FirstBank Nigeria - The Core Leader

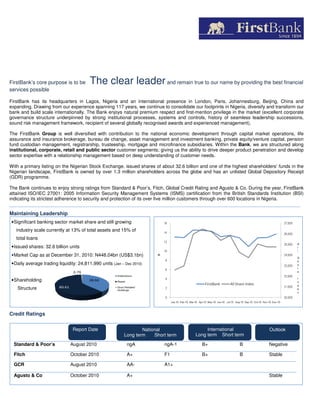

- 1. FirstBank’s core purpose is to be The clear leader and remain true to our name by providing the best financial services possible FirstBank has its headquarters in Lagos, Nigeria and an international presence in London, Paris, Johannesburg, Beijing, China and expanding. Drawing from our experience spanning 117 years, we continue to consolidate our footprints in Nigeria, diversify and transform our bank and build scale internationally. The Bank enjoys natural premium respect and first-mention privilege in the market (excellent corporate governance structure underpinned by strong institutional processes, systems and controls, history of seamless leadership successions, sound risk management framework, recipient of several globally recognised awards and experienced management). The FirstBank Group is well diversified with contribution to the national economic development through capital market operations, life assurance and insurance brokerage, bureau de change, asset management and investment banking, private equity/venture capital, pension fund custodian management, registrarship, trusteeship, mortgage and microfinance subsidiaries. Within the Bank, we are structured along institutional, corporate, retail and public sector customer segments; giving us the ability to drive deeper product penetration and develop sector expertise with a relationship management based on deep understanding of customer needs. With a primary listing on the Nigerian Stock Exchange, issued shares of about 32.6 billion and one of the highest shareholders’ funds in the Nigerian landscape, FirstBank is owned by over 1.3 million shareholders across the globe and has an unlisted Global Depository Receipt (GDR) programme. The Bank continues to enjoy strong ratings from Standard & Poor’s, Fitch, Global Credit Rating and Agusto & Co. During the year, FirstBank attained ISO/IEC 27001: 2005 Information Security Management Systems (ISMS) certification from the British Standards Institution (BSI) indicating its strictest adherence to security and protection of its over five million customers through over 600 locations in Nigeria. ____________________________________________________________________________________________________ Maintaining Leadership • Significant banking sector market share and still growing Share Price Performance industry scale currently at 13% of total assets and 15% of total loans A • Issued shares: 32.6 billion units l Share price Performance l • Market Cap as at December 31, 2010: N448.04bn (US$3.1bn) N S h • Daily average trading liquidity: 24,811,990 units (Jan – Dec 2010) a r 0.79 e Institutions I • Shareholding 38.60 Retail n d Structure 60.61 Govt Related e Holdings x Credit Ratings Report Date National International Outlook Long term Short term Long term Short term ____________________________________________________________________________________________________________ Standard & Poor’s August 2010 ngA ngA-1 B+ B Negative ____________________________________________________________________________________________________________ Fitch October 2010 A+ F1 B+ B Stable ____________________________________________________________________________________________________________ GCR August 2010 AA- A1+ ____________________________________________________________________________________________________________ Agusto & Co October 2010 A+ Stable

- 2. The primary focus in the near term is the growth and 3Q10 Financial results at a Glance transformation of the Bank while creating future growth Strong & liquid balance Sheet options for the Group • 17% Capital Adequacy Ratio, significantly above regulatory SEQUENCING GROW T H SYST EM AT ICAL LY requirements of 10%,Tier 1 capital ratio of 15.4% FirstBank Group – Priorities by grow th horiz on • Stable net loan to deposit ratio of 74.1% (Sept 09: 72.5%) Build scale internationally… • Liquidity ratio of 64.7% (Sept 09: 78.7%) • Non-performing loan ratio of 5.8% (Sept 09: 8.1%) Diversify group and transform bank… Business volume • Significant SSA Consolidate in expansion and grow th in • QoQ and YoY growth in deposit of 8.82% and 29.38% bank ing with s elec tiv e Nigeria… • Drive bank transform ation to c om pletion international foray s in non- respectively. YTD growth of 15.8% to N1.6tn • Build scale in inv . bank ing • bank financ ial s erv ic es Foc us on driving • Encouraging lending growth up; 4.98% QoQ, 5.36% YTD and and ins urance and leverage • Driv e organic and inorganic group synergies econom ies of scale and 32% YoY to N1.6tn expansion • Comm enc e SSA regional scope ac ross international • Continue agg res s iv e bank expansion in earnes t network and portfolio of transform ation • Struc ture for grow th in inv. bus ines ses Earnings banking and insurance • Rep offic e expans ion; initial • Resilient gross earnings at N177bn, down 10.57% YoY SSA exploration s • Improved mix of earnings with non-interest income contributing Short term M edium term Long term 23% (Sept 2009: 17.6%) The Transformation initiatives are organized along four strategic themes Profitability • Expanding net interest margins VISION BE THE CLEAR LEADER • Profit before tax of N40.7bn.(Year to Sept 09: N6.6bn loss) AND NIGERIA’S BANK OF FIRST CHOICE • ROAE: 14.1% MISSION TO REMAIN TRUE TO OUR NAME BY PROVIDING THE BEST FINANCIAL SERVICES POSSIBLE • ROAA:1.9% GROUP STRATEGIC PRIORITIES • Cumulative earnings per share of N1.33 from (Year to Sept 09: (N0.43)) Business line expansion International expansion Restructuring for growth Sequencing growth Focusing core banking on Continuing modest Restructuring the Group’s systematically profitable growth and the Group on strong growth expansion in the deployment of international operating model to optimally drive its strategy Structurally and timely sequencing growth Financial highlights businesses representative offices to with the right management initiatives and priorities major strategic oversight and governance over the planning horizon finance/trade hubs. Total Assets (N’bn) 2 ,4 2 4 19.23% BANK STRATEGIC PRIORITIES 2 ,2 9 2 2 ,2 6 2 2 ,1 7 2 1 ,9 7 4 2 ,0 3 3 Growth Attain full benefits of scale Service Excellence Drive unparalleled service Performance management Deliver unmatched results Talent management Become a hub for the Sept 2010: and scope by accelerating levels by developing by creating a performance best industry talent; growth and diversification world-class institutional culture with clear individual cultivate a highly N2,424billion of assets, revenue and processes, systems and accountability at all levels. motivated, capable and profit. capabilities. entrepreneurial workforce. Sept 2009: N2,033billion Group structure Q 1 '0 9 H 1 '0 9 9 m th s '0 9 Q 1 '1 0 H 1 '1 0 9 m th s '1 0 Deposit liabilities (N’bn) FIRSTBANK FBN BANK (UK) LIMITED 1 ,5 5 0 29.38% 1 ,4 0 7 1 ,4 2 7 1 ,3 3 9 FBN BANK (UK) 1 ,1 9 8 PARIS BRANCH 1 ,1 5 0 Sept 2010: FBN FBN FIRSTBANK FIRSTBANK N1,550billion FIRST FIRST FBN FIRST FBN FIRST FIRST FBN LIFE BEREAU DE MICROFINANCE SOUTH AFRICA CHINA FUNDS MORTGAGES PENSION CAPITAL REGISTRARS INSURANCE ASSUARANCE TRUSTEES CHANGE BANK (REP OFFICE) (REP OFFICE) BROKERS CUSTODIAN Sept 2009: FBN SECURITIES N1,198billion Q 1 '0 9 H 1 '0 9 9 m th s'0 9 Q 1 '1 0 H 1 '1 0 9 m th s'1 0 Gross Earnings (N’bn) New bank structure to drive deeper segment N o n -in te re s t in c o m e 196 41.60% specialisation In te re s t In c o m e 34 177 41 125 122 Sept 2010: 22 28 N177billion 61 162 62 136 11 12 103 94 Sept 2009: 50 50 N125billion Q 1 '0 9 H 1 '0 9 9 m th s'0 9 Q 1 '1 0 H 1 '1 0 9 m th s'1 0 Profit on ordinary activities after tax (N’bn) 1,266.67% 41 32 Sept 2010: N41billion 14 15 12 Sept 2009: 3 N3billion Q 1' 09 H 1 '09 9 m th s ' 09 Q 1' 10 H 1'1 0 9 m t hs '1 0

- 3. Financials Associate and Affiliate Companies FIRST BANK OF NIGERIA PLC Associate UNAUDITED BALANCE SHEET AS AT: The Group The Bank Sep. 2010 Dec. 2009 Sep. 2010 Dec. 2009 Kakawa Discount House Ltd Associates and Affiliate Companies N'million N'million N'million N'million Assets Cash and balances with central banks 66,356 70,332 65,775 67,576 Affiliate Treasury bills Due from other banks 25,253 510,459 14,219 514,193 25,203 213,234 14,219 255,902 Africa Finance Corporation Loans and advances to customers 1,139,499 1,078,452 1,034,059 1,022,486 African Export- Import Bank Advances under finance lease 8,754 10,835 8,754 10,835 Investment 490,252 289,848 474,501 303,889 Banque Internationale du Benin Managed funds 54,917 84,630 - - Consolidated Discounts Ltd Other assets 69,334 55,226 62,621 51,245 Investment property 6,639 6,631 - - Nigerian Interbank Settlement Scheme Plc Property and equipment 52,948 47,980 51,446 46,302 Valucard Nigeria Ltd 2,424,410 2,172,346 1,935,592 1,772,454 Liabilities Customer deposits 1,550,425 1,339,142 1,366,649 1,236,599 Due to other banks Liability on investment contracts 226,552 59,207 173,280 148,224 1,904 - 65,087 - Contact details Other borrowings 72,820 35,473 72,820 35,473 Tax-liability Other liabilities 23,375 182,474 30,237 136,432 19,530 160,102 25,092 92,716 Head, Investor Relations Oluyemisi Lanre-Phillips 2,114,852 1,862,788 1,621,004 1,454,967 Equity Email: investor.relations@firstbanknigeria.com Ordinary share capital 16,316 14,504 16,316 14,504 Tel: +234 1 9052720 Reserve 293,242 295,054 298,272 302,983 Total Equity 309,558 309,558 314,588 317,487 First Bank of Nigeria Plc Total equity and liabilities 2,424,410 2,172,346 1,935,592 1,772,454 Samuel Asabia House Acceptance and Gurantees 1,307,870 972,601 577,966 431,316 35 Marina Lagos Total Assets and Contingents 3,732,281 3,144,947 2,513,559 2,203,770 P.O. Box 5216 UNAUDITED PROFIT & LOSS FOR THE PERIOD: The Group The Bank Nigeria FOR THE PERIOD ENDED SEPTEMBER 30, 2010 9 Months 9 Months www.firstbanknigeria.com Sep-10 Sep-09 Sep-10 Sep-09 N'million N'million N'million N'million Gross earnings 177,065 197,988 154,736 172,729 Interest earnings 136,312 153,998 121,632 138,920 Interest expense (46,728) (60,347) (38,049) (49,284) Net interest income & commissions 89,584 93,650 83,583 89,637 Other income 40,753 43,990 33,103 33,809 Operating Income 130,337 137,640 116,687 123,445 Operating expenses (83,931) (71,252) (76,769) (71,570) Provision for Risk Assets (5,704) (73,049) (7,174) (36,482) Net Profit before Tax and Exceptional Items 40,703 (6,660) 32,743 15,394 Exceptional Items - - - - Net profit(loss) before tax 40,703 (6,660) 32,743 15,394 Taxation (8,141) (1,332) (6,549) (3,079) Profit after tax 32,562 (7,992) 26,195 12,315 Key Performance Information Total non-performing loans and advances 69,759 74,382 64,432 69,302 Total non-performing loans to total loans and advances 5.87 8.17 5.97 8.04 EPS (Basic) Naira 1.33 (0.43) 1.07 0.66 EPS (Diluted) Naira 1.33 (0.43) 1.07 0.66 Total loans and advances (Gross) 1,189,403 910,176 1,079,689 861,641 No of shares 32,632 24,862 32,632 24,862 Board of Directors Chairman Prince Ajibola Afonja Executive Stephen Olabisi Onasanya - Group Managing Director/CEO Kehinde Lawanson Bello Maccido Remi Odunlami Non-Executive Tunde Hassan-Odukale Obafemi Adedamola Otudeko Ibiai Ajumogobia Lawal Kankia Ibrahim Ibrahim Dahiru Waziri Khadijah Alao Straub Mahey Rafindadi Rasheed Ibukun Abiodun Awosika Ebenezer Adewale Jolaoso Ambrose Feese General Disclaimer This material is solely for information purposes, and may be amended and/or supplemented without notice at any time. FirstBank is not providing any investment advice, nor offering any advisory services through this document. Recipients should exercise discretion before relying on the statements and information contained herein because such statements and information do not take into consideration the particular circumstances or needs of any specific client. Accordingly, FirstBank makes no representation or warranty as to the accuracy of the information contained herein and shall have no liability, howsoever arising to the maximum extent permitted by law, for any loss or damage, direct or indirect, arising from the use of this information by you or any third party relying on this document. Last updated: December 2010