2011 10-31 migbank-daily technical-analysis-report

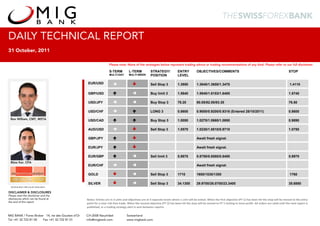

- 1. DAILY TECHNICAL REPORT 31 October, 2011 Please note: None of the strategies below represent trading advice or trading recommendations of any kind. Please refer to our full disclaimer. M S-TERM MULTI-DAY L-TERM MULTI-WEEK STRATEGY/ POSITION ENTRY LEVEL OBJECTIVES/COMMENTS STOP EUR/USD Sell Stop 3 1.3950 1.3840/1.3650/1.3470 1.4110 GBP/USD Buy limit 3 1.5840 1.5940/1.6153/1.6400 1.5740 USD/JPY Buy Stop 3 78.20 80.05/82.00/83.30 76.50 USD/CHF LONG 3 0.8600 0.9000/0.9200/0.9316 (Entered 28/10/2011) 0.8600 Ron William, CMT, MSTA USD/CAD Buy Stop 3 1.0050 1.0270/1.0660/1.0850 0.9890 AUD/USD Sell Stop 3 1.0570 1.0230/1.0010/0.9710 1.0750 GBP/JPY Await fresh signal. EUR/JPY Await fresh signal. EUR/GBP Sell limit 3 0.8870 0.8750/0.8580/0.8400 0.8970 Bijoy Kar, CFA EUR/CHF Await fresh signal. GOLD Sell Stop 3 1710 1600/1530/1300 1760 SILVER Sell Stop 3 34.1300 29.9700/26.0700/23.3400 35.6880 WINNER BEST SPECIALIST RESEARCH DISCLAIMER & DISCLOSURES Please read the disclaimer and the disclosures which can be found at Notes: Entries are in 3 units and objectives are at 3 separate levels where 1 unit will be exited. When the first objective (PT 1) has been hit the stop will be moved to the entry the end of this report point for a near risk‐free trade. When the second objective (PT 2) has been hit the stop will be moved to PT 1 locking in more profit. All orders are valid until the next report is published, or a trading strategy alert is sent between reports. MIG BANK / Forex Broker 14, rte des Gouttes d’Or CH-2008 Neuchâtel Switzerland Tel +41 32 722 81 00 Fax +41 32 722 81 01 info@migbank.com www.migbank.com

- 2. EUR/USD DAILY TECHNICAL REPORT EUR/USD 31 October, 2011 EUR/USD (Daily) BERMUDA FAILED TRIANGLE BREAKOUTS Sharp reversal from key resistance. EUR/USD has reversed sharply from key overhead resistance (including an important 2 year trend-line) and pushed back into the 200-day MA BREAKOUT ZONE (1.4102). (1.4000) A close beneath the 200-day MA will warn of an emotionally charged bull- trap and ultimately a further downside momentum through 1.3799 (26th 200-DMA (1.4102) SHARP REVERSAL Oct low) and 1.3653 (18th Oct low), with scope into 1.3146 (Oct swing low). FROM KEY RESISTANCE Further pressure may weigh from broad risk-related proxies such as the developed equity markets. The euro currently shares a high correlation of UPTREND (2 YEARS) 0.85% with the S&P500 which is now unwinding from new multi-week highs. EUR/USD daily chart, Bloomberg Finance LP USD INDEX Inversely, the USD Index has turned higher ahead support at 74.10 and USD INDEX EUR 57.6%, JPY 13.6%, GBP 11.9% CAD 9.1%, SEK 4.2%, CHF 3.6% (4 YEARS) 200-DMA 73.40. The bulls are likely to recapture the recent 6 month highs near 80. (75.74) Speculative (net long) liquidity flows are holding steady around their recent spike highs (3 standard deviations from the yearly average). This will likely +10% remain strong and help resume the USD’s major bull-run from its historic +27% +19% SO FAR oversold extremes (momentum, sentiment and liquidity). BREAKOUT ZONE DEMARK™ BUY SIGNAL Special Report: EUR/USD ˝A Fall From Grace˝ ? Decline Targets 1.3770/1.3410. VIDEO 3 STD ABOVE MIG Bank Webinar: “Why the US dollar is likely to gain up to 30% in 6‐12 months.” ONE YEAR AVERAGE MIG Bank US Dollar Interview on Bloomberg TRIGGER (15000) KEY SUPPORT + DEMARK™ 13 9 (73.50-73.00) EXTREME NET COT LIQUIDITY US $ SHORT BUY SIGNALS - POSITIONS S-T TREND L-T TREND STRATEGY USD Index daily, weekly chart and COT Liquidity, Bloomberg Finance LP Sell Stop 3: 1.3950, Obj: 1.3840/1.3650/1.3470, Stop: 1.4110 www.migbank.com Ron William, Technical Strategist, E-mail: r.william@migbank.com, Phone: +41 32 7228 454 2

- 3. DAILY TECHNICAL REPORT GBP/USD 31 October, 2011 Meets initial resistance close to the 200 day moving average. GBP/USD has seen a return to test the 200 day moving average ahead of the latest set back. However, structure from 1.5272 is suggestive of a potential higher low versus 1.5632, for a return to 1.6153 and then higher still. We remain wary of the general range bound nature of this market in the medium-term time frame. While above 1.5632 a further leg higher is favoured. However, if this region fails to contain the current corrective phase, then the bias will turn negative again. GBP/USD has already experienced a large devaluation versus the US GBP/USD daily chart, Bloomberg Finance LP Dollar, therefore any strengthening in the US Dollar may not see the full participation of GBP/USD. Instead GBP/USD is favoured to remain stronger than most. GBP/USD hourly chart, Bloomberg Finance LP S-T TREND L-T TREND STRATEGY Buy limit 3 at 1.5840, Objs: 1.5940/1.6153/1.6400, Stop: 1.5740. www.migbank.com Bijoy Kar, Technical Strategist, E-mail: b.kar@migbank.com, Phone: +41 32 7228 424 3

- 4. DAILY TECHNICAL REPORT USD/JPY 31 October, 2011 USD/JPY (Daily POST INTERVENTION 1 YEAR) RETRACEMENT (PIR I) USD/JPY intervention favours test of 80.00. USD/JPY’s latest intervention by the BOJ favours a test of that all- important psychological level at 80.00. This marks the BOJ’s third time to QUAKE SHOCK! officially intervene on the rate this year, after it carved out yet another new 83.30 POST post WWII record low at 75.35. G7 MOVE (I) HIGH Multiple DeMark buy signals were also triggered within the multi-week base pattern which has now broken higher (as had been expected by our 82.00 low volatility measures). POST BOJ The medium/long-term view is more bullish, favouring a sustained move MOVE (II) HIGH above our initial upside trigger level at 80.00, near 80.24 (post BOJ 80.24 intervention II high). POST Keep in mind that such a scenario would help reactivate the longer-term BOJ MOVE (III) technical bias, including prior monthly DeMark™ exhaustion signals, within HIGH USD/JPY Weekly ENDING PIR II (2007 – 2011) DIAGONAL the ending diagonal pattern, which was part of a major Elliott Wave cycle. PATTERN Only a sustained weekly close below 76.25 will lead to a reassessment of BREAKOUT TARGET the view and extend temporary weakness into 74.55. (85-79) Please select the link below to sign up for our MIG Bank webinar on USD/JPY. This will feature an update to our previous Special Report USD/JPY’s Long‐Term Structural Change (Wednesday, November 02nd – 15:00‐15:45 GMT). ‐ What do long‐term cycles tell us about the future of USD‐JPY? ‐ How do event shocks and Central Bank Interventions impact the market? ‐ Safe‐Haven Flows: A wave of change. MONTHLY DEMARK DEMARK™ BUY SIGNAL AFTER ‐ High‐Probability Trading Strategies. BUY SIGNAL NEW POST WWII LOW (75.35) S-T TREND L-T TREND STRATEGY USD/JPY daily, weekly chart, Bloomberg Finance LP Buy Stop at 78.20, Obj: 80.05/82.00/83.30, Stop: 76.50 www.migbank.com Ron William, Technical Strategist, E-mail: r.william@migbank.com, Phone: +41 32 7228 426 4

- 5. DAILY TECHNICAL REPORT USD/CHF 31 October, 2011 Further recovery anticipated while above 0.8600. Stop raised to entry. USD/CHF continues to trade close to the 200 day moving average. Given the structure of the fall from the recent high at 0.9316, a larger recovery is now anticipated towards 0.9000 initially. However, failure to hold above the entry level of the strategy below, at 0.8600, will warn of a larger fall to the 0.8000 region. In any case a further recovery leg higher is anticipated eventually. Movement in USD/CHF is likely to be affected by the SNB attempting to maintain EUR/CHF around 1.2200. However, back under 0.7712 is required to change the long-term bullish bias. USD/CHF daily chart, Bloomberg Finance LP A push back over 0.9083 is required to open up a return towards the recent high at 0.9316. USD/CHF hourly chart, Bloomberg Finance LP S-T TREND L-T TREND STRATEGY Long 3 at 0.8600, Objs: 0.9000/0.9200/0.9316, Stop: 0.8600 www.migbank.com Bijoy Kar, Technical Strategist, E-mail: b.kar@migbank.com, Phone: +41 32 7228 424 5

- 6. DAILY TECHNICAL REPORT USD/CAD 31 October, 2011 USD/CAD (Daily) USD/CAD (Weekly) Bears push back under the psychological 1.0000 level. August High (1.0673) USD/CAD’s short-term price activity remains negative, as the bears push back under the all-important psychological 1.0000 level (prior trading range). 200-DMA CONFIRMATION Only a sustained close beneath here will extend bearish setbacks into the (0.9813) ABOVE 1.0680 OPENS LARGER long-term 200-day MA at 0.9813 and 0.9726 (31st Aug low). Only a close RECOVERY beneath here will change the long-term positive view and encourage a sell trade setup in our model portfolio. Meanwhile, positive momentum needs to push above 1.0264 and 1.0400 DEMARK™ to rebuild the potential major upside reversal higher above the old BUY SIGNAL resistance level at 1.0673 (August high & Congestion zone). USD/CAD daily, weekly chart, Bloomberg Finance LP A strong directional confirmation above here will open a much larger MAJOR RESISTANCE CHF/CAD (Daily) REVERSAL recovery into 1.0850 plus. This would extend the upside breakout from the PATTERN rate’s ending triangle pattern, which was part of a major Elliott Wave cycle. EUR/CAD is extending above its 200-day MA, within a large multi-month trading range. Key resistance continues to hold at 1.4379 (June swing high), which has for some time marked a strong distribution pattern. 50% (1.3570) CHF/CAD is retesting its support nearby the 200-day MA at 1.1265, 61.8% (1.3379) 200-DMA 50% following the dramatic price slide lower (triggered by the SNB (1.1488) (1.3833) intervention). The cross-rate has now retraced more than half of its 2011 61.8% (1.0893) gains. 200-DMA (1.1275) EUR/CAD (Daily) S-T TREND L-T TREND STRATEGY EUR/CAD and CHF/CAD daily chart, Bloomberg Finance LP Buy Stop 3: 1.0050, Objs:1.0270/1.0660/1.0850, Stop: 0.9890 www.migbank.com Ron William, Technical Strategist, E-mail: r.william@migbank.com, Phone: +41 32 7228 454 6

- 7. DAILY TECHNICAL REPORT AUD/USD 31 October, 2011 AUD/USD AUD/USD (1 YEAR) DEMARK™ SELL SIGNALS (Weekly) Resistance at 1.0765 caps explosive recovery. AUD/USD’s explosive rally is currently unwinding from overbought STRUCTURAL conditions, ahead key resistance at 1.0765 (01st Sept high). LEVEL 38.2% This level is likely to cap gains back into the 200-day MA (1.0405) and (0.9144) 3 YEAR 50% UPTREND potentially resume downside pressure on the rate’s multi-year uptrend. (0.8546) IS UNDER PRESSURE 200-DMA The bears need to confirm beneath 1.0322 (26th Oct low) and 1.0188 (18th (1.0405) 61.8% (0.7947) KEY Oct low). A break here will unlock sharp setbacks into 1.0000. ZONE Elsewhere, the Aussie dollar remains stable against the New Zealand dollar. The pair is still locked within its new bear cycle structure while it holds beneath its 200-day MA. Key support can be found at 1.2320 and 1.2100. AUD/USD daily, weekly chart, Bloomberg Finance LP AUD/NZD AUD/JPY DEMARK™ The Aussie dollar is also gaining further against the Japanese yen, after 13 (Daily) (Daily) SELL SIGNAL spiking above the long-term 200-day MA which is currently at 83.12. Near- term support continues to hold at 77.63 (18th Oct low). A break here will 200-DMA CAPS resume downside scope into 76.70. BEAR MKT 38.2% (76.70) 200- DMA 50% (83.12) (72.58) 61.8% (68.47) KEY SUPPORT 1.2319 / 1.2100 S-T TREND L-T TREND STRATEGY Sell Stop 3: 1.0550, Obj: 1.0230/1.0010/0.9710, Stop: 1.0750 AUD/NZD and AUD/JPY daily chart, Bloomberg Finance LP www.migbank.com Ron William, Technical Strategist, E-mail: r.william@migbank.com, Phone: +41 32 7228 454 7

- 8. DAILY TECHNICAL REPORT GBP/JPY 31 October, 2011 Clear break over 123.31 suggests scope for a larger recovery. Short exited. GBP/JPY has been affected by the intervention last night of the BOJ in USD/JPY. This has led to a breach above the key 123.31 level, which now warns of a much larger corrective phase higher. In fact a return towards 129.00/130.00 is now possible given the daily structure present since 116.84. A push back under 121.39 is required to negate this positive structure. Assuming that further short-term strength can be realised, a lower high would be anticipated close to 129.00. Thus the region between 129.00 and 130.00 would be attractive for renewed short positioning. GBP/JPY daily chart, Bloomberg Finance LP GBP/JPY hourly chart, Bloomberg Finance LP S-T TREND L-T TREND STRATEGY Await fresh signal. Possibly looking to sell higher. www.migbank.com Bijoy Kar, Technical Strategist, E-mail: b.kar@migbank.com, Phone: +41 32 7228 424 8

- 9. DAILY TECHNICAL REPORT EUR/JPY 31 October, 2011 Breaks out of a falling channel. Short exited. EUR/JPY has seen a significant break higher out of a falling channel, leaving a false break lower at 100.76, in the daily timeframe. Potential now exists for a higher low to form versus 100.76 for a further recovery leg higher. This is further bolstered by the failure to remain below 108.03, which opens up a return towards the 200 day moving average, currently at 112.67. Should the region near 112.67 be met a lower high would be favoured to form in that region. In the meantime, scope is seen for a higher low versus EUR/JPY daily chart, Bloomberg Finance LP 104.75. Failure to maintain a foot hold over this level will negate expectations of a return towards the 200 day moving average. S-T TREND L-T TREND STRATEGY EUR/JPY hourly chart, Bloomberg Finance LP Await fresh signal. www.migbank.com Bijoy Kar, Technical Strategist, E-mail: b.kar@migbank.com, Phone: +41 32 7228 424 9

- 10. DAILY TECHNICAL REPORT EUR/GBP 31 October, 2011 Returns to test the 200 day moving average. EUR/GBP has returned to test the 200-day moving average, which is currently at 0.8739. As mentioned in prior reports the rise seen since 0.8530/0.8531 is viewed as corrective, with a push back under 0.8670 required to negate the possibility of a further squeeze higher to test the 0.8886/85 region. Should this move be realised, it would also take us close to the upper end of the recent trading range. There is an increased probability of general range bound trade, thus short entry at higher levels is also supported by the potential of a return to a period similar to that between 2003 and 2007 (not shown). EUR/GBP daily chart, Bloomberg Finance LP A move back over 0.8960 is required to neutralise our mild bearish bias, in a generally rangebound environment. S-T TREND L-T TREND STRATEGY EUR/GBP hourly chart, Bloomberg Finance LP Sell limit 3 at 0.8870, Objs: 0.8750/0.8580/0.8400, Stop: 0.8970 www.migbank.com Bijoy Kar, Technical Strategist, E-mail: b.kar@migbank.com, Phone: +41 32 7228 424 10

- 11. DAILY TECHNICAL REPORT EUR/CHF 31 October, 2011 Breaks under the support of an hourly channel. EUR/CHF failed to garner momentum after meeting supply close to the resistance of an hourly rising channel and has subsequently fallen under the support of this same structure. This now warns of a return to the key high near 1.1973, close to the 1.2000 floor in EUR/CHF. Should a re-test of the 1.2000 region take place with a fall under 1.1973 also taking place, this would warn of the end of the recovery seen since 1.0075, increasing the probability of a return to this level. This also brings back into focus the 1.2500 – 1.3000 zone where resistance was always anticipated. A sustained move under 1.2024 will alter our near-term bullish bias. EUR/CHF daily chart, Bloomberg Finance LP S-T TREND L-T TREND EUR/CHF hourly chart, Bloomberg Finance LP Await fresh trading signal. www.migbank.com Bijoy Kar, Technical Strategist, E-mail: b.kar@migbank.com, Phone: +41 32 7228 424 11

- 12. DAILY TECHNICAL REPORT GOLD 31 October, 2011 GOLD KEY TRIGGER LEVELS DOWNSIDE: $1600 / $1530 UPSIDE: $1760 / $1844 RISK ZONE III DOUBLE Risk of a larger decline beneath $1530. DEMARK™ SIGNAL TOP 20% WARNED OF GOLD’S OVERBOUGHT SO FAR Gold remains bearish after its dramatic 20% price fall, which helped CONDITIONS confirm the extreme overbought conditions (marked by DeMark™ $1760 indicators). This also timed a key cycle peak, ahead of that all-important $1704 $2000 glass-ceiling. Most concerning is that speculative (net long) flows have recently breached $1600 34% a key downside level which may threaten over 2 years of sizeable long gold $1532 positions. 200-DMA BREAKOUT NOT BROKEN IN 3 YEARS! In price terms, Gold’s latest 20% bearish slide is still worth less than the largest average drawdown measured since the start of the yellow metal’s 26% long-term bull market in 1999. CONFIRMATION BELOW $1530 UNLOCKS LARGER DECLINE There is heightened risk of a much larger decline if we confirm a weekly INTO $1300 & $1040-1000 TREND close beneath $1600 and $1554-30 (200-day MA/swing low), which has not CHANNEL been breached in 3 years! (12 YEARS) A number of “bargain hunting” trend-followers will be watching this COT NET LONG SPECULATOR benchmark “line in the sand” for repeat support or a potential big squeeze POSITIONS lower into $1300 and perhaps even $1040-1000. Remember, this would still offer a unique buying opportunity in the near future. I 25% OVER 2 YEARS OF Please select links for in-depth Gold coverage: SIZEABLE LONG Special Report “Gold’s mountainous peak at risk…beneath $1600” VIDEO GOLD POSITIONS UNDER THREAT MIG Bank Gold Interview on CNBC Squawk Box MIG Bank Gold Webinar video IF KEY LEVEL BREAKS (CNBC & BLOOMBERG REPORTS) II S-T TREND L-T TREND STRATEGY Gold weekly, daily chart and COT Liquidity, Bloomberg Finance LP Sell Stop 3: 1710, Obj: 1600/1530/1300, Stop: 1760 www.migbank.com Ron William, Technical Strategist, E-mail: r.william@migbank.com, Phone: +41 32 7228 454 12

- 13. DAILY TECHNICAL REPORT SILVER 31 October, 2011 Silver HITS 1980 Spike High! DEMARK™ SELL SIGNAL 13 Key support at $26.0700. Silver (Daily) I DEMARK™ Silver’s latest price capitulation is a painful reminder to the investment SELL SIGNALS community that lightning can strike twice. Note, this marks the second time silver has crashed, following its 30% fall last April. 200 DMA The move was triggered following a DeMark™ exhaustion sell signal and (36.5125) II has now wiped out almost 50% of silver’s prior gains (taken from Silver’s all-time high at 49.7900) which was last seen in 1980. KEY SUPPORT Such a dramatic move traditionally produces volatile trading ranges. This (26.0700) 38.2% (32.3135) allows the market to have enough time to recover and accumulate renewed buying interest. Gold/Silver "Mint" Ratio 50% (26.9150) Expect a large trading range to hold between $37.0000-26.0700 over the multi-week/month horizon, with downside macro risk into $21.5165 (61.8% Fib-1999 bull market) and $20.0000. This would still maintain silver’s long- 61.8% (21.5165) term uptrend and help offer a potential buying opportunity for the 13 YEAR LEVEL eventual resumption higher. UNWINDING 67% FROM Continue to watch the gold-silver “mint” ratio which has now accelerated OVERSOLD TERRITORY higher by 67%, suggesting further risk aversion over the next few weeks. OVER 30 YEAR BASE PATTERN BULL MARKET FROM 1999 Silver Monthly (since 1980) S-T TREND L-T TREND STRATEGY Spot Silver daily, weekly chart and Gold/Silver “mint” ratio, Bloomberg Finance LP Sell Stop 3: 34.1300, Obj: 29.9700/26.0700/23.3400, Stop: 35.6880 www.migbank.com Ron William, Technical Strategist, E-mail: r.william@migbank.com, Phone: +41 32 7228 454 13

- 14. LEGAL DAILY TECHNICAL REPORT 31 October, 2011 TERMS Limitation of liability DISCLAIMER MIG BANK disclaims, without limitation, all liability for any loss or damage of any kind, including any direct, indirect or consequential damages. Material Interests No information published constitutes a solicitation or offer, or recommendation, or advice, MIG BANK and/or its board of directors, executive management and employees may have to buy or sell any investment instrument, to effect any transactions, or to conclude any legal or have had interests or positions on, relevant securities. act of any kind whatsoever. Copyright The information published and opinions expressed are provided by MIG BANK for personal use and for informational purposes only and are subject to change without notice. MIG All material produced is copyright to MIG BANK and may not be copied, e-mailed, faxed or BANK makes no representations (either expressed or implied) that the information and distributed without the express permission of MIG BANK. opinions expressed are accurate, complete or up to date. In particular, nothing contained constitutes financial, legal, tax or other advice, nor should any investment or any other Notes: Entries are in 3 units and objectives are at 3 separate levels where 1 decisions be made solely based on the content. You should obtain advice from a qualified unit will be exited. When the first objective (PT 1) has been hit the stop will be expert before making any investment decision. moved to the entry point for a near risk-free trade. When the second objective All opinion is based upon sources that MIG BANK believes to be reliable but they have no (PT 2) has been hit the stop will be moved to PT 1 locking in more profit. All guarantees that this is the case. Therefore, whilst every effort is made to ensure that the orders are valid until the next report is published, or a trading strategy alert is content is accurate and complete, MIG BANK makes no such claim. sent between reports. www.migbank.com 14

- 15. DAILY TECHNICAL REPORT CONTACT 31 October, 2011 Howard Friend Ron William MIG BANK 14, rte des Gouttes d’Or www.migbank.com Bjioy Kar Chief Market Strategist Technical Strategist info@migbank.com CH-2008 Neuchâtel Technical Strategist h.friend@migbank.com r.william@migbank.com www.migbank.com Tel.+41 32 722 81 00 b.kar@migbank.com 15