Weekly newsletter

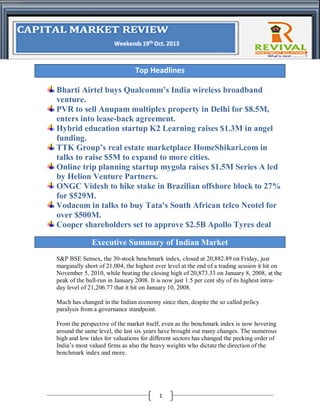

- 1. Top Headlines Bharti Airtel buys Qualcomm’s India wireless broadband venture. PVR to sell Anupam multiplex property in Delhi for $8.5M, enters into lease-back agreement. Hybrid education startup K2 Learning raises $1.3M in angel funding. TTK Group’s real estate marketplace HomeShikari.com in talks to raise $5M to expand to more cities. Online trip planning startup mygola raises $1.5M Series A led by Helion Venture Partners. ONGC Videsh to hike stake in Brazilian offshore block to 27% for $529M. Vodacom in talks to buy Tata's South African telco Neotel for over $500M. Cooper shareholders set to approve $2.5B Apollo Tyres deal Executive Summary of Indian Market S&P BSE Sensex, the 30-stock benchmark index, closed at 20,882.89 on Friday, just marginally short of 21,004, the highest ever level at the end of a trading session it hit on November 5, 2010, while beating the closing high of 20,873.33 on January 8, 2008, at the peak of the bull-run in January 2008. It is now just 1.5 per cent shy of its highest intraday level of 21,206.77 that it hit on January 10, 2008. Much has changed in the Indian economy since then, despite the so called policy paralysis from a governance standpoint. From the perspective of the market itself, even as the benchmark index is now hovering around the same level, the last six years have brought out many changes. The numerous high and low tides for valuations for different sectors has changed the pecking order of India’s most valued firms as also the heavy weights who dictate the direction of the benchmark index and more. 1

- 2. Here’s a quick look at what all has changed as per hard numbers. Sensex price-earnings ratio The froth in stock valuations was visible much before the markets tanked with the weight of sub-prime crises in January 2008. The average monthly price-to-earnings ratio (or P/E ratio) of the 30-stocks in the index hit a high of almost 27 in December 2007. This more than halved to just over 12 a year later, in the blood bath that followed the collapse of Lehman Brothers. As investors realised they have pulled the market to the over-sold region, valuations puffed up again and within two years the P/E ratio galloped back to around 24 in October 2010. Volatility in the market stabilised and the indices settled to a more modest level a year later and as the corporate earnings played catch up, despite the challenges from a governance deficit, the ratio is now at a level which many investors may consider as reasonable. Inside The Story Bharti Airtel buys Qualcomm’s India wireless broadband venture. India’s largest telecom operator Bharti Airtel Ltd has completely acquired the Indian wireless broadband venture of Qualcomm, which has broadband licences for Delhi, Mumbai, Haryana and Kerala, for an undisclosed amount, the company said in a release. This involved acquiring 26 per cent stake held by Qualcomm’s two India partners— Global Holding Corporation Pvt Ltd (the privately held group holding entity of GTL, promoted by Manoj Tirodkar) and Tulip Telecom Ltd, and the rest by subscribing to fresh equity of the BWA business entities. PVR to sell Anupam multiplex property in Delhi for $8.5M, enters into lease-back agreement. The country’s largest multiplex chain operator PVR Ltd has entered into an agreement for the sale of its Anupam multiplex property located in south Delhi for a total consideration of Rs 52 crore ($8.5 million), the company disclosed on Friday. Simultaneously it has also entered into a long-term lease agreement with the buyer of the property to continue to operate the multiplex property. The company said the sale and lease back of the above property would provide significant funds for expansion plans of the company and would release substantial capital to fund the future projects. The 2

- 3. transaction will also enable the company to improve its ROCE and focus on the core operating business of operating and managing multiplex properties across the country on long-term lease basis. Hybrid education startup K2 Learning raises $1.3M in angel funding. K2 Learning Resources (India) Pvt Ltd, a hybrid (online + offline) education startup, has raised Rs 8 crore ($1.3 million) in angel funding from Radheshyam Agarwal, founder and director of Calcutta Tube India, in his personal capacity. This is the first funding for the startup and it will primarily be utilised for content development, acquisitions (to increase reach and bring resources in terms of manpower at lower cost) and setting up ‘Tab Labs’.The startup plans to set up Tab Labs in over 100 colleges in the country, wherein, it would provide the colleges with specialised tablets with pre-loaded data relevant to any commerce student like online classes, chapters in a simplified manner, games and activities (relevant to the subject), etc. TTK Group’s real estate marketplace HomeShikari.com in talks to raise $5M to expand to more cities. HomeShikari.com, a real estate marketplace owned and operated by Bangalore-based business group TTK Services Pvt Ltd, is in talks with a few Indian VC investors to raise up to Rs 30 crore ($5 million) to expand to 7-8 cities in the next couple of years. The firm claims it follows a verified listing model where its team goes and visits the property for sale/rental, takes pictures and videos, measures the property, does an accurate floor plan and uploads all the information on the portal. These listings go with a verified symbol which is an assurance to the searcher that what he is seeing on the website is what he will get, if he physically visits the property. Online trip planning startup mygola raises $1.5M Series A led by Helion Venture Partners. Mygola Inc, the company that owns and operates customised online trip planning portal mygola with a crowd-sourced backbone, has secured $1.5 million in Series A round of funding led by Helion Venture Partners, with participation from existing investor Blumberg Capital, the company announced in a blog post.Mygola, which has an office in Maryland in the US besides Bangalore, will use the capital to expand its presence to Silicon Valley.As part of the deal, Helion’s senior MD Ashish Gupta joined the Board of mygola. We have contacted the company for more details, and will update the story. 3

- 4. ONGC Videsh to hike stake in Brazilian offshore block to 27% for $529M. ONGC Videsh Ltd (OVL), the overseas arm of oil & gas exploration major ONGC, through its affiliates, has signed definitive agreements to acquire additional 12 per cent participating interest (PI) in Block BC-10, Brazil as part of stake sale initiated by local energy giant Petrobras, for $529.03 million, as per a stock market disclosure.OVL had earlier acquired 15 per cent stake in the block in 2006. The other partners in the block include Shell and Petrobras with 50 per cent and 35 per cent stake respectively.Petrobras kicked off its plan to exit the block sometime back and entered into a deal with China’s Sinochem to sell its 35 per cent interest in the block for $1.543 billion in August. This was subject to pre-emption rights by the other partners Shell and OVL. Vodacom in talks to buy Tata's South African telco Neotel for over $500M. Vodacom Group is in talks to buy Tata Communications' stake in South African telecoms operator Neotel for more than 5 billion rand, Bloomberg reported on Friday, citing a person familiar with the matter.Vodacom is the South African unit of Vodafone Group Plc. Tata owns more than 60 percent of Neotel, a provider of fixed-line service and data.The talks are set to become exclusive, Bloomberg said. Cooper shareholders set to approve $2.5B Apollo Tyres deal Cooper Tire and Rubber Co shareholders will likely approve on Monday the U.S. company's $2.5 billion sale to India's Apollo Tyres, in a transaction that is expected to create the world's seventh-largest tyre maker.A green light from Cooper shareholders will bring Apollo one step closer to completing the takeover, although hurdles still remain due to opposition from workers at Cooper's joint venture in China and U share, a premium of more than 40 percent to its price before the acquisitio.S. labour issues which could delay the deal.Shareholders stand to receive $35 per Cooper n announcement. 4