International Outlet Journal - 2016

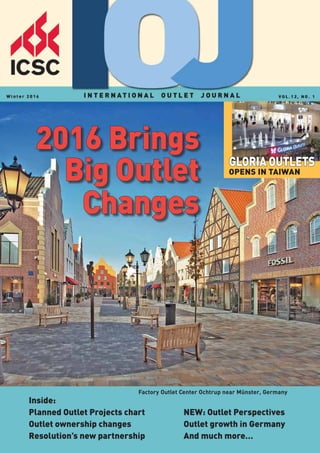

- 1. Factory Outlet Center Ochtrup near Münster, Germany 2016 Brings Big Outlet Changes Inside: Planned Outlet Projects chart NEW: Outlet Perspectives Outlet ownership changes Outlet growth in Germany Resolution’s new partnership And much more… Gloria Outlets opens in Taiwan

- 2. MCARTHURGLEN NOVENTA DI PIAVE PHASE IV A new phase for one of Europe’s most exciting designer outlets. For leasing contact Patrizia Pinato at Patrizia.Pinato@mcarthurglen.com or +39 02 888 36864. MCARTHURGLENGROUP.COM

- 3. Contents Inside Advertiser Index Fashion House Group........................... BC ICSC European Outlet Conference......... 13 ICSC RECon........................................... 23 McArthurGlen.......................................IFC Neinver....................................................5 Winter 2016 4 IOJ’s Planned Outlet Centers chart shows 30 new projects in the pipeline 6 Cover Story: McArthurGlen’s performance drives the developer’s growth in Germany and beyond 8 Ownership changes come quickly for outlet centers in Poland, the Czech Republic and Peru 10 Outlet Perspectives: IOJ’s new feature queries the industry on burning questions. For this issue, outlet executives talk about who spends more, tourists or locals. 12 Stable stays the course with new outlet centers in Germany 14 Silk Road, RDM keep up a steady outlet pace in China 16 The Outlet! Company and Gloria Hotel Group team up on Gloria Outlets in Taiwan 18 Nanjing East Outlets opens on a 77-acre site with plenty of room for expansion and recreation 20 Global News: Construction starts on Noventa di Piave’s fourth expansion; Fashion House Moscow will launch second phase in November; Fashion House Bucharest, which opened in 2008, added three new tenants in late 2015; holiday sales were joyful for Realm’s portfolio; Rioja wins approvals for Mill Green project; Millerchip promoted to new position at Realm; Resolution Property enters a new retail partnership. Vol. 12 No. 1 International Outlet Journal is a publication for the non-U.S. factory outlet industry. Copyright © 2016 STaFF Winter 2016 International Outlet Journal 3 IOJ/ICSC 1221 Avenue of the Americas 41st Floor New York, NY 10020-1099 www.valueretailnews.com ICSCEUROPE London, +44 20 7976 3100 icsc.europe@icsc.org Editor in Chief/Director Linda Humphers 1762 Emerald Dr. Clearwater, FL 33756 +1 727 781 7557 ext. 3 lhumphers@icsc.org Art Director/Ad Production Randy Gdovin +1 727 781 7557 ext. 4 rgdovin@icsc.org Advertising Sally Stephenson +1 847 835 1617 sstephenson@icsc.org Subscriptions/Customer Service Natasha Reed, Editorial Assistant +1 646 728 3558 nreed@icsc.org Contributing Writers/Editors Marie Driscoll 2015/2016 ICSC Officers Stephen D. Lebovitz,Chairman Thomas McGee, President and CEO Elizabeth I. Holland, Vice Chairman Robert F. Welantz, CRX, CSM, Past Chairman Glen Hale, Treasurer Patricia Norins, Publisher PAGE 6 PAGE 16PAGE 12

- 4. 4 International Outlet Journal Winter 2016 Planned Centers Europe: Planned Phase 1 Outlet Projects, 2016-2019* name city country Developer/Operator GLA sf GLA m2 date McArthurGlen Designer Ghent Belgium McArthurGlen Group 215,000 19,995 2019 Outlet Ghent Prague Outlet Prague Czech Prague Outlet 334,000 31,000 2016 Republic Billund Quality Outlets Billund Denmark Lalandia/REAM 129,600 12,000 Tallinn Outlet Tallinn Estonia Suda Maja/Rohleder Lumby 134,500 12,509 Zsar Outlet Village Vaalimaa Finland East Finland Real Estate 129,600 12,000 2017 Vaalimaa Luxury Outlet Vaalimaa Finland Gruppo Arcotecnica 115,344 10,680 2017 Outlet Village Helsinki Vantaa Finland Fortus and Glastad Farsund 108,000 10,000 Village d’Aquitaine Bordeaux France Bergerac Outlets SAS 161,500 15,020 Marques Avenue Colmar Colmar France Concepts & Distribution 193,800 18,023 Viaduc Village LaCavalerie France Stone Market 64,670 5,988 The Village, Villefontaine Lyon France Freeport Retail Ltd. 269,100 25,026 2016 McArthurGlen Designer Miramas France McArthurGlen Group 280,000 26,040 2017 Outlet Provence Le Village des Alpes Nimes France Bergerac Estates Limited 215,278 20,021 (Bellegarde) Leipzig Fashion Outlet Brehna Germany Stable International 172,200 16,015 2016 Designer Outlet Village Duisburg Germany Freeport Retail Ltd. 280,800 26,114 2017 McArthurGlen Designer Remscheid Germany McArthurGlen Group 286,200 26,500 2017 Outlet Köln (Köln) Werl The Style Outlets Werl Germany NEINVER 182,992 17,018 2016 MO Fashion Outlet Budapest Hungary Rioja Developments 161,500 15,020 San Pellegrino Outlet Village San Pellegrino Italy Arcus Real Estate 139,900 13,011 2016 Torino Outlet Village Turin Italy Arcus Real Estate 209,900 19,521 2016 Centerfalls Designer Beirut Lebanon Sidcom 324,000 30,132 2016 Outlet Resort Amsterdam The Style Outlets Amsterdam Netherlands NEINVER 204,520 19,020 2016 Zevenaar Fashion Outlets Zevenaar Netherlands Stable International 194,400 18,000 2018 Algarve The Style Outlets Faro Portugal NEINVER 252,960 23,525 2016 Fashion House Outlet Bucharest Romania FASHION HOUSE Group 189,000 17,500 2016 Centre Bucharest East FASHION HOUSE Outlet St Petersburg Russia FASHION HOUSE Group 398,000 37,014 2017 Centre St. Petersburg Viladecans The Style Outlets Barcelona Spain NEINVER 285,252 26,528 2016 Istanbul Fashion Outlet Istanbul Turkey ArcoRetail S.p.A. 559,700 52,052 McArthurGlen Designer Istanbul Turkey McArthurGlen Group 215,300 20,000 2018 Outlet Istanbul (Asia) McArthurGlen Designer Istanbul Turkey McArthurGlen Group 215,300 20,000 2018 Outlet Istanbul (Europe) 30 planned centers 18 developers/operators 6,622,316 615,272 *11 are planning 2016 openings Source: VRN/IOJ

- 5. Experience, Profitability and Future A quality shopping experience based on location, architectural design, brand mix and services. The Style Outlets and FACTORY outlet centres offer choices that are functional and efficient while remaining attractive to shop operators and visitors. Marketing and leasing strategies that ensure successful results, increasing sales and foot traffic with a total of 42 million customers visiting our outlet centres in 2014. And all this upholding the principles of economic and environmental sustainability. Vicolungo The Style Outlets 311,600 SQ.M. 1,450 SHOPS FRANCE GERMANY ITALY POLAND PORTUGAL SPAIN

- 6. 6 International Outlet Journal Winter 2016 Cover Story Long a believer in the outlet potential of Germany, MCG adds a 3rd center there as plans for a 4th move forward. A new joint venture announced in November gives McArthurGlen the majority stake in Hütten Holding’s Fac- tory Outlet Center Ochtrup near Münster in the Rhine-Ruhr region of northwest- ern Germany. MCG will operate the 18,000-m2 center, handling its day-to-day management, marketing and leasing. FOC Ochtrup was developed in 2004 by fashion and retail entrepreneur Thomas Dankbar, the principal of Hütten Holding. His vertical fashion company Bianca has its factory in Ochtrup, Already a successful center with more than 2 million visitors annually, Ochtrup Outlet is home to 65 tenants including Nike, Adidas, Liebeskind, Lacoste, Esprit, Bogner and Tom Taylor. McArthurGlen Group, which currently manages 22 centers in nine countries, al- ready operates two designer outlets in Ger- many: McArthurGlen Berlin and McAr- thurGlen Neumünster, near Hamburg. The group is also investing a further €150 mil- lion in what will become its fourth German outlet center, McArthurGlen Remscheid MC adds FOC Ochtrup to its German portfolio Adidas Airfield Alfi Allrounder Ara Shoes Armani Australian Footwear Bellybutton Bench Benvenuto Betty Barclay Bianca BiBA Björn Borg Blutsgeschwister Bogner Fire + Ice Bugatti CECEBA Bodywear Cecil Clarks Comma Converse Crocs Daniel Hechter DC Depot Desigual Diesel DKNY Dockers Dornbusch Eat Ants Ecco Edc by ESPRIT Esprit Eterna Fossil Gant Garcia Gelco Geox Gin Tonic Home Hunkemöller Jack & Jones Jacques Britt Kahla Kanz Kneipp Lacoste Lambert Lemmi Levi’s Liebeskind Berlin Lindt Marc Aurel Marc by Marc Jacobs Marc O’Polo Junior Marc O’Polo Underwear Marc Picard FOC Ochtrup Brands Maruti Mephisto Mexx Michael Kors More & More Möve Mustang Nike O’NEILL Footwear Only Otto Kern Patagonia Pieces Pierre Cardin Puma Quiksilver Ravensburger Redford Roxy Salamander Samsonite Sanetta Schiesser Schwarze Rose Seidensticker Sigikid Signum Silit Skägen Sons and Daughters Speidel Steiff Street One Superfit Tom Tailor Tom Tailor Denim Tom Tailor Underwear Vero Moda Watch Station WMF Zodiac At the center of Factory Outlet Center Ochtrup, which features neoclassic architecture, is the 123-year-old Gebrüder Laurenz textile building (top photo).

- 7. Winter 2016 International Outlet Journal 7 near Cologne, due to open in 2017. Gary Bond, McArthurGlen’s Managing Director of Development, told IOJ that MCG has been pursuing this center for a while. “We’ve known Thomas Dankbar for a numbers of years,” he said, “and we are de- lighted to be working with him on taking the center to the next level. Thomas has incred- ible contacts throughout Germany – we’re looking forward to working closely with him to secure permission to extend the center by a further 8,000 square-meters. I hope this will be the first of many new partnerships across Europe.” Ochtrup, 1½ hours north of Dusseldorf, has a huge catchment -- 13 million in a three-hour radius, Bond said, adding that McArthurGlen has access to the brands that German shoppers love. “Germany has always been a prime target for us because of its high wages and high spending – and it’s still underserved by retail.” Dankbar said that MCG’s track record will be good for the center and the commu- nity. “I am very proud of how Ochtrup has developed since we first opened 11 years ago with just 5,000 m2 of GLA,” he said. “It is now time to take the center to the next level. McArthurGlen’s skills, resources and ways of working will bring huge benefits to the center and to the local economy.” Factory Outlet Center Ochtrup is a 30 minutes from Münster, features neo- classical architecture and a brick and glass design. At its center is an iconic 1893 listed building that used to belong to the Gebrüder Laurenz textile company. c Within the next three years McArthurGlen plans to expand the GLA of its 22-center portfolio by 50 per- cent, growing to almost 900,000 m2 at the end of 2019 from 600,000 m2 today: 4 Seven new projects are under way or in planning, all due to open by the end of 2019 in Ghent, Málaga, Normandie, Provence, Remscheid and two in Istanbul. When complet- ed, the projects will total more than 215,000 m2 of GLA. 4 Seven existing centers are expanding, delivering an ad- ditional 78,000 m2 worldwide. These expansions will be at McArthurGlen Designer Outlet Villages in Ashford, Eng- land; Naples, Venice and Milan, Italy; Parndorf, Austria; Roermond, The Netherlands; and Vancouver, Canada. McArthurGlen’s performance factors: l Portfolio turnover grew to around €3.5 billion between MCG performance drives Portfolio’s GLA expansion the beginning of 2012 and the end of 2015 – an increase of nearly 30 percent. l For 2015, McArthurGlen saw double-digit growth in both footfall and customer spend; tourism sales grew by more than 40 percent. l Tourism sales quadrupled between 2010 and 2014. Across the portfolio, the average spend per international customer is more than six times the average spend of local customers, with China as the biggest international customer, account- ing for more than a third of all tax-free sales. In 2015 tax-free sales figures grew 25 percent over tax-free sales in 2014. McArthurGlen, which secures more than 600 leases a year, added 50 new brands in 2015 to its tenant line-ups. Some of the new brands include Coach, Cesare Paciotti, Frey Wille, J. Crew, Kiton, Ports 1961 and Thomas Sabo. McArthurGlen has acquired a majority stake in Factory Outlet Center Ochtrup, which was opened in 2004 by Hütten Holdings.

- 8. Ownership Changes 8 International Outlet Journal Winter 2016 Parque Arauco expands outlet portfolio in Peru Santiago, Chile-based Parque Arauco in December 2015 acquired 100 percent ownership of Strip Centers del Perú, giving it full control of two planned projects and three existing cen- ters, including the 80,730-sf InOutlet Faucett in Lima. Parque Arauco had previously owned 51 percent of SCP and acquired the remaining 49 percent from prior investor Los Portales. In January Parque Arauco held the grand opening of InOutlet Premium in Lúrin, which is in southern Peru on the Panamericana Sur Highway. Brands tenanting the 91,800-sf center include Nike, Adidas, Tommy Hilfiger, Kenneth Cole, Calvin Klein, Dunkelvolk, and Marathon. Parque Arauco operates 8.8 million sf of retail space in Peru, Columbia and Chile. The portfolio includes three outlet centers in Chile and the two in Peru. The 274,500-sf Arauco Premium Outlet Buenaventura in Santiago, Chile opened in 2012. In 2014, the developer opened the 70,000-sf Arauco Premium Outlet San Pedro in San Pedro de la Paz, Concepción, and the 75,500-sf Arauco Premium Outlet Curauma in Valparaíso. The company opened its first shopping center in Chile in 1982, entered Peru in 2005 and Colombia in 2008. LaSalle investment group buys Futura Park Wroclaw Wroclaw Futura Park in Poland has been sold by IRUS European Retail Property Fund to LaSalle Investment Manage- ment for €27 million. The transaction took place in November, according to Neinver, which established the IRUS fund in 2007. The 20,200-m2 project coexists with Neinver’s 14,000-m2 Factory Wroclaw, which has a tenant line-up that includes Guess, Chicco, O´Neill, Caramelo, Reebok, Samsonite, Miss Sixty, BillaBong, Mango, Pepe Jeans, Polo Ralph Lauren, Adidas, Diesel, Hugo Boss, Tommy Hilfiger, Lee, Dockers, Rip Curl, Desigual, Levis, Nike, Gas, Benetton, Asics, Calvin Klein, Converse, Gant, Lindt, Puma, Triumph and Vanity Fair. Neinver will continue to manage Futura Park, which attracts more than 1.5 million visitors annually. IRUS Fund portfolio comprises a total of 11 outlet schemes, located throughout Spain, Portugal, Germany, Italy and Poland with a total GLA of 265,695 m2. and an appraised value of € 1,146,900,000. Neinver is under way on the 25,600-m2 Viladecans The Style Outlets near Barcelona, set to open this year; the 17,000- m2 Werl The Style Outlets (between Dusseldorf and Han- nover) and the 18,000-m2 Amsterdam The Style Outlets in the Netherlands, set to open in 2017. Freeport center sold to Austrian group; ROS will manage it In November the owners of Austria’s Fashion Outlet Parndorf acquired Freeport Fashion Outlet in Hate, Czech Republic, from VIA Group Portfolio. Freeport Retail opened the 242,200-sf center in 2003. The site is at the Austria-Czech border 50 miles north of Vienna and was formerly a duty-free zone. Tenants include Asics, Clarks, Esprit, Huber, Juicy Couture, Lego Wear, O’Neill, Pearl Izumi, Ray Ban, Speedo, Tony Perotti, Wellensteyn and Zwilling. The Parndorf center is 30 miles southeast of Vienna. The purchaser, Fashion Outlet Parndorf Investment Group, is a JV of APM Holding and BETHA Zwerenz & Krause. An additional investor for this purchase is the pension fund Versorgungswerk der Zahnärztekam- mer Berlin & Babcock Pensionskasse VVaG. The Parndorf group has retained ROS Retail Outlet Shopping for management, marketing and leasing of the Freeport center. The immediate plan is to upgrade the tenancy, amenities and marketing of Freeport Fashion Outlet. ROS now provides services for six outlet centers – Fashion Outlet Parndorf (Austria), Freeport Outlet (Czech Republic), Shopinn Brugnato Outlet Village (Italy) and three in Germany, Designer Outlet Soltau, City Outlet Bad Munstereifel and Fabrikverkaufe Geis- lingen, a 19-tenant center near Stuttgart. c Brands at Parque Arauco’s InOutlet Faucett in Lima, Peru include Billabong, Calvin Klein Jeans, RipCurl, Tommy Hilfiger and Quiksilver. Among the 70-plus outlet tenants at Freeport Fashion Outlet in the Czech Republic are Adidas, Asics, Benetton, Desigual, Geox, Guess and Lacoste.

- 9. FOR MORE INFORMATION, PLEASE VISIT WWW.ICSC.ORG/2016EOS OR CALL +44 20 7976 3100 #ICSCEUROPE ICSC European Outlet Conference 22 March 2016 Business Design Centre, London, United Kingdom In Association with: ICSC Global Partners ICSC European Partners Save The Date!

- 10. 10 International Outlet Journal Winter 2016 Outlet Perspectives Colin Brooks Managing Director, REALM An analysis of tourist shoppers within the Realm portfolio of outlet centres in the UK reveals three key trends: The further people travel, the greater their one-off spend Tourists adopt a mindset that helps them spend as they tend to be more relaxed and open to impulse purchas- ing. There is a novelty value, too, from seeing brands and products that are not normally so readily available to them in their home town or country, and they are inclined to take full advantage of hard-to-find items. The further people travel, the less satisfied they are The counter-intuitive relationship between greater spending and lower sat- isfaction is an example of the sunk-cost bias – a phenomenon which makes us behave and shop irrationally. The longer range outlet shopper may well have set off with the intention of buying shoes, luggage and cosmetics but they may discover a shortage of product in their specific size or preferred brand. At this point the voice inside their head will say “I have travelled nearly two hours to get here; there must be something I can buy.” This response results in their being more purposeful in an effort to justify the trip, resulting in a higher spend but overall lower satisfaction as their original desires were not met. Locals are loyal; tourists are fleeting Local shoppers from the sub 30-min- ute drive-time have an annualised spend that is on average four times the value of tourists who originate from the 90-minute-plus catchment. Longer range shoppers are clearly less suscepti- ble to tactical advertising, which in turn influences many marketing decisions. The return on promotional investment is easier to establish with a local, loyal and more engaged shopper who spends less during the visit but more through- out the year. Carlos González Managing Director, NEINVER Shopping tour- ism has become an often-decisive fac- tor in consumers’ travel experiences. Although Europe lags behind Latin America, Japan and emerging markets in this area, we have detected an increase in foreign visitors who come to outlet centers proactively, in search of fashion and accessories. Targeting both local and foreign shoppers, certain centers in The Style Outlets platform, including those in Italy and Germany, find that tourists ac- count for about 8 percent of their foot traffic. The nationalities that buy the most include Chinese and Russian visi- tors, who continue to spend more than average, and we have seen increased spending by visitors from Kuwait, Saudi Arabia and, to a lesser extent, Switzer- land. As shopping tourism keeps growing (it could well see an 88 percent increase by 2019, according to Euromonitor), the retail sector’s strategy must focus on meeting the wants and needs of a fast-growing segment of its customer base. In fact, in 2014 alone, this type of traveler spent €217 million on brands worldwide, and therefore it is vital to work towards customizing offerings and generating synergies with public institu- tions and industry organizations. Ken Gunn Partner and Director, FSP The contribution made by tourists to European outlet performance ranges from zero to 60 per- cent of sales. Where an outlet centre sits on this range is determined by many factors, including the desirability of its brands, quality of environment and architecture, proximity to major tourist attractions, provision of relevant services (e.g., tourist informa- tion, tax refund and bureaux de change) and the ability of managers to provide first-class customer service (in many languages) and to work proactively and strategically with domestic and interna- tional hospitality industry partners. It is easy to simply think of tourists as brand-hungry Chinese or Russians but the reality is much more diverse. While some centers serve the world’s major cities, there are also outlet centres serving large domestic tourist markets (such as Clarks Village and Shopinn Brugnato) and others that are daytrip magnets for large regional populations (such as Gunwharf Quays Who really spends the most at outlets?For the first Outlet Perspectives column, a new feature for IOJ, we asked five industry executives to describe the difference in spend at outlet centers between tourists and local shoppers. As you might guess, tourists – especially internationals – tend to spend more than locals, at least on their one visit. However, our executives brought up a number of interesting side issues on this topic, such as how to define a tourist and the yearly value of shoppers who spend less per visit but come to the center more often. Another surprising aspect of the tourist/local equation turns out to be satisfaction levels – those who travel the furthest, well, read on to find out. Brooks González Gunn

- 11. Winter 2016 International Outlet Journal 11 and McArthurGlen Roermond). Nearly half of tourism trips involve visiting friends and families, so even cities with relatively few recognisable attractions can still attract large num- bers of domestic tourists. When FSP undertook a visitor survey at a rural site in a relatively unheralded part of the UK, 75 percent of respondents who had travelled for longer than 15 minutes considered themselves to be on a day out rather than a shopping trip. This tourist or leisure mindset is one of the key strengths that differentiates outlet and full-price shopping venues, and it’s one of the strongest opportunities for further growth. The food and beverage offer at many outlet centres, particularly those in France and Germany, is weak and out of step with the requirements of many visitors. Tourists typically spend 25 percent more on F&B than they do on fashion, but F&B is less than 5 percent of sales at most outlet centres on the European continent. There are also op- portunities for leisure, and indeed, many outlet centers, such as Gunwharf Quays or Zweibrücken The Style Outlets, benefit from their adjacency to major leisure attractions. International tourists can spend nearly twice as much per visit as the average outlet visitor while domestic tourists spend around one and a half times the average. While this sounds very attractive, it is worth remembering that the potential for repeat visits during the year is limited. Over the course of a year for example, FSP’s analysis of outlet shopper value shows that regular visitors from the inner catchment can in fact spend more than three times the average value of a tourist making a single annual visit. Seasonal patterns can also result in substantial swings from quiet to heav- ily congested periods, and for some consumers, this can be a reason not to visit. It is therefore important to plan seasonal promotions carefully and to seek to manage visits across the year. In FSP’s experience, tourists represent core business for some outlet centres, but simply icing on the cake at others. It is important for operators to recog- nise the unique tourist/resident value opportunities that exist at every site and to adopt an appropriately balanced approach to attract visitors of all types. Whether they have travelled halfway around the planet, or just around the block, the best outlet centres work hard to create a sense of enjoyment in their positioning, seek to curate the perfect day out experience and provide excep- tional customer service, which makes all visitors feel that they are valued guests. Brendon O’Reilly Managing Director, FASHION HOUSE Group Our experience in Fashion House Group is obviously based on our busi- ness focus on the emerging markets of Central & East- ern Europe and Russia, which have many different characteristics compared to the outlet sector in more developed territories. Consumers in these markets, particu- larly enthusiastic to acquire Western European and U.S. brands, use outlet centers much more regularly, spend- ing less money per visit but making regular monthly visits, compared to the norms of the more developed economies. Therefore, what is really important for our business is the lifetime value of regu- lar customers, which we see by looking at their spend with us over a year rather than only looking at an average trans- action value per visit. And, of course, there’s more value in regular customers’ referrals and recommendations. What is the same in CEE/Russia as in the global outlet sector is that consum- ers who travel from further away tend to spend more per visit and stay longer. That is practically a universal truth, for sure. In our Fashion House Outlet Cen- tres, either in a resort such as Gdańsk or in the capital cities Warsaw, Bucharest and Moscow, there is a distinct tourist element to the customer base. Many are “shopping tourists” from neighbouring countries with high prices or limited supplies of Western goods. But normally, a high-spending tourist may well visit only one time, whereas our enthusiastic local fashionista may come dozens of times, such that the lifetime value of the local, regular shop- per will always be greater. Simon Rosenberg Senior Retail Consultant, FSP Since the 1980s the evolution of the outlet centre has been one where the role of experiential tourism has begun to play an integral part of the industry’s focus and growth. Traditionally the outlet centre role was to clear high volumes of overstock from mid-market brand names to do- mestic shoppers. Global brands would scorn at the idea of having a large exposure in such a potentially brand damaging channel. Today’s 4th generation outlets (The Vil- lage format) have given shoppers a destina- tion that is fun, mixed-use, enticing and is in effect a destination for a family day out and in some cases an evening activity, too. With larger catchments being drawn to such experiences, global brands are increas- ingly enhancing their stores to attract those shoppers in order to see growth and profit- ability in their own retail portfolios. The international tourist is an impor- tant catalyst for spreading loyalty and engagement back home. Once a custom- er has bought into the outlet equation of brands and values, she is more likely to seek out the brand in other distribution channels around the world. It is a route to feeding brand loyalty via the medium of price, promotion and experience. Such is the importance of the inter- national tourist. More and more opera- tors seek to use translated POS material, targeted promotions, shuttle buses and link trips to ensure that whoever the shoppers are and wherever they originate from, they will feel compelled to spend. New outlet developments are now primarily located close to major cities with strong motorway and/or rail links. We know that one key to success is making sure that tourists from any- where can arrive at the outlet centre with seamless efficiency. c For the Spring 2016 IOJ, Outlet Perspectives will ask brands, “What common denominators do you see in the centers where your stores perform the best? How about commonalities in centers where your stores struggle?” If you would like to provide your perspective on this question in 250 words or less, please send it to IOJ editor Linda Humphers at lhumphers@icsc.org by Tuesday, 1 March. O’Reilly Rosenberg

- 12. 12 International Outlet Journal Winter 2016 Center Opening With the 2015 opening of Fashion Outlet Montabaur, Germany now supports 12 outlet centers totaling almost 230,000 m2. Stable will add another in April. By LINDA HUMPHERS Editor in Chief When Stable International opened Fashion Outlet Montabaur more than 85 percent occupied on July 31, 2015, the de- veloper knew the center would perform well. First, the scheme is right on the A3, between Cologne and Frankfurt, where 165,000 cars pass daily – the A3 is Germany’s second-most frequently traveled motorway. And the center is just two minutes from the bustling Inter City Express rail station. So when 52,000 people visited Fashion Out- let Montabaur in its first three days, Stable was even more confident that the center’s perfor- mance would grow. Five months later, more than 1.5 million shoppers had visited the center and turnover is now 20 percent above forecast. The center’s sleek and open architecture per- fectly fits the outlet center of the future. Montabaur is in the geographic center of the two densely populated regions of Rhine- Main and Rhine-Ruhr. With a population of 17.5 million within 90 minutes, and an FOC- relevant demand volume of €4.9 billion, there is ample, and now proven, sales potential in this market. IOJ first reported on Fashion Outlet Mon- tabaur in 2008, which shows the commitment required to develop an outlet center in most of Europe. Between economic downturns for consumers, investors and brands, tough approvals processes by concerned munici- palities, and tenant radius restrictions (now disallowed), the outlet business isn’t for the faint-hearted. But now that Stable has opened the 14,000- m2 Fashion Outlets Montabaur, the company’s second German project will open in April. Stable stays the course with FOCs in Germany Asics Bassetti Benetton Better Rich Betty Barclay Bruno Banani Bugatti Camel Active Carl Gross Clarks Columbia* Comma Converse Desigual Diesel Dressler Esprit Estella Fossil Gaastra Garcia G-Star Hunkemöller Juvia Kunert La Place Levis Marc O Polo Marvelis Melvin and Hamilton Michel Herbelin Möve Mustang Nike Neill Odlo* Olea Pano Rich and Royal S. Oliver Salamander Schneiders Society Shop Stefanel Tom Tailor Tommy Hilfiger Triumph Vingino WMF *opening soon Fashion Outlet Montabaur tenants The 14,000-m2 Fashion Outlets Montabaur has seen robust footfall since its opening day on July 31, 2015.

- 13. Winter 2016 International Outlet Journal 13 Fashion Outlet Leipzig, also on the planning list since 2008, is already 90 percent leased. Phase 1 will be 11,000 m2 with space for 65 tenants, which will be followed by a second phase of 8,000 m2 that will add another 50 shops. The center’s site is within the triangle of Leipzig, Halle and Dessau, near the crossroads of the motorways A9 (from Munich to Berlin) and A14 (from Dresden to Hannover). The one-level center, which will be enclosed to accommodate the weather in the region, has been designed in the style of a Victorian market hall. In other news, Fashion Outlet Rosada, which Stable manages, reported a 12 percent increase in sales for 2015 com- pared to 2014. An 8,000-m2 expansion and complete makeover of the common areas will open there in May, bringing the center to 24,396 m2 and more than 100 stores. Fashion Outlet Rosada is in Roosendaal, the Netherlands, between Rotterdam and Antwerp. c Existing Outlet Centers in Germany Center Developer/Operator GLA sf GLA m2 Opened Montabaur Fashion Outlet Stable International Development BV 156,600 14,564 2015 McArthurGlen Designer Outlet Neumünster McArthurGlen Group 291,150 27,077 2012 Designer Outlet Soltau Resolution Property 145,000 13,485 2012 Factory Outlet Center Ochtrup McArthurGlen/Retail Development Group 183,000 17,019 2012 McArthurGlen Designer Outlet Berlin McArthurGlen Group 226,000 21,018 2009 Designer Outlets Wolfsburg Outlet Centres International 189,000 17,577 2007 Seemaxx Factory Outlet Center Hesta Immobilien GmbH 48,440 4,505 2006 Ochtum Park Mullmann & Grundstucksverwaltung 66,960 6,227 2006 Ingolstadt Village Value Retail PLC 221,000 20,553 2005 Wertheim Village Value Retail PLC 225,000 20,925 2003 Zweibrucken The Style Outlets NEINVER 226,000 21,018 2001 OutletCity Metzingen Holy AG 484,400 45,049 1995 12 centers 2,462,550 229,017 Source: VRN/IOJ The architecture of Stable International’s Fashion Outlets Montabaur shows the clean, sweeping line of steel and glass of modern Germany.

- 14. 14 International Outlet Journal Winter 2016 Center Opening-Asia Silk Road, which opened its third outlet center in 2015, readies three more for this year and and two for 2017. Chinese consumers who enjoy dressing in Italian designer apparel and accessories – at bargain prices – have found a new Silk Road to these afford- able luxuries in the spreading network of Florentia Village Designer Outlet centers. The joint-venture of Silk Road Holdings and RDM Asia (which handles operations, marketing and leasing) has opened three Florentia Villages in the leading metro areas of Beijing-Tianjin, Shanghai and the most recent, in Guangzhou. The JV has also broken ground on two more centers with late 2016 opening dates and has another pair for 2017. In addition to those projects, as well as expansion to its Beijing and Shanghai centers, the team also plans a boutique-sized center of just 4,686 m2 set to open this fall in Hong Kong. The two-level center will be near the Kowloon Commerce Center in the Kwai Chung area. By yearend 2017, the eight Florentia Vil- lages will total nearly 385,000 m2. Silk Road anticipates serving 30 million shoppers an- nually in its eight outlet centers – the three operating Florentia Villages drew 8 million visitors during 2015, with combined retail sales of $700 million, according to RDM. The latest milestone was the Sept. 24 opening of 31,034-m2 Florentia Village Guangzhou-Foshan. RDM plans to open a 16,517-m2 phase 2 by this May, to bring total Guangzhou GLA to 47,551 m2. The center opened with about 75 signed tenants, including 15 with store openings planned for year this year. The FV Guangzhou site, on Shugang Road by the Guangzhou West Express- way has a 90-minute catchment of at least 28 million people and is within a 20-minute drive of the city centers of Guangzhou and Foshan. FV Guangzhou Silk Road, RDM keep steady pace in China Silk Road’s Steady Pace in China Florentia Village locations GLA sf GLA m2 Opening Beijing-Tianjin 538,200 50,053 2011 phase 2 86,100 8,007 2017 Shanghai 538,200 50,053 2015 phase 2 322,900 30,030 2017 Guangzhou-Foshan 333,700 31,034 2015 phase 2 177,600 16,517 2016 Chengdu 538,200 50,053 2016 Wuhan 473,600 44,045 2016 Hong Kong Elite 50,382 4,686 2016 Chongqing 538,200 50,053 2017 Qingdao 538,200 50,053 2017 8 Florentia Villages 4,135,282 384,581 Source: RDM Asia The 31,034-m2 Florentia Village Guangzhou, which opened September 24, 2015, is Silk Road/RDM’s third outlet center in China since 2011.

- 15. Winter 2016 International Outlet Journal 15 provides free shuttle bus service every 30 to 40 minutes connecting to Guang- zhou South Railroad Station, a massive modern facility that accommodates four railways including high-speed train service, as well as subway service. The center features an underground facility for a portion of its 2,500 parking spaces, a concession to the April-to- September rainy season. “Consumers have shown an equal display of interest under dif- ferent weather conditions. the footfall has performed steadier than the expectation,” Maurizio Lupi, managing direc- tor, RDM Asia, told IOJ. In a centerwide promotion during the first two weeks, shop- pers who spent €420 in one day received a €15 gift card, plus a scratch card with chances to win merchandise from Bottega Veneta, Celine, Prada and other tenants. Lupi said the U.S.-based brands Coach, Gap and Nike were among the most popular stores during the opening period. Etro, Folli Follie, Inniu, IT, J. Linderberg, Jorya, S.T. Dupont and Swarovski were among the global brands that chose FV Florentia Village Guangzhou Tenants Puma Sammy Samsonite Sasa Skechers Starbucks S.T. Dupont Stella Luna Subway Swarovski Teenie Weenie Test-Tube Timberland Todllon Tommy Hilfiger Under Armour* Venchi* Versace* * opening soon Adidas Aigle Anagram* Armani Bean Pole* Brooks Brothers Calvin Klein Jeans Calvin Klein Performance Calvin Klein Underwear Charriol* Clarks Coach Columbia Sportswear Converse Crocs Daniel Hechter Ecco E. Land Etro Fed Fila Folli Follie Furla* Gant Gap G-Star Raw* Guess Häagen Dazs Hazzys/Camicissima Hugo Boss* Hush Puppies Inniu I.T. Jack & Jones Jeep Jessica Episode* J. Lindeberg Jorya KFC Lacoste Lancy* Lee Levi’s Lily Marisfrolg MaxMara* Michael Kors* Moussy Navigare New Balance Nike The North Face Ochirly Only Philipp Plein* Pizza Hut Ports Guangzhou for their first outlet stores in southern China. Florentia Village centers offer a ten- ant mix tuned toward luxury brands, with iconic Italian designers from Armani to Versace prominent among them. Silk Road promotes the “Visit Italy without going to Italy” theme, amplified by extravagant Venetian-style architecture. For the Chinese New Year celebration in February, FV Guangzhou planned to offer both a traditional lion dance and a Venetian Carnevale parade. RDM Asia is a unit of Florence, Italy-based Fingen Group, a diversified real estate, textiles, retail and financial business that has a JV with McArthur- Glen for five outlet centers in Italy. RDM’s partners in Silk Road Holdings include Hong Kong-based Gaw Capital, London-based TH Real Estate and New York-based Waitex. c Florentia Village Guangzhou’s Venetian-style architecture goes hand in hand with the center’s “visit Italy without going to Italy” marketing campaign.

- 16. 16 International Outlet Journal Winter 2016 Center Opening-Asia The Outlet! Company and Gloria Hotel Group team up to bring Western-style outlet retailing to Taiwan. The retail scene in greater Taipei, capital of the island nation of Tai- wan, has a new landmark: The 210,867-sf Gloria Outlets opened by Outlet! Company and Gloria Hotel Group on Dec. 18. The center features 90 retailers in a largely open racetrack layout, something of a novelty for Taiwanese shoppers. Plans call for three phases that will ultimately lead to a 590,000- sf center with more than 250 stores. The site is in Qingbu, a 45-minute drive southwest of central Taipei on Local Road 31 just south of the interchange with Airport Expressway (Highway 2). More than 9 million people reside within 40 miles of Glo- ria Outlets in the dense Taipei-Keelung-Taoyuan metropo- lis of northern Taiwan. A 2015 study by CBRE showed that Taipei is the world’s fourth most-sought market by global retailers, behind Tokyo, Singapore and Abu Dhabi. Gloria Outlets has 2,500 underground parking spaces, is directly connected to the existing high-speed rail network, and a platform at the center will connect to an under-construction rail link to the main airport, Taoyuan International. At the grand opening, many consumers arrived by high speed rail, which connects to the relatively small second floor that houses the 600-seat food court and a dozen retailers, including Nautica, Nike Factory Store, Tommy Hilfiger and Under Armour. Long lines formed at these stores and in front of other brands. Roots, a Canadian lifestyle brand popular in Taiwan, offered 90-percent discounts on many prod- ucts. Hugo Boss, Timberland, Tommy Hilfiger and Tumi were among retailers with price cuts of 50 percent to 70 percent. Swarovski shoppers signed up for chances to win a limited edition bracelet. Retailers taking part in a centerwide promotion for extra-savings coupons included Aigner, Armani, Polo Ralph Lauren and Roberto Cavalli. Gloria Outlets’ developers retained Architects Orange, the California-based firm that has designed outlet centers for Simon, including Desert Hills Premium Outlets in Los Angeles and Yeoju Premium Outlets in South Korea. Surfaces are generally pastel, sleek and smooth, accented with rough stone and marble textures. Two sunken plazas help illuminate the parking areas below the main floor. The larger plaza provides common space for special events with fountains to tease the senses. The JV has already begun construction on a 140,470-sf phase 2 with a planned opening by holiday 2016. Further plans call for a 237,900-sf phase 3 to open by holiday 2017. Gloria Outlets draws Taiwan’s value shoppers Designed by architects from California, Gloria Outlets has the pastel colors and open plan of outlet centers in the U.S.

- 17. Winter 2016 International Outlet Journal 17 Gloria Outlets Tenants 0918 2020 EYEhaus Agatha Paris Agnes b. Aigner Alexandre de Paris Arena Armani Outlet Artifacts Best Hot Pot Restaurant Brooks Brothers Calvin Klein Underwear Chloe Chen Coach Columbia The Cosmetics Company Store Cotelac Desigual Diane Von Furstenberg Dubu House Korean Cuisine Dunhill Ecco Eden Park Paris Esprit Fei Yue Ji Thai & Vietnamese Cuisine Folli Follie Funbox GMP Baby Gyu-Kaku Japanese Grill Han House Korean Cuisine Hanlin Tea Room Hao Pin Teppan Dishes Harujuku Kitchen Hengdeli Hugo Boss iCB JEpoque J. Lindeberg Stockholm Jeep Jimmy Choo Jorya Outlet Joseph Kenzo Kipling Kuo Health Chinese Medicinal Cuisine La Bonta Italian Cuisine Laetitia Puff & Dessert Les Enphants Plus Les Nereides LeSportsac Levi’s Loewe Michael Kors Moiselle Mothercare Mountain Hardwear Napapijri Nautica New Balance Nike Factory Store Nike Golf Nishiki Ramen Nordic Orobianco Paul & Joe Paul Frank Philips Police Polo Ralph Lauren Factory Store Puma Ramen Sanji River Woods Roberto Cavalli Roots Roots Lodge Café Salvatore Ferragamo Samsonite Sanmin Sentosa Singaporean Cuisine Starbucks Coffee Subway Superdry Swarovski Swatch TGI Fridays Timberland Tin Café Tod’s Tommy Hilfiger Tough Jeansmith Triumph True Religion Trussardi Tsao Di Ting Traditional Taiwanese Food Tumi UGG Australia Outlet Store Under Armour Woogo Smoothie Xian Chu Teppanyaki Zwilling J.A. Henckels side of the city opened in 2005 l Leeco Outlet Gongguan District in the university area of Taipei opened in 2012 l The 500,000-sf E-DA Outlet Mall, in Kaohsiung, east of Taipei, is part of a complex that includes an amusement park, entertainment venues, hotels, residences and schools. Direct competition is due for Gloria Outlets in the form of Mitsui Outlet Park Linkou in New Taipei City, close to Taoyuan International and less than 20 miles from Gloria Outlets. Phase 1 of the planned 485,000-sf center is slated to open by this spring. The project is a JV of Japan’s Mitsui-Fudosan and Taiwan-based Farglory Group. c Gloria Hotel Group is based in Taipei, and The Outlet! Company has offices in Taipei, Shanghai and Hong Kong. The duo started a long-term development and management partnership in 2009. For Gloria Outlets Taiwan they worked with Cathay Life Insurance, the master plan developer for the 54-acre site where hotel, entertainment and office space will also be developed. TOC’s top executives, Daniel Kelly, president, and Anjelica Manalo, VP-finance and administration, were previously with Simon (then Simon Chelsea Premium Outlets) in its Asian outlet ventures. Rick Mao, VP leasing, has expertise in tenant negotiation and management for luxury retail properties in the Taipei market. TOC currently handles the leasing and manage- ment of two outlet centers in mainland China: Mega Mills in Shanghai, open since January 2013, and Nanjing East Outlets, which opened in October 2015 (see story on page 22). The greater Taipei region is home to at least three other outlet centers, although the layouts and shopping experi- ence are quite different from the Gloria Outlets model. l The multistory Leeco Outlet Neihu District on the east Shoppers have easy access to Gloria Outlets, which is directly connected to Taiwan’s high-speed rail network and will soon link to the island’s main airport.

- 18. 18 International Outlet Journal Winter 2016 Center Opening-Asia Nanjing East Outlets opens with fireworks The center’s 77-acre site has plenty of room for expansion and for family recreation activities, including picnic space, a Ferris wheel and a 9-hole miniature golf course. Nanjing East Outlets, a joint-venture of The Outlet! Company and WB Outlet Developments, grand opened in Zhenjiang City on Oct. 1, 2015. Although the 239,206-sf center soft-opened in February 2015, the autumn event was timed to coincide with and celebrate the National Holiday in China. Merriment was in the air, with traditional drum shows, fireworks, flash mob dances and a fashion show featuring wares from more than 50 tenants including Adidas, Armani, Coach, Ermenegildo Zegna, Gap, Nautica, Nike, Replay, Ted Baker and Under Armour. Shoppers tapped into cash coupons and gift-with-pur- chase certificates through both in-store promotions and centerwide lucky draws. The GM of the 4,736-sf Coach store said the retailer achieved the highest opening-day sales of any Coach outlet store in China. The Nanjing center is at the junction of the S243 Highway and the G25 Expressway, about 30 miles south of downtown Nanjing, and it is served by shuttle bus and high speed rail. The 77-acre site has ample space for family recreation, including a lakeside park with pedal boat rentals, picnic grill space, children’s playground equipment and a nine-hole miniature golf course topped off by a 165-ft Ferris wheel. Eight food retailers are arrayed around the central food court, which seats 500. TOC’s partner, WB Outlet Developments, is a Hong Kong-based consortium that was key in the land acquisition for the site. Nanjing, the capital of Jiangsu province, has a metro popu- lation of 8.2 million. Construction on a 114,100-sf phase 2 at the center will start this year and open in The Outlet! Company and WB Outlet Developments worked to- gether to develop Nanjing East Outlets; a second phase of 114,000 sf will open in 2017.

- 19. Winter 2016 International Outlet Journal 19 summer 2017. A 104,400-sf phase 3 has also been proposed. TOC’s first Chinese project, Mega Mills, opened in Shang- hai in January 2013. The two-level, 575,000-sf center is a joint-venture with Shanghai Welead Investment Co., a unit of the diversified Pearl River Investment Group. That center in- cludes a nine-screen cinema, a 600-seat food court, a selection of fast casual restaurants and more than 150 retailers, includ- ing Balmain, Furla, Gucci, Michael Kors, Roberto Cavalli, Shanghai Tang, Ted Baker and Versace. In December 2016, TOC opened with Gloria Hotel Group the 210,867-sf Gloria Outlets in Taiwan (see page 20 for further details). The Outlet! Company has not yet started a third main- land China project, but is considering both the Wuhan and Zhuhai markets. The developer is also exploring the potential for outlet centers in Philippines and Thailand. c Nanjing East Outlets Tenants 361° Able Jeans Adidas Aigle Aigner Anne Fontaine Arc’Teryx Armani Beaume Braun Buffel BTR CGX Charriol Coach Columbia Converse Crocs Daniel Hechter Delsey Devil Nut Diesel Dkode Ecco Edwin Eland Embry Form Eminent Erdos Ermenegildo Zegna Etam Fabi Ferre Milano Fila Folder Gap Gas Giovanni Valentino Hasbro He Feng Ting Ramen Interesting Outdoor I.T. Jack Wolfskin JB Martin Jorya Kailas Kolping Levi’s Mandarin Collar Modesto Bertotto Mothercare Nautica Navigare New Balance Nike Northland One Way Palladium Patagonia Paul & Joe Peuterey Plory Ports Rebecca Replay Rothschild Royalway Salomon Samsonite Satchi Seiko Starbucks Stella Luna Swarovski Ted Baker Teenie Weenie Test-tube Tru Trussardi UGG Under Armour Yooki The grand opening of Nanjin East Outlets was delayed to take advantage of China’s National Holiday, a time of huge promo- tions and merriment.

- 20. 20 International Outlet Journal Winter 2016 Global Briefs Resolution Property has formed a joint venture with the Chinese invest- ment group Fosun Property. Formed in June 2015, the entity is called Resolution Property Investment Management and will act as Fosun’s exclusive investment manager across Europe. Through the RPIM joint venture, Fosun Property will be the cornerstone investor in the forth- coming Resolution Real Estate Fund V. Resolution Property, which is approach- ing its 15th year as a value-add investor in the European retail property sector, will target Western and Central European markets, especially gateway locations in the United Kingdom, Germany, France, Netherlands, Belgium, Spain, Scandinavia, Poland, Hungary and Czech Republic. The company will build on its ex- tensive track record and proven asset management approach as a pioneering value-added investor in European outlet and shopping center assets. It will seek opportunities to reposition existing as- sets through reconfiguration, extension, redevelopment, rebranding and re-engi- neering of the tenant line-up. Meanwhile, Resolution is busy: l Construction of the 8,000-m2 exten- sion at Rosada Fashion Outlet in Roos- endaal, Netherlands, will open in May. New tenants will include Cecil, Street One, Adidas, La Place, Van Gils, G-sus and Gentiluomo. l At Designer Outlet Soltau, centrally located between Hamburg, Bremen and Hanover in Germany, Puma has opened ResolutionPropertyentersanewretailpartnership a 370-m2 store. The center is now fully let with 2015 sales up 12 percent and footfall up 7 percent. l More than 40 percent of units in the 12,000-m2 first phase of the newly acquired Honfleur Outlet Centre in Normandy are in legal hands or ad- vanced negotiations. Phase 1 is due to open in Q2 2017. The development is a joint-venture with SHEMA, the French public/private partnership. “The demand from top European brands for strategically-located, high quality outlet centers remains strong, reflecting high footfall and healthy cus- tomer spending power in key regional markets,” said Michel Nangia, principal at Resolution Property. Resolution Property, founded in 1998, has an outlet portfolio that includes the aforementioned Rosada, Soltau and Honfleur centers, as well as McArthur- Glen Designer Outlet center in Troyes and in Roubaix. Holiday sales joyful for Realm’s portfolio The Realm portfolio of UK Outlet Centres delivered particularly strong year-end and New Year trading figures. The 2015 totals for footfall were up by 5.1 percent and corresponding turnover increased by 11.25 percent. While many full price retailers suffered in the im- mediate run up to Christmas, the Realm portfolio saw turnover swell by 6.82 percent in December as a whole, with a stellar 20.8 percent uplift between Box- ing Day and New Year. The categories of sports and outdoor wear, which have always been outlet Construction of the 8,000-m2 extension at Resolution Property’s Rosada Fashion Out- let will open in May. The center is in Roosendaal, Netherlands. Resolution acquired the 13,500-m2 Designer Outlet Soltau in 2014; the three-year-old center is at the center of a triangle formed by Hamburg, Hannover and Bremen.

- 21. Winter 2016 International Outlet Journal 21 Construction starts on Noventa di Piave’s fourth expansion McArthurGlen has begun con- struction a €50 million expansion of its award-winning Noventa di Piave outlet center near Venice. Polo Ralph Lauren was the first brand to sign up for a major store in the extension, which is due to open by spring 2017. Opened in 2008, and with three expansions under its belt since then, McArthurGlen Noventa di Piave is one of Europe’s most visited designer outlets, welcom- ing more than 3 million custom- ers annually. Brands operating outlet concepts in the center include Armani, Bottega Veneta, Brioni, Burberry, Fendi, Ferragamo, Gucci, Loro Piana, Marc Jacobs, Prada and Versace. Over the past three years, the cen- ter has recorded a 59 percent increase in visitor numbers and 69 percent in- crease in sales. A popular destination for international travellers, long-haul tourist sales represent 25 per cent of the center’s total turnover. The stel- lar performance of the center is why Noventa di Piave is a major flagship in the McArthurGlen portfolio of 22 designer outlet centers, including five in Italy. The is 40 km from Venice with no direct outlet competition and with a population of nearly 5.5 million within a 90 minute radius. The 26,000-m2 center has 132 luxury and designer outlets, as well as eight cafes and restaurants, The newest expansion will add 6,000 m2 and 25 stores, as well as 1,000 parking places, bringing the center’s total to 3,500 parking spots. Winner of the prestigious ICSC Europe’s ‘Best Established Shop- ping Centre’ Award 2015, the Noventa di Piave designer outlet village features McArthurGlen’s signature architectural style of luxury piaz- zas, open walkways and landscaped gardens – in Noventa’s case inspired by the elegant palazzos of Venice and Treviso. McArthurGlen is also ex- panding four of its centers this year: n McArthurGlen Parndorf, in Austria, 5,000 m2 n McArthurGlen Ashford, in England, 9,290 m2 n McArthurGlen Serravale in Italy, 12,500 m2 n McArthurGlen Roer- mond in the Netherlands, 15,000 m2 staples (there is a Nike in three out of every four outlet centers in Europe), are now very much in ascendancy as the nation becomes more preoccupied with health, fitness and wellbeing. Footwear and apparel for running, gym and leisure grew by 35 percent across the portfolio. The eight UK centers operated by REALM are: l Clarks Village in Street l Freeport Braintree l Freeport Fleetwood l Freeport Talke l Junction 32 in Castleford l Lakeside Village in Doncaster l London Designer Outlet in Wembley l Livingston Designer Outlet in Scotland Realm’s 140,000-sf Lakeside Village, which opened in Doncaster, England in 1996, is one of Europe’s oldest outlet centers. McArthurGlen’s Designer Village Noventa di Piave near Venice is one of the developer’s top performers with a 69 percent increase in sales in the last three years.

- 22. 22 International Outlet Journal Winter 2016 Global Briefs Fashion House Moscow will launch second phase in November Fashion House Group, the largest outlet developer in the CEE and Russia, started construction in October 2015 on the second phase of its outlet center in Moscow. The €11 million, 4,500-m2 expansion to Fashion House Moscow will open on November 4 with 30 new brands, all in time for this year’s holiday season. The center, a 39,000-m2 en- closed mall – the first fully enclosed outlet center in Russia – experienced more than 30 percent sales growth in 2015. FH Moscow, which opened in June 2013, has become a popular spot for wedding photos, according to CEO Brendon O’Reilly. “Whole wedding parties just show up,” he said. “They love the big fountain and the interior concept that has a different city theme for each shop- ping street. They can be photographed in ‘London’ or ‘Milan’ or ‘Paris’ right in Moscow.” Tenants in FH Moscow include Adidas, Reebok, Nike, Puma, Lacoste, Le Creuset, Tommy Hilfiger, Benetton, Sam- sonite, Tom Tailor and Mango. The Red Carpet Alley, dedi- cated to the high-end fashion stores, includes Blumarine, Baldessarini, Dirk Bikkembergs, Bea YukMui, P.A.R.O.S.H., Doucal’s, Moreschi, Zanotti, Luca di Marco and Versace. FHG, which is part of Liebrecht & wooD Group, a Europe- an real estate development company established in 1991, is also working on Fashion House Outlet Centre St. Peters- burg. The center’s site is 20 km south of St. Petersburg’s city center. The infrastructure, including road access, power and water system connections, traffic lights and bus stops, has been completed. The €70 million, 20,260-m2 project is scheduled to open in spring 2017 with 120 store units. FHG has delivered and currently manages five Fashion House Outlet Centres: three in Poland (in Gdansk, Sosnow- iec and Warsaw), one in Bucharest, Romania, and the cen- ter one in Moscow for a total GLA of more than 86,000 m2. Fashion House Bucharest, which opened in 2008, added three new tenants in late 2015 – Sport Vision, R&R Bou- tique and Issimo Home – and an expanded Tom Tailor store. Sport Vision, 375 m2, is an international multi-brand store operator that hosts more than 40 footwear, ap- parel and equipment labels, including Nike, Adidas, Um- bro, Reebok, Champion, Converse, Ellese, Puma, Sergio Tacchini, Carrera, Karrimor and Slazenger Issimo Home, 78 m2, a manufacturer of premium home and bath textiles, operates 200 stores in Turkey and has retail partnerships in 15 countries. R&R Boutique, 144 m2, a shoe manufacturer, will oper- ate a multi-brand concept featuring its own creations, as well as international footwear brands. Tom Tailor decided to expand its current store in Fashion House Outlet Centre with an additional 173 m2, which raised the total area of the store to 320 m2. In the past 12 months, 10 other new tenants joined the 20,451-m2 Bucharest outlet center: Guess, Mustang Jeans, Spanish Kids, Kiddie Rides, Format Lady, Faith by MD, Nissa, Napoleoni, TED’s, Lacoste & Gant. The center is next to Bucharest’s ring road with direct access from the A1 highway, 30 minutes from the city center. The center has 2,150 parking places and 60 tenants, includ- ing Puma, Adidas, US Polo, Champion, Stefanel, Mango, Ecco, Camel Active, Lee Cooper, Nissa, Lacoste and Gant. Millerchip promoted to new position at Realm UK outlet center operations and management agency Realm has appointed Giles Millerchip head of legal, a newly cre- ated position. Miller- chip will be based in the North West Of- fice of Realm, sited in Alderley Edge. He was formerly head of legal at McArthurGlen, which he joined in 2000 after prior experience with several law firms in Chester and London. Colin Brooks, managing director of Realm, said, „We are delighted to have recruited Giles; he brings a wealth of specialist legal and leasing experience to the Realm business.” Rioja wins approvals for Mill Green project The joint venture of Rioja Developments and U+I won district council planning committee approval on Dec. 5, 2015 for their €145 million Mill Green Designer Village project in Cannock Chase, Staffordshire, Eng- land. Phase 1, with a planned opening in 2018, would have 80 stores, with another 48 stores and a multi-story parking garage to be added in phase 2. The ultimate buildout would encompass 255,730 sf. The site is just off the major M6 Toll Road at Eastern Way (Route A460), about 15 miles northwest of central Birmingham, and adjoins the Mill Green Nature Park. The nearest competitor is Genting Resorts World’s 50-store Out- lets at Resorts World Birmingham, about 30 miles away, which opened Oct. 15. c Millerchip As the Russian ruble tumbles, shoppers head to Fashion House Moscow, leading the developer to begin construction on the project’s phase 2, which opens November 4.

- 23. #RECon16 Good news! RECon is tracking ahead of last year. Register now so you don’t miss out. 5BLOCKBUSTER KEYNOTES 25EDUCATION & CERTIFICATION SESSIONS 18SPECIALTY LEASING SESSIONS 36,000 ATTENDEES 1,000 EXHIBITORS 830,000 SQUARE FEET Visit www.icscrecon.org for more information. May 22 – 25, 2016 I Las Vegas, NV Las Vegas Convention Center & Westgate Hotel REGISTER BY MARCH 31 TO RECEIVE YOUR BADGE BY MAIL