Commodity insight 03.05.12(Crde,Potato)

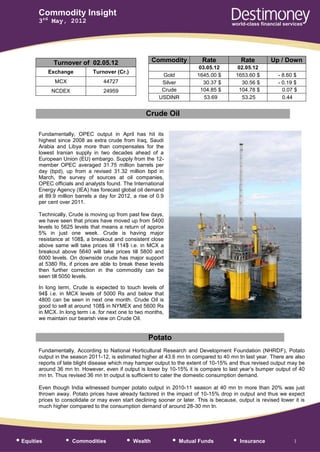

- 1. Commodity Insight 3rd May, 2012 Turnover of 02.05.12 Commodity Rate Rate Up / Down 03.05.12 02.05.12 Exchange Turnover (Cr.) Gold 1645.00 $ 1653.60 $ - 8.60 $ MCX 44727 Silver 30.37 $ 30.56 $ - 0.19 $ NCDEX 24959 Crude 104.85 $ 104.78 $ 0.07 $ USDINR 53.69 53.25 0.44 Crude Oil Fundamentally, OPEC output in April has hit its highest since 2008 as extra crude from Iraq, Saudi Arabia and Libya more than compensates for the lowest Iranian supply in two decades ahead of a European Union (EU) embargo. Supply from the 12- member OPEC averaged 31.75 million barrels per day (bpd), up from a revised 31.32 million bpd in March, the survey of sources at oil companies, OPEC officials and analysts found. The International Energy Agency (IEA) has forecast global oil demand at 89.9 million barrels a day for 2012, a rise of 0.9 per cent over 2011. Technically, Crude is moving up from past few days, we have seen that prices have moved up from 5400 levels to 5625 levels that means a return of approx 5% in just one week. Crude is having major resistance at 108$, a breakout and consistent close above same will take prices till 114$ i.e. in MCX a breakout above 5640 will take prices till 5800 and 6000 levels. On downside crude has major support at 5380 Rs, if prices are able to break these levels then further correction in the commodity can be seen till 5050 levels. In long term, Crude is expected to touch levels of 94$ i.e. in MCX levels of 5000 Rs and below that 4800 can be seen in next one month. Crude Oil is good to sell at around 108$ in NYMEX and 5600 Rs in MCX. In long term i.e. for next one to two months, we maintain our bearish view on Crude Oil. Potato Fundamentally, According to National Horticultural Research and Development Foundation (NHRDF), Potato output in the season 2011-12, is estimated higher at 43.6 mn tn compared to 40 mn tn last year. There are also reports of late blight disease which may hamper output to the extent of 10-15% and thus revised output may be around 36 mn tn. However, even if output is lower by 10-15% it is compare to last year’s bumper output of 40 mn tn. Thus revised 36 mn tn output is sufficient to cater the domestic consumption demand. Even though India witnessed bumper potato output in 2010-11 season at 40 mn tn more than 20% was just thrown away. Potato prices have already factored in the impact of 10-15% drop in output and thus we expect prices to consolidate or may even start declining sooner or later. This is because, output is revised lower it is much higher compared to the consumption demand of around 28-30 mn tn. • Equities • Commodities • Wealth • Mutual Funds • Insurance 1

- 2. Commodity Insight 3rd May, 2012 Technically, Potato prices are moving in upward direction, we have seen prices moving up from the levels of 900 to a recent high of 1132 levels i.e. a return of approx 25% in last one month. After a sharp upside rally now it’s time where prices need to consolidate and give some correction from present levels. Also on charts it seems that prices are highly overbought and there should be some correction in short term. RSI is also trading at 70 levels, which shows that Potato is overbought. So for Short term rise in prices till 1120 or 1130 levels should be used as selling opportunity for the target of 1070 and 1020 levels. If prices are able to break and give close below 1020 then an extended rally can be seen till 950 levels. We maintain our bearish view in Potato for next one to two months. Crude Chart CRUDE OIL - 1 BBL - 1 MONTH (5,598.00, 5,623.00, 5,575.00, 5,596.00, -4.00000) 5800 5700 5600 5500 5400 5300 5200 5100 5000 4900 4800 4700 4600 4500 4400 4300 4200 4100 4000 3900 3800 3700 3600 3500 Relative Strength Index (72.7685) 80 70 60 50 40 30 20 Volume (11,185,500) 35000 30000 25000 20000 15000 10000 5000 x1000 11 18 25 1 8 16 22 29 5 12 19 26 3 10 17 24 31 7 14 21 28 5 12 19 26 2 9 16 23 30 6 13 20 27 5 12 19 26 2 9 16 23 30 7 14 August September October November December 2012 February March April May • Equities • Commodities • Wealth • Mutual Funds • Insurance 2

- 3. Commodity Insight 3rd May, 2012 Daily Trading Range Crude Oil today’s trading levels are 5545 - 5640…. Intraday Support @ 5545 - 5580 and Resistance @ 5640 - 5680 Intraday Trend Sideways, Buy on dips & Sell on rise…. Crude Oil Sell @ 5610 SL 5640 TGT 5580…. Open Calls Type Stop Closing Date of Commodity Initiated Price Target Comments Loss Price Call 1st TGT Achieved, 02.05.12 Sell Lead Mini 114.4 115.1 113.50-111 113.15 Hold with SL @ Cost. Spread Calls Date Type Commodity Initiated Stop Target Comments of Call Price Loss Spread Spread Report by: - Sumeet Bagadia (Head - Commodities & Currencies Research) sumeet.bagadia@destimoney.com Kunal Kame (Research Associate) kunal.kame@destimoney.com Siddhesh Ghare (Research Associate) siddhesh.ghare@destimoney.com • Equities • Commodities • Wealth • Mutual Funds • Insurance 3

- 4. Commodity Insight 3rd May, 2012 For private circulation only Website: www.destimoney.com Disclaimer In the preparation of the material contained in this document, Destimoney* has used information that is publicly available, as also data developed in-house. Some of the material used in the document may have been obtained from members/persons other than Destimoney and which may have been made available to Destimoney. Information gathered & material used in this document is believed to be from reliable sources. Destimoney has not independently verified all the information and opinions given in this material. Accordingly, no representation or warranty, express or implied, is made as to the accuracy, authenticity, completeness or fairness of the information and opinions contained in this material. For data reference to any third party in this material no such party will assume any liability for the same. Destimoney does not in any way through this material solicit or offer for purchase or sale of any financial services, commodities, products dealt in this material. Destimoney and any of its officers, directors, personnel and employees, shall not be liable for any loss or damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner. The recipient alone shall be fully responsible, and/or liable for any decision taken on the basis of this material. All recipients of this material before dealing and/or transacting in any of the products advised, opined or referred to in this material shall make their own investigation, seek appropriate professional advice and make their own independent decision. This information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Destimoney or its affiliates to any registration requirement within such jurisdiction or country. This information does not constitute an offer to sell or a solicitation of an offer to buy any financial products to any person in any jurisdiction where it is unlawful to make such an offer or solicitation. No part of this material may be duplicated in whole or in part in any form and / or redistributed without the prior written consent of Destimoney. This material is strictly confidential to the recipient and should not be reproduced or disseminated to anyone else. Names such as Teji Mandi, Maal Lav, Maal Le or similar others for market calls and products are merely names coined internally and are not universally defined, and shall not be construed to be indicative of past or potential performance. Recipients of research reports shall always independently verify reliability and suitability of the reports and opinions before investing. *"Destimoney" means any company using the name “Destimoney” as part of its name. • Equities • Commodities • Wealth • Mutual Funds • Insurance 4