Finance department

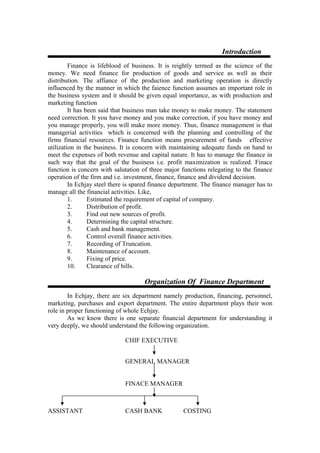

- 1. Introduction Finance is lifeblood of business. It is reightly termed as the science of the money. We need finance for production of goods and service as well as their distribution. The affiance of the production and marketing operation is directly influenced by the manner in which the faience function assumes an important role in the business system and it should be given equal importance, as with production and marketing function It has been said that business man take money to make money. The statement need correction. It you have money and you make correction, if you have money and you manage properly, you will make more money. Thus, finance management is that managerial activities which is concerned with the planning and controlling of the firms financial resources. Finance function means procurement of funds effective utilization in the business. It is concern with maintaining adequate funds on hand to meet the expenses of both revenue and capital nature. It has to manage the finance in such way that the goal of the business i.e. profit maximization is realized. Finace function is concern with salutation of three major functions relegating to the finance operation of the firm and i.e. investment, finance, finance and dividend decision. In Echjay steel there is spared finance department. The finance manager has to manage all the financial activities. Like, 1. Estimated the requirement of capital of company. 2. Distribution of profit. 3. Find out new sources of profit. 4. Determining the capital structure. 5. Cash and bank management. 6. Control overall finance activities. 7. Recording of Truncation. 8. Maintenance of account. 9. Fixing of price. 10. Clearance of bills. Organization Of Finance Department In Echjay, there are six department namely production, financing, personnel, marketing, purchases and export department. The entire department plays their won role in proper functioning of whole Echjay. As we know there is one separate financial department for understanding it very deeply, we should understand the following organization. CHIF EXECUTIVE GENERAL MANAGER FINACE MANAGER ASSISTANT CASH BANK COSTING

- 2. MANAGER ASSISTANT ASSISTANTS SENIOUR CLERK CLERK/TYPIST PEON Organization Of Finance Department Financial planning include the determining the proper amount of capital i.e. capitalization. It means plan relegating to the amount of each type of capital, the sources from which they are raised and the proportion of the total capital in relation to the earning of the business. Financial planning should be drifted from viewpoint at present as well as future. The success of failure of any business depends upon the financial planning. If the financial planning prepared carefully, accurately and without any fault, the net. Will get success in the business. It involves setting of objective and identification of the various affecting the objective. There are two types of financial planning. 1. Long term planning 2. Short term planning In the long term planning the firms has plan for expansion of its unit t a large extant where as in the short term planning the firm plan about the production incensement. Such financial planning is necessary to keep a proper balance between expanse and income. This company has computer system so there is no problem for calculation of debit bill regularly paid to the parties concerned. Source of Finance The sources of finance has been defined as “from where to collect fund and also at same time in which way it comes at the time of requirement, generally there are two main sources i.e. internal sources and external sources. Funds available for a period of one year of less as called short-term finance. Mostly short-term funds used to finance working capital of the firm. Echjay obtaines its short-term finance from profit funds, short term lone, share holders funds, etc… this short term finance is required to pay day to day expense and regular operation of the expenses and regular operation of the expense and regular operation of the business environment. Mostly these funds obtain internally. External sources means to borrow fund back, financial institute, etc…This unit has borrowed 2 crores from I.D.B.I. There is also borrowings ban of India, which is the lead bank of Echjay industry Ltd. Other banks like Indian overseas bank S.B.I. State Bank of Saurshtra is also helpful to this unit. Thus this company has both internal and external finance for its financial requirements. Capitalization Capitalization means total amount of a company’s capital or total value of its capital stock. It is the sum of all kind of long terms securities issued by the company as well as the surplus, which is not meant for distribution. It capitalization of a

- 3. company is just equal to its capital requirements. It is conceder to be proper capitalized. It is more than required, it is not desirable. CAPITALIZATION = Ownership capital + long term loan Capital SHARE CAPITAL = Free reserves + debenture capital + long term loan TYPES OF CAPITALIZATION 1. Normal capitalization If its expected earnings justify the total amount of capital invested in various aspects is it said to be normal capitalization. 2. Over capitalization When a company is consistently unable to earn the prevailing rate on its out standings securities, it is said to be over capitalization. 3. Under capitalization A company is in under capitalization when its actual capitalization is lower then its proper capital as warranted by its earning capacity Pertaining to this unit, it is difficult to say whether it is under capitalization or over capitalization because it does not face any problem, as there is proper finance planning and capital is utilized properly. Management o f fixed assets Fixed assets are distinguished from current asset on the basis of their physical and economical life. Fixed assets means the assets, which are used by the firm in long duration in the operation of the products. They are permanent capital, which helps the company in the continuous production process. Fixed assets have fixed cost burden and heaving long term and huge investments. They must be manage properly efficiently otherwise it may create danger for survival of the firm. Fixed assets are of two types, tangible and intangible. Machines, fixtures, buildings, etc… are tangible assets while goodwill; patent copyrights, etc… are intangible form of fixed assets. The size and nature of fixed assets can be determining by following factors. 1) Nature of business 2) Size of business 3) Types of product to be produced 4) Nature of production process 5) Technological development The finance manager of this company is ultimate responsible for maintaining proper management of fixed assets. It adopts proper depredation policies. The department is providing by using diminishing rate of method for the valuating of its fixed assets every year. Management of working capital The management of working capital or current assets management, is one of the most important of the most important of the all over financial management. Working capital management is an integral part of the over all financial management. It is essential for smooth running of day-to-day operation. There are two types of working capital. 1) GROSS WORKING CAPITAL :

- 4. It includes firm’s investment in current assets. 2) NET WORKING CAPITAL Net working capital refers to the difference between current assets and current liabilities. Thus, the goal of working capital is to manage the current assets and current liabilities in such a way that an acceptable level of working maintained. DEPARTMENTS OF WORKING CAPITAL : 1. Nature and size of business 2. Operating cycles 3. Business fluctuations 4. Credit policy 5. Growth and expansion Profit Graph YEARS SALES VALUE (Rs. In lacks) 1997 200 1998 225 1999 350 2000 420 2001 510 2002 625 2003 680 Here we can measure year on ‘X’ axis and profit on ‘y’ axis. We can see that profit is increasing every year. Thus, Echjay’s sales increasing trend. Scales On ‘x’ axis 1 c. m. = 7 year On ‘y’ axis 1 c. m.= 100 2004 800 2003 2003 700 2002 2002 680 2001 2001 625 600 2000 2000 510 500 1999 1999 420 400 1998 1998 350 300 1997 1997 225 200 200 1996 100 1995 1994 0 1 2 3 4 5 6 7

- 5. Year 1997 1998 1999 2000 2001 2002 2003 Sales value 200 225 350 420 510 625 680 Bonus share right issue & public deposit Echjay industry Ltd. Company is pvt. Ltd. Company but is can be treated as demand public ltd. Company. This company earns much profit and it run well so there is no need of such type of issue, this company has started its expansion plan. For this the company has enough money. It can take loan from bank so its financial position is very well. So far as bonus issue and right issues are concern there is no question for issue and public deposit is also not existing in this company. There is no bonus share, right issue and public deposited in this company. Capital budgeting Capital budgeting decision carried out by top-level management. It is decision regarding long term fixed investment in business by firm. Capital budgeting decision pertains to fixed assets or long-term assets, which in operation yield a return over a period of time usually exceeding one year. Capital budgeting may be defined as decision-making process by which firms evaluates the purchase of fixed assets. It may be describe as the forms formal planning process for the acquisition and investment of capital and result is capital budget, that is firms formal plan for the expenditure of money to purchase of fixed assets. There are many methods for selecting best investment proposal. It may be shown as 1. Unsophisticated or traditional method Average rate of return method Pay back method 2. Time adjust or modern method Present value method Internal rate of return method Echjay steels is managing its fixed assets efficiently and also preparing capital budgeting. It first estimated the requirement of capital for five years, then up to daily requirement of capital is estimated. Echjay has presently made investment in AGUL plan of Germany. In this plan they have introduced completely automatic system. So now we can say that this is modernization of investment The unit manages working capital very efficiently and yielding maximum return for the profitable management of working capital. This unit gives sharp attention for the following aspects basic. Cash in money, which a firm can disburse immediately without any restriction. Echjay looks after its cash very carefully. They keep enough cash to payB. MANAGEMENT OF BANK . INTERPRETATION: A variant of current ratio is the quick or liquid ration, which is designed to show the amount of cash available to meet immediate payment. It is obtained

- 6. by dividing the liquid assets by liquid liabilities. The hundred level of this ratio is 1 : 1 and in Echjay the ratio is 1.82 : 1 is satisfactory.