Highbank Resources Ltd. - Pi Financial LNG Industry Update (HBK Mentioned on Page 13)

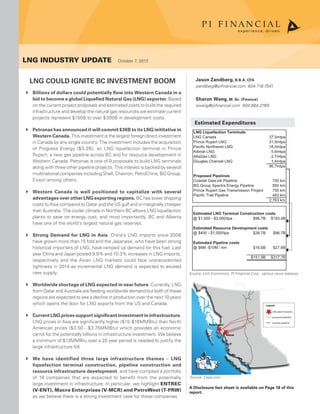

- 1. Prince Rupert Kitimat Legend LNG plant locations proposed pipeline existing pipeline LNG Liquefaction Terminals LNG Canada 37.5mtpa Prince Rupert LNG 31.5mtpa Pacific Northwest LNG 18.0mtpa Kitimat LNG 5.6mtpa AltaGas LNG 2.7mtpa Douglas Channel LNG 1.4mtpa 96.7mtpa Proposed Pipelines Coastal GasLink Pipeline 700 km BG Group Spectra Energy Pipeline 850 km Prince Rupert Gas Transmission Project 750 km Pacific Trail Pipeline 463 km 2,763 km Estimated LNG Terminal Construction costs @ $1,000 - $2,000/tpa $96.7B $193.4B Estimated Resource Development costs @ $400 - $1,000/tpa $38.7B $96.7B Estimated Pipeline costs @ $6M -$10M / km $16.6B $27.6B $151.9B $317.7B LNG Industry update October 7, 2013 Jason Zandberg, B.B.A, CFA jzandberg@pifinancial.com 604.718.7541 Sharon Wang, M. Sc. (Finance) swang@pifinancial.com 604.664.2789 Source: Unit Economics, PI Financial Corp., various news releases Source: Cepa.com A Disclosure fact sheet is available on Page 18 of this report. LNG Could Ignite BC Investment Boom Billions of dollars could potentially flow into Western Canada in a`` bid to become a global Liquefied Natural Gas (LNG) exporter. Based on the current project proposals and estimated costs to build the required infrastructure and develop the natural gas resources we estimate current projects represent $150B to over $300B in development costs. Petronas has announced it will commit $36B to its LNG inititative in`` Western Canada. This investment is the largest foreign direct investment in Canada by any single country. The investment includes the acquisition of Progress Energy ($5.2B), an LNG liquefaction terminal in Prince Rupert, a new gas pipeline across BC and for resource development in Western Canada. Petronas is one of 9 proposals to build LNG terminals along with three other pipeline projects. This interest is backed by several multinational companies including Shell, Chevron, PetroChina, BG Group, Exxon among others. Western Canada is well positioned to capitalize with several`` advantages over other LNG exporting regions. BC has lower shipping costs to Asia compared to Qatar and the US gulf and is marginally cheaper than Australia. The cooler climate in Northern BC allows LNG liquefaction plants to save on energy cost, and most importantly, BC and Alberta have one of the world’s largest natural gas reserves. Strong Demand for LNG in Asia`` . China’s LNG imports since 2006 have grown more than 15 fold and the Japanese, who have been strong historical importers of LNG, have ramped up demand for this fuel. Last year China and Japan posted 9.9% and 10.3% increases in LNG imports, respectively and the Asian LNG markets could face unprecedented tightness in 2014 as incremental LNG demand is expected to exceed new supply. Worldwide shortage of LNG expected in near future`` . Currently, LNG from Qatar and Australia are feeding worldwide demand but both of these regions are expected to see a decline in production over the next 10 years which opens the door for LNG exports from the US and Canada. Current LNG prices support significant investment in infrastructure.`` LNG prices in Asia are significantly higher ($15-$16MMBtu) than North American prices ($3.50 - $3.75MMBtu) which provides an economic carrot for the potentially billions in infrastructure investment. We believe a minimum of $12MMBtu over a 20 year period is needed to justify the large infrastructure bill. We have identified three large infrastructure themes`` – LNG liquefaction terminal construction, pipeline construction and resource infrastructure development, and have complied a portfolio of 16 companies that are expected to benefit from the potentially large investment in infrastructure. In particular, we highlight ENTREC (V-ENT), Macro Enterprises (V-MCR) and PetroWest (T-PRW) as we believe there is a strong investment case for these companies. Estimated Expenditures

- 2. LNG Industry Update – October 7, 2013 2 | INDUSTRY UPDATE Jason Zandberg, B.B.A, CFA | Sharon Wang, M. Sc. (Finance) Introduction Asia is hungry for energy and North America is spoiled in large resources especially natural gas that to date has been land-locked and unable to seek the highest bidder for its use. That may change, as bold plans for North American LNG liquefaction plants in both the US and Canada are beginning to emerge which would allow natural gas to be cooled, compressed to 1/600th its size and loaded on ocean vessels destined for ports in Japan, Korea, China and other Asian markets. These proposed plants would cost billions of dollars in investment but the international price for LNG may be worth the expense. Western Canada which has an estimated 371 Tcf in conventional and unconvential natural gas reserves (source: National Energy Board) hopes that new foreign markets will generate significant profits for everyone involved. We feel the near term opportunity will be in the companies that build the infrastructure needed to get the gas to overseas markets. The global LNG market has been experiencing a significant shift over the last five years. The decline in LNG shipments to financially challenged European marketplace (EU demand dropped 2.3% last year) has been replaced by rapid growth in Asia. China’s LNG imports since 2006 has grown more than 15 fold and the Japanese, who have been strong historical importers of LNG, have ramped up demand for this fuel following the Fukushima nuclear disaster in 2011. Last year China and Japan posted 9.9% and 10.3% increases in LNG imports, respectively and the Asian LNG markets could face unprecedented tightness in 2014 as incremental LNG demand is expected to exceed new supply (source: IEA). This growing demand is not limited to Japan and China – the number of countries importing LNG, which is currently less than 30, is expected to grow. Countries such as Bahrain, Croatia, El Salvador, Jamaica, Lithuania, Pakistan, the Philippines, South Africa, and Uruguay are buying LNG to power their industries. Even Indonesia, once the largest LNG exporter in the world, is thinking about importing natural gas to meet growing domestic demand (source: Fool.com). Western Canada is well positioned to capitalize as it has several advantages over other LNG exporting regions. First, the relatively close proximity of BC to Asia allows lower shipping costs relative to Qatar and the US gulf sources and is marginally cheaper than Australian sources. Second, the cooler climate in Northern BC allows LNG liquefaction plants to save on energy costs (more on that later). Lastly, BC and Alberta have large natural gas reserves. The main disadvantage this region has is the current lack of infrastructure – the resource located hundreds of kilometers away from the nearest ports so massive pipelines will need to be built. Additionally, there are currently no LNG plants to process and cool the natural gas and load it on LNG tankers. The BC government has proactively promoted the development of LNG exports in the province and has tried to encourage investment in an effort to create jobs and increase provincial tax revenue. Although there are still several unknown factors (tax regime, environmental issues, long-term sales agreements, etc.) there is no shortage of interest from industry participants as nine groups have expressed interest in building LNG capacity in BC. Many of these groups have indentified potential plant locations and pipeline corridors to ship the gas. As of this report, there are no detailed construction timelines but we believe these details will emerge in coming months and will represent a significant catalyst for the players involved. We believe that the there is a strong investment thesis to buy the stocks of companies that will help build this infrastructure. These include construction companies building the pipelines, pipeline facilities, LNG plants, export terminals as well as the ancillary investment in public infrastructure, businesses, offices and residential construction.

- 3. Jason Zandberg, B.B.A, CFA | Sharon Wang, M. Sc. (Finance) INDUSTRY UPDATE | 3 LNG Industry Update – October 7, 2013 Proposed LNG Projects in BC Currently there are two general locations for potential LNG liquefaction terminals; Prince Rupert (including Grassy Point) and Kitimat. Three LNG terminals are proposed for Prince Rupert, three LNG terminals are proposed for Kitimat and there potential expressions of interest for Grassy Point just north of Prince Rupert. Figure 1 illustrates the three locations. Figure 1 – Proposed Locations for LNG Liquefaction Terminals Source: Globe and Mail Figure 2 lists the proposed LNG facilities and the chosen pipeline projects that will support each plant. Grassy Point, just north of Prince Rupert, which has received interest from several potential groups to build LNG facilities after the BC government agreed to anchor the land. Figure 2 – Proposed LNG Facilities and Pipelines in BC Source: Various news releases LNG Facility Partners Capacity Location Pipeline Pipeline owner LNG Canada Royal Dutch Shell, PetroChina, Mitsubishi, Korea Gas 37.5mtpa Kitimat Coastal GasLink Pipeline TransCanada Prince Rupert LNG BG Group, Spectra Energy 31.5mtpa Prince Rupert BG Group Spectra Energy Pipeline Spectra Energy Pacific Northwest LNG Petronas, Progress Energy 18.0mtpa Prince Rupert Prince Rupert Gas Transmission TransCanada Kitimat LNG Chevron, Apache 5.6mtpa Kitimat Pacific Trail Pipeline Chevron, Apache Unnamed AltaGas, Idemitsu Kosan 2.7mtpa tbd Pacific Northern Gas (existing) AltaGas Douglas Channel LNG LNG Partners (Texas), Haisla Nation 1.4mtpa Kitimat Pacific Northern Gas (existing) AltaGas WCC LNG Imperial Oil (Exxon Mobil) tbd Prince Rupert undetermined tbd Unnamed Woodside Petroleum (Australia) tbd tbd undetermined tbd Unnamed CNOOC tbd tbd undetermined tbd

- 4. LNG Industry Update – October 7, 2013 4 | INDUSTRY UPDATE Jason Zandberg, B.B.A, CFA | Sharon Wang, M. Sc. (Finance) We estimate that if all the proposed projects are built, this represents an investment of $151.9B to $317.7B. If we add up all the proposed capacity from Figure 2 we get almost 100mtpa (actually it is 96.7mtpa). This is a huge number and may not be possible given that this capacity represents the majority of potential gas production in Western Canada. That being said, if Eastern natural gas supply floods the North America market then Western Canada may need to ship most of its gas to other markets. Based on current LNG project costs and data from Boston-based Unit Economics from around the world we estimate that the cost per mtpa is $1,000 to $2,000 to build a liquefaction terminal and $400 to $1,000 to develop the resource. For the estimate on the pipeline costs, we have used $6M to $10M per kilometer but the difficult terrain of Northern BC could push this figure upward. In aggregate, the total cost if all the proposed projects are built is $151.9B to $317.7B (see Figure on front page). LNG Project Status Douglas Channel LNG is just waiting for final investment decision.`` The most advanced project is the Douglas Channel LNG proposal. This proposal is a partnership between the Haisla First Nation and LNG Partners – a private Texas energy fund. The output from this potential facility is expected to be small – just 0.7 mtpa but it will have a maximum capacity of 1.4 mtpa. In fact, the facility is small enough that it does not need environmental assessments and will use existing pipeline capacity to supply the natural gas. This LNG facility already has an export license as well as a secured buyer for its output. Kitimat LNG stills needs a buyer for its output.`` This facility, which is backed by Chevron and Apache, expects to deliver 5.6 mtpa of LNG. The project has environmental approval, an export license as well as an approval pipeline (463km Pacific Trail Pipeline). There has been no final decision on the project which may depend on securing a customer. This group wants to have an oil-indexed pricing contract with its buyer which may be a stumbling block. Traditionally, LNG contracts have been oil-indexed but recently there has been a desire by importers to break from that pricing model to a price based on Henry Hub. Chevron has been offering prospective LNG customers an equity position in the project to entice a large Asian partner. LNG Canada boosts the largest potential output but still has many hurdles to overcome.`` This Kitimat-based facility is backed by four major multinational companies – Royal Dutch Shell, Korea Gas, Mitsubishi and PetroChina. The project which expects to generate 37.5 mtpa of LNG has an export license and should have no problem signing up a buyer as both Korea Gas and Mitsubishi are among the world’s largest LNG importers. The project lacks an environmental approval and the proposed pipeline (Shell Coastal GasLink Pipeline) and the required power line (from Prince George to Terrace) also require an environmental study. Pacific Northwest LNG is behind the other propsed projects but is moving quickly.`` The facility is backed by Malaysia-based Petronas which bought out Progress Energy and brought in Japex as a 10% partner. The Malaysia Prime Minister announced its intent to invest $36B into the project which represents the largest foreign direct investment into Canada. The liquefaction plant planned for Prince Rupert is expected to ship 18.0 mtpa and tentatively slated construction to start in late 2014. The project still needs environmental approval, an export license and a cecrued buyer so this target ma be ambitious. The rest of the groups are only at the expression of interest stage although the Imperial Oil / Exxon interest was followed with an application to export 30mtpa of LNG from BC (source: Globe and Mail) and the AltaGas group has an existing pipeline and capacity announced. Current Estimates for spending May be Low. Many proposals have provided an esitmate for development costs. We believe most of these estimates are too low. The pipeline estimates range from $1B (Pacific Trail Pipeline) to $8B (BG Group Spectra Energy Pipeline). While we estimate that the range is more likely to be $2.5B to $9B. Petronas (Pacific Northwest LNG) outlined in May that it will spend $9B to $11B to build its facility plus $5B for the pipeline. The company also indicated that “billions more” will be spent on upstream operations. We have made our calculations based

- 5. Jason Zandberg, B.B.A, CFA | Sharon Wang, M. Sc. (Finance) INDUSTRY UPDATE | 5 LNG Industry Update – October 7, 2013 on similar LNG projects around the globe. In Australia, the current cost of building LNG facilities are approximately $2,000 per tpa whereas it was estimated by the Canadian Energy Researh Institute that BC will be closer to $1,000 per tpa. Based on the current proposals we estimate that even at the low end of this range the investment on the LNG facilities alone could be $100B. (See Figure 9 on page 9. Not every project will be built. We do not feel that the market will support all nine groups but rather we believe that two or three LNG liquefaction terminals are likely to be built along with two or three pipelines. The demand for LNG appears to be strong but the number of LNG plants in BC is probably tied to the supply equation – namely the LNG supply coming from the US. The US also has a large natural gas resource and sees that same opportunity as the groups in BC. Canada is considered an ideal trading partner in Asia. This country has a stable political system which may not seem important until the alternatives for LNG are examined. In the Philippines, for example, Middle Eastern LNG exporters are only willing to sell gas to Muslim-dominated parts of the 7,107-island archipelago (source: Vancouver Sun). The timeline for shipping LNG will be several years but final investment decisions could happen by December 2013. The Douglas Channel facility decision could happen with a few months while the Apache-Chevron Kitimat LNG partnership has advanced to site preparation work. (source: Vancouver Sun). The future catalysts will also be announcements regarding long-term customer contracts – to date, only the Douglas Channel project has an announced buyer (Golar LNG). Korea Gas, Mitsubishi and Japex arel likely buyers since these companies have already invested in two of the four proposed BC LNG plants. The Economics of Selling LNG to Asia The economic carrot for this huge capital investment is the elevated price for natural gas over the Pacific. The price for natural gas in Japan is over four times the price in North America. This additional profit potential could provide a sizeable return on investment for BC natural gas industry – assuming the high prices in Asia continue over the long term. Figure 3 illustrates the current price differential for both Asia and Europe. North America produces a large amount of natural gas but to date this production has largely been trapped in the domestic markets which has created downward pressure on pricing. Figure 3 – Natural Gas Prices in Various Global Markets 0 5 10 15 20 25 2007 2008 2009 2010 2011 2012 2013 $/MMBtu Source: CNOOC The price differencial is even worse for Western Canadian gas producers. As much as North American gas producers complain about low prices relative to international LNG, producers in BC and Alberta are even worse off. The difference between Henry Hub pricing in the US and AECO pricing in Alberta has typically been $0.25/MMBtu to $0.50/MMBtu but in 2013 this spread has increased to as high as $1.50/MMBtu. The spread has increased as US gas has replaced WCSB gas in areas

- 6. LNG Industry Update – October 7, 2013 6 | INDUSTRY UPDATE Jason Zandberg, B.B.A, CFA | Sharon Wang, M. Sc. (Finance) like the Greater Toronto Area and pipeline operators have increased transit costs which has stranded Western gas into storage and put downward pressure on prices. We believe a $12MMBtu price is the threshold for capital investment in BC. In order to justify the resource development costs in Northeast BC / Northwest Alberta (Montney, Horn River, etc.), the pipeline infrastructure and the LNG liquefaction terminals we believe that a long-term price of at least $12MMBtu is needed. We feel the economic split among the various players include $4.00 to $5.00MMBtu to cover the LNG liquefaction costs and profit, $3.50 to $4.50MMBtu for the gas producers, $1.50 to $2.50 to cover the pipeline costs and $1.00 to $1.50 for shipping costs. This creates an average price of $12MMBtu to cover all participants and create a economic return. A Closer Look at Asian LNG Demand The nuclear disaster in Japan after the Tsunami of 2011 has highlighted the downside of nuclear power and has created a huge opportunity for natural gas to replace this power source. Not only has Japan been replacing nuclear power generation with natural gas powered plants but so has other Asian countries like South Korea. Natural gas is not only viewed as a safer alternative which is relatively clean but also can add additional electricity generation in a relatively short period of time. Japan is the world’s largest importer of LNG and its demands grow as as 48 of the country’s 50 reactors remain shut awaiting safety checks. Recent leaks at Fukushima have muddied the outlook for the other shutdown reactors which has kept the demand for alternative fuels, naming LNG, high. For the twelve months ending in March, Japan imported a record 87 million tonnes of LNG, more than a third of global supply of 240 million tonnes during 2011. (source: Reuters) China is also becoming a large importer of natural gas. Since 2006, demand for LNG from China has grown by a factor of 15x (see Figure 4). China built its first LNG import terminal in 2006 and today has five such facilities along its east coast. The country is planning to add another 12 import terminals in the near future to keep up with the demand for natural gas (source: Thomson Reuters). In 2012, China imported just under 15mmt and current estimates peg China’s import capacity to grow to 87mmt by 2020 (source: Hydrocarbon Asia) Figure 4 – China’s Growing LNG Imports Source: CNOOC In 2011, Asian countries imported 150mmt of LNG while the rest of the world imported a combined 90mmt (see Figure 5). Total LNG demand from Asian countries is expected to more than double to 310mmt per annum by 2025. Japan, South Korea and Taiwan are currently the biggest importers but India and China are expected to grow the fastest in coming years. Figure 6 illustrates the growth in Asian LNG imports which are projected to grow by 5.9% per annum. 0 5 10 15 2006 2007 2008 2009 2010 2011 2012 Milliontons China's LNG import

- 7. Jason Zandberg, B.B.A, CFA | Sharon Wang, M. Sc. (Finance) INDUSTRY UPDATE | 7 LNG Industry Update – October 7, 2013 Figure 5 – Global LNG Trade (2011 by importing country / region) Source: BP Statistical Review of World Energy Figure 6 – Asian LNG Imports (2000 to 2025) Source: Wood Mackenzie Currently, LNG from Qatar and Australia are feeding the Asian demand but both of these regions are expected to plateau in the next few years which opens the door for LNG exports from the US and Canada. Figure 7 illustrates the expected supply / demand gap if there are no new sources of LNG, which is expected to grow to 175mmt by 2025. The gap is expected to be filled by new sources of LNG particularly from the US and Canada. According to NERA Economic Consulting, Canada is expected to be exporting 22mmt to 29mmt per annum by 2025 while the US could supply over 100mmt. Middle East 1% Europe 27% US/Caribbean 9% Japan 33% Korea 15% Taiwan 5% India 5% China 5% Thailand 0% Rest of World 90mmt Asia 150mmt JKT India China New 0 50 100 150 200 250 300 350 2000 2005 2010 2015 2020 2025 mtpa CAGR 2000 -2010 6.2% pa CAGR 2010-2025 5.9% pa

- 8. LNG Industry Update – October 7, 2013 8 | INDUSTRY UPDATE Jason Zandberg, B.B.A, CFA | Sharon Wang, M. Sc. (Finance) Figure 7 – Global LNG Supply (2000 – 2025) Source: Mackenzie Group BC’s Cost Advantages Canada’s primary cost advantage is its relatively low transportation costs given its proximity to the Asian markets. The cost to transport LNG to Japan, for example, represents 9% to 25% of the total cost of the LNG. LNG arriving from Qatar costs more than LNG arriving from Australia giving Australian LNG producers a cost advantage. Canada cost to transport LNG to Japan is lower than other major exporters including Australia and is significantly lower than the US Gulf Coast which must pay additional fees to travel through the Panama Canal. Figure 8 illustrates the cost per Mcf – ranking BC first among the major export regions. Figure 8 – Shipping Costs to Tokyo $1.12 $1.30 $1.97 $2.89 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 Western Canada Australia Qatar US Gulf Coast Costsin$/Mcf Source: Unit Economics 0 50 100 150 200 250 300 350 400 450 500 2000 2005 2010 2015 2020 2025 mtpa

- 9. Jason Zandberg, B.B.A, CFA | Sharon Wang, M. Sc. (Finance) INDUSTRY UPDATE | 9 LNG Industry Update – October 7, 2013 Energy costs Not only is energy in BC relatively inexpensive but the total energy required to cool natural gas to -160C may be less in Northern BC due to a cooler climate relative to other exporting LNG regions like Australia, Southern US and Qatar. The average temperature in Kitimat and Prince Rupert is around 7C whereas Louisiana averages 22C. Not only does the cooler climate, especially in the winter months, naturally cool the natural gas initially but the cooled LNG may have to be stored at -160C for several days in large storage tanks. It is estimated that BC LNG liquefaction facilities will consume 25% less electricity (source: Wall Street Journal) to turn natural gas into liquid. Market Size We estimate that the potential investment in BC depends on the economics of exporting natural gas. There appears to be demand for the fuel but the global supply picture is not well understood given potential supply coming from other countries, like the US, or fuel substitutes like coal, nuclear, oil or even emerging fuel sources. We believe the most likely LNG facilities to be build are the Douglas Channel LNG (1.4mtpa), Kitimat LNG (5.6mtpa), LNG Canada (47.5mtpa) and the Pacific Northwest LNG (18.0mtpa). These projects require three pipelines (Pacific Trails, Coastal GasLink and Prince Rupert Gas Transmission pipelines). With just these four LNG plants we calculate $98.9B to $206.6B in total investment based our construction costs estimates (see figure 9). This includes $1,000 to $2,000 per tpa for LNG facility construction, $400 to $1,000 per tpa on resource development and $6M to $10M per kilometer for pipeline construction costs. These figures do not include the economic spin- off via ancillary investment in public infrastructure, businesses, offices and residential construction. Figure 9 – Base Scenario: LNG Assets that are most likely to be built Source: Unit Economics, PI Financial Corp., various news releases The BC government estimates that the LNG industry will create $1T in cumulative economic investment over the next 30 years. This estimate may be at the high end of the spectrum but the potential is significant. The BC Liberals have set a goal of having three facilities in operation by 2020 (source: BC Jobs Plan) Catalysts andThreats to the BC LNG Market We feel that an announcement regarding a commitment from a large LNG buyer for one of the proposed projects would serve as a strong catalyst for real investment in both terminals and pipelines as well as increasing investment appetite for stocks that will service this sector’s massive build out. Below we have listed what we feel is the most important events and milestones for investors to be aware of: Tax regime for LNG projects in BC The BC government has been aggressively pursuing an LNG industry but still hasn’t disclosed its tax regime for this new market. The government is expected to release its tax plan by the end of this year. We feel there is room for a small tax which would allow the industry to still remain profitable but excessive taxation will likely kill projects. We expect to see tax incentives to build infrastructure which would delay a large tax bill in the future. LNG Liquefaction Terminals LNG Canada 37.5mtpa Prince Rupert LNG Estimated LNG Terminal construction costs Pacific Northwest LNG 18.0mtpa @ $1,000 - $2,000/tpa $62.5B $125.0B Kitimat LNG 5.6mtpa AltaGas LNG Estimated Resource Douglas Channel LNG 1.4mtpa @ $400 - $1,000/tpa $25.0B $62.5B 62.5mtpa Estimated Pipeline costs Proposed Pipelines @ $6M -$10M / km $11.5B $19.1B Coastal GasLink Pipeline 700 km BG Group Spectra Energy Pipeline $98.9B $206.6B Prince Rupert Gas Transmission Project 750 km Pacific Trail Pipeline 463 km 1,913 km

- 10. LNG Industry Update – October 7, 2013 10 | INDUSTRY UPDATE Jason Zandberg, B.B.A, CFA | Sharon Wang, M. Sc. (Finance) Energy landscape Another unknown is the energy landscape for Northern BC. Freezing natural gas to -160C will be energy intensive and these LNG plants will need to consume significant amount of energy. The obvious answer is to use natural gas which will be in abundant supply but using this fuel could cripple BC’s efforts to reduce its carbon emissions. BC Hydro has a large hydro project which could power these facilities while not impacting the carbon footprint but this project is not without controversy. Final Investment Decision for LNG Proposal To date, there have been many proposals for LNG facilities along the BC Coast but none of these proposals have announced firm investment decisions. Part of the delay is commitments from customers to guarantee a long-term LNG contract. Several of the proposals have investors who are likely to be customers (Mitsubishi and Korea Gas are two good examples) but there still has not been any long-term commitments made. A final investment decision could create a domino effect leading to further investments in pipelines, energy infrastructure and accelerated natural gas development. Environmental approval for one or both of the two largest LNG proposals. An environmental approval for any of the big three LNG projects (LNG Canada, Prince Rupert LNG (BG Group) or Pacific Northwest LNG) would also serve as a catalyst for further investment interest. So far, Kitimat LNG (Chevron, Apache) is the only facility to get environmental approval (its pipeline has also received approval). Douglas LNG, the smallest LNG proposal, does not need environmental approval as it is not deemed large enough to warrant the review. US decision on LNG exports. The US has only granted licenses for export LNG to countries that do not have a free-trade agreement with the US. The US government views the low priced natural gas environment in North America as a cost advantage over its trading partners and if it were to export mass amounts of LNG it would only service to reduce international prices (and thus provide other countries a similar energy advantage) while increasing the prices within North America (and conversely eroding its current cost advantage). To date, three LNG terminal projects have received conditional approvals from the US Department of Energy – Freeport LNG terminal in Texas, Lake Charles and the Sabine Pass LNG terminal in Louisiana. These terminals would have the capacity to deliver 5.4B cubic feet of gas per day. It is expected that the US could eventually export between 6.5B to 8.5B cubic feet per day by 2020. We believe that any diversion from this range will have either a positive (lower than 6.5B) or negative (higher than 8.5B) effect on the BC LNG outlook. It is expected that of the 16 proposed LNG projects in the US only 6 will become a reality (source: Vancouver Sun) Continued use of oil-indexed LNG contracts The high price of LNG paid by international buyers has been, in large part, due to the nature of the pricing mechanism in long-term supply contracts. These contracts are indexed to the price of oil meaning that when crude oil prices increased over $100 per barrel, the price of LNG followed. In North America the two commodities have gone in very different directions. Many international buyers (Japan especially) want to break from oil related pricing and instead base contracts on natural gas priced at Henry Hub which is considerably lower. If this were to happen, the price of LNG would drop making the investment in BC LNG plants less profitable. Japan Continues Nuclear Retirements. After the nuclear disaster at the Fukushima Daiichi plant, the country shut down all 50 nuclear plants that provided Japan with power. Two of those plants were restarted last July and it is expected that another 12 plants will resume operation later this year (source: Wall Street Journal). Power from natural gas plants replaced most of this lost power and resulted in a significant increase in LNG prices for the region. This pricing pressure may decline slightly as more nuclear reactors are started up but it is not expected that all 50 will resume operations. The situation in Japan has a significant bearing on the BC LNG market as the more demand from Japan the bigger the investment in BC LNG infrastructure will be. Asian demand continues to grow Coal use continues to diminish. China is expected to be the main driver for future LNG demand. It is anticipated that Chinese imports of LNG will double between now and 2018 to 295B cmpa and

- 11. Jason Zandberg, B.B.A, CFA | Sharon Wang, M. Sc. (Finance) INDUSTRY UPDATE | 11 LNG Industry Update – October 7, 2013 represent one-third of the global growth over this period (source: Oilprice.com). But China produces gas domestically as well and any factors that increase that production or, alternatively, reduce demand will have a material impact on global suppliers like BC. The demand equation depends on China’s attitude toward burning coal for power – China’s coal market alone is seven times the scale of the world LNG market (source: Lexology.com) Alternative fuels remain expensive The long-term vision for the use of natural gas looks strong now but if any alternative fuel that could be delivered on a large scale at an economic price the demand for natural gas / LNG could decline. Japan has been investing millions of dollars to try to recover methane from underwater sources called methane hydrate. The amount of this underwater energy source is enormous but the cost to recover the deposits has been cost prohibitive. Canada abandoned research after years of trying to extract methane hydrate in the Mackenzie River Delta so the eventual success of this process is not certain. What stocks stand to benefit from the significant investment in BC’s LNG industry? We have provided a large range of potential investment to develop an LNG market in Western Canada but even the low end of our range presents a large opportunity for those companies that will build the infrastructure. We have identified three large infrastructure themes – LNG liquefaction terminal construction, pipeline construction and resource development. LNG LiquefactionTerminal Construction We believe that the majority of the infrastructure spending will be the building of the export terminals in Kitimat and Prince Rupert – we estimate 60% - 65% of the overall investment. Our expectations on a base case of just three LNG facilities would be around $45B which in itself would provide a significant opportunity for infrastructure stocks that operate in this arena. Figure 10 illustrates the stocks that we feel will benefit from the investment in these large facilities but we believe the stock which will be impacted the greatest is ENTREC Corp (T-ENT). ENTREC Corp. (V-ENT) $1.38 ENTREC specializes in the lifting, transportation, loading, off-loading and setting of`` overweight and oversized cargo for large industrial projects. This cargo is transported across large distances or within a work site for customers in the oil and gas, construction, petrochemical, mining and power generation industries. The Company operates in BC, Alberta and North Dakota. ENTREC is a market leader in the heavy haul conventional and platform transportation`` markets in Western Canada with 15% and 35% market share respectively. The Company is an emerging player in the mobile crane market, with 5% market shares in the picker / boom truck market, all-terrain and rough terrain crane markets. All of ENTREC’s markets are fragmented and may offer significant acquisition potential. Major industrial projects, like BC’s LNG development or Alberta’s oil sands projects, are`` driving demand for ENTREC’s services. In Northern Alberta alone, there are planned capital investment of $225B by 2021 with a projected annual maintenance spend of $40B. Our base case for LNG liquefaction terminal investment is $45B while the upper end is close to $200B. We feel ENTREC’s acquisitions of Raincoast Cranes and GT Cranes provides a regional`` leadership position in BC. Raincoast is the only crane service company in the Kitimat area and since acquiring the company, ENTREC has invested heavily in its crane fleet. GT Crane, another acquisition in Northern BC, is the market leader for mobile crane services within the gas producing regions near Dawson Creek.

- 12. LNG Industry Update – October 7, 2013 12 | INDUSTRY UPDATE Jason Zandberg, B.B.A, CFA | Sharon Wang, M. Sc. (Finance) ENTREC released strong Q2 FY13 results.`` Revenue was up 72% to $49.3M, EBITDA was up 58% to $12.7M and EPS (fd) was $0.04 compared to $0.04 last year. Of the 72% growth in revenue 61% was from acquisitions while 11% was organic. The larger fleet of equipment has helped generate larger opportunities. Since Q2 FY12, ENTREC has added 53% more multi-wheel trailers, 53% more cranes and 71% more tractors. We are forecasting revenue of $244.9M, EBITDA of $63.0M and net income of 28.6M or`` $0.25 per share for FY13. Our FY14 forecasts project revenue of $306.6M, EBITDA of $81.9M and net income of $39.8M or $0.33 per share. We recommend ENTREC Corporation (V-ENT) with a BUY rating (risk: ABOVE AVERAGE)`` and a 12-month target price of $2.75. Based on FY13 EV/EBITDA and P/E multiples, ENTREC is trading at 3.9x and 5.4x respectively, which are significantly below peer averages. MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA Stantec T-STN $53.04 2,434 2,688 2.94 3.33 252.9 279.9 15.9x 9.6x Description Opportunity MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA Aecon Group Inc. T-ARE $13.95 774 1,277 0.84 1.36 183.1 225.3 10.2x 5.7x Description Opportunity MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA Bird Construction T-BDT $12.50 536 463 0.54 0.98 49.6 76.2 12.8x 6.1x Description Opportunity MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA The Churchill Corporation T-CUQ $8.91 212 333 0.27 0.61 43.2 55.6 14.6x 6.0x Description Opportunity MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA ENTREC Corp. V-ENT $1.37 160 252 0.22 0.27 62.6 80.0 5.1x 3.1x Description Opportunity MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA EPS ($) EBITDA ($M) Trading multiples ('14) Stantec Inc. provides professional consulting services in planning, engineering, architecture, interior design, landscape architecture, surveying, environmental sciences, project management, and project economics for infrastructure and facilities projects in the North America and internationally. Stantec Inc. was founded in 1954 and is headquartered in Edmonton, Canada. Providing the coordination, management and engineering analyst for the geotechnical aspects of the Kitimate LNG Export Facility EPS ($) EBITDA ($M) Trading multiples ('14) EBITDA ($M) Trading multiples ('14) Aecon Group Inc. and its subsidiaries provide construction and infrastructure development services to private and public sectors in Canada and internationally. Aecon Group has four groups of companies and subsidiaries: Aecon Infrastructure, Aecon Concessions, Aecon Energy, and Aecon Mining. The company was founded in 1877 and is headquartered in Toronto, Canada. Significant exposure to construction and infrastructure development in Western Canada including oilsands, mine sites, etc. EPS ($) EBITDA ($M) Trading multiples ('14) Bird Construction Inc. operates as a general contractor primarily in Canada. The company focuses on various projects primarily in the industrial, mining, commercial, and institutional sectors of the general contracting industry. Bird Construction Inc. was founded in 1920 and is based in Mississauga, Canada. Potential to provide construction services to general build out of LNG facilities, ancillary development Provides hauling and lifting services for major infrastructure projects - has office / presence in Kitimat ENTREC Corp. provides the lifting, road transportation, loading, off-loading, and setting of overweight and oversized cargo for the oil and natural gas industries in Canada and internationally. As of March 31, 2013, it operated a fleet of 600 multiwheeled trailers, 375 hydraulic platform lines, and 160 tractors, as well as 170 cranes. ENTREC Corporation was founded in 1995 and is headquartered in Spruce Grove, Canada. EPS ($) EBITDA ($M) Trading multiples ('14) EPS ($) The Churchill Corporation, through its subsidiaries, provides building construction, commercial and industrial electrical contracting, earthmoving, and industrial insulation services to various public and private sector clients primarily in western Canada. The Churchill Corporation was founded in 1981 and is headquartered in Calgary, Canada. Geographically focused on construction and industrial services in Western Canada EPS ($) EBITDA ($M) Trading multiples ('14) Figure 10 – Companies Which Could Benefit from LNG Liquefaction Terminal Spending

- 13. Jason Zandberg, B.B.A, CFA | Sharon Wang, M. Sc. (Finance) INDUSTRY UPDATE | 13 LNG Industry Update – October 7, 2013 Pipeline Construction The larger liquefaction terminals will require a pipeline to feed natural gas to the plant in large quantities. This process will feed revenue to many companies and no single entity will have the lion share of this business. We believe that Macro Enterprises has the biggest upside based on the potential impact of large pipeline construction contracts relative to its size (Macro reported revenue of $148M in FY12 whereas a large pipeline construction contract could represent $500M to $750M. We feel that Macro has a good probability of being award a portion of any large pipeline project given their strong track record as well as their expertise in mountainous terrain. Macro Enterprises (V-MCR) $6.07 Macro Enterprises specializes in the construction and integrity of pipelines and oil & gas`` facilities. Based in Fort St. John, BC, the Company provides its services throughout Western Canada from Manitoba to BC. Macro’s financial results have been very strong over the past four years and have`` accelerated over the last 18 months. Revenue has grown at close to 20% CAGR over the last four years, from $48M in 2009 to $148M in 2012, substantially through organic efforts. BC’s LNG development could result in several multi-million contracts for pipeline and`` facilities construction business for Macro once final investment decisions are announced. Pipelines connecting Western Canada’s gas producing regions to Asia will encourage further development of natural gas resources which includes associated well-site water lines, natural gas flowlines and processing facilities. Macro Enterprises released very strong Q2 FY13 results.`` Revenue was up 34% to $37.3M, EBITDA was up 100% to $9.8M and EPS (fd) was $0.18 compared to $0.07 last year. Gross margins increased by 930 bps to 31.7% year over year due to a change in sales mix. There has only been one quarter where gross margins were higher than the 31.7% level reported this quarter – Q3 FY12 had gross margins of 31.8%. The Churchill Corporation T-CUQ $8.91 212 333 0.27 0.61 43.2 55.6 14.6x 6.0x Description Opportunity MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA ENTREC Corp. V-ENT $1.37 160 252 0.22 0.27 62.6 80.0 5.1x 3.1x Description Opportunity MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA Armtec Infrastructure T-ARF $2.34 56 389 0.01 0.42 42.9 54.9 5.6x 7.1x Description Opportunity MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA Highbank Resources V-HBK $0.07 4.8 4.8 N/A N/A N/A N/A N/A N/A Description Opportunity Armtec Infrastructure Inc. manufactures and markets infrastructure products and engineered construction solutions to national and regional public infrastructure and private sector markets in agricultural drainage, commercial building, residential construction, and natural resources in Canada and internationally. Armtec Infrastructure Inc. was founded in 1908 and is headquartered in Guelph, Canada. Their Precast solutions are well suited for LNG liquefaction terminals Provides hauling and lifting services for major infrastructure projects - has office / presence in Kitimat ENTREC Corp. provides the lifting, road transportation, loading, off-loading, and setting of overweight and oversized cargo for the oil and natural gas industries in Canada and internationally. As of March 31, 2013, it operated a fleet of 600 multiwheeled trailers, 375 hydraulic platform lines, and 160 tractors, as well as 170 cranes. ENTREC Corporation was founded in 1995 and is headquartered in Spruce Grove, Canada. EPS ($) EBITDA ($M) Trading multiples ('14) The Churchill Corporation, through its subsidiaries, provides building construction, commercial and industrial electrical contracting, earthmoving, and industrial insulation services to various public and private sector clients primarily in western Canada. The Churchill Corporation was founded in 1981 and is headquartered in Calgary, Canada. Geographically focused on construction and industrial services in Western Canada EPS ($) EBITDA ($M) Trading multiples ('14) The construction of LNG plants will require construction aggregates which Highbank can provide from aggregate project in Northern BC. EPS ($) EBITDA ($M) Trading multiples ('14) Highbank Resources Ltd. engages in the acquisition, exploration, and development of mineral properties. The company has a 100% working ownership interest in the Swamp Point gravel deposit located in British Columbia, Canada. It also explores for copper and molybdenum deposits. Highbank Resources Ltd. is headquartered in Vancouver, Canada. Source: PI Financial, Capital IQ

- 14. LNG Industry Update – October 7, 2013 14 | INDUSTRY UPDATE Jason Zandberg, B.B.A, CFA | Sharon Wang, M. Sc. (Finance) We expect revenue to grow 37% in FY13 and 23% in FY14.`` A significant growth constraint for this market is access to equipment and labour but Macro is in an enviable position with respect to both of these variables. We are forecasting EBITDA of $48.8M and $56.7M in FY13 and FY14 respectively while our EPS forecasts are $0.89 and $1.01, respectively. We recommend Macro Enterprises (V-MCR) with a BUY rating (risk: ABOVE AVERAGE)`` and a 12-month target price of $8.50. Our target represents 4.6x EV/EBITDA and 8.4x P/E ratios based on our FY14 forecasts. MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA Finning T-FTT $23.80 4,125 5,867 1.95 2.19 735.1 794.3 10.8x 7.4x Description Opportunity MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA ShawCor T-SCL $43.67 2,615 2,910 4.09 3.61 435.4 366.8 12.1x 7.9x Description Opportunity MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA Enerflex T-EFX $13.46 1,052 1,069 0.97 1.14 148.6 166.2 11.9x 6.4x Description Opportunity MktCap EV Company SYM Price (US$M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA North American Energy Partners N-NOA US$5.31 194 490 (0.51) 0.33 37.7 57.3 16.1x 8.6x Description Opportunity MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA Macro Enterprises V-MCR $6.00 179 189 0.76 0.94 43.5 52.0 6.4x 3.6x Description Opportunity MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA Enterprise T-E $0.78 63 80 0.10 0.14 13.1 22.9 5.6x 3.5x Description Finning International Inc. provides sales, rental, parts and support services for Caterpillar Inc. (Caterpillar) equipment and engines and equipment on three continents. Its operating units include Canadian operations, South American operations, the United Kingdom and Ireland operations, and Other. The company was founded in 1933 and is headquartered in Vancouver, Canada. Caterpillar equipment will likely be used in earthmoving site preparation as well as for pipelaying applications (sidebooms). Trading multiples ('14) EPS ($) EBITDA ($M) Trading multiples ('14) EPS ($) EBITDA ($M) Trading multiples ('14) ShawCor Ltd. is a global energy services company that operates through eight divisions which focus on products and services for the pipeline and pipe services market and the petrochemical and industrial market. The company has manufacturing and service facilities located in over fifteen countries around the world. ShawCor is active in building new large diameter pipeline infrastructure. Additionally, ShawCor is likely to benefit from the development of the gas fields as its Flexpipe is used for oilfield water and fluids and for gathering lines. EPS (US$) EBITDA (US$M) North American Energy Partners Inc. provides mining and heavy construction services primarily in Western Canada. Its services include site clearing and access road construction; site development and underground utility installation; construction and relocation of mine site infrastructure; stripping, muskeg removal and overburden removal; heavy equipment and labour supply; material hauling; and mine reclamation and tailings pond construction. North American Energy Partners Inc. was founded in 1953 and is based in Acheson, Canada. Trading multiples ('14)EPS ($) EBITDA ($M) Enerflex Ltd. supplies natural gas compression, oil and gas processing, refrigeration systems, and power generation equipment worldwide. It designs, manufactures, constructs and service hydrocarbon handling systems. Enerflex Ltd. was founded in 1980 and is headquartered in Calgary, Canada. Provided compressors and related equipment to many Australian LNG plants and should benefit from BC's market as well Exposure to Western Canadian project development - site preparation, pipeline construction Trading multiples ('14) Trading multiples ('14)EPS ($) Macro Enterprises Inc. provides pipeline and facility construction, and maintenance services to the oil and gas companies in northeastern British Columbia and northwestern Alberta. It is involved in the construction, alteration, repair, and installation of pipeline and facility pressure piping and structural steel. Macro Enterprises Inc. was founded in 1994 and is headquartered in Fort St John, Canada. Likely to provide pipeline and facilities construction for proposed LNG pipelines EBITDA ($M) Enterprise Group, Inc. engages in the provision of construction services for the energy, utility, and transportation infrastructure industry in Canada. The company is involved in the installation of underground power, telecommunications, and natural gas lines, as well as offers directional drilling services for the utility providers. Enterprise Group, Inc. is headquartered in St. Albert, Canada. EPS ($) EBITDA ($M) Figure 11 – Companies Which Could Benefit from Pipeline Construction Spending

- 15. Jason Zandberg, B.B.A, CFA | Sharon Wang, M. Sc. (Finance) INDUSTRY UPDATE | 15 LNG Industry Update – October 7, 2013 Macro Enterprises V-MCR $6.00 179 189 0.76 0.94 43.5 52.0 6.4x 3.6x Description Opportunity MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA Enterprise T-E $0.78 63 80 0.10 0.14 13.1 22.9 5.6x 3.5x Description Opportunity MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA Synodon V-SYD $0.22 15 15 N/A N/A N/A N/A N/A N/A Description Opportunity Trading multiples ('14) Macro Enterprises Inc. provides pipeline and facility construction, and maintenance services to the oil and gas companies in northeastern British Columbia and northwestern Alberta. It is involved in the construction, alteration, repair, and installation of pipeline and facility pressure piping and structural steel. Macro Enterprises Inc. was founded in 1994 and is headquartered in Fort St John, Canada. Likely to provide pipeline and facilities construction for proposed LNG pipelines Enterprise Group, Inc. engages in the provision of construction services for the energy, utility, and transportation infrastructure industry in Canada. The company is involved in the installation of underground power, telecommunications, and natural gas lines, as well as offers directional drilling services for the utility providers. Enterprise Group, Inc. is headquartered in St. Albert, Canada. Market focus includes utility and pipeline construction as well as tunnelling and horizontal augering EPS ($) EBITDA ($M) EPS ($) EBITDA ($M) Trading multiples ('14) Synodon Inc., a remote sensing technology company, develops a leak detection system called realSens for the remote measurement of ground-level gas concentrations. The company also focuses on the provision of various datasets, including aerial imagery, thermal and terrain mapping, and vegetation and ground type to energy companies. Synodon Inc. was founded in 2000 and is headquartered in Edmonton, Canada. Provides inspection services for gas pipelines Source: PI Financial, Capital IQ Infrastructure Development in Resource Producing Region We have taken a very narrow view of the resource development opportunity as we have omitted pure energy services companies who, we will concede, have a large role in the development of this market. That being said, we have turned our attention to those companies that provide basic infrastructure (roads, site clearing, etc.) or whose products are used in the process (hydrochloric acid, piping, etc,) rather than the drillers, pressure pumpers or other direct energy service providers. Figure 12 illustrates companies we feel will benefit within this market and we have highlighted PetroWest as a company which should benefit significantly. PetroWest (T-PRW) $0.80 Petrowest provides industrial and civil infrastructure support services.`` This includes site preparation for drilling sites and gas facilities, road development, proper disposal of environmentally hazardous waste material, gravel crushing and heavy duty hauling and transportation services. PetroWest has the largest fleet of equipment in Northeast BC / Northwest Alberta.`` Most of its competition has less than 60 pieces of equipment whereas PetroWest has 657. These include rock trucks, dozers, excavators, log loaders, compactors, among others. We anticipate its equipment should be well utilized in coming years.`` PetroWest’s large equipment fleet should be active in site preparation for the extensive drilling projects and gas facilities in Northeast BC / Northwest Alberta. In addition, this equipment can provide pipeline access and right of ways as well as build roads to remote areas in the region. The company also builds work camps which will be necessary given the remote nature`` of drilling and pipeline development. The BC government has forecasted the need for 70,000 additional workers required in LNG construction projects and it is estimated that an additional 24,000 beds will be required in remote camps. PetroWest acquired Peejay Environmental last year which has a landfill site north of Fort`` St. John, BC. PetroWest has master service agreements to receive contaminated soil from major oil and gas companies operating in Northeast BC. We feel revenue can grow 10% per annum in the next two years before significant LNG`` spending commences in FY15. Consensus estimates forecast EBITDA of $35M in FY13 and $44M in FY14. Based on FY14 EBITDA and taking into account net debt of $72.4M, PRW shares trade at just 3.8x EV/EBITDA. PetroWest is NON-RATED and we do not provide a target price.``

- 16. LNG Industry Update – October 7, 2013 16 | INDUSTRY UPDATE Jason Zandberg, B.B.A, CFA | Sharon Wang, M. Sc. (Finance) MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA Finning T-FTT $23.80 4,125 5,867 1.95 2.19 735.1 794.3 10.8x 7.4x Description Opportunity MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA ShawCor T-SCL $43.67 2,615 2,910 4.09 3.61 435.4 366.8 12.1x 7.9x Description Opportunity MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA Canexus Corp. T-CUS $7.30 1,121 1,529 0.14 0.39 108.8 174.0 18.7x 8.8x Description Opportunity MktCap EV Company SYM Price (US$M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA North American Energy Partners N-NOA US$5.31 194 490 (0.51) 0.33 37.7 57.3 16.1x 8.6x Description Opportunity MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA ENTREC Corp. V-ENT $1.37 160 252 0.22 0.27 62.6 80.0 5.1x 3.1x Description Opportunity MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA Macro Enterprises V-MCR $6.00 179 189 0.76 0.94 43.5 52.0 6.4x 3.6x Description Opportunity MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA PetroWest T-PRW $0.77 95 168 0.02 0.12 35.2 44.1 6.5x 3.8x Description Opportunity MktCap EV Exposure to Western Canadian project development - site preparation, pipeline construction. EPS (US$) EBITDA (US$M) Trading multiples ('14) North American Energy Partners Inc. provides mining and heavy construction services primarily in Western Canada. Its services include site clearing and access road construction; site development and underground utility installation; construction and relocation of mine site infrastructure; stripping, muskeg removal and overburden removal; heavy equipment and labour supply; material hauling; and mine reclamation and tailings pond construction. North American Energy Partners Inc. was founded in 1953 and is based in Acheson, Canada. EPS ($) EBITDA ($M) Trading multiples ('14) Finning International Inc. provides sales, rental, parts and support services for Caterpillar Inc. (Caterpillar) equipment and engines and equipment on three continents. Its operating units include Canadian operations, South American operations, the United Kingdom and Ireland operations, and Other. The company was founded in 1933 and is headquartered in Vancouver, Canada. Caterpillar equipment will likely be used in earthmoving site preparation as well as for pipelaying applications (sidebooms). EBITDA ($M) Trading multiples ('14) ShawCor is likely to benefit from the development of the gas fields as its Flexpipe is used for oilfield water and fluids and for gathering lines. EPS ($) EBITDA ($M) Trading multiples ('14) ShawCor Ltd. is a global energy services company that operates through eight divisions which focus on products and services for the pipeline and pipe services market and the petrochemical and industrial market. The company has manufacturing and service facilities located in over fifteen countries around the world. Canexus produces sodium chlorate and chlor-alkali products largely for the pulp and paper and water treatment industries. It has four plants in Canada and two at one site in Brazil. They also provide fee-for-service hydrocarbon transloading services to the oil and gas industry from a terminal at Bruderheim, Alberta Canexus' North Vancouver chlor-alkali plant produces hydrochloric acid which is used in oil & gas acid fracturing. We do not believe the use of acid fracturing will be commonplace for liquids rich natural gas production in Northern BC, but there maybe a small uptick in demand. EPS ($) EPS ($) EBITDA ($M) Trading multiples ('14) ENTREC Corp. provides the lifting, road transportation, loading, off-loading, and setting of overweight and oversized cargo for the oil and natural gas industries in Canada and internationally. As of March 31, 2013, it operated a fleet of 600 multiwheeled trailers, 375 hydraulic platform lines, and 160 tractors, as well as 170 cranes. ENTREC Corporation was founded in 1995 and is headquartered in Spruce Grove, Canada. Recent acquisition of GT's Cranes makes ENTREC a market leader in mobile cranes in Northern BC EPS ($) EBITDA ($M) Trading multiples ('14) Macro Enterprises Inc. provides pipeline and facility construction, and maintenance services to the oil and gas companies in northeastern British Columbia and northwestern Alberta. It is involved in the construction, alteration, repair, and installation of pipeline and facility pressure piping and structural steel. Macro Enterprises Inc. was founded in 1994 and is headquartered in Fort St John, Canada. Provides water lines and flow lines to multiwell pads in Northeast BC/Northwest AB. Trading multiples ('14) Petrowest Corporation provides pre-drilling and post-completion energy services to the oil and gas industry in Canada. The company operates in five divisions: Construction, Civil Services, Environmental Services, Rentals, and Transportation. Petrowest Corporation was founded in 2006 and is headquartered in Grande Prairie, Canada. Provides well site preparation services in Horn River /Montney region. EPS ($) EBITDA ($M) EPS ($) EBITDA ($M) Trading multiples ('14) Figure 12 – Companies Which Could Benefit from LNG Resource Development Spending

- 17. Jason Zandberg, B.B.A, CFA | Sharon Wang, M. Sc. (Finance) INDUSTRY UPDATE | 17 LNG Industry Update – October 7, 2013 Macro Enterprises V-MCR $6.00 179 189 0.76 0.94 43.5 52.0 6.4x 3.6x Description Opportunity MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA PetroWest T-PRW $0.77 95 168 0.02 0.12 35.2 44.1 6.5x 3.8x Description Opportunity MktCap EV Company SYM Price ($M) ($M) FY13 FY14 FY13 FY14 P/E EV/EBITDA Enterprise T-E $0.78 63 80 0.10 0.14 13.1 22.9 5.6x 3.5x Description Opportunity Macro Enterprises Inc. provides pipeline and facility construction, and maintenance services to the oil and gas companies in northeastern British Columbia and northwestern Alberta. It is involved in the construction, alteration, repair, and installation of pipeline and facility pressure piping and structural steel. Macro Enterprises Inc. was founded in 1994 and is headquartered in Fort St John, Canada. Provides water lines and flow lines to multiwell pads in Northeast BC/Northwest AB. Trading multiples ('14) Petrowest Corporation provides pre-drilling and post-completion energy services to the oil and gas industry in Canada. The company operates in five divisions: Construction, Civil Services, Environmental Services, Rentals, and Transportation. Petrowest Corporation was founded in 2006 and is headquartered in Grande Prairie, Canada. Provides well site preparation services in Horn River /Montney region. EPS ($) EBITDA ($M) Market focus includes utility and pipeline construction as well as tunnelling and horizontal augering. EPS ($) EBITDA ($M) Trading multiples ('14) Enterprise Group, Inc. engages in the provision of construction services for the energy, utility, and transportation infrastructure industry in Canada. The company is involved in the installation of underground power, telecommunications, and natural gas lines, as well as offers directional drilling services for the utility providers. Enterprise Group, Inc. is headquartered in St. Albert, Canada. Source: PI Financial, Capital IQ

- 18. LNG Industry Update – October 7, 2013 18 | INDUSTRY UPDATE Jason Zandberg, B.B.A, CFA | Sharon Wang, M. Sc. (Finance) Disclaimer Analyst or a member of the Analyst’s household owns shares of the following stocks on the Coverage List: none PI Financial Corp. has received compensation for acting as fiscal agent or advisor for the following company over the preceding 12-month period: none PI Financial Corp. and its afiliates’ holdings in the following company’s securities, in aggregate exceeds 1% of the company’s issued and outstanding securities: Macro Enterprises Members: All major Canadian Stock Exchanges, Investment Industry Regulatory Organization of Canada, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does PI Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and PI Financial Corp. assumes no obligation to update the information or advice on further developments relating to securities. PI Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. PI Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where PI Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited. For further disclosure information, reader is referred to the disclosure section of our website.

- 19. Jason Zandberg, B.B.A, CFA | Sharon Wang, M. Sc. (Finance) INDUSTRY UPDATE | 19 LNG Industry Update – October 7, 2013

- 20. Participants of all Canadian Marketplaces. Members: Investment Industry Regulatory Organization of Canada, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does PI Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and PI Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. PI Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. PI Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where PI Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited. For further disclosure information, reader is referred to the disclosure section of our website. Capital Markets Group Bert Quattrociocchi, BA, CFA Executive Vice President, Head of Capital Markets 604.664.2925 Head Office Suite 1900, 666 Burrard Street Vancouver, BC, Canada V6C 3N1 ph: 604.664.2900 fx: 604.664.2666 Calgary Office Suite 1560, 300 5th Avenue SW Calgary, AB, Canada T2P 3C4 ph: 403.543.2900 fx: 403.543.2800 Victoria Office Suite 620, 880 Douglas Street Victoria, BC, Canada V8W 2B7 ph: 250.405.2900 fx: 250.405.2911 Toronto Office Suite 3401, 40 King Street West Toronto, ON, Canada M5H 3Y2 ph: 416.883.9040 fx: 647.789.2401 PI Financial Corp. www.pifinancialcorp.com Research Analysts Consumer Products Sheila Broughton, MBA, CFA 604.664.2695 Energy Services Roy Ma, B.Comm, CFA 403.543.2823 Mining Aleem Ladak, B.Sc 647.789.2415 Philip Ker, P.Geo, MBA 647.789.2407 Oil & Gas Alistair Toward, B.Comm, CFA 403.543.2824 Kuno Ryckborst, B.Sc., MBA 403.543.2828 Technology Pardeep S. Sangha, B.A.Sc., MBA 604.718.7528 Special Situations Jason Zandberg, B.B.A, CFA 604.718.7541 Research Associates Neil Bakshi, B.Comm 604.718.7557 Sharon Wang, M.Sc. (Finance) 604.664.2789 Institutional Sales Head of Institutional Sales Jim Danis, B.Sc. (Hons.) 604.718.7551 Vancouver David Goguen, CFA 604.664.2963 Jeremiah Katz 604.664.2816 Doug Melton, FCSI 604.718.7532 Toronto Denton Creighton, BA, MBA 416.883.9043 Ian Mellon, BA 416.883.9045 Aman Jain, MBA 416.883.9044 Institutional Sales Associate Brodie Dunlop 604.718.7533 InstitutionalTrading Vancouver Darren Ricci 604.664.2998 or 800.667.6124 (US) or 877.682.7233 (CDN) Joe Tibble 604.718.7525 or 888.525.8811 Adam Dell, B.Comm 604.718.7517 or 888.525.8811 Toronto Jose Estevez, CFA 416.883.9042 Investment Banking Vancouver Blake Corbet, BA 604.664.2967 Jim Mustard, B.A.Sc., P. Eng. 604.664.3655 Carol Ellis, MBA, P.Geo. 604.664.3606 Jim Locke, CFA 604.664.2670 Leo Wilson, CA, CBV 604.718.7510 Calgary Arthur Kwan, MBA, CFA 403.543.2918 Equity Capital Markets/Syndication Erica Williamson 604.664.3637 Kinga Gadomska 604.664.3604 Marketing and Publishing Ida Chan 604.664.2707