Creating Value in a Climate Emergency

•

1 like•2,252 views

Jane Thostrup Jagd, Senior Finance Lead at Orsted, shared these slides as part of the Climate Week 2020 event hosted by IFAC and ACCA, Creating Value in a Climate Emergency.

Report

Share

Report

Share

Recommended

In this report we define the key financial ratios based on web search data in 2015. For some of the key financial ratios were defined their formulas and calculation examples. In all our calculations we used the official financial statements of Siemens AG for the fiscal years ended september 30, 2014 and 2013, namely the consolidated statements of income (D.1), financial position (D.3) and others.Examples of Key Financial Ratios: List of Financial Ratios, Interpretation, C...

Examples of Key Financial Ratios: List of Financial Ratios, Interpretation, C...The-KPI-Examples-Review

Recommended

In this report we define the key financial ratios based on web search data in 2015. For some of the key financial ratios were defined their formulas and calculation examples. In all our calculations we used the official financial statements of Siemens AG for the fiscal years ended september 30, 2014 and 2013, namely the consolidated statements of income (D.1), financial position (D.3) and others.Examples of Key Financial Ratios: List of Financial Ratios, Interpretation, C...

Examples of Key Financial Ratios: List of Financial Ratios, Interpretation, C...The-KPI-Examples-Review

More Related Content

What's hot

What's hot (20)

What Every Nonprofit Finance Committee Should Know About Operating Reserves

What Every Nonprofit Finance Committee Should Know About Operating Reserves

Similar to Creating Value in a Climate Emergency

Similar to Creating Value in a Climate Emergency (20)

Webinar slides: What does climate-related financial disclosure really look like

Webinar slides: What does climate-related financial disclosure really look like

Financial-Analysis-and-Planning-Ratio-Analysis.pdf

Financial-Analysis-and-Planning-Ratio-Analysis.pdf

goldman sachs barclays-conference-presentation 2017

goldman sachs barclays-conference-presentation 2017

OECD Budgeting Outlook: Focus on fiscal risks - Delphine MORETTI, OECD

OECD Budgeting Outlook: Focus on fiscal risks - Delphine MORETTI, OECD

Article Summary: IPSAS: Conceptual & Institutional Issues by James L. Chan

Article Summary: IPSAS: Conceptual & Institutional Issues by James L. Chan

financial management, accounting plays a fundamental role in captur.pdf

financial management, accounting plays a fundamental role in captur.pdf

Frequently Asked Questions about Not-for-Profit Audits

Frequently Asked Questions about Not-for-Profit Audits

6 Analyzing Financial ReportsLearning ObjectivesAfter .docx

6 Analyzing Financial ReportsLearning ObjectivesAfter .docx

6 Analyzing Financial ReportsLearning ObjectivesAfter .docx

6 Analyzing Financial ReportsLearning ObjectivesAfter .docx

6 Analyzing Financial ReportsLearning ObjectivesAfter .docx

6 Analyzing Financial ReportsLearning ObjectivesAfter .docx

More from International Federation of Accountants

Principios revisados de Gobierno Corporativo del G20 y de la OCDE, Febrero 2024IFAC Principios revisados de Gobierno Corporativo del G20 y de la OCDE

IFAC Principios revisados de Gobierno Corporativo del G20 y de la OCDEInternational Federation of Accountants

Experts from the International Auditing and Assurance Standards Board (IAASB), the European Commission (EC), the Committee of European Audit Oversight Bodies (CEAOB), assurance service providers, investors and the business community met to discuss the regulatory, policy and standard-setting path toward high-quality sustainability assurance. Preparing for High Quality Sustainability assurance Engagements

Preparing for High Quality Sustainability assurance EngagementsInternational Federation of Accountants

Train the Trainer: Introduction to IPSAS, Module 10 – Other PronouncementsOtros pronunciamientos: Información financiera según la base contable de efec...

Otros pronunciamientos: Información financiera según la base contable de efec...International Federation of Accountants

Train the Trainer: Introduction to IPSAS, Module 8 – PresentationPresentación de los Estados Financieros Estados de situación financiera, rend...

Presentación de los Estados Financieros Estados de situación financiera, rend...International Federation of Accountants

More from International Federation of Accountants (20)

IFAC Principios revisados de Gobierno Corporativo del G20 y de la OCDE

IFAC Principios revisados de Gobierno Corporativo del G20 y de la OCDE

IFAC Presentación IGEP sobre OCDE-G20, Febrero 2024

IFAC Presentación IGEP sobre OCDE-G20, Febrero 2024

Preparing for High Quality Sustainability assurance Engagements

Preparing for High Quality Sustainability assurance Engagements

Otros pronunciamientos: Información financiera según la base contable de efec...

Otros pronunciamientos: Información financiera según la base contable de efec...

Otros pronunciamientos: Guías de Prácticas Recomendadas

Otros pronunciamientos: Guías de Prácticas Recomendadas

Adopción por primera vez de las NICSP de base de devengo

Adopción por primera vez de las NICSP de base de devengo

Presentación de los Estados Financieros Estados de situación financiera, rend...

Presentación de los Estados Financieros Estados de situación financiera, rend...

Recently uploaded

Saudi Arabia [ Abortion pills) Jeddah/riaydh/dammam/++918133066128☎️] cytotec tablets uses abortion pills 💊💊 How effective is the abortion pill? 💊💊 +918133066128) "Abortion pills in Jeddah" how to get cytotec tablets in Riyadh " Abortion pills in dammam*💊💊 The abortion pill is very effective. If you’re taking mifepristone and misoprostol, it depends on how far along the pregnancy is, and how many doses of medicine you take:💊💊 +918133066128) how to buy cytotec pills

At 8 weeks pregnant or less, it works about 94-98% of the time. +918133066128[ 💊💊💊 At 8-9 weeks pregnant, it works about 94-96% of the time. +918133066128) At 9-10 weeks pregnant, it works about 91-93% of the time. +918133066128)💊💊 If you take an extra dose of misoprostol, it works about 99% of the time. At 10-11 weeks pregnant, it works about 87% of the time. +918133066128) If you take an extra dose of misoprostol, it works about 98% of the time. In general, taking both mifepristone and+918133066128 misoprostol works a bit better than taking misoprostol only. +918133066128 Taking misoprostol alone works to end the+918133066128 pregnancy about 85-95% of the time — depending on how far along the+918133066128 pregnancy is and how you take the medicine. +918133066128 The abortion pill usually works, but if it doesn’t, you can take more medicine or have an in-clinic abortion. +918133066128 When can I take the abortion pill?+918133066128 In general, you can have a medication abortion up to 77 days (11 weeks)+918133066128 after the first day of your last period. If it’s been 78 days or more since the first day of your last+918133066128 period, you can have an in-clinic abortion to end your pregnancy.+918133066128

Why do people choose the abortion pill? Which kind of abortion you choose all depends on your personal+918133066128 preference and situation. With+918133066128 medication+918133066128 abortion, some people like that you don’t need to have a procedure in a doctor’s office. You can have your medication abortion on your own+918133066128 schedule, at home or in another comfortable place that you choose.+918133066128 You get to decide who you want to be with during your abortion, or you can go it alone. Because+918133066128 medication abortion is similar to a miscarriage, many people feel like it’s more “natural” and less invasive. And some+918133066128 people may not have an in-clinic abortion provider close by, so abortion pills are more available to+918133066128 them. +918133066128 Your doctor, nurse, or health center staff can help you decide which kind of abortion is best for you. +918133066128 More questions from patients: Saudi Arabia+918133066128 CYTOTEC Misoprostol Tablets. Misoprostol is a medication that can prevent stomach ulcers if you also take NSAID medications. It reduces the amount of acid in your stomach, which protects your stomach lining. The brand name of this medication is Cytotec®.+918133066128) Unwanted Kit is a combination of two medicines, ounwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE AbudhabiAbortion pills in Kuwait Cytotec pills in Kuwait

Recently uploaded (20)

Cheap Rate Call Girls In Noida Sector 62 Metro 959961乂3876

Cheap Rate Call Girls In Noida Sector 62 Metro 959961乂3876

Call Now ☎️🔝 9332606886🔝 Call Girls ❤ Service In Bhilwara Female Escorts Serv...

Call Now ☎️🔝 9332606886🔝 Call Girls ❤ Service In Bhilwara Female Escorts Serv...

Uneak White's Personal Brand Exploration Presentation

Uneak White's Personal Brand Exploration Presentation

Mysore Call Girls 8617370543 WhatsApp Number 24x7 Best Services

Mysore Call Girls 8617370543 WhatsApp Number 24x7 Best Services

unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi

Call Girls In Noida 959961⊹3876 Independent Escort Service Noida

Call Girls In Noida 959961⊹3876 Independent Escort Service Noida

RSA Conference Exhibitor List 2024 - Exhibitors Data

RSA Conference Exhibitor List 2024 - Exhibitors Data

Call Girls Zirakpur👧 Book Now📱7837612180 📞👉Call Girl Service In Zirakpur No A...

Call Girls Zirakpur👧 Book Now📱7837612180 📞👉Call Girl Service In Zirakpur No A...

Malegaon Call Girls Service ☎ ️82500–77686 ☎️ Enjoy 24/7 Escort Service

Malegaon Call Girls Service ☎ ️82500–77686 ☎️ Enjoy 24/7 Escort Service

Call Girls in Delhi, Escort Service Available 24x7 in Delhi 959961-/-3876

Call Girls in Delhi, Escort Service Available 24x7 in Delhi 959961-/-3876

Russian Call Girls In Gurgaon ❤️8448577510 ⊹Best Escorts Service In 24/7 Delh...

Russian Call Girls In Gurgaon ❤️8448577510 ⊹Best Escorts Service In 24/7 Delh...

Nelamangala Call Girls: 🍓 7737669865 🍓 High Profile Model Escorts | Bangalore...

Nelamangala Call Girls: 🍓 7737669865 🍓 High Profile Model Escorts | Bangalore...

Falcon Invoice Discounting: Empowering Your Business Growth

Falcon Invoice Discounting: Empowering Your Business Growth

Call Girls Kengeri Satellite Town Just Call 👗 7737669865 👗 Top Class Call Gir...

Call Girls Kengeri Satellite Town Just Call 👗 7737669865 👗 Top Class Call Gir...

Eluru Call Girls Service ☎ ️93326-06886 ❤️🔥 Enjoy 24/7 Escort Service

Eluru Call Girls Service ☎ ️93326-06886 ❤️🔥 Enjoy 24/7 Escort Service

Call Girls Service In Old Town Dubai ((0551707352)) Old Town Dubai Call Girl ...

Call Girls Service In Old Town Dubai ((0551707352)) Old Town Dubai Call Girl ...

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

Creating Value in a Climate Emergency

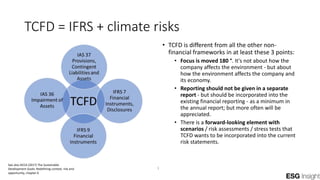

- 1. TCFD = IFRS + climate risks • TCFD is different from all the other non- financial frameworks in at least these 3 points: • Focus is moved 180 °. It's not about how the company affects the environment - but about how the environment affects the company and its economy. • Reporting should not be given in a separate report - but should be incorporated into the existing financial reporting - as a minimum in the annual report; but more often will be appreciated. • There is a forward-looking element with scenarios / risk assessments / stress tests that TCFD wants to be incorporated into the current risk statements. See also ACCA (2017) The Sustainable Development Goals: Redefining context, risk and opportunity, chapter 6 1

- 2. TCFD in praxis • Per September 2020, have 1,440+ organizations expressed support for TCFD • Clear dominance of financial companies (e.g. Bloomberg, BlackRock, Barclays, Industrial & Commercial Bank of China, Swiss Re, JP Morgan, etc. - but non-financials are also signing up now. • At the beginning only historical reporting - but now the scenario reporting also emerges. See e.g. AXA, Scor or Aviva • But the the reporting is still often not useful for the investors: It is not quantified or monetised, often reported in illustrations and not in user-friendly tables, and often still detached from the remaining annual report. 2 Examples from AXA’s TCFD reporting 2018, https://www-axa-com.cdn.axa-contento-118412.eu/www-axa- com%2F334f7447-30fe-4f81-a8e5-90c1975e2563_2018+tcfd+full+report+-+final.pdf

- 3. How can your company do investor-friendly climate scenario reporting? 3 See more in: Jagd , J.T. (2018) How to make TCFD scenarios useful for investors – a short guide, Center for ESG Research & CDSB, https://www.cdsb.net/sites/default/files/how_to_make_tcfd_scenarios_useful_for_investors_a_short_guide.pdf - or MIT (2019) Climate-Related Financial Disclosures – The Use of Scenarios, p 32, https://climate.mit.edu/sites/default/files/2020-02/Climate%20Finance%20Disclosures%20-%20Scenarios.pdf