Financial statements

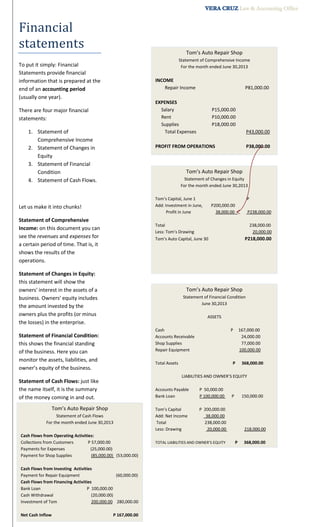

- 1. Financial statements To put it simply: Financial Statements provide financial information that is prepared at the end of an accounting period (usually one year). There are four major financial statements: 1. Statement of Comprehensive Income 2. Statement of Changes in Equity 3. Statement of Financial Condition 4. Statement of Cash Flows. Let us make it into chunks! Statement of Comprehensive Income: on this document you can see the revenues and expenses for a certain period of time. That is, it shows the results of the operations. Statement of Changes in Equity: this statement will show the owners' interest in the assets of a business. Owners' equity includes the amount invested by the owners plus the profits (or minus the losses) in the enterprise. Statement of Financial Condition: this shows the financial standing of the business. Here you can monitor the assets, liabilities, and owner’s equity of the business. Statement of Cash Flows: just like the name itself, it is the summary of the money coming in and out. Tom’s Auto Repair Shop Statement of Comprehensive Income For the month ended June 30,2013 INCOME Repair Income P81,000.00 EXPENSES Salary P15,000.00 Rent P10,000.00 Supplies P18,000.00 Total Expenses P43,000.00 PROFIT FROM OPERATIONS P38,000.00 Tom’s Auto Repair Shop Statement of Changes in Equity For the month ended June 30,2013 Tom’s Capital, June 1 P Add: Investment in June, P200,000.00 Profit in June 38,000.00 P238,000.00 Total 238,000.00 Less: Tom’s Drawing 20,000.00 Tom’s Auto Capital, June 30 P218,000.00 Tom’s Auto Repair Shop Statement of Financial Condition June 30,2013 ASSETS Cash P 167,000.00 Accounts Receivable 24,000.00 Shop Supplies 77,000.00 Repair Equipment 100,000.00 Total Assets P 368,000.00 LIABILITIES AND OWNER’S EQUITY Accounts Payable P 50,000.00 Bank Loan P 100,000.00 P 150,000.00 Tom’s Capital P 200,000.00 Add: Net Income 38,000.00 Total 238,000.00 Less: Drawing 20,000.00 218,000.00 TOTAL LIABILITIES AND OWNER’S EQUITY P 368,000.00 Tom’s Auto Repair Shop Statement of Cash Flows For the month ended June 30,2013 Cash Flows from Operating Activities: Collections from Customers P 57,000.00 Payments for Expenses (25,000.00) Payment for Shop Supplies (85,000.00) (53,000.00) Cash Flows from Investing Activities Payment for Repair Equipment (60,000.00) Cash Flows from Financing Activities Bank Loan P 100,000.00 Cash Withdrawal (20,000.00) Investment of Tom 200,000.00 280,000.00 Net Cash Inflow P 167,000.00