Square Pharmaceuticals LTD.

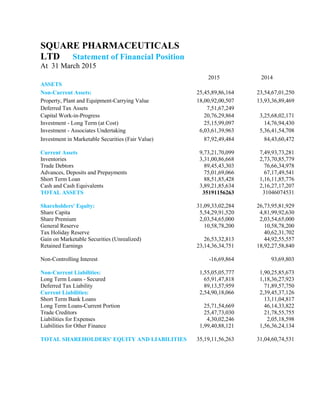

- 1. SQUARE PHARMACEUTICALS LTD Statement of Financial Position At 31 March 2015 2015 2014 ASSETS Non-Current Assets: 25,45,89,86,164 23,54,67,01,250 Property, Plant and Equipment-Carrying Value 18,00,92,00,507 13,93,36,89,469 Deferred Tax Assets 7,51,67,249 Capital Work-in-Progress 20,76,29,864 3,25,68,02,171 Investment - Long Term (at Cost) 25,15,99,097 14,76,94,430 Investment - Associates Undertaking 6,03,61,39,963 5,36,41,54,708 Investment in Marketable Securities (Fair Value) 87,92,49,484 84,43,60,472 Current Assets 9,73,21,70,099 7,49,93,73,281 Inventories 3,31,00,86,668 2,73,70,85,779 Trade Debtors 89,45,43,303 76,66,34,978 Advances, Deposits and Prepayments 75,01,69,066 67,17,49,541 Short Term Loan 88,51,85,428 1,16,11,85,776 Cash and Cash Equivalents 3,89,21,85,634 2,16,27,17,207 TOTAL ASSETS 35191156263 31046074531 Shareholders' Equity: 31,09,33,02,284 26,73,95,81,929 Share Capita 5,54,29,91,520 4,81,99,92,630 Share Premium 2,03,54,65,000 2,03,54,65,000 General Reserve 10,58,78,200 10,58,78,200 Tax Holiday Reserve 40,62,31,702 Gain on Marketable Securities (Unrealized) 26,53,32,813 44,92,55,557 Retained Earnings 23,14,36,34,751 18,92,27,58,840 Non-Controlling Interest -16,69,864 93,69,803 Non-Current Liabilities: 1,55,05,05,777 1,90,25,85,673 Long Term Loans - Secured 65,91,47,818 1,18,36,27,923 Deferred Tax Liability 89,13,57,959 71,89,57,750 Current Liabilities: 2,54,90,18,066 2,39,45,37,126 Short Term Bank Loans 13,11,04,817 Long Term Loans-Current Portion 25,71,54,669 46,14,33,822 Trade Creditors 25,47,73,030 21,78,55,755 Liabilities for Expenses 4,30,02,246 2,05,18,598 Liabilities for Other Finance 1,99,40,88,121 1,56,36,24,134 TOTAL SHAREHOLDERS' EQUITY AND LIABILITIES 35,19,11,56,263 31,04,60,74,531

- 2. AMOUNT PERCENT 1,91,22,84,914 8.12% 4,07,55,11,038 29.25% 7,51,67,249 0.00% -3,04,91,72,307 -8.66% 10,39,04,667 0.30% 67,19,85,255 1.91% 3,48,89,012 0.10% 2,23,27,96,818 6.34% 57,30,00,889 1.63% 12,79,08,325 0.36% 7,84,19,525 0.22% -27,60,00,348 -0.78% 1,72,94,68,427 4.91% 4,14,50,81,732 11.78% 4,35,37,20,355 12.37% 72,29,98,890 2.05% 0 0.00% 0 0.00% -40,62,31,702 -1.15% -18,39,22,744 -0.52% 4,22,08,75,911 11.99% -1,10,39,667 -0.03% -35,20,79,896 -1.00% -52,44,80,105 -1.49% 17,24,00,209 0.49% 15,44,80,940 0.44% -13,11,04,817 -0.37% -20,42,79,153 -0.58% 3,69,17,275 0.10% 2,24,83,648 0.06% 43,04,63,987 1.22% 4,14,50,81,732 11.78% Square Pharmaceuticals Ltd. Horizontal Analysis of Balance Sheet

- 3. Amount Percent Amount Percent 25458986164 72.34% 23,54,67,01,250 75.84% 18009200507 51.18% 13,93,36,89,469 44.88% 75167249 0.21% 0 0.00% 207629864 0.59% 3,25,68,02,171 10.49% 25,15,99,097 0.71% 14,76,94,430 0.48% 6,03,61,39,963 17.15% 5,36,41,54,708 17.28% 87,92,49,484 2.50% 84,43,60,472 2.72% 9,73,21,70,099 27.66% 7,49,93,73,281 24.16% 3,31,00,86,668 9.41% 2,73,70,85,779 8.82% 89,45,43,303 2.54% 76,66,34,978 2.47% 75,01,69,066 2.13% 67,17,49,541 2.16% 88,51,85,428 2.52% 1,16,11,85,776 3.74% 3,89,21,85,634 11.06% 2,16,27,17,207 6.97% 35,19,11,56,263 100.00% 31,04,60,74,531 100.00% 31,09,33,02,284 88.36% 26,73,95,81,929 86.13% 5,54,29,91,520 15.75% 4,81,99,92,630 15.53% 2,03,54,65,000 5.78% 2,03,54,65,000 6.56% 10,58,78,200 0.30% 10,58,78,200 0.34% 0.00% 40,62,31,702 1.31% 26,53,32,813 0.75% 44,92,55,557 1.45% 23,14,36,34,751 65.77% 18,92,27,58,840 60.95% -16,69,864 0.00% 93,69,803 0.03% 1,55,05,05,777 4.41% 1,90,25,85,673 6.13% 65,91,47,818 1.87% 1,18,36,27,923 3.81% 89,13,57,959 2.53% 71,89,57,750 2.32% 2,54,90,18,066 7.24% 2,39,45,37,126 7.71% 0.00% 13,11,04,817 0.42% 25,71,54,669 0.73% 46,14,33,822 1.49% 25,47,73,030 0.72% 21,78,55,755 0.70% 4,30,02,246 0.12% 2,05,18,598 0.07% 1,99,40,88,121 5.67% 1,56,36,24,134 5.04% 35,19,11,56,263 100.00% 31,04,60,74,531 100.00% Square Pharmaceuticals Ltd. Vertical Analysis of Balance sheet 2015 2014

- 4. Amount Percent 3,88,78,83,691 14.57% 47,17,23,792 1.77% 3,41,61,59,899 12.80% -1,98,21,31,472 -7.43% 1,43,40,28,427 5.37% -35,20,70,119 -1.32% -32,59,00,147 -1.22% -4,46,87,061 -0.17% 1,85,17,089 0.07% 1,08,19,58,308 4.05% 4,85,96,632 0.18% 1,13,05,54,940 4.24% -7,93,56,220 -0.30% 1,05,11,98,720 3.94% -16,10,75,802 -0.60% -2,94,34,161 -0.11% 7,51,67,249 0.00% 93,58,56,006 3.51% 9,95,75,169 0.37% 1,03,54,31,175 3.88% 0 -31,96,46,077 -1.20% 71,57,85,098 2.68% 1,03,54,31,175 3.88% 1,03,92,51,291 3.89% -38,20,116 -0.01% 71,57,85,098 2.68% 71,96,05,214 2.70% -38,20,116 -0.01% 0 2 0.00% 0 0.00% Square Pharmaceuticals Ltd. Horizontal Analysis of Income statement

- 5. Amount Percent Amount Percent 30,83,35,71,248 115.55% 26,94,56,87,557 115.80% 4,14,89,98,132 15.55% 3,67,72,74,340 15.80% 26,68,45,73,116 100.00% 23,26,84,13,217 100.00% -14,94,28,70,155 -56.00% -12,96,07,38,683 -55.70% 11,74,17,02,961 44.00% 10,30,76,74,534 44.30% -4,69,20,91,383 -17.58% -4,34,00,21,264 -18.65% -3,75,78,38,863 -14.08% -3,43,19,38,716 -14.75% -77,56,38,213 -2.91% -73,09,51,152 -3.14% -15,86,14,307 -0.59% -17,71,31,396 -0.76% 7,04,96,11,578 26.42% 5,96,76,53,270 25.65% 29,37,30,506 1.10% 24,51,33,874 1.05% 7,34,33,42,084 27.52% 6,21,27,87,144 26.70% -37,97,95,062 -1.42% -30,04,38,842 -1.29% 6,96,35,47,022 26.10% 5,91,23,48,302 25.41% -1,67,98,77,193 -6.30% -1,51,88,01,391 -6.53% -17,24,00,209 -0.65% -14,29,66,048 -0.61% 7,51,67,249 0.28% 0 0.00% 5,18,64,36,869 19.44% 4,25,05,80,863 18.27% 79,51,99,468 2.98% 69,56,24,299 2.99% 5,98,16,36,337 22.42% 4,94,62,05,162 21.26% 0.00% -183922744.00 -0.69% 13,57,23,333 0.58% 5,79,77,13,593 21.73% 5,08,19,28,495 21.84% 5,98,16,36,337 22.42% 4,94,62,05,162 21.26% 5,98,38,06,201 22.42% 4,94,45,54,910 21.25% -21,69,864 -0.01% 16,50,252 0.01% 5,79,77,13,593 21.73% 5,08,19,28,495 21.84% 5,79,98,83,457 21.73% 5,08,02,78,243 21.83% -21,69,864 -0.01% 16,50,252 0.01% 0.00% 0.00% 11 0.00% 9 0.00% 55,42,99,152 2.08% 55,42,99,152 2.38% Square Pharmaceuticals Ltd. Vertical Analysis of Income statement

- 6. Square Pharmaceuticals Limited Ratio Analysis Liquidity Ratio Current Ratio Current Ratio = Current Asset ÷ Current Liability 9,732,170,099 ÷ 2,549,018,066 = 3.818 Quick ratio or acid test Ratio (Current asset- inventories)/Current liabilities 9732170099- 3,310,086,668 / 2,549,018,066 =2.519 Accounts Receivable Turnover Net credit sales/Average net Accounts Receivable 26684573116/ 894,543,303+766,634,978 /2 = 17.44 20.65 days Inventory Turnover Cost of Goods Sold / Average Inventory 14942870155/3,310,086,668+2,737,085,779 /2 = 4.51 80.93 Days Profitability Ratio profit margin Net Income/Net sales 5186436869/26,684,573,116*100 = 19.45% Total asset turnover Ratio Net Sales / Total asset

- 7. 26,684,573,116/ 35,191,156,263 = 75.83% Return on asset Ratio Net Income/Total Assets 5186436869/35,191,156,263= 14.738 total asset turnover Ratio Net income / Common stockholders “equity 5186436869/31093302284 = 16.7% Earnings Per Share Net income /weighted average number of share outstanding 5186436869/4,819,992,630 + 5,542,991,520 /2 = 0.683 Price Earnings Ratio Market price Per Share of Stock/Earning Per Share 270.3/0.683 = 395.754 payout Ratio Cash dividend /Net Income 1,445,997,789/5186436869 = 27.88% Solvency Ratios Debt to Asset ratio: Debt/Total Asset 4099523843/35,191,156,263 = 11.65% Time Interest Earned : Income before Income taxes and Interest Expense/ Interest Expense 7122161329/158614307 = 44.90 times