Report on Forex Exposure

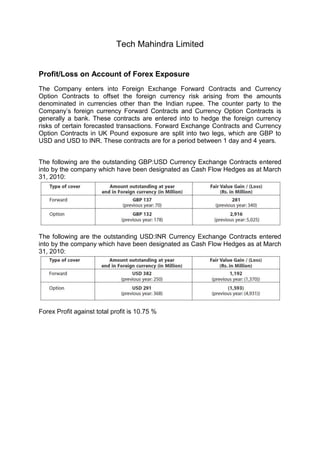

- 1. Tech Mahindra Limited Profit/Loss on Account of Forex Exposure The Company enters into Foreign Exchange Forward Contracts and Currency Option Contracts to offset the foreign currency risk arising from the amounts denominated in currencies other than the Indian rupee. The counter party to the Company’s foreign currency Forward Contracts and Currency Option Contracts is generally a bank. These contracts are entered into to hedge the foreign currency risks of certain forecasted transactions. Forward Exchange Contracts and Currency Option Contracts in UK Pound exposure are split into two legs, which are GBP to USD and USD to INR. These contracts are for a period between 1 day and 4 years. The following are the outstanding GBP:USD Currency Exchange Contracts entered into by the company which have been designated as Cash Flow Hedges as at March 31, 2010: The following are the outstanding USD:INR Currency Exchange Contracts entered into by the company which have been designated as Cash Flow Hedges as at March 31, 2010: Forex Profit against total profit is 10.75 %

- 2. Quarter to Quarter Profit/Loss Hedging Policy of the company Foreign currency transactions: Transactions in foreign currencies are recorded at the exchange rates prevailing on the date of transaction. Monetary items are translated at the year end rates. The exchange difference between the rate prevailing on the date of transaction and on the date of settlement as also on translation of monetary items at the end of the year/period is recognised as income or expense, as the case may be. Any premium or discount arising at the inception of the forward exchange contract is recognized as income or expense over the life of the contract, except in the case where the contract is designated as a cash flow hedge. Derivative instruments and hedge accounting: The Company uses foreign currency forward contracts / options to hedge its risks associated with foreign currency fluctuations relating to certain forecasted transactions. Effective April 1, 2007 the Company designates some of these as cash flow hedges applying the recognition and measurement principles set out in the Accounting Standard 30 “Financial Instruments: Recognition and Measurements”(AS-30). The use of foreign currency forward contracts/options is governed by the Company’s policies approved by the board of directors, which provide written principles on the use of such financial derivatives consistent with the Company’s risk management strategy. The counter party to the Company’s foreign currency forward contracts is generally a bank. The Company does not use derivative financial instruments for speculative purposes. Foreign currency forward contract/option derivative instruments are initially measured at fair value and are re-measured at subsequent reporting dates. Changes in the fair value of these derivatives that are designated and effective as hedges of future cash flows are recognized directly in reserves and the ineffective portion is recognized immediately in Profit and Loss Account. The accumulated gains and

- 3. losses on the derivatives in reserves are transferred to Profit and Loss Account in the same period in which gains or losses on the item hedged are recognized in Profit and Loss Account. Changes in the fair value of derivative financial instruments that do not qualify for hedge accounting are recognized in the Profit and Loss Account as they arise. Hedge accounting is discontinued when the hedging instrument expires or is sold, terminated or exercised or no longer qualifies for hedge accounting. When hedge accounting is discontinued for a cash flow hedge, the net gain or loss will remain in reserves and be reclassified to Profit and Loss Account in the same period or periods during which the formerly hedged transaction is reported in Profit and Loss Account. If a hedged transaction is no longer expected to occur, the net cumulative gain or loss recognized in reserves is transferred to Profit and Loss Account. Split of Revenue During the year, 58.6% of your Company’s revenue came from Europe, 29.4% came from USA and 12.0% came from Rest of the World (ROW) in which 4.6 % came from India. As the country operates majorly in UK and rest of Europe, the 2 currencies which dominates are GBP and EURO. Exchange rate risks Forecast The exchange rate between the Indian rupee and the British pound and the rupee and the U.S. dollar has changed substantially in last year and may continue to fluctuate significantly in the future. The value of the rupee as on March 31, 2010 against the British pound appreciated by approx 4% and against U.S. dollar by approx 11% over March 31, 2009. Accordingly, our operating results have been and will continue to be impacted by fluctuations in the exchange rate between the Indian rupee and the British pound and the Indian rupee and the U.S. dollar, as well as exchange rates with other foreign currencies. Any strengthening of the Indian rupee against the British pound, the U.S. dollar or other foreign currencies could adversely affect our profitability.

- 4. Oracle Profit/Loss on Account of Forex Exposure The following table includes the U.S. Dollar equivalent of cash, cash equivalents and marketable securities denominated in certain major foreign currencies as of May 31, 2010: If overall foreign currency exchange rates in comparison to the U.S. Dollar weakened by 10%, the amount of cash, cash equivalents and marketable securities we would report in U.S. Dollars would increase by approximately $695 million, assuming constant foreign currency cash, cash equivalent and marketable securities balances. Quarter to Quarter Profit/Loss Hedging Policy of the company We transact business in various foreign currencies and are subject to risks associated with the effects of certain foreign currency exposures. We have a

- 5. program that primarily utilizes foreign currency forward contracts to offset these risks associated with foreign currency exposures. Our program may be suspended from time to time. This program was active for the majority of fiscal 2010 and was suspended during our fourth quarter of fiscal 2010. When this program is active, we enter into foreign currency forward contracts so that increases or decreases in our foreign currency exposures are offset by gains or losses on the foreign currency forward contracts in order to mitigate the risks and volatility associated with our foreign currency transactions. Our foreign currency exposures typically arise from intercompany sublicense fees and other intercompany transactions that are expected to be cash settled in the near term. Although we have suspended our historical foreign currency forward contract program as of May 31, 2010, our subsidiaries continue to enter into cross-currency transactions and create cross-currency exposures via intercompany arrangements and we expect that these transactions and exposures will continue. Our ultimate realized gain or loss with respect to currency fluctuations will generally depend on the size and type of cross-currency transactions that we enter into, the currency exchange rates associated with these exposures and changes in those rates, whether we have entered into foreign currency forward contracts to offset these exposures and other factors. Historically, we have neither used these foreign currency forward contracts for trading purposes nor have designated these forward contracts as hedging instruments pursuant to ASC 815. Accordingly, we recorded the fair value of these contracts as of the end of our reporting period to our consolidated balance sheet with changes in fair value recorded in our consolidated statement of operations. The balance sheet classification for the fair values of these forward contracts was prepaid expenses and other current assets for unrealized gains and other current liabilities for unrealized losses. The statement of operations classification for the fair values of these forward contracts was non-operating income (expense), net, for both realized and unrealized gains and losses. As of May 31, 2010, we had a nominal amount of foreign currency forward contracts outstanding. As of May 31, 2009, the notional amounts of the forward contracts we held to purchase and sell U.S. Dollars in exchange for other major international currencies were $860 million and $1.1 billion, respectively, and the notional amounts of the foreign currency forward contracts we held to purchase European Euros in exchange for other major international currencies were €142 million ($198 million).

- 6. Split of Revenue Disclosed in the table below is geographic information for each country that comprised greater than three percent of our total revenues for fiscal 2010, 2009 or 2008. Exchange rate risks Forecast Foreign Currency Transaction Risk We transact business in various foreign currencies and are subject to risks associated with the effects of certain foreign currency exposures. We have a program that primarily utilizes foreign currency forward contracts to offset these risks. Our program may be suspended from time to time. This program was active for the majority of fiscal 2010 and was suspended during our fourth quarter of fiscal 2010. When the program is active, we enter into foreign currency forward contracts so that increases or decreases in our foreign currency exposures are offset by gains or losses on the foreign currency forward contracts in order to mitigate the risks and volatility associated with our foreign currency transactions. Our foreign currency exposures typically arise from intercompany sublicense fees and other intercompany transactions that are expected to be cash settled in the near term. Although we have suspended our historical foreign currency forward contract program as of May 31, 2010, our subsidiaries continue to enter into cross-currency transactions and create cross-currency exposures via intercompany arrangements and we expect that these transactions and exposures will continue. Our ultimate realized gain or loss with respect to currency fluctuations will generally depend on the size and type of cross currency transactions that we enter into, the currency exchange rates associated with these exposures and changes in those rates, whether we have entered into foreign currency forward contracts to offset these exposures and other factors. Historically, we have not used foreign currency forward contracts for trading purposes and have not designated these forward contracts as hedging instruments pursuant to ASC 815. Accordingly, we have recorded the fair value of these historical contracts as of the end of our reporting period to our consolidated balance sheet with changes in fair value recorded to non-operating income (expense), net in our consolidated statement of operations. As of May 31, 2010, we estimate that certain of our U.S. Dollar and Euro functional subsidiaries have the equivalent of

- 7. approximately $2.0 billion and approximately €410 million (approximately $500 million) of net intercompany receivables whereby the amounts to be received by these subsidiaries are in currencies other than U.S. Dollars or Euros, respectively, and are therefore subject to remeasurement as of each balance sheet date. As of May 31, 2010, we have no financial instruments in place to mitigate the risks associated with these foreign currency exposures. If overall foreign currency exchange rates weaken (strengthen) against both the U.S. Dollar and Euro by 10%, we estimate that we would incur approximately $250 million of remeasurement losses (gains) in connection with these intercompany balances assuming the balances remained constant with those as of May 31, 2010. Net foreign exchange transaction (losses) gains included in non-operating income (expense), net in the accompanying consolidated statements of operations were $(149) million, $(65) million and $17 million in fiscal 2010, 2009 and 2008, respectively. Included in the net foreign exchange transaction losses for fiscal 2010 were foreign currency losses relating to our Venezuelan subsidiary’s operations, which are more thoroughly described under “Non-Operating Income (Expense), net” in Management’s Discussion and Analysis of Financial Condition and Results of Operations above. As a large portion of our consolidated operations are international, we could experience additional foreign currency volatility in the future, the amounts and timing of which may vary. Foreign Currency Translation Risk Fluctuations in foreign currencies impact the amount of total assets and liabilities that we report for our foreign subsidiaries upon the translation of these amounts into U.S. Dollars. In particular, the amount of cash, cash equivalents and marketable securities that we report in U.S. Dollars for a significant portion of the cash held by these subsidiaries is subject to translation variance caused by changes in foreign currency exchange rates as of the end of each respective reporting period (the offset to which is recorded to accumulated other comprehensive income on our consolidated balance sheet). Periodically, we hedge net assets of certain international subsidiaries from foreign currency exposure and provide a discussion in “Foreign Currency Net Investment Risk” below. As the U.S. Dollar fluctuated against certain international currencies as of the end of fiscal 2010, the amount of cash, cash equivalents and marketable securities that we reported in U.S. Dollars for these subsidiaries as of May 31, 2010 declined relative to what we would have reported using a constant currency rate as of May 31, 2009. As reported in our consolidated statements of cash flows, the estimated effect of exchange rate changes on our reported cash and cash equivalents balances in U.S. Dollars for fiscal 2010, 2009 and 2008 was a (decrease) increase of $(107) million, $(501) million, and $437 million, respectively. Foreign Currency Net Investment Risk Periodically, we hedge net assets of certain of our international subsidiaries using foreign currency forward contracts to offset the translation and economic exposures related to our foreign currency-based investments in these subsidiaries. These contracts have been designated as net investment hedges pursuant to ASC 815. We entered into these net investment hedges for all of fiscal 2009 and the majority of

- 8. fiscal 2010. We suspended this program during our fourth quarter of fiscal 2010 and, as of May 31, 2010, we have no contracts outstanding. We used the spot method to measure the effectiveness of our net investment hedges. Under this method for each reporting period, the change in fair value of the forward contracts attributable to the changes in spot exchange rates (the effective portion) was reported in accumulated other comprehensive income on our consolidated balance sheet and the remaining change in fair value of the forward contract (the ineffective portion, if any) was recognized in non-operating income (expense), net, in our consolidated statement of operations. We recorded settlements under these forward contracts in a similar manner. The fair values of both the effective and ineffective portions were recorded to our consolidated balance sheet as prepaid expenses and other current assets for amounts receivable from the counterparties or other current liabilities for amounts payable to the counterparties. Net gains (losses) on our net investment hedges reported in stockholders’ equity, net of tax effects, were $(131) million, $(41) million and $(53) million in fiscal 2010, 2009 and 2008, respectively. Net gains on our net investment hedges reported in non- operating income (expense), net were $1 million, $10 million and $23 million in fiscal 2010, 2009 and 2008, respectively. Discussion on Hedging Policy The move from a fixed exchange rate system to a market determined one as well as the development of derivatives markets in India have followed with the liberalization of the economy since 1992. In this context, the market for hedging instruments is still in its developing stages. In order to understand the alternative hedging strategies that Indian firms can adopt, it is important to understand the regulatory framework for the use of derivatives here. The recent period has witnessed amplified volatility in the INR-US exchange rates in the backdrop of the sub-prime crisis in the US and increased dollar-inflows into the Indian stock markets. In this context, the paper has attempted to study the choice of instruments adopted by prominent firms to stem their foreign exchange exposures. All the data for this has been compiled from the 2006-2007 Annual Reports of the respective companies. A summary of the foreign exchange risk hedging behaviour of select Indian firms is given in Table 1.

- 9. From Table 1, it can be seen that earnings of all the firms are linked to either US dollar, Euro or Pound as firms transact primarily in these foreign currencies globally. Forward contracts are commonly used and among these firms, Ranbaxy and RIL depend heavily on these contracts for their hedging requirements. As discussed earlier, forwards contracts can be tailored to the exact needs of the firm and this could be the reason for their popularity. The tailorability is a consideration as it enables the firms to match their exposures in an exact manner compared to exchange traded derivatives like futures that are standardised where exact matching is difficult. RIL, Maruti Udyog and Mahindra and Mahindra are the only firms using currency swaps. Swap usage is a long term strategy for hedging and suggests that the planning horizons for these companies are longer than those of other firms. These businesses, by nature involve longer gestation periods and higher initial capital outlays and this could explain their long planning horizons.

- 10. Another observation is that TCS prefers to hedge its exposure to the US Dollar through options rather than forwards. This strategy has been observed among many firms recently in India11. This has been adopted due to the marked high volatility of the US Dollar against the Rupee. Options are more profitable instruments in volatile conditions as they offer unlimited upside profitability while hedging the downside risk whereas there is a risk with forwards if the expectation of the exchange rate (the guess) is wrong as firms lose out on some profit. The use of Range barrier options by Infosys also suggests a strategy to tackle the high volatility of the dollar exchange rates. Software firms have a limited domestic market and rely on exports for the major part of their revenues and hence require additional flexibility in hedging when the volatility is high. Another implication of this is that their planning horizons are shorter compared to capital intensive firms. It is evident that most Indian firms use forwards and options to hedge their foreign currency exposure. This implies that these firms chose short-term measures to hedge as opposed to foreign debt. This preference is possibly a consequence of their costs being in Rupees, the absence of a Rupee futures exchange in India and curbs on foreign debt. It also follows that most of these firms behave like Net Exporters and are adversely affected by appreciation of the local currency. There are a few firms which have import liabilities which would be adversely affected by Rupee depreciation. However it must be pointed out that the data set considered for this study does not indicate how the use of foreign debt by these firms hedges their exposures to foreign exchange risk and whether such a strategy is used as a substitute or complement to hedging with derivatives. Conclusion Derivative use for hedging is only to increase due to the increased global linkages and volatile exchange rates. Firms need to look at instituting a sound risk management system and also need to formulate their hedging strategy that suits their specific firm characteristics and exposures. In India, regulation has been steadily eased and turnover and liquidity in the foreign currency derivative markets has increased, although the use is mainly in shorter maturity contracts of one year or less. Forward and option contracts are the more popular instruments. Regulators had initially only allowed certain banks to deal in this market however now corporates can also write option contracts. There are many variants of these derivatives which investment banks across the world specialize in, and as the awareness and demand for these variants increases, RBI would have to revise regulations. For now, Indian companies are actively hedging their foreign exchanges risks with forwards, currency and interest rate swaps and different types of options such as call, put, cross currency and range-barrier options. The high use of forward contracts by Indian firms also highlights the absence of a rupee futures exchange in India. However, the Dubai Gold and Commodities Exchange in June, 2007 introduced Rupee- Dollar futures that could be traded on its exchanges and had provided another route for firms to hedge on a transparent basis. There are fears that RBI’s

- 11. ability to control the partially convertible currency will be subdued by this introduction but this issue is beyond the scope of this study. The partial convertibility of the Rupee will be difficult to control if many exchanges offer such instruments and that will be factor to consider for the RBI.