Weitere ähnliche Inhalte

Kürzlich hochgeladen (20)

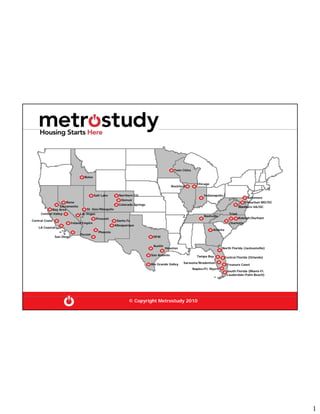

Metrostudy 2010 Housing Forecast For Distribution 1 13 10

- 1. Twin Cities

Boise

Chicago

Rockford

Salt Lake Northern CO Indianapolis

Baltimore

Denver

Reno Suburban MD/DC

Colorado Springs

Sacramento Northern VA/DC

Bay Area St. Geo/Mesquite

Central Valley Las Vegas Triad

Nashville

Prescott Raleigh/Durham

Central Coast Santa Fe

Inland Empire Charlotte

Albuquerque

LA Coastal

Atlanta

Phoenix

Tucson

San Diego DFW

Austin

Houston North Florida (Jacksonville)

San Antonio Tampa Bay Central Florida (Orlando)

Rio Grande Valley Sarasota/Bradenton

Treasure Coast

Naples/Ft. Myers

South Florida (Miami-Ft.

Lauderdale-Palm Beach)

© Copyright Metrostudy 2010

1

- 2. NATIONAL ECONOMIC OVERVIEW

Overall Consumer Confidence Index-Monthly

120

Dec. 2009 = 52.9

100

80

60

40

20

0

Dec-01 Dec-02 Dec-03 Dec-04 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09

Source: Conference Board

© Copyright Metrostudy 2010

2

- 3. NATIONAL ECONOMIC OVERVIEW

Annual U.S. Non-Ag Job Growth

5,000,000

12 Months Ending

3,000,000 Nov. 2009: <4,659,000> Jobs

1,000,000

-1,000,000

-3,000,000

Nov. 2009 Unemployment

-5,000,000 Rate = 10%

-7,000,000

Nov-99 Nov-00 Nov-01 Nov-02 Nov-03 Nov-04 Nov-05 Nov-06 Nov-07 Nov-08 Nov-09

Source: BLS

© Copyright Metrostudy 2010

3

- 4. THE U.S. HOUSING MARKET

ANNUAL RATE OF SINGLE FAMILY HOUSING STARTS

Thousands

2,000

1,800

1,600

1,400

1,200

1,000

800 Nov. 2009 Annual Starts= 482,000

600 (+5.7% from Nov. 2008)

(-74% from Peak in January 2006)

400

200

Nov-89

Nov-90

Nov-91

Nov-92

Nov-93

Nov-94

Nov-95

Nov-96

Nov-97

Nov-98

Nov-99

Nov-00

Nov-01

Nov-02

Nov-03

Nov-04

Nov-05

Nov-06

Nov-07

Nov-08

Nov-09

Source: Census Bureau

© Copyright Metrostudy 2010

4

- 5. TOP 15 STATES RANKED BY SF PERMITS – (Nov ’09)

Rank State SF Annual Permit SF Annual Change

1 Texas 63,222 -20,425

2 Florida 26,574 -16,802

3 North Carolina 24,859 -18,941

4 California 23,305 -11,714

5 Virginia 15,933 -5,350

6 Pennsylvania 13,899 -5,678

7 Georgia 13,673 -14,030

8 South Carolina 13,203 -7,998

9 Washington 12,282 -5,519

10 Arizona 12,049 -7,241

11 Tennessee 11,174 -5,858

12 Louisiana 10,574 -1,515

13 Ohio 10,554 -6,959

14 Indiana 9,521 -3,321

15 New York 9,481 -3,611

Source: Metrostudy - MetroUSA 270,303 -134,962

© Copyright Metrostudy 2010

5

- 6. THE U.S. HOUSING MARKET

Months

MONTHS OF SUPPLY OF NEW HOMES

15

14 Nov. 2009 MOS = 7.9 MOS

13

12

11

10

9

8

7

6

5

4

3

2

1

Nov-89

Nov-90

Nov-91

Nov-92

Nov-93

Nov-94

Nov-95

Nov-96

Nov-97

Nov-98

Nov-99

Nov-00

Nov-01

Nov-02

Nov-03

Nov-04

Nov-05

Nov-06

Nov-07

Nov-08

Source: Census Bureau Nov-09

© Copyright Metrostudy 2010

6

- 7. THE U.S. HOUSING MARKET

ANNUAL % CHANGE IN HOME PRICES BY QUARTER

S&P CASE SHILLER and FHFA FIGURES

20.0%

FHFA 3Q09 <3.8%>

15.0%

10.0%

5.0%

0.0%

-5.0%

S&P Case Shiller FHFA

-10.0%

-15.0% Case Shiller 3Q09 <8.9>%

-20.0%

3Q94

3Q95

3Q96

3Q97

3Q98

3Q99

3Q00

3Q01

3Q02

3Q03

3Q04

3Q05

3Q06

3Q07

3Q08

SOURCE: S&P/Case Shiller & FHFA 3Q09

© Copyright Metrostudy 2010

7

- 8. THE TEXAS HOUSING MARKETS

AVERAGE ANNUAL % CHANGE IN HOME PRICES

San Antonio Austin Dallas

Ft. Worth Houston Texas

16

14 3Q09 Austin = -0.6%

12

10

8

6

4

2

0

-2

-4

3Q99 3Q00 3Q01 3Q02 3Q03 3Q04 3Q05 3Q06 3Q07 3Q08 3Q09

SOURCE: FHFA

© Copyright Metrostudy 2010

8

- 9. JOB GROWTH-MAJOR TEXAS MARKETS

Annual Rate 2007, 2008 & Nov. 2009

120,000

87,000 76,000 2007 2008 Nov-09

70,000

22,500 26,100 24,800 9,900

20,000 4,800

-2,500 -6,200 -4,300

-30,000

-50,700

-80,000

-88,900

-130,000

HOUSTON DALLAS/FT. WORTH SAN ANTONIO AUSTIN

SOURCE: Texas Workforce Commission

© Copyright Metrostudy 2010

9

- 10. AUSTIN ECONOMIC OVERVIEW

Non-Ag Job Growth: Annual Totals

50,000 Net Job Losses Nov. ’08 to Nov. ’09 = 4,300

40,000

30,000

20,000

10,000

0

-10,000 Total Non-Ag

-20,000

Employment

780,900

-30,000

1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 Nov-

09

Source: Texas Workforce Commission

© Copyright Metrostudy 2010

10

- 11. AUSTIN APARTMENT MARKET

Occupancy/Rents

100% $1.25

OCCUPANCY 3Q09

$1.20

RENT RATE Avg. Rent = $.93/SF

Avg. Occ. = 89% $1.15

95%

$1.10

$1.05

90%

$1.00

$0.95

85%

$0.90

$0.85

80% $0.80

$0.75

75% $0.70

3Q99 3Q00 3Q01 3Q02 3Q03 3Q04 3Q05 3Q06 3Q07 3Q08 3Q09

Source: Austin Investor Interests

© Copyright Metrostudy 2010

11

- 12. AUSTIN RESALE MARKET-MLS STATISTICS

Annual Closings History

Closings

35,000

32,500 Nov. ‘09 Annual Closings = 20,758

30,000

27,500

25,000

22,500

20,000

17,500

15,000

12,500

10,000

Nov-99 Nov-00 Nov-01 Nov-02 Nov-03 Nov-04 Nov-05 Nov-06 Nov-07 Nov-08 Nov-09

Source: Real Estate Center

© Copyright Metrostudy 2010

12

- 13. AUSTIN RESALE MARKET - MLS STATISTICS

Active Listings & Months of Supply

Listings Nov. ’09 Months of

Listings 9,836 Listings Supply

14,000

Months Supply 9

5.7 MOS

8

12,000

7

10,000 6

5

8,000

4

6,000 3

2

4,000

1

2,000 0

Nov-99 Nov-00 Nov-01 Nov-02 Nov-03 Nov-04 Nov-05 Nov-06 Nov-07 Nov-08 Nov-09

Source: Real Estate Center

© Copyright Metrostudy 2010

13

- 14. AUSTIN RESALE MARKET – MLS DATA

Single Family MOS By Price Range-November 2009

MOS Previously Owned & New Construction

30

26.4

Prev. Owned New Const. 25.9

24

18

13.4

12 9.6

8.7

6.8 5.9

6.4 6.0 6.7

4.5 6.1

6

0

<$ 12 5 K $ 12 5 K- $ 17 5 K $ 17 5 K- $ 2 5 0 K $ 2 5 0 K- $ 4 0 0 K $ 4 0 0 K- $ 7 5 0 K >$ 7 5 0 K

Source: ABOR

© Copyright Metrostudy 2010

14

- 15. AUSTIN RESALE MARKET-MLS STATISTICS

Average & Median Price Trend

$290,000

Nov. 2008 Avg.

=$236,041

$265,000 (Single Family/TH/Condo)

$240,000 Average Price

$215,000 Median Price

$190,000

$165,000

$140,000

Nov. 2008 Median=

$115,000 $176,300

(Single Family)

$90,000

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 Nov-

09

Source: Real Estate Center

© Copyright Metrostudy 2010

15

- 16. AUSTIN MLS CLOSED SALES

Distributed by Sales Price

YTD Sept. 2008 vs. YTD Sept. 2009

30%

25%

2008 2009

20%

15%

10%

5%

0%

<$100K $100K-$150k $150K-$200K $200K-$300K $300K-$500K +$500K

SOURCE: Austin Board of Realtors

© Copyright Metrostudy 2010

16

- 17. THE AUSTIN NEW HOME MARKET

ANNUAL STARTS TREND: 2001 to 2009

Detached Housing

18,000

17,000

15,940

16,000

14,638

15,000

14,000

12,190 12,436

13,000

11,225

12,000

10,260 10,450

11,000

10,000

9,000

8,012

8,000

6,490

7,000

6,000

5,000

2001 2002 2003 2004 2005 2006 2007 2008 2009

© Copyright Metrostudy 2010

17

- 18. THE AUSTIN NEW HOME MARKET

ANNUAL STARTS TREND: 3Q06 to 4Q09

Detached Housing

18,000

16,502

17,000

15,940

16,000

14,540

15,000

14,009

14,000

13,152

12,436

13,000

11,543

12,000

10,399

11,000

10,000 9,315

9,000

8,012

8,000 7,301

6,587 6,511 6,490

7,000

6,000

5,000

3Q06 4Q06 1Q07 2Q07 3Q07 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09

© Copyright Metrostudy 2010

18

- 19. THE AUSTIN NEW HOME MARKET

ANNUAL STARTS & CLOSINGS

20,000

DETACHED HOUSING

18,000 Annual Closings

16,000 Annual Starts

14,000

12,000

10,000

8,000

6,000 6,490 Annual Starts

4,000

7,487 Annual Closings

2,000

0

4Q95 4Q96 4Q97 4Q98 4Q99 4Q00 4Q01 4Q02 4Q03 4Q04 4Q05 4Q06 4Q07 4Q08 4Q09

© Copyright Metrostudy 2010

19

- 20. THE AUSTIN NEW HOME MARKET

2009 ANNUAL STARTS BY SUB-MARKET

Detached Housing

1,400

1,264

1,200

1,000

833

800 734

608

600 536

433

368

400 308 300

203 166

172

200

0 C P / Le a n. R R oc k K y l e / B uda S W A us. P f l ug. G. Town M a nor D . Va l l e H ut t o S E A ust i n Dr . L. Tr a v i s

S pr i ngs

© Copyright Metrostudy 2010

20

- 21. THE AUSTIN NEW HOME MARKET

Annual Starts by Price Range

The Detached Market

2006 2007 2008 2009

5,000

4,500

4,000

3,500

3,000

2,500

2,000

1,500

1,000

500

0

<$150 $150- $200- $300- $500- >$750

$200 $300 $500 $750

© Copyright Metrostudy 2010

21

- 22. TOTAL NEW HOME INVENTORY TREND

(Under Construction & Finished Vacant Units)

Detached Housing

10,000

9,000 Under. Const. Inv. = 1,420 Units

8,000 Fin. Vac. Inv. = 1,703 Units

Total Inv. = 3,494 Units

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

4Q89 4Q91 4Q93 4Q95 4Q97 4Q99 4Q01 4Q03 4Q05 4Q07 4Q09

© Copyright Metrostudy 2010

22

- 23. THE AUSTIN NEW HOME MARKET

Annual Starts/ Vacant Developed Lot Trend

Lot Inventory MOS

30,000

The Detached Market 48

Annual Starts

Vacant Developed Lots

Months of Supply 42

25,000

36

20,000 30

24

15,000 18

12

10,000

6

5,000 0

4Q99 4Q00 4Q01 4Q02 4Q03 4Q04 4Q05 4Q06 4Q07 4Q08 4Q09

© Copyright Metrostudy 2010

23

- 24. FORECLOSURE POSTING & SALES TREND

Travis & Williamson Counties

Annual Rate

13,000

12,000

Annual Postings

11,000

10,000

Annual Foreclosure Sales

9,000

8,000

7,000

6,000

5,000

Annual Postings + 61% from Jan. ’09 to Jan. ‘10

4,000

3,000

2,000

1,000 Annual Sales +24% from Dec. ’08 to Dec. ‘09

0

Jan-07 May-07 Sep-07 Jan-08 May-08 Sep-09 Jan-09 May-09 Sep-09 Jan-10

SOURCE: Real Estate Foreclosures

© Copyright Metrostudy 2010

24

- 25. Top 20 MSAs-Highest Rates of Home Appreciation

Annual Change as of 3Q09

Wichita Falls, TX 6.0%

Corpus Christi, 5.5%

San Angelo, TX 5.4%

Hinesville, GA 5.2%

Texarkana, TX 4.7%

Jonesboro, AR 4.5%

Brownsville, TX 4.4%

St. Joseph, MO- 3.7%

Dubuque, IA 3.6%

Midland, TX 3.5%

Tyler, TX 3.4%

Amarillo, TX 3.3%

Wichita, KS 3.3%

Abilene, TX 3.3%

Lawton, OK 3.3%

Sioux City, IA- 3.1%

State College, PA 3.1%

Pittsfield, MA 3.0%

Burlington, NC 3.0%

Elmira, NY 2.9%

SOURCE: FHFA 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%

© Copyright Metrostudy 2010

25

- 26. Bottom 20 MSAs-Lowest Rates of Home Appreciation

Annual Change as of 3Q09

El Centro, CA -24.5%

Las Vegas-Paradise, NV -22.5%

Miami, FL -20.5%

Bend, OR -19.4%

Merced, CA -18.6%

Reno-Sparks, NV -17.5%

Phoenix-Mesa-Scottsdale, AZ -16.9%

Lakeland-Winter Haven, FL -16.2%

Port St. Lucie, FL -15.8%

Ft. Lauderdale, FL -15.4%

Visalia-Porterville, CA -14.9%

Ocala, FL -14.9%

Orlando-Kissimmee, FL -14.7%

St. George, UT -14.0%

Modesto, CA -13.9%

Fresno, CA -13.8%

Madera-Chowchilla, CA -13.6%

Vallejo-Fairfield, CA -13.5%

Prescott, AZ -13.4%

Lake Havasu City-Kingman, AZ -13.4%

-35% -30% -25% -20% -15% -10% -5% 0%

SOURCE: FHFA

© Copyright Metrostudy 2010

26

- 27. STATES WITH HIGHEST SHARE OF NEGATIVE EQUITY AS

OF THIRD QUARTER 2009

Oklahoma 6.0%

TEXAS 11.0%

New Mexico 11.0%

Idaho 20.0%

Ohio 20.0%

Maryland 22.0%

Virginia 24.0%

Georgia 24.0%

California 35.0%

Michigan 37.0%

Florida 45.0%

Arizona 48.0%

Nevada 65.0%

0% 10% 20% 30% 40% 50% 60% 70%

SOURCE: First American Core Logic

© Copyright Metrostudy 2010

27

- 28. 0

5,000

10,000

15,000

20,000

25,000

Houston

Dall as/Ft Wort h

Orl ando

Phoe ni x

Mary land

Aust in

Austin

San Antonio

MD - C

Northern Vi rginia

Charlotte

Cent Cal

Inland Empir e

Rale igh-Durha m

NoVa-C

Chicago

© Copyright Metrostudy 2010

Atl anta

Salt Lake City

So Cal Coast

Annual Starts Comparison

Las Vegas

National Comparison – 3Q09

Tampa

San Francisc o

Jack sonvi lle

Nashvill e

Minneapol is

Denver

28

- 29. 0

5,000

10,000

15,000

20,000

25,000

Chicago

Orland o

Atlanta

Hou ston

Phoenix

Las Vegas

San Francisco

Dallas/Ft Worth

So Cal Coast

Maryland

Inland Emp ire

Char lotte

Raleigh-Durham

Denver

Salt Lake City

© Copyright Metrostudy 2010

North ern Virginia

Cent C al

Tamp a

Jackso nville

National Comparison – 3Q09

San Anto nio

Minneapo lis

Aust in

Total New Housing Inventory - # of Units

MD - C

Austin

NoVa-C

Nashville

29

- 30. 0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

Orland o

Atlanta

Chicago

Las Vegas

Phoenix

So Cal Coast

Hou ston

Dallas/Ft Worth

San Francisco

Maryland

Char lotte

Raleigh-Durham

Jackso nville

Denver

Inland Emp ire

© Copyright Metrostudy 2010

Tamp a

Cent C al

Minneapo lis

National Comparison – 3Q09

Salt Lake City

North ern Virginia

Nashville

San Anto nio

Total Finished Vacant Inventory - # of Units

Aust in

MD - C

Austin

NoVa-C

30