Synchronous Lesson Plan Intro To Accounting

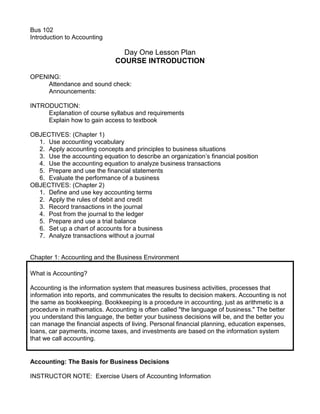

- 1. Bus 102 Introduction to Accounting Day One Lesson Plan COURSE INTRODUCTION OPENING: Attendance and sound check: Announcements: INTRODUCTION: Explanation of course syllabus and requirements Explain how to gain access to textbook OBJECTIVES: (Chapter 1) Use accounting vocabulary Apply accounting concepts and principles to business situations Use the accounting equation to describe an organization’s financial position Use the accounting equation to analyze business transactions Prepare and use the financial statements Evaluate the performance of a business OBJECTIVES: (Chapter 2) Define and use key accounting terms Apply the rules of debit and credit Record transactions in the journal Post from the journal to the ledger Prepare and use a trial balance Set up a chart of accounts for a business Analyze transactions without a journal Chapter 1: Accounting and the Business Environment What is Accounting? Accounting is the information system that measures business activities, processes that information into reports, and communicates the results to decision makers. Accounting is not the same as bookkeeping. Bookkeeping is a procedure in accounting, just as arithmetic is a procedure in mathematics. Accounting is often called the language of business. The better you understand this language, the better your business decisions will be, and the better you can manage the financial aspects of living. Personal financial planning, education expenses, loans, car payments, income taxes, and investments are based on the information system that we call accounting. Accounting: The Basis for Business Decisions INSTRUCTOR NOTE: Exercise Users of Accounting Information Users of Accounting Information Go to the group assigned by your instructor and see if you can envision how these various will use the accounting information. Group One: Individuals Businesses Investors Creditors Group Two: Government Regulatory Agencies Taxing Authorities Nonprofit Organizations Other Users The groups should arrive at the following information: Users of Accounting Information Individuals People such as you use accounting information to manage bank accounts, evaluate job prospects, make investments, and decide whether to rent or buy a house. Harold Nix, one of the Texas tobacco lawyers, uses accounting information to manage his law office. Businesses Business managers use accounting information to set goals for their organizations, to evaluate progress toward those goals, and to take corrective action if necessary. Decisions based on accounting information may include which building to purchase, how much merchandise to keep on hand, and how much cash to borrow. Investors Investors provide the money a business needs to begin operations. To decide whether to invest in a company, potential investors evaluate what income they can expect from their investment. This means analyzing the financial statements of the business and keeping up with developments in the business press—for example, The Wall Street Journal and Business Week. Creditors Before making a loan, creditors (lenders) such as banks determine the borrower's ability to meet scheduled payments. This evaluation includes a report on the borrower's financial position and a prediction of future operations, both of which are based on accounting information. To borrow from a bank before striking it rich, Harold Nix probably had to document his income and financial position. Government Regulatory Agencies Most organizations face government regulation. For example, the Securities and Exchange Commission (SEC), a federal agency, requires businesses to disclose certain financial information to the investing public. Taxing Authorities Local, state, and federal governments levy taxes on individuals and businesses. Income tax is figured using accounting information. Businesses determine the sales tax they owe from accounting records that show how much they have sold. Nonprofit Organizations Nonprofit organizations—such as churches, hospitals, government agencies, and colleges—use accounting information in much the same way that profit-oriented businesses do. Other Users Employees and labor unions make wage demands based on employers' reported income. Consumer groups and the general public are also interested in the amount of income businesses earn. Newspapers report improved profit pictures for companies as the nation emerges from economic downturns. Such news, based on accounting information, has an effect on our standard of living. Financial Accounting and Management Accounting Users of accounting information may be categorized as external users or internal users. This distinction allows us to classify accounting into two fields—financial accounting and management accounting. Financial accounting focuses on information for people outside the firm. Creditors and outside investors, for example, are not part of the day-to-day management of the company. Government agencies and the general public are external users of a firm's accounting information. Chapters 2-18 of this book deal primarily with financial accounting. Management accounting focuses on information for internal decision makers, such as top executives, department heads, college deans, and hospital administrators. Chapters 19-26 cover management accounting The Authority Underlying Accounting In the United States, a private organization called the Financial Accounting Standards Board (FASB) determines how accounting is practiced. The FASB works with a governmental agency, the Securities and Exchange Commission (SEC), the American Institute of Certified Public Accountants (AICPA), and the Institute of Management Accountants (IMA), two large professional organizations of accountants. Certified public accountants, or CPAs, are accountants who are licensed to serve the general public rather than one particular company. Certified management accountants, or CMAs, are licensed accountants who work for a single company. The rules that govern public accounting information are called generally accepted accounting principles (GAAP). Exhibit 1-2 diagrams the relationships among the various accounting organizations. Ethics in Accounting and Business Standards of Professional Conduct Types of Business Organizations Proprietorships Partnerships Corporations INSTRUCTORS NOTE: SHOW EXHIBIT 1-3 ON PAGE 4 Accounting Concepts and Principles The Entity Concept The most basic concept in accounting is that of the entity. An accounting entity is an organization or a section of an organization that stands apart as a separate economic unit. In accounting, boundaries are drawn around each entity so as not to confuse its affairs with those of other entities. Consider Harold Nix, one of the Texas lawyers. Think back to when Nix was starting out as a young lawyer, fresh out of law school. Suppose he began his law practice with $5,000 obtained from a bank loan. Following the entity concept, Nix would account for the $5,000 separately from his personal assets, such as his clothing, house, and automobile. To mix the $5,000 of business cash with his personal assets would make it difficult to measure the financial position of Nix's business. Consider Toyota, a huge organization with several divisions. Toyota management evaluates each division as a separate accounting entity. If sales in the Lexus division are dropping, Toyota can find out why. If sales figures from all divisions of the company are combined, management will not know that Lexus sales are going down. Thus, the entity concept also applies to the parts of a large organization—in fact, to any economic unit that needs to be evaluated separately. The Reliability (Objectivity) Principle Accounting records and statements are based on the most reliable data available so that they will be accurate and useful. This guideline is the reliability principle, also called the objectivity principle. Reliable data are verifiable. They may be confirmed by any independent observer. For example, Harold Nix's $5,000 bank loan is supported by a promissory note. This is objective evidence of the loan. Ideally, accounting records are based on information that flows from activities documented by objective evidence. Without the reliability principle, accounting data might be based on whims and opinions. Suppose you want to open a stereo shop. For a store location, you transfer a small building to the business. You believe the building is worth $155,000. To confirm its cost to the business, you hire two real estate appraisers, who value the building at $147,000. Which is the more reliable estimate of the building's value, your estimate of $155,000 or the $147,000 professional appraisal? The appraisal of $147,000 is more reliable because it is supported by an independent, objective observation. The business should record the building cost as $147,000. The Cost Principle The cost principle states that acquired assets and services should be recorded at their actual cost (also called historical cost). Even though the purchaser may believe the price is a bargain, the item is recorded at the price paid in the transaction and not at the expected cost. Suppose your stereo shop purchases equipment from a supplier who is going out of business. Assume that you get a good deal and pay only $2,000 for equipment that would have cost you $3,000 elsewhere. The cost principle requires you to record the equipment at its actual cost of $2,000, not the $3,000 that you believe the equipment is worth. The cost principle also holds that the accounting records should maintain the historical cost of an asset for as long as the business holds the asset. Why? Because cost is a reliable measure. Suppose your store holds the stereo equipment for six months. During that time, stereo prices rise, and the equipment can be sold for $3,500. Should its accounting value—the figure on the books —be the actual cost of $2,000 or the current market value of $3,500? According to the cost principle, the accounting value of the equipment remains at actual cost, $2,000. The Going-Concern Concept Another reason for measuring assets at historical cost is the going-concern concept, which holds that the entity will remain in operation for the foreseeable future. Most firm resources—such as supplies, land, buildings, and equipment—are acquired to use rather than to sell. Under the going-concern concept, accountants assume that the business will remain in operation long enough to use existing resources for their intended purpose. To understand the going-concern concept better, consider the alternative, which is to go out of business. A store that is holding a Going-Out-of-Business Sale is trying to sell all its holdings. In that case, instead of historical cost, the relevant measure is current market value. Going out of business, however, is the exception rather than the rule. The Stable-Monetary-Unit Concept In the United States, we record transactions in dollars because the dollar is the medium of exchange. British accountants record transactions in pounds sterling, and the Japanese record transactions in yen. The value of a dollar or a Mexican peso changes over time. A rise in the price level is called inflation. During inflation, a dollar will purchase less milk, less toothpaste, and less of other goods. When prices are stable—when there is little inflation—a dollar's purchasing power is also stable. Accountants assume that the dollar's purchasing power is stable. The stable-monetary-unit concept is the basis for ignoring the effect of inflation in accounting. It allows us to add and subtract dollar amounts as though each dollar has the same purchasing power as any other dollar at any other time. ACCOUNTING CONCEPTS AND PRINCIPALS The Entity Concept The Reliability (Objectivity) Principle The Cost Principle The Going-Concern Concept The Stable-Monetary-Unit Concept The Accounting Equation INSTRUCTORS NOTE: SHOW RESOURCE “The Accounting Equation” Assets and Liabilities Assets are the economic resources of a business that are expected to be of benefit in the future. Cash, office supplies, merchandise, furniture, land, and buildings are assets. Liabilities are outsider claims, which are economic obligations—debts—payable to outsiders. These outside parties are called creditors. Owner's Equity Insider claims to the business's assets are called owner's equity, or capital. These are the claims held by the owners of the business. Owners have a claim to the entity's assets because they have invested in the business. Accounting for Business Transactions In accounting terms, a transaction is any event that both affects the financial position of the business entity and can be recorded reliably INSTRUCTOR NOTE: OPEN AND EXPLAIN TRANSACTIONS 1 THRU 11 STUDENTS SHOULD UNDERSTAND THE FOLLOWING: TRANSACTION 1: For every transaction, the amount on the left side of the equation must equal the amount on the right side. The first transaction increases both the assets (in this case, Cash) and the owner's equity of the business (Gay Gillen, Capital). To the right of the transaction, we write Owner investment to keep track of the reason for the effect on the owner's equity. TRANSACTION 2: The cash purchase of land increases one asset, Land, and decreases another asset, Cash, by the same amount. After the transaction is completed, Gillen's business has cash of $10,000, land of $20,000, no liabilities, and owner's equity of $30,000. Note that the sums of the balances (abbreviated Bal.) on both sides of the equation must always be equal. TRANSACTION 3: Office Supplies is an asset, not an expense, because the supplies can be used in the future. The liability created by this transaction is an account payable. Recall that a payable is a liability. TRANSACTION 4: This revenue transaction caused the business to grow, as shown by the increases in total assets and in the sum of total liabilities plus owner's equity. A company that sells goods to customers is a merchandising business. Its revenue is called sales revenue. By contrast, Gay Gillen and Harold Nix, the attorney, perform services for clients; their revenue is called service revenue TRANSACTION 5: Expectations included in problem TRANSACTION 6: Because expenses have the opposite effect of revenues, they cause the business to shrink, as shown by the smaller balances of total assets and owner's equity. Each expense should be recorded in a separate transaction. They are listed together here for simplicity. We could record the cash payment in a single amount for the sum of the four expenses, $3,100 ($400 + $1,100 + $1,200 + $400). In all cases, the balance of the equation holds, as we know it must. Businesspeople, Gay Gillen included, run their businesses to have more revenues than expenses. An excess of total revenues over total expenses is called net income, net earnings, or net profit. If total expenses exceed total revenues, the result is a net loss. TRANSACTION 7: The payment of cash on account has no effect on the asset Office Supplies because the payment does not increase or decrease the supplies available to the business. TRANSACTION 8: Gillen remodels her home at a cost of $15,000, paying cash from personal funds. This event is not a transaction of Gay Gillen eTravel. It has no effect on the travel agency and therefore is not recorded by the business. It is a transaction of the Gay Gillen personal entity, not Gay Gillen eTravel. This transaction illustrates the entity concept. TRANSACTION 9: Total assets are unchanged from the preceding transaction's total. Why? Because Gillen merely exchanged one asset for another. Also, total liabilities and owner's equity are unchanged TRANSACTION 10: Expectations included in problem TRANSACTION 11: Gillen's withdrawal of $2,100 cash decreases the asset Cash and also the owner's equity of the business. The withdrawal does not represent a business expense because the cash is used for personal affairs. We record this decrease in owner's equity as Withdrawals or as Drawings. The double underlines below each column indicate a final total. The Financial Statements Financial Statement Headings Relationships Among the Financial Statements Chapter 2: Recording Business Transactions The Account The basic summary device of accounting is the account, the detailed record of the changes that have occurred in a particular asset, liability, or owner's equity during a period of time. For convenient access to the information, accounts are grouped in a record called the ledger. This is what we mean when we say keeping the books and auditing the books. A ledger usually takes the form of a computer listing. Accounts are grouped in three broad categories, according to the accounting equation: ASSETS = LIABILITIES + OWNER'S EQUITY Assets INSTRUCTORS NOTE: OPEN RESOURCE Assets Liabilities INSTRUCTORS NOTE: OPEN RESOURCE Liabilities Owner's Equity INSTRUCTORS NOTE: OPEN RESOURCE Owner’s Equity Double-Entry Accounting Accounting is based on a double-entry system, which means that we record the dual effects of a business transaction. Each transaction affects at least two accounts. For example, Gay Gillen's $30,000 cash investment in her travel agency increased both the Cash account and the Capital account of the business. It would be incomplete to record only the increase in the entity's cash without recording the increase in its owner's equity. Consider a cash purchase of supplies. What are the dual effects of this transaction? The purchase (1) decreases cash and (2) increases supplies. A purchase of supplies on credit (1) increases supplies and (2) increases accounts payable. All transactions have at least two effects on the entity. The T-Account Increases and Decreases in the Accounts Recording Transactions in the Journal Copying Information (Posting) from the Journal to the Ledger The Flow of Accounting Data Transaction Analysis, Journalizing, and Posting to the Accounts Accounts After Posting The Trial Balance Correcting Trial Balance Errors Details of Journals and Ledgers Posting from the Journal to the Ledger The Four-Column Account Format: An Alternative to the T-Account Format Chart of Accounts in the Ledger The Normal Balance of an Account Expanding the Accounting Equation to Account for Revenues and Expenses Expanded Problem Including Revenues and Expenses Transaction Analysis, Journalizing, and Posting Ledger Accounts After Posting Trial Balance Lab Day One Read Chapters 1, 2 and 3