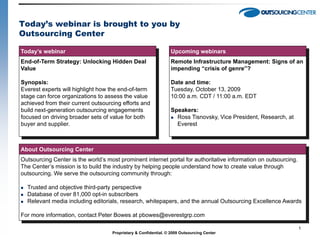

More Related Content Similar to End-of-Term Strategy: Unlocking Hidden Deal Value (20) More from Everest Group (20) 1. Today’s webinar is brought to you by

Outsourcing Center

Today’s webinar Upcoming webinars

End-of-Term Strategy: Unlocking Hidden Deal Remote Infrastructure Management: Signs of an

Value impending “crisis of genre”?

Synopsis: Date and time:

Everest experts will highlight how the end-of-term Tuesday, October 13, 2009

stage can force organizations to assess the value 10:00 a.m. CDT / 11:00 a.m. EDT

achieved from their current outsourcing efforts and

build next-generation outsourcing engagements Speakers:

focused on driving broader sets of value for both Ross Tisnovsky, Vice President, Research, at

buyer and supplier. Everest

About Outsourcing Center

Outsourcing Center is the world’s most prominent internet portal for authoritative information on outsourcing.

The Center’s mission is to build the industry by helping people understand how to create value through

outsourcing. We serve the outsourcing community through:

Trusted and objective third-party perspective

Database of over 81,000 opt-in subscribers

Relevant media including editorials, research, whitepapers, and the annual Outsourcing Excellence Awards

For more information, contact Peter Bowes at pbowes@everestgrp.com

1

Proprietary & Confidential. © 2009 Outsourcing Center

2. Q&A

To ask a question during the Q&A session

Click the question mark (Q&A) button located on the floating tool bar in the bottom right

of your screen. This will open the Q&A Panel

Be sure to keep the default set to “send to a Panelist”

Then, type your question in the rectangular field at the bottom of the Q&A box and click

the send button to submit

2

Proprietary & Confidential. © 2009 Outsourcing Center

3. Introductions

Katrina Menzigian Betty Breukelman

Vice President, Research Engagement Director

Everest Group Everest Group

kmenzigian@everestgrp.com bbreukelman@everestgrp.com

3

Proprietary & Confidential. © 2009 Outsourcing Center

5. Introduction

Late last year, Everest conducted a webinar on End-of-Term Strategies (ETS) for

outsourcing contracts discussing market changes and considerations when developing

an ETS

In today’s discussion, we shall delve deeper into a best-practice framework to compare

the current outsourcing agreement against the market development and to assess

alignment of potential value levers for expansion

Some of the key questions that we will explore include:

What is an ETS?

What key dimensions should be considering in reviewing an existing outsourcing

agreement?

What market changes could influence your ETS?

What are the key value drivers for an ETS?

What ETS strategic options should be considered?

What is the high-level ETS development timeline?

5

Proprietary & Confidential. © 2009 Everest Global, Inc.

6. Agenda

Introduction

What is an End-of-Term Strategy?

Key dimensions of reviewing a current outsourcing agreement

Understanding sourcing market changes

End-of-Term Strategy options available

Key takeaways

6

Proprietary & Confidential. © 2009 Everest Global, Inc.

7. An end-of-term event provides several opportunities to

buyers, incumbent suppliers, as well as non-incumbent

suppliers

Non-incumbent supplier Buyer opportunities

opportunities Review the value derived from

Target buyers that might be the outsourcing engagement

looking for another suppliers against the original objectives

because of one or more of the Understand recent changes in

following: the marketplace across key

The incumbent supplier is dimensions (i.e., process,

exiting the market solution, supplier, and pricing)

The overall satisfaction with and evaluate how best to

the incumbent supplier is benefit from it

low Identify how best to modify the

Buyer’s future existing deal to access

considerations are not enhanced value- creation and

aligned with incumbent capture opportunities

supplier’s strategy Realign the overall sourcing

strategy with the current and

future considerations

Incumbent supplier opportunities

Build on the success of the existing relationship

by enhancing value through scope expansion

Restructure the engagement to align it with the

supplier’s go-forward strategy

Renegotiate to ensure margin protection/

improvement

Exit contracts that cannot be aligned with margin

expectations

7

Proprietary & Confidential. © 2009 Everest Global, Inc.

8. What is an End-of-term Strategy?

An organization currently in an outsourcing services contract that is coming to an end

should consider developing its end-of-term strategy (ETS)

An end-of-term strategy (ETS) is a strategic plan to review an outsourcing relationship

and re-evaluate your sourcing strategy. The key questions that should be addressed

are:

Did the relationship achieve its original objectives?

Is the agreement currently achieving its value potential?

How has the outsourcing market place changed?

What needs to be done in advance of and post the end of the deal term?

Having a well-thought out ETS in place enables the organization to:

Leverage market opportunities

Correct prior limitations associated with the existing contract

Re-align with business objectives and goals

Strengthen and maximize value from supplier relationship

8

Proprietary & Confidential. © 2009 Everest Global, Inc.

9. Agenda

Introduction

What is an End-of-Term Strategy?

Key dimensions of reviewing a current outsourcing agreement

Understanding sourcing market changes

End-of-Term Strategy options available

Key takeaways

9

Proprietary & Confidential. © 2009 Everest Global, Inc.

10. Review of the agreement and the market changes uses

the following four dimension framework

Dimensions of current agreement review

Process review sub-dimensions: Solution review sub-dimensions:

Scope Technology

Performance management Global sourcing

Operational infrastructure Governance

Transition

A. Process B. Solution

C. Supplier D. Contract

Supplier review sub-dimensions: Contract review sub-dimensions:

Supplier portfolio Contract size and duration

Supplier strategy and focus Pricing

Supplier capability Key terms and conditions

10

Proprietary & Confidential. © 2009 Everest Global, Inc.

11. Assess outsourced Process maturity and review the

current Solution to identify major gaps and levers to

expand value

Dimension Sub dimension Brief description

Assessing the process coverage and degree of outsourcing to

Scope identify opportunities for evolution

A. Process

Performance Assessment of type and purpose of metrics, number of SLAs,

management performance levels, and enforcement strategy

Review of transition methodology, resources, engagement

Transition modes, and timelines/cost

Assessing the underlying technology solution in terms of

Technology ownership, fragmentation, and deployment options

B. Solution

Comparing the global sourcing adoption to the global sourcing

Global sourcing market maturity from process and delivery location

perspectives

Assessing the governance structure in place to address

Governance operational and strategic aspects

11

Proprietary & Confidential. © 2009 Everest Global, Inc.

12. Evaluate Supplier profile and Contract elements to

identify evolution themes for next stage of relationship

Dimension Sub dimension Brief description

Assessment of client’s overall supplier portfolio strategy in

Supplier portfolio terms of having a single-supplier strategy versus multi-

supplier strategy

C. Supplier

Supplier strategy Examining current supplier’s strategy in the market and

& focus assessing their alignment with client’s objectives

Supplier Evaluating current supplier’s capability across key parameters

capabilities (such as scale, scope, technology capabilities, and delivery

footprint) and its positioning as compared to other suppliers in

the market

Contract size & Comparison of contract size and duration with market average

duration in view of the stage of the relationship

D. Contract

Assessment of the pros and cons of current pricing structure

Pricing and indicative overall pricing levels along with pricing evolution

opportunities

Terms & Coverage of key terms and conditions with potential key

conditions additions to formalize in the next stage of relationship

12

Proprietary & Confidential. © 2009 Everest Global, Inc.

13. Agenda

Introduction

What is an End-of-Term Strategy?

Key dimensions of reviewing a current outsourcing agreement

Understanding sourcing market changes

End-of-Term Strategy options available

Key takeaways

13

Proprietary & Confidential. © 2009 Everest Global, Inc.

14. In the HRO marketplace, 82% of buyers are extending

outsourcing contracts nearing term

Outsourced to a third party

Status of HRO Deals

Percentage 1

Extension

100% = 34

82%

3

Repatriation

12%

Multi-process

HRO deal 2

Transfer

6%

Key reasons behind a high number of extensions are:

Buyer-supplier relationship

Buyer’s HRO solution

Market dynamics

HRO buyers went through intensive renegotiation and/or restructuring to extend their existing

contracts

Sample size: End-of-term decisions in 34 HRO transactions

Source: Everest Research Institute (2009)

14

Proprietary & Confidential. © 2009 Everest Global, Inc.

15. Buyers nearing an end-of-term strategy will likely need

to reevaluate the sourcing strategy for each HR process

A. Process

Share of extended HRO transactions by

changes in process scope

Number of transactions

Process market drivers

A shift from full-scope approach to componentized

100% = 28 approach

Supplier improvements in service level metrics,

Scope expansion reporting, and tracking

Buyers are more knowledgeable and more selective

7%

in the service level metrics they choose to purchase

Majority of extended contracts have scope stability

with a significant percentage of extended contracts

reducing scope of services

Scope

reduction 39% 54% No scope

change Impact to buyers

Outsource end-to-end service delivery model vs.

bundled transactional and strategic processes

Existing agreement must be reviewed to ensure

currency and applicability of the service levels being

applied

Buyers should understand the maturity of the

More than one-third of buyers that extend processes outsourced

contracts towards term-end reduced the Multi-vendor strategy option maybe ideal instead of

scope of services single-supplier option

Sample size: 28 HRO transactions that buyers extended towards the end of contract term

Source: Everest Research Institute (2009)

15

Proprietary & Confidential. © 2009 Everest Global, Inc.

16. HRO buyers are increasingly adopting global sourcing

as part of their solution set

B. Solution

Share of HRO transactions that will near term end during 2010-12 by offshore component

Number of transactions

100% = 111 100% = 45

1-25% of service

offshore

13%

>75% of

service offshore 36%

No offshoring

59% 41% Some offshoring

component component

42% 25-50% of

9% service

50-75% of service offshore offshore

Solution market drivers Impact to buyers

Shift in market preferences from pure offshoring Buyers should leverage suppliers’ global delivery

towards global sourcing centers of excellence to service global operations

Buyer’s adoption of supplier standardized solutions Global sourcing provides buyers advantages of labor

offerings that allows for easier transition of services to arbitrage, increased capacity, and access to large

global delivery locations talent pool

Buyer increased comfort with global sourcing to deliver Buyers should place greater importance on location

similar or better quality of service optimization

Sample size: 111 HRO deals that will expire during 2010-2012

Source: Everest Research Institute (2009)

16

Proprietary & Confidential. © 2009 Everest Global, Inc.

17. Suppliers are increasing in scale, capabilities, and

service offerings

Share of HRO transactions near term end during C. Supplier

2010-2012 by incumbent supplier

Number of transactions

Supplier market drivers

Consolidation of the supplier marketplace

100% = 111 Suppliers have acquired shared services and captive

operations from buyer community

Others1 Emergence of niche market suppliers

Xchanging Suppliers have new service offerings based on changing

Wipro 8%

Convergys 3% technologies; i.e., RIMO

3% ADP

27% Many suppliers have changed their focus on specific

ACS 3% geographies, market segments, processes, service

5%

delivery models, and technology platforms

NorthgateArinso 7%

Impact to buyers

Ceridian 8% 15% Buyers should conduct research and due diligence to

Accenture understand the current supplier landscape, supplier

9% capabilities, and their solution offerings

IBM 14% Supplier’s current strategy and focus will impact their

Hewitt motivation to renew contract and willingness to invest in

the future relationship

ADP, Accenture, and Hewitt account for 56% of the

total deals that will near term end during 2010-2012

1 Caliber Point, ExcellerateHRO, Fidelity, Logica, Steria, and TCS

Sample size: 111 HRO deals that will expire during 2010-2012

Source: Everest Research Institute (2009)

17

Proprietary & Confidential. © 2009 Everest Global, Inc.

18. There is a shift in market preferences from FTE-based

pricing to variable-based pricing

Pre 2005

Pricing structures used within different buyer segments D. Contract

2006-July 2008

Percentage

3K-15K employees >15K employees Contract market drivers

segment segment There has been a shift from ‘big-bang’ approach to

100% = 118 82 ‘phased’ approach

There is a shift from FTE-based pricing to volume-based

pricing plus incentives

42% 77%

Base cost plus Variable pricing allows buyers flexibility to scale up or

variable price down based on changing business requirements

31% 49%

Suppliers offer variable pricing structures that bundles

license costs, technology costs, and process delivery

58% 21% costs

Variable price

68% 44%

Impact to buyers

Buyers can consider a ‘phased’ approach to test supplier

solutions and solidify relationships

Fixed base 0% 2% Buyer should reassess pricing structures to alignment

plus 0% 3% with requires for flexibility and scope and delivery model

It is not an ‘either-or’ decision - FTE-based pricing and

volume-based pricing can both co-exist in the same

contract

0% 0%

Fixed price

2% 5%

Sample size: 200 transactions signed as of July 2008 for which data is available

Source: Everest Research Institute (2009)

18

Proprietary & Confidential. © 2009 Everest Global, Inc.

19. Agenda

Introduction

What is an End-of-Term Strategy?

Key dimensions of reviewing a current outsourcing agreement

Understanding sourcing market changes

End-of-Term Strategy options available

Key takeaways

19

Proprietary & Confidential. © 2009 Everest Global, Inc.

20. Developing an ETS should be a collaborative, comprehensive,

and non-threatening process designed to identify how to best

leverage the different ETS options by process

Renew Renegotiate Restructure Re-compete Repatriate

Re-sign existing Modify one or a Re-think the structure Terminate existing Terminate current

contract terms with limited number of of key contract contract and enter outsourcing contract

minimal changes elements of an provisions and key into competitive bid and bring previously

outsourcing contract, business terms, and process with outsourced services

e.g., price and re-think in-scope potential suppliers to back in-house

service levels processes evaluate and select

one or multiple

suppliers to replace

the current services

agreement

Buyers should take six key questions under consideration in choosing their sourcing option

1. To what degree will each sourcing option lead to lower ongoing costs and equal or improved services?

2. What is the approximate one-time cost of each sourcing option?

3. What is the risk of executing each option?

4. What is the effort and duration of implementing each option?

5. How can a client maximize its negotiating leverage?

6. To what extent is the sourcing option strategically aligned?

The optimal sourcing approach is one that is most likely meet a buyer’s targeted outcomes

Examples of outcomes: Financial return Service quality

Legal and compliance Acceptable risk

20

Proprietary & Confidential. © 2009 Everest Global, Inc.

21. Buyers should initiate an ETS at least two years before

the end of current contract term, earlier if inclusive of

transition assistance period

ILLUSTRATIVE

End of term

Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2009 2010 2010 2010 2010 2011 2011 2011 2011 2012 2012 2012

ETS Renew

Renegotiate Transition1

Re-compete Transition1

Repatriate Transition1

Restructure Transition1

Re-compete Transition1

Repatriate Transition1

Re-compete Transition1

Repatriate Transition1

Repatriate Transition1

1 Example assumes current agreement contains provision for transition and transition assistance

21

Proprietary & Confidential. © 2009 Everest Global, Inc.

22. Agenda

Introduction

What is an End-of-Term Strategy?

Key dimensions of reviewing a current outsourcing agreement

Understanding sourcing market changes

End-of-Term Strategy options available

Key takeaways

22

Proprietary & Confidential. © 2009 Everest Global, Inc.

23. Key takeaways: Best practices for unlocking value

from the end-of-term process

A combination of the buyer’s business strategy, solution requirements,

the desired buyer-supplier relationship, and market dynamics will

influence buyer’s end-of-term decision

Buyers are recommended to conduct a strategic review of their current

outsourcing agreement, investigating any major gaps that exist in the current

scope, solution delivery model, supplier relationship, and contracting terms

A thorough understanding of market dynamics, the supplier landscape,

contracting trends, and buying patterns will help identify opportunities to

improve contract competitiveness

The comparison of the current outsourcing agreement to market trends will

enable buyers to identify value levers and implement a strategy that can

effectively meet current and future objectives

23

Proprietary & Confidential. © 2009 Everest Global, Inc.

24. Q&A

Attendees will receive an email with a link to download today’s webinar presentation. To access a

recorded audio version of this webinar, please contact Ben Kuhn (bkuhn@everestgrp.com)

For advice and assistance regarding End-of-Term Strategy, please contact Everest:

Katrina Menzigian, kmenzigian@everestgrp.com

Betty Breukelman, bbreukelman@everestgrp.com

For background information on Everest, please visit:

www.everestgrp.com

www.everestresearchinstitute.com

Thank you for attending today

To ask a question during the Q&A session

Click the question mark (Q&A) button located on the floating tool bar in the bottom right of your

screen. This will open the Q&A Panel

Be sure to keep the default set to “send to a Panelist”

Then, type your question in the rectangular field at the bottom of the Q&A box and click the send

button to submit

24

Proprietary & Confidential. © 2009 Everest Global, Inc.