Collision Forces: Scientific Integrity Meets the Capital Markets

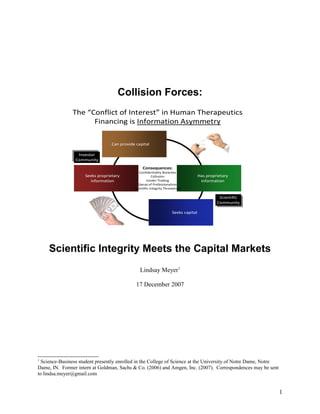

- 1. Collision Forces: Scientific Integrity Meets the Capital Markets Lindsay Meyer1 17 December 2007 1 Science-Business student presently enrolled in the College of Science at the University of Notre Dame, Notre Dame, IN. Former intern at Goldman, Sachs & Co. (2006) and Amgen, Inc. (2007). Correspondences may be sent to lindsa.meyer@gmail.com 1 The “Conflict of Interest” in Human Therapeutics Financing is Information Asymmetry Seeks proprietary information Can provide capital Has proprietary information Seeks capital Consequences: Confidentiality Breaches Collusion Insider Trading Decay of Professionalism Scientific Integrity Threatened Investor Community Scientific Community

- 2. Introduction As David Blumenthal was quick to point out in his 2004 commentary in the New England Journal of Medicine, “When a great profession and the forces of capitalism interact, drama is likely to result.” His discourse reflected a topic that has emerged on the legal forefront in the past decade with the prosecution of over 26 biomedical researchers and physicians for leaking unreleased information about drug-research to investment analysts (Lancet, 2005). Unfortunately, the rise of this phenomenon has been rather untimely. The background noise of public scrutiny about the nature of relationships between pharmaceutical companies and physicians has strained the notion that physicians have the best interest of patients at heart. 2 Abstract The landscape for innovation in the life sciences requires substantial participation from the investment community to finance new ventures and support existing projects. As such, appropriate risk-adjusted returns are expected by investors. Gaining insight into the progress of important clinical trials has catalyzed an information asymmetry between direct participants in the scientific process and the investment community. Direct participants can gain materially by breaching confidentiality agreements or engaging in insider trading, unethical practices that compromise scientific integrity. This report explores the nature of conflicts that can arise from the unique relationships specific to entities developing human therapeutics and proposes three mechanisms for minimizing negative externalities of the research process: raising awareness of the problem, mandating professional organizations to adopt and enforce strict policies for sharing material information, and establishing project work teams to limit the number of individuals exposed to non-public information.

- 3. Scientific integrity is characterized as “a commitment to truthfulness, to personal accountability, and to vigorous adherence to standards of professional conduct including accuracy, fairness, collegiality, and transparency” (Warner & Roberts, 2004). The dynamic nature of life sciences investing has supported the development of novel therapeutics, but as the stakes get higher, market participants have an increased reason to solicit scientists for proprietary information, posing a visible threat to scientific integrity. The lack of “best practices” training to research scientists and practicing physicians about minimizing conflicts of interest has spawned the development of a poorly documented dilemma unique to the life sciences industry. For the purposes of this report, the “life sciences industry” is a blanket term extending coverage to pharmaceutical, biotech and to a lesser extent, medical device companies. Collectively, health care companies comprise roughly 15% of the US economy, illustrating the magnitude of fortunes to be made or lost (Lancet, 2005). 3

- 4. Industry Drivers There are two important differentiators between pharmaceutical and biotech companies. First, pharmaceutical companies have larger drug portfolios spanning several therapeutic areas making them much larger in size and scale. Second, traditional pharmaceutical firms rely upon a small molecule platform, whereas biotech companies support the development of viruses, serums, toxins, vaccines, antibodies and protein derivatives in a product class known generally as biologics. The lines are beginning to blur in big pharma, as the potential for generating additional revenue is amplified by addition of biotech product offerings. Specialty pharmaceutical and biotech companies are typically limited by the availability of capital. The cost to finance a new drug has been the topic of much attention recently, with conservative estimates in excess of $800 million. As the expense profile for novel drug development increases, so has the time horizon. The lifecycle of a compound from preclinical trial to commercialization may require upwards of 6-8 years. Because of the lengthy project duration and the high costs associated with drug development, many biotech and start-up pharmaceutical companies are unprofitable in their infancy – or at least until a new product is brought to market. The failure rate is also high in this industry, as unsuccessful clinical trials can prove catastrophic for highly leveraged firms with undiversified pipelines. Biotech companies are generally entrepreneurial in nature and rely on venture funding to back their research. As many venture capital firms prefer to assemble diversified portfolios of investments, biotech companies have a conceptually limited source of capital, thereby restricting the quantity of trials they can conduct. As such, these groups choose to focus their research on areas that will hypothetically confer the greatest scientific (and economic) benefit. These areas 4

- 5. often include rare and unmet medical conditions and disease areas in which no effective treatment exists (several forms of cancer, genetic diseases, AIDS and many immune disorders). The need for higher efficacy therapeutics sits at the core of the life sciences industry, propelling it forward. This is best illustrated by the exponential increase in research support to pharmaceutical companies from 1980 to 2001. Over this 21 year time period, funding escalated from $1.5 billion by 1367% to $22 billion (Warner & Roberts, 2004). As a discipline, science is always self-correcting and the inherent nature of continued discovery extends to human therapeutics. Seeking more efficient ways to deliver essential therapies ensures that this industry will remain dynamic into perpetuity. 5

- 6. The Scientific Community The scientific community encompasses all individuals that are involved in any facet of the research processes including researchers and physicians (who conduct experiments) as well as corporate officers (who oversee projects). In addition, peer reviewers, journalists, lawyers, and consultants are often exposed to highly sensitive data before it becomes public (Lehrman, 1999) as part of the scientific process. Academic medical centers, medical schools with teaching hospitals, are vital to the scientific community and represent the convergence of highly-trained academics with skilled physicians and residents. These institutions are known for producing high volumes of well- touted research and receive substantial public (government) and private (business) funding. 6

- 7. The Investment Community Participants in the “Investment Community” include stockbrokers, research analysts, investment bankers, venture capitalists, hedge funds, asset managers, and other related investment entities (Steinbrook, 2005). Collectively, this group helps to underwrite the issuance of new securities (ie: take a company public, assist with placing debt) and facilitate the flow of securities (namely, equity) between investors. Each of these parties benefits from a specific mechanism when life sciences companies prosper. Investment bankers collect fees for their fiduciary advice and underwriting services. Stockbrokers earn spreads on trading securities at favorable prices. Venture capitalists win when their direct investments generate positive returns. Research analysts earn incentives from making accurate buy/sell calls on individuals stocks. Hedge funds and asset managers benefit from price movements on publicly-traded securities. According to Topol and Blumenthal (2005), nearly one-third of hedge fund investments are in the life sciences and approximately 30% of the $21 billion of venture capital invested in 2004 was in life sciences companies, of which 63% was earmarked for pharmaceutical and biotechnology companies. The investment community profits considerably from favorable news surrounding human therapeutics companies. Two important milestones exist in the development phase for new drugs: (1) – successful Phase III Clinical trial data, and (2) – a favorable recommendation from one of the FDA’s drug advisory panels. However, there is a similar effect for hedge funds and stockbrokers that take short positions or research analysts who issue “buy” signals when life sciences entities are unsuccessful in Phase III trials or in obtaining the recommendation of the FDA. Non-public information about the outcome of either event is considered “material,” meaning that it has the potential to move the stock price (Prentice, 1999). 7

- 8. Material information for stockbrokers, research analysts and investment managers can also be sourced externally. Academic work conducted independently of a company may also be considered material if it is expected to have an impact in the decisions made by investors. The high-risk, high-reward nature of life sciences investing has fostered the development of illegal information exchange. 8

- 9. When Science Meets Business The investment community may turn to scientists and physicians for seemingly innocuous participation in conference calls, meetings, or panels. The motivation to establish connections with scientists is due in part because investment professionals are not familiar with industry trends or the outlook for individual therapeutic algorithms. Given the nature of investments in volatile life sciences companies, many market participants are attempting to gain an edge by obtaining non-public information. Therefore, investment firms wishing to reach out to the scientific community frequently seek out the counsel of leaders of academic departments and prominent researchers who are most likely to have unpublished information (Steinbrook, 2005). The medical industry has been highly criticized for becoming overly industrialized in the past decade. This trend has been marked by the movement of physicians to in-house resource groups at investment firms on Wall Street. These doctors help firms target the right researchers to reach out to; craft questions to ask of the researchers, and assess their responses (Steinbrook, 2005). Some interaction is beneficial for society; well-informed investors can help finance promising areas of research (Lancet, 2005) and the efficient allocation of funds in capital markets further promotes general economic welfare (Topol & Blumenthal, 2005). Despite the theoretical benefits, conflicts of interest can impair a professional’s ability to “observe, judge, and act according to the moral requirements of their role” (Warner & Roberts, 2004). The primary goal of scientific research is to find truth – a goal that becomes less convincing to the public as science and business become inextricably linked (Lancet, 2005). 9

- 10. Facilitated Interaction To serve the needs of investment managers seeking the counsel of influential intellects, firms such as Leerink, Swann & Company and the Gerson Lehrman Group have sprouted up, capitalizing on the internet to match investors with experts in several fields. Gerson Lehrman counts some 48,000 physicians among its ranks, available to act as consultants to investors. Members of the group set their own consulting fees, ranging from $200 to $1000+ per hour (Steinbrook, 2005). Leerink, Swann & Company, the Boston-based consultancy placement agency has an additional 15,000 physicians in its database involving 55 clinical care specialties, 21 basic science disciplines, and 100 academic medical centers (Topol & Blumenthal, 2005). Facilitated consultations have helped make the due diligence process one-stop shopping for investors in highly technical industries like biotech. Recent estimates have suggested that nearly one in ten doctors have signed up to work as consultants. The financial benefits of consulting can exceed the hourly salaries in the highest- compensated specialty practice areas. In one documented case, an asset management firm paid Leerink Swann $5000 for a 30 minute phone conversation with a physician. Leerink Swann notes that their “major focus of contact has been the conduct, status, and preliminary results of ongoing clinical trials” (Topol & Blumenthal, 2005). For physicians consulting about the status of pivotal clinical trials, monetary remuneration may not be the only reason to talk with prominent investment managers. Often times, establishing relationships with prominent investment firms can help physicians obtain access to private investment vehicles that have been closed. As Prentice pointed out in his 1999 publication in the Journal of Legal Medicine, as a group, physicians typically have “substantial incomes and often invest in securities.” The double-incentive system of cash payment and 10

- 11. opportunities to invest in closed-end funds is often too lucrative for even highly-compensated physicians to resist, particularly for those with a special interest in capital markets activity. But when physicians and research scientists co-invest in their own work, an obvious conflict of interest arises out of the temptation to manipulate data or study design to illustrate false trends. 11

- 12. Best Practices in Information Sharing Ideally, information from clinical trials and FDA should be disclosed to the marketplace promptly and accurately (Skolnick, 1998). Targeted Genetics, the Seattle-based biotech company embodied this value by gracefully navigating through a tumultuous series of events between July and September 2007, surrounding the death of a patient receiving one of their experimental compounds as part of a clinical trial. The company was quick to acknowledge the death, an event that catalyzed a 50% drop in share price. Concurrent to this unfortunate event, the company partnered with leading academic research centers and the Recombinant DNA Advisory Committee (“RDAC”) of the FDA to conduct an extensive study of what caused the death. Ultimately the company was vindicated of responsibility for the death. Immediately after RDAC convened to discuss what had triggered the adverse event, Targeted Genetics led an investor community conference call to share information. The communication process was seamless, and the stock price has partially recovered from its mid-August lows. This vignette illustrates the benefit conferred by being honest and swift in sharing information. Virtually all life sciences companies are aware of the propensity for problems related to information sharing and attempt to circumvent problem by issuing a summary of clinical results as soon as possible. Generally, this will occur even before publication in peer-reviewed journals. By keeping investors informed of the status of important events, life sciences companies can prevent having to respond to uncomfortable requests for illegal information. So is rapid information sharing always best? Perhaps for investors, but Freestone and Mitchell (1993) raised an important point in their British Medical Journal publication that swift dispersal of price-sensitive information may not be in the best interest of patients. They argued that peer review prevents sensationalism and helps further the field of medicine. 12

- 13. Dynamics of Insider Trading Scientific breakthroughs are more likely to be reported in the popular press than in other technological areas, magnifying the impact of positive or negative clinical trial results on a company’s stock price (Lehrman, 1999). Because biotechnology companies are usually unprofitable, rumors about the fate of important molecules can lead to major swings based on speculation (Ferguson, 1997). The incentive to obtain accurate information before it reaches the newswires is high. In 1998, Geron Corp. successfully synthesized human embryonic pluripotent (stem) cells. The day that the article was released in Science, the value of Geron stock nearly tripled (Lehrman, 1999). Overgaard, Broek, Kim, and Detsky (2000) retroactively studied the stock prices of biotech companies in the 120 day period before two pivotal events – successful Phase III Clinical Trial Data, and favorable recommendations from the FDA’s drug advisory panels. Three days before positive announcements about Phase III trials were made, the stock price of “winners” appreciated by an average of 27% while the “losers” fell by 4%. On the FDA Advisory Panel Review front, the stock prices of winning and losing products were less correlated with the outcome of the panel reviews, but products given the green light still experienced tremendous upside in the three days preceding the announcement. While “no attempt was made to provide any direct evidence that insider trading is occurring” (Overgaard, 2000), the importance of this study is clear. Forces are at work in the days leading up to the two critical events in a potential new drug’s lifespan and an assessment of the plausible causes of these sharp movements suggests more than just speculation. As Overgaard et. al discussed, price speculation is generally reflected in trading volume because even small pools of savvy investors can not consistently make accurate calls about the outcomes 13

- 14. of these events. Relying on existing information from the first two rounds of clinical trials is also largely futile. Historically, evidence from Phase II trials frequently fails to predict future results. Therefore, it seems likely that pockets of analysts and investors have material information – and know in advance of public release, what the outcomes of Phase III trials are. Acting on this information leads to sharp, directionally accurate movements in the final days before the public is aware of the results. The Securities and Exchange Commission (“SEC”) has elected to refrain from defining insider trading in an attempt to avoid setting a rule that could then be evaded. On a case by case basis, the judicial branch applies general concepts to prosecute perpetrators. As one might imagine, the rules aren’t always black and white. Robert Prentice (1999) outlined four prosecution paradigms for insider trading, but many permutations exist. Among these four classifications are company insiders, temporary insiders, misappropriators, and tippees. Company insiders have a responsibility to the shareholders of the corporation to abstain from disclosing information. Company insiders include entry-level employees, managers, directors, vice presidents, executives, and the Board of Directors. For example, a cardiologist who sits on the board of directors at a start-up medical device company has a duty to the shareholders of the company, even though they may be private. Communicating confidential information about the company’s developmental or financial plans to family members, friends, or even distant acquaintances is prosecutable in court. Temporary insiders include people who have “special relationships” with the company to perform a service or deliver a good. This class of people includes lawyers and investment bankers who help counsel on legal matters or arrange financing for deals. Auditors who evaluate the financial statements and internal controls of a company are also considered temporary 14

- 15. insiders. Physicians working as consultants for drug companies can become temporary insiders if they are provided with confidential information for business purposes. Infringement of confidentiality can also be grounds for insider trading. Misappropriators are those who do not have direct relationships with companies, but rather have a fiduciary duty to the source of the information. For physicians, this includes the duty to keep patient information confidential, an obligation taken via the Hippocratic Oath. Using information obtained in the course of interacting with patients would violate the Hippocratic Oath. Finally, tippees are on the receiving end of information windfalls. If tippees act on this information, the tipper can be prosecuted. If the tippee is also aware that the information is non-public, they can also be held responsible. 15

- 16. Solution #1 – Raise the Awareness Level about Potential Problems from the Bottom Up The obvious solution is to generate heightened awareness about insider trading laws and what constitutes illegal dissemination of information. Prentice (1999) pointed out that many professionals in the securities industry are “largely unschooled in the nuances of insider trading rules.” Academic medical centers are brimming with intellectual capital, but many of these brilliant scientists require coaching to become versed in securities laws. This form of “continuing education” is essential for the scientific community. Because the SEC has only begun to investigate insider trading in life sciences companies within the past decade, it seems likely that within the next decade, the penalties will become harsher and harder to evade. Brennan et al. published a highly contended policy proposal for academic medical centers (“AMC’s”) in the January 2006 volume of the Journal of the American Medical Association. His policy proposal working group noted that policing conflict of interest problems lies within the scope of professional responsibilities set forth in the Physician Charter on Medical Professionalism. More importantly however, Brennan et al. suggested that AMC’s must only accept grants from life sciences companies if they are not earmarked for use by specific individuals. This well-intentioned proposal sought to limit the amount of control that industry groups can exercise over individual research projects. Whatever their ultimate form, efforts must also be taken to reduce conflicts of interest between research groups and the parties that help finance them. But how? The creation of conflict of interest committees in academic medical centers is an important step. Requiring researchers who act as consultants to disclose their relationships to their institutions and the 16

- 17. sponsors of their research (Lancet, 2005) is another method for ensuring that physicians and scientists are taking responsibility for their actions. In a study of 61,134 publications in prestigious science and medical journals in 1997, only 0.5% included conflict of interest disclosures. More recent data was not immediately available to illustrate if any notable shifts have occurred in light of efforts to reduce scientific conflicts of interest, but the 1997 statistic alone is a harrowing stimulus for action. Educating physicians about what constitutes insider trading, establishing best practices for the allocation of funds within academic medical centers, and creating conflict of interest committees which require consulting physicians to acknowledge their ties to third parties are all viable ways to draw attention to the problems plaguing the scientific community. 17

- 18. Solution #2 – Mandate Professional Organizations to Adopt and Enforce Strict Policies for Communicating Non-Public Information The American Society of Clinical Oncologists has a membership of over 25,000 oncology practitioners. Their Annual Meeting has been the source of public scrutiny as meeting abstracts are circulated in advance of the symposium, giving members an early taste of market- moving information. Wrapped in cellophane, these anthologies of lab work arrive with an embargo that prohibits the use of the information until the beginning of the conference and in some cases, the scientific sessions. The embargo is crafted to extend coverage to all meeting materials, regardless of where it is obtained from. In theory, there are no checks and balances in place to prevent meeting materials from being distributed to healthcare investment analysts who can issue research notes about companies they may be covering. As the world’s leading organization for oncology professionals, ASCO has a duty to reconsider the material effects of releasing abstracts discussed at their Annual Meeting. Mounting pressure on the group to revise their policies and strengthen their embargo will force the group to consider if the benefit of distributing its meeting materials in advance of the conference is worth the criticism. Presumably, ASCO will act out of external pressure before their 2008 meeting to avoid the press that appeared in the Wall Street Journal in May 2007. The biggest challenge to strengthening or scripting a new policy is the cost to enforce it. Monitoring the activity of 25,000 clinical oncologists across the United States so as to prevent illegal information dissemination is an impossible task. Circumventing the regulation/enforcement problem will likely require an investment in technology to ensure that each member only receives one, uniquely coded package of abstracts. Therefore, if any information leaks beforehand, it is traceable. 18

- 19. Solution #3 – Establishing Project Work Teams Because numerous individuals have access to sensitive, material information, public companies and academic research groups can reduce the risk of information leaks by forming advisory committees that are comprised of a small, select group of professionals. These project work teams should involve the minimum number of researchers and support staff. To the highest extent possible, efforts should be made to keep the team intact for an extended period of time (minimally for an entire project lifecycle, ideally for multiple projects). By creating a collegial “insider” atmosphere, the group becomes fraternal and may exhibit some self-policing mechanisms that arise from social influences and a shared code of conduct. Retaining the same legal counsel, journalists, and consultants will minimize the number of people who become “insiders” as non-public information reaches the newswires. Project work teams should be prohibited from maintaining personal investment accounts. Just as professionals at investment firms are not allowed to maintain personal trading accounts, project work teams should also be exempted. Employees of most Wall Street investment banks must clear investment activity with their firm by trading only during specified windows and by using a broker that the firm can monitor (or by using a firm account that is objectively monitored). The costs associated with this practice are high. Maintaining watch over the personal trading patterns of scientists and researchers is an understandable burden to academic medical centers and life science companies. In addition, restricting personal investment activity may further compel these individuals to “tip” other people, thereby erasing the reputational gains made by establishing the policy in the first place. 19

- 20. Critics of this proposal may also point out that by exposing a small group of people with similar goals to sensitive information, the group has a higher propensity to engage in collusion on any number of fronts – illegal information sharing via highly-paid consulting engagements, insider trading schemes, or manipulating data. Many life sciences companies operate in teams already, so this paradigm may not be of value to all scientific entities. However it can be achieved, restricting the flow of non-public information has a cascade of compliance benefits. 20

- 21. Conclusion The triple-tiered approach to managing this problem puts most of the onus on science professionals. Is that really fair? Of course not, but it is the price that scientific community must pay to reassure the public that the practice of medicine is fully objective and patient focused. Fully ameliorating the information asymmetry in the life sciences will require additional support from Wall Street. The big investment firms and influential private investment entities must also be proactive about their approach to seeking value. Financiers are the critical link between the capital markets and the parties that need these funds. The opinions and actions within the investment community can greatly alter public perception. Regulatory bodies within the United States must recognize that the illegal activity resulting from improper relations between science and business is a two way street. Setting criminal penalties for investment groups that coerce material information from both unknown scientists and those well versed in securities laws is an important catalyst in eliminating the dishonest activities that have become all too common in life sciences. Agreeably, the asymmetry of information is tilted towards the scientific community, but conceptually it can be slanted right back in favor of investors if the right pieces of data are gleaned from under the radar detector. Because financial analysts can exert remarkable sway over market movements, regulatory agencies should be highly concerned about the tactics used in obtaining the information analysts publish in their investment notes and communicate to investors during conference calls. Bringing the scientific community up to speed on the nature of problems inherent to the industry they work in is more than a three-step process of attention-getting, policy-making, and workflow reform. Repeating the Overgaard study over a more current time interval is one 21

- 22. necessary method for benchmarking progress. It also serves as an acid test for measuring the strength of new defensive tactics to reduce the harmful effects of the information asymmetry that exists between life sciences investors and practitioners. Scientific progress is dictated by non-exploitative, truthful, and socially beneficial interactions of special interest groups (Warner & Roberts, 2004). Science would not progress without the help of an efficient capital markets system. The relationships between the investment community and the scientific community facilitate continued innovation, improved human health, and limitless economic potential. Successfully managing the distribution of market-moving scientific information is a noble challenge, but ultimately one that is worth rising to. 22

- 23. References American Society of Clinical Oncology. 2007 Annual Meeting: Corporate and Institutional Public Relations Policies. Brennan, T. A., Rothman, D. J., Blank, L., Blumenthal, D., Chimonas, S. C., Cohen, J. J., et al. (2006). Health industry practices that create conflicts of interest. Journal of the American Medical Association, 295(4), 429-33. Ferguson, J. R. (1997). Biomedical research and insider trading. New England Journal of Medicine, 337(7), 631-4. Freestone, D. S., Mitchell, H. (1993). Inappropriate publication of trial results and potential for allegations of illegal share dealing. British Medical Journal, 306(6885), 1112-4. Horwich, A. (2006). The clinical trial research participant as an inside trader: a legal and policy analysis. Journal of Health Law, 39(1), 77. Insider trading versus medical professionalism (2005). Lancet, 366, 781. Lehrman, S. (1999). Insider trading alert over bioscience companies. Nature, 397, 185. Overgaard, C. B. (2000). Biotechnology stock prices before public announcements: evidence of insider trading? Journal of Investigative Medicine, 48(2), 118-24. Prentice, R. A. (1999). Clinical trial results, physicians, and insider trading. Journal of Legal Medicine, 20, 195-222. Skolnick, A. (1998). SEC going after insider trading based on medical research results. Journal of the American Medical Association, 280(1), 10-11. Skolnick, A. (1998). SEC slaps another researcher for insider trading. Journal of the American Medical Association, 280(2), 124. Steinbrook, R. (2005). Wall Street and clinical trials. New England Journal of Medicine, 23

- 24. 353(11), 1091-3. Topol, E. J. (2005). Physicians and the investment industry. Journal of the American Medical Association, 293(21), 2654-57. Warner, T. D. (2004). Scientific integrity, fidelity and conflicts of interest in research. Current opinion in psychiatry, 17, 381-5. 24