Value investing congress notes

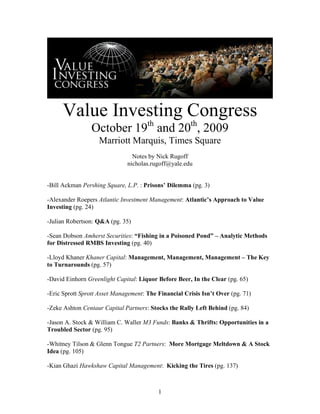

- 1. Value Investing Congress October 19th and 20th, 2009 Marriott Marquis, Times Square Notes by Nick Rugoff nicholas.rugoff@yale.edu -Bill Ackman Pershing Square, L.P. : Prisons’ Dilemma (pg. 3) -Alexander Roepers Atlantic Investment Management: Atlantic’s Approach to Value Investing (pg. 24) -Julian Robertson: Q&A (pg. 35) -Sean Dobson Amherst Securities: “Fishing in a Poisoned Pond” – Analytic Methods for Distressed RMBS Investing (pg. 40) -Lloyd Khaner Khaner Capital: Management, Management, Management – The Key to Turnarounds (pg. 57) -David Einhorn Greenlight Capital: Liquor Before Beer, In the Clear (pg. 65) -Eric Sprott Sprott Asset Management: The Financial Crisis Isn’t Over (pg. 71) -Zeke Ashton Centaur Capital Partners: Stocks the Rally Left Behind (pg. 84) -Jason A. Stock & William C. Waller M3 Funds: Banks & Thrifts: Opportunities in a Troubled Sector (pg. 95) -Whitney Tilson & Glenn Tongue T2 Partners: More Mortgage Meltdown & A Stock Idea (pg. 105) -Kian Ghazi Hawkshaw Capital Management: Kicking the Tires (pg. 137) 1

- 2. -David Nierenberg The D3 Family Funds: D3 War Stories: Practical Lessons About Building and Protecting Shareholder Value by Improving Corporate Governance (pg. 154) Candace King Weir & Amerlia F. Weir Paradigm Capital Management – Bottom-up Stock Picking: Back in Fashion? (pg. 163) -Paul Isaac Cadogan Management: Investing as a Pari-Mutuel Proposition (pg. 167) -Joel Greenblatt Gotham Capital: Formula Investing with a Value Mindset (pg. 171) 2

- 3. Bill Ackman Pershing Square, L.P. : Prisons’ Dilemma Bill Ackman is is the Managing Member and General Partner of Pershing Square, L.P. Prior to forming Pershing Square, he cofounded Gotham Partners, L.P. in 1993, a public and private equity investment partnership. Mr. Ackman earned an MBA from the Harvard Business School. Corrections Corporation of America: Ticket: CXW Stock price: $24.50 -Corrections Corp owns and operates private prisons -Owns the land and buildings at most of its facilities -Largest private prison company -Fifth largest prison manager behind California, Capitalization: -Enterprise value: $4.1 billion -Equity market value: $2.9 billion Recent valuation multiples: -2009 e Cap rate: 12.2% -2009 P/Free Cash Flow Per Share: 13.3x CXW operates its business in two segments: 3

- 4. Strong national footprint: Tenants are unlikely to default as the consequences of default let your prisoners lose 4

- 5. CXW is the clear leader in privatized prisons, controlling approximately 46% of the private prison and jail beds in the US: CXW addresses a total U.S. market that exceeds $65 billion, of which only approximately 8% is outsourced. Privatized beds have grown from nearly 11,000 in 1990 to over 185,000 today (17% CAGR). 5

- 6. Public-sector correctional systems are currently operating at, or in excess of, design capacity: -19 states were operating at 100% or more of their highest capacity measure (29 states were operating at 100% or more of their lowest capacity measure) -In total, state prisons were operating at 96% of their highest capacity measure and 113% of their lowest capacity measure -The Federal prison system was at 137% of capacity California prisons are running at 170% of designed capacity: Competitive advantage in state vs. private: -CXW has historically outperformed the public sector in safety and security 6

- 7. -As a private company, CXW has cost and efficiency advantages compared with its largest competitor (the US government): Increasing market penetration: -Because of constraints in new public prison construction, private prison operators were able to capture 49% of the incremental growth in U.S. inmate populations in 2007 7

- 8. -Historically, inmate populations in the U.S. have grown regardless of economic factors: Prison populations are expected to rise: 8

- 9. Federal demand drives growth: -Federal demand alone could fill CXW’s approximately 12,000 bed inventory over the coming years - The Federal Bureau of Prisons (“BOP”) is currently operating at 137% of rated capacity, with a stated desire to operate closer to 115% - The BOP projects that between 2008 and 2011 its population will grow by ~19,000 inmates, with just over 12,000 new beds planned for development by 2012 -The United States Marshals Service (“USMS”) has a population of about 60,000-65,000 and has grown 8%-10% per annum over the last five years -Since 1994, Immigration and Customs Enforcement (“ICE”) detainee populations have grown by over 300% to ~35,000 State demand drives growth: - State prison populations are projected to increase by more than 90,000 over the next three years. If CXW can capture ~13% of this demand, it could achieve 100% occupancy - “Of the 19 state customers that CCA does business with, we are currently estimating that those states will have an incremental growth that will be twice as much as their funded plan capacity by 2013.” – Damon Hininger, CEO, Q1 Earnings Call 9

- 10. Supply / Demand Imbalance Drives Growth: - If private prisons can capture just 25% of the incremental growth in the U.S. inmate population, CXW should achieve >98% occupancy in its Owned & Managed business by 2012. Private prison operators captured 49% of the growth in 2007 as state budget pressures have postponed new prison construction Near-Term Catalysts: Post-Recession Growth: -Inmate populations have historically grown at an accelerated rate after recessions -Of 300,000 prisoners released from 15 states in 1994, 67.5% were rearrested for a new offense within three years 10

- 11. Near-Term Catalysts: Increased Occupancy Drives EBITDA: - At current margins, CXW management estimates its inventory of existing beds could generate an additional ~$100mm of EBITDA -Available bed inventory increases likelihood of winning contracts and provides pricing leverage Near-Term Catalysts: Operating Leverage - Management derives its ~$100mm estimate by applying CXW’s Q2’09 margin to the lease-up of its existing inventory; however, approximately 84% of the costs in CXW’s Owned & Managed Facilities segment are fixed 11

- 12. Near-Term Catalysts: Stock Buyback -CXW’s repurchase of 10.7 million shares in Q4 ’08 – Q2 ’09 (~8.5% of total shares) provides a tailwind for NTM free cash flow per share growth Strong Free Cash Flow Generation: -Because prisons are made of concrete and steel, depreciation expense meaningfully exceeds maintenance capex. As a result, CXW’s free cash flow per share is substantially greater than earnings per share 12

- 13. Strong Balance Sheet: As of Q2’09, CXW’s interest coverage ratio was 5.4x. Its next debt maturity is not until 2012. Its cash interest expense is less than 6%, and more than 80% of its debt is fixed rate High Returns on Capital: 13

- 14. Culture of Equity Ownership: 14

- 15. Valuation: 15

- 16. Historical stock chart: 16

- 17. Opportunity for multiple expansion: CXW’s earning quality has improved since 2007 as its owned and management segment now accounts for more than 90% of Facility EBIDTA Key attributes: 17

- 18. Health care REITs are the best comparison: Sum-of-the-parts valuation: -CXW is composed of two businesses: an operating company (“OpCo”) and a real estate company (“PropCo”) 18

- 19. An OpCo/PropCo analysis suggest the stock could be worth between $40 and $54 per share CXW used to be a REIT: -From 1997 through 1999, CXW operated as two separate companies: CCA Prison Realty Trust (a REIT), and Old CCA (the operating company) CCA Prison Realty Trust was a huge success -IPO’d in July 2007 at $21 per share and immediately traded up to $29 - Upon its formation, CCA Prison Realty Trust purchased 9 correctional facilities from Old CCA for $308mm. It then leased the facilities to Old CCA pursuant to long- term, noncancellable triple-net leases with built-in rent escalators - Within five months of its IPO, CCA Prison Realty Trust used the remaining proceeds from its IPO and its revolver to purchase three additional facilities from Old CCA By December-97, CCA Prison Realty Trust’s stock had moved up to the $40s, trading at a ~5% cap rate and a ~4% dividend yield 19

- 20. -On January 1, 1999, Old CCA and CCA Prison Realty Trust merged to form an even larger REIT, “New Prison Realty.” In order for New Prison Realty to qualify as a REIT, it had to spin off its management business (“OpCo”) New Prison Realty was not a Success -New Prison Realty saddled itself with debt to fund new prison builds -Before the new prisons had been completed and could generate revenue, OpCo’s operating fundamentals began to decline and occupancy fell -OpCo struggled to maintain profitability and rental payments to New Prison Realty soon had to be deferred -As a result, New Prison Realty’s stock price declined precipitously, limiting its ability to raise liquidity. This was further exacerbated by a shareholder lawsuit stemming from the fall in the stock price -By the Summer of 2000, CXW was on the verge of default and had to raise dilutive capital to restructure and avoid bankruptcy Why Did New Prison Realty Fail? New Prison Realty did not fail because it was a REIT, it failed because: -It had too much leverage -It had an overly aggressive development plan -Its tenant, OpCo, was also over-leveraged - CXW has not been a large taxpayer for the last eight years because of substantial NOLs that are now exhausted 20

- 21. -Since 2000, CXW has increasingly shifted away from a business focused on the management of prisons toward a business focused on the ownership of prisons Management Gets It: “The other thing I would point out is before we'd even sell stock, that there's a lot of value in these assets. I hear people talking to me about regional malls selling at six cap rates or parking garages selling at five cap rates or 20 times cash flow and you think about -- or highways selling at 50 times cash flow, you think about prisons as infrastructure or some type of real estate asset, I think these could be even sold and harvested in some fashion to avoid selling stock in the future. So there are a number of things that we could do to finance our growth, but just with respect to cash flow and leverage, we could go quite a ways.” – Irving Lingo, Former-CFO of Corrections Corp, Q2’06 Earnings Call 21

- 22. Conclusions: -Very shareholder-oriented management team -Did very aggressive buyback at $10.61 in march -Company is rated BB, but Ackman thinks it is definitely investment grade -Very little competition -Passive investment for Ackman (thinks board and management is incentivized in the right way) -Potential pair trade: short Realty Income -Ackman owns 9.5% of the company Q: Are you concerned about occupancy trends, because there does appear to be decriminalization pressure for drug use from Washington? A: 140% on average in Federal prisons, 170% in California. There is a lot of room and I think the political backlash of letting people out early will keep prison populations high. Just filling out the existing overcapacity fills out their available beds. 22

- 23. Q: When you think about incentives and how that played into the mortgage mess, and now you look at privatized prison, the state wants less people going to prison, whereas the company wants people back in prison. Do you see any issues with these contracts given the company’s incentive to keep people coming back to prison? A: They do their best to rehabilitate prisoners and do the right thing, which is what wins them contracts. They have higher quality of life than Federal prisons, and I think they have their priorities in order. Q: What keeps the government from saying that the ROC is too much and regulating their ROC? What are leases like? A: Leases are typically 3-5 years (called “management contracts”), with inflation-type rates. They win these contracts and earn a high ROC due to their credibility, which results in their large market share. Everyone wins in this scenario. Q: What are barriers to entry? A: It costs a lot of money to build a prison ($60-80,000 bed). It’s very hard to get financing just to build one prison because just one asset is much riskier than a pool. The biggest barrier is having the expertise and credibility, which makes it extremely hard for new entrants. The management business, however, is extremely competitive. Q: Is there a risk of political opposition? A: Biggest risk is that people stop committing crimes, which is a low probability event. There are more likely to be civil liberties groups suing prisons that are at overcapacity, rather than private groups. Q: What’s your current view on MBIA? A: No longer short bond insurers, it takes too much psychological energy. MBIA is a bad business, and it was allowed to leave all it’s bad risks at another company, which seems very wrong. Bond insurance is a bad business and there are a lot of easier ways to make money. Q: David Einhorn told us that he’s moving into gold amidst long-term risks of a major currency collapse. What are your thoughts on this? A: I am not a fan of gold. I think gold is really just greater fool – you need to go around convincing everyone else to buy it. I think the best way to protect against say, a devalued dollar, is to own high quality businesses with pricing power. For example, we own McDonald’s, which is now at a low multiple, and is generally, a currency-hedged, inflation-protected stream of money. Also, Visa could be a good idea, as long as you’re comfortable with the regulation risk. 23

- 24. Alexander Roepers Atlantic Investment Management: Atlantic’s Approach to Value Investing Alexander Roepers is the Portfolio Manager of Atlantic Investment Management, Inc., which he founded in 1988, a $4.2 billion global Registered Investment Advisor, with offices in New York and Tokyo. Mr. Roepers is a graduate of Harvard Business School. Roepers: 2,042% return in past 16 years, long only, no derivatives Before 1988: -Six years with Thyssen-Bornemisza Group and Dover Corporation, both multi-billion dollar conglomerates -Primarily active in corporate development, i.e. buying and selling of companies -Learned a lot about valuing companies and due diligence, but came to dislike: -Illiquidity, as it takes 9 to 12 months to sell to a private/controlled company -Premiums of 30 to 50% when buying companies Atlantic: -Founded in 1988 in New York -Premise: deploy highly concentrated, value investment strategy in the public equity markets to get liquidity and eliminate need to pay premiums -Today: AUM $1.5 billion, offices in New York and Tokyo -Single strategy firm offering 5 funds: long/short U.S.; long/short Europe/Japan; long- only funds for the U.S., Europe and Japan -Supported by 13 highly experienced equity analysts and 3 traders providing 24 hour coverage. Non-investment functions managed by COO/CFO Concentrated Investment: -Simple concept: -Define your universe and know your companies -Do not use leverage -Supposed one has 20 compelling value investment ideas Continue due diligence to select 5 or 6 highest conviction names --Concentrate capital on those as they should outperform the other 14 to 15 names Focus on core competency: -Deep knowledge and experience in universe should yield superior capital appreciation 24

- 25. Rules of the road when concentrating investments: -Universe definition is key -Invest in transparent companies that can be understood and analyzed -Don’t use leverage -Only invest in companies with solid balance sheets Track record: 25

- 26. Stock Selection Process: 1. Investment Universe 2. Investment Criteria 3. Buy/Sell Discipline 1. Investment Universe: 26

- 27. 2. Investment criteria: Investment-grade balance sheet -Interest expense less than 25% of gross cashflows (EBITDA) Avoid commodity pricing dependent firms -Always profitable companies through economic cycles -Avoid deep cyclical firms Recurring and predictable revenues and cashflows -Function of nature of business, diversity of customer, products and regions served -Prefer consumable and maintenance/repair/overhaul (MRO) businesses over capital spending-related businesses Low insider ownership -Need vulnerability to takeover bids 27

- 28. 3. Buy/Sell Discipline -Likes to own between 2-7% of shares of the company (2% gives you top 10 status, with which you can knock on the door), but do not want to become illiquid (over 7%) because wants to be able to get out within 30 days without affecting price 28

- 29. Constructive Shareholder Engagement: Objectives: -Create unique due diligence opportunities at the CEO/CFO level as well as the operational level through constructive engagement -Enhance and accelerate the process of shareholder value creation -Maintain liquidity as well as ability to continue dialogue with top management (ie avoid proxy battles and Board seats) Process: -Build strong rapport with CEO/CFO through multiple on-site and face-to-face meetings -Craft and discuss win-win proposals for management and shareholders, including corporate development, corporate governance, operational restructurings and use of free cash -Submit these proposals in writing to CEO and, as needed, to the Board of Directors -As appropriate, broaden discussion of proposals to include other large shareholders, financial media and private equity groups -As needed, apply public pressure through press articles and regulatory/public filings 29

- 30. Case study: JM Smucker (SJM) In Atlantic’s Investment Universe? Yes Liquidity? Yes 30

- 31. Business description • $4.6 billion leading producer of branded packaged foods • Acquired Folgers from P&G in late 2008, doubling sales • 75% of sales from products with #1 share positions • 90% of sales from U.S. customers Thesis • Defensive business: Consumer staples; trend to more meals and coffee brewed at home • Well positioned among food peers: Little exposure to food service customers; iconic market leading brands • Margins expanding: Falling commodity prices; realizing synergies from Folgers deal • Strong cashflows: Rapid debt repayment; solid 2.5% dividend yield; room for M&A • Reported EPS, understate cash EPS: $0.40 of non-cash amortization from Folgers deal • Folgers acquisition: Greater power with distributors and retail trade; larger market cap makes SJM a potential holding for more institutional investors • Valuation multiple expansion: from current 8.9x EV/EBIT (on next year’s estimates) to 12x, which has occurred repeatedly over the past 15 years • Low insider control: Vulnerable to unsolicited takeover attempts Sales and earning have grown steadily both organically and through acquisitions: 31

- 32. Despite recent share price recovery, valuation remains compelling: -Has been part of Atlantic’s universe of investment candidates for over 15 years -Visited their headquarters several times in past years, analyzed repeatedly, attended company presentations, but did not invest until early 2009 when its valuation fell below 8x EV/EBIT 32

- 33. Atlantic’s Other Observations: -Up 30% this year, but strategy has been hard because real move has been in cyclical recovery plays Tremendous rally in commodities and banking as well, which hurt their shorts -Current portfolio is trading at 8x EV/EBIT for 2010 -In 1999, tech bubble sucked all money away from value stocks We see that again here with money running towards cyclical recovery plans and forgetting other companies -ACS (Affiliated Computer Services) in Dallas is an example of this -$7 billion in sales -Potential acquisition target -Share price absolutely flat March – August -ACS is growing earnings year after year, and 85% of next year’s sales are all ready guaranteed -6% top-line growth through recession -In Japan, in Secom, home security company with 25% margins and 97% renewal rates -Should be trading at 12-14x EBIT -Only trading at 9x -Down 5 times year to date -Yamato Holdings (Japanese shipper) is highly attractive as well In Europe, like UK company G4S -Security force deployed around the world (hotels in India, nuclear labs, US-Mexico boarder, embassies, etc) -Very large, stable, growing business -Trading at P/E of 11 Q: Is Smucker a takeover candidate? A: It certainly could be. It’s not very controlled by insiders, but there is a long history and the Smucker family is still very involved. There is a lot of tradition, but there is nothing stopping someone from giving a big cash bid. Q: If the rally keeps going how will this affect your buy/sell discipline? 33

- 34. A: We haven’t changed our buy/sell discipline in 20 years. Should the market decide to value stocks like ours properly, as it does from time to some, we’ll sell into it and sit on 40% cash for a while. We’ll scale out and sell our positions once they cross our EBIT and P/E/ levels and analyze other companies as we wait for the next big thing. We are not market timers and we are not going to pay up and chase things. For example, in June we got out of many names, some of them too early, but it’s not our job to hold companies at these levels. We are extremely disciplined with our methods. Q: What are your thoughts on Kraft? A: Kraft is way too big for us to analyze. I think they would overpay for Cadbury by quite a bit. Kraft is relatively inexpensive, but I imagine if they buy Cadbury at 14x EBIT, there will be eventual earnings dilution. Q: What is your criteria for shorts? A: Short is 10-50% of gross exposure. 1 or 2% positions, no ETFs. Find names in the space where we look for longs, and find those stocks with more leverage, fundamental issues, etc. Especially now, there are many cyclical recovery plays that are overvalued. Typical holding period – 2 weeks to 2 months. Want to stay a little more net contained with high VIX. Q: Do you have any thoughts on home security firms such as Brinks? A: We’ve been in Brinks before. We might like it again, but it’s market cap is small, so it could be illiquid for us. We want it to get a little cheaper, around $23 or $24. Q: How concerned are you about private label competition for Smucker? How large are the price gaps between the two? What do you think Smucker’s organic growth rate is? A: Wal-mart and these other stores need Smucker brands to build traffic. Food scares always push people towards branded products. These brands have been there for over 100 years, people rely on them and know the quality. Overall, this differs by region and distributor, as do price differences. The organic growth has been GDP +1 or 2%. In recessions, it quite often does better as people change their behavior and eat at home more. Q: What themes are you pursuing over the next 12-18 months? A: We mainly focus on valuations. We could get into cyclical companies, but only if these current valuations come way down. If you look at the 2000 tech bubble, people hitting it now on cyclical recoveries will raise a lot of money, but by next March, 2010 economic data points should show that these 2011 expectations are too high. 34

- 35. Julian Robertson – Q & A Julian Robertson founded Tiger Management in 1980. Known as the “Wizard of Wall Street”, he is credited with turning $8 million of start-up capital into over $23 billion by 1998. In 2000 the fund returned its capital to investors, though Mr. Robertson retained Tiger for personal investments. Today he is admired for his continued investing success, his seeding and mentoring a large group of "Tiger Cub" hedge funds, which have also been remarkably successful, and his philanthropic activities revolving around his three foundations, The Robertson Foundation, The Tiger Foundation, and The Blanche and Julian Robertson Family Foundation. Q: What have you been doing over the past few years? A: I’ve been seeding new hedge funds, which has been a lot of fun for me and allowed me to live a different lifestyle. I always worried that my epitaph might be “he died getting a quote on the yen.” In addition to the hedge funds, I’ve really enjoyed meeting a lot of good and worthy charities, which has also been a lot of fun. Q: You were incredibly prescient 2-3 years ago regarding value investing and the US housing market. What is your current macro view? A: My big concern is the fact that we are still spending more than we earn, and like any family, when that goes on too long, there comes a point where you have to pay it back. We’re not even thinking about that; we’re thinking about continuing to borrow, and the only people that can lend us that kind of money are the Chinese. I wonder if they will continue to lend to us, as there are a lot of other things they can do with their money, which in my opinion, would be better investments. They may eventually come to that conclusion as well. Q: Do you have an opinion on peak oil? A: On peak oil, I’m kind of bullish on oil stocks, but I am tremendously impressed with the environmentalists who’ve showed me what is happening with solar power. Just this summer, for instance, a golf club where I play, had an entire fleet of solar powered golf carts. As I investigated, I found out that there were cost savings as well as environmental good. I think that solar power will get stronger and stronger, wind will get bigger and better, and as soon as our grid is fitted out in good fashion, I think this will be big enough to improve the environment and hurt the price of oil. Q: During your career you took some time off from investing. The story is that you took that time to reflect. What did you do during those 2 years and how did that change your life? A: It was between the time that I worked at Kitter Peabody and the time that I started Tiger. I went to New Zealand ostensibly to write the great American novel, and I ended up as a house-husband down there. I think every man likes to do something more normally productive, and after a certain period of time, I was ready to come back and start Tiger, which I did in 1980. 35

- 36. Q: Could you comment on China? Do you think it’s the next bubble in the making or that it is going to pull us out of the recession? A: It very well could be a bubble in the making and I don’t think it’s going to pull us out of the recession. It’s prosperity lies in effect in creating jobs which are used to export goods, which take away jobs elsewhere. I don’t think their consumption patterns will be big enough to offset all of that. Q: What characteristics do you think the Tiger cubs share that contribute to their success? A: I think there are a number of them, and we’ve developed a test over the years that demonstrates some of these qualities. They must be honest, reasonably smart, and very competitive. Those three factors are key to being a really good hedge fund investor. In addition to that, I think that there are so many hedge fund people that are trying to change the world for the better (ex: George Soros, who probably did more to encourage the free enterprise system in Eastern Europe than anybody, among many other great things, Paul Tudor Jones and his help to budding charities, etc) and it’s been a thrill for me to be associated with these people. Q: What do you think about the price of gold? We heard earlier today that it is an attractive asset to hold at this time. Does the price matter? A: I’ve never been a big believer in gold. None of it has ever been used since it was first discovered. There is no such thing as supply or demand in gold, you just state it, and it’s there. You hope that someone who is economically turned towards gold will buy it in higher and higher prices. The price of gold is almost the same today as it was 30 years ago. In my own business, I’ve been the luckiest guy in the world on gold. I was presented a seeding proposition with a guy who specialized and did only gold, and I planned to turn that down, because I don’t really believe in gold. However, I believed in him, and this man, over the last five years, has compounded about 50%, and I don’t know of anybody else who has. I think one of the reasons he’s done so well, is because you have a group that he’s competing with (“the gold bugs”), who are in many instances, certifiably crazy. The next group is someone like me, who gets scared of inflation and wants to get into gold. I’m told you don’t want into get into gold, but get into gold miners, because the price of extracting gold is going down. Q: An earlier speaker noted that we’re borrowing too much money, which will lead to higher interest rates and inflation. How can investors protect against this? A: I think that some sort of negative bond approach is a pretty good way to look at higher inflation. There are a lot of ways to do that. I’ve been buying some things called curve caps, which are for all intensive purposes, puts on 30 year bonds out 5 years. In other words, these are bonds that will be issued in 5 years for a 30 year duration. That’s one of 36

- 37. the things I am very strong on. I’m sure there are a number of commodities that would fit that bill as well. Q: You made your reputation as a value investor. Can you discuss the essence of your value investing philosophy? A: It’s changed over the years. I originally thought that a value investment was one that was extremely cheap based on assets and earnings. I’ve changed now to feeling that a value investment is one where there is a low price relative to the expected earnings that the company will have over the next several years. You could make a very good case for a lot of companies, for instance, that haven’t always been classified as value stocks. Intel is trading at 16 or 17 times next years earnings – not bad for an company with its sort of intellectual superiority. Google is another one that appears to be over the moon, but is still growing rapidly. Q: Are you diversifying out of the US dollar? If so, how? A: I’m glad you asked that question because it gives me a chance to promote my own book. I think the Norweigan Krona is the way to go, because I think Norway may be the most prosperous, sound country in the world. It has a normal amount of reserves from its oil sales, which are invested well for all of the 4 million people in Norway. I think some other good currencies are New Zealand, in Eastern Europe – the Czech Republic is extremely well run and I think that currency is pretty good. I have a negative view in particular of the British Pound. Q: I think you had some experience at one time investing in the airline industry. What would have to happen for there to be a long-term opportunity in that business to make money. A: I think the airline industry is going to be a decent industry. I think the unions are no longer in a governing position in the airlines, and I believe as that their influence continues to wane, airlines hopes for survival get better and better. A company like RyanAir, which is the lowest cost producer in the world, has been extremely prosperous through this entire decimation of the rest of the industry. Q: What is your future outlook on agricultural commodities? On treasuries? Is there a bubble building up? A: In light of my outlook for the economy and what’s going to happen, interest rates are too low and bonds are too high, but I don’t think that’s really a bubble being created – more of a wrong valuation. Q: Is there any particular country or industry that you are especially bullish on right now? Anything you are especially bearish on? 37

- 38. A: There are a number of individual companies that I’m bearish on. I think that Mastercard and Visa have a good situation in the credit area, and they’re really not taking much credit risk. I think that the deal now may be to look around and try to find low cost producers like RyanAir and maybe like Intel, which is sort of like an intellectual biggie in terms of technology. Q: When you look back over your career, what are some of the key lessons you’ve learned? A: Never be terribly overconfident. There is always something that can come and swat you in the head. I think the best advice I’ve ever got is that a lot of us sometimes get overly enthusiastic about our business. I did that when I was very young, and my sister came up to me after a cocktail party when I’d expounded on some sort of theory I had at the time, and said that I was becoming a business bore. It was excellent advice and I found that instead of pushing my advice on other people, if I was kind of the quiet guy in the corner of the room, people would come and solicit what I thought. Q: It’s been attributed to you that you believe being invested 200% gross was a less risky than being 100% invested long only? A: I still think that say 120-80 is 40% exposure to the market. I’ve always felt that in this business, if the 50 best (long positions) didn’t outperform what you thought were the 50 worst (short positions), you ought to be in a new business. I’ve been shocked in this business, however, how often the bad outperform the good. Q: Can you talk about saving and government policy? A: I hope the government would change policy and encourage saving rather than spending, which they are doing now. We are totally dependent on the Chinese. Can you imagine 30 years ago someone telling you that for our financial stability we would need the support of China? It’s almost unbelievable. Q: You mentioned the factors that Tiger Cubs have. What characteristics encourage you to seed a new manager? A: Of course, I’d like to see where they’ve been. I do like to see evidence of those characteristics I pointed out, and that’s really what we look primarily for. It’s nice for them to have a particular expertise, and if they’ve worked for some good people along the way. 38

- 39. Q: How much can you teach yourself and how important is it to work for someone great? A: I think it’s important to do both. I was extremely lucky to have hired some very good competitive, honest, and extremely ambitious young people, who really propelled me along. The learning goes both ways. I think it’s important to get that relationship with the people you work with. 39

- 40. Sean Dobson Amherst Securities: “Fishing in a Poisoned Pond” – Analytic Methods for Distressed RMBS Investing Sean Dobson is CEO and Chairman of the Board and head trader for Amherst Securities. Widely recognized as one of the leading traders in the RMBS markets, and currently serves on the Executive Committee for MBS and Securitized Products Division of the Securities Industry and Financial Markets Association (SIFMA). Mr. Robson has over 20 years of experience in the mortgage industry, including previous positions with Spires Financial and the MMAR Group, Inc. -Close to 8 million homeowners in USA not paying their mortgages -We view the world in a very specific way, in a certain light. It can be perceived that we have cast the homeowner as a very treacherous opponent for investors. It is the system that’s in place that makes it difficult for investors in mortgages to manage the risk that the homeowner acts in a perfectly efficient way. -The Pre-2005 Definition of Single Family Mortgage: -Secured by Valuable Real Estate -Guaranteed by a Fully Vetted and Credit Worthy Borrower -Senior to Equity Position Commensurate with the Price Risk of the Asset -Originated Under Standards Established by Investor or Guarantor -His firm went around the country in 2005 and saw that single family home loans had moved entirely away from our past expectations (buyer can no longer be expected to sustain payments, no guarantee on fundamental real estate values, your significant equity position in the home would be aligned with the borrower) -By 2006, we were 0/4 on these 4 criteria 40

- 41. Now: -Terrible Lending Standards – Namely, Limited Documentation Loans to Borrowers with Poor Credit Histories – Account for Bulk of Defaulted Mortgages -There is no one factor that prescribes a bad loan (all depends on rate, equity, etc) -Average credit score used to be FICO around 700, by 2006, below 700s start to take over market (2/3 of people fail to pay loans) 41

- 42. -Among securitized loans, new defaults have plunged, in part due to seasonality; liquidations also have dropped recently -Once new defaults equal liquidations, the inventory overhang stops getting larger every month -Broad averages of recovery outcomes is between $.20 - $.90 on the dollar -Gap between time borrower stops paying and loss is recognized creates period of confusion -In 2007, homeowners are abandoning their loans at rate of 120,000 people/month. -Private label mortgage market is left with 2.2 million loans not being serviced by the borrowers (Fannie MAC estimates 1/3 of these homes are now empty) -November 2008 was realization of losses of 60,000 abandoned loans/month. -The inventory problem continues to worsen rapidly among prime mortgages held by portfolio lenders or insured by GSEs, as new defaults remain high and liquidations low 42

- 43. -Cure rates have fallen such that once a homeowner misses two payments, a foreclosure is almost inevitable 30 Day Delinquent Cure Rate is under 30% 60 and 90 Day Delinquent Cure Rates are under 5% -The resolution process is grinding to a halt Real Estate Owned liquidation rates have doubled to 20% per month, while the rate at which non-performing loans are being foreclosed upon has fallen by half to less than 10% per month, resulting in falling REO, but rising inventory 43

- 44. -The Current “Housing Overhang” is 7 million homes (which doesn’t include any new defaults) -Affordability is a reasonable predictor of home prices Home prices today are fair to cheap without adjusting for supply demand imbalances 44

- 45. Where are we today? -Overall median income numbers are actually not that far down, while interest rates are very low Boosted buying power beyond where it was in 2005 and 2006, this should serve as a buffer for the market -Borrower behavior is rational and efficient Believes expecting otherwise is dangerous Example: -90% of borrowers who took out a GSE-insured mortgage in the year 2000 at a 7.5% rate had refinanced within four years 90% efficiency -50% of these borrowers refinanced when the savings were less than $200 per month Deadly efficient Example: -Mortgages originated in California in 2006 went from experiencing $165k of equity relative to the first lien on average in January 2007 to an average Negative Equity of $149k -The Cumulative Default Rate during the same period went from 1% to 48.5% 45

- 46. -In a recent Harvard Business School report, the authors estimated the implied value of the homeowners’ option to walk away. By refinancing their homes at peak prices, borrowers increased the value of this option by $1.3 trillion in only three years. -The Cash Flow Process (Before Modifications Became Common): -More than half of always-performing loans are at high risk of default 46

- 47. -51% of the performing loans have attributes that have recently experienced a significantly greater rate of default than prepayment -The worst category of borrowers (limited doc, sub-730 FICO, >120 LTV), accounting for 11.3% of the total, has an annual default rate of 32.7%, while prepayments are 0.8%. If this pattern continues, 98% of these loans will default in only 3 years. -Borrowers who are underwater are much more likely to default and are far less likely to prepay Those borrowers that can prepay generally will and those that cannot will likely exercise the other option – the option to default 47

- 48. Default rates are brutally high: 48

- 49. -Another wave of resetting loans is on the horizon. The last wave was driven by subprime loans. This time, it will be option ARMs. -Re-Performing loans are of very poor quality 61% of borrowers with modified loans are currently underwater Only 11% of borrowers have equity in their homes today, and, at origination, had an LTV below 80% and were fully documented at origination -29-50% of modified loans have re-defaulted within six months -Re-Performing loans are re-defaulting at a pace of over 11% per month -All modifications are performing poorly, regardless of loan type or credit score 49

- 50. -Non-Performing Securitized Loans are of terrible quality 79% of all defaulted loans have a current combined LTV above 120% 48% are borrowers with limited documentation loans and negative equity Among defaulted fully documented loans, 60$ are borrowers with below-700 FICO scores and negative equity 50

- 51. -Non-Performing loans are taking much longer to go through the foreclosure pipeline in 2007, only 4.5% of all defaulted loans were delinquent more than 18 months In 2008, this number rose to 8.8% Today, 17.5% -Loss Severities (Recovery Rates) have stabilized in all states As the mix of properties getting liquidated changes, average severity will increases The final disposition of the overhang of distressed properties looms 51

- 52. -When Non-Performing loans are finally liquidated, severities range from 40% on large prime loans to 90% for small subprime loans 52

- 53. Investment Opportunities: The Search for Double-Digit Returns: Investment Themes they like: I. Loss severities will not increase substantially properly priced Alt-A Senior Securities II. Loses will take longer to realize Subprime mezz and select Subprime Senior Sequentials III. Loan Modifications/Government programs will evolve Various bonds where extension and success of lower coupon loan/principal “cram down” modification boost return even in the face of forward rates 53

- 54. Highly likely that there will be a re-tooled modification plan, that will hopefully start to solve the major problem of buyers willingness to pay (in addition to their ability to pay). This plan will hopefully reduce the loan plan to something that is less than the losses that the investors would sustain in the foreclosure process (which helps no one). -On some assets, they believe borrow can pay 50-60% of original payment, which while impairing the asset, greatly decreases the risk of default (everyone wins). -A brief word on Commercial Mortgage Backed Securities (CMBS): Parallels Between RMBS and CMBS: RMBS 1. Higher debt to income (DTI) expanded leverage 2. Low documentation begat larger loans and dodgier borrowers 3. Subordinated finance changed borrower behavior 4. Teaser payment created funding mismatch CMBS 1. Lower debt service coverage ratio (DSCR) expanded leverage 2. Pro-forma underwriting begat larger loans and dodgier borrowers 3. Mezzanine and B-Note finance changed borrower behavior 4. Balloon loan and lease terms create funding mismatch Rating agencies set lending standards Ratings-based capital allocation determined “leverageability: Shadow banking system provided the capital Ex: CMBSs paid lower and lower entry yields as the bubble inflated from 2000-2007 as debt entry yield declined 54

- 55. -The CMBS market in the bubble years was characterized by adverse selection. As the riskiest hospitality/retail loans exploded more than 10x from 2000-2005. -Net Operating Income for CMBSs is dropping 55

- 56. -When they mature, most CMBS loans today are simply being extended, with no loss taken (extend and pretend) -For a typical bubble-era commercial mortgage loan, if NOI drops 20% and the cap rate rises to 8%, LTV jumps to 200% Typical commercial mortgage loan: -NOI = $1 million annually -Cap rate = 4% -Property value - $25 million -At 80% LTV, loan amount = $20 million As cap rate increases from 4% to 8%, the value of the property falls from $25 million to only $10 million, which is half the amount of the loan 56

- 57. Lloyd Khaner Khaner Capital: Management, Management, Management – The Key to Turnarounds Lloyd Khaner is the General Partner of Khaner Capital, L.P., a long-short hedge fund. Without the use of leverage and after all fees the fund has outperformed the S&P 500 for the following standard comparable periods: one year, three years, five years, ten years, fifteen years and eighteen years. Mr. Khaner earned a Bachelor of Arts, cum laude, from Tufts and holds an M.F.A from NYU. -We think about turnarounds the way real estate people think about successful real estate investing (location, location, location management, management, management) The Key to Turnarounds – 18 years of Outperformance No use of leverage, no illiquid investments, all investments made in regulated public markets, Mr. Khaner has 90% of his net worth in the fund -Up almost 450% in past 18 years -Down 14% in 2008 57

- 58. -Significant underperformance in 1999, but significant out-performance in bubble crash of 2000 -Focus on turnarounds shows that the portfolio will protect him. The Key to Turnarounds: Strategy: Value with a Catalyst -Screening out process to avoid value traps First look at debt level, anything about 60-70% debt to equity gets tossed out You can find great value in dying industries, but bad industry often beats out great managers -It takes unique management talent to turn around a troubled company. Finding and investing in this talent is their expertise 58

- 59. Researching Management and finding companies: “Past is often prologue” -Screens for C-Suite changes -Newspaper/news service reports of management changes -52 week low list -Value investing newsletters -Value investing world in general -Research from anywhere (industry experts, former employees, lexus-nexus, etc) CEO Family Trees: 59

- 60. Great CEOs train great future CEOs Also look for board seats Extends to finance: Wait to see where great management goes when they leave companies Turnaround Hall of Fame CEOs: 60

- 61. Signs of a Successful Turnaround: -Cut unprofitable sales stock gets hit hard (why are you cutting sales?) -Cut headcount -Bring in new senior managers -Communicate with entire company -CEO must visit with every part of the company -Coach employees to a winning spirit, winning attitude -Fix relationships with customers (apologize, deal with them directly) -CEO must present a new plan within 3 months of taking over (most importantly, for Wall Street) -Set high, yet achievable goals (build confidence within the company) -Improve products and/or services -Sales down (slammed by Wall Street, people freak out, but this helps gross margin) -Gross margins up -SG&A down (cutting fat, creating lean and mean organization, you want to see this early on) -Operating expenses down -Inventory levels decline, inventory turns rise (inventory probably bloated so levels have to come down, but you want to see turns going up) -Cut and/or restructure debt and covenants if needed (want to maximize breathing room) -No acquisitions for at least 1 year (first figure out what you are before you figure out what you’re going to be) -Focus on Return on Invested Capital Return on Investment Capital (ROIC): -How effectively and efficiently a company reinvests capital back into its own operations 61

- 62. The Key to Turnarounds: Turnaround Categories: Example 1: Molex, Inc. (MOLXA) 62

- 63. Example 2: Praxair, Inc. (PX) Example 3: Campbell Soup Co. (CPB) 63

- 64. Starbucks: Q: Clearly McDonalds and other regional stores have taken away Starbucks market share. Does your model take into account that these people may not return to Starbucks? A: It’s definitely built in. I believe you’ll see Starbucks taking market share back in 2010. Surveys are all ready starting to show this. Additionally, you really cannot get the same product at McDonalds or Dunkin Donuts than you can at Starbucks. Q: Anthony Mozillo, Ken Lay, etc were all legends. The worst guys are always good salesman. How do you avoid them? A: One simple rule, if I’m going into a meeting and asking the questions, if I walk out of the meeting with more questions than before, I walk away quickly. A background check is very helpful since you can see when a CEO just jacked up a company’s financial through leverage as opposed to actually solid 64

- 65. David Einhorn Greenlight Capital: Liquor Before Beer, In the Clear David Einhorn is Chairman of Greenlight Capital (a value-oriented investment advisor), believes an investment approach emphasizing intrinsic value will achieve consistent absolute investment returns and safeguard capital regardless of market conditions. Prior to founding Greenlight, he was at DLJ. -Even though you may not always be right in investments, you don’t have to be. Decent portfolio management allows for bad luck and bad decisions (which you can learn from). A bad decision and its lessons: -At May 2005 Ira Sohn Investment Conference, Einhorn recommended MDC Holdings, which quickly shot up, then collapsed with the rest of its sector -5 years later, anyone who listened to David would have lost 40% -Loss was not bad luck, but bad analysis -Downplayed risk of housing bubble fueled by growing debt bubble -Smart investors have been complaining about the housing bubble since at least 2001. -David ignored Stan Druckenmiller’s advice on the bubble Lesson: it isn’t reasonable to be agnostic about the big picture -Considered himself a bottom-up investor, neglected macro viewpoints, which hurt him -Must view overall industries, sometimes move into macro-level insurance -2 basic problems in government 1. Short-term bias (caused by need for immediate popularity, upcoming elections, etc) Internet, modern news cycle, etc, demands short-term solutions -Bernanke and Geithner are examples of short-term decision makers -Paul Volcker made unpopular decisions in the 1980s, but history ultimately shows that these were wise long-term choices 2. Problem of special interests Small minorities get heard through intensive lobbying -Banking lobby is an example of this -Small consequences spread out across individuals across the country -Financial institutions caused the problems, received bailout Once you bail them out, what do you do to discipline the misbehavior? -In the last few months, we see the beginning of another party, which satisfies both need for short-term solutions and banking special interests -These new regulations don’t make anything safer -We’ve now institutionalized too big to fail 65

- 66. Test ought to be that no institution should ever be of individual importance that if we were faced with its demise, the government would have to intervene Lesson of Lehman: Not that government should have intervened, but that Lehman should have never been that big to begin with -Government dismantled AT&T 25 years ago, which led to great growth and social benefit in the telecommunications industry -Leaders are too influenced by banking special interests -Bailouts have installed a great deal of moral hazard, which in the absence of radical change, every major financial institution will be granting a government backed stock -In effect, we all continue to subsidize the big banks, even though we keep hearing that the worst of the crisis is behind us -Big banks are now developing oligopolies -Mortgage originators are now earning ridiculous profits -Proposed reform does not deal with our current needs -CDS are highly anti-social instrument, because basis packages (bond + CDS) make more money if company fails, so these basis package holders have an incentive to create bankruptcies (GM, Six Flags, etc) -Idea of CDS Clearinghouse just maintains private profits and socialized risks -Trying to make safer CDS is like trying to make safer asbestos -Money markets created systemic risk -During the bubble, companies like GMAC, AIG, GE Capital, etc took enormous, unregulated risks -Rather than deal with simple problems with simple obvious solutions, reform plans are convoluted, only have veneer of reform, serve special interests, and actually reduce transparency -Idea that asset bubbles don’t matter because they can be dealt with after they pop is entirely false -Now told most important thing is to maintain fiscal and monetary support 66

- 67. -Alternative lesson from 1938 double dip economy: GDP created by massive stimulus is artificial (whenever it is removed, there will be significant economic fallout) We must accept some level of fiscal discipline -Social security and Medicare commitments to retiring baby-boomer generation is astronomical, and federal government does not even count future promises to these retirees -In near term, deficit on cash basis is $1.6 trillion, next years forecast - $1.4 trillion Other studies show US fiscal scenario compares to other countries on verge of default -Fed cannot sell its treasuries without destroying the market -Fed will have to shrink the monetary base if inflation actually shows up -Fed must make sure not to repeat error of holding rates too low too long -Higher rates will become both a fiscal and monetary issue -Fed may need to become a buyer of treasuries of first and last resort -Japan may all ready be past the point of no return since it cannot reduce its ratio of debt/GDP, it can only refinance, but never repay its debt -Japanese debt is financed at 2%, but even with this cheap financing, it cannot repay its debt Imagine effect of market changing Japanese rate to 5% -If market re-prices Japanese debt, Japan could experience default, hyperinflation debt spiral and currency crises -Fiat currencies with structural deficits and large unfunded commitments to agencies are of serious concern -Structural risks are exacerbated by credit rated agencies who overrate sovereign debt of large companies No reason to believe credit agencies will do better on sovereign risk than on corporate risk Greenlight met with Moody’s sovereign agency team, and Greenlight was very disappointed (lack of quantitative models, incredible small team, very short term outlook) Credit ratings only pile on downgrades at the worst possible time, which just makes everything worse 67

- 68. -Einhorn’s views have changed in the recent crisis How does one know what the dollar is worth given that it can be created out of thin air? -We should continue to buy stocks in great companies, but we must look at gold as well -Gold does well when monetary fiscal policies are poor, and poorly when they are sensible -Gold did great in Great Depression when FDR debased the currency -Ultimately made bottom in 2001 when excitement about future budget surpluses peaked -Gold will do very well in sovereign debt default or currency crisis -Einhorn is tempted to short the dollar, but upon examination of Euro, Yen, and British Pound, everything looks bad Holding gold is better than holding cash (especially now when both are no yield) -Buys options because he can limit losses and create as much leverage as needed -Believes that our solvency is ultimately at risk -Investors need to buy some insurance to protect themselves from some systemic event -As investors, we can’t change the course of events, but we can protect capital in the face of foreseeable risks Q: How can you peg the value of a dollar in this environment? Can you peg the intrinsic value of an ounce of gold? A: Gold is a monetary asset. It is a unique asset because it has no liability associated with it (dollar bills actually say Federal Reserve note actually liabilities of Fed balance sheet). No corresponding liability with an ounce of gold (not subject to leverage, so therefore, highest quality monetary asset). When you look at a dollar, you see a secondary monetary asset. The question isn’t so much what is gold worth relative to a dollar, but what is dollar worth relative to gold. We need to look at gold as a currency of its own. Q: You predicted collapse of Lehman Brothers by looking at its balance sheet, what do you see when you look at the Federal government’s balance sheet? A: Lehman was not an inevitable failure. I didn’t label it as such, I just thought it had a lot of risks and its equity was overvalued. The fact that it went bankrupt had a lot to do with a colossal mismanagement of the situation. The leaders of our country didn’t force Lehman to do the right thing quickly enough. I don’t believe the US is past the point of no return, btu there is a risk that we are heading in that direction unless we do something soon. 68

- 69. Q: Why are you short GE? A: Not discussing that. Q: Why do you own physical gold versus ETFs or futures? A: Physical gold is cheaper and is actually more liquid than the ETF market, with lower carrying costs. Plus, just fun to visit bars at the vault. Q: Where is the gold located? In the depression era, US government confiscated gold, and the Nixon administration made it illegal to own gold as Americans. A: Gold is located in New York. Q: Could you update your views on the rating agencies? A: The rating agencies are a problem for many reasons. They do a bad job on pretty much everything ranging from municipal to corporate to sovereign debt. Typically, lawsuits against rating agencies are either too vague or dismissed by the First Amendment. Recent ruling stated that the plaintiffs had secure enough reason and potentially viable fraud claim of several billions against rating agencies. The rating agencies may ultimately suffer the fate of the asbestos companies. The regulators should just get rid of credit agencies (too interested in protected shareholders of rating agencies). If shares lost value from this lawsuit, it would help. Major issue with credit agencies is that they are cyclical. They excessively boost companies in good times and excessively harm them in bad times. Q: Are oil or energy stocks a hedge against inflation? A: They are more of a play on the supply and demand of oil or other commodities. There are reasons to worry that the price of oil could go a lot higher (but also worries that it could go a lot lower). Greenlight sometimes invests in energy companies, but this is based on individual valuations, not as a form of solid macro insurance that he spoke about. Q: To what extent is gold all ready pricing in some sort of currency crisis? A: I don’t think that gold is necessarily just about CPI and Inflation. I think there are other forms of inflation (ex: asset inflation). You can look at overall sensibility of fiscal and monetary policies. As they seem to go awry, the price of gold goes up. I think that it makes sense for everybody to have a small fraction of their assets in gold as an insurance just in case something bad happens. Q: What (housing, wages, equity markets, etc) is going to cause inflation? 69

- 70. A: In 1930s, we had tremendous deflation. Effectively, we defaulted when FDR changed price of gold, and gold performed well. We should not measure a gold investment by inflation vs. deflation, but rather sensible vs. non-sensible policy. Q: How are you executing the trade betting on higher Japanese interest rates? A: Effectively buying call options sold by big banks, 2-5 years out. Volatility is low so premiums are low as Japanese rates have been stable for so long. Q: Do you think there are prospects of higher future taxes? A: There need to be a variety of means to resolve our situation. Taxes can be one of them. There is too much current concern about economic slowdown, which causes us to avoid sacrifices. Q: Japanese have a lot of short-term debt. How does this effect your options? A: There is no way to know exactly what the course will be. What we’ve seen, particularly with AAA rated financial institutions, is that they go from AAA to basically insolvent very very suddenly. The underlying basis for why they were AAA was flawed from the first instance. So, seemingly suddenly, you wake up and find that no one will lend to them. You certainly find that possibility in Japan as well. Q: In inflationary periods, gold is probably the premier asset, but there are other precious metals, as well as real estate and productive economic assets. Have you considered other productive assets as alternatives to gold? A: P/E ratios will collapse with significant inflation (future earnings will have to be discounted back to account for inflation). Real estate is an interesting idea, but the problem is that we all ready have a very over-levered, and probably still very overvalued commercial real estate sector. Q: Have you looked at a pair trade, say short copper/long gold, that could increase the your return? A: We haven’t considered that short of pair trade. I have heard questionable things about the copper market and that the price may be overvalued. The better way to manage risk is through position sizing, 70

- 71. Eric Sprott Sprott Asset Management – The Financial Crisis Isn’t Over Canada's “Energy Guru”, manages $4.8 billion worth of hedge and mutual funds as CEO and portfolio manager of Sprott Asset Management. After graduating from Canada’s Carleton University and earning his designation as a Chartered Accountant, he entered the investment industry as a research analyst for Merrill Lynch. In 1981, he founded Sprott Securities Inc. (SSI), which became one of Canada’s largest independently owned institutional brokerage firms. In 2000, he divested his entire ownership of SSI to its employees and formed Sprott Asset Management to focus on the investment management business. He is also Chairman of public company Sprott Resources. -Fund run out of Toronto Mining is becoming huge, Toronto is the place to be -Sprott Hedge Fund LP has returned over 450% in the past 10 years. 71

- 72. Dow now at 10,000. We were at 10,000 at 1999 and we’ve accomplished nothing. This could go down as the lost decade. A History of Market Forecasts: -Excessive Speculation (March 2000): “In the next few motnhs, if not weeks, we anticipate that the Nasdaq will capiutlate to market liquidity. Valuations are screaming at us! Excessive speculation is running rampant. DON’T BE A PART OF IT!!!” -All That Glitters is Gold (October 2001) “But what will happen to the price of gold if and when it is universally considered as the safe haven of last resort? $400? $500? $700? This is easily conceivable. - Requiem for a Housing Bubble (August 2006) “All manias play out the same way. They are dynamics of greed and fear. The greed of making easy money. The fear of missing the boat.…The housing market was a textbook bubble. It was déjà vu all over again.” “Wealth creation via a housing bubble will ultimately prove to be a sham. In our view, it’s a tautology that a hard landing in housing will mean a hard landing in the economy…and with it, a rough ride for the stock market as well.” 72

- 73. The Financial System is a Farce (October 2007) “We have long maintained that the magnitude of the credit bubble that has been built up over the past several years continually needs more and more credit and liquidity to sustain itself, else it would implode under its own weight…. Therefore (central banks) will use all means at their disposal to ensure that the bubble lives on for as long as possible, and the means available in this case is the only one they know: to indiscriminately throw money at all problems that surface.” Surreality Check … Dead Men Walking (November 2007) “In spite of recent beatings, the markets continue to believe that (GM’s) stock is worth $27 per share, or a market cap of $15 billion. Yet after the latest write-down in the third quarter, the book value of GM now stands at an eye-popping minus $74 per share. … The stock markets need a surreality check. Connect the dots and the evidence is overwhelming that the equity of many companies is at risk of being wiped out. They are dead men walking.” Looking into the abyss: “Britain was within hours of a banking shutdown last autumn as the government batteld to piece together a rescue plan for the stricken Halifax and Royal Bank of Scotland, it has emerged. Treasury mandarins and Bank of England officials battled the clock to come up with a support package on the weekend of October 12th, 2008. If they had failed, the Financial Services Authority could have ordered the closure of cash machines and prevented deposits at either of the two main casualties of the global financial chaos” -The Observer, September 9th, 2009 73

- 74. The Bank Balance Sheet: -Fundamental problem: what is appropriate leverage ratio for banks? -Certainly not 20/1, as Einhorn said, banks must de-leverage -Banks’ assets are only getting riskier (both short term and over the long term) FDIC to the Rescue: ColonialBank, Alabama (Aug 14): -Total Assets: $25 billion -Total Deposits: $20 billion -Cost to FDIC: $2.8 billion (11% write down) Guaranty Bank, Texas (Aug 21): -Total Assets: $13 billion -Total Deposits: $12 billion -Cost to FDIC: $3 billion (25% write down) 74

- 75. Corus Bank, Chicago (Sep 11): -Total Assets: $27 billion -Total Deposits: $7 billion -Cost to FDIC: $1.7 billion (24% write down) Georgian Bank, Atlanta (Sep 25): -Total Assets: $2 billion -Total Deposits: $2 billion -Cost to FDIC: $892 million (45% write down) Quantatative Easing: -Won’t be found in economics books, new thing, essentially the simple printing of money -From Federal Open Market Committee minutes (Aug 11-12, 2009): “The [Federal Open Market] Committee directs the Desk to purchase agency debt, agency MBS, and longer-term Treasury securities during the intermeeting period with the aim of providing support to private credit markets and economic activity... The Desk is expected to purchase up to $200 billion in housing-related agency debt and up to $1.25 trillion of agency MBS by the end of the year. The Desk is expected to purchase about $300 billion of longer-term Treasury securities by the end of October, gradually slowing the pace of these purchases until they are completed. The Committee anticipates that outright purchases of securities will cause the size of the Federal Reserve’s balance sheet to expand significantly in coming months.” 75

- 76. -Basically said commercial banks are not buyers of bonds and nobody in their right mind would be a buyer of US bonds -US government raised 200% in the bond market this year than last year Who is buying 200% more? Nobody, the central banks are the buyers of the bonds -This gets to the heart of the potential problem: what happens when quantitative easing finishes? -China is growing, but has done some odd things: -Had a $600 billion stimulus in $4 trillion GDP economy -Exports aren’t improving and have yet to recover -Economy is export driven -Chinese market had tough August when government-owned banks slowed down lending, which brought down the market 25% -Beyond stimulus, we have the same situation in the US (big stimulus, but what happens after?) 76

- 77. Beyond the stimulus: - In their 2008 annual report, the Bank for International Settlements (BIS) reviewed previous banking crises and suggested that a sustainable recovery would require the banking system to take losses, dispose of non-performing assets, eliminate excess capacity and rebuild capital bases. The BIS concludes that “these conditions are not being met and any stimulus will therefore only lead to a temporary pick up in growth followed by a protracted stagnation.” 77

- 78. -We all ready have 2 data points: -Car sales (cash for clunkers ended) -Housing incentive for first time buyers (being abused, expires in November) Data point from homebuilders survey is that foot-traffic fell 15%, building permits down 1.5% -If there is no extension, since 35% of homes have been sold under this program, December home sales will fall by 35% “Revenues in 2009 were almost $420 billion (or 17 percent) below receipts in 2008 and totaled about 15 percent of GDP, the lowest level in over 50 years. At the same time, outlays increased by over $530 billion (or 18 percent) in 2009, to nearly 25 percent of GDP, the highest level in over 50 years. Individual income taxes, the largest source of tax receipts, account for more than half of the total drop in receipts, declining by $230 billion (or 20 percent). Corporate tax receipts declined for the second consecutive year, falling by about $166 billion (or 54 percent).” - Congressional Budget Office Oct. 7, 2009 78

- 79. HUI Gold Index: Up 1,133% Greatest stealth bull market of all time While Dow flat-lined for 10 years, you could’ve had over a 1100% return -Sprott Asset Management hit this Various reasons to like gold: -Supply/demand situation (failures to deliver, impure gold) -Sprott sees shortage of gold (more used than produced every year) -Central banks have decided to sell gold for the past 10 years and instead, bought US bonds -Sprott thinks central banks will sell less gold We’re in the stealing business: -We focus on long-term secular trends. “Buy and hold” is not dead if you own the right things -We tend to look for small-mid cap “hidden gems” with a strong chance of significant upside potential, similar to the style of Peter Lynch. -We typically take a big ownership interest -Is it too risky to “swing for the fences?” We don’t believe it is. If market expectations of growth are well below our own growth expectations, we leave ourselves plenty of room for error. -“Prospectivity” is paramount, regardless of “quality” management team. 79

- 80. Want small to mid-cap stocks, overlooked (little analyst coverage, news coverage), trading at low multiples within the industry Cheapness in the peer group is key -Gold and silver can always be sold (don’t need to worry that there won’t be a market) Investment examples: -Norseman Gold Plc (ASX: NGX): -Market Cap: A$138 mill. / Ownership: 11.1%* -Based in Australia where they operate the country’s longest continually running gold mine -Successful at reducing costs and increasing production after undergoing operational restructuring in late 2008 -Current goal is to increase production to over 100,000 ounces by reaching capacity at their underutilized mill -Further exploration could lead to an upward revision of their production forecast -First 2 long run targets on gold are $2160 and $2450 (from Sprott’s chartist) Multiple at 2000 will be like buying this stock at 0.5x earnings -Every time you hear quantitative easing, you should think gold 80

- 81. -Corridor Resources Inc. (TSX: CDH) -Market Cap: C$287 mil -Ownership: 19.7% -Based in New Brunswick, Canada -Net production of 20 million cubic feet per day from tight sands play, which could double in the near future as two newly producing wells come on line -Independent report recently estimated the potential for over 50 trillion cubic feet (tcf) of gas is in place amongst its extensive shale properties -If they can prove our reserves of 1 tcf, it should be worth C$1 billion in the market, more than triple the current market cap -Sensio Technologies Inc (TSX-V:SIO): -Market Cap: C$67 mil -Ownership: 13% -Montreal-based company with patented technology that facilitates the broadcast and distribution of 3-D content using existing 2D/HD infrastructure -They can also enable broadcasters to upgrade their HD channels from 1080i to 1080p/60 without using any additional bandwidth not reflected in analysts’ estimates -They provide encoding/compression software for minimal or no cost to 3D movie, television and video games producers -Generate revenue by licenses decoding software to makers of televisions, video game consoles, BluRay/DVD players, set-top boxes, personal computers or other playback devices -Addressable market of at least 1.2 billion units per year with royalty rates ranging from $0.50-$8.00 per unit -Expect typical IP licensing gross margins in the 70-80% range 81

- 82. Other stocks: Yukon Nevada Gold Corp (TSX:YNG) -Just got license to restart mill, got 600 million to replace mill -Expects $60 million cash flow Excellon Resources Inc. (TSX:EXN) -Lead zinc silver worth $1000/ounce Romarco Minerals Inc (TSX-V:R) -Think they could have 5 to 7 million ounces of ore, potentially 10 million At market cap of 330, that’s still pretty cheap ($33/ounce) History of out-performance: Q: You commented a few weeks ago that a few major financial institutions were short maybe 600 million ounces of silver. Can you talk about this? A: On the commodity exchange, there’s a report every week that shows if people are long or short silver. The silver short is usually about $6 billion, and about $30 billion of gold is short. These precious metals are moving up. Two banks have about 80% of the short silver position and about 4 represent 60% of gold short(doesn’t know who they are). If it continues to jump up, it’s going to hurt them big time. Q: Can you comment on your position of rare earth metals? A: We’re not in them, even though they’re getting a lot of attention. There are a lot of rare earth metals with all sorts of strange names. Each one has an incredibly small market, so there is hardly anything to invest in, in that area. I have no doubt that they are rare, but it’s not something that I tend to invest in. 82

- 83. Q: You previously wrote about dead firms walking (Fannie, Freddie, GM, etc). What is your updated version of this list? Who’s walking around dead these days? A: Government. What my concern is, is that people have to buy these government bonds everyday. The research we find says that the central banks are buying the bonds. This can’t go on forever - there will be an auction where we face this problem. When we step back and realize the size of demands on the bond market, and the unwillingness of most people to buy them (why should anyone in Canada buy a US bond with the currency risk?). With social security, unfunded pension payments to federal employees, health care, etc, these government liabilities are unfunded and estimated around $70 trillion. There is no way that the government can deal with these commitments, which are coming due. The piper’s coming. Q: You like to invest in real things. What do you consider real things (aside from gold and other resources)? A: 70% of our long side funds are in gold and silver. About half of which is in physical bullion, the rest in stocks. We believe in peak oil, so we invest in oil and gas stocks as well. We’ll look at anything else, but those make up 85-95% of our holdings. Q: Can you talk about your views on inflation and deflation? A: That is the toughest question these days. I think we’re in a deflationary economy, where left to its own devices, we’d be very deflated. If there is another round of quantitative easing, then the move will be on to real things, and we’ll get inflation of real things. We still may have a deflating economy, but real things will inflate. Q: What are your thoughts on natural gas? On the Canadian economy? A: I don’t spend a lot of time thinking about the Canadian economy. Whatever happens in the US, happens in Canada a day or two later, so I tend to focus on the US. Everyone believes that Canada is in great shape, but we really depend on the US, so bad things in the US hurt Canada. The Canadian budget deficit has exploded. We are creating jobs, but any US issues affect Canada. I think natural gas can go into double digits. Since oil and gas drilling has been cut by 50%, production will fall off (decline rate on natural gas could be 30%). With 30% less gas with no drilling, we can lose 15% of the gas production we now have. I think this is setting the stage for a big move in the natural gas price, and a cold winter would only further boost this. 83

- 84. -Zeke Ashton Centaur Capital Partners: Stocks the Rally Left Behind Zeke Ashton is the founder and Managing Partner of Centaur Capital Partners, a Dallas-based value-oriented investment firm. He and co-portfolio manager Matthew Richey are the advisors to the Centaur family of private partnerships using a long / short equity strategy, and are the sub- advisors to the Tilson Dividend Fund, a mutual fund utilizing a unique, income-oriented value investing strategy. About Centaur Capital Partners: Founded in 2002, Centaur Capital Partners (CCP) specializes in value-oriented strategies based on fundamental, bottoms-up securities research and analysis. CCP is based in Southlake, Texas, just outside Dallas. CCP serves as the investment advisor to the Centaur Value Fund, a long / short, long-biased private investment partnership that was launched in August, 2002. Centaur Capital is also the sub-advisor to a retail mutual fund, the Tilson Dividend Fund (TILDX), launched in March 2005 in partnership with Whitney Tilson and Glenn Tongue of T2 Partners in New York. In managing TILDX, CCP utilizes a unique, value-based long-only equity income strategy that seeks to identify undervalued securities and emphasizes income through a combination of dividends and selective use of written covered call options. Early seed investors in Centaur Capital include Whitney Tilson, John Schwartz, and West Coast Asset Management. As of September 30, 2009, Centaur Capital had ~ $80M in AUM. 84

- 85. Stocks that left the rally behind: Alleghany: Good value, low risk Alleghany (NYSE:Y) is a unique holding company that operates primarily in the specialty and property & casualty insurance industry. The company has produced an enviable long-term track record of value creation, by building, acquiring, and selling businesses, and has particular expertise in the insurance, investment management, and natural resource areas. Alleghany uses a “total return” approach to investing its float, and has a very good investing track record. Over the five years ended 2008, the Alleghany equity portfolio produced an average annualized return of 10.6% versus a -2.2% annualized return for the S&P500. Despite the terrible double-shot of large gulf hurricanes in 2008 (Ike was the third most costly weather event in the history of the insurance industry) and the destruction on the asset side of the ledger due to declining equity and fixed income prices, Alleghany managed to see its book value per share decline by only 5%. In mid 2008, Y sold its 55% interest in Darwin Specialty Insurance at 2X BV. As of mid-2009, the company is sitting on a $4.2 billion investment portfolio, of which about $725 million is at the parent company. Alleghany has a fortress balance sheet, with no debt after redeeming convertible debt in June ’09. Alleghany reported book value per share at June 30, 2009 of $284.00 per share An overview of the assets at Alleghany: RSUI is a very profitable underwriter of commercial property insurance and casualty lines including professional liability. RSUI writes over $1 billion in premiums annually, and has produced extraordinary combined ratios the past three years: 80.1% in ’08, 68.9% in ’07, and 70.6% in ’06. The average annual underwriting profit for these three years is ~ $185 million / year. 85