Bull and bear markets

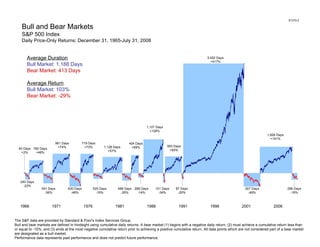

- 1. S1370.2 Bull and Bear Markets S&P 500 Index Daily Price-Only Returns: December 31, 1965-July 31, 2008 The S&P data are provided by Standard & Poor's Index Services Group. Bull and bear markets are defined in hindsight using cumulative daily returns. A bear market (1) begins with a negative daily return, (2) must achieve a cumulative return less than or equal to -15%, and (3) ends at the most negative cumulative return prior to achieving a positive cumulative return. All data points which are not considered part of a bear market are designated as a bull market. Performance data represents past performance and does not predict future performance. Average Duration Bull Market: 1,188 Days Bear Market: 413 Days Average Return Bull Market: 103% Bear Market: -29% 40 Days +2% 240 Days -22% 541 Days -36% 630 Days -48% 525 Days -19% 498 Days -25% 288 Days -14% 101 Days -34% 87 Days -20% 927 Days -49% 296 Days -19% 782 Days +48% 961 Days +74% 719 Days +73% 1,128 Days +57% 424 Days +69% 1,127 Days +128% 953 Days +65% 3,452 Days +417% 1,826 Days +101% 1966 1971 1976 1981 1986 1991 1996 2001 2006

- 2. Bull and Bear Markets S&P 500 Index (USD) Monthly Returns: January 1926-July 2008 The S&P data are provided by Standard & Poor's Index Services Group. Bull and bear markets are defined in hindsight using cumulative monthly returns. A bear market (1) begins with a negative monthly return, (2) must achieve a cumulative return less than or equal to -10%, and (3) ends at the most negative cumulative return prior to achieving a positive cumulative return. All data points which are not considered part of a bear market are designated as a bull market. 1925 1930 1935 1940 1945 1950 1960 1965 1970 1975 1980 1985 1990 2000 2005 Average Duration: Bull Market: 32 Months Bear Market: 11 Months Months = Duration of Bull/Bear Mkt. % = Total Return for the Bull/Bear Mkt. 44 months 193% 34 months -83% 2 months 92% 6 months 100% 3 months 26% 4 months 12% 23 months 133% 6 months -30% 2 months -19% 6 months -21% 4 months -10% 9 months 61% 5 months 22% 4 mos. -16% 31 mos. -30% 49 months 210% 6 months -22% 116 months 491% 13 mos. -50% 5 mos. 12% 7 months -10% 5 months -15% 48 mos. 105% 6 months -22% 9 mos. 55% 15 mos. 35% 20 mos. -17% 61 months 282% 3 months -30% 30 mos. 71% 2 mos. -15% 92 months 355% 24 mos. 63% 9 months -17% 61 months 108% 8 months -16% 19 mos. -29% 21 months -43% 3 mos. -11% 5 months -15% 25 months -45% 43 months 90% 26 mos. 52% 30 months 76% 33 months 86% 14 mos. -14% S1370.2

- 3. Bull and Bear Markets Russell 2000 Index (USD) Monthly Returns: January 1979-July 2008 Russell data copyright © Russell Investment Group 1995-2008, all rights reserved. Bull and bear markets are defined in hindsight using cumulative monthly returns. A bear market (1) begins with a negative monthly return, (2) must achieve a cumulative return less than or equal to -10%, and (3) ends at the most negative cumulative return prior to achieving a positive cumulative return. All data points which are not considered part of a bear market are designated as a bull market. 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 8 mos. 38% 2 mos. 11% 3 mos. 26% 2 mos. -20% 14 months 82% 14 months -22% 11 months 100% 13 months -21% 22 months 69% 4 months -12% 11 mos. 32% 3 months -36% 22 months 65% 13 months -32% 67 months 234% 2 months -12% 21 months 57% 4 months -30% 18 months 74% 31 months -35% 2 months 12% 3 months -11% 22 months 85% 4 months -11% 25 months 50% 9 months -18% 4 months 1% Average Duration: Bull Market: 18 Months Bear Market: 8 Months Months = Duration of Bull/Bear Market % = Total Return for the Bull/Bear Market S1370.2

- 4. Bull and Bear Markets MSCI EAFE Index, Net Dividends (USD) Monthly Returns: January 1970-July 2008 MSCI data copyright MSCI 2008, all rights reserved. Bull and bear markets are defined in hindsight using cumulative monthly returns. A bear market (1) begins with a negative monthly return, (2) must achieve a cumulative return less than or equal to -10%, and (3) ends at the most negative cumulative return prior to achieving a positive cumulative return. All data points which are not considered part of a bear market are designated as a bull market. 1970 1972 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 7 months 41% 4 mos. 19% 5 months -15% 34 months 103% 18 months -42% 39 months 93% 5 mos. -13% 13 months 36% 15 mos. 53% 18 mos. 67% 2 mos. -11% 37 months 323% 17 months -20% 26 months 47% 4 months -17% 2 months -15% 57 months 93% 9 months -31% 5 months 26% 20 months -15% 8 mos. 18% 55 months 206% 4 mos. -11% 9 months 19% Average Duration: Bull Market: 24 Months Bear Market: 10 Months Months = Duration of Bull/Bear Market % = Total Return for the Bull/Bear Market 2 mos. -15% 39 months -48% 9 mos. -13% S1370.2

- 5. Bull and Bear Markets MSCI Emerging Markets Index, Gross Dividends (USD) Monthly Returns: January 1988-July 2008 MSCI data copyright MSCI 2008, all rights reserved. Bull and bear markets are defined in hindsight using cumulative monthly returns. A bear market (1) begins with a negative monthly return, (2) must achieve a cumulative return less than or equal to -10%, and (3) ends at the most negative cumulative return prior to achieving a positive cumulative return. All data points which are not considered part of a bear market are designated as a bull market. 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 8 mos. 43% 4 mos. 31% 1 mo. -12% 17 months 98% 1 mo. -14% 16 months 101% 4 months -29% 17 months 92% 5 months -14% 5 mos. 21% 3 months -12% 29 months 38% 5 months -25% 19 months 114% 13 months -56% 18 months -48% 7 months 42% 5 months -24% 18 months 89% 4 months -11% 21 months 109% 16 months 85% 2 months -11% 9 months 21% Average Duration: Bull Market: 15 Months Bear Market: 6 Months Months = Duration of Bull/Bear Market % = Total Return for the Bull/Bear Market S1370.2

Hinweis der Redaktion

- Talking Points: This graph documents bull and bear market periods in the S&P 500 Index from December 31, 1965 to July 31, 2008. Financial Management, a Blue-Ash, ohio based fee-only advisor uses this historical information to help structure a global diversified portfolio using low cost, institutional class mutual funds and ETF’s, with an emphasis on using institutional mutual funds by DFA, Dimensional Fund Advisors. See more at www.fmgonline.com The market cycles are identified in hindsight using historical cumulative daily returns. These are price-only returns which do not consider the payment or reinvestment of dividends. All observations are performed after the fact. A bear market is identified in hindsight when the market experiences a negative daily return followed by a cumulative loss of at least 15%. The bear market ends at its low point, which is defined as the day of the greatest negative cumulative return before the reversal. A bull market is defined by data points not considered part of a bear market. The rising trend lines in blue designate the bull markets occurring since 1965, and the falling trend lines in red document the bear markets. The bars that frame the trend lines help to describe the length and intensity of the gains and losses. The numbers above or below the bars indicate the duration (in calendar days) and cumulative return percentage of the bull or bear market. Keep in mind that this graph does not show total compounded returns or growth of wealth since 1965. Once the cycle is established in retrospect, the first day of that cycle resets the performance baseline to zero. Investors may draw a number of lessons from this graph. First, since 1965, bull markets in the S&P 500 Index have lasted longer than bear markets and delivered price gains that are disproportionately greater than the bear market losses. Second, fluctuating performance within each trend illustrates that volatility and uncertainty occur even within established market cycles: bull markets may have short-term dips, and bear markets may have short-term advances. The immediate trend is not readily apparent to market observers, and in fact, may become clear only in hindsight. This illustrates the difficulty of accurately predicting and timing market cycles. Finally, the graph suggests the importance of maintaining a disciplined investment approach that views market events and trends from a long-term perspective. Investors who react emotionally to short-term movements are at risk of making ill-timed decisions that compromise long-term performance.

- Talking Points: This graph documents bull and bear market periods in the S&P 500 Index from January 1926 to July 2008. The market cycles are identified in hindsight, applying the same methodology as the other slides in the “Bull and Bear Markets” series. Monthly index returns are total returns, which include reinvestment of dividends. Financial Management, a Blue-Ash, ohio based fee-only advisor uses this historical information to help structure a global diversified portfolio using low cost, institutional class mutual funds and ETF’s, with an emphasis on using institutional mutual funds by DFA, Dimensional Fund Advisors. See more at www.fmgonline.com

- Talking Points: This graph documents bull and bear market periods in the Russell 2000 Index from January 1979 to July 2008. The market cycles are identified in hindsight, applying the same methodology as the other slides in the “Bull and Bear Markets” series. Monthly index returns are total returns, which include reinvestment of dividends. Financial Management, a Blue-Ash, ohio based fee-only advisor uses this historical information to help structure a global diversified portfolio using low cost, institutional class mutual funds and ETF’s, with an emphasis on using institutional mutual funds by DFA, Dimensional Fund Advisors. See more at www.fmgonline.com

- Talking Points: This graph documents bull and bear market periods in the MSCI EAFE Index from January 1970 to July 2008. Financial Management, a Blue-Ash, ohio based fee-only advisor uses this historical information to help structure a global diversified portfolio using low cost, institutional class mutual funds and ETF’s, with an emphasis on using institutional mutual funds by DFA, Dimensional Fund Advisors. See more at www.fmgonline.com The market cycles are identified in hindsight using historical cumulative monthly returns. These returns consider the reinvestment of dividends, net of foreign government withholding taxes. All monthly observations are performed after the fact. A bear market is identified in hindsight when the market experiences a negative monthly return followed by a cumulative loss of at least 10%. The bear market ends at its low point, which is defined as the month of the greatest negative cumulative return before the reversal. A bull market is defined by data points not considered part of a bear market. The rising trend lines in blue designate the bull markets occurring since 1970, and the falling trend lines in red document the bear markets. The bars that frame the trend lines help to describe the length and intensity of the gains and losses. The numbers above or below the bars indicate the duration (in months) and cumulative return percentage of the bull or bear market. Keep in mind that this graph does not show total compounded returns or growth of wealth since 1970. Once the cycle is established in retrospect, the first month of that cycle resets the performance baseline to zero. Investors may draw a number of lessons from this graph. First, since 1970, bull markets in the MSCI EAFE Index have lasted longer than bear markets and delivered gains that are disproportionately greater than the bear market losses. Keep in mind, however, that this time series is relatively short. Second, fluctuating performance within each trend illustrates that volatility and uncertainty occur even within established market cycles: bull markets may have short-term dips, and bear markets may have short-term advances. The immediate trend is not readily apparent to market observers, and in fact, may become clear only in hindsight. This illustrates the difficulty of accurately predicting and timing market cycles. Finally, the graph suggests the importance of maintaining a disciplined investment approach that views market events and trends from a long-term perspective. Investors who react emotionally to short-term movements are at risk of making ill-timed decisions that compromise long-term performance.

- Talking Points: This graph documents bull and bear market periods in the MSCI Emerging Markets Index from January 1988 to July 2008. Financial Management, a Blue-Ash, ohio based fee-only advisor uses this historical information to help structure a global diversified portfolio using low cost, institutional class mutual funds and ETF’s, with an emphasis on using institutional mutual funds by DFA, Dimensional Fund Advisors. See more at www.fmgonline.com The market cycles are identified in hindsight, applying the same methodology as the other slides in the “Bull and Bear Markets” series. Monthly index returns include the reinvestment of gross dividends. The graph demonstrates the same principles as the previous data: In the data since 1988, which is a relatively short time series, bull markets in the MSCI Emerging Markets Index have lasted longer than bear markets and delivered gains that are disproportionately greater than the bear market losses. Index performance fluctuates, even within established market cycles. Investors who maintain a disciplined investment approach may avoid making ill-timed decisions amidst the market volatility.