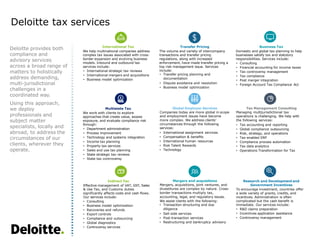

Deloitte tax services guide for international, transfer pricing, business, multistate, employer, management, indirect, and M&A taxes

- 1. Deloitte tax services Deloitte provides both compliance and advisory services across a broad range of matters to holistically address demanding, multi-jurisdictional challenges in a coordinated way. Using this approach, we deploy professionals and subject matter specialists, locally and abroad, to address the circumstances of our clients, wherever they operate. International Tax We help multinational companies address complex tax issues associated with cross- border expansion and evolving business models. Inbound and outbound tax services include: • International strategic tax reviews • International mergers and acquisitions • Business model optimization Transfer Pricing The volume and variety of intercompany transactions and transfer pricing regulations, along with increased enforcement, have made transfer pricing a top risk management issue. Services include: • Transfer pricing planning and documentation • Dispute avoidance and resolution • Business model optimization Business Tax Domestic and global tax planning to help businesses satisfy tax and statutory responsibilities. Services include: • Consulting • Financial accounting for income taxes • Tax controversy management • Tax compliance • Post merger integration • Foreign Account Tax Compliance Act Multistate Tax We work with clients to explore approaches that create value, assess exposure, and evaluate compliance risk through: • Department administration • Process improvement • Technology and systems integration • Income tax planning • Property tax services • Sales and use tax planning • State strategic tax reviews • State tax controversy Global Employer Services Companies today are more global in scope and employment issues have become more complex. We address clients’ circumstances through the following services: • International assignment services • Compensation & benefits • International human resources • Risk Talent Rewards • Technology Tax Management Consulting Managing multijurisdictional tax operations is challenging. We help with the following services: • Tax accounting and reporting • Global compliance outsourcing • Risk, strategy, and operations • Tax-enabled ERP • Compliance process automation • Tax data analytics • Operations Transformation for Tax Indirect Tax Effective management of VAT, GST, Sales & Use Tax, and Customs duties significantly affects costs and cash flows. Our services include: • Consulting • Business model optimization • Recoveries and refunds • Export controls • Compliance and outsourcing • Global diagnostics • Controversy services Mergers and acquisitions Mergers, acquisitions, joint ventures, and divestitures are complex by nature. Cross- border transactions multiply tax, accounting, legal, and regulatory issues. We assist clients with the following: • Transaction structuring and due diligence • Sell-side services • Post-transaction services • Restructuring and bankruptcy advisory Research and Development and Government Incentives To encourage investment, countries offer a wide variety of grants, credits, and incentives. Administration is often complicated but the cash benefit is immediate. Our services include: • R&D claims preparation • Incentives application assistance • Controversy management