Financial analysis nobel biocare holding ag develops and produces dental implants and dental prosthetics. the company manufactures permanent replacements for tooth roots, and dental crowns and bridges

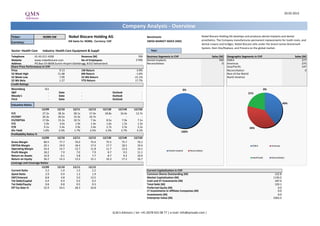

- 1. 20.02.2013 Company Analysis - Overview Ticker: NOBN SW Nobel Biocare Holding AG Benchmark: Nobel Biocare Holding AG develops and produces dental implants and dental SIX Swiss Ex: NOBN, Currency: CHF SWISS MARKET INDEX (SMI) prosthetics. The Company manufactures permanent replacements for tooth roots, and Currency: dental crowns and bridges. Nobel Biocare sells under the brand names Branemark System, Steri-Oss/Replace, and Procera on the global market. Sector: Health Care Industry: Health Care Equipment & Suppli Year: Telephone 41-43-211-4200 Revenue (M) 700 Business Segments in CHF Sales (M) Geographic Segments in CHF Sales (M) Website www.nobelbiocare.com No of Employees 2'496 Dental Implants 700 EMEA 277 Address PO Box CH-8058 Zurich-Airport Glattbrugg, 8152 Switzerland Reconciliation 0 Americas 275 Share Price Performance in CHF Asia/Pacific 147 Price 9.13 1M Return -3.9% Reconciliation 0 52 Week High 11.68 6M Return -1.6% Rest of the World 52 Week Low 7.09 52 Wk Return -21.1% North America 52 Wk Beta 1.27 YTD Return 17.7% Credit Ratings Bloomberg IG1 0% 0% S&P - Date - Outlook - 21% Moody's - Date - Outlook - Fitch - Date - Outlook - 40% Valuation Ratios 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E P/E 27.2x 38.3x 28.1x 17.4x 18.8x 16.4x 12.7x EV/EBIT 20.3x 20.5x 15.5x 10.7x - - - EV/EBITDA 17.0x 15.2x 10.7x 7.3x 8.5x 7.9x 7.1x P/S 5.0x 3.0x 1.9x 1.4x 1.6x 1.5x 1.5x P/B 9.1x 5.4x 3.9x 2.4x 2.7x 2.5x 2.2x 39% Div Yield 1.6% 2.5% 1.7% 2.5% 2.3% 2.7% 3.1% 100% Profitability Ratios % 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Gross Margin 80.5 77.7 76.0 75.4 75.5 75.7 76.1 EBITDA Margin 29.1 19.9 18.4 17.4 17.7 18.5 19.4 EMEA Americas Operating Margin 24.4 14.7 12.7 11.8 11.7 12.6 14.1 Dental Implants Reconciliation Profit Margin 18.2 7.9 7.0 7.9 8.7 9.5 11.1 Return on Assets 14.9 6.1 5.8 7.7 8.7 9.2 10.0 Asia/Pacific Reconciliation Return on Equity 36.2 14.3 13.2 15.1 16.3 17.2 16.7 Leverage and Coverage Ratios 12/09 12/10 12/11 12/12 Current Ratio 3.2 1.0 1.5 2.2 Current Capitalization in CHF Quick Ratio 2.9 0.9 1.3 1.9 Common Shares Outstanding (M) 122.8 EBIT/Interest 8.8 4.8 5.0 13.5 Market Capitalization (M) 1130.2 Tot Debt/Capital 0.4 0.4 0.3 0.2 Cash and ST Investments (M) 187.0 Tot Debt/Equity 0.8 0.8 0.5 0.3 Total Debt (M) 120.1 Eff Tax Rate % 22.9 54.5 28.3 24.8 Preferred Equity (M) 0.0 LT Investments in Affiliate Companies (M) 0.0 Investments (M) 0.0 Enterprise Value (M) 1063.2 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 2. Company Analysis - Analysts Ratings Nobel Biocare Holding AG Target price in CHF Broker Recommendation Buy and Sell Recommendations vs Price and Target Price Price Brokers' Target Price 16 30 100% 14 25 80% 42% 42% 20 46% 46% 46% 46% 46% 46% 50% 50% 50% 50% 12 15 10 60% 10 8 5 40% 33% 33% 42% 6 0 38% 38% 38% 46% 42% Bryan Garnier & Cie Morgan Stanley Barclays Kepler Capital Markets Main First Bank AG Equita SIM SpA S&P Capital IQ Commerzbank Corporates & CA Cheuvreux Credit Suisse Exane BNP Paribas Sanford C. Bernstein & Co JPMorgan Helvea Nomura Bank Vontobel AG HSBC EVA Dimensions Berenberg Bank Goldman Sachs Northcoast Research Deutsche Bank Zuercher Kantonalbank Jefferies 42% 42% 42% 46% 4 20% 2 Markets 17% 21% 21% 17% 17% 17% 13% 12% 8% 8% 8% 4% 0% 0 févr.12 mars.12 avr.12 mai.12 juin.12 juil.12 août.12 sept.12 oct.12 nov.12 déc.12 janv.13 Buy Hold Sell Price Target Price Date Buy Hold Sell Date Price Target Price Broker Analyst Recommendation Target Date 31-Jan-13 4% 46% 50% 20-Feb-13 9.13 8.69 Deutsche Bank YI-DAN WANG sell 5.90 20-Feb-13 31-Dec-12 8% 42% 50% 19-Feb-13 9.61 8.91 Goldman Sachs VERONIKA DUBAJOVA neutral/neutral 9.20 20-Feb-13 30-Nov-12 8% 42% 50% 18-Feb-13 9.93 8.91 Credit Suisse CHRISTOPH GRETLER neutral 10.80 20-Feb-13 31-Oct-12 8% 42% 50% 15-Feb-13 9.62 8.91 Berenberg Bank TOM JONES buy 12.25 20-Feb-13 28-Sep-12 12% 42% 46% 14-Feb-13 9.62 8.58 Kepler Capital Markets MAJA PATAKI hold 9.30 20-Feb-13 31-Aug-12 13% 46% 42% 13-Feb-13 9.78 8.58 S&P Capital IQ JACOB THRANE sell 8.60 20-Feb-13 31-Jul-12 17% 38% 46% 12-Feb-13 9.44 8.42 Main First Bank AG STEPHAN VOLLERT underperform 8.80 20-Feb-13 29-Jun-12 17% 38% 46% 11-Feb-13 9.38 8.42 Exane BNP Paribas JULIEN DORMOIS underperform 9.00 20-Feb-13 31-May-12 17% 42% 42% 8-Feb-13 9.34 8.63 Barclays ALEXANDER KLEBAN underweight 6.60 20-Feb-13 30-Apr-12 21% 33% 46% 7-Feb-13 9.15 8.63 Morgan Stanley MICHAEL K JUNGLING Underwt/Attractive 5.90 19-Feb-13 30-Mar-12 21% 33% 46% 6-Feb-13 9.33 8.63 JPMorgan DAVID J ADLINGTON underweight 7.30 19-Feb-13 29-Feb-12 17% 38% 46% 5-Feb-13 9.28 8.63 Sanford C. Bernstein & Co LISA BEDELL CLIVE market perform 9.00 19-Feb-13 4-Feb-13 9.17 8.63 Bank Vontobel AG CARLA BAENZIGER hold 8.60 19-Feb-13 1-Feb-13 9.46 8.63 Bryan Garnier & Cie MATHIEU CHABERT sell 8.90 19-Feb-13 31-Jan-13 9.54 8.63 Nomura MARTIN BRUNNINGER neutral 10.00 19-Feb-13 30-Jan-13 9.58 8.56 Helvea SIMON GOETSCHMANN neutral 9.70 19-Feb-13 29-Jan-13 9.58 8.52 Northcoast Research EDWIN SNYDER sell 6.50 19-Feb-13 28-Jan-13 9.69 8.52 Commerzbank Corporates & Markets OLIVER METZGER hold 9.10 15-Feb-13 25-Jan-13 9.71 8.52 HSBC HENDRIK LOFRUTHE neutral 9.00 15-Feb-13 24-Jan-13 9.70 8.52 EVA Dimensions ANDREW S ZAMFOTIS underweight 23-Jan-13 23-Jan-13 9.90 8.52 Zuercher Kantonalbank SIBYLLE BISCHOFBERGER FRICK underperform 16-Jan-13 22-Jan-13 9.44 8.40 CA Cheuvreux DANIEL JELOVCAN underperform 7.25 8-Nov-12 21-Jan-13 9.42 8.40 Jefferies INGEBORG OIE hold 9.00 15-Oct-12 18-Jan-13 9.50 8.40 Equita SIM SpA FABIO FAZZARI not rated 26.00 21-May-09 17-Jan-13 9.05 8.40 16-Jan-13 8.69 8.40 15-Jan-13 8.70 8.43 14-Jan-13 8.60 8.43 11-Jan-13 8.65 8.43 10-Jan-13 8.65 8.43 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 3. 20.02.2013 Nobel Biocare Holding AG Company Analysis - Ownership Ownership Type Ownership Statistics Geographic Ownership Distribution Geographic Ownership 0% Shares Outstanding (M) 122.8 United States 29.78% 5% 5% Float 87.0% Britain 24.96% 6% Short Interest (M) Switzerland 10.66% 30% Short Interest as % of Float Singapore 9.98% Days to Cover Shorts 45% Canada 8.38% 8% Institutional Ownership 54.70% 55% Norway 5.69% Retail Ownership 45.07% Luxembourg 5.32% Insider Ownership 0.23% Others 5.23% 10% 25% Institutional Ownership Distribution Investment Advisor 62.78% 11% Government 15.52% Mutual Fund Manager 10.29% Institutional Ownership Retail Ownership Insider Ownership Other 5.74% United States Britain Switzerland Singapore Pricing data is in CHF Others 5.66% Canada Norway Luxembourg Others Top 20 Owners: TOP 20 ALL Institutional Ownership Holder Name Position Position Change Market Value % of Ownership Report Date Source Country SILCHESTER INTL INVE 12'605'473 6'383'119 115'087'968 10.18% 24.08.2012 EXCH BRITAIN 6% FRANKLIN RESOURCES 7'387'481 72'834 67'447'702 5.97% 14.01.2013 ULT-AGG UNITED STATES 6% GOVT OF SINGAPORE IN 6'795'557 0 62'043'435 5.49% 31.12.2011 ULT-AGG SINGAPORE INVESCO LTD 6'216'059 2'445'504 56'752'619 5.02% 11.04.2012 EXCH UNITED STATES 10% TRIMARK INVESTMENT M 5'030'544 0 45'928'867 4.06% 30.09.2012 MF-AGG CANADA GOVERNANCE FOR OWNER 3'909'643 0 35'695'041 3.16% 31.12.2011 Co File BRITAIN NORGES BANK 3'768'834 0 34'409'454 3.04% 05.02.2013 EXCH NORWAY 62% CREDIT SUISSE ASSET 2'500'726 -42'449 22'831'628 2.02% 28.12.2012 MF-AGG SWITZERLAND 16% VANGUARD GROUP INC 2'274'825 21'757 20'769'152 1.84% 31.12.2012 MF-AGG UNITED STATES NEW JERSEY DIVISION 2'183'120 0 19'931'886 1.76% 30.06.2012 MF-AGG UNITED STATES UNION INVESTMENT GMB 2'000'000 -232'723 18'260'000 1.62% 28.09.2012 MF-AGG GERMANY CAPITAL GROUP COMPAN 1'350'000 0 12'325'500 1.09% 31.12.2012 ULT-AGG UNITED STATES SWISSCANTO FONDSLEIT 1'325'169 -51'431 12'098'793 1.07% 30.11.2012 MF-AGG SWITZERLAND UNION INVESTMENT LUX 1'323'847 0 12'086'723 1.07% 28.09.2012 MF-AGG LUXEMBOURG Investment Advisor Government Mutual Fund Manager Other Others NOBEL BIOCARE HOLDIN 1'303'120 0 11'897'486 1.05% 31.12.2011 Co File SWITZERLAND PICTET & CIE 681'647 1'555 6'223'437 0.55% 31.10.2012 MF-AGG SWITZERLAND UBS FUND MANAGEMENT 670'183 1'761 6'118'771 0.54% 31.10.2012 MF-AGG SWITZERLAND INVESCO CANADA LTD 565'501 0 5'163'024 0.46% 30.09.2012 MF-AGG CANADA SCHRODER INVESTMENT 529'332 -192'242 4'832'801 0.43% 31.10.2012 MF-AGG BRITAIN FMR LLC 427'359 427'359 3'901'788 0.35% 30.04.2012 ULT-AGG UNITED STATES Top 5 Insiders: Holder Name Position Position Change Market Value % of Ownership Report Date Source LAUBE RICHARD T 110'000 1'004'300 0.09% 31.12.2011 Co File BREU RAYMUND 70'000 639'100 0.06% 31.12.2011 Co File WATTER ROLF URS 53'500 488'455 0.04% 31.12.2011 Co File LILJA ROBERT 18'375 167'764 0.02% 31.12.2011 Co File FLURI EDGAR 16'500 150'645 0.01% 31.12.2011 Co File Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 4. Company Analysis - Financials I/IV Nobel Biocare Holding AG Financial information is in CHF (M) Equivalent Estimates Periodicity: Fiscal Year 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Income Statement Revenue 456 508 600 750 945 1'094 982 878 796 702 700 705 731 770 - Cost of Goods Sold 111 120 122 133 151 175 199 171 178 168 172 Gross Income 345 388 478 617 794 919 783 706 619 533 527 532 553 586 - Selling, General & Admin Expenses 242 255 291 364 452 548 572 493 501 444 444 (Research & Dev Costs) 19 21 22 26 28 37 52 38 44 36 42 Operating Income 103 133 190 270 342 371 211 214 117 89 83 83 92 109 - Interest Expense 4 5 3 4 3 6 28 24 24 18 6 - Foreign Exchange Losses (Gains) 1 0 13 19 16 4 -97 -40 -44 -36 -0 - Net Non-Operating Losses (Gains) 9 -11 -5 -44 4 12 27 23 -2 39 4 Pretax Income 90 139 179 292 319 348 253 207 139 68 74 80 91 110 - Income Tax Expense 34 28 37 52 70 75 79 47 76 19 18 Income Before XO Items 56 111 142 239 249 273 174 160 63 49 55 - Extraordinary Loss Net of Tax 0 0 0 0 0 0 0 0 0 - Minority Interests 1 1 1 0 0 0 0 0 0 0 0 Diluted EPS Before XO Items 1.09 1.85 1.98 2.20 1.43 1.28 0.51 0.39 0.45 Net Income Adjusted* 55 109 147 201 249 273 184 160 109 49 59 61 70 85 EPS Adjusted 0.44 0.87 1.15 1.57 1.99 2.21 1.50 1.30 0.88 0.39 0.47 0.49 0.56 0.72 Dividends Per Share 0.15 0.26 0.53 0.70 0.85 0.95 0.59 0.55 0.48 0.18 0.19 0.21 0.24 0.29 Payout Ratio % 34.8 29.5 74.5 58.7 44.0 46.2 41.7 42.4 95.0 46.3 43.6 0.44 0.44 0.40 Total Shares Outstanding 126 127 129 126 124 122 123 123 123 122 123 Diluted Shares Outstanding 132 132 130 130 126 124 122 124 123 123 123 EBITDA 135 163 221 290 366 399 256 256 158 129 121 125 135 149 *Net income excludes extraordinary gains and losses and one-time charges. Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 5. Company Analysis - Financials II/IV Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Balance Sheet Total Current Assets 206.207909 331.12563 463.403059 500.117142 492.379793 762.130423 629.90881 626.598869 532.918185 325.679126 365.411287 + Cash & Near Cash Items 76 171 301 201 213 312 246 358 299 131 177 + Short Term Investments 0 0 54 0 82 6 15 9 10 + Accounts & Notes Receivable 77 92 110 163 200 253 211 203 166 133 116 + Inventories 41 35 27 47 49 59 55 30 29 29 25 + Other Current Assets 12 33 25 35 31 139 37 30 23 24 38 Total Long-Term Assets 265 259 263 302 319 324 410 445 430 395 359 + Long Term Investments 1 1 1 3 4 3 0 Gross Fixed Assets 104 126 136 159 180 204 215 239 241 251 249 Accumulated Depreciation 64 82 86 94 102 110 109 127 128 146 164 + Net Fixed Assets 40 44 49 66 78 94 106 112 113 105 86 + Other Long Term Assets 224 214 213 234 237 227 304 332 317 290 274 Total Current Liabilities 78 97 120 201 185 270 213 198 519 212 163 + Accounts Payable 20 14 20 29 51 49 42 33 24 19 23 + Short Term Borrowings 2 0 1 2 3 42 3 315 45 0 + Other Short Term Liabilities 56 83 100 171 131 217 128 162 179 148 140 Total Long Term Liabilities 81 48 56 45 46 373 429 402 45 166 170 + Long Term Borrowings 43 1 1 0 0 342 356 351 0 120 120 + Other Long Term Borrowings 37 46 55 45 46 31 72 51 45 47 50 Total Liabilities 159 144 176 246 231 643 641 600 563 378 333 + Long Preferred Equity 0 0 0 0 0 0 0 0 0 0 0 + Minority Interest 3 4 2 0 0 0 0 0 0 0 0 + Share Capital & APIC 135 175 188 205 247 365 322 294 228 174 169 + Retained Earnings & Other Equity 174 267 361 352 334 78 77 177 171 169 223 Total Shareholders Equity 312 446 551 557 581 444 399 471 399 342 392 Total Liabilities & Equity 471 590 727 803 811 1'086 1'040 1'071 963 721 725 Book Value Per Share 2.46 3.47 4.27 4.42 4.67 3.64 3.24 3.83 3.25 2.80 3.19 3.34 3.64 4.22 Tangible Book Value Per Share 2.79 2.72 2.91 1.95 0.99 1.33 0.98 0.68 1.17 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 6. Company Analysis - Financials III/IV Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Cash Flows Net Income 55 109 141 239 249 273 174 160 63 49 55 61 71 86 + Depreciation & Amortization 32 30 31 20 24 28 45 42 41 40 39 + Other Non-Cash Adjustments 24 1 43 -37 7 -4 -12 17 5 -0 2 + Changes in Non-Cash Capital -11 -13 -10 -53 -27 -76 56 39 17 21 21 Cash From Operating Activities 100 128 205 170 254 222 263 258 126 110 117 + Disposal of Fixed Assets 0 0 + Capital Expenditures -16 -19 -25 -30 -31 -41 -48 -28 -32 -21 -9 -30 -31 -36 + Increase in Investments -54 + Decrease in Investments + Other Investing Activities -4 5 -26 46 42 -120 -50 -43 2 -39 0 Cash From Investing Activities -20 -14 -51 -39 11 -161 -98 -71 -30 -60 -9 + Dividends Paid -12 -20 -33 -68 -88 -106 -117 -68 -64 -41 -18 + Change in Short Term Borrowings 22 -38 -2 -284 -45 + Increase in Long Term Borrowings 7 0 382 0 118 + Decrease in Long Term Borrowings -33 -42 -1 0 -18 -49 + Increase in Capital Stocks 1 39 13 17 41 248 50 8 0 3 + Decrease in Capital Stocks -182 -214 -486 -26 -10 -7 -6 + Other Financing Activities -3 -4 -2 -0 0 -9 -130 55 24 0 -1 Cash From Financing Activities -39 -27 -22 -234 -260 30 -201 -70 -98 -213 -61 Net Changes in Cash 41 87 132 -103 5 91 -36 117 -2 -163 47 Free Cash Flow (CFO-CAPEX) 84 108 180 139 222 181 215 230 94 89 108 66 78 86 Free Cash Flow To Firm 86 112 183 142 224 186 234 249 105 102 112 Free Cash Flow To Equity 58 67 138 222 563 236 175 43 -77 Free Cash Flow per Share 0.67 0.86 1.41 1.09 1.78 1.46 1.76 1.87 0.76 0.73 0.88 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 7. Company Analysis - Financials IV/IV Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Ratio Analysis Valuation Ratios Price Earnings 40.8x 28.1x 37.2x 30.7x 35.3x 27.1x 16.0x 27.2x 38.3x 28.1x 17.4x 18.8x 16.4x 12.7x EV to EBIT 21.6x 22.2x 26.2x 25.9x 25.0x 19.8x 13.7x 20.3x 20.5x 15.5x 10.7x EV to EBITDA 16.5x 18.0x 22.6x 24.1x 23.3x 18.4x 11.3x 17.0x 15.2x 10.7x 7.3x 8.5x 7.9x 7.1x Price to Sales 4.9x 6.1x 8.8x 9.8x 9.3x 6.8x 2.8x 5.0x 3.0x 1.9x 1.4x 1.6x 1.5x 1.5x Price to Book 7.3x 7.3x 9.7x 13.1x 15.4x 16.6x 6.6x 9.1x 5.4x 3.9x 2.4x 2.7x 2.5x 2.2x Dividend Yield 0.9% 1.1% 1.3% 1.2% 1.2% 1.6% 2.6% 1.6% 2.5% 1.7% 2.5% 2.3% 2.7% 3.1% Profitability Ratios Gross Margin 75.6% 76.4% 79.7% 82.3% 84.0% 84.0% 79.7% 80.5% 77.7% 76.0% 75.4% 75.5% 75.7% 76.1% EBITDA Margin 29.5% 32.1% 36.9% 38.7% 38.7% 36.5% 26.0% 29.1% 19.9% 18.4% 17.4% 17.7% 18.5% 19.4% Operating Margin 22.6% 26.1% 31.8% 36.0% 36.2% 33.9% 21.5% 24.4% 14.7% 12.7% 11.8% 11.7% 12.6% 14.1% Profit Margin 12.1% 21.6% 23.6% 31.9% 26.3% 25.0% 17.7% 18.2% 7.9% 7.0% 7.9% 8.7% 9.5% 11.1% Return on Assets 11.5% 20.6% 21.6% 31.4% 31.0% 28.7% 16.2% 14.9% 6.1% 5.8% 7.7% 8.7% 9.2% 10.0% Return on Equity 17.9% 29.1% 28.7% 43.4% 44.0% 52.9% 41.0% 36.2% 14.3% 13.2% 15.1% 16.3% 17.2% 16.7% Leverage & Coverage Ratios Current Ratio 2.64 3.42 3.86 2.49 2.67 2.83 2.96 3.16 1.03 1.54 2.24 Quick Ratio 1.96 2.72 3.42 2.08 2.23 2.09 2.54 2.86 0.93 1.29 1.86 Interest Coverage Ratio (EBIT/I) 27.26 28.76 67.10 70.90 132.22 58.89 7.54 8.75 4.81 5.04 13.51 Tot Debt/Capital 0.13 0.00 0.00 0.00 0.00 0.44 0.50 0.43 0.44 0.32 0.23 Tot Debt/Equity 0.14 0.00 0.00 0.00 0.00 0.78 1.00 0.75 0.79 0.48 0.31 Others Asset Turnover 0.95 0.95 0.92 0.98 1.18 1.15 0.92 0.82 0.77 0.83 0.97 Accounts Receivable Turnover 5.80 5.97 5.97 5.51 5.24 4.81 4.21 4.18 4.28 4.70 5.65 Accounts Payable Turnover 6.34 6.42 6.73 6.19 3.78 3.62 4.37 3.86 6.35 7.92 8.07 Inventory Turnover 2.93 3.14 3.94 3.60 3.16 3.24 3.49 3.98 5.86 5.77 6.44 Effective Tax Rate 37.4% 20.4% 20.7% 17.9% 22.0% 21.6% 31.2% 22.9% 54.5% 28.3% 24.8% Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 8. Company Analysis - Peers Comparision NOBEL BIOCAR- STRAUMANN SONOVA HOLDING SIRONA DENTAL FRESENIUS TECAN GROUP AG- ZIMMER HLDGS DENTSPLY INTL WILLIAM DEMANT SMITH & NEPHEW FRESENIUS SE & C CELESIO AG GALENICA -REG REG HLDG-R A SY MEDICA R Latest Fiscal Year: 12/2012 12/2011 12/2012 03/2012 12/2012 09/2012 12/2011 12/2011 12/2012 12/2011 12/2011 12/2011 12/2011 52-Week High 11.68 160.70 76.75 115.30 43.51 73.98 60.27 596.50 738.00 96.93 90.00 15.57 626.00 52-Week High Date 27.04.2012 29.05.2012 13.02.2013 15.02.2013 19.02.2013 08.02.2013 30.07.2012 19.07.2012 30.01.2013 16.10.2012 13.02.2013 22.10.2012 11.07.2012 52-Week Low 7.09 97.90 57.46 82.23 35.04 40.59 47.79 454.00 567.50 68.60 59.05 10.72 479.25 52-Week Low Date 21.11.2012 16.11.2012 26.07.2012 22.05.2012 02.08.2012 04.06.2012 10.01.2013 16.11.2012 06.06.2012 26.04.2012 06.06.2012 05.06.2012 16.11.2012 Daily Volume 1'761'304 97'702 314'095 97'282 218'400 347'910 424'277 88'274 806'940 312'402 15'262 303'411 8'643 Current Price (2/dd/yy) 9.13 127.00 76.04 113.80 43.14 71.51 51.84 487.50 711.00 88.74 88.15 13.50 539.50 52-Week High % Change -21.8% -21.0% -0.9% -1.3% -0.9% -3.3% -14.0% -18.3% -3.7% -8.4% -2.1% -13.3% -13.8% 52-Week Low % Change 28.8% 29.7% 32.3% 38.4% 23.1% 76.2% 8.5% 7.4% 25.3% 29.4% 49.3% 25.9% 12.6% Total Common Shares (M) 122.8 15.5 173.5 66.5 141.7 55.1 304.1 57.6 902.5 163.2 11.4 170.1 6.4 Market Capitalization 1'130.2 1'990.9 13'193.1 7'600.9 6'122.8 4'063.6 15'865.5 28'445.6 6'432.9 15'815.0 1'008.8 2'296.4 3'506.8 Total Debt 99.5 1.8 1'820.9 257.8 1'766.7 75.5 7'211.4 2'312.0 468.0 10'208.0 4.4 2'067.0 1'165.2 Preferred Stock - - - - - - - - - - - - - Minority Interest - - - 1.8 36.1 3.0 570.0 4.0 - 4'923.0 - 32.2 45.7 Cash and Equivalents 154.9 378.0 1'555.9 198.7 77.1 151.1 457.3 288.0 178.0 635.0 165.1 448.3 345.3 Enterprise Value 860.3 1'874.1 13'458.1 7'648.6 7'754.6 4'018.3 22'364.4 30'530.6 10'127.5 31'578.0 875.8 4'142.0 4'422.8 Valuation Total Revenue LFY 580.5 693.6 4'471.7 1'619.8 2'928.4 979.4 12'795.1 8'041.0 4'137.0 16'522.0 377.0 23'026.4 3'480.6 LTM 580.5 688.0 4'471.7 1'729.3 2'928.4 993.6 13'417.2 8'399.0 4'137.0 18'533.0 377.3 22'560.6 3'545.8 CY+1 570.8 694.9 4'612.8 1'839.0 2'996.3 1'086.7 13'734.6 8'673.0 4'408.4 19'233.0 393.0 22'542.0 3'441.6 CY+2 591.7 699.3 4'798.8 1'988.6 3'172.3 1'181.4 14'706.6 9'384.5 4'599.3 20'953.4 425.3 22'562.5 3'558.3 EV/Total Revenue LFY 1.3x 3.0x 2.6x 3.9x 2.4x 3.6x 2.4x 4.1x 2.5x 1.9x 1.5x 0.2x 1.4x LTM 1.3x 3.0x 2.6x 3.7x 2.4x 3.5x 2.3x 3.9x 2.5x 1.7x 1.5x 0.2x 1.4x CY+1 1.5x 2.6x 2.9x 4.1x 2.4x 3.6x 2.2x 3.5x 2.2x 1.6x 2.2x 0.2x 1.2x CY+2 1.4x 2.5x 2.7x 3.7x 2.2x 3.1x 2.0x 3.2x 2.0x 1.4x 1.9x 0.2x 1.1x EBITDA LFY 100.7 116.7 1'676.9 366.1 421.6 263.5 2'632.2 1'905.0 1'271.0 3'237.0 60.4 486.6 399.9 LTM 100.7 128.5 1'676.9 416.9 488.9 266.7 2'817.0 - 1'236.0 3'672.0 62.1 597.0 408.2 CY+1 100.9 130.2 1'767.4 462.0 632.9 297.0 2'907.4 1'955.8 1'257.4 3'830.3 63.6 554.7 417.9 CY+2 109.4 156.6 1'846.2 522.1 672.9 330.1 3'114.3 2'260.3 1'365.9 4'161.5 72.3 612.1 421.7 EV/EBITDA LFY 7.3x 17.7x 7.1x 17.4x 16.7x 13.3x 11.7x 17.2x 8.1x 9.9x 9.6x 8.7x 12.1x LTM 7.3x 16.1x 7.1x 15.3x 14.4x 13.1x 11.0x - 8.3x 8.7x 9.3x 7.1x 11.8x CY+1 8.6x 14.0x 7.6x 16.2x 11.4x 13.0x 10.2x 15.5x 7.7x 8.0x 13.4x 7.4x 10.1x CY+2 7.5x 11.3x 7.0x 14.0x 10.2x 11.1x 9.3x 13.2x 6.8x 7.2x 11.1x 6.4x 9.6x EPS LFY 0.37 4.54 5.30 3.71 1.99 2.33 3.51 - 0.67 4.18 4.12 0.46 34.46 LTM 0.37 4.91 5.32 4.40 1.94 2.42 4.08 21.23 0.82 5.30 3.63 1.01 36.64 CY+1 0.39 5.27 5.76 5.02 2.45 3.46 3.72 21.12 0.78 5.41 4.06 1.20 37.80 CY+2 0.45 6.75 6.26 5.73 2.72 3.84 4.00 25.90 0.85 5.94 4.86 1.34 39.02 P/E LFY 20.0x 25.9x 14.3x 25.9x 22.2x 29.5x 17.0x 23.0x 13.3x 16.7x 24.3x 13.4x 14.7x LTM 20.0x 25.9x 14.3x 25.9x 22.2x 29.5x 17.1x - 16.0x 18.7x 24.4x 12.8x 14.8x CY+1 18.8x 24.1x 13.2x 22.7x 17.6x 20.7x 18.6x 23.1x 13.9x 16.4x 21.7x 11.3x 14.3x CY+2 16.4x 18.8x 12.1x 19.9x 15.9x 18.6x 17.3x 18.8x 12.8x 14.9x 18.1x 10.1x 13.8x Revenue Growth 1 Year 2.0% (6.0%) 0.4% 0.2% 15.4% 7.2% 6.2% 16.7% (3.1%) 3.4% 1.7% (1.1%) 1.0% 5 Year (3.2%) 0.9% 2.0% 8.4% 7.5% 6.8% 7.1% 10.0% 2.3% 11.9% (1.2%) 0.2% 7.4% EBITDA Growth 1 Year (3.7%) (44.7%) 3.7% (2.0%) - 8.8% 8.5% 17.5% 5.2% 5.9% (6.8%) (26.8%) (9.9%) 5 Year (16.1%) (11.5%) 1.6% 3.7% 2.6% 11.9% 10.7% 6.0% 6.2% 11.9% (0.9%) (9.3%) 21.9% EBITDA Margin LTM 17.4% 18.7% 37.5% 24.1% 16.8% 26.8% 21.0% - 29.9% 19.8% 16.4% 2.6% 11.5% CY+1 17.7% 18.7% 38.3% 25.1% 21.1% 27.3% 21.2% 22.6% 28.5% 19.9% 16.2% 2.5% 12.1% CY+2 18.5% 22.4% 38.5% 26.3% 21.2% 27.9% 21.2% 24.1% 29.7% 19.9% 17.0% 2.7% 11.9% Leverage/Coverage Ratios Total Debt / Equity % 30.6% 0.3% 31.0% 17.5% 95.6% 7.6% 91.3% 70.1% 12.0% 171.0% 1.6% 81.2% 100.7% FALSE Total Debt / Capital % 23.4% 0.3% 23.7% 14.9% 48.4% 7.1% 46.0% 41.2% 10.8% 48.4% 1.6% 44.5% 49.2% FALSE Total Debt / EBITDA 0.988x 0.011x 1.086x 0.604x 3.373x 0.283x 2.996x - 0.379x 3.072x 0.101x 3.317x 2.978x FALSE Net Debt / EBITDA -0.550x -0.910x 0.158x 0.111x 3.258x -0.183x 2.777x - 0.235x 2.808x -2.143x 3.041x 2.189x FALSE EBITDA / Int. Expense 19.811x 197.209x 23.003x 61.253x 9.623x 54.441x 7.386x 22.952x 105.917x 5.514x 597.723x 3.093x 10.010x FALSE Credit Ratings S&P LT Credit Rating - - A- - BBB+ - BB+ - - BB+ - - - FALSE S&P LT Credit Rating Date - - 13.04.2007 - 02.09.2011 - 19.09.2012 - - 19.09.2012 - - - FALSE Moody's LT Credit Rating - - Baa1 - Baa2 - - - - WR - - - FALSE Moody's LT Credit Rating Date - - 12.11.2009 - 16.08.2011 - - - - 30.04.2006 - - - FALSE Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |