Weitere ähnliche Inhalte

Ähnlich wie Income tax & law (business income deductions)

Ähnlich wie Income tax & law (business income deductions) (20)

Kürzlich hochgeladen (20)

Income tax & law (business income deductions)

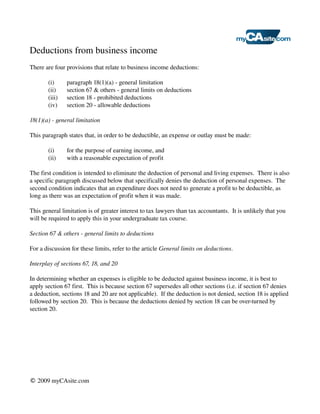

- 1. Deductions from business income

There are four provisions that relate to business income deductions:

(i) paragraph 18(1)(a) general limitation

(ii) section 67 & others general limits on deductions

(iii) section 18 prohibited deductions

(iv) section 20 allowable deductions

18(1)(a) general limitation

This paragraph states that, in order to be deductible, an expense or outlay must be made:

(i) for the purpose of earning income, and

(ii) with a reasonable expectation of profit

The first condition is intended to eliminate the deduction of personal and living expenses. There is also

a specific paragraph discussed below that specifically denies the deduction of personal expenses. The

second condition indicates that an expenditure does not need to generate a profit to be deductible, as

long as there was an expectation of profit when it was made.

This general limitation is of greater interest to tax lawyers than tax accountants. It is unlikely that you

will be required to apply this in your undergraduate tax course.

Section 67 & others general limits to deductions

For a discussion for these limits, refer to the article General limits on deductions.

Interplay of sections 67, 18, and 20

In determining whether an expenses is eligible to be deducted against business income, it is best to

apply section 67 first. This is because section 67 supersedes all other sections (i.e. if section 67 denies

a deduction, sections 18 and 20 are not applicable). If the deduction is not denied, section 18 is applied

followed by section 20. This is because the deductions denied by section 18 can be overturned by

section 20.

© 2009 myCAsite.com

- 2. Section 18

Subsection 18(1) denies the following deductions:

Paragraph Description Comments

(b) Expenditures of a capital includes depreciation and interest paid/payable on funds

nature use to finance capital expenditures

(c) Expenditures to produce gambling profits and windfalls (i.e. lottery winnings) are

exempt income not taxable and so, related expenses are not deductible

income from criminal activity is taxable but expenditures

are not deductible

(e) Reserves prohibited unless there exists a legally enforceable claim

against taxpayer with a reasonable expectation of payment

(f) Payments on discounted where bond is issued for less than face value, repayment of

bonds discount is not deductible

(g) Payments on income bonds considered dividends

(h) Personal & living expenses includes premiums for life insurance, expenses for

property maintained for beneficiary of an estate or a person

connected by blood, marriage or adoption

(l) Club dues dues related to a club or recreational facility are denied

also denied are expenses incurred for the use or

maintenance of a yacht, camp, lodge or golf course

(n) Political & charitable individuasl can claim these expenses as tax credits, while

donations corporations receives a tax credit and a Division C

deduction

(p) Expenses of a personal deductions are limited to those available to an employee

services business

(r) Automobile allowances in allowances paid to employees are limited to $0.52 on first

excess of limit 5,000 kms and $0.46 thereafter, unless employee includes

allowance in income

(t) Payments under the Act income taxes, interest and penalties are not deductible

© 2009 myCAsite.com

- 3. Other subsections in section 18 include:

18(2) Carrying charges on vacant land

carrying charges on vacant land include interest and property taxes

carrying charges on vacant land deducted in the year are limited to the taxpayer's net income from the

land and the excess is added to the cost of the land if it is capital property

this limitation applies only to land held, but not used, in the course of business or to land held

primarily for resale or developer

this limitation does not apply to incomeproducing land or land owned by a corporation whose

principal business is leasing real property1

the intent of this provision is to discourage speculation in real estate

18(3.1) Soft costs relating to construction of buildings or ownership of lands

soft costs include interest, legal fees, accounting and mortgage fees, insurance and property taxes

incurred during a period of construction or renovation

soft costs are only deductible against income earned by the taxpayer on the building being renovated

or constructed, otherwise, soft costs are not deductible and are added to the capital cost of property,

soft costs can be deducted once construction or renovation is complete

costs to acquire financing such as underwriter's fees are amortized over a five year period

18(12) Work space in home

the costs of maintaining a work space in an individual's home is prohibited unless the work space is:

(i) the individual's principal place of business, or

(ii) used on a regular and continuous basis to meet clients, customers or patients

the deduction of home office expenses is limited to the income for the year from the business which

the home office is used

expenses not deducted in the year can be carried forward indefinitely and applied to income from the

business which the home office is used in the future

this provision parallels subsection 8(13) that restricts the deduction of home office expenses by an

employee

1 A corporation whose principal business is leasing real property can deduct carrying charges in excess of net income, but

cannot deduct in excess of their baseline deduction, which is interest at the prescribed rate computed on a $1 mil loan

held throughout the year.

© 2009 myCAsite.com

- 4. Section 20

Notwithstanding Section 18, subsection 20(1) allows the following deductions:

Paragraph Description Comments

(a) Capital cost of property taxpayer may claim CCA as determined by regulation

(b) Eligible capital property taxpayer may claim CEC as determined by regulation

(c) Interest includes amounts paid/payable on funds borrowed to earn

business income or finance capital expenditures

(e) Expenses of issuing e.g. filing, accounting or legal fees, printing, advertising

shares/debt amortized over 5 years

(e.2) Life insurance used as premiums are deductible provided interest payable on the

collateral for a loan loan is deductible and lender's principal business is making/

buying loans

(f) Discount on debt discount is fully deductible if debt issued for at least 97%

of par value or effective interest rate does not exceed ⁴/₃ of

the coupon rate

otherwise, discount is ½ deductible

deduction taken at earlier of maturity or redemption

(l) Reserve for doubtful debts must be brought back into income in subsequent year

(m) Reserve for goods not must be brought back into income in subsequent year

delivered or services not

rendered

(m.1) Reserve for manufacturer's must be brought back into income in subsequent year

warranty

(q) Employer contributions to contributions to a defined benefit plan are deductible if

registered pension plan considered actuarially necessary

contributions to a defined contribution plan are deductible

provided the total of employer & employee contributions

does not exceed lesser of (i) 18% of employee's

compensation and (ii) the money purchase limit (i.e.

$20,000 for 2009)

contributions in excess of limit can result in revocation of

plan meaning all amounts are taxable

contributions made not more than 120 days after yearend

can be deducted in previous year

© 2009 myCAsite.com

- 5. Paragraph Description Comments

(z) Cancellation of lease amount paid by lessor to lessee for cancellation of lease is

amortized over remaining lease term and renewal periods

not to exceed 40 years

(aa) Landscaping of grounds otherwise considered a capital expenditure

(cc) Expenses of representation incurred to obtain a license, permit, franchise or trademark

(ee) Utility services connection otherwise considered a capital expenditure

There are three other deductions to discuss:

Subsection 20(10) Convention expenses

taxpayer is able to claim cost of attending up to two conventions per year

convention must be related to taxpayer's business and be within its territorial scope

otherwise considered a capital expenditure

Deductibility of provincial capital and payroll taxes

provincial health levies, payroll taxes and capital taxes are deductible, but this is subject to change

Scientific Research & Experimental Development

see attached article

© 2009 myCAsite.com