Market may remain volatile due to expiry of near month f&o contracts

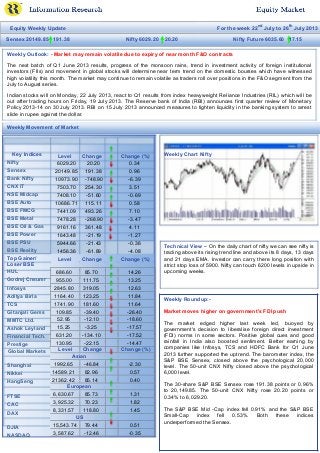

- 1. Equity Weekly Update For the week 22nd July to 26th July 2013 Sensex 20149.85 191.38 Nifty 6029.20 20.20 Nifty Future 6035.60 17.15 Weekly Outlook: - Market may remain volatile due to expiry of near month F&O contracts The next batch of Q1 June 2013 results, progress of the monsoon rains, trend in investment activity of foreign institutional investors (FIIs) and movement in global stocks will determine near term trend on the domestic bourses which have witnessed high volatility this month. The market may continue to remain volatile as traders roll over positions in the F&O segment from the July to August series. Indian stocks will on Monday, 22 July 2013, react to Q1 results from index heavyweight Reliance Industries (RIL) which will be out after trading hours on Friday, 19 July 2013. The Reserve bank of India (RBI) announces first quarter review of Monetary Policy 2013-14 on 30 July 2013. RBI on 15 July 2013 announced measures to tighten liquidity in the banking system to arrest slide in rupee against the dollar. Weekly Movement of Market Key Indices Nifty Sensex Bank Nifty CNX IT NSE Midcap BSE Auto BSE FMCG BSE Metal BSE Oil & Gas BSE Power BSE PSU BSE Reality Top Gainer/ Loser BSE HUL Godrej Cnsumr Infosys Aditya Birla TCS Gitanjali Gems MMTC Ltd. Ashok Leyland Financial Tech. Prestige Global Markets Shanghai Nikkei HangSeng FTSE CAC DAX DJIA NASDAQ Level Change Change (%) 6029.20 20.20 0.34 20149.85 191.38 0.96 10973.90 -748.90 -6.39 7503.70 254.30 3.51 7408.10 -51.60 -0.69 10686.71 115.11 0.58 7441.09 493.26 7.10 7478.28 -268.90 -3.47 9161.16 361.48 4.11 1643.48 -21.19 -1.27 5944.66 -21.43 -0.36 1456.36 -61.89 -4.08 Level Change Change (%) 686.60 85.70 14.26 955.00 111.75 13.25 2845.80 319.05 12.63 1164.40 123.25 11.84 1741.90 181.60 11.64 109.85 -39.40 -26.40 52.95 -12.10 -18.60 15.25 -3.25 -17.57 631.20 -134.10 -17.52 130.95 -22.15 -14.47 Level Change Change (%) Asian 1992.65 -46.84 -2.30 14589.21 82.96 0.57 21362.42 85.14 0.40 European 6,630.67 85.73 1.31 3,925.32 70.23 1.82 8,331.57 118.80 1.45 US 15,543.74 79.44 0.51 3,587.62 -12.46 -0.35 Weekly Chart Nifty Technical View – On the daily chart of nifty we can see nifty is trading above its rising trend line and above its 8 days, 13 days and 21 days EMA. Investor can carry there long position with strict stop loss of 5900. Nifty can touch 6200 levels in upside in upcoming weeks. Weekly Roundup:- Market moves higher on government's FDI push The market edged higher last week led, buoyed by government's decision to liberalise foreign direct investment (FDI) norms in some sectors. Positive global cues and good rainfall in India also boosted sentiment. Better earning by companies like Infosys, TCS and HDFC Bank for Q1 June 2013 further supported the uptrend. The barometer index, the S&P BSE Sensex, closed above the psychological 20,000 level. The 50-unit CNX Nifty closed above the psychological 6,000 level. The 30-share S&P BSE Sensex rose 191.38 points or 0.96% to 20,149.85. The 50-unit CNX Nifty rose 20.20 points or 0.34% to 6,029.20. The S&P BSE Mid -Cap index fell 0.91% and the S&P BSE Small-Cap index fell 0.53%. Both these indices underperformed the Sensex.

- 2. RR, All Rights Reserved Page 1 of 4

- 3. Institutional Activities (Rs Cr) Calls for the Week FIIs Buy Sold Net Stock on the Move: - NMDC Monday 1908.56 2135.81 -227.25 Tuesday 2503.01 2860.41 -357.40 Wednesday 4218.43 4244.52 -26.09 Thursday 3188.45 3366.74 -178.29 Friday 3396.35 3144.09 252.26 DIIs Buy Sold Net Monday 1217.46 763.18 454.28 Tuesday 1371.11 1581.66 -210.55 Technical View: - On the daily chart of NMDC we can see Wednesday 1902.53 1976.39 -73.86 stock has bounced back from its lower levels and currently Thursday 1423.83 1663.24 -239.41 trading above its 8 days, 13 days and 21 days EMA. Investor Friday 1364.71 1593.27 -228.56 can buy NMDC at current levels with stop loss of 103 for target price of 115. Highlights of the Week Red marks in scorecard make DBT a lost poll opportunity Weak rupee, other income shore up RIL net by 19% CBI court summons Anil, Tina Ambani as witnesses in 2G case Parties fear losing trusted election winners Spurred by Amazon model, online supermarkets push ahead Warring suitors woo Mallya in MCF battle Sector multipliers of new bank licences Centre clears RIL's $1.53-billion investment plan Air travel falls 1.8% in June Realty funds draw leading global investors Vodafone service revenue up 13.8% Bajaj posts Rs 738-cr profit on back of exports TVS to launch 5 models by December 2014 HDFC to buy former HUL headquarters Federal Bank net down 44% UCO Bank net rises 41% on trading gains US-based off-road vehicle maker Polaris comes to UP Insecticides India to hike product prices by 5 per cent Ansuman Das new full-time CMD of Nalco HDFC Q1 profit at 17% on higher interest income Jindal SAW fined for construction prior to EC Exchange rate volatility not to hit Hyd metro: L&T Titan Ind, Seiko set to expand strategic partnership British Govt-owned fund to assist Ashok Leyland's UK arm's R&D More FDI reforms on cards Central bank steps to help rupee strengthen Bond auction devolves partially; yields soften Real estate regulator at least 2 yrs away Forex reserves rise to $280.19 bn Weak rupee to stoke inflation, fiscal pressures Derivative Trend 3000 FII'S Activity in F&O Previous Ten Session 450,000 Call 2500 400,000 Put 2000 350,000 1500 300,000 1000 250,000 500 200,000 0 150,000 1 2 3 4 5 6 7 8 9 10 100,000 -500 -1000 50,000 -1500 0 5800 5900 6000 6100 6200 6300

- 4. RR, All rights reserved Page 2 of 4

- 5. For Further Details/Clarifications please contact: RR Information & Investment Research Pvt. Ltd. 47, MM Road Jhandewalan New Delhi-110055 (INDIA) Tel: 011-23636362/63 research@rrfcl.com RR Research Products and Services: Online Equity Calls during Market Hours (9:00 AM to 3:30 PM) Online Commodity Calls during Market Hours (10:00 AM to 11:30 PM) Online Currency Calls during Market Hours (10:00 AM to 5:00 PM) Daily Morning Reports Equity Morning Update Debt Morning Update Commodity Morning Update Currency Morning Update Mid Session Market Daily Market Review Weekly Reports Equity Weekly Report Debt Weekly Report Commodity Weekly Report Currency Weekly Report Fundamental Research Global Market Analysis Economic Analysis Industry Analysis Company Research & Valuations Result Updates News Updates Events Updates IPO / FPO Analysis Mutual Fund Analysis Insurance Analysis Investment Monitor – The complete monthly magazine design for Indian investors Join us on face book: - https://www.facebook.com/RRFinancialConsultants Follow us on Twitter: - https://twitter.com/rrfinance1 Follow us on Google+:- https://plus.google.com/102387639341063312684/about Follow our Blog: - http://rrfinancialconsultants.wordpress.com/ Connect with us on LinkedIn: - http://www.linkedin.com/in/rrfinance RR, All rights reserved Page 3 of 4

- 6. Disclaimer: Kindly read the Risk Disclosure Documents carefully before investing in Equity Shares, Derivatives or other instruments traded on the Stock Exchanges. RR would include RR Financial Consultants Ltd. and its subsidiaries, group companies, employees and affiliates. The information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of RR. The information contained herein is obtained from public sources and sources believed to be reliable, but independent verification has not been made nor is its accuracy or completeness guaranteed. RR or their employees may have or may not have an outstanding buy or sell position or holding or interest in the products mentioned herein. The contents and the information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial and insurance products and instruments. Nothing in this report constitutes investment, legal, accounting and/or tax advice or a representation that any investment or strategy is suitable or appropriate to recipients specific circumstances. The securities and products discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs. Please note that fixed deposits, bonds, debentures are loans/lending instruments and the investor must satisfy himself/herself on the financial health of the company/bank/institution before making any investment. RR and/or its affiliates take no guarantee of soundness of any company or scheme. RR has/will make available all required information to the prospective investor if asked for in respect of any scheme/fixed deposit/bond/loan/debenture. RR is only acting as a broker/distributor and is not representing any company in any manner except to distribute its schemes. Mutual Fund Investments are subject to market risks, read the offer document carefully before investing. Any recipient herein may not take the content in substitution for the exercise of independent judgment. The recipient should independently evaluate the investment risks of any scheme of a mutual fund. RR and its affiliates accept no liability for any loss or damage of any kind arising out of the use of any information contained herein. Past performance is not necessarily a guide to future performance. Actual results may differ materially from those set forth in projections. RR may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. The information herein is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject RR and its affiliates to any registration or licensing requirement within such jurisdiction. The securities and products described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform them of and to observe such restriction(s). The display, description or references to any products, services, publications or links herein shall not constitute an endorsement by RR. Insurance is a subject matter of solicitation. Kindly also note all the risk disclosure documents carefully before investing in Equity Shares, IPO’s, Mutual Fund Schemes, Insurance Schemes, Fixed Deposit schemes, Debt offers, Hybrid Instruments, or other instruments traded on Stock Exchanges or otherwise. Prospective investors can get all details and information from the sites of SEBI, IRDA, AMFI or respective Mutual Fund Companies, Insurance Companies, Rating Agencies, Stock Exchanges and individual corporate websites. Prospective investors are advised to fully satisfy themselves before making any investment decision NSE - INB 231219636, INF 231219636 BSE - INB 011219632, NCDEX Membership No: 00635 | MCX Membership No: 28850 | SEBI Registration No: MCX-SX: INE261219636 SEBI Registration No: NSE Currency: INE231219636 About RR RR is first generation business set up in 1986. Shri. Rajat Prasad, a professional qualified Chartered Accountant, is the main founder. He is the architect of its growth and in the last decade has steered the group to be a diverse and respected financial and Insurance Services Organization with nationwide presence with offices in more than 100 cities and a team of 800 Employees. RR has the presence in all metro cities and towns across the length and breadth of the country. RR is headquartered in New Delhi, Capital of India with regional offices in Mumbai, Ahmedabad, Baroda, Jaipur, Chandigarh, Lucknow, Calcutta, Bangalore, Chennai, Noida and Dehradun. It has Associate offices in other cities and Locations totaling 600 locations & 100 cities. It has agent presence in over 500 cities across the country. RR is the only Company in India which provides research based seamless service to its customers through own offices, franchisees and agents. About RR Research RR Research provides unbiased and independent research in Equity Shares, Commodity Brokers, Currency, Fixed Income, Debt Market, Mutual Funds, Company Fixed Deposits, Fixed Deposits, Equity Brokers, Tax Saving Schemes, Equity Linked Scheme, Online Share Trading and Insurance. The research team consists of more than 10 analysts, most of which are CAs and MBAs from premier business school with experience ranging from 0 to 10 years. The team is equipped with state of the art analysis tools, software. The research team is engaged in almost every activities of the capital market. In the fundament research front, the team is involved in Economic Analysis, Sectoral Analysis, Company Coverage and Updates. In the trading front, dedicated technical team is employed to provide online technical calls, trading tips, derivative strategies to clients. The team is online during the market hours and anyone through our website can chat live with analysts and can solve any investment related query. The team has extensive network of industry contacts and regularly attending analyst meets/ conference calls to get insight of the company. On regular basis, the team shares its view with leading electronic & print media houses. For More information please visit: - http://www.rrfinance.com/ RR, All rights reserved Page 4 of 4

- 7. Disclaimer: Kindly read the Risk Disclosure Documents carefully before investing in Equity Shares, Derivatives or other instruments traded on the Stock Exchanges. RR would include RR Financial Consultants Ltd. and its subsidiaries, group companies, employees and affiliates. The information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of RR. The information contained herein is obtained from public sources and sources believed to be reliable, but independent verification has not been made nor is its accuracy or completeness guaranteed. RR or their employees may have or may not have an outstanding buy or sell position or holding or interest in the products mentioned herein. The contents and the information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial and insurance products and instruments. Nothing in this report constitutes investment, legal, accounting and/or tax advice or a representation that any investment or strategy is suitable or appropriate to recipients specific circumstances. The securities and products discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs. Please note that fixed deposits, bonds, debentures are loans/lending instruments and the investor must satisfy himself/herself on the financial health of the company/bank/institution before making any investment. RR and/or its affiliates take no guarantee of soundness of any company or scheme. RR has/will make available all required information to the prospective investor if asked for in respect of any scheme/fixed deposit/bond/loan/debenture. RR is only acting as a broker/distributor and is not representing any company in any manner except to distribute its schemes. Mutual Fund Investments are subject to market risks, read the offer document carefully before investing. Any recipient herein may not take the content in substitution for the exercise of independent judgment. The recipient should independently evaluate the investment risks of any scheme of a mutual fund. RR and its affiliates accept no liability for any loss or damage of any kind arising out of the use of any information contained herein. Past performance is not necessarily a guide to future performance. Actual results may differ materially from those set forth in projections. RR may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. The information herein is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject RR and its affiliates to any registration or licensing requirement within such jurisdiction. The securities and products described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform them of and to observe such restriction(s). The display, description or references to any products, services, publications or links herein shall not constitute an endorsement by RR. Insurance is a subject matter of solicitation. Kindly also note all the risk disclosure documents carefully before investing in Equity Shares, IPO’s, Mutual Fund Schemes, Insurance Schemes, Fixed Deposit schemes, Debt offers, Hybrid Instruments, or other instruments traded on Stock Exchanges or otherwise. Prospective investors can get all details and information from the sites of SEBI, IRDA, AMFI or respective Mutual Fund Companies, Insurance Companies, Rating Agencies, Stock Exchanges and individual corporate websites. Prospective investors are advised to fully satisfy themselves before making any investment decision NSE - INB 231219636, INF 231219636 BSE - INB 011219632, NCDEX Membership No: 00635 | MCX Membership No: 28850 | SEBI Registration No: MCX-SX: INE261219636 SEBI Registration No: NSE Currency: INE231219636 About RR RR is first generation business set up in 1986. Shri. Rajat Prasad, a professional qualified Chartered Accountant, is the main founder. He is the architect of its growth and in the last decade has steered the group to be a diverse and respected financial and Insurance Services Organization with nationwide presence with offices in more than 100 cities and a team of 800 Employees. RR has the presence in all metro cities and towns across the length and breadth of the country. RR is headquartered in New Delhi, Capital of India with regional offices in Mumbai, Ahmedabad, Baroda, Jaipur, Chandigarh, Lucknow, Calcutta, Bangalore, Chennai, Noida and Dehradun. It has Associate offices in other cities and Locations totaling 600 locations & 100 cities. It has agent presence in over 500 cities across the country. RR is the only Company in India which provides research based seamless service to its customers through own offices, franchisees and agents. About RR Research RR Research provides unbiased and independent research in Equity Shares, Commodity Brokers, Currency, Fixed Income, Debt Market, Mutual Funds, Company Fixed Deposits, Fixed Deposits, Equity Brokers, Tax Saving Schemes, Equity Linked Scheme, Online Share Trading and Insurance. The research team consists of more than 10 analysts, most of which are CAs and MBAs from premier business school with experience ranging from 0 to 10 years. The team is equipped with state of the art analysis tools, software. The research team is engaged in almost every activities of the capital market. In the fundament research front, the team is involved in Economic Analysis, Sectoral Analysis, Company Coverage and Updates. In the trading front, dedicated technical team is employed to provide online technical calls, trading tips, derivative strategies to clients. The team is online during the market hours and anyone through our website can chat live with analysts and can solve any investment related query. The team has extensive network of industry contacts and regularly attending analyst meets/ conference calls to get insight of the company. On regular basis, the team shares its view with leading electronic & print media houses. For More information please visit: - http://www.rrfinance.com/ RR, All rights reserved Page 4 of 4