Houston Economy at a Glance - Augst 2011

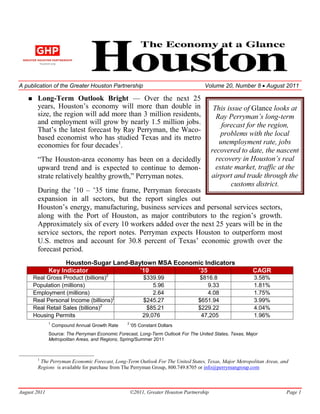

- 1. A publication of the Greater Houston Partnership Volume 20, Number 8 August 2011 Long-Term Outlook Bright Over the next 25 years, This issue of Glance looks at size, the region will add more than 3 million residents, -term and employment will grow by nearly 1.5 million jobs. forecast for the region, the latest forecast by Ray Perryman, the Waco- problems with the local based economist who has studied Texas and its metro economies for four decades1. unemployment rate, jobs recovered to date, the nascent -area economy has been on a decidedly upward trend and is expected to continue to demon- estate market, traffic at the airport and trade through the customs district. During the 10 35 time frame, Perryman forecasts expansion in all sectors, but the report singles out facturing, business services and personal services sectors, along with the Port of Houston, as major c Approximately six of every 10 workers added over the next 25 years will be in the service sectors, the report notes. Perryman expects Houston to outperform most U.S. metros and account for over the forecast period. Houston-Sugar Land-Baytown MSA Economic Indicators Key Indicator 10 35 CAGR Real Gross Product (billions)2 $339.99 $816.8 3.58% Population (millions) 5.96 9.33 1.81% Employment (millions) 2.64 4.08 1.75% Real Personal Income (billions)2 $245.27 $651.94 3.99% Real Retail Sales (billions)2 $85.21 $229.22 4.04% Housing Permits 29,076 47,205 1.96% 1 2 Compound Annual Growth Rate 05 Constant Dollars Source: The Perryman Economic Forecast, Long-Term Outlook For The United States, Texas, Major Metropolitan Areas, and Regions, Spring/Summer 2011 1 The Perryman Economic Forecast, Long-Term Outlook For The United States, Texas, Major Metropolitan Areas, and Regions is available for purchase from The Perryman Group, 800.749.8705 or info@perrymangroup.com August 2011 ©2011, Greater Houston Partnership Page 1

- 2. HOUSTON THE ECONOMY AT A GLANCE s Just Yet Houston s June unemployment rate stood at 9.0 percent, up from 8.2 percent in May. The increase cause for alarm, though. It reflects historical patterns stemming largely from teens seeking summer work and the expiration of 10-month contracts for many teachers. Hou unemployment rate has increased from May to June for the past 10 years, the increase typically ranging from 0.4 to 0.9 percent, with 0.65 percent being the average. Th 0.8 percent increase, while slightly above the norm, may reflect discouraged workers returning to the job market. June Unemployment Rate, Houston MSA And Change from Previous Month Year June Rate Change From May 02 6.6 +0.7 03 7.6 +0.9 04 6.7 +0.6 05 5.7 +0.4 06 5.5 +0.5 07 4.6 +0.6 08 5.0 +0.6 09 8.2 +0.9 10 8.7 +0.5 11 9.0 +0.8 Source: Texas Workforce Commission According to Bureau of Labor Statistics (BLS) methodology, if people stop seeking work (which many did during the recession), they aren t counted as unemployed. As the economy recovers, which is clearly the case in Houston, discouraged workers will reenter the job market and the unemployment rate goes up. That June, the civilian labor force grew by 20,800 workers at the same time. Ironically, , it may continue to report high unemployment rates. The Uneven Jobs Recovery , when the recession ended here, the Houston-Sugar Land-Baytown Metropolitan Statistical Area has recouped 118,300 jobs, or about three-fourths of the 152,800 lost during the recession.2 But 2 This is a seasonally unadjusted number. On a seasonally adjusted basis, the region lost fewer jobs 121,200 and has since recovered 92,400 of them, or 76.2 percent. However, seasonally adjusted data is not available for the individual industry sectors so any analysis of the employment must be performed on unadjusted data.. August 2011 ©2011, Greater Houston Partnership Page 2

- 3. HOUSTON THE ECONOMY AT A GLANCE the recovery has been uneven. Four sectors personal services, health care, accommodation and food services, and educational services have recovered all jobs lost and continue to grow. Employment in those sectors stands above their pre-recession peaks. In contrast, four sectors finance, construction, real estate, and information have recovered less than one-fifth of their losses. Given recent trends, it will be some time before those sectors return to their previous peaks. So influencing recovery? % Jobs Lost Recovered So Far Other Services +100% Health Care +100% Hotels & Food Services +100% Education Services +100% Arts, Entertainment 98.3% Administrative Support 90.0% Utilities 80.0% Oil & Gas 68.2% Wholesale Trade 51.5% Retail Trade 50.9% Professional Services 45.8% Manufacturing 39.2% Transport & Warehouse 20.4% Information 16.4% Real Estate 16.4% Construction 14.1% Finance 0.0% Source: Texas Workforce Commission, July 2011 the region adds nearly 120,000 residents per year the demand for services continues to grow. The other services sector includes auto and household repairs, salons and barber shops, dry cleaning, funeral services and religious, business, civic and social organizations. This sector lost 3,700 jobs in the recession, but has created 5,900 during the recovery. Health care never lost jobs during the recession. This sector added 16,000 jobs and another 8,900 jobs from the trough to the present. Two factors create a growing demand for health care a growing population, noted above, and an aging population. As -plus population grows by 15,000 residents each year, its demand for health care services will grow as well. August 2011 ©2011, Greater Houston Partnership Page 3

- 4. HOUSTON THE ECONOMY AT A GLANCE Accommodation and food services lost 13,700 jobs in the recession but has added more than Personal services, health care, 20,600 jobs in the recovery. The bulk of the accommodations and food growth has occurred in food services, again services, and educational services supported by the growing population, and by now employ more workers than growing consumer confidence, at least locally. they did prior to the recession. At The restoration of corporate travel budgets the opposite end of the spectrum, slashed during the recession has helped finance, construction, real estate Houston recover two-thirds of the jobs lost in and information have yet to accommodations. experience significant job growth. Education services also never lost jobs during the recession. It added 1,200 jobs from peak to trough and another 1,200 from trough to the present. Many workers, fearful of losing their jobs, enrolled in classes to upgrade their skills and increase their value to their employers. Those who had already lost jobs returned to school to increase their marketability or acquired skills for career changes. Arts, entertainment and recreation lost 5,700 jobs during the recession. Uncer- tain about their financial futures, many consumers reduced their discretionary spending. The collapse of the stock market and dramatic fall in corporate profits reduced grants and other funds available to the arts community. Currently, the sector appears to have recovered all the jobs lost in the recession; however unclear whether this is a true recovery or the artifice of measuring job growth during the summer peak season. Administrative support lost 28,200 jobs in the recession. This sector includes office administrative services, temporary help, security services, and janitorial and waste management services. The bulk of the losses occurred in two subsectors employment services and services to buildings. During layoffs, contract workers are the first to be let go. Also, there was less need to clean space vacated during the recession. As the economy improves, employers reluctant to hire full-time permanent workers have taken on contract workers to handle increased business. The office market is experiencing positive absorption, which means there is more occupied space to be cleaned. As a result, 23,000 jobs have been recouped, including all those in building services and two-thirds of those in employment services. Utilities lost the fewest jobs of any sector. Of the 500 lost, 400 have been recovered. This sector has benefited from continued population growth and the generally improving economy. August 2011 ©2011, Greater Houston Partnership Page 4

- 5. HOUSTON THE ECONOMY AT A GLANCE The collapse of oil prices from near $150 a barrel to a low near $35 a barrel contributed to the loss of 2,900 oil and gas extraction jobs. The price collapse led to a drilling collapse, which was exacerbated by the Gulf of Mexico drilling moratorium. Oil field services lost 12,700 jobs. The recovery in oil prices and the frenetic pace of drilling in the oil and gas shale plays have rejuvenated the industry, recouping all the extraction jobs and 7,300 of the service jobs. The recession brought a decline in global trade. In dollar terms, trade through the Houston-Galveston Customs District dropped by one-third, contributing to a loss of 10,100 jobs in wholesale trade. Most of the loss occurred in durable goods, mainly machinery and equipment, as companies cut back capital expenditures. The rebound in global trade and the need to restock depleted inventories has led to wholesale trade recouping 5,200 of the jobs lost in the recession. Retail trade is highly sensitive to job growth, income growth and consumer confidence. All three plummeted during the recession. As a result, local merchants cut 22,200 jobs. Recent local job growth, especially in well-paid industries such as energy, has generated increasing retail sales and subsequently rising retail employment. This sector has recouped 11,300 of the jobs lost in the recession. Professional services lost 14,400 jobs. Engineering was especially hard hit as companies delayed or canceled major projects. Job growth in accounting, engineering and legal services remains weak. Computer systems design has created as many jobs (1,700) as these three sectors combined. As a whole, this sector has recouped 6,600 of the jobs it lost. When consumers and businesses stop buying, manufacturer simple as that. The downturn in drilling activity reduced the need for oil field equipment. The drop-off in construction reduced the need for structural steel. These two industries accounted for more than half the jobs lost in manufacturing, which numbered 29,300 by the end of the recession. Conversely, those two sectors account for 8,200 of the 11,300 jobs recovered so far. The reduction in global trade, the drop in manufacturing activity and the cutback in retail sales contributed to the loss of 9,800 transportation and warehousing jobs. Thus far, 2,000 have been recouped. Given the strong customs district traffic, it s The information sector includes newspapers, periodicals, books, directories, software, motion pictures, sound recording, radio and television broadcasting, wireless telecommunications and data processing services. This sector lost 6,100 jobs. The recession exacerbated a long-term trend: the industry has been losing August 2011 ©2011, Greater Houston Partnership Page 5

- 6. HOUSTON THE ECONOMY AT A GLANCE jobs nation their news and information. Real estate lost 6,100 jobs in the recession. Declining home sales and weak office leasing hit the industry hard. On an annual basis, 28,000 fewer homes are being sold now than at the peak. The office market endured 2½ years of negative absorption. Demand for housing and office space is improving, but remains weak. Only 1,000 of the jobs lost have been recouped so far. Construction suffered the greatest job cuts of all sectors, losing 39,800 from peak to trough one in every four local jobs lost in the recession. The end of subprime financing, severe job cuts in other industries, and plummeting consumer confidence devastated home construction. With the onset of the recession, construction financing disappeared. Little office or industrial space was built. Surplus production capacity and concerns over proposed cap and trade regulations curtailed construction along the ship channel. Finally, federal, state, county and city budget woes reduced the number of contracts being let for infrastructure projects. This sector has recovered 5,500 jobs, less than one-seventh of the jobs lost, and will be among the last to fully recover. The consolidation of the banking industry, the collapse of the mortgage market, and the reluctance to make loans contributed to the finance of 5,200 jobs. This sector has yet to recover any of the jobs lost in the recession. Government often lags the rest of the economy going into a recession and is among the last to come out. That s the case again this time. The public sector started reporting jobs losses only recently. The length of the government sector t be known for some time. Long-Awaited Recovery in Real Estate , retail and residential markets show signs of recovery. Houston absorbed 434,473 square feet of office space in the second quarter, reports Jones Lang LaSalle. Strong activity in several submarkets notably the Central Business District (CBD), Katy Freeway/Energy Corridor, West Loop/Galleria and The Woodlands made it the third consecutive quarter of positive absorption for the region. The vacancy rate for industrial space dropped from 6.5 percent in the first quarter to 6.0 percent in the second quarter, reports CB Richard Ellis. With 1.3 million square feet absorbed in the second quarter and only 1.8 million square feet under construction, supply and demand remain in balance. All submarkets reported August 2011 ©2011, Greater Houston Partnership Page 6

- 7. HOUSTON THE ECONOMY AT A GLANCE positive absorption in the second quarter, with the exception of the CBD, which reported minimal (-5,157 square feet) negative absorption. The retail sector has reported four consecutive quarters of positive absorption, according to CB Richard Ellis. The market recorded the third quarter of , the sector has absorbed 1.2 million square feet of space. The Houston Association of REALTORS® influenced by the First Time Home Buyers Tax Credit; eligible homebuyers had until September 30 to qualify for the incentive. There was no such incentive in place this June. The fact that sales fell only 14 units shy of last June, when sales were propped up by the tax credit, suggests the market may be stabilizing. International Trade Growth The Houston-Galveston Customs District handled trade valued at $106.0 billion through May this year, up 26.3 percent from $83.9 billion during the same period last year. Tonnage through the Houston region ports grew 2.5 percent to 120.8 million short tons through , compared to 117.8 million short tons during the same period last year. If current patterns hold wide margin. Historic and Projected Values, 35 $29.9 Houston's Top Six Trading Partners 30 Actual '10 Forecast '11 $22.1 25 $19.3 $15.9 $ Billions 20 $14.9 $12.5 $11.9 $11.3 $10.7 15 $10.3 $9.1 $8.9 10 5 0 Mexico Venezuela Brazil Nigeria Russia China Source: U.S. Census Bureau and GHP Calculations August 2011 ©2011, Greater Houston Partnership Page 7

- 8. HOUSTON THE ECONOMY AT A GLANCE quarter were mineral fuel and oil ($15.2 billion), industrial machinery ($7.3 billion), organic chemicals ($6.7 billion), plastics ($3.2 billion), and cereals ($2.3 billion). Year-to-date i leading imports so far this year are mineral fuel and oil ($38.3 billion), industrial machinery ($3.7 billion), iron and steel ($2.9 billion), electric machinery ($2.5 billion), and organic chemicals ($1.9 billion). ing partners (combined imports and exports) through the first in ($8.0 billion), Brazil ($6.2 billion), Nigeria ($5.0 billion), Russia ($4.5 billion) and China ($4.3 billion). Based on current trends, trade with Mexico, Venezuela, Brazil, Russia and China should surpass levels, while trade with Nigeria may slip below last total. Air Traffic Growth The Houston Airport System (HAS) handled 4,588,785 passengers in June, a 1.1 percent increase from the 4,538,752 handled in June last year. For the first half of this year, 24,437,799 passengers traveled through As it has for many years, growth in domestic travel continues to lag behind international travel. While international travel rose by 4.2 percent through June, domestic travel increased only 0.6 percent. Freight traffic remains strong within HAS, moving 77.0 million pounds in June volume grew in both domestic and international markets for IAH, while cargo volume decreased for Hobby. Fuel expenses continue to exert pressure on airfares. U.S. Gulf Coast kerosene jet .00 in August 2011 ©2011, Greater Houston Partnership Page 8

- 9. HOUSTON THE ECONOMY AT A GLANCE I make dozens of presentations on the economy each the year. During a recent Q&A session I was asked provided an off-the cuff answer, but the question led me to ponder for Houston, and will we recognize it when we see it gathering data, crunching numbers, and developing fresh insights into the question of normal and the definition of recovery. I am packaging my research into a presentation titled, Getting back to Normal: The Last Leg on the Road to which I will present Tuesday, August 23, in the offices of the GHP. You are invited to attend. My presentation starts at 8 a.m. in the GHP Board Room. There is a $20 fee to attend, which covers the cost of the light breakfast fare that will be served. This is a members-only event. If you are interested in attending, you can sign up at the Events section of the GHP website at http://events.houston.org/Events/Upcoming- Events/. I hope to see you August 23rd. Thanks. Patrick Jankowski VP Research, GHP Patrick Jankowski and Jenny Hsu contributed to this issue of The Economy at a Glance. STAY UP TO DATE! Are you a Partnership Member? If so, log-in to your account here and access archived issues of Glance available only to members. You can also sign-up for RSS feeds to If you are a non-member and would like to receive this electronic publication on the first working day of each month, please e-mail your request for Economy at a Glance to dmorrow@houston.org. Include . For information about joining the Greater Houston Partnership and gaining access to this powerful resource, call Member Services at 713-844-3683. The foregoing table is updated whenever any data change typically, 11 or so times per month. If you would like to receive those updates by e-mail, usually accompanied by commentary, please e-mail your request for Key Economic Indicators to dmorrow@houston.org with the same identifying infor- mation. You may request Glance and Indicators in the same e-mail. August 2011 ©2011, Greater Houston Partnership Page 9

- 10. HOUSTON THE ECONOMY AT A GLANCE HOUSTON MSA NONFARM PAYROLL EMPLOYMENT (000) Change from % Change from June '11 May '11 June '10 May '11 June '10 May '11 June '10 Total Nonfarm Payroll Jobs 2,593.8 2,583.6 2,542.9 10.2 50.9 0.4 2.0 Total Private 2,216.6 2,197.8 2,161.1 18.8 55.5 0.9 2.6 Goods Producing 492.0 485.1 470.3 6.9 21.7 1.4 4.6 Service Providing 2,101.8 2,098.5 2,072.6 3.3 29.2 0.2 1.4 Private Service Providing 1,724.6 1,712.7 1,690.8 11.9 33.8 0.7 2.0 Mining and Logging 89.2 87.7 81.1 1.5 8.1 1.7 10.0 Oil & Gas Extraction 48.3 47.8 46.1 0.5 2.2 1.0 4.8 Support Activities for Mining 38.4 37.9 34.0 0.5 4.4 1.3 12.9 Construction 175.3 173.3 171.7 2.0 3.6 1.2 2.1 Manufacturing 227.5 224.1 217.5 3.4 10.0 1.5 4.6 Durable Goods Manufacturing 148.3 146.1 139.4 2.2 8.9 1.5 6.4 Nondurable Goods Manufacturing 79.2 78.0 78.1 1.2 1.1 1.5 1.4 Wholesale Trade 135.0 134.2 131.6 0.8 3.4 0.6 2.6 Retail Trade 267.4 266.6 262.0 0.8 5.4 0.3 2.1 Transportation, Warehousing and Utilities 123.1 122.0 122.2 1.1 0.9 0.9 0.7 Utilities 16.4 16.3 16.2 0.1 0.2 0.6 1.2 Air Transportation 24.1 24.0 24.0 0.1 0.1 0.4 0.4 Truck Transportation 21.1 20.9 20.1 0.2 1.0 1.0 5.0 Pipeline Transportation 10.4 10.3 10.2 0.1 0.2 1.0 2.0 Balance, incl Warehousing, Water & Rail Transport 51.1 50.5 51.7 0.6 -0.6 1.2 -1.2 Information 30.0 29.9 32.5 0.1 -2.5 0.3 -7.7 Telecommunications 15.3 15.1 16.7 0.2 -1.4 1.3 -8.4 Finance & Insurance 86.4 86.6 86.9 -0.2 -0.5 -0.2 -0.6 Real Estate & Rental and Leasing 48.0 47.5 49.3 0.5 -1.3 1.1 -2.6 Professional & Business Services 377.9 374.7 363.6 3.2 14.3 0.9 3.9 Professional, Scientific & Technical Services 179.1 177.3 176.3 1.8 2.8 1.0 1.6 Legal Services 23.1 22.7 23.4 0.4 -0.3 1.8 -1.3 Accounting, Tax Preparation, Bookkeeping 17.2 17.3 17.0 -0.1 0.2 -0.6 1.2 Architectural, Engineering & Related Services 57.7 57.1 59.0 0.6 -1.3 1.1 -2.2 Computer Systems Design & Related Services 25.7 25.6 24.7 0.1 1.0 0.4 4.0 Admin & Support/Waste Mgt & Remediation 180.0 178.5 167.8 1.5 12.2 0.8 7.3 Administrative & Support Services 169.3 167.7 159.8 1.6 9.5 1.0 5.9 Employment Services 61.2 61.0 57.9 0.2 3.3 0.3 5.7 Educational Services 42.8 43.7 42.4 -0.9 0.4 -2.1 0.9 Health Care & Social Assistance 268.8 269.9 266.5 -1.1 2.3 -0.4 0.9 Arts, Entertainment & Recreation 30.2 28.2 30.7 2.0 -0.5 7.1 -1.6 Accommodation & Food Services 219.2 214.5 210.4 4.7 8.8 2.2 4.2 Other Services 95.8 94.9 92.7 0.9 3.1 0.9 3.3 Government 377.2 385.8 381.8 -8.6 -4.6 -2.2 -1.2 Federal Government 27.5 27.6 35.5 -0.1 -8.0 -0.4 -22.5 State Government 68.4 70.5 69.2 -2.1 -0.8 -3.0 -1.2 State Government Educational Services 35.4 37.4 35.4 -2.0 0.0 -5.3 0.0 Local Government 281.3 287.7 277.1 -6.4 4.2 -2.2 1.5 Local Government Educational Services 193.1 200.2 191.1 -7.1 2.0 -3.5 1.0 SOURCE: Texas Workforce Commission August 2011 ©2011, Greater Houston Partnership Page 10

- 11. HOUSTON THE ECONOMY AT A GLANCE PURCHASING MANAGERS INDEX HOUSTON & U.S. 2002-2012 70 65 60 55 50 45 40 35 30 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 HOUSTON U.S. Source: Institute for Supply Management-Houston HOUSTON MSA EMPLOYMENT 2002-2012 2.65 160 2.60 140 2.55 120 2.50 100 NONFARM PAYROLL EMPLOYMENT (000,000) 2.45 80 12-MONTH CHANGE (000) 2.40 60 2.35 40 2.30 20 2.25 0 2.20 -20 2.15 -40 2.10 -60 2.05 -80 2.00 -100 1.95 -120 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 12-MONTH CHANGE JOBS Source: Texas Workforce Commission August 2011 ©2011, Greater Houston Partnership Page 11

- 12. HOUSTON THE ECONOMY AT A GLANCE GOODS-PRODUCING AND SERVICE-PROVIDING EMPLOYMENT HOUSTON MSA 2002-2012 550 2.25 540 2.20 530 2.15 2.10 520 SERVICE-PROVIDING (000,000) 2.05 GOODS-PRODUCING (000) 510 2.00 500 1.95 490 1.90 480 1.85 470 1.80 460 1.75 450 1.70 440 1.65 430 1.60 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 GOODS-PRODUCING JOBS SERVICE-PROVIDING JOBS Source: Texas Workforce Commission UNEMPLOYMENT RATE HOUSTON & U.S. 2002-2012 11 10 9 8 PERCENT OF LABOR FORCE 7 6 5 4 3 2 1 0 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 HOUSTON U.S. Source: Texas Workforce Commission August 2011 ©2011, Greater Houston Partnership Page 12

- 13. HOUSTON THE ECONOMY AT A GLANCE SPOT MARKET ENERGY PRICES 2002 - 2012 140 28 120 24 HENRY HUB NATURAL GAS ($/MMBTU) WEST TEXAS INTERMEDIATE ($/BBL) 100 20 80 16 60 12 40 8 20 4 0 0 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 WTI MONTHLY WTI 12-MO AVG GAS MONTHLY GAS 12-MO AVG Source: U.S. Energy Information Administration INFLATION: 12-MONTH CHANGE 2002-2012 6% 5% 4% 3% 2% 1% 0% -1% -2% -3% Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 HOUSTON CPI-U U.S. CPI-U Source: U.S. Bureau August 2011 ©2011, Greater Houston Partnership Page 13

- 14. HOUSTON THE ECONOMY AT A GLANCE Houston Economic Indicators YEAR-TO-DATE A Service of the Greater Houston Partnership MONTHLY DATA TOTAL OR AVERAGE* Most Year % Most Year % Month Recent Earlier Change Recent Earlier Change ENERGY U.S. Active Rotary Rigs June '11 1,860 1,531 21.5 1,774 * 1,428 * 24.2 Spot Crude Oil Price ($/bbl, West Texas Intermediate) June '11 95.87 75.24 27.4 98.18 * 77.91 * 26.0 Spot Natural Gas ($/MMBtu, Henry Hub) June '11 4.50 4.82 -6.6 4.22 * 4.66 * -9.4 UTILITIES AND PRODUCTION Houston Purchasing Managers Index June '11 61.4 55.6 10.4 57.3 * 52.4 * 9.4 Nonresidential Electric Current Sales (Mwh, CNP Service Area) May '11 4,315,317 4,150,542 4.0 20,019,110 19,545,221 2.4 CONSTRUCTION Total Building Contracts ($, Houston MSA) May '11 706,972,000 839,872,000 -15.8 3,405,098,000 3,779,557,000 -9.9 Nonresidential May '11 291,740,000 384,289,000 -24.1 1,384,078,000 1,410,365,000 -1.9 Residential May '11 415,232,000 455,583,000 -8.9 2,021,020,000 2,369,192,000 -14.7 Building Permits ($, City of Houston) May '11 311,260,200 338,766,046 -8.1 1,304,907,809 1,333,474,827 -2.1 Nonresidential May '11 239,101,648 236,421,670 1.1 893,268,952 860,831,177 3.8 New Nonresidential May '11 95,781,160 48,901,000 95.9 276,250,249 290,503,011 -4.9 Nonresidential Additions/Alterations/Conversions May '11 143,320,488 187,520,670 -23.6 617,018,703 570,328,166 8.2 Residential May '11 72,158,552 102,344,376 -29.5 411,638,857 472,643,650 -12.9 New Residential May '11 54,382,941 71,845,143 -24.3 330,102,251 356,900,371 -7.5 Residential Additions/Alterations/Conversions May '11 17,775,611 30,499,233 -41.7 81,536,606 115,743,279 -29.6 Multiple Listing Service (MLS) Activity Closings June '11 6,520 6,535 -0.2 30,838 32,364 -4.7 Median Sales Price - SF Detached June '11 161,000 157,500 2.2 151,142 * 150,837 * 0.2 Active Listings June '11 51,342 53,934 -4.8 51,342 * 53,934 * -4.8 EMPLOYMENT (Houston-Sugar Land-Baytown MSA) Nonfarm Payroll Employment June '11 2,593,800 2,542,900 2.0 2,563,500 * 2,513,300 * 2.0 Goods Producing (Natural Resources/Mining/Const/Mfg) June '11 492,000 470,300 4.6 481,000 * 466,200 * 3.2 Service Providing June '11 2,101,800 2,072,600 1.4 2,082,500 * 2,047,100 * 1.7 Unemployment Rate (%) - Not Seasonally Adjusted Houston-Sugar Land-Baytown MSA June '11 9.0 8.7 8.5 * 8.5 * Texas June '11 8.8 8.4 8.2 * 8.3 * U.S. June '11 9.3 9.6 9.2 * 9.9 * Unemployment Insurance Claims (Gulf Coast WDA) Initial Claims June '11 22,523 23,729 -5.1 19,784 * 22,449 * -11.9 Continuing Claims June '11 82,436 108,819 -24.2 79,793 * 109,619 * -27.2 TRANSPORTATION Port of Houston Authority Shipments (Short Tons) June '11 3,411,089 3,448,962 -1.1 21,298,115 19,123,164 11.4 Air Passengers (Houston Airport System) June '11 4,588,785 4,538,752 1.1 24,437,799 24,143,096 1.2 Domestic Passengers June '11 3,808,145 3,764,338 1.2 20,118,718 19,999,674 0.6 International Passengers June '11 780,640 774,414 0.8 4,319,081 4,143,422 4.2 Landings and Takeoffs June '11 74,660 72,892 2.4 431,264 421,988 2.2 Air Freight (000 lb) June '11 76,985 74,935 2.7 460,801 431,072 6.9 Enplaned June '11 40,698 39,036 4.3 233,837 226,446 3.3 Deplaned June '11 36,287 35,899 1.1 226,964 204,626 10.9 CONSUMERS New Car and Truck Sales (Units, Houston MSA) June '11 16,882 20,994 -19.6 125,332 122,009 2.7 Cars June '11 7,265 9,345 -22.3 55,213 55,813 -1.1 Trucks, SUVs and Commercials June '11 9,617 11,649 -17.4 70,119 66,196 5.9 Total Retail Sales ($000,000, Houston MSA, NAICS Basis) 4Q10 27,634 26,953 2.5 94,866 88,070 7.7 Consumer Price Index for All Urban Consumers ('82-'84=100) Houston-Galveston-Brazoria CMSA June '11 201.309 194.734 3.4 197.209 * 192.468 * 2.5 United States June '11 225.722 217.965 3.6 220.968 * 216.735 * 2.0 Hotel Performance (Harris County) Occupancy (%) 4Q10 53.8 51.6 51.5 * 56.2 * Average Room Rate ($) 4Q10 90.51 91.29 -0.9 92.04 * 95.80 * -3.9 Revenue Per Available Room ($) 4Q10 48.67 47.14 3.2 51.46 * 54.05 * -4.8 POSTINGS AND FORECLOSURES Postings (Harris County) July '11 3,138 4,092 -23.3 26,267 26,947 -2.5 Foreclosures (Harris County) July '11 782 1,031 -24.2 5,982 7,839 -23.7 August 2011 ©2011, Greater Houston Partnership Page 14

- 15. HOUSTON THE ECONOMY AT A GLANCE Sources Rig Count Baker Hughes Incorporated Port Shipments Port of Houston Authority Spot WTI, Spot Natural Gas U.S. Energy Information Agency Aviation Aviation Department, City of Houston Purchasing Managers National Association of Houston Index Purchasing Management Car and Truck Sales TexAuto Facts Report, InfoNation, Houston, Inc. Inc., Sugar Land TX Electricity CenterPoint Energy Retail Sales Building Construction Contracts McGraw-Hill Construction Consumer Price Index U.S. Bureau of Labor Statistics City of Houston Building Permits Building Permit Department, City Hotels PKF Consulting/Hospitality Asset of Houston Advisors International MLS Data Houston Association of Realtors Postings, Foreclosures Foreclosure Information & Listing Employment, Unemployment Texas Workforce Commission Service August 2011 ©2011, Greater Houston Partnership Page 15