Sustainability of Microfinance: A Case of Tea SACCOs in Kericho, Buret and Bomet Districts of Kenya

- 1. WORLD ACADEMIC JOURNAL OF BUSINESS & APPLIED SCIENCES-MARCH-OCTOBER 2013 EDITION Journal of Economics & Finance (JEF) October 2013 VOL.1, No.8 Sustainability of Microfinance: A Case of Tea SACCOs in Kericho, Buret and Bomet Districts of Kenya M.C. Maina (Corresponding author), G. Owuor, B.K. Mutai and L.K. Kibet Egerton University, Kenya Accepted 28 September 2013 Abstract Tea SACCOs are tea based rural SACCOs formed by tea growers, whose functions are to keep member’s savings in form of shares, savings accounts and deposit accounts among others. Little is known about the factors influencing financial sustainability of Tea SACCOs. The study covered all six Tea SACCOs in Kericho, Bomet and Buret districts in the Rift valley province of Kenya. Analysis involved evaluating growth in net worth, administrative efficiency, loan portfolio quality, staff productivity and transaction costs. The study found that the growth of net assets had been on the decline over the years, loan portfolio was poor and default rates were high. According to the indicators evaluated, Tea SACCOs had not yet reached their full potential in outreach and that high transaction costs hindered their financial sustainability. Key Words: Microfinance, Tea SACCOs, Outreach, sustainability, Small Scale farmers, Transaction costs 1. Introduction Following the liberalization of Kenya’s financial markets in the 1990’s, lending from commercial banks and the government, to agriculture, reduced substantially (G.O.K, 2002d). The liberalization of the Kenyan economy, brought havoc to the institutional arrangements that supported the agricultural credit system and many such as the Agricultural Finance Corporation, Kenya Farmers Association and National Cereals and Produce Board were negatively affected. These arrangements were also not accessible to most farmers, they were limited to relatively large producers and the situation worsened when funds were in short supply. Also by mid 1990’s large banks reduced their presence in rural areas by closing branches. This not only affected access to credit across rural Kenya but also to basic financial services like saving and checking accounts (Argwings-Kodek, 2004). Microfinance, both micro credit and micro savings, provide poor people with a way to procure and build up assets. It encourages borrowers to invest in productive activities and savers to amass assets and earn interest. Microfinance institutions (MFIs) focus on rural and urban poor households and their demand for financial services. Experience shows that microfinance can help the poor to increase income and reduce their vulnerability to external shocks (Mosley, 2002). Expectations have been that microfinance will lead to poverty alleviation in low income countries, through expanding people’s set of capabilities or opportunities to develop (Morduch, 2000). Microfinance has twin missions. The first concerns household level goals of economic and social empowerment , such as; raising incomes, building assets, improving access to financial services for the poor, and other positive and social 320

- 2. WORLD ACADEMIC JOURNAL OF BUSINESS & APPLIED SCIENCES-MARCH-OCTOBER 2013 EDITION externalities. The other mission is the financial sustainability of the MFI. The drive for financial sustainability and lower operational costs may lead to a tendency to provide larger loans to less poor clients, a drift from the poverty alleviation goal of MFIs, a case referred to as a ‘mission drift’. This new paradigm has however stimulated research on financial performance and financial efficiency of MFIs. A successful rural finance institution needs to be financially sustainable and have substantial outreach to the targeted rural population (Yaron, 1994). A sustainable institution is one which is viable and does not depend on donor resources but on its own resources. A viable institution is able to cover its costs and make a profit from its business operations. Savings are a pillar of sustainability. Delinquency or non payment of loans has disastrous consequences on sustainability (Gibbons, 1996). High operating costs damage the viability of lending institutions even if they recover most of their loans (Meyer and Laison, 1996). The finding of one study of MFIs in Burkina Faso indicates that MFI institutions have low outreach. Factors holding back their outreach performance include unwillingness to mobilize local savings and the high cost of supply of micro financial services. The results of the study also showed the MFI institutions to be unviable and unsustainable due to the low interest rates charged for loans. Many studies also show that donor funded microfinance institutions are unsustainable and of limited outreach (Congo, 2002). A study of the performance of the Lesotho credit union movement in relation to external/aid financing over several years showed disappointing results and when support was withdrawn the majority of the unions collapsed (Sparreboom-Burger, 2000). Various studies in Kenya identify inadequate financial resources for investment in rural agriculture as the key impediment to the adoption of improved production technologies and growth of the sector (Odendo et al, 2002, Salasya et al, 1996). In the last three decades, Kenya’s rural finance has been left to the private sector. With liberalization and the bringing of more and more of the financial sector under the banking act, farmers and the rural sector are now starved of both credit and other financial services (G.O.K, 2002d). Savings and Credit Cooperative Societies (SACCOs) are semi-formal financial institutions which developed as alternative channels of Savings and Credit. These have continued to experience an expansion in numbers and their client base during the post economic liberalization era (Oketch et al, 1995). The growth of financial cooperatives in Kenya has fast overtaken those of the agricultural marketing cooperative societies in terms of membership and turnover. There were 10,184 registered cooperative societies in 2004, 38% of them were SACCOS. The SACCOs contribute over 70% of the cooperative gross domestic product. They provide about 31% of national savings and have a membership of over 2.8million (48%) out of a total of 5.77million cooperative members (G.O.K, 2004b). There are currently over 100 rural SACCOs and most are linked to formal agricultural marketing systems and the associated cash crop as the common bond. Majority of rural SACCOs members and clientele are small scale farmers (ICA, 2003). Tea SACCOs are tea based rural SACCOs formed by tea growers. Tea SACCOs keep member savings in form of shares, savings accounts and deposit accounts. Uncertainty therefore remains over how the savings and credit services of Tea SACCOs in Kenya affect agricultural production, incomes and the overall economic well being of small scale farmers. Studies are also lacking which assess the economic impacts of Tea SACCOs on small-scale tea farmers in Kenya. Little is known about how their financial services affect agricultural production, incomes and the overall economic well being of these farmers. Kenyan rural SACCOs and especially Tea SACCOs are poorly documented in the current literature on microfinance. This study is an attempt to fill this knowledge gap. And finally, due to the inconclusive results of earlier MFI impact studies the need arises for further research (Goldberg, 2005). The economic impacts on participants need to be examined and the link to the performance of the Tea SACCOs. The 321

- 3. WORLD ACADEMIC JOURNAL OF BUSINESS & APPLIED SCIENCES-MARCH-OCTOBER 2013 EDITION first specific objective was to evaluate factors that influence financial sustainability in terms of portfolio quality, transaction costs, networth, administrative efficiency, and staff productivity of Tea SACCOs in Kericho, Bomet and Buret Districts. The second objective was to evaluate the impact of participation in Tea SACCOs on the economic welfare of small scale farmers in Kericho, Bomet and Buret Districts. 2. Methodology The study area covers Kericho, Bomet and Buret districts in the Rift valley province of Kenya. These districts were chosen for study because of the high rural poverty of 60% and low agricultural productivity. These districts would be expected to have lower poverty due to its high agricultural potential due to favourable rains, soils and climate. The three districts are dominated by small scale farming communities, who constitute upto seventy percent of farm households. Besides they have witnessed increased activities of Tea SACCOs from the 1992 to date. The numbers of Tea SACCOs registered with the Ministry of Cooperative Development and Marketing increased and the membership expanded over the same period (G.O.K., 2002a, G.O.K., 2002b, and G.O.K., 2002c). The population for this study consisted of small-scale farmer households operating tea enterprises in Kericho, Buret and Bomet districts. A combination of purposive, multistage and stratified random sampling techniques was used to select the samples. The districts were purposively selected because of the foregoing reasons. All 10 tea processing factories in Buret, Bomet and Kericho Districts were selected for study. Buret had six factories namely, Kapkatet, Kapset, Litein, Kaptebennet, Kobel and Mogogosiek. Kericho District had Tegat and Chemomul factories and finally Bomet District had Kapkoros and Tigaga factories. Each factory has a tea catchment area of several villages, which are served by Bandas (Tea collection centres) that are used as collection points for harvested tea leaf for onward transportation to the factory for processing. Both primary and secondary data were collected for the study. Cross sectional primary data were collected by administering questionnaires to the Tea SACCOs managers. The data included, age of SACCOs, membership size, facilities, range of services and products, financial management practices, supervision and governance. All the Tea SACCOs were reluctant to provide their financial statements and other data relating to their loan portfolios. However the financial statements, which formed the secondary data, for the years 2003 to 2009, were obtained from the District Cooperative and Marketing Officer, who had the responsibility of supervising the Tea SACCOs. To achieve the first objective, financial sustainability was evaluated using a range of indicators. These included growth in net worth, administrative efficiency, loan portfolio quality, staff productivity and transaction cost analysis. These indicators were calculated and compared with MicroRate and MicroBanking Bulletin benchmark ratios. MicroRate presents average values for efficiently managed microfinance institutions and MicroBanking Bulletin gives average values for credit unions. These 2009 averages were developed from survey data of microfinance institutions across the continents. 3. Results and discussion The three districts had a total of 240,097 households (G.O.K., 2002a,2002c,2002d) and those that produced tea and marketed through KTDA were 45.5 % (KTDA , 2009). The KTDA operated through a total of 10 tea factories and had an average of 44 Bandas each. Up to 62.9 % of tea growers, who used KTDA services, also used Tea SACCOs services. Among the small scale farmer households in the districts, 28.6 % were members of a Tea SACCOs (KTDA, 2009). In terms of establishment, the oldest Tea SACCOs was 20 years and the youngest was 2 years. According to Micro Banking bulletin benchmarks (Microfinance Information Exchange, 2010). MFIs which are older than 322

- 4. WORLD ACADEMIC JOURNAL OF BUSINESS & APPLIED SCIENCES-MARCH-OCTOBER 2013 EDITION 14 years are considered mature. With 83.3 % of the Tea SACCOs being older than 14 years, these institutions would be considered mature. The highest number of employees at a SACCOs was 30 and the least was 14. The average number of employees was 22, as against a credit union median of 24 (Microfinance Information Exchange, 2010). All these Tea SACCOs had branches in rural shopping centers, which included mobile units to members living far from the branches. They offered their services through a total of 18 outlets as compared to commercial banks and MFIs combined (Barclays, KCB, Standard Chartered, Equity, Transnational Bank, Faulu Kenya, K-Rep, KWFT and Jamii Bora) which had 19 outlets. This makes the Tea SACCOs dominant players in microfinance provision to the farming community in the area. According to the Tea SACCOs survey data results, the main competitors of Tea SACCOs are commercial banks, microfinance institutions, other primary cooperatives in the area and other non-Tea SACCOs. The only Non-Bank Financial institution available in the area is Agricultural Finance Corporation (AFC). Apparently all these financial institutions are concentrated in only 4 major towns within the 3 districts, i.e Kericho, Bomet, Litein and Sotik.. Only one Tea SACCOs had a branch located in major town, and within the vicinity of commercial banks and MFIs. The rest of the Tea SACCOs and their branches were located in rural shopping centers and market centers. The trend appears to have been to expand to new and remote areas which were poorly served by financial institutions. The average proximity to Tea SACCOs was 7.43 kilometers (kms) while the average distance to the nearest commercial bank or MFIs was 20.8 kms in Kenyan rural areas (Nyoro, 2002).This showed that Tea SACCOs were relatively closer to the farmers. This might have been as a result of Tea SACCOs deliberately targeting commercially viable rural areas which had not been reached by other formal financial institutions. A household’s proximity to a financial institution is crucial to its demand for financial services because proximity strongly determines transaction costs. Equity or networth represents the capital of the organisation. It is an item on the balance sheet and refers to equity position at a point in time. It includes capital contributions of members, retained earnings and the surplus for the particular year. The Tea SACCOs main component of equity is member share contributions. The average net assets per member represents the share holders equity or member funds invested in the Tea SACCOs. The value FOR Tea SACCOs was positive, was an indication that they were solvent i.e assets exceed liabilities. All the Tea SACCOs surveyed had positive net worth over the 2003 to 2009, hence the positive average net assets per member. Table 1 shows annual growth of mean member net worth. Table 1: Annual Percentage Growth of Net Worth Year 2004 2005 2006 2007 2008 2009 Growth (%) 19.7 9.3 -2.8 .30 -2.3 17.3 Inflation rate (%) 9.8 9.0 10.3 10.5 9.7 26.3 Table 1 shows positive growth in the years 2004, 2005, 2007 and 2009. In 2006 and 2008 growth was negative. The absence of government regulations in this sector raised fears of losses during the referendum of 2005 and the general election of 2007 leading to investor panic that led to membership and share withdrawals. This explains the negative growth in net worth that followed in 2006 and 2008. According to a study by Hamid (2011), financial institutions with high deposits and short term funds were more susceptible to withdrawals and as a result the probability of their failure is higher. PEARLS is a financial performance monitoring system designed by World Council of Credit Unions (WOCCU) to offer management guidance for credit unions and other savings institutions. According to the WOCCU’s PEARLS performance ratios annual growth should be greater than the inflation rate, for real growth to have occurred (Evans and Branch, 2002). Table 1 show that in 2006 to 2008 the real growth in net worth was negative. An MFI portfolio report contains all information about lending operations.The loan portfolio refers to the number of loans, repayment rates, delinquent rate, default rate and diversification. The loan portfolio is the major 323

- 5. WORLD ACADEMIC JOURNAL OF BUSINESS & APPLIED SCIENCES-MARCH-OCTOBER 2013 EDITION source of earning for MFIs, while the default rate affects financial sustainability. In order to examine the Tea SACCOs loan portfolio quality, percentage loan and default accounts for 2006 to 2009 were the indicators calculated and are shown in Table 2. Data for the rest of the years were not available. Table 2: BOSA Borrowers and Defaulters Rates YEAR 2006 2007 2008 2009 % Bosa Borrowers 52 59 34 32 % Bosa Defaulters 23 23 29 17 As an indicator of loan portfolio quality, percentage borrowers showed fluctuation and decline from 2006 to 2009. The post election violence in the region may have disrupted the lending activities from 2008 resulting in the decline. This would have negative implications for interest revenues, more so, because it is the major source of revenue generation. A decline in borrowers combined with high costs of operation undermine the viability and hence sustainability of Tea SACCOs. Loan default rate was also high at an average of 17%, compared to the Kenyan industry average of 7.5% in 2009. The high default rate could be attributed to an ineffective repayment enforcement mechanism, lack of effective collateral and poor selection of creditors. The increased default rate of 29 % in 2008 would have been due to the effect of post election violence which disrupted economic activities of members. This would have resulted in the loss of funds and revenues to the Tea SACCOs and hence affected their liquidity and financial sustainability. The evaluation of these two indicators, (loan accounts and defaulted accounts) indicate poor quality loan portfolio, which may have led to financial losses, affected operations and undermined outreach. According to WOCCU’s PEARLS technical recommendations, an excess of defaulted or delayed repayment of loans and high percentages of other non-earning assets have negative effects on credit union earnings because these assets are not earning income (Richardson, 2001). Interest rates structure is an indicator of financial sustainability. Lending interest rates were 12 to 15 percent per annum and savings and deposit interest rates ranged from 5 to 7 %per annum and below. The cooperative principle of benefit to members keeps lending interest rates low, and this requires that its funds for lending come at lower interest rates. Hence the low yielding interest on it’s saving and deposit products. The consequences would be a failure to attract savings and deposits, and a poor supply of loan funds. This leads to reliance on external funds for loaning to members, a narrowing of interest spread and reduced profits. This would have a negative effect on viability and financial sustainability. Administrative Efficiency Sustainability of an MFI also depends on its capacity to minimize transaction costs, especially administrative expenditures. Tea SACCO mean administrative efficiency was calculated for years 2003 to 2009, as shown in Table 2. The data for use in calculation was obtained from the Tea SACCO income statements. Transaction costs are the sum of administrative expenses and the loan loss provision. Administrative efficiency was calculated as the ratio of annual administrative expenses to transaction costs. The annual mean for all the Tea SACCOs for each of the seven years was then calculated and results are provided in the Table 2. According to Christen (1997), the norms of optimal practices assume that a well managed MFI’s ratio of administrative expenses to transaction costs be between 15-25%. According to MicroRate benchmark ratios, administrative efficiency is at 18 % for efficient MFIs. On the whole the Tea SACCOs were administratively inefficient, their ratio being above the 25% limit, except in the year 2008 when it was 19.8%. This low efficiency 324

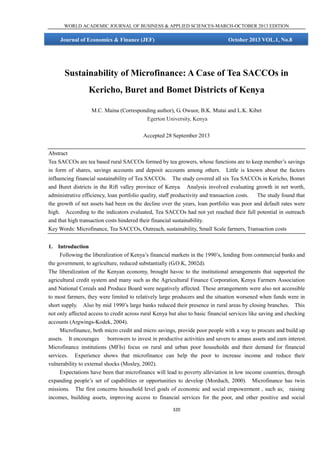

- 6. WORLD ACADEMIC JOURNAL OF BUSINESS & APPLIED SCIENCES-MARCH-OCTOBER 2013 EDITION would have arisen from the poor loan portfolio, small loan sizes and high cost of external funds. The overall effect would be a reduction in profitability. Table 3: Mean Tea SACCO Administrative Expenses, Transaction Cost and Administrative Efficiency *sho Years Administrative Transaction Administrative ws Expenses(Ksh.) Costs(Ksh.) efficiency (%) the 2009 2628924 8960300 29.3 only 2008 2411586* 12209707* 19.8* year 2007 4675975 13378306 34.5 when 2006 1987528 14198454 37.4 admi 2005 4471240 9392630 47.6 nistra 2004 3939897 11449806 34.4 tive 2003 4184775 6761116 61.9 effici ency was achieved Staff productivity is a measure of financial sustainability. BOSA loan accounts for all the Tea SACCOs were divided by the total number of employees to arrive at the respective accounts per employee. The calculation showed that loan accounts per employee in the BOSA section was 52. This value was way below the average of 155loan accounts per employee for credit unions with large outreach in sub-Saharan Africa (Microfinance Information Exchange, 2010). This showed that Tea SACCOs had low staff productivity with regard to this indicator. To evaluate the profitability (viability) of Tea SACCOs, their unit transaction costs and unit gross margins were calculated.Transaction costs include operational or administrative expenses and the cost of bad debts. Unit transaction costs are defined as the total transaction costs as percentage of all liabilities plus assets (Desai and Namboodiri, 1991). Gross revenue is the sum of interest revenue from all loans and non-interest revenue. Unit gross revenue is gross revenue as a percentage of all liabilities plus assets. Financial costs refer to the cost of funds extended as loans. Unit financial costs U_FC) are financial costs as a percentage of all liabilities plus assets. Unit gross margin (U_GR)is unit gross revenue minus unit financial costs. Table 4 shows all the mean values of unit costs for the Tea SACCOs.Figure 1 shows the trend for the mean unit transaction costs (U_TC) and unit gross margins (U_GM) for all Tea SACCOs from 2003 to 2009. If the unit gross margin is greater than, equal to or less than unit transaction cost, the MFI would be profitable, break- even or unprofitable respectively. Table 4: 2003 -2009 Tea SACCO Mean Values of Unit Gross Revenue, Unit Financial Costs and Unit Gross Margin and Unit Transaction Cost. Years 2003 2004 2005 2006 2007 2008 U_GR 0.045 0.035 0.045 0.125 0.07 0.03 U_FC 0.0055 0.0055 0.015 0.05 0.0395 0.0295 0.030 0.045* 0.035 0.045 0.08 U_GM 2009 0.025 0.020* -0.015* 0.010 U_TC 0.026 0.029 0.022 0.063* 325 0.03* 0.024* 0.013

- 7. WORLD ACADEMIC JOURNAL OF BUSINESS & APPLIED SCIENCES-MARCH-OCTOBER 2013 EDITION Figure 1: Unit Transaction costs and Unit Gross Margins The Figure 1 shows that on average the Tea SACCOs were profitable /viable from 2003 to 2005. In 2006 to 2009, the SACCOs were not viable because the unit transaction costs were greater than unit gross margins. In 2008, unit gross margins were negative, meaning that the financial costs could not be recovered. High transaction costs are associated with dissemination and recovering of a large number of small size loans. A possible explanation for 2006 to 2009 poor performance may have resulted from increased inflation in the economy, after the referendum of 2005 and the general election of 2007(Ahlin, et al., 2010). Inflation raises the cost of living making it difficult for members to set aside savings and hinders their capacity to borrow and make repayment. The uncertainty that accompanied the post election violence also contributed towards poor performance. These events led to low borrowing from the Tea SACCOs. This would have reduced income from lending operations. The financial sustainability of Tea SACCOs was measured against some Consultative Group to Assist the Poor(CGAP) standards for efficient MFIs, and the findings support the hypothesis that Tea SACCOs were not financially self sustaining based on some indicators as follows. Over the period under analysis from 2003 to 2009, there were indications that the Tea SACCOs were financially unsustainable. A major contributor to transaction costs are the administrative costs and the finding showed that Tea SACCOs were administratively inefficient. Administrative efficiency measures the cost of managing the organization’s assets. These costs were way above the maximum 25% of transaction costs allowed for efficient MFIs (Christen, 1997). This would lead to high transaction costs in operations and reduces profitability. This finding is supported by a study in Namibia by Adongo and Stork (2005) which found credit unions to be unviable. Although the explanation given was that there was a conflict between low interest rates charged by credit unions and the possibility of increasing profits but at higher interest charges to members. Unviability meant revenue generated was unable to cover the high costs of borrowed funds and other operational expenses. Low lending and low interest rates may have been contributing factors to low revenue in Tea SACCOs. The increasing reliance on high cost borrowed funds of 7-10 % interest rate per annum narrowed the interest spread for Tea SACCOs. SACCOs lending rates were kept low, ranging from 12 -15%, which were fixed at annual general meetings. This situation would have led to lower revenues against high financial costs and hence reduce viability. The inability to raise own funds from savings and deposits was hindered by low interest rates offered and low dividends for shares. The high cost of borrowed funds and the narrow interest spread reduces profitability and revenues from lending respectively. Loan portfolio quality deteriorated with percentage borrowers in Bosa section declining over the years, coupled with high default rate at an average of 23 percent. Low borrowing lowers revenues from lending activities, while defaults lead to loss of funds and revenues. These would negatively affect the Tea SACCOs 326

- 8. WORLD ACADEMIC JOURNAL OF BUSINESS & APPLIED SCIENCES-MARCH-OCTOBER 2013 EDITION profitability and sustainability. The causes might be ineffective repayment enforcement mechanism, lack of effective collateral and improper selection. Many households lacked collateral in form of land title deeds. Tea production and its main marketing structure was used as a collateral substitute.More collateral substitutes like group lending and joint liability partnership, may improve the lending portfolio. Other farm and non-farm enterprises can be considered and repayment linked to local production cycles, like market days. These activities would encourage more borrowing and improve ability to repay. Staff efficiency in terms of the number of loan accounts per employees was low. This coupled with the fact that the average loan amount was low in 2009 (Ksh. 13,745.72), would imply that revenue generation per employee was low, viewed against the costs of maintaining an employee. This scenario negatively affects profitability of operations and reduces the level of financial sustainability. This may have resulted from of the lack of an efficient management information system, lack of facilities and slow procedures. This situation could be addressed, through new operational designs mechanisms which would include compatible incentives and performance based compensations, such as profit sharing, collection fees, efficiency wages and quasi-equity. A study of Ethiopian MFIs showed they were financially sustainable with low default rate of 2 %( Kereta, 2007), compared to 17% for Tea SACCOs. An explanation given for this was that MFIs in Ethiopia provided farmers with advice on utilization of credit. This factor could have improved repayment. However Tea SACCOs do not provide advisory services for credit uses, hence credit may have been used in non income generating activities. Failure to become financially self-sufficient may linked to low client density, limited lending, and difficult socio-economic contexts, low staff productivity and high costs. The findings of this study show that Tea SACCOs performed well on outreach but poorly on financial sustainability. A number of studies support this finding that there is often a trade-off between financial sustainability and outreach (Hermes, et al., 2011; Cull and Spreng, 2010). Hermes, Lensink and Meesters (2011), also reported that low average loan balances were found in financially unsustainable MFIs, a feature manifested by Tea SACCOs. 4. Conclusion At the institutional level, indicators of outreach were evaluated and revealed poor performance of the Tea SACCOs over 2003 to 2009 periods. A high (54.5%) percentage of tea growers, a higher percentage (73%) of all small scale farmers and an equally high percentage (79.8%) of women were non-users of their services. The Tea SACCOs showed extreme vulnerability to external shocks, such as the referendum and the general elections, as a result of the absence of financial regulation in the sector at the time. These national events were associated with a decline in growth of membership, shares, total BOSA loans and FOSA deposits of the Tea SACCOs due to panic withdrawals by members arising from the absence of safeguards for their funds. Regarding the evaluation of financial sustainability of Tea SACCOs’s, the study found that the growth of net assets had been on the decline over the years, loan portfolio was poor and default rates were high. The SACCOs had low administrative and staff efficiency. On the issue of profitability, they had been unviable over recent years, due to their low revenues and high transaction costs, which made them financially unsustainable. There was extensive use of the high cost external funding in its business operations. The mean member shareholdings remained steadily low, and mean Bosa loans had been on the decline over the period 2003 to 2009. The low interest rates offered for savings and deposits led to limited financial resources for operations. These challenges undermined their capacity to serve their members and expand outreach to new clients. It also offers some explanation for their inactive/dormant cycles.These institutions are therefore faced with financial sustainability challenges and this would affect the services received by members. According to the indicators evaluated, Tea SACCOs had not yet reached their full potential in outreach and that high transaction costs hindered their financial sustainability. 327

- 9. WORLD ACADEMIC JOURNAL OF BUSINESS & APPLIED SCIENCES-MARCH-OCTOBER 2013 EDITION References Adongo, J. and Stork, C. (2005). “Factors Influencing the Financial Sustainability of Selected Microfinance Institutions in Namibia”. Nepru. Agrekon, Vol 46, No 2 Ahlin,C.; Lin, J. and Maio, M. (2010). “Where Does Microfinance Flourish? Microfinance Institution Performance in Macroeconomic Context”. Journal of Development Economics. Vol 95, Issue 2, 105-120. Argwings – Kodhek, G. (2004). Feast and Famine: Financial Services for Rural Kenya. Tegemeo institute of agricultural policy and development., Egerton University. Christen, R.P. ( 1997). Banking Services for the Poor: Managing for Financial Success — (An Expanded and Revised Guidebook for Microfinance Institutions). ACCION International. Washington, DC. Congo, Y. (2002). Performance of Microfinance institutions in Burkina Faso. Discussion paper number 2002/01World institute of development economic research. United Nations University, UNU-WIDER. Helsinki Cull, R. and Spreng, C. P. (2011). "Pursuing efficiency while maintaining outreach: Bank privatization in Tanzania, "Journal of Development Economics, Elsevier, vol. 94(2), pages 254-261. Desai, B.M. and Namboodiri, N.V. (1991). Institutional finance for agriculture. Centre for Management in Agriculture. Monograph. Oxford & IBH Publishing Company Evans, A. C. and Branch, B. (2002). A Technical Guide to PEARLS A Performance Monitoring System. World Council of Credit Unions. www.woccu.org G.o.K - (2002a). Bomet District Development Plan 2002- 2008, Effective Management for Sustainable Economic Growth and Poverty Reduction. Ministry of Finance and Planning. Government Printers, Nairobi. - (2002b). Buret District Development Plan 2002 – 2008. Effective Management for Sustainable Economic Growth and Poverty Reduction. Ministry of Planning and National Development. Government Printers, Nairobi. - (2002c). Kericho district Development Plan 2002-2008. Effective Management for Sustainable Economic Growth and Poverty Reduction. Ministry of Finance and Planning. Government. Printers, Nairobi. - (2002d). Survey of the Financial Services Sector. Report Prepared by Deregulation Section, Ministry of Labour and Human Resources Development, Government Printers. Nairobi. - (2004b). The Ministry of Cooperatives Development and Marketing. Government Printers. Nairobi. Gibbons, D (1996). Resource mobilisation for maximising MFI outreach and financial self-sufficiency. Issues Paper No. 3 for Bank-Poor `96’ Workshop. Kuala Lumpar. Goldberg, N. (2005). Measuring the Impact of Microfinance: Taking Stock of What we know. Grameen Foundation. USA Publication Series Hamid, S. F. (2011).An Analysis on the Effect of Panic and Fundamentals in Bank FailurePredictions: Evidence from East Asian Countries. University of Exeter, United Kingdom. http://www.qass.org.uk/2011-May_Brunel-conference/ Hermes, N.; Lensink, R. and Meesters, A. (2011). “Outreach and Efficiency of Microfinance Institutions”. World Development. Vol 39, No 6. I.C.A. (2003). Cooperative Micro finance: Regional workshop. International Cooperative Alliance Regional Office for East, Central and Southern Africa, ICA/SCC, Nairobi Meyer, R.L. and Laison, D. W. (1996). “Issues in providing Agricultural Services in Developing Countries.” Economics & Sociology occational paper, No. 2323, Rural Finance Program, The Ohio State University. Ohio. Microfinance Information Exchange, (2010). 2009 MFI Benchmarks Data. MicroBanking Bulletin, Issue 20. http://www.mixmarket.org Morduch, J. (2000). “The Microfinance Schism”. World Development. Elsevier. 328

- 10. WORLD ACADEMIC JOURNAL OF BUSINESS & APPLIED SCIENCES-MARCH-OCTOBER 2013 EDITION Mosley, Paul. (2002). The Use of Control Groups in Impact Assessments for Microfinance. ILO, Working Paper 19. Odendo,M.; De Groote, H.; Odongo,O. and Oluoch,P. (2002). Participatory Rural Appraisal of Farmers’ Maize Selection Criteria and Perceived Production Constraints in the Moist Mid-altitude Zone of Kenya. Socio-Economic Working Paper No. 02-01. CIMMYT, Mexico and KARI, kenya. Oketch, H.; Abaga, A. and Kulundu, D. (1995). Demand and Supply of Micro and Small Enterprise Finance in Kenya. K-Rep, Working Paper , Nairobi. Richardson, C. D. (2001). PEARLS Monitoring System, Research Monograph number 4. World Council of Credit unions. Madison, Winconsin. http://www.woccu.org/pubs/monograp.htm. Salasya, B.D. S.,Mwangi W., Verkuyl, H., Odendo, M., and Odenya, J. O.,(1998). An Assessment of Adoption of Seed and Fertilizer Packagesand the Role of Credit in Smallholder Maize Production in Kakamega and Vihiga Districts of Kenya. CIMMYT, Mexico and KARI, Kenya. Sparreboom-Burger, P. (2000). The Performance of the Lesotho Credit Union Movement: Internal Financing and External capital Inflow. Enterprise and Cooperative Development Department. Poverty-Oriented Banking working Paper No. 17. International Labour Office, Geneva. Yaron, J. (1994). “What Makes Rural Finance institutions successful?” The World bank Research Observer, Vol. 9 No. 1. 329