Melden

Teilen

Weitere ähnliche Inhalte

Was ist angesagt?

Was ist angesagt? (19)

Haryana Budget: What and How related to the budget of the Government.

Haryana Budget: What and How related to the budget of the Government.

Economic Analysis and Emerging Opportunities Assingment two

Economic Analysis and Emerging Opportunities Assingment two

Andere mochten auch

Andere mochten auch (16)

Who wants to be a millionaire income and expenditure and budgeting

Who wants to be a millionaire income and expenditure and budgeting

Ähnlich wie The budget

Ähnlich wie The budget (20)

Rod thomas investment - financial goals budgeting worksheet

Rod thomas investment - financial goals budgeting worksheet

Cash Flow Planning Bonus ProjectPlan AheadWe are told, in

Cash Flow Planning Bonus ProjectPlan AheadWe are told, in

CCSN Powerpoint Template_planningfornewreality.pptx

CCSN Powerpoint Template_planningfornewreality.pptx

Budgeting and Savings with ING Driect and ACCION USA

Budgeting and Savings with ING Driect and ACCION USA

Mehr von BSTAI

Mehr von BSTAI (15)

Presentation on suspense and cash flow for bstai conference

Presentation on suspense and cash flow for bstai conference

Presentation on question one adjustments for bstai conference

Presentation on question one adjustments for bstai conference

The budget

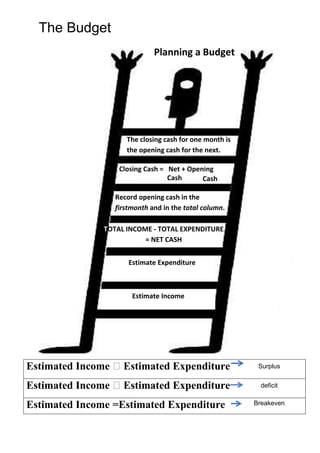

- 1. The Budget Estimated Income ˃Estimated Expenditure Surplus Estimated Income ˃Estimated Expenditure deficit Estimated Income =Estimated Expenditure Breakeven Planning a Budget Estimate Income Estimate Expenditure TOTAL INCOME - TOTAL EXPENDITURE = NET CASH Record opening cash in the firstmonth and in the total column. Closing Cash = Net + Opening CashCash The closing cash for one month is the opening cash for the next.

- 2. The Budget If a family had a deficit for the year, what possible changes could they make to the household budget? 1. Cut back on discretionary expenditure- birthdays, holidays, entertainment, presents, etc. 2. Reduce household coststhrough better buying. 3. Cut back on household costs and car costs. 4. Spread large payments over a number of months rather than paying for them all at once, e.g. car insurance, health insurance. 5. Try and increase income by doing overtime or part-time work. CURRENT EXPENDITURE This is spending on items that we need to run the house on a daily basis, e.g. food, fuel, clothes, etc. CAPITAL EXPENDITURE This is spending on items that will last a long time,e.g. car, television, cooker, washing machine, etc. ACCRUALS These are services that we do not pay for at the time of use, e.g. electricity, telephone bill. We pay for the amount we owe when we get the bill. SAVINGS This is putting money aside for the future, e.g. emergencies, to buy a car, to pay for children’s education. Remember: A budget is a plan which forecasts future income, future expenditure and savings. We must guess what these figures will be.