhibit 6: DuPont Analysis: Continued branch expansion led to higher opex in 4QFY15 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 4QFY14 1QFY15 2QFY15 3QFY15 4QFY15 NII 4.19 4.21 4.19 4.38 4.33 4.23 4.12 4.13 4.21 4.40 4.36 4.27 Fees (ex-forex) 1.32 1.32 1.49 1.41 1.26 1.28 1.40 1.27 1.14 1.23 1.38 1.30 Fees to core Inc 31.50 31.43 35.50 32.18 29.07 30.25 33.98 30.71 27.19 27.88 31.69 30.51 Core Income 5.51 5.54 5.67 5.79 5.59 5.50 5.52 5.40 5.35 5.63 5.75 5.58 Opex 3.01 2.91 2.93 3.20 2.98 2.77 2.58 2.65 2.59 2.79 2.65 2.74 Cost Core Inc (%) 54.69 52.63 51.68 55.24 53.27 50.32 46.62 49.04 48.32 49.63 46.04 49.12 Employee Exps. 1.14 1.04 1.06 1.03 1.09 0.98 0.87 0.88 0.92 0.93 0.87 0.94 Other Expenses 1.87 1.87 1.88 2.17 1.89 1.79 1.71 1.76 1.67 1.86 1.78 1.80 Core Oper. Profit 2.49 2.62 2.74 2.59 2.61 2.73 2.95 2.75 2.77 2.84 3.10 2.84 Trading and others 0.57 0.27 0.54 0.43 0.63 0.46 0.51 0.40 0.36 0.41 0.56 0.52 Operating Profit 3.07 2.89 3.28 3.02 3.24 3.20 3.46 3.15 3.13 3.24 3.66 3.36 Provisions 0.67 0.42 0.43 0.31 0.52 0.36 0.35 0.24 0.39 0.36 0.43 0.41 PBT 2.40 2.47 2.86 2.72 2.72 2.83 3.11 2.91 2.74 2.88 3.23 2.95 Tax 0.78 0.78 0.90 0.79 0.92 0.96 1.04 0.97 0.92 0.98 1.09 0.95 Tax Rate 32.30 31.53 31.56 29.01 33.65 33.94 33.53 33.40 33.56 33.93 33.75 32.29 ROA 1.62 1.69 1.95 1.93 1.81 1.87 2.07 1.94 1.82 1.90 2.14 2.00 Leverage (x) 11.34 11.35 11.07 10.94 10.94 10.74 10.79 11.11 10.98 10.57 10.41 9.90 ROE 18.43 19.21 21.62 21.10 19.77 20.10 22.32 21.55 19.95 20.10 22.27 19.75 Source: Company, MOSL

- 8. 23 April 2015 8 HDFC Bank Story in charts Exhibit 7: Robust loan growth led by wholesale book Source: MOSL, Company Exhibit 8: Deposits growth driven by momentum in CASA Source: MOSL, Company Exhibit 9: CASA ratio bounces back after a decline 3QFY15 Source: MOSL, Company Exhibit 10: Margins remained stable QoQ Source: MOSL, Company Exhibit 11: Retail loan growth picking up gradually Loan Break-up (INR b) 4Q FY15 4Q FY14 YoY Gr (%) 3Q FY15 QoQ Gr (%) Auto 405 331 23 400 1 PL 258 204 27 248 4 LAS 14 11 21 12 13 2Wheerlers 42 33 25 40 5 CV and CE 128 144 -11 132 -3 CC 162 123 32 154 5 Bus. Banking 188 250 -25 213 -12 Home loans 241 193 25 200 21 Gold loans 41 40 0 39 4 Kissan gold cards 162 106 53 136 19 Others 89 61 45 74 19 Retail loans 1,728 1,497 15 1,648 5 Corp and International 1,927 1,533 26 1,823 6 Total loans 3,655 3,030 21 3,471 5 Source: MOSL, Company Exhibit 12: ..however weakness in CV/CE portfolio persists Source: MOSL, Company

- 9. 23 April 2015 9 HDFC Bank Story in charts Exhibit 13: Fee income growth at 9 quarter high Source: MOSL, Company Exhibit 14: CD Ratio declined during the quarter Source: MOSL, Company Exhibit 15: Highest ever branch additions of 611 in FY15 Source: MOSL, Company Exhibit 16: GNPA improves led by asset sale to ARC Source: MOSL, Company 83 82 84 79 83 85 85 81 85 86 85 82 84 84 84 81 1QFY12 1HFY12 9MFY12 FY12 1QFY13 1HFY13 9MFY13 FY13 1QFY14 1HFY14 9MFY14 FY14 1QFY15 1HFY15 9MFY15 FY15 CDRatio

- 10. 23 April 2015 10 HDFC Bank Exhibit 17: Quarterly Snapshot FY14 FY15 Variation (%) Cumulative Numbers 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q QoQ YoY FY14 FY15 YoY Gr (%) Profit and Loss (INR m) Net Interest Income 44,187 44,765 46,348 49,527 51,716 55,110 56,999 60,132 5 21 184,827 223,957 21 Other Income 19,256 18,444 21,483 20,014 18,506 20,471 25,349 25,638 1 28 79,196 89,963 14 Trading profits 1,995 -1,733 509 333 250 951 2,655 1,961 -26 489 1,104 5,817 427 Exchange Profits 3,143 5,014 3,332 2,521 2,242 2,217 2,534 3,287 30 30 14,010 10,280 -27 Others (Ex non core) 14,118 15,163 17,642 17,160 16,014 17,303 20,160 20,390 1 19 64,082 73,866 15 Total Income 63,443 63,209 67,830 69,541 70,222 75,581 82,348 85,769 4 23 264,023 313,920 19 Operating Expenses 30,382 29,342 28,951 31,747 31,784 34,979 34,563 38,550 12 21 120,422 139,876 16 Employee 11,091 10,357 9,730 10,612 11,259 11,669 11,325 13,256 17 25 41,790 47,510 14 Others 19,291 18,985 19,221 21,135 20,525 23,310 23,238 25,294 9 20 78,632 92,366 17 Operating Profits 33,061 33,867 38,880 37,794 38,438 40,602 47,786 47,220 -1 25 143,602 174,045 21 Provisions 5,271 3,859 3,888 2,861 4,828 4,559 5,604 5,767 3 102 15,880 20,758 31 PBT 27,790 30,007 34,991 34,933 33,610 36,043 42,181 41,453 -2 19 127,721 153,287 20 Taxes 9,351 10,184 11,734 11,667 11,280 12,228 14,236 13,384 -6 15 42,937 51,128 19 PAT 18,439 19,823 23,257 23,266 22,330 23,815 27,945 28,069 0 21 84,785 102,160 20 Asset Quality GNPA 27,190 29,417 30,178 29,893 33,562 33,617 34,679 34,384 -1 15 NNPA 6,890 7,672 7,973 8,200 10,074 9,173 9,037 8,963 -1 9 GNPA (%) 1.0 1.1 1.0 1.0 1.1 1.0 1.0 0.9 -6 -5 NNPA (%) 0.3 0.3 0.2 0.3 0.3 0.3 0.3 0.2 -10 -10 PCR (Calculated, %) 74.7 73.9 73.6 72.6 70.0 72.7 73.9 73.9 -1 137 Ratios (%) Fees to Total Income 22.3 24.0 26.0 24.7 22.8 22.9 24.5 23.8 24.3 23.5 Cost to Core Income 49.4 45.2 43.0 45.9 45.4 46.9 43.4 46.0 48.4 47.0 Tax Rate 33.6 33.9 33.5 33.4 33.6 33.9 33.8 32.3 33.6 33.4 CASA (Reported) 44.7 45.0 43.7 44.8 43.0 43.2 40.9 44.0 Loan/Deposit 85.3 85.8 85.0 82.5 83.9 83.8 83.8 81.1 RoA 1.8 1.9 2.1 1.9 1.8 1.9 2.1 2.0 RoE 19.8 20.1 22.3 21.5 20.0 20.1 22.3 19.8 Margins (%) - Calculated Yield on loans 11.8 11.7 11.6 11.3 11.4 11.4 11.3 11.0 -29 -29 11.6 11.3 -32 Yield On Investments 8.2 8.9 8.7 7.7 7.6 8.3 8.2 8.1 -4 48 8.4 8.1 -30 Yield on funds 10.5 10.8 10.6 10.0 10.2 10.4 10.3 10.1 -25 2 10.5 10.2 -25 Cost of funds 6.2 6.5 6.4 5.8 5.9 6.0 6.1 5.9 -18 5 6.2 6.0 -26 Spreads 4.3 4.3 4.2 4.2 4.3 4.4 4.3 4.2 -8 -3 4.3 4.3 1 Margins 4.8 4.8 4.6 4.6 4.7 4.8 4.7 4.7 -9 4 4.7 4.7 2 Margins (%) - Reported 4.6 4.3 4.2 4.4 4.4 4.5 4.4 4.4 0 0 4.4 4.4 5 Source: MOSL, Company

- 11. 23 April 2015 11 HDFC Bank Exhibit 18: Quarterly Snapshot continued FY13 FY14 FY15 Variation (%) 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q QoQ YoY Balance Sheet (INR b) ESC 5 5 5 5 5 5 5 5 5 5 5 5 4 4 Reserves and Surplus 311 329 350 357 379 400 424 430 456 482 512 615 20 43 Net Worth 316 333 354 362 384 405 429 435 460 487 517 620 20 43 Deposits 2,575 2,741 2,841 2,962 3,033 3,130 3,492 3,673 3,721 3,907 4,141 4,508 9 23 Borrowings+Sub Debt 261 310 316 330 391 393 438 394 386 385 397 452 14 15 Other Liabiliites 448 389 326 349 355 383 322 413 346 320 294 325 11 -21 Total Liabilities 3,600 3,774 3,837 4,003 4,163 4,312 4,681 4,916 4,914 5,100 5,349 5,905 10 20 Cash 183 217 200 146 190 199 213 253 221 204 210 275 31 9 Money at call 57 50 47 127 64 81 139 142 80 113 121 88 -27 -38 Investments 902 917 960 1,116 1,048 1,019 1,106 1,210 1,237 1,296 1,340 1,665 24 38 Advances 2,133 2,316 2,415 2,397 2,586 2,686 2,967 3,030 3,121 3,273 3,471 3,655 5 21 Total earning assets 3,092 3,284 3,422 3,640 3,699 3,786 4,213 4,382 4,438 4,681 4,931 5,408 10 23 Fixed Assets 24 25 26 27 29 29 29 29 29 29 29 31 6 6 Other Assets 301 248 190 190 246 297 226 251 226 186 178 191 7 -24 Total Assets 3,600 3,774 3,837 4,003 4,163 4,312 4,681 4,916 4,914 5,100 5,349 5,905 10 20 Loan Break Up (%) Retail 52.4 53.2 53.8 56.9 54.3 53.6 49.7 49.4 48.1 48.3 47.5 47.3 -20 -211 Auto Loans 12.9 12.5 12.4 12.9 12.5 12.1 11.3 10.9 11.1 11.5 11.5 11.1 -44 18 Personal Loans 6.9 6.8 7.0 7.3 7.2 7.2 6.8 6.7 6.9 7.1 7.1 7.1 -8 33 Loan against securities 0.5 0.4 0.4 0.5 0.4 0.4 0.3 0.4 0.3 0.3 0.3 0.4 3 0 Two wheeler 1.2 1.2 1.2 1.3 1.2 1.2 1.1 1.1 1.1 1.1 1.1 1.1 0 4 CV & CE 6.8 7.1 6.8 6.7 6.5 6.3 5.6 4.8 4.3 4.2 3.8 3.5 -31 -126 Credit Cards 3.6 3.7 4.1 4.2 4.1 4.0 3.9 4.0 4.3 4.3 4.4 4.4 -1 37 Business Banking 9.2 9.3 9.6 10.2 9.2 9.6 9.0 8.3 7.1 6.7 6.1 5.2 -100 -311 Home loans 6.4 6.7 6.6 7.0 6.6 6.1 5.4 6.4 6.3 6.0 5.8 6.6 85 23 Gold loans 1.6 1.7 1.9 2.1 1.8 1.6 1.4 1.3 1.2 1.2 1.1 1.1 -1 -22 Kissan Gold Cards 2.1 2.9 2.9 3.5 3.5 3.9 3.9 4.4 50 94 Other Retail loans 3.4 3.7 1.7 2.2 2.3 2.2 1.9 2.0 2.0 2.0 2.1 2.4 28 40 Corp. & International 47.6 46.8 46.2 43.1 45.7 46.4 50.3 50.6 51.9 51.7 52.5 52.7 20 211 Franchise Branches 2,564 2,620 2,776 3,062 3,119 3,251 3,336 3,403 3,488 3,600 3,659 4,014 10 18 ATM 9,709 10,316 10,490 10,743 11,088 11,177 11,473 11,256 11,428 11,515 11,633 11,766 1 5 Source: Company, MOSL

- 12. 23 April 2015 12 HDFC Bank Exhibit 19: Financials: Valuation metrics 62.34 Rating CMP Mcap EPS (INR) P/E (x) BV (INR) P/BV (x) RoA (%) RoE (%) (INR) (USDb) FY16 FY17 FY16 FY17 FY16 FY17 FY16 FY17 FY16 FY17 FY16 FY17 ICICIBC* Buy 312 28.9 23.0 27.1 10.7 8.7 131 150 1.89 1.58 1.63 1.64 15.8 16.4 HDFCB Buy 1,014 40.7 52.0 63.1 19.5 16.1 287 336 3.53 3.02 2.00 1.99 19.5 20.3 AXSB Buy 538 20.3 37.5 44.0 14.4 12.2 219 255 2.46 2.11 1.79 1.75 18.4 18.5 KMB* Neutral 1,377 17.0 49.2 60.4 28.0 22.8 371 427 3.72 3.22 1.86 1.86 14.3 15.0 YES Buy 851 5.7 60.9 76.4 14.0 11.1 332 393 2.56 2.17 1.68 1.70 19.9 21.1 IIB Buy 857 7.3 43.2 54.6 19.8 15.7 227 274 3.77 3.13 1.90 1.97 20.7 21.8 DCBB Buy 119 0.5 7.3 9.5 16.5 12.6 63 72 1.90 1.65 1.12 1.17 12.3 14.1 FB Buy 129 1.8 13.0 15.6 9.9 8.3 100 112 1.29 1.15 1.20 1.19 13.7 14.7 JKBK Neutral 100 0.8 13.6 18.1 7.3 5.5 137 151 0.73 0.66 0.81 0.95 10.4 12.6 SIB Buy 25 0.5 3.7 4.7 6.8 5.4 29 33 0.86 0.77 0.78 0.86 13.3 15.2 Private Aggregate 123.6 17.2 14.3 2.78 2.41 SBIN (cons)* Buy 277 33.2 29.0 36.2 9.2 7.3 231 260 1.15 1.01 0.77 0.84 12.8 14.5 PNB Buy 160 4.6 26.8 36.2 6.0 4.4 231 263 0.69 0.61 0.77 0.91 12.2 14.6 BOI Neutral 218 2.3 50.3 64.3 4.3 3.4 455 511 0.48 0.43 0.46 0.49 11.6 13.3 BOB Neutral 179 1.2 24.1 30.8 7.5 5.8 184 208 0.97 0.86 0.70 0.78 13.7 15.7 UNBK Buy 153 1.6 36.6 47.1 4.2 3.2 320 359 0.48 0.43 0.57 0.64 12.0 13.9 INBK Buy 158 1.2 28.7 33.5 5.5 4.7 287 313 0.55 0.50 0.63 0.63 10.4 11.2 CRPBK Neutral 57 0.2 16.5 21.9 3.5 2.6 141 158 0.41 0.36 0.54 0.64 12.3 14.7 ANDB Buy 77 0.7 17.9 22.5 4.3 3.4 169 185 0.46 0.42 0.55 0.60 11.0 12.7 IDBI Neutral 79 2.0 14.4 19.7 5.4 4.0 157 173 0.50 0.45 0.58 0.69 9.5 11.9 DBNK Neutral 50 0.4 9.7 13.6 5.2 3.7 130 141 0.39 0.36 0.36 0.44 7.7 10.0 Public Aggregate 47.4 7.7 6.0 0.83 0.75 HDFC* Buy 1,276 31.9 38 46 21.6 16.4 165 192 5.03 3.93 2.53 2.53 23.8 24.9 LICHF Buy 443 3.6 33 39 13.5 11.3 198 229 2.24 1.93 1.43 1.42 17.8 18.3 IHFL Buy 561 3.3 64 79 8.7 7.1 215 246 2.61 2.28 4.23 4.29 32.4 34.3 IDFC Buy 169 4.3 13 14 13.4 11.8 109 120 1.29 1.16 2.20 2.19 11.5 12.0 RECL Buy 323 5.1 66 75 4.9 4.3 300 358 1.08 0.90 3.50 3.36 24.2 22.8 POWF Buy 276 5.8 55 63 5.0 4.4 288 334 0.96 0.83 3.18 3.11 20.6 20.1 SHTF Buy 1,031 3.8 78 92 13.2 11.3 494 573 2.09 1.80 2.27 2.44 16.3 17.7 MMFS Neutral 281 2.5 18 21 16.0 13.1 113 128 2.49 2.19 2.61 2.76 16.5 17.7 BAF Buy 4,281 3.4 219 267 19.5 16.1 1,137 1,360 3.77 3.15 2.94 2.88 21.0 21.4 NBFC Aggregate 63.8 14.8 12.8 2.74 2.38 *Multiples adj. for value of key ventures/Investments; For ICICI Bank and HDFC Ltd BV is adjusted for investments in subsidiaries

- 13. 23 April 2015 13 HDFC Bank Financials and valuations Income Statement (INR Million) Y/E March 2011 2012 2013 2014 2015 2016E 2017E 2018E Interest Income 203,808 278,742 350,649 411,355 484,699 592,737 724,585 898,368 Interest Expense 93,851 149,896 192,538 226,529 260,742 309,903 374,621 460,780 Net Interest Income 109,957 128,846 158,111 184,826 223,957 282,834 349,964 437,588 Change (%) 26.7 17.2 22.7 16.9 21.2 26.3 23.7 25.0 Non Interest Income 49,452 57,836 68,526 79,196 89,963 101,373 116,979 135,297 Net Income 159,409 186,682 226,637 264,023 313,920 384,207 466,943 572,885 Change (%) 20.3 17.1 21.4 16.5 18.9 22.4 21.5 22.7 Operating Expenses 77,800 92,776 112,361 120,422 139,876 165,053 197,503 236,337 Pre Provision Profits 81,609 93,906 114,276 143,601 174,045 219,154 269,440 336,548 Change (%) 20.4 15.1 21.7 25.7 21.2 25.9 22.9 24.9 Provisions (excl tax) 23,422 18,774 16,770 15,880 20,758 26,070 28,025 35,532 PBT 58,187 75,132 97,506 127,721 153,287 193,084 241,415 301,017 Tax 18,923 23,461 30,249 42,937 51,128 64,683 80,874 100,841 Tax Rate (%) 32.5 31.2 31.0 33.6 33.4 33.5 33.5 33.5 PAT 39,264 51,671 67,257 84,784 102,159 128,401 160,541 200,176 Change (%) 33.2 31.6 30.2 26.1 20.5 25.7 25.0 24.7 Equity Dividend (Incl tax) 8,948 11,749 15,360 19,275 23,803 29,917 37,406 46,641 Core PPP* 68,179 79,428 97,607 122,227 149,922 193,797 242,107 306,979 Change (%) 30.7 16.5 22.9 25.2 22.7 29.3 24.9 26.8 *Core PPP is (NII+Fee income-Opex) Balance Sheet (INR Million) Y/E March 2011 2012 2013 2014 2015 2016E 2017E 2018E Equity Share Capital 4,652 4,693 4,759 4,798 5,013 5,013 5,013 5,013 Reserves & Surplus 249,140 294,553 357,383 429,988 615,081 713,565 836,699 990,234 Net Worth 253,793 299,247 362,141 434,786 620,094 718,578 841,712 995,247 Deposits 2,085,864 2,467,064 2,962,470 3,673,375 4,507,957 5,499,707 6,819,637 8,456,349 Change (%) 24.6 18.3 20.1 24.0 22.7 22.0 24.0 24.0 of which CASA Dep 1,099,083 1,194,059 1,405,215 1,646,214 1,984,920 2,421,602 3,027,003 3,783,754 Change (%) 26.2 8.6 17.7 17.2 20.6 22.0 25.0 25.0 Borrowings 143,941 238,465 330,066 394,390 452,136 523,562 612,045 721,788 Other Liabilities & Prov. 289,929 374,319 348,642 413,444 324,844 394,400 492,879 615,977 Total Liabilities 2,773,526 3,379,095 4,003,319 4,915,995 5,905,031 7,136,247 8,766,273 10,789,362 Current Assets 296,688 209,377 272,802 395,836 363,315 424,713 510,648 627,526 Investments 709,294 974,829 1,116,136 1,209,511 1,664,600 1,914,290 2,297,147 2,756,577 Change (%) 21.0 37.4 14.5 8.4 37.6 15.0 20.0 20.0 Loans 1,599,827 1,954,200 2,397,206 3,030,003 3,654,950 4,532,138 5,665,173 7,081,466 Change (%) 27.1 22.2 22.7 26.4 20.6 24.0 25.0 25.0 Fixed Assets 21,706 23,472 27,031 29,399 31,217 35,967 41,251 46,535 Other Assets 146,011 217,216 190,144 251,246 190,949 229,139 252,053 277,258 Total Assets 2,773,526 3,379,095 4,003,319 4,915,995 5,905,031 7,136,247 8,766,273 10,789,362 Asset Quality (%) GNPA (INR m) 16,943 19,994 23,346 29,893 34,393 43,264 55,042 69,817 NNPA (INR m) 2,964 3,523 4,690 8,200 12,957 12,266 13,552 11,459 GNPA Ratio 1.0 1.0 1.0 1.0 0.9 0.9 1.0 1.0 NNPA Ratio 0.2 0.2 0.2 0.3 0.4 0.3 0.2 0.2 PCR (Excl Tech. write off) 82.5 82.4 79.9 72.6 62.3 71.6 75.4 83.6 E: MOSL Estimates

- 14. 23 April 2015 14 HDFC Bank Financials and valuations Ratios Y/E March 2011 2012 2013 2014 2015 2016E 2017E 2018E Spreads Analysis (%) Avg. Yield-Earning Assets 9.4 10.4 10.6 10.3 9.9 9.9 9.8 9.8 Avg. Yield on loans 10.9 11.9 12.3 11.7 11.1 11.1 11.0 11.0 Avg. Yield on Invt 7.2 7.7 7.5 7.8 7.4 7.4 7.4 7.4 Avg. Cost-Int. Bear. Liab. 4.7 6.1 6.4 6.2 5.8 5.6 5.6 5.5 Avg. Cost of Deposits 4.3 5.6 6.0 5.7 5.5 5.2 5.1 5.1 Interest Spread 4.7 4.4 4.2 4.1 4.1 4.2 4.2 4.3 Net Interest Margin 5.1 4.8 4.8 4.6 4.6 4.7 4.7 4.8 Profitability Ratios (%) RoE 16.7 18.7 20.3 21.3 19.4 19.2 20.6 21.8 RoA 1.6 1.7 1.8 1.9 1.9 2.0 2.0 2.0 Int. Expense/Int.Income 46.0 53.8 54.9 55.1 53.8 52.3 51.7 51.3 Fee Income/Net Income 27.5 29.3 27.3 27.2 24.2 22.8 22.0 21.1 Non Int. Inc./Net Income 31.0 31.0 30.2 30.0 28.7 26.4 25.1 23.6 Efficiency Ratios (%) Cost/Income* 48.6 49.2 49.9 45.8 47.0 45.0 44.1 42.8 Empl. Cost/Op. Exps. 36.5 36.6 35.3 34.7 34.0 34.0 33.8 33.6 Busi. per Empl. (INR m) 61.5 66.5 72.4 87.9 106.7 125.2 148.8 178.1 NP per Empl. (INR lac) 0.7 0.8 1.0 1.2 1.5 1.8 2.1 2.5 * ex treasury Asset-Liability Profile (%) Loans/Deposit 76.7 79.2 80.9 82.5 81.1 82.4 83.1 83.7 CASA Ratio 52.7 48.4 47.4 44.8 44.0 44.0 44.4 44.7 Investment/Deposit 34.0 39.5 37.7 32.9 36.9 34.8 33.7 32.6 CAR 16.2 16.5 16.8 16.1 17.6 16.4 15.1 14.0 Tier 1 12.2 11.6 11.1 11.8 14.0 13.3 12.6 11.9 Valuation Book Value (INR) 109.1 127.4 152.1 181.3 247.4 286.7 335.8 397.1 Change (%) 16.0 16.8 19.4 19.2 36.5 15.9 17.1 18.2 Price-BV (x) 9.3 8.0 6.7 5.6 4.1 3.5 3.0 2.6 Adjusted BV (INR) 108.2 126.4 150.7 178.9 243.8 283.3 332.1 393.9 Price-ABV (x) 9.4 8.0 6.7 5.7 4.2 3.6 3.1 2.6 EPS (INR) 16.9 22.0 28.3 35.3 40.8 51.2 64.0 79.9 Change (%) 31.0 30.4 28.4 25.0 15.3 25.7 25.0 24.7 Price-Earnings (x) 60.1 46.1 35.9 28.7 24.9 19.8 15.8 12.7 Dividend Per Sh (INR) 3.3 4.3 5.5 6.9 8.2 10.2 12.8 16.0 Dividend Yield (%) 0.3 0.4 0.5 0.7 0.8 1.0 1.3 1.6 E: MOSL Estimates

- 15. 23 April 2015 15 HDFC Bank Corporate profile: HDFC Bank Exhibit 21: Shareholding pattern (%) Mar-15 Dec-14 Mar-14 Promoter 21.7 22.5 22.6 DII 9.7 10.0 9.9 FII 51.4 50.6 51.1 Others 17.2 16.9 16.4 Note: FII Includes depository receipts Exhibit 22: Top holders Holder Name % Holding Europacific Growth Fund 3.8 LIC of India 2.6 ICICI Prudential Life Insurance Company Ltd 1.6 ICICI Prudential Focused Bluechip Equity Fund 1.2 Government of Singapore 1.2 Exhibit 23: Top management Name Designation Aditya Puri Managing Director Paresh Sukthankar Deputy Managing Director Sashidhar Jagdishan CFO Exhibit 24: Directors Name Name Shyamala Gopinath Renu Karnad Aditya Puri Bobby Parikh* Paresh Sukthankar Pandit Palande* A N Roy* Partho S Datta* Keki Mistry Kaizad Bharucha *Independent Exhibit 25: Auditors Name Type BSR & Co LLP Statutory Exhibit 26: MOSL forecast v/s consensus EPS (INR) MOSL forecast Consensus forecast Variation (%) FY16 51.2 51.8 -1.1 FY17 64.0 63.5 0.8 FY18 79.9 72.7 9.9 Company description HDFC Bank amongst the ten private sector bank which were awarded license post liberalization of 1990s. The bank was incorporated in August 1994 and is promoted by the biggest mortgage lender in the country, HDFC Limited (21.6% stake). The bank is now the second largest private sector bank in India with asset size of ~INR6t and market share of ~5% in deposit and loans respectively. As on March 31, 2015, the bank had a network of 4,014 branches and 11,766 ATMs spread across 2,464 cities/towns in the country. Exhibit 20: Sensex rebased

- 16. 23 April 2015 16 HDFC BankDisclosures This document has been prepared by Motilal Oswal Securities Limited (hereinafter referred to as Most) to provide information about the company(ies) and/sector(s), if any, covered in the report and may be distributed by it and/or its affiliated company(ies). This report is for personal information of the selected recipient/s and does not construe to be any investment, legal or taxation advice to you. This research report does not constitute an offer, invitation or inducement to invest in securities or other investments and Motilal Oswal Securities Limited (hereinafter referred as MOSt) is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your general information and should not be reproduced or redistributed to any other person in any form. This report does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any advice or recommendation in this material, investors should consider whether it is suitable for their particular circumstances and, if necessary, seek professional advice. The price and value of the investments referred to in this material and the income from them may go down as well as up, and investors may realize losses on any investments. Past performance is not a guide for future performance, future returns are not guaranteed and a loss of original capital may occur. MOSt and its affiliates are a full-service, integrated investment banking, investment management, brokerage and financing group. We and our affiliates have investment banking and other business relationships with a some companies covered by our Research Department. Our research professionals may provide input into our investment banking and other business selection processes. Investors should assume that MOSt and/or its affiliates are seeking or will seek investment banking or other business from the company or companies that are the subject of this material and that the research professionals who were involved in preparing this material may educate investors on investments in such business. The research professionals responsible for the preparation of this document may interact with trading desk personnel, sales personnel and other parties for the purpose of gathering, applying and interpreting information. Our research professionals are paid on the profitability of MOSt which may include earnings from investment banking and other business. MOSt generally prohibits its analysts, persons reporting to analysts, and members of their households from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover. Additionally, MOSt generally prohibits its analysts and persons reporting to analysts from serving as an officer, director, or advisory board member of any companies that the analysts cover. Our salespeople, traders, and other professionals or affiliates may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed herein, and our proprietary trading and investing businesses may make investment decisions that are inconsistent with the recommendations expressed herein. In reviewing these materials, you should be aware that any or all of the foregoing among other things, may give rise to real or potential conflicts of interest. MOSt and its affiliated company(ies), their directors and employees and their relatives may; (a) from time to time, have a long or short position in, act as principal in, and buy or sell the securities or derivatives thereof of companies mentioned herein. (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.; however the same shall have no bearing whatsoever on the specific recommendations made by the analyst(s), as the recommendations made by the analyst(s) are completely independent of the views of the affiliates of MOSt even though there might exist an inherent conflict of interest in some of the stocks mentioned in the research report Reports based on technical and derivative analysis center on studying charts company's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamental analysis. In addition MOST has different business segments / Divisions with independent research separated by Chinese walls catering to different set of customers having various objectives, risk profiles, investment horizon, etc, and therefore may at times have different contrary views on stocks sectors and markets. Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. The person accessing this information specifically agrees to exempt MOSt or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse and agrees not to hold MOSt or any of its affiliates or employees responsible for any such misuse and further agrees to hold MOSt or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays. The information contained herein is based on publicly available data or other sources believed to be reliable. Any statements contained in this report attributed to a third party represent MOSt’s interpretation of the data, information and/or opinions provided by that third party either publicly or through a subscription service, and such use and interpretation have not been reviewed by the third party. This Report is not intended to be a complete statement or summary of the securities, markets or developments referred to in the document. While we would endeavor to update the information herein on reasonable basis, MOSt and/or its affiliates are under no obligation to update the information. Also there may be regulatory, compliance, or other reasons that may prevent MOSt and/or its affiliates from doing so. MOSt or any of its affiliates or employees shall not be in any way responsible and liable for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MOSt or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations. This report is intended for distribution to institutional investors. Recipients who are not institutional investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents. Most and it’s associates may have managed or co-managed public offering of securities, may have received compensation for investment banking or merchant banking or brokerage services, may have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months. Most and it’s associates have not received any compensation or other benefits from the subject company or third party in connection with the research report. Subject Company may have been a client of Most or its associates during twelve months preceding the date of distribution of the research report MOSt and/or its affiliates and/or employees may have interests/positions, financial or otherwise of over 1 % at the end of the month immediately preceding the date of publication of the research in the securities mentioned in this report. To enhance transparency, MOSt has incorporated a Disclosure of Interest Statement in this document. This should, however, not be treated as endorsement of the views expressed in the report. Motilal Oswal Securities Limited is under the process of seeking registration under SEBI (Research Analyst) Regulations, 2014. There are no material disciplinary action that been taken by any regulatory authority impacting equity research analysis activities Analyst Certification The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report. The research analysts, strategists, or research associates principally responsible for preparation of MOSt research receive compensation based upon various factors, including quality of research, investor client feedback, stock picking, competitive factors and firm revenues Disclosure of Interest Statement HDFC BANK LIMITED § Analyst ownership of the stock No § Served as an officer, director or employee No Regional Disclosures (outside India) This report is not directed or intended for distribution to or use by any person or entity resident in a state, country or any jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject MOSt & its group companies to registration or licensing requirements within such jurisdictions. For U.S. Motilal Oswal Securities Limited (MOSL) is not a registered broker - dealer under the U.S. Securities Exchange Act of 1934, as amended (the"1934 act") and under applicable state laws in the United States. In addition MOSL is not a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended (the "Advisers Act" and together with the 1934 Act, the "Acts), and under applicable state laws in the United States. Accordingly, in the absence of specific exemption under the Acts, any brokerage and investment services provided by MOSL, including the products and services described herein are not available to or intended for U.S. persons. This report is intended for distribution only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the Exchange Act and interpretations thereof by SEC (henceforth referred to as "major institutional investors"). This document must not be acted on or relied on by persons who are not major institutional investors. Any investment or investment activity to which this document relates is only available to major institutional investors and will be engaged in only with major institutional investors. In reliance on the exemption from registration provided by Rule 15a-6 of the U.S. Securities Exchange Act of 1934, as amended (the "Exchange Act") and interpretations thereof by the U.S. Securities and Exchange Commission ("SEC") in order to conduct business with Institutional Investors based in the U.S., MOSL has entered into a chaperoning agreement with a U.S. registered broker-dealer, Motilal Oswal Securities International Private Limited. ("MOSIPL"). Any business interaction pursuant to this report will have to be executed within the provisions of this chaperoning agreement. The Research Analysts contributing to the report may not be registered /qualified as research analyst with FINRA. Such research analyst may not be associated persons of the U.S. registered broker-dealer, MOSIPL, and therefore, may not be subject to NASD rule 2711 and NYSE Rule 472 restrictions on communication with a subject company, public appearances and trading securities held by a research analyst account. For Singapore Motilal Oswal Capital Markets Singapore Pte Limited is acting as an exempt financial advisor under section 23(1)(f) of the Financial Advisers Act(FAA) read with regulation 17(1)(d) of the Financial Advisors Regulations and is a subsidiary of Motilal Oswal Securities Limited in India. This research is distributed in Singapore by Motilal Oswal Capital Markets Singapore Pte Limited and it is only directed in Singapore to accredited investors, as defined in the Financial Advisers Regulations and the Securities and Futures Act (Chapter 289), as amended from time to time. In respect of any matter arising from or in connection with the research you could contact the following representatives of Motilal Oswal Capital Markets Singapore Pte Limited: Anosh Koppikar Kadambari Balachandran Email : anosh.Koppikar@motilaloswal.com Email : kadambari.balachandran@motilaloswal.com Contact : (+65)68189232 Contact : (+65) 68189233 / 65249115 Office Address : 21 (Suite 31),16 Collyer Quay,Singapore 04931 Motilal Oswal Securities Ltd Motilal Oswal Tower, Level 9, Sayani Road, Prabhadevi, Mumbai 400 025 Phone: +91 22 3982 5500 E-mail: reports@motilaloswal.com