Surya scams

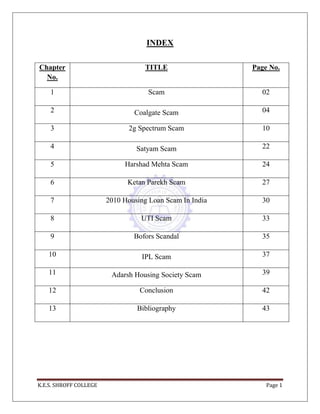

- 1. K.E.S. SHROFF COLLEGE Page 1 INDEX Chapter No. TITLE Page No. 1 Scam 02 2 Coalgate Scam 04 3 2g Spectrum Scam 10 4 Satyam Scam 22 5 Harshad Mehta Scam 24 6 Ketan Parekh Scam 27 7 2010 Housing Loan Scam In India 30 8 UTI Scam 33 9 Bofors Scandal 35 10 IPL Scam 37 11 Adarsh Housing Society Scam 39 12 Conclusion 42 13 Bibliography 43

- 2. K.E.S. SHROFF COLLEGE Page 2 CHAPTER-1 SCAM What is Scam? The term SCAM in the computer or Internet world has been loosely defined. However, the exact definition of a SCAM is when a person tries to cheat you by first giving you a good offer but later on going back on this, as a result of which you lose money. An example of this is the lottery scam. For example, a person calls or emails you and tells you that you have won a lottery prize, but to get the money there is a small processing fee, which you have to pay before the money is sent to you. On hearing this many people believe what they are told joy and immediately pay the fee to get the big reward, however after paying the fee the scammer simply disappears and the victim never hears from him or her again. Scammers have many ways of approaching their victims, and some of them can be personal. A scammer can email you to inform you about an offer, or he can send you an SMS, or sometimes even call you on your personal cell number. Another type of SCAM that is extremely harmful and dangerous is the phishing scam, in which the scammer impersonates a legitimate online company and compels or convinces you to pay money or give valuable, confidential information to the scammer. Fortunately, with adequate skills and proper knowledge you can detect when somebody is trying to cheat you. Make sure you are aware of the major Internet scams and keep your wits about you! A scam is designed to trick you into giving away your money or personal information. Scams are very common and anyone can fall for them. Scammers can approach you anywhere: in person on the street, at home, on the phone, by email or over the Internet. Scammers try to trap you by promising things like fantastic prizes, easy money, miracle cures or even love! In return, they will ask you for money or personal details. You must be very careful not to reveal any personal details to people you do not know very well. Scams work because they look like the real thing and often, people do not bother to check them properly. Scammers are also very manipulative and creative. They know what will appeal to most people (easy money, free gifts etc) and take advantage of this to trick them.

- 3. K.E.S. SHROFF COLLEGE Page 3 Scammers will always rip you off and will never give you what they promise you in the first place. Don‘t fall for it! Listen to your common sense. If it seems too good to be true, then it probably is! Recent Scams and its impact on Indian Politics and Economy India has seen in recent past many scams like 2G scams, mining scam, corruption in CWG, recent revelation by Nira Radia tapes exposing corruption at highest decision making level in the country involving politicians, babus and corporate world. What is the implication of all these scams in terms of political stability, economic sentiments and image of the country which boasts of world‘s largest democracy and one of the fastest growing economies in the world. Major points in this regard could be observed in the following areas: 1. Pro-active role of judiciary in dispensing justice by forcing political executive to act fast against corruption. It is believed that it is the pro- active role of Supreme Court that forced Congress-led UPA government in Centre to act against Raja, tainted former Telecom Minister believed to amassed huge kickbacks in license auction. PM is forced to act swiftly by asking CBI to interrogate Raja and to divert the attention of opposition for a JPC in the Parliament. 2. The non-functioning of parliamentary session by opposition parties led by BJP and washing away of entire winter session is not good for our democracy and economy. 3. Market works on sentiments besides other economic fundamentals. Scams after scams have not only tarnished the image of the country but also hitting hard our markets. 4. People and judiciary has to act in tandem along with Media to stop the kind of loot of public money by politicians so revealed by various scam at both Centre and State level and stop sort of branding our country going to become a banana republic as apprehended by Ratan Tata in a recent interview. 5. Issues like inflation, unemployment, delays in infrastructure projects and many pressing issues the nation is facing should be addressed by the party in power and not passing the buck and going for easy way of playing blaming game and diverting core issue of corruption.

- 4. K.E.S. SHROFF COLLEGE Page 4 CHAPTER-2 COALGATE SCAM Coal allocation scam or Coalgate,as referred by the media, is a political scandal concerning the Indian government's allocation of the nation's coal deposits to public sector entities (PSEs) and private companies. In a draft report issued in March 2012, the Comptroller and Auditor General of India (CAG) office accused the Government of India of allocating coal blocks in an inefficient manner during the period 2004-2009. Over the Summer of 2012, the opposition BJP lodged a complaint resulting in a Central Bureau of Investigation probe into whether the allocation of the coal blocks was in fact influenced by corruption. The essence of the CAG's argument is that the Government had the authority to allocate coal blocks by a process of competitive bidding, but chose not to. As a result both public sector enterprises (PSEs) and private firms paid less than they might have otherwise. In its draft report in March the CAG estimated that the "windfall gain" to the allocatees was 1,067,303 crore (US$201.72 billion). The CAG Final Report tabled in Parliament put the figure at 185,591 crore (US$35.08 billion)On August 27, 2012 Indian Prime Minister Manmohan Singh read a statement in Parliament rebutting the CAG's report both in its reading of the law and the alleged cost of the government's policies. While the initial CAG report suggested that coal blocks could have been allocated more efficiently, resulting in more revenue to the government, at no point did it suggest that corruption was involved in the allocation of coal. Over the course of 2012, however, the question of corruption has come to dominate the discussion. In response to a complaint by the BJP, the Central Vigilance Commission (CVC) directed the CBI to investigate the matter. The CBI has named a dozen Indian firms in a First Information Report (FIR), the first step in a criminal investigation. These FIRs accuse them of overstating their net worth, failing to disclose prior coal allocations, and hoarding rather than developing coal allocations. The CBI officials investigating the case have speculated that bribery may be involved. The issue has received massive media reaction and public outrage. During the monsoon session of the Parliament, the BJP protested the Government's handling of the issue demanding the resignation of the Prime Minister and refused to have a debate in the Parliament. The deadlock resulted in Parliament functioning only seven of the twenty days of the session.

- 5. K.E.S. SHROFF COLLEGE Page 5 Firms eligible for a coal allocation Historically, the economy of India could be characterized as broadly socialist, with the government directing large sectors of the economy through a series of five-year plans. In keeping with this centralized approach, between 1972 and 1976, India nationalized its coal mining industry, with the state-owned companies Coal India Limited (CIL) and Singareni Collieries Company (SCCL) being responsible for coal production. This process culminated in the enactment of the Coal Mines (Nationalisation) Amendment Act, 1976, which terminated coal mining leases with private lease holders. Even as it did so, however, Parliament recognized that the nationalized coal companies were unable to fully meet demand, and provided for exceptions, allowing certain companies to hold coal leases: 1976. Captive mines owned by iron and steel companies. 1993. Captive mines owned by power generation companies. 1996. Captive mines owned by cement companies. The coal allocation process ―In July 1992 Ministry of Coal, issued the instructions for constitution of a Screening Committee for screening proposals received for captive mining by private power generation companies.‖ The Committee was composed of government officials from the Ministry of Coal, the Ministry of Railways, and the relevant state government. ―A number of coal blocks, which were not in the production plan of CIL and SSCL, were identified in consultation with CIL/SSCL and a list of 143 coal blocks were prepared and placed on the website of the MoC for information of public at large. Companies could apply for an allocation from among these blocks. If they were successful, they would receive the geological report that had been prepared by the government, and the only payment required from the allocate was to reimburse the government for their expenses in preparing the geological report. Coal allocation guidelines The guidelines for the Screening Committee suggest that preference be given to the power and steel sectors (and to large projects within those sectors). They further suggest that in the case of competing applicants for a captive block, a further 10 guidelines may be taken into consideration: status (stage) level of progress and state of preparedness of the projects; net worth of the applicant company (or in the case of a new SP/JV, the net worth of their principals);

- 6. K.E.S. SHROFF COLLEGE Page 6 production capacity as proposed in the application; maximum recoverable reserve as proposed in the application; date of commissioning of captive mine as proposed in the application; date of completion of detailed exploration (in respect of unexplored blocks only) as proposed in the application; technical experience (in terms of existing capacities in coal/lignite mining and specified end- use); recommendation of the administrative ministry concerned; recommendation of the state government concerned (i.e., where the captive block is located); track record and financial strength of the company. Results of the coal allocation program The response to the allocation process between 2004 and 2009 was spectacular, with some 44 billion metric tons of coal being allocated to public and private firms. By way of comparison, the entire world only produces 7.8 billion tons annually, with India being responsible for 585 million tons of this amount. Under the program, then, captive firms were allocated vast amounts of coal, equating to hundreds of years of supply, for a nominal fee. Out of the above 216 blocks, 24 blocks were de-allocated (three blocks in 2003, two blocks in 2006, one block in 2008, one block in 2009, three blocks in 2010, and 14 blocks in 2011) for non-performance of production by the allocatees, and two de-allocated blocks were subsequently reallocated (2003 and 2005) to others. Hence, 194 coal blocks, with aggregates geological reserves of 44.44 billion metric tons, stood allocated as at March 31, 2011. The foregoing supports the following conclusions: The allocation process prior to 2010 allowed some firms to obtain valuable coal blocks at a nominal expense The eligible firms took up this option and obtained control of vast amounts of coal in the period 2005-09 The criteria employed for awarding coal allocations were opaque and in some respects subjective.

- 7. K.E.S. SHROFF COLLEGE Page 7 Overview The CAG report, leaked to the press in March as a draft and tabled in Parliament in August, is a performance audit focusing on the allocation of coal blocks and the performance of Coal India in the 2005-09 period. On March 22, the Times Of India, broke the story on the contents of the Draft CAG Report: NEW DELHI: The CAG is at it again. About 16 months after it rocked the UPA government with its explosive report on allocation of 2G spectrum and licences, the Comptroller & Auditor General's draft report titled 'Performance Audit Of Coal Block Allocations' says the government has extended "undue benefits", totalling a mind-boggling Rs 10.67 lakh crore, to commercial entities by giving them 155 coal acreages without auction between 2004 and 2009. The beneficiaries include some 100 private companies, as well as some public sector units, in industries such as power, steel and cement. Allegations against Subodh Kant Sahai In September 2012, it was revealed that Subodh Kant Sahay, Tourism Minister in the UPA government sent a letter to Prime Minister Manmohan Singh trying to persuade him for allocation of a coal block to a company, SKS Ispat and Power which has Sudhir Sahay, his younger brother, as honorary Executive Director. The letter was written on 5 February 2008. On the very next day, Prime Minister's Office (PMO) sent a letter to the coal secretary on February 6, 2008, recommending allotment of coal blocks to the company. However, Sahay denied these allegations, citing that the coal block was allocated to SKS Ispat, where his brother was only an "honorary director". On 15 September 2012, an Inter Ministerial Group (IMG) headed by Zohra Chatterji (Additional Secretary in Coal Ministry) recommended cancellation of a block allotted to SKS Ispat and Powe. Allegations against Vijay Darda and Rajendra Darda Vijay Darda, a Congress MP and his brother Rajendra Darda, the education minister of Maharashtra, have been accused of direct and active involvement in the affairs of three companies JLD Yavatmal Energy, JAS Infrastructure & Power Ltd., AMR Iron & Steel Pvt. Ltd, which received coal blocks illegally by means of inflating their financial statements and overriding the legal tender process.

- 8. K.E.S. SHROFF COLLEGE Page 8 BJP Response In response to the Times of India story there was an uproar in Parliament, with the BJP charging the government with corruption and demanding a court-monitored probe into coal allocations: "'The CWG scam is (to the tune) of Rs 70,000 crore, 2G scam is Rs 1.76 lakh crore. But, now the new coal scam is Rs 10.67 lakh crore. It is a government of scams... from airwaves to mining, everywhere the government is involved in scams,' party spokesperson Prakash Javadekar told reporters." The BJP governments themselves were embroiled in this, since the states ruled by BJP had also opposed public auctions of the mines. CBI Investigation On 31 May 2012, Central Vigilance Commission (CVC) based on a complaint of two Bharatiya Janata Party Member of Parliament Prakash Javadekar and Hansraj Ahir directed a CBI enquiry. There were leaks of the report in media in March 2012 which claimed the figure to be around 1,060,000 crore (US$200.34 billion). It is called by the media as the Mother of all Scams. Discussion about the issue was placed in the Parliament on 26th Aug, 2012 by the Prime MinisterManmohan Singh with wide protests from the opposition. According to the Comptroller and Auditor General of India, this is a leak of the initial draft and the details being brought out were observations which are under discussion at a very preliminary stage. On 29 May 2012, Prime Minister Manmohan Singh offered to give up his public life The CAG Final Report Overview On 17 August the CAG submitted its Final Report to Parliament. Much less detailed than the Draft Report, the Final Report still made the same charges against the government: The Government had the authority to auction the coal blocks but chose not to. As a result allocatees received a "windfall gain" from the program. First CAG charge: the Government had the legal authority to auction coal blocks The CAG continued its contention that the Government had the legal authority under the existing statute to auction coal by making an administrative decision, rather than needing to amend the statute itself. From this record, the CAG draws the following conclusions:

- 9. K.E.S. SHROFF COLLEGE Page 9 The Government decided to bring transparency and objectivity in the allocation process of coal blocks, with 28 June 2004 taken as the cutoff date. The DLA advice of July 2006 was sufficient grounds upon which to introduce competitive bidding, by means of an administrative decision. Despite this DLA advice, there was prolonged legal examination as to whether an administrative decision or amendment of the statute was necessary for competitive bidding to be introduced. This stalled the decisionmaking process through 2009. In the period between July 2006 and the end of 2009, 38 coal blocks were allocated under the existing process of allocation, "which lacked transparency, objectivity, and competition." Second CAG charge: "windfall gains" to the allocatees were 185,591 crore (US$35.08 billion) The biggest change from the Draft Report was the dramatic reduction in the windfall gains from 1,067,303 crore (US$201.72 billion) to 185,591 crore (US$35.08 billionThis change is due to: windfall gain/ton decreased 8% from 322 (US$6.09) in the Draft Report to 295 (US$5.58) in the Final Report number of tons decreased 81% from 33.169 to 6.283 billion metric tons of coal. This is because the Final Report considers "extractable coal" (i.e. coal that could actually be used in production) as against the Draft Report, which considered coal in situ (i.e. coal in the ground without taking into account losses that occur during mining and washing the coal). Overview Typically once a CAG Report has been tabled (submitted to Parliament) it is received by the Public Accounts Committee (PAC). The PAC then calls in the relevant minister to discuss the report, and the PAC prepares its own report, which is then discussed in Parliament as a whole. In an unusual step, on 27 August, the Prime Minister bypassed this process and made a statement to Parliament directly, addressing the findings of the Final CAG Report. The major coal and lignite bearing states like West Bengal, Chhattisgarh, Jharkhand, Orissa and Rajasthan that were ruled by opposition parties, were strongly opposed to a switch over to the process of competitive bidding as they felt that it would increase the cost of coal, adversely impact value addition and development of industries in their areas and would dilute their prerogative in the selection of lessees.

- 10. K.E.S. SHROFF COLLEGE Page 10 CHAPTER-3 2G SPECTRUM SCAM The 2G spectrum scam involved politicians and government officials in India illegally undercharging mobile telephony companies for frequency allocation licenses, which they would then use to create 2G subscriptions for cell phones. The shortfall between the money collected and the money which the law mandated to be collected is estimated to be 176,645 crore (US$33.39 billion), as valued by the Comptroller and Auditor General of India based on 3G and BWA spectrum auction prices in 2010.However, the exact loss is disputed. In a chargesheet filed on 2 April 2011 by the investigating agency, Central Bureau of Investigation (CBI), the loss was pegged at 30,984.55 crore (US$5.86 billion) whereas on 19 August 2011 in a reply to CBI, Telecom Regulatory Authority of India (TRAI) said that the govt gained over 3,000 crore (US$567 million) by giving 2G Spectrum. Similarly Kapil Sibal, the Minister of communications & IT, claimed in 2011, during a press conference, that "zero loss" was caused by distributing 2G licenses on first-come-first-served basis. All the speculations of profit, loss and no-loss were put to rest on 2 February 2012 when the Supreme Court of India delivered judgement on a public interest litigation (PIL) which was directly related to the 2G spectrum scam. The Supreme Court declared allotment of spectrum as"unconstitutional and arbitrary," and quashed all the 122 licenses issued in 2008 during tenure of A. Raja (then minister for communications & IT) the main official accused in the 2G scam case.The court further said that A. Raja "wanted to favour some companies at the cost of the public exchequer" and "virtually gifted away important national asset." The "zero loss theory" was further demolished on 3 August 2012 when as per the directions of the Supreme Court, Govt of India revised the base price for 5 MHz 2G spectrum auction to 14,000 crore (US$2.65 billion), which roughly gives the value of spectrum to be around 2,800 crore (US$529.2 million) per MHz that is close to the CAG's estimate of 3,350 crore (US$633.15 million) per MHz. The original plan for awarding licences was to follow a first-come-first-served policy to applicants. A. Raja manipulated the rules so that the first-come-first-served policy would kick in - not on the basis of who applied first for a license, but who complied with the conditions. On 10 January 2008, companies were given just a few hours to provide their Letters of Intent and cheques. Those allegedly tipped off by Mr Raja were waiting with their cheques and other documents. Some of their executives were sent to jail along with the Minister himself.

- 11. K.E.S. SHROFF COLLEGE Page 11 Background India is divided into 22 telecom zones, with a total of 281 zonal licenses in the market. According to the telecom policy of India, when a licence is allotted to an operator, some start-up spectrum is bundled along with it. The policy does not have a provision for auctioning the spectrum. In 2008, 122 new second generation (2G) Unified Access Service (UAS) licenses were given to telecom companies at the 2001 price and on a first-come-first-serve basis. As per the chargesheet filed by the Central Bureau of Investigation (CBI), several rules were violated and bribes were paid to favour certain firms while awarding 2G spectrum licenses. The audit report of Comptroller and Auditor General of India (CAG) says that several licenses were issued to firms with no prior experience in the telecom sector or were ineligible or had suppressed relevant facts. In November 2007 Prime Minister of India Dr Manmohan Singh had written a letter to telecom minister A. Raja directing him to ensure allotment of 2G spectrum in a fair and transparent manner and to ensure license fee was properly revised. Raja wrote back to the Prime Minister rejecting many of his recommendations. In the same month Ministry of Finance wrote a letter to Department of Telecommunications (DOT) raising concerns over the procedure adopted by it but DOT went ahead with its plan of giving 2G licenses. It preponed the cut-off date to 25 September, from 1 October 2007. Later on the same day, DoT posted an announcement on its website saying those who apply between 3.30 and 4.30 pm on that very day would be issued licences in accordance with the said policy. Companies like Unitech & Swan Telecom got licenses without any prior telecom experience. Swan Telecom got the license even though it did not meet eligibility criteria. Swan got license for 1,537 crore (US$290.49 million) and then it sold 45% stake to UAE based company Etisalat for 4,200 crore (US$793.8 million).Unitech Wireless, a subsidiary of the Unitech Group, got license for 1,661 crore (US$313.93 million) and later sold 60% stake for 6,200 crore (US$1.17 billion) to Norway based company Telenor. Following is the list of companies who received 2G licenses during the tenure of A. Raja as Telecom Minister. (The licenses were later quashed by Supreme Court) Parties accused of involvement The selling of the licenses brought attention to three groups of entities – politicians and bureaucrats who had the authority to sell licenses, corporations who were buying the licenses and media professionals who mediated between the politicians and the corporations. On 2 February 2012 Supreme Court of India delivered judgement on petitions filed by Subramanian Swamy and Centre for Public Interest Litigation (CPIL) which had challenged allotment of 2G licenses granted in 2008.The Supreme Court quashed all 122 spectrum licences granted during the tenure of former communications minister

- 12. K.E.S. SHROFF COLLEGE Page 12 A Raja. and described the allocation of 2G spectrum as "unconstitutional and arbitrary". The bench of Justice GS Singhvi & Justice AK Ganguly imposed fine of 5 crore (US$0.95 million) on Unitech Wireless, Swan telecom and Tata Teleservices and 50 lakh (US$94,500) fine on Loop Telecom, S Tel, Allianz Infratech and Sistema Shyam Tele Services Ltd.The Supreme Court's ruling said the current licences will remain in place for four months, in which time the government should decide fresh norms for issuing licences. Telecom companies affected by cancellation of licenses The table below shows list of companies whose license were cancelled Name of company Parent group Number of licenses cancelled Uninor Joint venture between Unitech Group of India and Telenor of Norway Unitech Group 22 Sistema Shyam TeleServices Limited, now MTS India Joint venture between Shyam group of Indian and Sistema of Russia 21 Loop Mobile formerly BPL Mobile Owned by Khaitan Holding Group 21 Videocon Telecommunications Limited Owned by Videocon group of India 21 Etisalat-DB Joint venture between Swan Telecom of India and Etisalat of UAE 15 Idea Cellular Aditya Birla Groupof India (49.05%), Axiata Group Berhad of Malaysia (15%) & Providence Equity(10.6%)of USA 13

- 13. K.E.S. SHROFF COLLEGE Page 13 Response to scam Opposition demands Joint Parliamentary Committee (JPC) - As soon as the Indian media started citing Comptroller and Auditor General of India's report which pegged the loss at 1.76 lakh crore, the Indian opposition parties unanimously demanded formation of Joint parliamentary committee (JPC) to investigate 2G scam. However the Indian government rejected the demand of opposition.Later when the winter session of parliament began on 9 November 2010, opposition again pressed for (JPC) but once again the demand was rejected. The opposition's demand for (JPC) gained further momentum when Comptroller and Auditor General of India's report was tabled in Parliament on 16 November 2010. The opposition blocked parliament proceedings and again pressed for JPC. With Govt again rejecting the demand there was logjam in parliament. Speaker of the Lok Sabha, Meira Kumar tried to break the logjam but her efforts didn't bear any fruit. Finally the winter session of parliament concluded on 13 December 2010 . The plan was to introduce 22 new bills, take up 23 pending bills for consideration and passing and withdraw three bills but that didn't happen because the parliament was allowed to function for only 9 hours. In February 2011, after resisting the Opposition demand for over three months, the government finally agreed to constitute a Joint Parliamentary Committee (JPC) to probe the 2G spectrum allocation issue. The government announced it formally on 22 February 2011. On 24 July 2012, JPC took CBI to task for the leniency shown to PM, AG, Dayanidhi Maran and Chidambaram and reluctance to investigate their role in 2G Spectrum scam. Recently after questioning former telecom minister Dayanidhi Maran, his brother Kalanithi and the head of Maxis Communications, CBI alleged that Maran brothers have accrued illegal gratification of Rs 550 crore by purchase of Sun Direct TV share at highly "inflated prices". Jayalalitha accuses M. Karunanidhi - In early November 2010 Jayalalithaa accused the state chief minister M Karunanidhi of protecting A. Raja from corruption charges and called for A. Raja's resignation By mid November A. Raja resigned. Concerns and controversies over the 2010 Commonwealth Games A number of concerns and controversies surfaced before the 2010 Commonwealth Games in New Delhi, India, which received widespread media coverage both in India (the host nation) and internationally. The Commonwealth Games was severely criticised by several prominent Indian politicians and social activists because billions of dollars have been spent on the sporting event despite the fact that India has one of the world's largest concentration of poor people. Additionally, several other problems related to the 2010 Commonwealth Games have been highlighted by Indian investigative agencies and media outlets; these include — serious corruption by officials of the Games' Organising Committee, delays in the construction of main Games' venues, infrastructural compromise, possibility of a terrorist attack, and exceptionally poor ticket sales before the event.

- 14. K.E.S. SHROFF COLLEGE Page 14 Socio-economic impact Social and environmental impact Nearly 400,000 people from three large slum clusters in Delhi have been relocated since 2004. Gautam Bhan, an Indian urban planner with the University of California-Berkeley, said that the 2010 Commonwealth Games have resulted in "an unprecedented increase in the degree, frequency and scale of indiscriminate evictions without proper resettlement. We haven‘t seen [these] levels of evictions in the last five years since the Emergency." In response to a Right to Information (RTI) application filed for study and statements by civil society groups, a report by the Housing and Land Rights Network (HLRN) - an arm of the Habitat International Coalition - detailed the social and environmental consequences of the event. It stated that no tolerance zones for beggars are enforced in Delhi, and the city has arbitrarily arrested homeless citizens under the "Bombay Prevention of Begging Act 1959". Labour laws violations Campaigners in India have accused the organisers of enormous and systematic violations of labour laws at construction sites. Human Rights Law Network reports that independent investigations have discovered more than 70 cases where workers have died in accidents at construction sites since work began Although official numbers have not been released, it is estimated that over 415,000 contract daily wage workers are working on Games projects. Unskilled workers are paid 85 (US$1.6) to 100 (US$1.9) per day while skilled workers are paid 120 (US$2.3) to 130 (US$2.5) INR per day for eight hours of work. Workers also state that they are paid 134 (US$2.5) to 150 (US$2.8) for 12 hours of work (eight hours plus four hours of overtime). Both these wages contravene the stipulated Delhi state minimum wage of 152 (US$2.9) for eight hours of work. Nearly 50 construction workers have died in the past two years while employed on Games projects. These represent violations of the Minimum Wages Act, 1948; Interstate Migrant Workmen (Regulation of Employment and Condition of Services) Act 1979, and the constitutionally enshrined fundamental rights per the 1982 Supreme Court of India judgement on Asiad workers. The public have been banned from the camps where workers live and work – a situation which human rights campaigners say prevents the garnering of information regarding labour conditions and number of workers. There have been documented instances of the presence of young children at hazardous construction sites, due to a lack of child care facilities for women workers living and working in the labour camp style work sites. Furthermore, workers on the site of the main Commonwealth stadium have reportedly been issued with hard hats, yet most work in open-toed sandals and live in cramped tin tenements in which illnesses are rife. The High Court of Delhi is presently hearing a public interest petition relating to employers not paying employees for overtime and it has appointed a four-member committee to submit a report on the alleged violations of workers rights.

- 15. K.E.S. SHROFF COLLEGE Page 15 During the construction of the Games Village, there was controversy over financial mismanagement, profiteering by the Delhi Development Authority and private real estate companies, and inhumane working conditions. Child labour CNN has broadcast evidence showing children, as young as seven, being used in the construction of the game venues. According to Siddharth Kara, who provided CNN with the evidence, he documented 14 cases of child labor within a few days. In reply to a question whether it could have been just a case of kids being present at the construction site along with their parents, he replied: "It's not just kids playing in the dirt or using a hammer as a toy." He further stated about the kids: "They're told to do the work and they just do the work. They don't know that they should be in school or that they should be playing." Even though the New Delhi chief minister Sheila Dikshit claimed that nobody had approached her, according to CNN, they had tried to contact her as far back as 23 July 2010. In spite of repeated attempts, according to them, no official reply was ever made. Preparation delays In September 2009, CGF chief Mike Fennell reported that the games were at risk of falling behind schedule and that it was "reasonable to conclude that the current situation poses a serious risk to the Commonwealth Games in 2010". A report by the Indian Government released several months prior found that construction work on 13 out of the 19 sports venues was behind schedule. The Chief of the Indian Olympic Association Randhir Singh has also expressed his concerns regarding the current state of affairs. Singh has called for the revamp of the Organising Committee commenting that India now has to "retrieve the games" Other Indian officials have also expressed dismay at the ongoing delays but they have stated that they are confident that India will successfully host the games and do so on time. As the Times of India reports, all CWG projects were to be completed by May 2009 and the last year should have been kept for trial runs. The newspaper further reports that the first stadium was handed over for trial runs in July 2010 only. To put the delays in perspective, Beijing National Stadium was completed much ahead of schedule for the 2008 Summer Olympics, while the venues for 2012 Summer Olympics in London are scheduled to be delivered one year before the games and the construction of the venues is on track. In August 2010, the Cabinet Secretariat took a decision to appoint 10 officers of the rank of Joint and Additional Secretaries to oversee the progress of the construction of stadiums. Each officer is allocated a stadium and given the responsibility to ensure that the work completes in time for the games.

- 16. K.E.S. SHROFF COLLEGE Page 16 Mass volunteer walkout Around 10,000 of the 22,000 selected volunteers quit, less than a week before the event. This has been blamed on a lack of training for personnel, or dissatisfaction with assignments. There are reports that some who have quit have not returned their uniforms. Poor ticket sales and attendance The start of the Games saw extremely poor ticket sales, with many venues near empty. In a press conference, organising chairman Suresh Kalmadi admitted that there were problems, and blamed empty venues on ticket booths not being set up outside stadiums. Commonwealth Games chief Mike Fennell admitted that many venues had been nearly empty on the opening day of the Games, saying "A number of venues do not have lots of spectators [...] one area which causes us concern" On the second day of competition, less than 100 people filled the hockey venue–the 19,000-seat MDC Stadium. Less than 20 people watched the first tennis match of the tournament in the 5,000-seat tennis stadium, and just 58 fans watched the netball opening match. One Indian competitor tried to buy tickets for relatives online, only to be informed by the website that tickets were sold out. When he arrived to compete, he found the venue to be empty. The streets of Delhi were deserted for the cycling road races and walking event. Spectators' response at opening ceremony At the opening ceremony, the chairman of the organising committee, Suresh Kalmadi, faced embarrassment, when he was booed by spectators at the start of his welcome speech to 60,000 spectators Kalmadi came under further strain when he "thanked" the late Princess Diana for attending the opening ceremony of the games. The chairman made the blunder at a press conference saying ‘Yes, Princess Diana was there,‘ after which he immediately corrected himself by saying ‗Prince Charles and (Camilla) the Duchess of Cornwall. Opening ceremony The Australian Commonwealth contingent expressed frustration over the opening ceremony, in which there were claims that the athletes and delegation support staff were "treated like cattle" and subjected to "disgraceful" and unbearable conditions. Australia's chef de mission Steve Moneghetti complained about the athletes being trapped in "absolute cauldron conditions" under the main stadium before marching for the opening ceremony. The Australians were stuck in a tunnel, where Moneghetti described the temperature as exceeding 40 °C (104 °F) due to a lack of airconditioning and ventilation.

- 17. K.E.S. SHROFF COLLEGE Page 17 When attempting to move out, the Australian delegation was stopped by staff. When the contestants were finally able to move out into the arena, they were described as being emotionally affected. Racism allegations African countries have complained that they are getting second-class treatment from the Games organisers, in spite of them offering India a hand in the preparation of the Games. They have alleged that accommodation given to them was inferior compared to the accommodation provided to the Australian and New Zealand teams. They went on to state that India was complaining about being victims of racial bias in the reporting of the Games; while simultaneously perpetrating the same kind of racism against the African countries. Infrastructure issues Transport infrastructure The Delhi Airport Metro Express built by Reliance Infrastructure and CAF Beasain missed its deadline of 31 July 2010 and the private consortium was fined Rs 11.25 crore. Venues Less than two weeks before the opening ceremony, Fennell wrote to the Indian cabinet secretary, urging action in response to the village being "seriously compromised." He said that though team officials were impressed with the international zone and main dining area, they were "shocked" by the state of the accommodation. "The village is the cornerstone of any Games and the athletes deserve the best possible environment to prepare for their competition." The BBC published photographs of the village taken two days before 23 September showing unfinished living quarters. New Zealand, Canada, Scotland and Northern Ireland have expressed concern about unliveable conditions. The Times of India newspaper reports that the Scottish delegation apparently submitted a photograph of a dog defecating on a bed in the games village Hooper said that there was "excrement in places it shouldn't be" in the athletes' quarters and that members of visiting delegations had to help clean up the unsanitary things The BBC released images of bathrooms with brown-coloured paan stains on the walls and floor, liquids on the floor, and brown paw prints on athletes' beds. Lalit Bhanot, the secretary general of the Organising Committee, rejected the complaint that sanitation was poor by saying that, due to cultural differences, there are different standards about cleanliness in India and the western world, a statement for which he was widely ridiculed in Indian and international media. Bhanot went on to say of the athletes' village that, "This is a world-class village, probably one of the best ever."

- 18. K.E.S. SHROFF COLLEGE Page 18 Meanwhile, Pakistan also made reservations over the condition of the athletes‘ village and asked for an alternate accommodation to be made available to its contingent while preparation was still in progress. The Pakistan Olympic Association president Arif Hasan remarked: "We want the CGF to ensure that the athletes‘ village is in good condition. Athletes cannot stay at a substandard place." Hasan however added that there were no doubts over Pakistan‘s participation and the contingent would leave as planned. On the other hand, England's Chef de mission Craig Hunter praised the Games Village, remarking that "the Commonwealth Games Village here [in New Delhi] is better than the Beijing Olympics". He added that the arrangements at the Games Village is much better than that at the 2008 Summer Olympics. Canada's sports minister also supported the Games, saying that big events always face issues, and the media often exaggerates them, as Canada found during the Vancouver Winter Olympics. He added that "We are coming in full force." Problems with functionality of equipment and infrastructure during events On the first night of swimming, debris landed in the swimming pool, causing delays ahead of a race. It is believed that part of the ceiling or its paint had fallen off. Before the last night of swimming finals, the filtration system broke down and the pool was turbid and murky during the warmup session and the finals, and the pool has been described as the least clear ever seen for a swimming competition. A disproportionate number of swimmers fell ill with intestinal complaints, leading to concerns over the cleanliness and sanitation of the pool Early suspicions rested on the quality of water in the swimming pools of the SPM Complex, but other competing teams, including South Africa, reported no such illness.] Daily water quality tests were being carried out on the water of the pools, as mandated by the event standards. Additional tests were ordered after news of the illnesses, but they also did not find anything amiss. The Australian team's chief doctor, Peter Harcourt, ruled that the "chances of the [Delhi] pool being the cause of the problem is very remote" and praised the hygiene and food quality in the Delhi Games Village. He suggested that it could be a common case of Traveler's diarrhea (locally called Delhi belly), or the Australian swimmers could have contracted the stomach virus during their training camp in Kuala Lumpur, Malaysia. English Olympic and Commonwealth gold-medalist swimmer Rebecca Adlington said that the water quality was absolutely fine. A dog entered the athletics arena. After the opening ceremony, the ground at the athletics arena was damaged, and the grass infield and the track was still being re-laid two hours before competition started. Athletes under investigation for trashing apartments Australian athletes have been accused of vandalizing the towers of the athletes' village they were staying in by breaking furniture and electrical fittings Delhi Police did not press the case after the Organizing Committee refused to file a complaint while Indian external affairs minister SM Krishna dismissed it as a one-off incident. A washing machine was hurled from the eighth floor of the same tower. Nobody on the ground was hit, but it is unclear who the culprit was. Indian newspapers have reported that the Australian Commonwealth Games Authority agreed to pay for the damages[ and have apologised for the incident.

- 19. K.E.S. SHROFF COLLEGE Page 19 The Australian High Commissioner rejected the claim, stating that the incident was the result of partying and celebrations. Later comments by Australian officials have contradicted claims by Lalit Bhanot that they had admitted responsibility. Perry Crosswhite said that it was still unclear if athletes from other nations present in the tower at the time had been responsible. Safety and security concerns Small monkeys roam Delhi's streets and prefer heavily urbanized areas with plenty of living space among buildings. They cannot be killed because many Indians see them as sacred so instead a larger, domesticated monkey, the langur, is brought in to scare away the smaller monkeys. On the second day of the games, three Ugandan officials were injured by a malfunctioning security barrier at the games' village, and a senior official from that country raised allegations of discrimination by Indian officials. Uganda's sports minister lashed out at Indian officials and demanded an apology for the accident. The officials had cuts and bruises and were hospitalized overnight for observation The chairman of the Games' Organising Committee, Suresh Kalmadi, apologized to the Ugandan High Commissioner to India for the freak car accident Infrastructural compromise On 21 September 2010, a footbridge under construction for the Games near the Jawaharlal Nehru Stadium collapsed, injuring at least 23 people, mainly workers, underscoring fears of poor workmanship. Commenting on the incident, Chief Minister of Delhi Sheila Dikshit controversially remarked that the footbridge was only meant for spectators and not for athletes. Following the collapse, Fennell expressed concern that conditions at the Games Village, which had "shocked the majority", would seriously compromise the entire event. The company that was building the foot bridge, P&R Infraprojects, was subsequently blacklisted by the Delhi Government and was not allowed to get government contracts. Terror threats Following the 2008 Mumbai attacks, some athletes and their representative bodies expressed security fears during the games. In April 2010, during the Indian Premier League, two low intensity bombs went off outside the stadium in Bangalore. Although there were no casualties, this postponed the start of the game by an hour. Following this attack, foreign cricketers like Kevin Pietersen expressed fears for their safety and questions were raised regarding the safety of athletes during the Commonwealth Games The UK and Canada also warned about potential attacks on commercial targets in Delhi ahead of the games.

- 20. K.E.S. SHROFF COLLEGE Page 20 Fear of dengue outbreak The heaviest monsoon rains in 15 years, along with large quantities of standing water on CWG construction sites as well as in tanks and ponds, raised concerns over increased levels of mosquito-borne disease in Delhi.[ In the run-up to the games it was reported that 65-70 cases ofdengue fever were being diagnosed each day in the city, with the number of cases "likely to hit the 3,000 mark" by the opening on 3 October. Illness Many swimmers were reported to have fallen ill. Initially, concerns were raised over the quality of water in the swimming pools of the SPM Complex. It was said that more than 20 percent of the English team's swimmers — about eight to 10 competitors — had been struck down with a stomach virus. The Australian team also reported that at least six of its swimmers had been sick, including Andrew Lauterstein, who had to withdraw from the 50-meter butterfly. Commonwealth Games Federation president Mike Fennell said officials would conduct tests to make sure the pools were not the source of the illness.However, other competing teams, including South Africa, reported no such illness. Daily water quality tests were being carried out on the water of the pools, as mandated by the event standards. Additional tests were ordered after news of the illnesses, but they also did not find anything amiss. The Australian team's chief doctor, Peter Harcourt, ruled that the "chances of the [Delhi] pool being the cause of the problem is very remote" and praised the hygiene and food quality in the Delhi Games Village. He suggested that it could be a common case of Traveler's diarrhea(locally called Delhi belly), or the Australian swimmers could have contracted the stomach virus during their training camp in Kuala Lumpur, Malaysia. English Olympic and Commonwealth gold-medalist swimmer Rebecca Adlington said that the water quality was absolutely fine.

- 21. K.E.S. SHROFF COLLEGE Page 21 Reactions and responses Responding to media concerns, the organisers said there were 48 hours to save the Games after warnings of a pull out. Numerous Bollywood actors also expressed their dismay at the state of the Games. Four days before the start of the games the opening, the closing ceremonies, and the 100 m athletics, were still not sold out. The Sydney Morning Herald wrote that despite Kalmadi's "blind optimism", the games were not going to be the best ever. Instead, it wrote that it was "probably the most interesting." The opening ceremony played a key role in improving the image of the Games. As athletes arrived and competitions started, many earlier critics changed their view. The Australian Sports Minister said that India could now aim for the Olympics, and the President of the International Olympic Committee, Jacques Rogge, said that India had made a good foundation for a future Olympics bid.[127][128] As the Games concluded, many observers remarked that they began on an apprehensive note, but were an exceptional experience with a largely positive ending Some observers accused sections of the media of bias, unfair expectations, and negative reporting. Within India, the Games saw criticism due to the Games' origins as a celebration of the British Empire, with Arindam Chaudhuri arguing for India's disassociation from the "slavish games" which he viewed as a "celebration of racial discrimination, colonialism [and] imperialism".

- 22. K.E.S. SHROFF COLLEGE Page 22 CHAPTER-4 SATYAM SCAM Ramalinga Raju is a former Indian IT Industrialist, who founded Satyam Computers in 1987 and was a Chairman of the company until January 7, 2009. Early life Ramalinga Raju was born on September 16, 1954 in a family of farmers. He did his B. Com from Andhra Loyola College at Vijayawada and subsequently did his MBA from Ohio University, USA. He was enrolled in the Executive Owner/President Management Program (OPM) at Harvard Business School. After returning to India in 1977, Ramalinga Raju moved away from the traditional agriculture business and set up a spinning and weaving mill named Sri Satyam. . Thereafter he shifted to the real estate business and started a construction company called Satyam Constructions. In 1987, Ramalinga Raju founded Satyam Computer Services along with one of his brothers-in-law, DVS Raju. The company went public in 1992. With the launch of Satyam Infoway (Sify) Satyam became one of the first to enter Indian internet service market. Accounting scandal Ramalinga Raju resigned from the Satyam board after admitting to falsfiying revenues, margins and over Rp50bn of cash balances as the company. A botched acquisition attempt involving Maytas in December 2008 led to a plunge in the share price of Satyam. In January 2009, Raju indicated that Satyam's accounts had been falsified over a number of years. He admitted to an accounting dupery to the tune of 14000 crore rupees or 1.5 Billion US Dollars and resigned from the Satyam board on January 7, 2009. In his letter of resignation, Raju described how an initial cover-up for a poor quarterly performance escalated: "It was like riding a tiger, not knowing how to get off without being eaten." Raju and his brother, B Rama Raju, were then arrested by the CID Andhra Pradesh police headed by Mr. V S K Kaumudi, IPS on charges of breach of trust, conspiracy, cheating, falsification of records. Raju may face life imprisonment if convicted of misleading investors. Raju had also used dummy accounts to trade in Satyam's shares, violating the insider trading norm. It has now been alleged that these accounts may have been the means of siphoning off the missing funds. Raju has admitted to overstating the company's cash reserves by USD$ 1.5

- 23. K.E.S. SHROFF COLLEGE Page 23 billion. Raju was hospitalized in September 2009 following a minor heart attack and underwent angioplasty. Raju was granted bail on condition that he should report to the local police station once a day and that he shouldn't attempt to tamper with the current evidence. This bail was revoked on 26 October 2010 by the Supreme Court of India and he has been ordered to surrender by 8 November 2010. The people of his native village, Garagaparru, hail the development works undertaken by the Byrraju Foundation, the charitable arm of Satyam. Ramalinga Raju was Granted a bail by the supreme court on 4 November 2011 after the Central Bureau of Investigation failed to chargesheet Raju within the statutory period. Supreme court verdict The Supreme Court on November 4, 2011 granted bail to Ramalinga Raju, founder and former chairman of outsourcing firm Satyam Computer Services Ltd, in a $1.5 billion financial fraud case, after the Central Bureau of Investigation (CBI) failed to file charges on time.

- 24. K.E.S. SHROFF COLLEGE Page 24 CHAPTER-5 HARSHAD MEHTA SCAM Harshad Shantilal Mehta was a famous stockbroker of his time. Mehta was famous for ripping higher profits from stock market and trading, and for his famous financial scandal, worth of 5,000 crore (US$945 million) in Bombay Stock Exchange (BSE), of 1992. He was tried for 9 years, until he died in the late 2001. Early life Mehta was born on 29 July 1953, at Paneli Moti, Rajkot district, in a Gujarati Jain family. His early childhood was spent in Kandivali, Mumbai, where his father was a small-time businessman. Later, the family moved to Raipur, Chattisgarh. Mehta studied in S S Kalibadi Higher Secondary School, in Raipur. He briefly worked for New India Assurance Company, until he decided to trade in the Stock Market of BSE and [NSE]. Career By 1990, Mehta rose to prominence in the stock market. He was buying shares heavily. The shares which attracted attention were those of Associated Cement Company (ACC). The price of ACC was bid up to Rs. 10,000. When asked, he used the replacement cost theory as an explanation. He was alleged to have an expensive lifestyle. Through the second half of 1991 Mehta had earned the nickname of the ‗Big Bull‘, because he was said to have started the bull run. Mehta made a brief comeback as a stock market guru, giving tips on his own website as well as a weekly newspaper column. On April 23, 1992, journalist Sucheta Dalal exposed Mehta's illegal methods in a column in The Times of India. Mehta was dipping illegally into the banking system to finance his buying.It was this ready forward deal that Mehta and his accomplices used with great success to channel money from the banking system. A typical ready forward deal involved two banks brought together by a broker in lieu of a commission. The broker handles neither the cash nor the securities, though that wasn‘t the case in the lead-up to the scam. In this settlement process, deliveries of securities and payments were made through the broker. That is, the seller handed over the securities to the broker, who passed them to the buyer, while the buyer gave the cheque to the broker, who then made the payment to the seller. In this settlement process, the buyer and the seller might not even know whom they had traded with, either being known only to the broker. This the brokers could manage primarily because by now they had become market makers and had started trading on their account. To keep up a semblance of legality, they pretended to be undertaking the transactions on behalf of a bank.

- 25. K.E.S. SHROFF COLLEGE Page 25 Another instrument used was the Bank receipt (BR). In a ready forward deal, securities were not moved back and forth in actuality. Instead, the borrower, i.e., the seller of securities, gave the buyer of the securities a BR. As the authors write, a BR ―confirms the sale of securities. It acts as a receipt for the money received by the selling bank. Hence the name - bank receipt. It promises to deliver the securities to the buyer. It also states that in the mean time, the seller holds the securities in trust of the buyer.‖ Having figured out his scheme, Mehta needed banks which issued fake BRs (Not backed by any government securities). ―Two small and little known banks - the Bank of Karad (BOK) and the Metropolitan Co-operative Bank (MCB) - came in handy for this purpose. These banks were willing to issue BRs as and when required, for a fee,‖ the authors point out. Once these fake BRs were issued, they were passed on to other banks and the banks in turn gave money to Mehta, assuming that they were lending against government securities when this was not really the case. This money was used to drive up the prices of stocks in the stock market. When time came to return the money, the shares were sold for a profit and the BR was retired. The money due to the bank was returned. This went on as long as the stock prices kept going up, and no one had a clue about Mehta‘s operations. Once the scam was exposed, though, a lot of banks were left holding BRs which did not have any value - the banking system had been swindled of a whopping 4,000 crore (US$756 million). When the scam was revealed, the Chairman of the Vijaya Bank committed suicide by jumping from the office roof. He knew that he would be accused if people came to know about his involvement in issuing checks to Mehta. M J Pherwani of UTI also died in this scandal. Exposure and trial Exploiting several loopholes in the banking system, Mehta and his associates siphoned off funds from inter-bank transactions and bought shares heavily at a premium across many segments, triggering a rise in the Sensex. When the scheme was exposed, banks started demanding their money back, causing the collapse. He was later charged with 72 criminal offenses, and more than 600 civil action suits were filed against him. He was arrested and banished from the stock market with investigators holding him responsible for causing a loss to various entities. Mehta and his brothers were arrested by the CBI on November 9, 1992 for allegedly misappropriating more than 27 lakh shares (2.7 million) of about 90 companies, including ACC and Hindalco, through forged share transfer forms. The total value of the shares was placed at 250 crore (US$47.25 million). Bribery case Mehta again raised a furore in 1995 when he made a public announcement that he had paid 1 crore (US$189,000) to the then Congress President and Prime Minister, Mr P.V. Narasimha Rao, as donation to the party, for getting him off the scandal case.

- 26. K.E.S. SHROFF COLLEGE Page 26 Death Mehta was under judicial custody in the Thane prison. Mehta complained of chest pain late at night and was admitted to the Thane civil Hospital. He died following a brief heart ailment, at the age of 47, in December 31, 2001. He is survived by his wife and two sons. Mehta died on with many litigation still pending against him. He had altogether 28 cases registered against him. The trial of all except one, are still continuing in various courts in the country. Market watchdog, Securities and Exchange Board of India, had banned him for life from stock market-related activities.

- 27. K.E.S. SHROFF COLLEGE Page 27 CHAPTER-6 KETAN PAREKH SCAM Who is Ketan Parekh? Ketan Parekh is a former stockbroker based in Mumbai who was convicted in 2008 for being involved in engineering the technology stocks scam in India‘s stock market in 1999-2001. A chartered accountant by training, Parekh comes from a family of brokers and is currently serving a period of disqualification from trading in the Indian bourses till 2017. Ketan Parekh has been accorded with sobriquets such as the Pentafour Bull and the One Man Army by the country‘s national business newspapers, while the market simply refers to him as ‗KP‘ or associates him with his firm NH Securities. Parekh is known to have no reluctance in meeting the press. He is also known to have razor-sharp forecasts on market developments. What distinguishes Ketan Parekh from the 'Big Bull' late Harshad Mehta? The two have been compared by people to have operated their scams using similar means and that their backgrounds were similar as well. But the differences are very conspicuous. At the outset, Mehta came from a lower middle-class and modest background, while KP‘s family has been engaged as stockbrokers for a significant time. He is also related to many prominent brokers. Secondly, when Mehta was operating, the market was still a closed one and was just beginning to liberalize. It was revealed later that Mehta operated using the money of other people as his last recourse. Further, Mehta is known to have resorted to aggressive publicity campaigns whereas KP operates almost clandestinely. The latter has also been successful at creating stories and selling them aggressively to institutional investors. The Midas touch Parekh attracted the attention of market players and they kept track of every move of Parekh as everything he was laying his hands on was virtually turning into gold. But the Pentafour Bull still kept a low profile, except when he hosted a millennium party that was attended by politicians, business magnates and film stars. And by 1999-2000, as the technology industry began embracing the entire world, India‘s stock markets started showing signs of hyper-activity as well and this was when KP struck. Almost everyone, from investment firms which were mostly controlled by promoters of listed companies to foreign corporate bodies and cooperative banks were eager to entrust their money with Parekh, which, he in turn used to inflate stock prices by making his interest obvious. Almost immediately, stocks of firms such as Visual soft witnessed meteoric rises, from Rs 625 to Rs 8,448 per unit, while those of Sonata Software were up from Rs 90 to Rs 2,150. However, this fraudulent scheme did not end with price rigging. The rigged-up stocks needed dumping onto someone in the end and KP used financial institutions such as the UTI for this. When companies seek to raise money from the stock market, they take the help of brokers to back them in raising share prices. KP formed a network of brokers from smaller bourses such as the Allahabad Stock Exchange and the Calcutta Stock Exchange. He also used ‗BENAMI‘ or

- 28. K.E.S. SHROFF COLLEGE Page 28 share purchase in the names of poor people living in Mumbai‘s shanties. KP also had large borrowings from Global Trust Bank and he rigged up its shares in order to profit significantly at the time of its merger with UTI Bank. While the actual amount that came into Parekh's kitty as loan from Global Trust Bank was reportedly Rs 250 crore, its chairman Ramesh Gelli is known to have repeatedly asserted that Parekh had received less than Rs 100 crore in keeping with RBI norms. Parekh and his associates also secured Rs 1,000-crore as loan from the Madhavpura Mercantile Co-operative Bank despite RBI regulations that the maximum amount a broker could get as a loan was Rs15-crore. Hence, it was clear that KP‘s mode of operation was to inflate shares of select companies in collusion with their promoters. Lady luck disfavours Parekh! Notably, a day after the presentation of the Union Budget in February 2001, Parekh appeared to have run out of luck. A team of traders, Shankar Sharma, Anand Rathi and Nirmal Bang, known as the bear cartel, placed sell orders on KP‘s favorite stocks, the so called K-10 stocks, and crushed their inflated prices. Even the borrowings of KP put together could not rescue his scrips. The Global Trust Bank and the Madhavpura Cooperative were driven to bankruptcy as the money they had lent Parekh went into an abyss with his reportedly favourite K-10 stocks. The exposure of the dupe As with the Harshad Mehta scam, Ketan Parekh's fraudulent practices were first exposed by veteran columnist Sucheta Dalal. Sucheta's column read, ―It was yet another black Friday for the capital market. The BSE sensitive index crashed another 147 points and the Central Bureau of Investigation (CBI) finally ended Ketan Parekh‘s two-year dominance of the market by arresting him in connection with the Bank of India (BoI) complaint. Many people in the market are not surprised with Parekh‘s downfall because his speculative operations were too large, he was keeping dubious company, and he was dealing in too many shady scrips.‖ When the prices of select shares started constantly rising, innocent investors who had bought such shares believing that the market was genuine were about to stare at huge losses. Soon after the scam was exposed, the prices of these stocks came down to the fraction of the values at which they had been bought. When the scam did actually burst, the rigged shares lost their values so heavily that quite a few people lost their savings. Some banks including Bank of India also lost significant amounts of money. Dalal goes on to state that Parekh's scheme was not visible to a layman given the positive deflection that media had made him a hero while some of the biggest national dailies had even quoted him profusely on that year‘s Union Budget. Dalal added that KP‘s arrest and the uncanny similarity of his operations to the Harshad Mehta securities scam of 1992 vindicated the miserable inadequacy of the country‘s regulatory system. The Securities Exchange Board of India (SEBI) and the Reserve Bank of India (RBI) had remained complacent when the stock bubble was created during the latter half of 1999 and through 2000 while it had not bothered to take any action through 2001 when it was ready to burst. SEBI‘s damage control measures SEBI investigations into Parekh's money laundering affairs revealed that KP had used bank and promoter funds to manipulate the markets. It then proceeded with plugging the many loopholes in the market. The trading cycle was cut short from a week to a day. The carry-forward system in stock trading called ‗BADLA‘ was banned and operators could trade using this method. SEBI

- 29. K.E.S. SHROFF COLLEGE Page 29 formally introduced forward trading in the form of exchange-traded derivatives to ensure a well- regulated futures market. It also did away with broker control over stock exchanges. In KP‘s case, the SEBI found prima facie evidence that he had rigged prices in the scrips of Global Trust Bank, Zee Telefilms, HFCL, Lupin Laboratories, Aftek Infosys and Padmini Polymer. Furthermore, the information provided by the RBI to the Joint Parliamentary Committee (JPC) during the investigation revealed that financial institutions such as Industrial Development Bank of India (IDBI Bank) and Industrial Finance Corporation of India (IFCI) had given loans of Rs 1,400 crore to companies known to be close to Parekh. Criticism of SEBI Some of the regulatory actions SEBI undertook came under scathing criticism from some quarters who accused it of still being clueless about its supervisory duties. Observers said the regulator still continued believing that its only priority was to prevent a fall in stock prices. It was rumored that SEBI banned short sales and increased margins creating a virtual cash market in the process and squeezed turnover to a sixth of the normal level. It also fired all broker directors from the Bombay Stock Exchange and Calcutta Stock Exchange and declared the completion of three controversial settlements of the Kolkata bourse by retaining a sizeable proportion of the payout of operators who had allegedly tied-up for collusive deals. Furthermore, SEBI rounded up the bear operators and launched an inquiry into their alleged short sales. Stringent regulatory measures follow Parekh episode Parekh's fraudulent operations motivated the authorities to take necessary steps that have made made India's stock markets relatively safer in present times. He can also be credited for having forced indolent policy-makers to bring about reforms in the financial system. An active trader According to an Intelligence Bureau report, though disbarred from trading in the country‘s bourses until 2017, is still operating in the markets through conduits, vindicating Dalal Street‘s belief that he has never left the market. The report says that as recently as December 2010, KP has been rallying behind different stocks and placing some of them at rigged up prices to large institutions such as the LIC. He is operating through little-known investment firms, market operators and a following of loyal brokers. KP, who was at the forefront during the technology shares-led bull run in 1999-2000, is apparently using front entities such as Orchid Chemicals , GMR Infrastructure, Cairn India, Deccan Chronicles Holdings, Reliance Industries, Punj Lloyd, Indiabulls Real Estate, Pipavav Shipyard, Amtek Auto, Hindustan Oil Exploration, UCO Bank, State Bank of India, EIH and JSW Steel, among others, to trade in shares. The report further states that KP has been instrumental in inflating the share price of SKS Microfinance from Rs850 to Rs1,100 following its listing in August 2010. He has also rigged IPOs of little known companies by buying out 50% of the issue in collusion with his Kolkata- based associates. KP and his associates have also acquired very large positions in petroleum companies such as ONGC and HPCL, according to the report. An IB official has further said that KP and his team have revealed to their close associates that they have insider information on the government's proposal to decontrol the sale of gas which is expected to raise profit margins of these companies by about 20%.

- 30. K.E.S. SHROFF COLLEGE Page 30 CHAPTER-7 UTI SCAM Robbery Through other Means The line between ‗legitimate‘ business and the mafia is getting increasingly diffused. The greater the liberalisation/globalisation of the economy, the more rampant is the loot. Phoolan Devi as a dacoit in the ravines of Madhya Pradesh could not even dream of the type of wealth made as a Member of Parliament. Her wealth at the time of her death was estimated at a minimum of Rs. 10 crores. But this is small fry compared to the Harshad Mehtas, Bharat Shahs, Ketan Parekhs, Subramanyams etc and the top politicians/bureaucrats/corporate houses with whom they are linked. Phoolan Devi appears as a petty thief compared to these gangsters. The amount robbed through the UTI scam intails thousands of crores — the bulk of which belongs to small investors who have put their life-savings into this scheme. What is the UTI ? The Unit Trust of India is the largest mutual fund in the country created in 1964 through an act of parliament. Mutual Funds are financal institutions that invest people‘s money in various schemes, giving a ‗gauranteed‘ return to the investor. The UTI (of which the US-64 scheme is the largest) was set-up specifically to channel small savings of citizens into investments giving relatively large returns/interest. The US-64 scheme has 2 crore investors, the bulk of whom are small savers, retired people, widows and pensioners. Besides the US-64 the UTI runs 87other schemes giving inverstors various options. But the US-64 has been most popular, giving returns as high as 18% in 1993 and 94. Genisis of the Scam Liberalisation of the economy immediately led to the liberalisation of the UTI, throwing it to the mercy of the stock market. In 1992, itself the US-64 scheme was changed from a debt-based fund to one linked to equity. In 1992 only 28% of its funds was in equity; today it is over 70%. Further liberalisation was pushed by Chidambram, as the finance minister of the U F government, who, in 1997, removed all government nominees from the board of the UTI. Besides, the US-64 does not come under SEBI regulations, its investment delails are kept secret (ever depositors cannot know where their funds are being parked) and the chairman has arbitrary powers to personally decide an investment upto a huge Rs 40 crores. Such ‗liberalisation‘ is tailor-made for frauds. Not surprisingly, within one year of Chidambram‘s liberalisation, in 1998, the UTI crashed, and the new BJP-led government organised a large Rs. 3,500 crore bail- out to prevent default.

- 31. K.E.S. SHROFF COLLEGE Page 31 It was during this crisis that the new chairman, P.S. Subramanyam, was appointed. Subramanyam was a direct appointee of thug Jayalalitha, who had made his selection a condition for her continuing the support of the then NDA government. Later, though Jayalalitha withdrew from the government, Subramanyam developed close links with the Prime Minister‘s Office, and corporative big-wigs. Small investor‘s funds were used to promote big business houses, shower favours to politicians, and invest huge amounts in junk bonds....all for a fat commission. Subramanyam functioned like a fascist, arbitrarily transferring hundreds of senior staff, in order to cover his tracks. He was a key player in the Ketan Parekh scam. Huge amount of UTI funds were channelled into the infamous K-10 list of Keten Parekh stock, such as Himachal Futuristic, Zee Telefilims, Global Tele, DSQ, etc. The UTI continued to buy these shares even when their market value began to crash in mid-2000, in order to prop up the share values of these stocks. The Trust saw its Rs. 30,000 portfolio (value of stocks) lose half its value within a year since Feb. 2000. To take just one example on how the UTI operated : In August 2000, much after the software stocks had begun to crash, the UTI bought Rs. 34 crores worth of shares in Cyberspace Infosys Ltd at the huge price of Rs 930 per share. Today the shares have no value and its Lacknow based promoters, the Johari Group, are in jail. But, what is astounding is that it was none other than India‘s prime minister, Vajpayee, who, as late as Jan. 31, 2001, laid the foundation stone for the Software Tectnology Park (STP) in Luknow, promoted by this group. (Incidentally the UP government had a 26% share in this STP). Coincidentally, in the four days when the UTI reversed its earlier decision and subscribed to 3.45 lakh shares of Cyberspace, Subramanyam had rung up N.K. Singh (then secretary in the PMO) at least 4 times. It does not take much imagination to link UTI purchases in Cyberspace with Vajpayee. Similar were the investments in DSQ Software, HFCL, Sriram Multitech. and others. Besides, the UTI also invested in junk bonds like Pritish Nandy communications (Rs. 1.5 crores), Jain Studios(Rs.5 crores), Sanjay Khan‘s Numero Uno International (Rs. 7.5 crores), Malavika Spindles(Rs. 188 crores) etc. This amounted to nothing but handing over people‘s money (investments) to the rich and powerful. Thereby thousands of crores were siphoned off to big business and prominent individuals, with the UTI chairman, bureaucrats and politicians taking their cuts. But this was not all. The fraud continues even further. With knowledge that the UTI was in a state of collapse, the Chairman organised a high profile propaganda campaign promoting UTI (spending crores of rupees on the top advertising company, Rediffusion), while at the same time leaking information to the big corporates to withdraw their funds. The Chairman thereby duped the lakhs of small investors through false propaganda, while allowing windfall profits to the handfull of big corporates who had invesed in UTI.

- 32. K.E.S. SHROFF COLLEGE Page 32 So, in the two month prior to the freezing of dealings in UTI shares, a gigantic sum of Rs. 4,141 crores was redeemed. Of this Rs.4,000 crores (97%) were corporate investments. What is more,they were re-purched at the price of Rs. 14.20 per share (face value Rs.10) when in fact its actual value (NAV — net asset value) was not more than Rs. 8. As a result UTI‘s small investors lost a further Rs. 1,300 crores to the big corporates. In fact these huge withdrawals further precipated the crisis. On July 4, 2001 the board of UTI took the unprecedented step of freezing the purchase and sale of all US-64 UTI shares for six months. Simultaneously it declared a pathetic dividend of 7% (10% on face-value), which is even lower than the interests of the banks and post office saving schemes. Such freezing of legally held shares is unheard of — and is like overnight declaring Rs. 100 notes as invalid for some time. In other words the 2 crore shareholders could not re-invest their money elsewhere — and would have to passively see their share price erode from Rs. 14 (at which they would have purchased it) to Rs 8 — and get interest at a mere 7% on their initial investments. Fearing a back-lash, the government/UTI later announced the ability to repurchase UTI shares at Rs. 10 — i.e. at 30 % below the purchase price. Imagine the plight of a retired person who would have put a large part of his/her PF, gratuity etc. in the US-64 scheme, considering it the safest possible investment. Not only has the person‘s income (interest/dividend) halved overnight, he/she also stands to lose a large part of the investment. So, a person who invested Rs. 1 lakh would now only get back Rs 70,000. Today, the entire middle class is being robbed of their savings — first it was by the private mutual funds (NBFCs), now by the govt. sponsored mutual fund. Those who gain are the robber barons who run the country‘s economics, finance, politics. The middle-classes, affected by these scame, will soon realise the facts and come out of the euphoria of consumerism that has numbed their senses. They will see through the hoax of globalisation/liberalisation, and will turn their wrath on these so-called pillars of society. It is important that this impending explosion be channeled in a revolutionary direction, or else it will be diverted by the ruling elite into fatricidal clashes. The middle-classes are most prone to fall prey to ruling-class propaganda. But life itself is the best educator. Faced with unemployment, loot of their savings, price rise of all essentials, etc. they will no doubt, join the working class and their peasant brethrens in revolt.