Shares and share capital

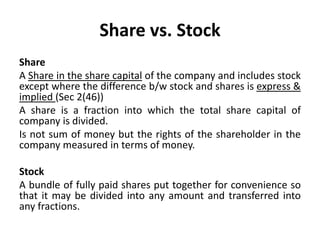

- 1. Share vs. Stock Share A Share in the share capital of the company and includes stock except where the difference b/w stock and shares is express & implied (Sec 2(46)) A share is a fraction into which the total share capital of company is divided. Is not sum of money but the rights of the shareholder in the company measured in terms of money. Stock A bundle of fully paid shares put together for convenience so that it may be divided into any amount and transferred into any fractions.

- 2. Stock vs. Share 1. 2. 3. 4. 5. Share Can be issued in original May be fully or partly paid Are of fixed denomination Has a definite number Transferred in its entirety or in its multiples only. 6. Registration of share capital is compulsory 1. 2. 3. 4. 5. 6. Stock Cannot be issued in original Always be Fully paid No such fixed denomination No such number Divisible into any amount and even transferred into fractional amount Issued after passing OR if AOA permit

- 3. Legal Nature of Share 1. Regarded as Goods (Sec 2(7) of Sale of Good Act 1930) 2. U/S 82 – Transferable(movable property) 3. U/S 83 – Must bear a distinctive number 4. Must have a nominal value Not Applicable in case shares are held with depository

- 4. SHARE CAPITAL •Amount of capital raised by the issue of shares •Members are liable to pay difference between reduced and nominal value. KINDS OF SHARE CAPITAL AUTHORISED ISSUED SUBSCRIBED CALLED UP UNCALLED CAPITAL CAPITAL CAPITAL CAPITAL CAPITAL PAID UP CAPITAL RESERVE CAPITAL

- 5. REDUCTION OF SHARE CAPITAL • To ensure that the company’s assets are not freely distributed to the shareholders • It is done to: 1. 2. Write off lost capital To pay off surplus capital PROCEDURE: • • • • Authority of articles must be secured Special resolution Petition to the Court Registration

- 6. METHODS OF REDUCTION According to Section 100 of the Companies Act: 1. Reduce liability of members on shares not fully paid up 2. Write off lost capital 3. Pay off excess paid-up share capital

- 7. KINDS OF SHARES Participating or non participating Cumulative Convertible or non-convertible Redeemable Preferences Participating or non-participating Noncumulative Equity Convertible or non-convertible With voting rights Shares Redeemable With differential rights as to dividend and voting

- 8. Preference shares Provides Preferential rights •As to Payment of dividend at a fixed rate during the life of the company •As to Return of capital on winding up of company Voting rights on: •Resolutions directly affecting preference shareholders •Winding up of company •Repayment or reduction of company’s share capital •Entitled to vote on every resolution at any general meeting if dividend or part thereof unpaid •For cumulative shares a period of not less than 2 years preceding the meeting date • For non cumulative shares, either a period of 2 consecutive years or for 3 years aggregate in the 6 years ending with the expiry of financial year immediately preceding the meeting date.

- 9. Redemption-Paying back of capital • Company limited by shares authorized to issue redeemable preference shares • Authorized by articles • Only fully paid up shares to be redeemed • Distributable profits from Capital redemption reserve account ,’proceeds of a fresh issue of shares’ to be used for redemption of shares • Premium payable on redemption to be paid out of company’s profits or securities premium account

- 10. Equity Shares • Those shares which are not preference shares • Carry the right to receive the whole of surplus profits after the preference shares, if any, have received their fixed dividend • If no profits left after paying fixed preference dividends for equity shareholders Kinds of Equity Shares •Equity shares with voting rights – The holders have normal voting rights in the company. •Equity shares with differential rights – The holders have differential rights as to dividends, voting and otherwise in accordance with rules prescribed by the Central Government.

- 11. The following are the “Companies Rule 2001” • Every company limited by shares may issue equity shares with differential rights to the extent of 25 percent of the total share capital only. • The AOA must authorize the issue of such shares and the approval of shareholders must be obtained in general meeting by passing an ordinary resolution. • The resolution referred above must inter-alia provide for (a) The rate of voting right and (b) The rate of additional dividend. • The company will not be allowed to convert its equity capital with normal voting rights into equity share capital with differential voting rights and vice-versa. • The holders of equity shares with differential rights shall be entitled to bonus shares and rights of the same class and shall enjoy all rights as a member of the company except right to vote as indicated above.

- 12. Issue of Securities at Premium Sometimes company with good prospects issues securities at a premium. No restriction upon the issue of securities at premium and the company is free to make such an issue whenever it so desired. Certain restrictions upon the use of premium amount The premium amount must be transferred to the Securities Premium Account and this account is to be treated as share capital for reduction purposes ,except when it is to be used for the following – • To issue fully paid bonus shares to members. • To write off preliminary expenses of the company. • To write off expenses of, or commission paid or discount allowed on any issue of shares or debenture of the company

- 13. • To provide the premium payable on the redemption of redeemable preference shares or debenture. • For buyback of own securities under Section 77A.

- 14. Issue of Shares at a Discount A company is permitted to issue shares at a discount provided – • The shares must be of a class already issued. • At least 1 yr. must have elapsed since the company started business. • The issue must be authorized by an ordinary resolution in the general meeting which must state the max. rate of discount. • The issue must be sanctioned by the Company Law Board. No such issue shall be sanctioned by the Company Law Board if the max. rate of discount specified in the resolution exceeds 10%, unless the board is of the opinion that higher percentage of discount be allowed. • The issue must be made within two months.

- 15. Issue of Sweat Equity Shares Sweat equity shares means equity shares issued by the company to employees or directors at a discount or for consideration other than cash. The company may issue Sweat equity shares if the following conditions are fulfilled – • The shares must be of a class already issued. • At least 1 yr. must have elapsed since the company started business. • The issue must be authorized by a special resolution passed by the company in the general meeting. • The resolution must specify the no. of shares, their current market price, consideration, if any, and the class or classes of directors or employees to whom they are issued. • The shares must be issued in accordance with SEBI guidelines in case of listed shares or Central Govt. in case of unlisted shares.

- 16. Payment of Underwriting Commission and Brokerage UNDERWRITING • It is an agreement entered into before the shares are brought before the public. • Kind of insurance against risk. BROKERAGE • It is the reward or commission paid to a sort of middle man. • Lawful brokerage. • Payable brokerage is to be disclosed in the prospectus.

- 17. • SECTION 76 • provides for the payment of commission to the underwriters, broker’s and public. • Shares are offered to the public first. • Authorized by articles of association. • Rate of commission should not exceed 5% in case of shares and 2.5% in case of debentures. • Rate of commission agreed should be disclosed in prospectus. • A copy of contract should be delivered to the registrar. SUB SECTION • The commission is paid to the first mention person.

- 18. Restriction on Purchase by a Company of its Own Shares • Public or private ltd. – no company can buy its own shares. • CONDITIONS UNDER WHICH COMPANY CAN BUY ITS OWN SHARES• Section 100-104 • Special sanction of court is needed for reduction of share of capital. • Section 402 • Buy its shares from certain oppressed members.

- 19. • Unlimited companies are free from such restrictions. • Sub section(2) – no public co. can give any financial assistance to buy its own shares. • EXCEPT• When loan is made by banking company. • When provision of money is under scheme. • When loan are made by company to employers other than director.

- 20. Buyback of own securities • Companies (Amendment) Act, 1999 permits the companies to buyback their shares • Rationale – Repurchase of shares reduces the number of shares outstanding and thus improves EPS – increases market price of share – Buyback maybe used to prevent a hostile takeover – A means of investment • Funds out of which buyback may be financed [Sec. 77A(1)] – Free reserves – Securities premium account – Proceeds of any shares or other specified securities

- 21. • Transfer of certain sum to “Capital Redemption Reserve Account” [Sec. 77 AA] – When co. purchases its own shares out of ‘free reserves’, then a sum equal to the nominal value of shares so purchased must be transferred to CRR a/c • Conditions to be fulfilled before resorting to buyback [Sec. 77A(2),(3) & (4)] – There should be a provision in AoA authorizing buyback – Special resolution must be passed in the general meeting of co. authorizing buyback, notice for convening the meeting should be accompanied by explanatory statement disclosing all material facts of the buyback – Amount of buyback should not exceed 25% of total paid up capital and free reserves of the co., in case of buyback of equity shares, amount should not exceed 25% of co.’s total paid up equity capital

- 22. – After buyback, ratio of debt to capital and free reserves should not be more than 2:1 – Shares or securities sought to be bought back must be fully paid up – Buyback should be in accordance with SEBI guidelines in case of listed securities or in accordance with guidelines prescribed by Central govt. in case of unlisted securities – Buyback operations must be completed within 12 months from date of passing special resolution • Methods of buyback [Sec. 77A(5)] – – – – From the existing security holders on a proportionate basis From the open market From odd lots i.e. Securities of listed public co. By purchasing the securities issued to employees • Declaration of solvency[Sec. 77A(6)] – To be filed with Registrar of Co. and SEBI

- 23. • Physical destruction of securities [Sec. 77A(7)] – Within 7 days of completion of buyback • Further issue after buyback [Sec. 77A(8)] – Co. is free to issue other types of securities other than the type bought back – Same kind cannot be issued before 6 months • Register of bought back securities [Sec. 77A(9)] – Register has to be maintained with all particulars of securities bought back • Return of buyback [Sec. 77A(10)] – After completion of buyback a return is to be filed with Registrar of Co. and SEBI within 30 days • Penalty [Sec. 77A(11)] – Imprisonment up to 2 years and fine up to Rs. 50000 in case of noncompliance with the above provisions

- 24. • Buyback methods – Tender method • Co. fixes and announces a price at which it intends to buyback • If no. of shares offered for buyback is more than what is sought, they are bought back proportionately – Open market purchases • Stock exchange purchase method • Dutch auction method

- 25. FURTHER ISSUE OF SHARE CAPITAL Additional funds for expanding business Further issue of shares Under two conditions: 1.Shared Capital already issued < Authorized Capital 2.Shared Capital already issued = Authorized Capital Need authorization by its Articles + Board of Directors’ resolution for cond. 1 Need authorization by its Articles + Board of Directors’ resolution + a sanction of Shareholders by means of ordinary/special resolution for cond. 2

- 26. Manner of allotment of further issue of shares • Equitable distribution of shares without disturbing the established equilibrium of shareholding in the company. A public company proposes to increase its subscribed capital (whichever is earlier): After the expiry of 2 years from incorporation of the company After the expiry of 1 year from the first allotment of shares Following conditions must be fulfilled: Offers must be made to present equity shareholders on a pro-rata basis (i.e., in proportion to their present shareholdings) Pro-rata offer is to be made by giving a notice specifying no. of shares offered. Offer must be made kept open for a period of at least 15 days. Members have the right of renunciation of the offer in favour of hid nominee.

- 27. Contd.. On expiry of notice period or receipt of earlier declination ,the board of directors may dispose of them in most beneficial manner. Right of Pre-emption to Shareholders or Issue of Right Shares EXCEPTIONS: Further shares aforesaid may be offered to outsiders, in following two cases: 1. If a special resolution is passed 2. If an ordinary resolution is passed + Approval of Central Govt. is obtained Above restrictions do not apply To private companies To public companies , in case increase in subscribed capital is due to use of convertible debentures or loans and the terms of issue are given by central govt. or by a special resolution