030311 econ loans and real estate 100m

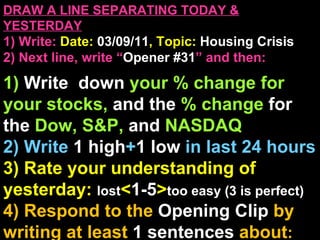

- 1. DRAW A LINE SEPARATING TODAY & YESTERDAY 1) Write: Date: 03/09/11 , Topic: Housing Crisis 2) Next line, write “ Opener #31 ” and then: 1) Write down your % change for your stocks, and the % change for the Dow, S&P, and NASDAQ 2) Write 1 high + 1 low in last 24 hours 3) Rate your understanding of yesterday: lost < 1-5 > too easy (3 is perfect) 4) Respond to the Opening Clip by writing at least 1 sentences about : Your opinions/thoughts OR/AND Questions sparked by the clip OR/AND Summary of the clip OR/AND Announcements: None

- 2. Agenda 1) Good Loans vs Bad Loans 2) Real Estate Investing End Goal, you will be able to… 1) When is it good to borrow? Reminder 1) Find a house and print it out: trulia.com

- 3. Notes #28a , Title: “ Loans ” 1) Credit Basics : 3 Companies Track Your Credit History: Experian, Equifax, Transunion. 500-850 670 avg, 750+ good a) Length of Good Credit History: Having a credit card and loans paid on time. b) % of Credit Card Balances Used: Keep under 25% each account c) New Credit or Loans Getting new loans + credit cards lowers score. Credit checks lower small bit (but not when you check your own credit)

- 5. Power of Good Credit http://www.bankrate.com/calculators/mortgages/mortgage-calculator.aspx

- 7. 2) Credit Safety: a) Check your credit report once a year ($10) or sign up for a monthly monitoring system ($10/mo) b) Using credit card is safer than using debit card (since easier to dispute credit card bill than to retrieve money) c) Careful who you give SSN#, Mother’s Name, and passwords ( phishing ) d) Read your bills, you only have 60 days e) You must request fixes, won’t fix itself f) Mint.com (free) account/budget monitor

- 11. Most Common Passwords 1. 123456, 123, 123123, 01234, 2468, 987654, etc 2. 123abc, abc123, 246abc 3. First Name 4. Favorite Band 5. Favorite Song 6. first letter of given name then surname 7. qwerty, asdf, and other keyboard rolls 8. Favorite cartoon or movie character 9. Favorite sport, or sports star 10. Country of origin 11. City of origin 12. All numbers 13. Some word in the dictionary 14. Combining 2 dictionary words 15. any of the above spelled backwards 16. aaa, eee, llll, 999999, and other repeat combinations

- 14. Notes #28a , Title: “ Loans ” 3) Credit Cards: Credit cards are a type of open ended bank loan. Your credit card is with a bank or company. Visa and MasterCard are just the money messengers like a UPS/FedEx.

- 15. Bank X Bank Y Savings Rate % + Loan Defaults (costs) Loan Rate % (profits)

- 17. Credit Card Traps : 1) Missing one payment or spending beyond your limit may raise your APR (even on other cards) 2) A high APR card, paying just the minimum balance may never pay off your debt. 3) Remember APR is compounding, so credit cards want you to be in debt. ALWAYS PAY OFF HIGHEST RATE DEBT FIRST! http://www.credit.com/products/credit_cards/secure.jsp

- 18. ALWAYS PAY OFF HIGHEST RATE DEBT FIRST! Scenario: You have an extra $1000 dollars, do you: A-$1000 save for rainy day B-$1000 invest in mutual funds earning 10% C-Pay off $1000 credit card debt (15% APR) D-Pay towards $8000 crt crd debt (5% APR)

- 22. Journ #29a , Title “ Negotiating Rate ” 1) Write a call script to Chase Bank, trying to get your credit card rates reduced. Make sure you cover: a) What are you asking for? b) Why? c) What will happen if they don’t. If you close down your card, you will be expected to pay off your balance.

- 23. Notes #29a , Title: “ Loans ” 1) Appreciating : Gain value over time: education, real estate, businesses 2) Depreciating : Lose value over time: clothes, cars 3) Loans and the American Dream : Loans allow anyone who will work hard to get a chance. Without loans, the economy would grow slower since you’d have to raise $. Poor students can get an education, small businesses can expand into a new area.

- 24. Journ #29b , Title “ Spending List ” 1) List the things you spend money on in a year. Next to each, put down 2 things: $ spent AND + - for if it will + appreciate or - depreciate over time. Example: Eating out $1500 - (using avg of 50 weeks a year) Be ready to present 2) Share with a partner, have them sign your notebook.

- 25. Notes #29b , Title: “ Loans ” 4) FAFSA : Universal gov form to calculate how wealthy you are, all citizens can always borrow full cost of their education. (ability to pay for college) a) Subsidized Loans : Gov pay part of the interest, making loan cheaper (pay after you graduate) b) Unsubsidized Loans : You pay market rate for loan (pay after you graduate) If a $120,000 law school loan will make you $120,000 a year, a great investment. If 120k, to become an actor, hmmmmm. http://www.forbes.com/2006/05/20/06Journ_bestpayjobs_slide.html?partner=msnedit

- 26. Student Aid Steps Collect tax forms (w2) Fill out FAFSA Colleges will provide you their package of aid + loans Minus tuition, college issues a check of whatever is leftover Pay back after graduating

- 27. Notes #29b , Title: “ Personal Finance ” 5) Business Loan : Most small businesses borrow from small banks (but can also apply for gov small biz loans). Larger biz will sell bonds (complex loan by investors)

- 28. Notes #30a , Title: “ Personal Finance ” 1) Home Loans : a) 80/20 Loan: Pay 20% down, cheapest APR, right now about 5% APR. b) <20 Down: Add mortgage insurance (PMI) c) Fixed Loan: Fixed APR (15yr or 30yr) d) ARM Loan: Adjust to inflation, good current int is high, (sometimes a mix: 5/1) . e) Interest Loan: Pay interest first, then principal, cheaper bills earlier, more exp later (used if you plan to sell right away) f) Equity: All wealth you own minus all debt g) Home Equity Loan: Use house equity (% of value you own) as down for new loan.

- 29. Journ #30a , Title “ Should You Buy ” Here’s the scenario, you make: $70k, after tax monthly: $4000 (48k). 1) List your monthly cost, ranges: a) Food (out+cook): $150-X b) Cable+Internet: $30-200 c) Cell: $10-80 d) Electricity: $20-80 e) Gas + Insurance (liability or full): $80-200 f) Shopping: $50-X g) Car Payments (10k-40k): $150-600 h) College Loans (15k-150k): $100-1000 i) Savings: $4000 - (A thru H) DOUBLE CHECK

- 30. Journ #30a , Title “ Should You Buy ” Here’s the scenario, you make: $70k, after tax monthly: $4000 (48k). You live in San Jose: Monthly Mortgage: $1700+400=2100 P Tax (1% of price): $250=2,350 Just Rent: $1,569 2) Explain if you should buy or rent. 3) Share, write down your partner’s reason ( include their name )

- 31. Journ #30b , “ Buy or Not Debate ” 1) Read the 2 sides, choose 1 side, and write which you choose and explain why . 2) Then write down what your partner thinks ( include their name at the end ). 1 2 3 4 5 CON: Not Buy 1) You aren’t tied down to one location, you+your money can move 2) You could find something better later 3) House have expenses: taxes, repairs, disasters PRO: Buy House 1) Property is fixed in supply, so value will go up over time 2) Also, houses are investments you can live in and save money that way 3) Loan % is tax deducible

- 32. Go to Trulia.com or other housing sites (like: siliconvalleylofts.com ) Fill out: http://tinyurl.com/chiangfindahome

- 33. Journ #30c , Title “ Should You Buy ” 1) Write down these steps: a) Find a broker b) Go to bank, get pre-approved loan c) Find house, make offer d) Escrow: Inspect, Draft Contract e) Mortgage: Hand over bank check 2) Copy Source Title: Property Ladder 3…) Discuss questions on the board

- 34. Notes #30a , Title: “ Housing Bubble ” 1) Rising Market : More Loans=Rise House Prices Gov wants more Am. to reach Am. Dream of home ownership, pressures Fannie Mae+Freddie Mac Federal National Mortgage Assoc + Federal Home Loan Mortgage Corp 9/11, Fed Reserve lower interest rates to prevent econ panic Early 2000s dot com bust, ppl switch to put $ into housing More money + low interest rates = more loans/more home buys

- 36. Notes #31a , Title: “ Housing Bubble ” 2) Housing Crisis : a) Traditional Bank Profit Model: Loan, make money off interest % , bank owns mortgage b) Liquidity: Amount banks have to lend (trad. based on what’s in saving accts) c) Subprime Loan: Loans to low credit borrowers (banks used to avoid these) BANKING MODEL: Banks attract savers by paying % Use savers money to loan, getting % The margin between % is their profit

- 37. Notes #30a , Title: “ Housing Bubble ” Increasing available money for more home loans

- 38. Bank Video

- 39. 2) Housing Crisis : d) Securitization: Bank sells mortgage to investment firm, that will sell it investors e) Mortgage Back Security: The security investors buy (bits of many mortgages)

- 40. 2) Housing Crisis : f) Fannie + Freddie: Gov agencies created to buy “good” MBS, to increase bank liquidity (thus increase home loans) g) Goldman Sachs: One of many firms that sell risky MBS

- 41. Fox Clip Video

- 42. 3) Derivatives : Investments that earn money off other investments. 4) Federal National Mortgage Association ( Fannie Mae ) and Federal Home Loan Mortgage Corporation ( Freddie Mac ) : Launched by gov (meant to be private once launched) to buy loans (keep %) and then to sell as bonds (pay % to investor) so banks can lend more (poorer ppl get easier loans) 5) Mortgage Backed Securities ( MBS ) : a kind of derivative, inst. like FM bundle up loans to sell as bonds. MBS spread risk, bank now safer, but economy exposed to wide/small risk 1000 1000 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 2000 bank liquid

- 43. Notes #30a , Title: “ Housing Bubble ” 6) Where are the profits : Home owner pays Check (interest 5% ) Bank doesn’t own the mortgage anymore, but gets partial % for operating the loan Goldman Sachs (private) + Fannie (gov) keeps partial % for packaging the loan Investors who buy these mort. back securities get remainder of the %

- 44. The secondary market help spreads the risk So if one house goes bad, it is less painful for anyone party 1000 1000 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10

- 45. Notes #30a , Title: “ Housing Bubble ” 7) Why Banks Loan to Poor ? Banks loan to ppl who can’t pay, person misses mortgage payments (defaults) Bank sells loan to financial firm, gets fee for managing loan (volume more imp than quality) Bank forecloses, and sells house on rising market Bank recoups loan from the sell + makes money of the interest before the default

- 46. 60 Minutes Video

- 47. SETUP Mortgage: Loan agreement specifies how much you pay monthly. Securities: Any investment that buyers/sellers have agreed to terms. Bonds: A paper saying someone owes you money. On a regular basis they pay interest to you, at end of agreed time, they pay off principle. Stage 1: Person 1: Borrower Person 2` : Chase Bank Stage 2: Person 3: Financial Institution (Person 1 is safe: Fannie Mae)/Person 1 is risky: Goldman Sachs) Person 4: Investor MATERIALS: Person 1: 10x$10X Person 2: 10x$1 and one piece of paper that will become the mortgage Person 3: 10x$10X and 10 small pieces of paper that will become MBS Person 4: 10x$10 STEPS 1) Borrower borrows $100X, writes a mortgage saying how much he/she will pay back each month. Borrower gets bank's money, bank gets mortgage. 2) Bank keeps mortgage and collects the routine mortgage payments. 3) Bank sells mortgage to financial institution, gets money 4) Financial institution all get together, collects all the mortgages, mixes them all up, and writes bonds that are mortgage backed 5) Financial institution sells them to investors. Investors get the trickle down money from the loans. (Bonds are loans, so financial institution owes investors money)

- 49. MATERIALS: 1-Banker: 5x$100 2-Borrower: 10x$1 AND one piece of paper that will become the mortgage 3-Financial Institution: 5x$100 AND 4 small pieces of paper that will become MBS 4-Investor: 5x$100

- 50. STEPS 1) Borrower borrows $400, WRITES a mortgage saying how much he/she will pay back each month. Borrower gets bank's money, bank gets mortgage. SIGN it and exchange mortgage for money. 2) Bank keeps mortgage and collects the routine agreed to mortgage payments. 3) Bank sells $400 mortgage to financial institution, bank gets $400 money (bank gets some % of the mortgage as a fee for servicing a loan they don’t own) 4) Financial institution all get together, collects all the mortgages, mixes them all up, and writes bonds that are mortgage backed (bond=iou, so investors get mort. $) 5) Financial institution sells them to investors. Investors get the trickle down money from the loans. (Bonds are loans, so financial institution owes investors money)

- 51. Derivatives Are Not Bad They spread the risk, which means the system is more stable, since a larger group of investor feel just a small part of the pain. Derivatives free up money, and if banks are loaning to risky people, it’s creating more and more risk for everyone.

- 52. Notes #24a , Title: “ Housing Bubble ” 6) Collateralized Debt Obligation (CDO) : Broader term for any loan packed and sold as bonds (MBS is a kind of CDO, CDO just broader term) 7) Goldman Sachs : Investment bank that packages many riskier MBS + CDO.

- 53. Notes #24a , Title: “ Housing Bubble ” 8) Credit Default Swap (CDS) : An insurance policy that fin. inst. can buy, so in case the derived money stream dries up, insurance pay off bond. 9) AIG : America’s largest insurance company

- 54. CDS Video

- 55. Notes #31a , Title: “ Housing Notes ” 10) AIG received $85 billion taxpayer bailouts AIG uses the money to honor their insurance policies, including paying Goldman Sachs for the CDS. Goldman Sachs reports earning $13 billion in 2009, avg $380,000 bonus per worker.

- 56. Notes #31a , Title: “ Housing Bubble ” 11) Glass-Steagall Act of 1933 : Banned banks from doing investments + insurance 12) Financial Services Modernization Act of 1999 : Allowed banks, investment firms, and insurance companies to merge. Traditionally, banks were to use savers money for restrict to two things: a) loans b) bonds. All foreclosed property had to be sold right away, no speculating. If all services combined, if one service fails, it can bring the wider bank and all everyone down .

- 57. Notes #31a , Title: “ Housing Bubble ” 13) Glass-Steagall Act of 1933 : Banned banks from doing investments + insurance 12) Financial Services Modernization Act of 1999 : Allowed banks, investment firms, and insurance companies to merge. Traditionally, banks were to use savers money for restrict to two things: a) loans b) bonds. All foreclosed property had to be sold right away, no speculating. If all services combined, if one service fails, it can bring the wider bank and all everyone down .

- 60. Housing Bubble Pops Summary: 9/11, Fed Reserve lower interest rates to prevent econ panic. Gov encourage loans to poorer ppl. Fannie, Freddie (and financial firms take riskiest) buy bank’s loans to free them to loan more. Cheap/easy loans AND house flippers fuel hot housing market Invest. banks develop new ways to package loans into bonds. Even more, more riskier loans!

- 62. Housing Bubble Pops Summary: Property prices drop, money flow to those derivatives stop. No one knows which derivates aren’t tainted (MBS, but also in commercial real estate and business loans packaged in other CDOs) Loans dry up > biz stop producing excess (lay offs), biz cycle correction taking place Prices drop, surplus gone, but loans still hard, and psychology still in recession mode.

- 64. Mr. Chiang’s 7 Speech Tips 1) 3 Part: Opening > Argument > Closing 2) Think of your audience and use local examples 3) Stories are remembered 4) Cite authoritative evidence 5) Call audience to action 6) Repetition, pauses, tone 7) Speak slowly and make eye contact (or try looking over heads) Last, the majority of speech is body language, not words.

- 65. Journ #31a , Title “ Video: Mortgage Meltdown ” 1) Copy Source Title: CNN 2…) Discuss questions on the board with a partner. Summarize your discussion ( include their name at the end ). Remember participation points are deducted if off task. 5 Reading/Film Qs Come From These Journ Sections Time Bookmark: 00:00

- 66. Journ # , Title “ Marketplace: 3/04 ” Pre-Sale 1a-b-c) a- List items b- est cost c- sell prices Post-Sale 2) Record your sales $ at the end of the round 3) Reflect on what can be done better to increase business next time, focus on what products are in demand (not mean you can or want to supply it) and how marketing can be improved next time (branding+advertising). -Remember you can pay with checks -If your salary is higher, you should feel obliged to spend more + pay more -Norm our market, treat as real $ (think of your cost) -Cleaners