The question paper will consist of five sections A, B, C, D and E.Section A will contain questions from the following topics:- Introduction to accounting- Accounting concepts and conventions- Accounting equation- Journal and ledger- Trial balanceSection B will contain questions from the following topics: - Final accounts (Trading, Profit & Loss account and Balance Sheet)- Preparation of financial statements- Analysis of financial statementsSection C will contain questions from the following topics:- Ratio analysis- Fund flow statement- Cash flow statementSection D will contain questions from the following topics:- Cost accounting- Marginal costing

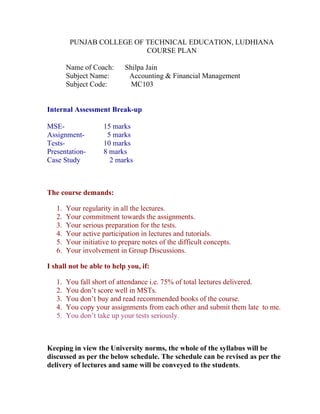

- 1. PUNJAB COLLEGE OF TECHNICAL EDUCATION, LUDHIANA COURSE PLAN Name of Coach: Shilpa Jain Subject Name: Accounting & Financial Management Subject Code: MC103 Internal Assessment Break-up MSE- 15 marks Assignment- 5 marks Tests- 10 marks Presentation- 8 marks Case Study 2 marks The course demands: 1. Your regularity in all the lectures. 2. Your commitment towards the assignments. 3. Your serious preparation for the tests. 4. Your active participation in lectures and tutorials. 5. Your initiative to prepare notes of the difficult concepts. 6. Your involvement in Group Discussions. I shall not be able to help you, if: 1. You fall short of attendance i.e. 75% of total lectures delivered. 2. You don’t score well in MSTs. 3. You don’t buy and read recommended books of the course. 4. You copy your assignments from each other and submit them late to me. 5. You don’t take up your tests seriously. Keeping in view the University norms, the whole of the syllabus will be discussed as per the below schedule. The schedule can be revised as per the delivery of lectures and same will be conveyed to the students.

- 2. LECTURE CONTENTS OF THE LECTURE Assignment Test Case Study 1. Introduction • Meaning and definition of accounting, • What is the need of accounting, • Functions Accounting and bookkeeping, • Advantages of accounting 2 Introduction 1 • Basic terms of accounting • Branches of accounting • Accounting equation 3 • Accounting equation 4 • Accounting Concepts & Conventions 5 • Accounting Concepts & 2 Conventions 6 1 7 Recording of entries in the books of Accounts: Journal • Meaning of Journal • Performa of Journal • Rules of journal • How entries are passed in journal 8 • Practice Of Journal Entries DOD Of Assignment 1 9 • Practice Of Journal Entries 10 • Practice of Journal Entries DOS of Assignment 1

- 3. 11 Subsidiary books: • Meaning of subsidiary books, • Types of subsidiary books, Performa of subsidiary books, • How entries are recorded in the subsidiary books, • Advantages of subsidiary books 12 2 13 Preparation of subsidiary books 14 Classification of entries (Ledger) • Meaning of ledger meaning of account • Performa of an account • Types of accounts • How entries are recorded in the accounts • Balancing of accounts 15 Practice of ledger DOD of 3 Assignment 2 16 Practice of ledger 17 Relationship between Journal and DOS of ledger & other theoretical concepts assignment 2 18 Tutorial 19 Trial balance • Meaning and objective of trial balance • How it is prepared • Errors, which are not disclosed by the trial balance • Errors, which are revealed by trial balance • Location of errors

- 4. 21 Final accounts • Meaning of final accounts: Trading & P&L, Balance sheet • Objective of preparing final statements • Performa of final statements • Types of expense, Types of Assets • Arrangement of balance sheet items 22 Preparation of Trading and P&L account 23 Preparation of Trading and P&L DOD of account assignment 3 24 Tutorial 25 Preparation of Trading and P&L account 26 Preparation of Trading and P&L DOS of account (with adjustments) assignment 3 27 3 28 • Meaning of Financial analysis, • Objective of financial analysis, • Common size financial statement analysis, • how these statements can be interpreted 29 Comparative and trend analysis Some basic rules to interpret financial statements through comparative analysis 30 Tutorial 31 Ratio Analysis Meaning of ratio Analysis • Types of ratios • Advantages and Limitations of ratio analysis 32 Calculation of Ratios 33 Calculation of Ratios Interpretation of ratios according to thumb rules

- 5. 34 Calculation of Ratios 4 Interpretation of ratios according to thumb rules 35 Some technical numerical on ratio analysis 36 Tutorial 37 4 38 Fund Flow Statement: • Meaning, • Objectives, • Importance and • Performa of FFS 39 Preparation of fund flow statement DOD of (simple) assignment 4 40 Preparation of fund flow statement 41 Preparation of fund flow statement (with Adjustment) 42 Tutorial DOS of Assignment 4 43 Cash flow statement • Meaning, • Difference between cash flow & fund flow statement • Performa of cash flow statement 44 Preparation of cash flow statement 45 5 46 Cost Accounting: • Meaning of cost accounting, • Scope of cost accounting, Classification of costs, • Difference cost and management accounting, • Difference between cost and financial accounting 47 Objectives of cost accounting, DOD of Advantages of cost accounting, Types assignment 5 and techniques of cost accounting,

- 6. Methods of costing 48 Tutorial 49 Absorption Costing: Profit ascertainment, Advantages and limitations of absorption costing, Meaning of marginal costing, Features of marginal costing, ascertainment of profit under marginal costing and difference between absorption costing and marginal costing 50 CVP Analysis: Break Even point and applications of marginal costing 51 Applications of marginal costing DOS of Assignment 5 52 5 53 6 54 Cost Control techniques: Budget, Meaning and need of budget, Forecasting and budget, Difference between budgeting and forecasting, Types of budgets 55 Preparation of Budgets 56 Master Budgets, Fixed and flexible budgets 57 Zero Based Budgeting 58 Standard Costing and Variance Analysis 59 Tutorial 60 Standard Costing & Variance Analysis 61 Computerized Accounting: Meaning & Advantages 62 Computer Programmes for accounting,

- 7. Accounting control & Audit 63 Sub Modules Of Computerized accounting 64 Revision 7

- 8. ASSIGNMENTS: The marks for the assignment for the purpose of internal assessment will be taken as the average of the marks of all the assignments. The students will be given the topic for the assignment on the scheduled date and will be required to submit the same by due date. Late submissions will not be accepted. The students are required to keep a record of all the assignments given so that at the time of giving the assessment no confusion is created.

- 10. PRESENTATION TOPICS Following are the topics on which you will have to give presentation in a group of 3-4 students. Presentation dates and allocation of topics will be announced in the class. Some additional topics related to operations research will be given later in the class depending upon the syllabus covered. 1. Computerized Accounting 2. Sub Modules of computerized accounting systems 3. Accounting control and audit 4. Introduction to accounting 5. Concepts and conventions 6. Larry Bought the world into your lap 7. Google Vs Microsoft 8. Amazon: is it really a internet giant? 9. Outsoursing To India : does it make a difference? 10.How Much does WWW matter? 11.Google’s New Operating System 12.Ethical Issues in IT 13.free video-sharing site such as You Tube : curse or blessing 14.Social "networking" sites 15.Is the Library being substituted by Internet.

- 11. MCA-103 (N2) ACCOUNTING AND FINANCIAL MANAGEMENT Internal Assessment: 40 External Assessment: 60 Instructions for paper-setter The question paper will consist of five sections A, B, C, D and E. Section A, B, C and D will have two questions from the respective sections of the syllabus and will carry 10 marks each. Section E will have 10-20 short answer type questions, which will cover the entire syllabus uniformly and will carry 20 marks in all. Instruction for candidates Candidates are required to attempt one question each from sections A, B, C and D of the question paper and the entire section E Use of non-programmable scientific calculator is allowed ____________________________________________________________________ _____________ Section A Accounting: Principles, concepts and conventions, double entry system of accounting, introduction to basis books of accounts of sole proprietary concern, closing of books of accounts and preparation of trial balance. Final Accounts: Trading, Profit and Loss accounts and Balance sheet of sole proprietary concern(without adjustment) Section B Financial Management: Meaning, scope and role, a brief study of functional areas of financial management. Introduction to various FM tools: Ration Analysis, Fund Flow statement and cash flow statement (without adjustments)

- 12. Section C Costing: nature, importance and basic principles. Marginal costing: Nature scope and importance,Break even analysis, its uses and limitations, construction of break even chart, Standard costing: Nature, scope and variances (only introduction) Section D Computerized accounting: Meaning and advantages, Computer Programs for accounting, Balancing accounts, Trial balance and final accounts in computerized, Accounting, control, and Audit, Sub-Modules of computerized accounting systems. References: S.No Author Title 1 J.C.Katyal Principles A Book-Keeping 2 Jain and Narang Principles of Accounting 3 I.M.Pandey Financial Management 4 Sharma, Gupta & Bhalla Management Accounting 5 Jain and Narang Cost Accounting 6 Katyal Cost Accounting 7 . P.H.Barrett Computerized Accounting Also Financial Accounting for mgt (Tata Mc Graw hill) by Ramachandran & kakani Cengage learning and Taxman Sr no. Title Case1 BHEL AND ITS STAKEHOLDERS Case2 Importance Of Accounting Concepts Case3 PC Depot Case 4 Alpha Chemicals Industries Case 5 Analysis Of different costs of Best Manufacturing Group Corporation

- 13. Case1: BHEL AND ITS STAKEHOLDERS Bharat Heavy Electrical Limite( BHEL) is the largest engineering & manufacturing enterprise in India, in the energy related infrastructure sector today. BHEL was established more than 40 years ago ushering in the indigenous heavy electrical equipment industry. BHEL manufacturers over 180 products, under 30major product groups and cater to core sectors like Power Generation & Transmission, Transportation, Telecommunication and renewable energy. It has 14 manufacturing divisions and 18 regional offices. Like all other organizations Bhel is also preparing books of accounts. Question: 1.why is important to keep books of accounts? 2.Give the list of stakeholders who would be interested in looking at the financial statements of the Co. and also state the reasons for the same. Stakeholder Due to Govt & its agencies To look at income tax and other tax liabilities of firm Top Managers, Officers , Workers & Potential for pay hikes, bonusv& their unions incentive deals Public The ethical & environmental activities of firm. Long term Lenders, Present & Whether the firm has long term Potiential shareholders future, does it meet investment norms. Equity Analysts & Fund Managers Profitability & Share Price performance Customer The ability of firm to take bigger orders, carry on providing a service Supplier & other Creditors To decide whether to offer the firm its products on credit and if so , at what terms. Case2: Importance Of Accounting Concepts Tapas and Tanmay were two school friends. After passing from school both went for graduation courses but at different places. After completing the graduation courses, the two met met with each other and they discussed about their future plans. Both of them were sure that they would take up to doing business after finishing

- 14. their post graduation courses. Tapas was very ambitious and always thought of growing fast and managing a large empire of business. He was contemplating the setting up of a corporation with nos of subsidiaries. Due to unforeseen circumstances he could not complete his post graduation and managed to open a small scale clothing unit from where he used to supply fabrics to boutiques. Tanmay never believed in such large dreams and had always believed in self reliant. Tanmay was planning to start a cycle part unit and he did that after completion of his post graduation course. After a month of start of their respective businesses, both of these friends met at a restaurant where Tapas discovered that Tanmay has employed accountant whereas he himself was maintaining books of accounts. On the advise of Tanmay, Tapas showed his books to Tanmay’s accountant. The following particulars were found: 1Business owns Rs 100000 cash, 30,000 raw material, 1 trucks for delievery of goods, 500 square feet building space and so on. 2He bought a plot of land worth Rs.250000 and sold for 275000 3Wages for the next three months were already paid. 4 Life insurance premium(personal)was paid out of business bank balance worth Rs.10000. 5 Distributed few samples of cloth to new boutiques. Payment of Rs 20,000 made from personal account. 6Opened account in name of business with new bank in which Rs.40,000 were deposited out of personal money. 7Firm believes that some of its debtors will default. 8Depreciation @ 10% will be charged. 9Raw materials are picked from store and sent to machines. 10Profit for the month is Rs.80,000 which includes an amount of Rs.24,000 for the order just received relating to next month. On enquiry, further information was revealed that cost of raw material was Rs.2 per unit, cost of 1 truck is Rs100000, Rs.500 per square feet. Estimation of debtors making defaut is Rs 22,000. Questions for discussion: 1. Identify the problems which Tapas could have faced in future by moving on with the same system of maintaining books. 2. Give the accounting concepts for all the information disclosed by stating the reasons along with it. 3. What is the effect of information disclosed on each account. Give in detail.

- 16. Case3: PC Depot PC Depot was a retail store for personal computers and hand held calculators, selling several national brands in each product line. The store was opened in early Sept. by Jenia, a young woman previously employed in direct computer sales for a national firm specializing in business computers. Zenia knew the importance of adequate records. One of her first decisions, therefore, was to hire Ramesh a local accountant, to set up her bookkeeping system. Ramesh wrote up the store’s pre opening financial transactions in journal form to serve as an example. Zenia agreed to write up the remainder of the store’s Sept. financial transactions for Ramesh’s later review. At the end of Sept. Zenia had the following items to record: Entry Dr.(Amt.) Cr. No. (Amt.) account 1 Cash 1,65,000 To Bank Loan 100,000 payable (15%) 65,000 To Proprietor’s Capital 2 Rent Expense (Sept) 1,485 To cash 1,485 3 Merchandise 137,500 inventory 137,500 To Accounts payable 4 Furniture and 15,500 fixture(10yrs life) 15,500 To cash 5 Advertising 1,320 expenses 1,320 To cash 6 Wages expenses 935 To Cash 935 7 Office supplies 1,100 expenses 1,100 To cash 8 Utilities expenses 275 To cash 275 9 Cash sales for Sept. 38,000 10 Credit sales for Sept. 14,850

- 17. 11 Cash received from 3,614 credit customers 12 Bills paid to 96195 merchandise suppliers 13 New merchandise 49,940 received on credit from suppliers 14 Ms. Zenia 38,140 ascertained the cost of merchandise sold was 15 Wages paid to 688 assistant 16 Wages earned but 440 un paid at the end of Sept. 17 Rent paid for Oct. 1,485 18 Insurance bill paid 2,310 for one year (Sept. 1-Aug.31) 19 Bills received, but 226 unpaid from electric Co. 20 Purchased 1,760 typewriter, Paying Rs.660 cash and agreeing to pay the Rs.1,100 balance by Dec 31 a. Explain the events that probably gave rise to journal entries 1 through 8 b. Set upto a ledger account for each account. Post entries 1 through 8 to these accounts. c. Analyze the facts listed as 9 through 20, resolving them into debit and credit elements. Prepare journal entries and post to ledger accounts. d. Consider any other transaction that should be recorded. Why are these adjusting entries required? Prepare journal entries for them and post to ledger accounts.

- 18. Case Study 4 Alpha Chemicals Industries Alpha Chemical Industries is an organization into the manufacture and sale of medicines which is a highly competitive industry. The company must maintain an aggressive marketing posture to survive. The company had recently appointed a new president to look into the affairs of the company. The management of the Alpha Chemicals is concerned about the future of the company and has decided to use ratio analysis to identify potential trouble areas so that the performance of the organization could significantly increase in the coming years. In addition to the balance sheet and the income statement for years, i.e. 2005 and 2006 the industry averages have also been given. 1) Is Alpha Chemical Industries a strong firm in the industry? 2) Identify the strength and weaknesses of the company based on ratio analysis. 3) Do the changes in ratios from 2005 to 2006 give evidence that the firm is growing stronger or weaker? Mention the ratios. 4) Give suggestions to the company to improve their performance in the coming years. Industry Averages for Financial Ratios Particulars (Rs) Current Ratio 1.50

- 19. Quick ratio 1.3 Gross Profit ratio 23.0 % Net Profit ratio 8.0% Return-on-Capital Employed 9.0% Return-on-Shareholders Equity 13.1% Earnings per Share 6.0 Debt-Equity Ratio 0.96 Interest-Coverage Ratio 2.5 Total-Asset Turnover times Fixed-Assets Turnover 0.85 Debtors Turnover times Average Collection period 2.85 Stock-Turnover ratio times 5 times 74 days 4.3 times Balance Sheet as on 30 June 2006 For Year 2006 2006 2005 2005 (Rs in (Rs in (Rs in (Rs in 000) 000) 000) 000) Source of Funds 1. Shareholder’s Funds 2,64,800 2,50,000 a) Share Capital 26,00,78 21,90,00 b) Reserve & Surplus 0 28,65,58 0 24,40,000 0 2. Loan Funds 90,000 a) Secured 2,70,800 500 b) Unsecured 25,30,500 Total 31,36,38 Application of 0 Funds 1. Fixed Assets 8,10,600 6,60,800 a) Gross Block 2,10,700 1,75,400 b) Less: Depreciation 5,99,900 4,85,400 c) Net Block 5,35,400 d) Capital-work-in 80,000 50,000 10,25,000 Progress at cost including 6,79,900 Advances 790,500

- 20. 2. Investment 15,00,80 11,40,79 0 0 3. Current Assets 3,16,300 1,34,000 9,14,790 Loans Advances 18,17,10 12,74,79 63,310 a) Current Assets 0 0 25,38,500 b) Loans & Advances 4,00,600 14,16,50 3,60,000 Less: 0 Current Liabilities & 2,49,480 Provisions 31,36,38 Net Current Assets 0 Miscellaneous Expenditure Total Profit and Loss Account for the year ending 30 June, 2006 2006 2005 (Rs in 000) (Rs in 000 Income Sale 22,00,000 20,00,000 Other income 1,47,000 71,450 Total 23,47,000 20,71,450 Expenditure Material Consumed 9,24,900 790,000 Power and Fuel 44,000 33,000 Repair and Maintenance 66,000 50,000 Salaries, Wages, and other Benefits 125,800 92,000 Administrative and Selling Expenses 590,700 602,000 Interest 58,000 30,000 Depreciation 38,400 33,600 Total 18,47,800 16,30,600 Profit for the Year before Tax 4,99,200 4,40,850 Less: provision for Income Tax 10,000 Net Profit for the Year after Tax 4,99,200 4,30,850

- 21. Case5: Analysis Of different costs of Best Manufacturing Group Corporation The Best Manufacturing Group Corporation manufactures four products in separate factories and then markets them through different channels. The company’s accountant has asked several members to describe their expectations of the business environment for the coming year. Each member was asked to write up his personal outlook, including changes in selling prices, product demand, variable production costs, and variable selling costs, fixed production costs, and fixed selling and administrative costs. At a recent staff meeting, the four vice president’s of different departments met and made suggestions regarding the profitability of the company. The VP Data Processing, VP Finance, and VP Sales have made their suggestions about the expected business environment for the coming year. As a consultant to the company, comment on the suggestions made by the vice president of the four departments. The income statement for the company in contribution income statement format is given as under: Particulars (Rs) (R s) Total Sales (66,000 Units at Rs 12.00 per 7, unit) 92 Less: Variable Production Costs 2,90 ,0 (66,000 Units @ Rs 4.40 per unit) ,400 00 Variable Selling Costs (66,000 Units @Rs 2.80 per unit) 1,84 Total Variable Costs ,800 Contribution Margin Less: Fixed Production Costs 4, Fixed Selling and Administrative Costs 1,30 75 Total Fixed Costs ,500 ,2 Income Before Taxes 48,2 00 00 3, 16 ,8 00 1,

- 22. 78 ,7 00 1, 38 ,1 00 1. Changes in Production Costs Only: The manager of production believes that variable production costs will increase by 10 percent and that fixed production costs will rise by 5 percent. With no other anticipated changes, what is the projected profit for the coming year? Particulars (Rs) (Rs) Total Sales (66,000 Units at Rs 12.00 per 7,92,000 unit) Less: Variable Production Costs 3,19,44 (66,000 Units @ Rs 4.84 per unit) 0 Variable Selling Costs (66,000 Units @Rs 2.80 per unit) 1,84,80 5,04,240 Total Variable Costs 0 2,87,760 Contribution Margin 1,37,025 Less: Fixed Production Costs (Rs 1,30,500 48,200 x 1.05) 1,85,225 Fixed Selling and Administrative 1,02,535 Costs Total Fixed Costs Projected Income before Taxes Thus, if the variable and fixed production costs do not change and no adjustments to selling price or volume are made, the company’s profit will decrease by Rs 35,565. Because both variables and fixed production costs are projected to increase, management may want to increase the selling price to offset the rise in costs. Increasing the number of units produced and sold also would help offset the higher fixed costs. Because the production manger has commented on only production costs, the controller should try to augment the forecast by having other managers develop projections in their areas of expertise.

- 23. 2. Changes in All Cost Areas: all costs will change, according to the manager of data processing. He believes that all variable costs will go up by 10 percent, and that all fixed costs will rise by 5 percent. He does not anticipate any other changes. Particulars (Rs) (Rs) Total Sales (66,000 Units at Rs 12.00 per 7,92,000 unit) Less: Variable Production Costs 3,19,44 (66,000 Units @ Rs 4.84 per unit) 0 Variable Selling Costs (66,000 Units @Rs 2.80 per unit) 2,03,28 5,22,720 Total Variable Costs 0 2,69,280 Contribution Margin 1,37,025 Less: Fixed Production Costs (Rs 1,30,500 50,610 x 1.05) 1,87,635 Fixed Selling and Administrative Costs 81,645 (48,200 x 1.05) Total Fixed Costs Projected Income before Taxes Like the manager of production, the manager of data processing has concentrated only on projected costs. In this scenario, all costs are expected to increase. Profit decrease to Rs 81,645. 3. Changes in Demand and in All Costs Areas: The manager of Finance anticipates volume changes as well as changes in all cost areas. He believes that unit demand will increase by 8 percent, all variable costs will go up by 20 percent, and all fixed costs will decrease by 10 percent. Particulars (Rs) (Rs) Total Sales (71,280Units at Rs 12.00 per 8,55,360 unit) Less: Variable Production Costs 3,76,35 (71,280Units @ Rs 5.28 per unit) 8

- 24. Variable Selling Costs 6,15,859 (71,280Units @Rs 3.36 per unit) 2,39,50 2,39,501 Total Variable Costs 1 Contribution Margin Less: Fixed Production Costs (Rs 1,30,500 x 0.9) 1,17,45 1,60,830 Fixed Selling and Administrative Costs 0 78,671 (48,200 x 0.9) 43,380 Total Fixed Costs Projected Income before Taxes The profit here further gets reduced. The manager of finance believes not only that variable costs are going to increase but that volume also will increase. 4. Changes in Selling Price, Product Demand, and Selling Costs: According to the manager of sales, the company should increase the selling price by 10 percent, which will cause demand to fall by 8 percent. In addition, variable selling costs will go down by 5 percent, and administrative costs will go up by 10 percent. Particulars (Rs) (Rs) Total Sales (66,720 Units at Rs 13.20 per 8,80,704 unit) Less: Variable Production Costs 2,93,568 (66,720 Units @ Rs 4.40 per unit) Variable Selling Costs 1,61,51 (66,720Units @Rs 2.66 per unit) 4,28,683 Total Variable Costs 3,72,821 Contribution Margin 1,30,50 Less: Fixed Production Costs (Rs 1,30,500 0 x 0.9) 53,020 1,83,520 Fixed Selling and Administrative Costs 1,89,301 (48,200 x 0.9) Total Fixed Costs Projected Income before Taxes

- 25. The manager of sales has the most optimistic outlook. Overall, in this scenario, profits increase by Rs 51,201 (189,301 – 1, 38,100). Appendix-I is a comparative summary of the four executive’s predictions. Appendix I Comparative CVP Analysis Best Manufacturing Group Corporation Summary of Projected Income before Taxes For the Year Ended 31 December 2006 Particulars (Rs) (R (R (Rs) s) s) Total Sales 7,92, 7, 8, 8,01,5 Less: Variable Production Costs 000 92 55 04 Variable Selling Costs 3,19, ,0 ,3 2,67,1 Total Variable Costs 440 0 60 68 Contribution Margin 1,84, 3, 3, 1,61,5 Less: Fixed Production Costs 800 19 76 15 Fixed Selling and Administrative 5,04, ,4 ,3 4,28,6 Costs 240 40 58 83 Total Fixed Costs 2,87, 2, 2, 3,72,8 Projected Income before Taxes 760 03 39 21 1,37, ,2 ,5 1,30,5 025 80 01 00 48,2 5, 6, 53,020 00 22 15 1,83,5 1,85, ,7 ,8 20 225 20 59 1,89,3 1,02, 2, 2, 01 535 69 39 ,2 ,5 80 01 1, 1, 37 17

- 26. ,0 ,4 25 50 50 43 ,6 ,3 10 80 1, 1, 87 60 ,6 ,8 35 30 81 78 ,6 ,6 45 71 Review Questions 1) Identify specific types of variable and fixed costs, and comment on the changes in these costs caused by changes in operating activity. 2) Define fixed cost, variable cost, semi-variable cost and give example of each one of them. 3) Briefly analyze the cost behavior patterns in a service-oriented business. 4) Why is an understanding of cost behavior useful to managers? Give examples to illustrate your answer. 5) Define cost-volume-profit analysis and explain how CVP analysis can be used for managerial planning. 6) ‘Fixed costs remain constant in total but decrease per unit as productive output increases’, Comment.

- 27. Case Study 4 Alpha Chemicals Industries Alpha Chemical Industries is an organization into the manufacture and sale of medicines which is a highly competitive industry. The company must maintain an aggressive marketing posture to survive. The company had recently appointed a new president to look into the affairs of the company. The management of the Alpha Chemicals is concerned about the future of the company and has decided to use ratio analysis to identify potential trouble areas so that the performance of the organization could significantly increase in the coming years. In addition to the balance sheet and the income statement for years, i.e. 2005 and 2006 the industry averages have also been given. 5) Is Alpha Chemical Industries a strong firm in the industry? 6) Identify the strength and weaknesses of the company based on ratio analysis. 7) Do the changes in ratios from 2005 to 2006 give evidence that the firm is growing stronger or weaker? Mention the ratios. 8) Give suggestions to the company to improve their performance in the coming years. Industry Averages for Financial Ratios Particulars (Rs) Current Ratio 1.50 Quick ratio 1.3 Gross Profit ratio 23.0 % Net Profit ratio 8.0% Return-on-Capital Employed 9.0% Return-on-Shareholders Equity 13.1% Earnings per Share 6.0 Debt-Equity Ratio 0.96 Interest-Coverage Ratio 2.5 Total-Asset Turnover times Fixed-Assets Turnover 0.85 Debtors Turnover times Average Collection period 2.85 Stock-Turnover ratio times 5 times 74 days 4.3 times Balance Sheet as on 30 June 2006

- 28. For Year 2006 2006 2005 2005 (Rs in (Rs in (Rs in (Rs in 000) 000) 000) 000) Source of Funds 3. Shareholder’s Funds 2,64,800 2,50,000 c) Share Capital 26,00,78 21,90,00 d) Reserve & Surplus 0 28,65,58 0 24,40,000 0 4. Loan Funds 90,000 a) Secured 2,70,800 500 b) Unsecured 25,30,500 Total 31,36,38 Application of 0 Funds 4. Fixed Assets 8,10,600 6,60,800 a) Gross Block 2,10,700 1,75,400 b) Less: Depreciation 5,99,900 4,85,400 c) Net Block 5,35,400 d) Capital-work-in 80,000 50,000 10,25,000 Progress at cost including 6,79,900 Advances 790,500 5. Investment 15,00,80 11,40,79 0 0 6. Current Assets 3,16,300 1,34,000 9,14,790 Loans Advances 18,17,10 12,74,79 63,310 c) Current Assets 0 0 25,38,500 d) Loans & Advances 4,00,600 14,16,50 3,60,000 Less: 0 Current Liabilities & 2,49,480 Provisions 31,36,38 Net Current Assets 0 Miscellaneous Expenditure Total

- 29. Profit and Loss Account for the year ending 30 June, 2006 2006 2005 (Rs in 000) (Rs in 000 Income Sale 22,00,000 20,00,000 Other income 1,47,000 71,450 Total 23,47,000 20,71,450 Expenditure Material Consumed 9,24,900 790,000 Power and Fuel 44,000 33,000 Repair and Maintenance 66,000 50,000 Salaries, Wages, and other Benefits 125,800 92,000 Administrative and Selling Expenses 590,700 602,000 Interest 58,000 30,000 Depreciation 38,400 33,600 Total 18,47,800 16,30,600 Profit for the Year before Tax 4,99,200 4,40,850 Less: provision for Income Tax 10,000 Net Profit for the Year after Tax 4,99,200 4,30,850

- 30. Case 5: Analysis Of different costs of Best Manufacturing Group Corporation The Best Manufacturing Group Corporation manufactures four products in separate factories and then markets them through different channels. The company’s accountant has asked several members to describe their expectations of the business environment for the coming year. Each member was asked to write up his personal outlook, including changes in selling prices, product demand, variable production costs, and variable selling costs, fixed production costs, and fixed selling and administrative costs. At a recent staff meeting, the four vice president’s of different departments met and made suggestions regarding the profitability of the company. The VP Data Processing, VP Finance, and VP Sales have made their suggestions about the expected business environment for the coming year. As a consultant to the company, comment on the suggestions made by the vice president of the four departments. The income statement for the company in contribution income statement format is given as under: Particulars (Rs) (R s) Total Sales (66,000 Units at Rs 12.00 per 7, unit) 92 Less: Variable Production Costs 2,90 ,0 (66,000 Units @ Rs 4.40 per unit) ,400 00 Variable Selling Costs (66,000 Units @Rs 2.80 per unit) 1,84 Total Variable Costs ,800 Contribution Margin Less: Fixed Production Costs 4, Fixed Selling and Administrative Costs 1,30 75 Total Fixed Costs ,500 ,2 Income Before Taxes 48,2 00 00 3, 16 ,8 00 1, 78 ,7

- 31. 00 1, 38 ,1 00 5. Changes in Production Costs Only: The manager of production believes that variable production costs will increase by 10 percent and that fixed production costs will rise by 5 percent. With no other anticipated changes, what is the projected profit for the coming year? Particulars (Rs) (Rs) Total Sales (66,000 Units at Rs 12.00 per 7,92,000 unit) Less: Variable Production Costs 3,19,44 (66,000 Units @ Rs 4.84 per unit) 0 Variable Selling Costs (66,000 Units @Rs 2.80 per unit) 1,84,80 5,04,240 Total Variable Costs 0 2,87,760 Contribution Margin 1,37,025 Less: Fixed Production Costs (Rs 1,30,500 48,200 x 1.05) 1,85,225 Fixed Selling and Administrative 1,02,535 Costs Total Fixed Costs Projected Income before Taxes Thus, if the variable and fixed production costs do not change and no adjustments to selling price or volume are made, the company’s profit will decrease by Rs 35,565. Because both variables and fixed production costs are projected to increase, management may want to increase the selling price to offset the rise in costs. Increasing the number of units produced and sold also would help offset the higher fixed costs. Because the production manger has commented on only production costs, the controller should try to augment the forecast by having other managers develop projections in their areas of expertise.

- 32. 6. Changes in All Cost Areas: all costs will change, according to the manager of data processing. He believes that all variable costs will go up by 10 percent, and that all fixed costs will rise by 5 percent. He does not anticipate any other changes. Particulars (Rs) (Rs) Total Sales (66,000 Units at Rs 12.00 per 7,92,000 unit) Less: Variable Production Costs 3,19,44 (66,000 Units @ Rs 4.84 per unit) 0 Variable Selling Costs (66,000 Units @Rs 2.80 per unit) 2,03,28 5,22,720 Total Variable Costs 0 2,69,280 Contribution Margin 1,37,025 Less: Fixed Production Costs (Rs 1,30,500 50,610 x 1.05) 1,87,635 Fixed Selling and Administrative Costs 81,645 (48,200 x 1.05) Total Fixed Costs Projected Income before Taxes Like the manager of production, the manager of data processing has concentrated only on projected costs. In this scenario, all costs are expected to increase. Profit decrease to Rs 81,645. 7. Changes in Demand and in All Costs Areas: The manager of Finance anticipates volume changes as well as changes in all cost areas. He believes that unit demand will increase by 8 percent, all variable costs will go up by 20 percent, and all fixed costs will decrease by 10 percent. Particulars (Rs) (Rs) Total Sales (71,280Units at Rs 12.00 per 8,55,360 unit) Less: Variable Production Costs 3,76,35 (71,280Units @ Rs 5.28 per unit) 8 Variable Selling Costs 6,15,859 (71,280Units @Rs 3.36 per unit) 2,39,50 2,39,501

- 33. Total Variable Costs 1 Contribution Margin Less: Fixed Production Costs (Rs 1,30,500 x 0.9) 1,17,45 1,60,830 Fixed Selling and Administrative Costs 0 78,671 (48,200 x 0.9) 43,380 Total Fixed Costs Projected Income before Taxes The profit here further gets reduced. The manager of finance believes not only that variable costs are going to increase but that volume also will increase. 8. Changes in Selling Price, Product Demand, and Selling Costs: According to the manager of sales, the company should increase the selling price by 10 percent, which will cause demand to fall by 8 percent. In addition, variable selling costs will go down by 5 percent, and administrative costs will go up by 10 percent. Particulars (Rs) (Rs) Total Sales (66,720 Units at Rs 13.20 per 8,80,704 unit) Less: Variable Production Costs 2,93,568 (66,720 Units @ Rs 4.40 per unit) Variable Selling Costs 1,61,51 (66,720Units @Rs 2.66 per unit) 4,28,683 Total Variable Costs 3,72,821 Contribution Margin 1,30,50 Less: Fixed Production Costs (Rs 1,30,500 0 x 0.9) 53,020 1,83,520 Fixed Selling and Administrative Costs 1,89,301 (48,200 x 0.9) Total Fixed Costs Projected Income before Taxes The manager of sales has the most optimistic outlook. Overall, in this scenario, profits increase by Rs 51,201 (189,301 – 1, 38,100).

- 34. Appendix-I is a comparative summary of the four executive’s predictions. Appendix I Comparative CVP Analysis Best Manufacturing Group Corporation Summary of Projected Income before Taxes For the Year Ended 31 December 2006 Particulars (Rs) (R (R (Rs) s) s) Total Sales 7,92, 7, 8, 8,01,5 Less: Variable Production Costs 000 92 55 04 Variable Selling Costs 3,19, ,0 ,3 2,67,1 Total Variable Costs 440 0 60 68 Contribution Margin 1,84, 3, 3, 1,61,5 Less: Fixed Production Costs 800 19 76 15 Fixed Selling and Administrative 5,04, ,4 ,3 4,28,6 Costs 240 40 58 83 Total Fixed Costs 2,87, 2, 2, 3,72,8 Projected Income before Taxes 760 03 39 21 1,37, ,2 ,5 1,30,5 025 80 01 00 48,2 5, 6, 53,020 00 22 15 1,83,5 1,85, ,7 ,8 20 225 20 59 1,89,3 1,02, 2, 2, 01 535 69 39 ,2 ,5 80 01 1, 1, 37 17 ,0 ,4 25 50

- 35. 50 43 ,6 ,3 10 80 1, 1, 87 60 ,6 ,8 35 30 81 78 ,6 ,6 45 71 Review Questions 7) Identify specific types of variable and fixed costs, and comment on the changes in these costs caused by changes in operating activity. 8) Define fixed cost, variable cost, semi-variable cost and give example of each one of them. 9) Briefly analyze the cost behavior patterns in a service-oriented business. 10) Why is an understanding of cost behavior useful to managers? Give examples to illustrate your answer. 11) Define cost-volume-profit analysis and explain how CVP analysis can be used for managerial planning. 12) ‘Fixed costs remain constant in total but decrease per unit as productive output increases’, Comment.

- 36. OUT OF BOX ACTIVITY Visit To Banks • Knowledge about various types of Deposits /Advances • Rates of Interest (current) • Procedure of working There will be one session to know about how to calculate income tax.