RMPG Learning Series CRM Workshop Day 1 session 3

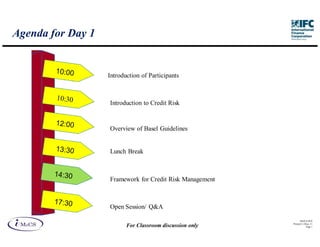

- 1. Agenda for Day 1 Introduction of Participants Introduction to Credit Risk Overview of Basel Guidelines Lunch Break Framework for Credit Risk Management Open Session/ Q&A IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 1

- 2. A loan creation planning process in a bank Credit Credit Lending Strategy Policy Policy Focus Volume / Risk-Return / Client-base Norms/ Ratios • Business targets • Characteristics of • Basis preferred borrowers • Risk-return relationship • Corporate objectives • Customer base • Thrust areas • Concentration Norms The above aspects are captured in Business Plan, Credit Policy, Manual of Instructions, Circulars IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 2

- 3. Credit Risk defined Manifestation of Credit Risk Likely Causes Credit risk is the possibility that Inability to pay payments would not happen as Short term cash flow or per agreed terms – uncertainty in liquidity problems amount and timeliness of Longer term solvency issues repayments Delays in payment due to Inadequate repayments operational issues with the Untimely repayments treasury function Default risk is the risk that the Unwillingness to pay repayments stop all together IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 3

- 4. Sources of Credit Risk • Repayment inability due to bad financial performance, Asset Based point in the business cycle, poor management quality lending • Unwillingness on part of obligor to make repayments on time • Delays in completion • Uncertain cash flows during operation due to lower PLFs, Cash flow price risk, offtaker credit risk based lending • Sponsor and Technology risks • Force Majeure • Political risks IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 4

- 5. Assessing and Managing Credit Risk Effects of credit Measurement of Management of risk credit risk credit risk • Potential inability of the • Appraisal and assessment. • Identification potential organization to meet the • Use of internal and venerable credit liabilities as they become external rating • Assessment of potential due risk • Borrowing under • Monitoring and follow up unfavorable terms and • Control and mitigation conditions like collaterals. • Distress asset sale • Reputational risk IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 5

- 6. Credit Risk Management Process has to be installed Identification Identification of products (e.g. loan product, derivative, forex, guarantees), geographical locations (e.g. country risk), industry sectors (e.g. real estate, NBFCs) from where the credit risk is originating Analyse past credit trends, macro-economic factors and expected trends Measurement Measuring credit risk using validating scoring / rating models Estimating historical probability of default and recovery rates and loan loss rates to bank Linking risk scoring with quantification of risk Control Limits on individual / group exposure, specific sectors like real estate, unsecured exposure etc. Eligible collaterals and their frequent valuations Loan Review Mechanism IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 6

- 7. Credit risk management function at Bank Credit Risk Management Function Quantification Management Management Monitoring Quantification Tools Policy Organization Tools Processes Processes and Control The Board of Directors has the overall responsibility for the credit risk management and shall approve the credit risk management policy, procedures and set prudential and other limits. IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 7

- 8. Policy Guidelines of Bank Structure of Credit guidelines of banks 1. Credit objectives 6. Credit appraisal 2A. Quality of asset base (Industry 7. Assessment of limits Exposure) 8. Pricing 2B. Quality of asset base (Selection 9. Credit monitoring of Borrower) 10. Delegation of authority 3. Exposure norms 11. Recovery and exit policy 4. Tenure of credit 5. Credit acquisition 12. Internal Audit IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 8

- 9. Prudential limits for Individual and Group exposure Prudential limits Exposure ceiling Individual Exposure Exposure of its owned fund Lending ≤ 35 % Group exposure Lending ≤ 35 % IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 9

- 10. Credit risk management function at Bank Credit Risk Management Function Quantification Management Management Monitoring Quantification Tools Policy Organization Tools Processes Processes and Control The Board of Directors has the overall responsibility for the credit risk management and shall approve the credit risk management policy, procedures and set prudential and other limits. IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 10

- 11. Organization structure •Overall risk management •Decide the risk management Policy Board •Loan Sanction •Setting up internal limit for portfolio management •Implementation of policy •Adherence to limits set by the Board • Recommendation of ceiling for various types of internal limits to the Board for effective portfolio management. RMC •Monitoring and reporting of risk levels •Review the risk based pricing • Review the appraisal note , results and trends •Preparation and presentation of appraisal note • Objective assessment of the credit risks involved Credit Officer • Ensuring the validity and accuracy of the data used for Credit decision IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 11

- 12. Comprehensive risk management structure Organisation Structure Internal Documents Board of Directors Risk Management Policy Risk Management Committee of Board Asset Liability Policies for Credit Risk Management Operational Risk Management Committee Management Committee (CRMC) Committee (ORMC) Risk (ALCO) Management Business Unit •Business units unit RM Policies for Policies Policies for Department management Different Different of different business operations risks units procedures RM interacts and functions with business units IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 12

- 13. A Board level Risk Management Committee should be put in place to implement risk management across the bank Desirable • Managing Director / Chief Executive Officer, Executive Directors , Composition Heads of Credit and Head of Risk. Reporting • Board of Directors Supported By • Credit Risk Management Committee, Asset Liability Management Committee and Operational Risk Management Committee Frequency • At minimum quarterly intervals Roles • Devisingpolicy and strategy for integrated risk management containing various risk exposures • Providing guidance to various risk management committees operating under it • Oversee the identification, measuring and monitoring the risk profile of the Bank IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 13

- 14. Bank should set up multiple risk management committees to create focus and handle different constituents of risk CRMC ALCO ORMC Should be headed by Should be headed by Should be headed by Desirable Chairman/Executive Chairman/ED/CEO Chairman/ED/CEO Composition Director/Chief Executive and comprises of and comprises of Officer (CEO) and heads of Credit, heads of Credit, comprises of heads of Investment, Treasury, Information Credit and Risk Resource and Technology, Human Management Dept & International Banking Resource and Risk Chief Economist Management Reporting Risk Management Committee of Board Supported By Credit Risk ALCO Cell / Middle Operational Risk Management Office Management Department Department IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 14

- 15. The committees should meet at frequent intervals to discuss to monitor various aspects of risk CRMC ALCO ORMC Frequency of Meeting At Frequent Intervals (Minimum Monthly) Supported By Risk Management Department Roles Measure, Control and Measure, Control and Formulation of Bank Manage Bank wide Manage Bank wide risk wide Operational Credit Risk on liquidity, interest Risk Policy Compliance with rates and foreign Act as agency for lending and credit risk exchange creating awareness on management policy Product Pricing for operational risk in the Enforce compliance Deposits & Advances Bank with prudential limits Strategy for Resources Development of Mobilisation Operational Risk Management tools IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 15

- 16. Bank should install an independent risk management department housed in the Head Office Location At Head Office / Corporate Office Headed By An officer with a minimum rank of General Manager, having expert knowledge of banking business and credit, market and operational risk management Supported By Minimum of 3/4 persons on current scale of operations and shall be increased with the enlargement of operations Desired Chartered Accountants, MBA, Cost Accountant, CFA, M. Sc. – Qualifications Statistics and any other equivalent degree IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 16

- 17. Credit risk management function at Bank Credit Risk Management Function Quantification Quantification Management Management Monitoring Policy Organization Tools Processes and Control Tools Processes The Board of Directors has the overall responsibility for the credit risk management and shall approve the credit risk management policy, procedures and set prudential and other limits. IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 17

- 18. The Policy would enable a structured assessment of risks, mitigants enabling credit and pricing decision Assessment of risks Financial Parameters Qualitative Parameters Assessment of mitigants on offer for the proposed transaction Contractual arrangements in a project Financial collaterals, guarantees etc. for asset based lending Credit Decision Additional collaterals, covenants, higher Approve / Reject pricing Portfolio Risk Management Monitoring, Oversight and Governance Exposure Limits IM aCS 2010 For Classroom discussion only Structure Printed 11-M ay-11 Page 18

- 19. Structure of rating model for balance sheet based lending Financial Risk Project evaluation and status Business Risk Final Borrower Borrower + Industry Risk Risk Score Risk Score Management Risk Account conduct Credit rating model enables to view the borrowers with the risk perspective based on grades. IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 19

- 20. Multiple components of model* and multiple parameters for each component * Slide provides an outline of a rating model for Corporate Customers IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 20

- 21. Key Risks that need to be assessed for a project Market / Construction Technology Revenue risk risk Risk Sponsor Risk O& M Risk DSCR, IRR Financial Overall Fuel supply Best Case project Risk risk Worst Case risk Equity Contribution IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 21

- 22. Bank would need to finalise an approach for implementing robust risk rating models Financial Risk Score W1 Collateral Basic Structuring Management W2 Borrower Risk Score Risk Score W3 Modified Transaction PLUS Risk Score Score Industry Risk Conduct of Score account Risk Score Calibration and Validation Robust & Acceptable Risk Scoring Model IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 22

- 23. Estimation of Loss Given Default (LGD) Security Type Market Value of Present Value security of Recovery LGD=(1 -RR) Rate (RR) Loan Outstanding at Default IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 23

- 24. Assessment of risks would also enable risk based pricing besides building a good quality portfolio Aligns the incentive to balance risk with return Pricing is a tool to maintain proactive provisioning Necessary for value creation and preservation Loan Price Credit Overhead & (Interest Cost of Funds Rate and = + Charge + Operating fee income) Risk IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 24

- 25. Credit risk management function at Bank Credit Risk Management Function Quantification Management Management Monitoring Quantification Tools Policy Organization Processes and Control Tools Processes The Board of Directors has the overall responsibility for the credit risk management and shall approve the credit risk management policy, procedures and set prudential and other limits. IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 25

- 26. Bank would need to install a three tier structure for Lending process loan management . Front Office Mid Office Back Office Origination/Renew Credit Risk Analysis Post disbursement al • Assessment •Monitoring Regulatory Reporting Sales/Acquisition •Sanction • Support to front and • Pre disbursement mid office Borrower formalities •NPA Management Evaluation •Disbursement Collect and review data Risk Management Sanctioning Authority Audit and Control IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 26

- 27. Lending Process in Banks: Origination DSA/DMA convert prospective loan RM/Branch seekers into loan applicant Front office checks whether all documents are in order and as per norms CPU Check whether file has been Check MIS to know the status of the file and already logged Yes if declined, reasons for decline No No Refer to Credit File is processed by Yes CPU as per policy Initiate Contact point verification (send details of the applicant containing customer number, residence address, residence telephone no. , employer name ,office address, telephone no. etc.) and income document verification Initiate contact point verification and income document verification Prepare CAM (Credit Appraisal Memorandum) by leaving column blank for remarks about Income document verification Check for discrepancies and email the IM aCS 2010 Printed 11-M ay-11 same to RM For Classroom discussion only Page 27

- 28. Lending Process: Assessment , Risk Management and Sanction Update the status of Income document verification, on receipt of the same in CAM (Credit Appraisal Memorandum) and MIS and complete the credit .Valuation and assessment of guarantor will also be done based on prescribed guidelines Credit officer adds the remarks on the basis of deviation observed and credit process checks Credit and Risk Department assesses the case based on score card / internal rating model for quantification of Risk In case Personal discussion felt necessary conduct the same Note: Please refer to credit process checks and policy for requirement to conduct the personal discussion Approved Hold Declined Communicate For want of Subject to to Br/RM conditions signinging Communicate to Br/RM deviation so that the customer can Br/RM collects PDC Communicate to Communicate to be informed ,loan agreement and Br/RM so that the Br/RM so that the other documents conditions can be conditions can be fulfilled fulfilled Inspection officer Operation for Verifies Communicate approval Disbursement/Post disbursal activities IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 28

- 29. Lending Process: Pre disbursement and disbursal Creation of Review of security documents, execution of new set of prescribed mortgage and loan document as advised by Legal department and entry of details into document execution register. charges in Register of Charges Collection of Post Dated cheques (PDC) Customer has bank account with cheque book facility. No Customer will have to Yes open savings account and PDC will be issued thereafter Creation of account into CBS by following extant guidelines issued with respect to KYC norms and setting up of limits Update Drawing Power limit, Recovery of margin money and recovery of fees and charges ,if any . Creation of insurance on financed assets, issue of cheque book in the case of revolving credit, Send copy of all executed document to CPU for disbursal clearance Disbursal IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 29

- 30. Lending Process: Post disbursal Calculation of DP will be done at regular interval based on submitted • Closure of Account stock and debtors statement and the • Returned securities same will be allowed in CBS. documents and unused PDC End Revolving • All loan documents Credit marked as cancelled and closed Credit admin Foreclosure and Post officer loan maturity disbursal regularly Loan Servicing checks monitor Yes activities in loan account Monitoring of • Repayment • Penalties & charges Loan account • Change in interest rate performance as • Revival of time bared per agreement documents and pre decided • Collection of required terms additional PDC and No extension of ECS mandate period Triggers and early IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only warning signals Page 30

- 31. Credit risk management function at Bank Credit Risk Management Function Quantification Management Quantification Tools Monitoring Policy Organization Processes Tools Processes and Control The Board of Directors has the overall responsibility for the credit risk management and shall approve the credit risk management policy, procedures and set prudential and other limits. IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 31

- 32. Lending Process: Monitoring ,Follow-up and NPA Management No Escalate to Head CPU Credit Performance officer needs to Credit Admin and Credit Credit officer and improved by be assigned Officer to analyze unit Admin to examine moratorium, Credit sanctioning prepare unit and prepare deferment of authority will take recommendations recommendations interest pay, final decision on re-assessment recommendation s If any of Review Yes, Escalate to put forth by Credit the defined and decide Head CPU Yes Officer triggers or to escalate Escalation of a weakness further/ke Execute remedial case to observed ep in view solution and Credit Recovery/NPA cell than CR Admin to can happen only Admin •Monitor to ensure after review and Officer Keep in recommendations are final decision by escalate the Escalate to view implemented appropriate matter to it Credit •Prepare specific check authority superior's admin supervisor Credit Admin and its points during supervisor to review If sign of inspections unit on a monthly basis deteriorati for next two months on persist NO If unit End complying Yes NO with the condition End IM aCS 2010 and situation Printed 11-M ay-11 For Classroom discussion only improves Page 32

- 33. Risk monitoring and control Objectives of monitoring :- • Improvement in the quality of credit portfolio • Review of sanction process • Compliance of due diligence process • Feedback on regulatory compliance • Picking-up early warning signals and suggesting remedial measures • Recommending corrective action to improve credit quality, credit administration and credit skills of staff etc. Phase wise monitoring :- • During construction phase • During operating phase IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 33

- 34. Risk mitigation Collateral securities can be broadly classified into two categories viz. Financial and Non- financial Financial collaterals :- • Cash (including deposits), • Gold, • Securities issued by Central and State Government etc. Non-financial collaterals :- Land and building, Raw materials, stock in trade, produce, and other goods Movable assets such as machineries. Documents of title to goods etc. •The other forms of credit mitigation includes various form of guarantees and letter of comfort etc. Few other mitigation arrangement includes escrow mechanism ,TRA and DSRA IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 34

- 35. Portfolio concentration needs to be minimised to manage Credit Risk at the portfolio level Bank shall aim to diversify exposures through: Prudential limits for individual and group borrowers Rating-wise distribution of all the borrowers Exposure to particular sub-sector Geographical distribution of borrowers IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 35

- 36. The need for a more comprehensive risk assessment for cash flow based lending Limited recourse to the sponsors Extent of risks differ during different phases of Limited tangible security from the project the project till the assets are Need for specific assessment for each phase created Highly capital intensive Commissioning Due to long gestation period of Risks power projects repayment of principals starts after quite some time. Steady state operations Lack of diversification and there is a single stream of revenue Financial Closure Time IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 36

- 37. Preliminary analysis would help banks optimise effort spent on detailed appraisal Minimum information required for evaluation of credit request Status of land acquisition and statutory clearances Availability of construction infrastructure and status of fuel linkage. Status of all contracts e.g. EPC, Package contract and Shareholders agreement are in place d) Proposed off take mechanism – through long term PPA or merchant sale. Cost of the project, Debt Equity ratio proposed. Proposed Shareholding pattern Promoters’ background and their capability to bring their share of contribution. Financial projections and ratios like IRR, DSCR of the project worked out by the applicant. Principle business of the promoters and their ability to implement the current project. IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 37

- 38. Assessment of credit risks in cash flow (SPV) based lending…1 Financial Parameters • Project IRR • Average DSCR and Minimum DSCR for the base case. • Sensitivity of DSCR and IRR to the project cost o Change in Project Cost o Change in PLF o Change in Sale rate o Change in Interest rate o Change in fuel Cost • CDM benefit • Any other project specific critical risk IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 38

- 39. Assessment of credit risks in cash flow based (SPV) lending…2 Qualitative parameters • The promoters and Quality & expertise of management. • Market size, growth prospects and business environment. • Global market outlook. • Govt. policies & economic situation. Risks could arise during the construction phase: • Non completion of the project or various milestones. • Time and cost overrun due to delay in completion. • Cost overrun even though part of the project completed on time. Risks could arise during the operating phase: • Fuel risk, Hydrological risk , Technology risk , Revenue risk , O & M risk ,Sponsor risk and Supplier risk etc IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 39

- 40. Assessment of credit risks in balance sheet based lending…1 Financial Parameters • Quantitative factors: o Financials, ratios e.g. Sales growth , gearing , ROCE ,Quick ratio , Cash interest coverage ratio and retained earnings to equity etc. o Sensitivity analysis. o Industry inter-firm comparison. • Sensitivity analysis. • Industry inter-firm comparison. Qualitative parameters • The promoters and Quality & expertise of management. • Market size, growth prospects and business environment. • Global market outlook. • Govt. policies & economic situation. IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 40

- 41. Assessment of credit risks in balance sheet based lending…2 Risks could arise during the construction phase: • Non completion of the project or various milestones. • Time and cost overrun due to delay in completion. • Cost overrun even though part of the project completed on time. Risks could arise during the operating phase: • Fuel risk, Hydrological risk , Technology risk , Revenue risk , O & M risk ,Sponsor risk and Supplier risk etc Product fit & pricing. Credit rating. Review of account operation. Collateral offered. IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 41

- 42. DISCUSSIONS IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 42

- 43. All the contents of the presentation are confidential and should not be published, reproduced or circulated without the written consent of IFC, Bangladesh Bank and IMaCS. IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 43