Account cycle

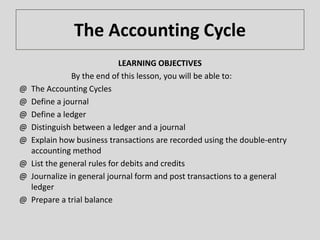

- 1. The Accounting Cycle LEARNING OBJECTIVES By the end of this lesson, you will be able to: @ The Accounting Cycles @ Define a journal @ Define a ledger @ Distinguish between a ledger and a journal @ Explain how business transactions are recorded using the double-entry accounting method @ List the general rules for debits and credits @ Journalize in general journal form and post transactions to a general ledger @ Prepare a trial balance

- 3. The Accounting Cycles • A business may engage in thousands of transactions during a year. Can you imagine preparing a transaction analysis, like we did in the previous unit, for all of those transactions? It would take a lot of time and the spreadsheet would be large! There has to be a better way to classify and summarize the data in these transactions to create useful information. We will learn the first part of the accounting cycle: • An account is a part of the accounting system used to classify and summarize the increases, decreases, and balances of each asset, liability, stockholders’ equity item, dividend, revenue, and expense. Firms set up accounts for each different business element, such as cash, accounts receivable, and accounts payable. Every business has a Cash account in its accounting system because knowledge of the amount of cash on hand is useful information. • Accountants may differ on the account title (or name) they give the same item. For example, one accountant might name an account Notes Payable and another might call it Loans Payable. Both account titles refer to the amounts borrowed by the company. The account title should be logical to help the accountant group similar transactions into the same account. Once you give an account a title, you must use that same title throughout the accounting records.

- 4. journal • A journal is a chronological (arranged in order of time) record of business transactions. A journal entry is the recording of a business transaction in the journal. A journal entry shows all the effects of a business transaction as expressed in debit(s) and credit(s) and may include an explanation of the transaction. A transaction is entered in a journal before it is entered in ledger accounts. Because each transaction is initially recorded in a journal rather than directly in the ledger, a journal is called a book of original entry.

- 5. ledger (general ledger) is the complete collection of all the accounts and transactions of a company. The ledger may be in loose-leaf form, in a bound volume, or in computer memory. The chart of accounts is a listing of the titles and numbers of all the accounts in the ledger. The chart of accounts can be compared to a table of contents. The groups of accounts usually appear in this order: assets, liabilities, equity, dividends, revenues, and expenses. Think of the chart of accounts as a table of contents of a textbook. It provides direction as to what exactly will be found in the financial statement preparation. Individual accounts are in order within the ledger. Each account typically has an identification number and a title to help locate accounts when recording data. For example, a company might number asset accounts, 100-199; liability accounts, 200-299; equity accounts, 300-399; revenue accounts, 400-499; and expense accounts, 500-599. We use this numbering system in this text. The uniform chart of accounts used in the first 11 chapters appears in a separate file at the end of the text. You should print that file and keep it handy for working certain problems and exercises. Companies may use other numbering systems. For instance, sometimes a company numbers its accounts in sequence starting with 1, 2, and so on. The important idea is that companies use some numbering system.

- 6. Trial balance • A trial balance is a listing of all accounts (in this order: asset, liability, equity, revenue, expense) with the ending account balance. It is called a trial balance because the information on the form must balance. We will illustrate this later in the chapter. However, before you can record the journal entry, you must understand the rules of debit and credit. You will learn this concept and journal entries in the next section.

- 7. General Rules for Debits and Credits • One of the first steps in analyzing a business transaction is deciding if the accounts involved increase or decrease. However, we do not use the concept of increase or decrease in accounting. We use the words “debit” and “credit” instead of increase or decrease. The meaning of debit and credit will change depending on the account type. Debit simply means left side; credit means right side. Remember the accounting equation? ASSETS = LIABILITIES + EQUITY The accounting equation must always be in balance and the rules of debit and credit enforce this balance. • In each business transaction we record, the total dollar amount of debits must equal the total dollar amount of credits. When we debit one account (or accounts) for $100, we must credit another account (or accounts) for a total of $100. The accounting requirement that each transaction be recorded by an entry that has equal debits and credits is called double-entry procedure, or duality.

- 8. Recording Changes in Balance Sheet Accounts Balance Sheet accounts are assets, liabilities and equity. The balance sheet proves the accounting equation. Recording transactions into journal entries is easier when you focus on the equal sign in the accounting equation. Assets, which are on the left of the equal sign, increase on the left side or DEBIT side. Liabilities and stockholders’ equity, to the right of the equal sign, increase on the right or CREDIT side. There is an exception to this rule: Dividends (or withdrawals for a non-corporation) is an equity account but it reduces equity since the owner is taking equity from the company. This is called a contra- account because it works opposite the way the account normally works. For Dividends, it would be an equity account but have a normal DEBIT balance (meaning, debit will increase and credit will decrease).

- 9. • Recording changes in Income Statement Accounts • We learned that net income is added to equity. We also learned that net income is revenues – expenses and calculated on the income statement. The recording rules for revenues and expenses are: The reasoning behind this rule is that revenues increase retained earnings, and increases in retained earnings are recorded on the right side. Expenses decrease retained earnings, and decreases in retained earnings are recorded on the left side.

- 10. • he side that increases (debit or credit) is referred to as an account’s normal balance. Remember, any account can have both debits and credits. Here is another summary chart of each account type and the normal balances.

- 11. Journal Entries Double-entry bookkeeping, in accounting, is a system of bookkeeping so named because every entry to an account requires a corresponding and opposite entry to a different account. This lesson will cover how to create journal entries from business transactions. Journal entries are the way we capture the activity of our business. • When a business transaction requires a journal entry, we must follow these rules: • The entry must have at least 2 accounts with 1 DEBIT amount and at least 1 CREDIT amount. • The DEBITS are listed first and then the CREDITS. • The DEBIT amounts will always equal the CREDIT amounts. For another example, let’s look at the transaction analysis we did in the previous chapter for Metro Courier (click Transaction analysis): The owner invested $30,000 cash in the corporation. We analyzed this transaction by increasing both cash (an asset) and common stock (an equity) for $30,000. We learned you increase an asset with a DEBIT and increase an equity with a CREDIT. The journal entry would look like this:

- 12. • Purchased $5,500 of equipment with cash. We analyzed this transaction as increasing the asset Equipment and decreasing the asset Cash. To increase an asset, we debit and to decrease an asset, use credit. This journal entry would be: • Purchased $500 in supplies on account. We analyzed this transaction as increasing the asset Supplies and the liability Accounts Payable. To increase an asset, we debit and to increase a liability, use credit. This journal entry would be:

- 13. All the journal entries illustrated so far have involved one debit and one credit; these journal entries are called simple journal entries. Many business transactions, however, affect more than two accounts. The journal entry for these transactions involves more than one debit and/or credit. Such journal entries are called compound journal entries. How do we prepare financial statements from these journal entries? The journal entries just allowed us to capture the activity of the business. In the next section we will organize the information to make it easier to prepare financial statements.

- 14. Preparing a Trial Balance Accountants use a trial balance to test the equality of their debits and credits. A trial balance is a listing of the ledger accounts and their debit or credit balances to determine that debits equal credits in the recording process. Preparing and adjusting trial balances aid in the preparation of accurate financial statements. Although you can prepare a trial balance at any time, you would typically prepare a trial balance before preparing the financial statements. On the trial balance the accounts should appear in this order: assets, liabilities, equity, dividends, revenues, and expenses. Within the assets category, the most liquid (closest to becoming cash) asset appears first and the least liquid appears last. Within the liabilities, those liabilities with the shortest maturities appear first. Study the following example of a trial balance for the More Flowers business. Note that totals for the Debit and Credit entries come from the ending balance of the T-accounts or ledger cards. When using T-accounts, if the left side is greater, the account has a DEBIT balance. If the right side is greater, the account has a CREDIT balance. When using ledger cards, you will be calculating the balance after each transaction and the balance typically follows the normal balance of the accounts (remember, normal balance is how we increase an account).

- 16. The equality of the two totals in the trial balance does not necessarily mean that the accounting process has been error-free. Serious errors may have been made, such as failure to record a transaction, or posting a debit or credit to the wrong account. For instance, if a transaction involving payment of a $ 100 account payable is never recorded, the trial balance totals still balance, but at an amount that is $ 100 too high. Both cash and accounts payable would be overstated by $ 100. While we still have not prepared financial statements, we have captured the activity and organized it into a trial balance. Next up is editing the information before we can publish our story in financial statements.

- 17. Error Correction When the trial balance does not balance, try re-totaling the two columns. If this step does not locate the error, divide the difference in the totals by 2 and then by 9. If the difference is divisible by 2, you may have transferred a debit-balanced account to the trial balance as a credit, or a credit-balanced account as a debit. When the difference is divisible by 2, look for an amount in the trial balance that is equal to one-half of the difference. If the difference is divisible by 9, you may have made a transposition error in transferring a balance to the trial balance or a slide error. A transposition error occurs when two digits are reversed in an amount (e.g. writing 753 as 573 or 110 as 101). A slide error occurs when you place a decimal point incorrectly (e.g. $ 1,500 recorded as $ 15.00). Thus, when a difference is divisible by 9, compare the trial balance amounts with the general ledger account balances to see if you made a transposition or slide error in transferring the amounts. If you still cannot find the error, it may be due to one of the following causes: o Failing to post part of a journal entry. o Posting a debit as a credit, or vice versa. o Incorrectly determining the balance of an account. o Recording the balance of an account incorrectly in the trial balance. o Omitting an account from the trial balance. o Making a transposition or slide error in the accounts or the journal

- 18. Usually, you should work backward through the steps taken to prepare the trial balance. Assuming you have already re-totaled the columns and traced the amounts appearing in the trial balance back to the general ledger account balances, use the following steps: Verify the balance of each general ledger account, verify postings to the general ledger, verify general journal entries, and then review the transactions and possibly the source documents.

- 19. • END