Capital marketing

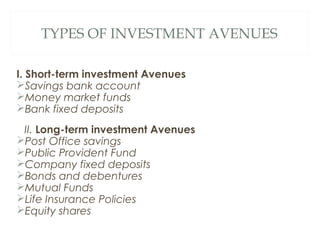

- 1. TYPES OF INVESTMENT AVENUES I. Short-term investment Avenues Savings bank account Money market funds Bank fixed deposits II. Long-term investment Avenues Post Office savings Public Provident Fund Company fixed deposits Bonds and debentures Mutual Funds Life Insurance Policies Equity shares

- 2. SAVINGS BANK ACCOUNT • Savings accounts offer low interest compared to bank deposits and money market fund. • But marginally better than safe deposit lockers.

- 3. MONEY MARKET FUNDS • Provides opportunity to investors to invest in short term securities like treasury bills and commercial papers • Safe investment avenue • Provides high returns

- 4. BANK DEPOSITS • Also referred to as term deposits. • Offered by all private and nationalised commercial banks, cooperative banks, Foreign banks, etc. • Minimum investment period for bank FDs is 30 days. • Early withdrawals typically carry a penalty.

- 5. ADVANTAGES OF BANK DEPOSITS • Low risk • Banks deposits come with very low default risk and offer security for investor capital. • Capital guarantee • Investors deposit of up to Rs 1 lakh in any bank is protected under RBI's Deposit Guarantee Scheme. • This means if investor place their deposit in a bank that defaults, they will get up to Rs 1 lakh of their money in the deposit.

- 6. Fixed returns Interest rate on bank deposits is fixed for the entire tenure of the deposit. FDs of different tenures carry different interest rates. Generally, higher the tenure, higher is the rate. Liquidity Investor can invest in a FD for as little as a month too. Thus, it provides ample liquidity as investor can place their surplus for the short term. Besides, bank deposits can be prematurely withdrawn. However, the investor will need to pay a penalty of 1 per cent of the interest rate. Good returns With high interest rates at present, FD returns have become attractive. For a longer tenure deposit (two to three years), investor can even get a rate of around eight to nine per cent per annum. However, rates vary from bank to bank.

- 7. COMPANY FIXED DEPOSIT • Company fixed deposits- present in the Indian market for a long time. • Used by Corporates to raise funds. • For some years though, its use had become scarce as companies found it more convenient to raise money from the share market. • But, in the recent years, corporates have again started to issue company fixed deposits • The main reason is the economic slowdown and the increased difficultly faced by them to raise money through the share markets

- 8. FEATURES OF COMPANY FDS Company fixed deposit is a deposit in company for a fixed rate of return over a fixed period of time The interest rates offered on Company FDs are generally higher than those offered on bank fixed deposits. The interest income is provided on a fixed periodic basis such as monthly, quarterly, half yearly or annually. The deposit made in a company fixed deposit is governed by section 58A of the Companies Act. The company fixed deposits have different maturity periods ranging from six months to seven years. Company FDs are riskier as compared to bank FDs. The returns on the former are only assumed. The interests paid on corporate fixed deposits are not fixed and can vary depending upon the financial conditions of the company. For example, if a corporate FD carries an interest rate of 9 percent, the actual rates received can also be 5 percent. If the firm faces difficult financial situation, the investors will be paid interest only after all the secured creditors have been paid off. In case of default by a company, the investor cannot sell the deposit documents to recover his amount. The investor has no claim over the assets of the company in case of winding up of the company.

- 9. DEBENTURES • Meaning of Debenture:A bond which is not secured by any asset or collateral is known as a debenture. Debentures are mostly long term in nature and at times, the holder has an option of exchanging debentures for stocks of the issuing company. • Two types of Debenture • Convertible and • Non Covertable

- 10. CONVERTIBLE DEBENTURES • Convertible debenture - Convertible debentures are those which can be converted into company stocks. These types of debentures generally command a lower interest rate when compared with non convertible debentures

- 11. NON CONVERTIBLE DEBENTURES • Non convertible debenture - Non convertible debentures are those which cannot be converted into company stocks. These types of debentures generally command a higher interest rate when compared with convertible debentures

- 12. DIFFERENTIATE BETWEEN CONVERTIBLE AND NON CONVERTIBLE DEBENTURES • Reducing Downside Risk • Convertible debentures help in reducing the risk involved as they are backed by the company’s assets. • In case of volatility in the markets, convertible debentures are a safer bet when compared with non convertible debentures

- 13. BENEFITS TO ISSUERS • One of the primary reasons for companies to issue convertible bonds is that there is a higher interest cost associated with them. • They can take advantage of this by offering bond holders the option to convert them into company stocks. • Convertible bonds are also associated with less risk and hence are more desirable for investors

- 14. VALUE AT MATURITY • In case of a convertible bond, the maturity value can either be lower or higher than the par value, depending on the market situation. • In case of a conversion to company stocks, debenture holders are treated exactly the same as the company shareholders. • This means they are either free to hold the securities or sell them in the open market

- 15. MARKETS AT WORK • Once the convertible bonds are issued, their market value is decided depending on the interest rate, which is also dependent on market fluctuations. • Investors, in this situation, can take a lot of advantage; maximum benefit can be reaped when they are close to the underlying stock and they also experience appreciation of the value of the security

- 16. NON CONVERTIBLE DEBENTURES VS FIXED DEPOSITS • Interest Rate: Banks offers an interest rate of 9%-10% for fixed deposits, NCDs are offer above 11% interest for the amount invested. Unsecured NCDs give higher returns than secured NCDs. This is because unsecured NCDs have no underlying asset to give value to the debentures. This makes it more risky and hence higher returns are promised.

- 17. Maturity: Maturities range from 90 days to as long as 10 or even 20 years. Therefore time is not a constraint when taking decisions to invest in debentures. Investor can either opt for a short time debenture or one with a long maturity period. Fixed deposits typically have a maturity period ranging from 1 year to 5 years. Therefore short term investments and very long term investments are not possible with fixed deposits. The choice of time is limited.

- 18. • Risk: Non convertible debentures like shares are highly risky because companies might face loss at any time and lose value. • Whereas fixed deposits are more secure than NCDs though the returns are less. This is because FDs are provided by banks, which are more stable and regulated by highly efficient Reserve Bank of India.

- 19. • Liquidity: Debentures have more liquidity than fixed deposits. Investor can sell debentures in the secondary market before the maturity date and can be traded just like stocks. • Fixed Deposits on the other hand is not liquid. Banks do not allow investors to take money from Fixed deposits easily. The process is very time consuming and cumbersome.

- 20. • Traded in Stock Exchange: Non convertible debentures are listed on stock exchanges and can be traded as shares. • However fixed deposits have nothing to do with stock markets. It is an instrument provided by banks and post offices.

- 21. EQUITY SHARES • Equity shares are most common share. • The holders of these shares are the real owners of the company.

- 22. FEATURES OF EQUITY SHARES • Different values • Equity shares contains face value which is also called normal value. • Depending upon the value of the shares, the market fluctuates. • Market value is the value at which the shares are traded in the stock exchange.

- 23. PERMANENT CAPITAL • The capital procured by issue of equity shares is a permanent source of funds to the company as it need not be redeem during the life time of the company. • At the same time shareholders can get money by sale of shares in the stock exchanges.

- 24. NO NEED FOR SECURITY • There is no need to offer security to the shareholders. • Hence, the assets of the company are free from charge.

- 25. NO FIXED RATE OF RETURN • The rate of dividend of these shares depends upon the profits to the company. • They may b paid a higher rate of dividend or they may not get anything.

- 26. NO OBLIGATION TO PAY DIVIDEND There is no specific assurance to equity shareholders regarding the rate of dividend. • If the company makes sufficient profit in the year to declare the dividend it may do so and if not no dividend will be paid. • Even if they have adequate profits, dividend may not be declared if the management feels that the profits should be earmarked for future contingencies. • Whether dividend should be paid or not, even if it is to be paid what should be the rate of dividend, etc. would be decided by the Board of Directors in general body meetings.

- 27. RESIDUAL CLAIM TO ASSETS • At the liquidation of the company, the equity shareholders will be paid only if any amount is left after all the other claims against the company are settled.

- 28. RIGHT TO CONTROL • Equity share holders have voting rights and they elect board of directors who controls the affairs of the company • Thus the equity shareholders are collectively responsible for efficient management of the company.

- 29. FORM THE BASIS FOR LOANS • Equity share capital forms the basis for getting the loans to the business.

- 30. PRE-EMPTIVE RIGHTS • Any share holders owning 2% of the existing issued capital is entitled to a preemptive rights to acquire 2% of additional shares issued by the company. He can exercise or sell or renounce this right.

- 31. SPECULATION • Investing public purchase equity shares with speculative motive. • This is possible because the market value of shares fluctuates depending upon the good will of the firm, rate of dividend is declared.

- 32. LIMITED LIABILITY • In the case of companies where the liability is limited by shares the liability of the share holders is limited only upto the unpaid value of shares. • He is not personally responsible for the liability of the company as in the case of sole trading concern and partnership firm.

- 33. ADVANTAGES OF EQUITY SHARES • Dividend: • An investor is entitled to receive dividend from the company. • It is one of the two main sources of return on his investment. • Capital Gain: • The other source of return on investment apart from dividend is the capital gains. • Gains which arise due to rise in market price of the share.

- 34. • Limited liability: • Liability of shareholder or investor is limited to the extent of the investment made. • If the company goes into losses, share of loss over and above the capital investment would not be borne by the investor.

- 35. • Exercise control: • By investing in the company, the shareholder gets ownership in the company and thereby he can exercise control. • In official terms, he gets voting rights in the company.

- 36. • Claim over Assets and Income: • An investor of equity share is the owner of the company and so is the owner of the assets of that company. • He enjoys share in the incomes of the company. • He will receive some part of that income in cash in the form of dividend and remaining capital is reinvested in the company.

- 37. • Rights Shares: • Whenever companies require further capital for expansion etc, they tend to issue ‘rights shares’. • By issuing such shares, ownership and control of existing shareholders is preserved and the investor receives investment priority over other general investors.

- 38. • Bonus Shares: • At times, companies decide to issue bonus shares to its shareholders. • It is also a type of dividend. • Bonus shares are free shares given to existing shareholders and many a times they are given in lieu of dividends. • Liquidity: • The shares of the company which are listed on stock exchanges have benefit of any time liquidity. • The shares can very easily transfer ownership.

- 39. DISADVANTAGES OF EQUITY SHARE INVESTMENT: Dividend: The dividend which a shareholder receives is neither fixed nor controllable by him. The management of the company decides how much dividend should be given. High Risk: Equity share investment is a risky share compared to any other investment like debts etc. The money is invested based on the faith an investor has in the company. There is no collateral security attached with it.

- 40. Fluctuation in Market Price: The market price of any equity share has a wide variation. It is always very difficult to book profits from the market. On the contrary, there are equal chances of losses. Limited Control: An equity investor is a small investor of the company therefore it is hardly possible to impact decision of the company using the voting rights.

- 41. • Residual Claim: An equity shareholder has a residual claim over both the assets and the income. • Income which is available to equity shareholders is after the payment of all other stakeholders’ viz. debenture holders etc

- 42. ADVANTAGES OF MUTUAL FUNDS • Benefits of Mutual Fund are for people who want to invest small amounts. Daily Wage Workers, Rickshaw Taxi Drivers, Labourers who wish to invest into Mutual Funds. • Professional Investment Management. Mutual funds are managed and supervised by investment professionals. As per the stated objectives set forth in the prospectus, along with prevailing market conditions and other factors, the mutual fund manager will decide when to buy or sell securities. This eliminates the investor of the difficult task of trying to time the market.

- 43. DIVERSIFICATION • Using mutual funds can help an investor to diversify their portfolio with a minimum investment. • When investing in a single fund, an investor is actually investing in numerous securities. • Spreading investors investment across a range of securities can help to reduce risk. • A stock mutual fund, for example, invests in many stocks - hundreds or even thousands • This minimizes the risk attributed to a concentrated position. • If a few securities in the mutual fund lose value or become worthless, the loss maybe offset by other securities that appreciate in value.

- 44. CONVENIENCE: • With most mutual funds, buying and selling shares, changing distribution options, and obtaining information can be accomplished conveniently by telephone, by mail, or online.

- 45. LIQUIDITY • Mutual Funds shares are liquid and orders to buy or sell are placed during market hours. • However, orders are not executed until the close of business when the NAV (Net Average Value) of the fund can be determined. • Fees or commissions may or may not be applicable. • Fees and commissions are determined by the specific fund and the institution that executes the order.

- 46. MINIMUM INITIAL INVESTMENT: • Top Mutual Fund Companies offer its investors an option to invest extremely small amounts such as Rs 100/-, Rs 500/-, Rs 1000/- each month depending on individual’s capacity into many of its mutual fund schemes.

- 47. EASE OF INVESTING ON CONVENIENT DATES • Investor can invest in top Mutual Fund Scheme on their choice of dates. • Many large Mutual Fund companies offer multiple dates for investing into its top performing mutual fund schemes. • E.g Few dates would be 1st, 5th, 10th, 15th, 25th of each month. • This makes regular investments on salary dates possible.

- 48. INVESTING WITHOUT PHYSICAL PRESENCE • Investments in Mutual Funds can be done through Assignment of a Power of Attorney for effective financial planning. • Army Personnel, Officers posted on-duty at far off places, owners/directors of limited companies, Non- Resident Indians, Resident Indian posted onsite/outside India can invest through the convenience of POA.

- 49. SAFEKEEPING • When investor own shares in a mutual fund, he own securities in many companies. • He don't even have to worry about handling the mutual fund stock certificates. • The fund maintains the investor’s account on its books and sends the periodic statements keeping track of all investor’s transactions.

- 50. ONLINE SERVICES • The internet provides a fast, convenient way for investors to access financial information.

- 51. GOLD AN INVESTMENT AVENUE • Gold is one of the most popular precious metals for investment today. • There are 5 ways of investing in gold: • Purchase of physical gold • Investment through Gold Mutual Funds: • Investment through Derivative Markets: • ETFs • Electronic Gold (E-Gold):

- 52. I. PURCHASE OF PHYSICAL GOLD: • It’s the most conventional way of investment. • It includes buying of readymade jewelry, coins, bars, biscuits, etc through jewelers and banks.

- 53. DRAWBACKS OF INVESTMENT IN PHYSICAL GOLD Storage & Safety: ▫ Physical gold requires storage like a safe or bank locker and ▫ there is also a risks of theft or losing it. Emotional Touch: ▫ Most of the times jewelry or ornaments have an emotional value attached to it. ▫ Hence it cannot be considered as a liquid asset in times of crisis. Costs involved: ▫ It involves some expenses like making charges, locker charges, if insured then insurance premium and so on. Wealth Tax: ▫ Physical gold attracts wealth tax if the value of the gold exceeds 30 lakhs.

- 54. INVESTMENT THROUGH GOLD MUTUAL FUNDS: • Investing in gold mutual funds is like investing in any mutual fund actively managed by a fund manager through Systematic Investment Plans (SIPs). • The funds are invested in gold mines to reap the benefits.

- 55. FEATURES OF INVESTMENT IN GOLD MUTUAL FUNDS: Benefit of Rupee Cost Averaging: ▫ Since the investments are in the form of Systematic Investments Plans (SIPs), the investor enjoy the benefits of rupee cost averaging without bothering much about the swinging markets. Ease of Operation: ▫ No Demat A/C is required like in case of gold Exchange Traded Funds (ETFs) or E-gold. ▫ Meaning of Demat A/C: ▫ Demat A/C is Dematerialized Account. ▫ In a demat account, share and securities are held electronically instead of the investor taking physical possession of certificates. ▫ Demat account is opened by the investor while registering with an investment broker. ▫ Purchase or transfer of securities or shares is initiated trough demat account. ▫ It eliminates the risks associated with forgery and due to damaged stock certificates. ▫

- 56. Safety & Security: ▫ Since no physical gold is involved it is safer to invest in gold mutual funds. Costs Involved: ▫ Expenses on account of fund management charges are higher as compared to the ETFs but lower compared to the expenses incurred on physical gold. Profitability: ▫ In case gold mining companies are making profits, the investors in turn are benefitted. Wealth Tax: ▫ Gold Mutual Funds do not attract any wealth tax liability.

- 57. GOLD EXCHANGE TRADED FUNDS (ETFS) • Exchange Traded Funds or ETF is like trading shares on a stock exchange. • In case of Gold ETFs, Gold is a security under consideration. • Investor can purchase units of gold in multiples of 1 unit. • 1 Unit = 1 gram of gold. • (A few fund houses also trade ½ gram gold as one unit.)

- 58. FEATURES OF GOLD ETFS Safety & Storage: ▫ Since there is no physical gold involved it is a safer avenue for investment in gold. ▫ So there is no question of storage as well. Less Expensive: ▫ No making charges, locker charges are applicable in case of ETFs. Tax Efficiency: ▫ ETFs are tax efficient if held for more than a year as compared to physical gold sales. ▫ ETFs don’t attract Wealth Tax, Security Transaction Tax (STT). Affordability: ▫ Gold can be bought in as small quantity as 1 gram gold. Purity: ▫ ETFs guarantee purity of gold, usually 99.5%. Liquidity & Transparency: ▫ Gold ETFs can easily be bought & sold on exchanges and hence there is liquidity and transparency in the prices.

- 59. INVESTMENT THROUGH DERIVATIVE MARKETS • A gold future means gold bought at the price and quantity decided today, at a future date. • Gold future can be good form of hedge in rising gold prices as one need to pay the price today. • Hedging covers the risk arising out of changes in the Gold rate. • If the prices fall in future as compared to today’s prices then it turns out to be a business of loss. • Exchanges like MCX, NCDEX deals in gold futures.

- 60. FEATURES OF GOLD FUTURES ▫ Good Investment Avenue if investor is expecting increase in gold prices in future. ▫ Investors need not put in the entire amount at the time of entering into the contract, only 5% of the transaction value. ▫ When the delivery takes place, profit is treated as a business income and taxed according to appropriate tax brackets. ▫ And, if the contract is settled without the delivery, proceeds are treated as an income from speculation and are taxed under short-term capital gains. ▫ Risk averse investors or new investors should refrain from investment in futures as these are highly uncertain in returns. ▫ It is preferred by speculators & big investors with high risk

- 61. ELECTRONIC GOLD (E-GOLD) • E-Gold is invented and implemented by National Spot Exchange Ltd. (NSEL). • Like ETFs, Investor can invest in E-gold through demat A/C and purchase as small as 1 gm of gold. • This trading facility is available on Monday to Friday (except Exchange specific holidays) from 10.30 am to 11.30pm.

- 62. FEATURES OF E-GOLD Ease of trading: ▫ Investor can buy/ sell gold through the exchange easily from the comfort of home/office. Smaller quantity: ▫ Even a smaller quantity of 1 gm of gold can be bought. 1 unit=1 gm of gold. Lower Expense Ratio: ▫ The management expenses are lower compared to Gold ETFs. No making charges, no locker charges. Conversion in physical gold: ▫ Opportunity to convert the units in physical gold i.e. coins/bars in seamless manner. Purity: ▫ Gold purity is 99.5% Safety & Storage: ▫ Since there is no physical gold involved it is a safer avenue for investment in gold. So there is no question of storage as well.

- 63. POST OFFICE SAVING DEPOSITS • Post Office Small savings schemes are designed to fulfill dual objective: • to provide safe and attractive investment options to the public and • to mobilise resources for development. • These schemes are operated through about 1.54 lakh post offices throughout the country.