RCA 2012 Q3 Multifamily Trend Report

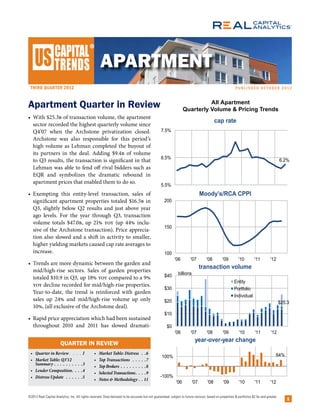

- 1. ® third quarter 2012 Published oct ober 2012 Apartment Quarter in Review All Apartment Quarterly Volume & Pricing Trends • With $25.3b of transaction volume, the apartment cap rate sector recorded the highest quarterly volume since Q4’07 when the Archstone privatization closed. 7.5% Archstone was also responsible for this period’s high volume as Lehman completed the buyout of its partners in the deal. Adding $9.4b of volume 6.5% to Q3 results, the transaction is significant in that 6.2% Lehman was able to fend off rival bidders such as EQR and symbolizes the dramatic rebound in apartment prices that enabled them to do so. 5.5% • Exempting this entity-level transaction, sales of Moody’s/RCA CPPI significant apartment properties totaled $16.5b in 200 Q3, slightly below Q2 results and just above year ago levels. For the year through Q3, transaction volume totals $47.0b, up 21% yoy (up 44% inclu- 150 sive of the Archstone transaction). Price apprecia- tion also slowed and a shift in activity to smaller, higher yielding markets caused cap rate averages to increase. 100 '06 '07 '08 '09 '10 '11 '12 • Trends are more dynamic between the garden and transaction volume mid/high-rise sectors. Sales of garden properties billions totaled $10.9 in Q3, up 18% yoy compared to a 9% $40 Entity yoy decline recorded for mid/high-rise properties. $30 Portfolio Year-to-date, the trend is reinforced with garden Individual sales up 24% and mid/high-rise volume up only $20 $25.3 10%, (all exclusive of the Archstone deal). $10 • Rapid price appreciation which had been sustained throughout 2010 and 2011 has slowed dramati- $0 '06 '07 '08 '09 '10 '11 '12 year-over-year change Quarter in Review • Quarter in Review�����������1 • Market Table: Distress �����6 64% 100% • Market Table: Q3’12 • Top Transactions ��������������7 Summary����������������������������3 • Top Brokers��������������������������8 • Lender Composition����������4 • Selected Transactions����������9 • Distress Update �����������������5 -100% • Notes Methodology�����11 '06 '07 '08 '09 '10 '11 '12 ©2012 Real Capital Analytics, Inc. All rights reserved. Data believed to be accurate but not guaranteed; subject to future revision; based on properties portfolios $2.5m and greater. 1

- 2. ® third quarter 2012 Quarterly Volume Pricing Trends cally in 2012. Many REIT and institutional buyers are opting to develop rather than buy at premium Garden Mid/high-rise prices. Other investors are being drawn to the rela- cap rate tively higher cap rates available in secondary and 7.5% tertiary markets. Apartment sales in the six major 7.0% metros fell 23% yoy in Q3 while secondary market 6.5% activity rose 21% and tertiary sales surged 54%. The 6.0% trend is apparent across both the garden and mid/ 5.5% Major Metro Avg. Cap high-rise sectors. Avg. Cap Rate 5.0% '08 '09 '10 '11 '12 '08 '09 '10 '11 '12 • With investors opting to build rather than buy price per unit in thousands prime properties combined with the significant $300 shift in sales to higher-yielding markets, cap rate $250 averages took a turn upward in Q3, rising roughly $200 20 bps to 6.3%. While there are plenty of deals trans- $150 acted at 4.0% or lower yields, far more transactions $100 are happening in secondary and tertiary markets $50 where cap rates have average 70 to 140 bps higher '08 '09 '10 '11 '12 '08 '09 '10 '11 '12 than in major metros. Thus, the uptick in average transaction volume cap rates does not indicate a re-pricing throughout $20 billions the apartment sector. In fact, due to recent declines $15 in mortgage interest rates and a more competitive environment among lenders (see page 4), cap rates $10 remain under downward pressure. $5 • Student housing properties remain in high demand $0 '08 '09 '10 '11 '12 '08 '09 '10 '11 '12 by investors and volume for that niche topped $1.8b year-over-year change through Q3, up 23% yoy. Senior housing transac- 300% tions, not included in the apartment sector totals, 100% are off significantly this year chiefly due to few large entity or portfolio deals. Sales of individual senior -100% housing properties were actually up a robust 43% in '08 '09 '10 '11 '12 '08 '09 '10 '11 '12 Q3 and are up 23% year-to-date. Summary Table volume YTD Through Q3'12 vs YOY average pricing YTD Through Q3'12 vs YOY $ bil yoy # props yoy $/unit % chng cap bps Apartment Total $55.8 44% 3,525 37% $104,418 4% 6.2% -25 Garden $35.0 44% 2,466 33% $82,121 12% 6.3% -29 Mid/High-rise $20.8 43% 1,059 48% $190,311 -13% 5.8% -5 Major Metros $25.1 38% 1,493 39% $195,323 2% 5.6% -20 Secondary Mkts $24.5 49% 1,455 33% $80,623 16% 6.4% -21 Tertiary Mkts $5.9 45% 484 22% $68,398 13% 7.1% -46 Student Housing $1.8 26% 92 6% $113,531 -3% 7.0% -40 Senior Housing* $5.2 -79% 423 -73% $107,140 -3% 8.7% -86 * not included in apartment volume or pricing statistics ©2012 Real Capital Analytics, Inc. All rights reserved. Data believed to be accurate but not guaranteed; subject to future revision; based on properties portfolios $2.5m and greater. 2

- 3. ® third quarter 2012 Market table: Q3’12 Apartment Summary Volume Pricing Transactions Reported YOY YOY PPU Cap Rate Closed Through Q3’12 Vol ($M) # Props Low High Low High Change Change Avg Avg Baltimore $726.7 74% 26 100% $40,313 $127,535 $253,725 5.4% 6.9% 9.0% Mid- DC 1,203.9 239% 35 169% 51,790 284,059 453,774 DC MD burbs 1,214.6 19% 24 -17% 62,366 142,899 418,650 4.6% 6.3% 7.2% Atlantic DC VA burbs 2,478.6 22% 38 12% 98,780 199,936 395,928 5.7% 6.4% 7.0% Philadelphia 304.1 -26% 22 -27% 15,741 89,397 925,625 4.2% 5.9% 7.0% Pittsburgh 13.3 -72% 2 -60% 48,408 53,414 61,957 6.7% 7.0% 7.3% Richmond/Norfolk 313.8 -32% 18 -25% 31,776 104,560 154,167 5.2% 6.1% 7.0% Tertiary Mid-Atlantic 437.6 38% 25 -7% 38,580 82,410 140,899 6.0% 7.5% 9.0% Total $6,692.6 32% 190 9% $15,741 $137,121 $925,625 4.0% 6.5% 9.0% Chicago 1,005.8 -21% 59 -2% 25,417 148,858 497,738 5.8% 7.5% 8.5% Midwest Cincinnati 146.2 -3% 11 -35% 33,333 56,619 162,295 Cleveland 106.6 65% 12 71% 21,739 41,895 122,321 7.8% 8.6% 10.1% Columbus 136.0 9% 16 78% 8,125 35,126 152,174 Detroit 300.2 126% 23 53% 9,390 57,300 122,137 Indianapolis 110.6 -25% 10 -38% 32,474 51,842 70,330 6.7% 8.1% 9.5% Kansas City 237.5 44% 13 -19% 11,333 61,204 114,583 5.8% 7.1% 9.0% Minneapolis 273.2 37% 23 77% 22,404 93,843 358,333 St Louis 120.7 45% 13 160% 24,630 54,014 86,705 4.2% 6.5% 9.0% Tertiary Midwest 945.3 162% 82 39% 15,152 60,704 153,125 4.7% 7.3% 8.7% Total $3,382.1 25% 262 21% $8,125 $73,236 $497,738 4.2% 7.5% 10.1% Boston 1,516.6 57% 76 130% 57,157 201,740 800,000 4.5% 5.5% 6.0% Northeast Hartford 52.6 190% 19 280% 23,435 44,570 122,500 Long Island 228.6 277% 7 0% 83,784 230,190 261,111 Manhattan 5,765.8 49% 299 99% 35,762 329,803 2,666,667 3.0% 5.1% 6.9% No NJ 582.8 -47% 59 -3% 33,333 111,764 325,153 5.0% 6.0% 8.0% NYC Boroughs 1,394.6 22% 215 39% 49,123 134,893 903,226 4.5% 7.0% 9.9% Stamford 303.3 237% 10 100% 47,656 164,525 1,058,824 4.0% 5.9% 7.8% Westchester 90.4 16% 9 0% 64,286 113,053 150,000 7.2% 7.2% 7.3% Tertiary Northeast 156.7 2% 28 75% 11,416 55,022 180,198 6.2% 7.4% 9.5% Total $10,091.5 35% 722 64% $11,416 $205,268 $2,666,667 3.0% 6.1% 9.9% Atlanta 2,361.3 51% 132 25% 5,627 66,171 276,483 4.8% 7.6% 9.9% Southeast Broward 667.7 88% 30 88% 22,159 97,338 454,688 4.5% 6.4% 7.5% Charlotte 486.9 8% 23 15% 14,527 89,838 208,333 5.0% 6.0% 7.8% Jacksonville 372.8 32% 26 30% 17,630 55,804 150,195 Memphis 271.6 30% 20 0% 6,641 49,083 102,586 6.3% 7.8% 9.2% Miami 310.9 86% 40 60% 25,000 92,936 436,042 4.1% 5.8% 7.3% Nashville 503.9 82% 30 150% 12,017 67,874 170,455 7.0% 7.5% 7.9% Orlando 701.3 54% 35 21% 15,076 71,726 245,833 5.8% 6.5% 7.5% Palm Beach 445.5 140% 19 46% 18,750 89,067 180,282 Raleigh/Durham 941.3 58% 41 37% 28,175 97,515 346,721 4.6% 6.0% 7.8% Tampa 790.8 0% 50 4% 14,946 69,411 156,896 3.7% 6.7% 9.5% Tertiary Southeast 2,451.8 12% 187 1% 9,368 59,989 210,301 5.0% 7.1% 10.8% Total $10,305.8 37% 633 21% $5,627 $69,754 $454,688 3.7% 6.7% 10.8% Austin 1,575.4 287% 64 121% 27,721 108,485 278,075 4.7% 6.1% 7.1% Southwest Dallas 2,119.1 16% 148 22% 11,407 54,991 269,266 6.0% 7.3% 9.1% Denver 1,569.2 88% 71 27% 30,303 100,951 251,563 5.3% 6.3% 7.6% Houston 1,642.7 17% 111 17% 11,656 76,361 159,033 5.4% 6.0% 6.6% Phoenix 2,076.9 57% 109 14% 16,185 74,197 366,667 3.6% 6.3% 8.6% San Antonio 481.4 16% 37 95% 44,401 75,889 115,702 4.4% 5.7% 7.0% Tertiary Southwest 1,268.6 101% 104 68% 16,129 74,398 143,049 4.7% 7.4% 10.3% Total $10,733.4 57% 644 35% $11,407 $79,470 $366,667 3.6% 6.7% 10.3% East Bay 786.7 -8% 50 22% 40,476 154,224 277,083 4.8% 5.8% 7.2% West Inland Empire 572.8 2% 32 -6% 28,527 105,540 243,243 5.0% 5.8% 6.6% Las Vegas 328.7 -1% 29 32% 12,153 42,207 96,739 6.5% 7.7% 9.3% Los Angeles 4,286.0 60% 350 48% 31,600 169,469 802,857 3.0% 5.4% 9.5% Orange Co 1,024.0 170% 43 72% 105,269 242,745 487,106 4.5% 5.5% 6.6% Portland 489.3 10% 32 39% 38,362 117,123 240,718 4.5% 6.5% 8.9% Sacramento 424.0 100% 28 100% 24,600 89,792 310,714 5.3% 6.1% 8.5% Salt Lake City 52.6 5% 7 17% San Diego 1,147.4 171% 71 78% 65,789 139,795 466,667 4.1% 5.8% 7.7% San Francisco 1,236.7 10% 122 -22% 86,111 217,957 664,000 3.3% 5.2% 7.1% San Jose 1,109.7 227% 47 213% 113,571 251,029 553,991 3.7% 5.1% 9.0% Seattle 1,725.2 63% 93 58% 32,461 151,307 417,550 4.0% 5.2% 6.5% Tertiary West 1,046.6 92% 77 35% 23,810 133,952 540,323 3.3% 6.0% 9.3% Total $14,229.5 58% 981 34% $12,153 $146,413 $802,857 3.0% 5.6% 9.5% US Other 350.3 50% 93 675% Total US $55,785.1 44% 3,525 37% $5,627 $104,418 $2,666,667 3.0% 6.2% 10.8% ©2012 Real Capital Analytics, Inc. All rights reserved. Data believed to be accurate but not guaranteed; subject to future revision; based on properties portfolios $2.5m and greater. 3

- 4. ® third quarter 2012 Apartment Lender Composition • With interest rates on long term, fixed rate deals now Apartment Lender Composition H1’12 averaging below 4.0% and better rates to be had for CMBS Financial shorter term and floaters, positive leverage is achievable Gov't Agency Insurance for all but the lowest cap rate deals. The agencies continue Int'l Bank Nat'l Bank to dominate originations, but their market share is slowly Reg'l/Local Bank Pvt/Other declining as other lenders ramp up activity. All Apartment Past 5 Years • The government agencies accounted for 64% of all mul- H1'12 64% 8% 8% 10% tifamily mortgage originations in the first half of 2012, down from 68% in 2011. The agencies remain very aggres- 2011 68% 8% 10% sive and are increasingly packaging their multifamily loans into securitizations. To date this year, Freddie and 2010 76% 4% 9% Fannie have securitized $23b of multi-family loans, well ahead of the $17b of issuance for all of 2011. Freddie has 2009 87% 6% been most active and recently completed its 14th issue this year. 2008 8% 61% 10% 13% • There are few areas where the agencies do not have a By Apartment Subtypes majority market share such as for mid/high-rise prop- erties, where insurance companies and banks are more Garden 76% 7% 6% 5% active. Agen- Commercial Mortgage Rates cies are also less Mid/high- 8% 48% 13% 8% 17% Commercial rise Multifamily dominant in the Student 7.0% Northeast, where Hsg 13% 70% 5% 6.5% regional and local 6.0% 5.5% banks have a 27% By Major, Secondary and Tertiary Markets 5.0% share of multi- Major 4.5% family lending. Metro 5% 59% 8% 9% 16% 4.0% 3.5% • Private label Secondary 71% 11% 2009 2010 2011 2012 CMBS has not Fixed rate loans with 7-10 year terms Tixed rate loans with 7-10 year terms been very impact- Tertiary 80% ful on the multifamily lending landscape, so far account- 3-month average ing for just 3% of originations this year and last. The By Region CMBS conduits have a greater penetration in lending for student housing properties and also in the Midwest Northeast 9% 47% 7% 7% 27% region. Mid-Atlantic 81% 6% • Many banks have returned to commercial property lend- ing again and their share of multifamily originations Southeast 76% 9% increased to 19% in the first half of 2012 compared to 16% in 2011. Much of that activity has been in the major met- Midwest 8% 70% 6% ros as well as a concentration in the Northeast and West. Banks are also active in construction financing which is Southwest 75% 9% 5% not included in this analysis. West 67% 12% 11% 6% • In tertiary markets, the agencies remain the primary lender and account for 80% of all apartment property loans. ©2012 Real Capital Analytics, Inc. All rights reserved. Data believed to be accurate but not guaranteed; subject to future revision; based on properties portfolios $2.5m and greater. 4

- 5. ® third quarter 2012 Distress update • Defaults and transfers to special servicing of loans Cumulative DistressDistress Cumulative for Apartment for apartment properties totaled $660m in Q3’12, for Apartment Properties Properties the lowest since 2007. Most of the newly distressed $90 billions situations are resulting from maturity defaults $80 Troubled of CMBS loans. Workout activity fell to $2.4b in REO $70 Restructured Q3’12, resulting in a significant decline in outstand- Resolved $60 ing distress. Year-to-date outflows have exceeded $50 inflows by $5.2b. $40 • At the end of Q3’12, a total of $30.9b of mortgages $30 on apartment property remained distressed with $20 $20.9b in the workout process and $10.0b converted $10 to REO. Throughout the cycle, a total of $81.8b of $0 apartment property has become distressed, and 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 to date, 63% of that total has been resolved. Banks '08 '09 '10 '11 '12 and other lenders are much farther along at work- ing out distressed situations while just 51% of dis- Quarterly AdditionsAdditions and to Quarterly and Reductions Reductions to Distress Distress tressed CMBS loans have been resolved. billions $15 Summary by Lender Type Newly Troubled Outstanding % Chg Worked RR* Worked out Net Change Distress ($M) vs Q1'11 Out (%) (%) $10 CMBS $14,820 -14% 51% 74% Int'l Bank $1,250 2% 75% 72% $5 Domestic Bank $8,201 -19% 66% 68% Insurance $382 -33% 81% 83% $0 Gov't Agency $1,120 -31% 67% 64% Other $5,116 -14% 72% 70% All Apartments $30,888 -16% 63% 70% -$5 * recovery rate before costs and fees -$10 • The recovery rate on liquidations of defaulted apart- 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 ment loans was 70% as of Q3, yet greater recoveries '08 '09 '10 '11 '12 have been available for mid/high-rise properties (85%), especially in the gateway cities (see “Q3’12 % of Sales Associated with Distress % of Sales Associated with Distress Recovery Rates”, published October 10). billions $4 35% Distress • Year-to-date, outstanding distress is down in 30% % of Total $3 25% almost every US market. Several large markets Sales have worked out more than 80% of identified dis- 20% $2 tress including Washington DC, DC/VA burbs, 15% San Francisco, San Jose, Broward, and Nashville. $1 10% Markets resolving the most distress in 2012 include 5% those that had been among the most illiquid such $0 0% as Atlanta, Phoenix, Las Vegas, Baltimore and ter- 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 tiary markets in the Southeast. '08 '09 '10 '11 '12 ©2012 Real Capital Analytics, Inc. All rights reserved. Data believed to be accurate but not guaranteed; subject to future revision; based on properties portfolios $2.5m and greater. 5

- 6. ® third quarter 2012 Market table: Distress and workouts Current Outstanding Distress Recent Trends YTD Through Q3’12 Current Known Distress Cumulative in Default/ Total Worked Out % Recovery Through October 24, 2012 Total Special Serv Held as REO Outstanding Total Worked Out Rate Inflows Workouts Baltimore 1,045.1 169.3 15.8 185.1 859.9 82% 87% 386.1 416.0 Mid- DC 718.2 51.4 4.0 55.4 662.8 92% 83% - 8.8 DC MD burbs 1,615.4 339.8 - 339.8 1,275.5 79% 77% 20.3 250.7 Atlantic DC VA burbs 1,353.8 - 32.8 32.8 1,321.0 98% 88% 56.0 226.0 Philadelphia 981.8 498.3 34.0 532.3 449.5 46% 74% - 21.6 Pittsburgh 156.4 20.2 1.9 22.1 134.4 86% 96% - 7.8 So NJ 250.2 84.2 - 84.2 166.0 66% 97% - 82.9 All Others 689.1 204.3 72.7 277.1 412.0 60% 84% 104.6 162.0 Mid-Atlantic $6,809.9 $1,367.5 $161.2 $1,528.8 $5,281.2 78% 83% $567.0 $1,175.9 Chicago 2,447.7 734.9 217.3 952.3 1,495.5 61% 68% 56.0 148.5 Midwest Cincinnati 248.3 62.8 14.4 77.3 171.1 69% 74% - 52.5 Cleveland 312.7 56.1 2.6 58.6 254.1 81% 56% 4.1 66.3 Columbus 577.6 222.6 101.8 324.4 253.2 44% 65% 49.4 55.5 Detroit 792.3 97.1 214.2 311.3 481.0 61% 43% 5.3 82.1 Indianapolis 470.7 143.7 83.6 227.3 243.5 52% 65% 14.9 33.3 Kansas City 263.8 78.4 17.3 95.7 168.1 64% 78% 48.3 43.7 Milwaukee 228.7 8.5 121.1 129.6 99.1 43% 68% 5.8 3.5 Minneapolis 91.8 24.2 5.7 29.8 62.0 68% 70% 7.1 2.3 St Louis 255.1 112.4 64.7 177.1 78.0 31% 72% 28.1 18.6 All Others 1,089.6 394.2 100.7 494.9 594.7 55% 63% 53.1 107.6 Midwest $6,778.6 $1,934.8 $943.5 $2,878.3 $3,900.3 58% 64% $272.1 $613.7 Boston 604.4 70.4 155.9 226.3 378.0 63% 77% 11.0 31.7 Northeast Hartford 174.6 39.8 18.1 57.8 116.8 67% 6.0 17.4 Long Island 59.1 - - - 59.1 100% 22.5 22.5 Manhattan 10,005.0 5,198.0 284.3 5,482.4 4,522.7 45% 89% 116.6 1,412.6 No NJ 865.9 160.5 343.6 504.1 361.8 42% 90% 3.9 24.4 NYC Boroughs 1,092.5 387.0 82.5 469.5 623.0 57% 93% 14.4 118.3 Stamford 254.2 24.1 9.3 33.3 220.9 87% 0.4 50.0 Westchester 71.4 5.9 - 5.9 65.5 92% 64% - - All Others 303.7 100.3 38.2 138.5 165.2 54% 76% 7.4 12.2 Northeast $13,430.9 $5,986.1 $931.9 $6,917.9 $6,513.0 48% 89% $182.2 $1,689.2 Atlanta 4,505.2 589.8 929.7 1,519.6 2,985.6 66% 65% 248.4 615.6 Southeast Broward 1,568.9 197.7 73.4 271.1 1,297.8 83% 57% 2.0 199.2 Charlotte 1,206.0 506.0 88.8 594.8 611.2 51% 78% 462.4 322.4 Jacksonville 1,047.7 303.6 138.9 442.5 605.2 58% 55% 47.6 106.2 Miami 3,329.5 550.5 946.3 1,496.8 1,832.7 55% 62% 85.3 218.5 Nashville 547.7 54.3 13.1 67.4 480.3 88% 59% - 173.5 Orlando 2,415.0 294.3 366.5 660.8 1,754.1 73% 62% 41.2 122.8 Palm Beach 1,660.4 451.6 177.2 628.7 1,031.7 62% 64% 198.2 79.5 SW Florida 1,414.1 256.3 61.9 318.2 1,095.9 77% 52% 33.6 100.9 Tampa 2,116.9 380.1 217.8 597.8 1,519.1 72% 60% 58.4 155.8 All Others 5,839.6 1,465.4 811.0 2,276.4 3,563.2 61% 73% 551.5 608.0 Southeast $25,651.1 $5,049.6 $3,824.6 $8,874.1 $16,776.9 65% 65% $1,728.8 $2,702.6 Austin 967.1 286.7 12.0 298.7 668.3 69% 68% 70.6 95.7 Southwest Dallas 2,816.4 688.2 326.0 1,014.3 1,802.1 64% 74% 369.7 362.7 Denver 722.5 235.8 12.8 248.6 473.9 66% 80% - 58.8 Houston 3,061.2 813.1 625.0 1,438.1 1,623.1 53% 71% 201.1 354.4 Phoenix 4,820.8 1,081.7 586.2 1,668.0 3,152.8 65% 65% 178.5 477.0 San Antonio 578.6 176.8 15.0 191.8 386.9 67% 94% 38.8 89.5 All Others 1,701.3 508.8 109.9 618.7 1,082.7 64% 69% 173.0 263.1 Southwest $14,667.9 $3,791.2 $1,686.9 $5,478.0 $9,189.9 63% 68% $1,031.6 $1,701.2 Central CA 338.2 106.8 36.4 143.2 195.0 58% 65% 6.3 34.6 West East Bay 548.4 52.4 161.0 213.3 335.1 61% 79% - 7.8 Hawaii 57.5 - 29.5 29.5 28.0 49% 100% - - Inland Empire 835.0 292.3 115.7 408.0 427.0 51% 78% 7.4 26.5 Las Vegas 3,870.8 1,043.2 1,082.5 2,125.7 1,745.1 45% 59% 133.3 514.6 Los Angeles 2,927.2 431.1 275.1 706.3 2,221.0 76% 85% 82.1 331.1 Orange Co 533.1 108.0 - 108.0 425.2 80% 83% 22.9 0.8 Portland 296.8 95.6 13.6 109.2 187.6 63% 93% 1.6 43.7 Reno 440.5 46.1 198.9 245.1 195.4 44% 64% 31.2 112.0 Sacramento 726.0 173.5 28.2 201.7 524.3 72% 73% 47.9 119.8 San Diego 571.3 46.9 14.5 61.4 509.9 89% 86% 1.7 11.3 San Francisco 2,154.6 98.6 67.3 165.9 1,988.7 92% 87% 4.0 230.2 San Jose 453.0 2.2 2.0 4.2 448.7 99% 78% - 3.1 Seattle 1,273.1 150.9 515.7 666.6 606.4 48% 82% 8.3 59.1 All Others 497.8 243.6 26.6 270.2 227.6 46% 76% 27.7 60.9 West $15,523.4 $2,891.2 $2,567.2 $5,458.4 $10,065.0 65% 77% $374.2 $1,555.4 ©2012 Real Capital Analytics, Inc. All rights reserved. Data believed to be accurate but not guaranteed; subject to future revision; based on properties portfolios $2.5m and greater. 6

- 7. ® third quarter 2012 top Apartment transactions of Q3’12 Top 25 Property Sales by Investment Volume Transaction Location Inv Vol ($M)* Units PPU Buyer 1 Waterfront at Pu'uloa Ewa Beach, HI $311.0 1,461 212,868 Carmel Partners 2 Apthorp (Bulk Condo) New York, NY 215.1† 110 2,606,773 AREA Property Partners 3 The Beatrice New York, NY 280.0 301 930,233 Equity Residential 4 Savoy Park New York, NY 216.0 1,802 119,867 LM Development Partners JV Citigroup 5 Howard Crossing Ellicott City, MD 186.0 1,350 137,778 Home Properties 6 Oak Grove Village Melrose, MA 175.0 550 318,182 GID 7 Mass Court Washington, DC 168.4 371 453,774 TIAA-CREF 8 Georgian Towers Silver Spring, MD 168.0 890 188,764 Pantzer Properties 9 The Block Austin, TX 165.0 669 246,637 American Campus Communities 10 Sussex at Kingstowne Alexandria, VA 125.5 556 225,719 Praedium Group JV Milestone Group 11 Club Laguna Laguna Beach, CA 120.8 421 286,936 Invesco RE 12 The Brewster New York, NY 98.0 144 680,556 Cornerstone RE Advisers JV Adelco 13 The Electra New York, NY 95.0 163 582,822 Carmel Partners 14 Archstone Legacy Place Dedham, MA 94.3 285 330,702 Archstone 15 Legacy Apartment Homes San Diego, CA 91.0 412 220,874 RV Management Corp 16 Canyon Creek Bothell, WA 90.7 558 162,616 Greystar RE Partners 17 Landmark at Ontario Towne Center Ontario, CA 90.5 469 192,964 Camden Property Trust 18 Hamptons at Town Center Germantown, MD 90.3 768 117,513 AHC 19 Highpoint Apartments Quincy, MA 88.0 394 223,350 Berkshire Property Advisors 20 Avalon Arlington Heights Arlington Heights, IL 87.3 409 213,325 John Hancock 21 Waterford Hayward, CA 86.5 544 159,007 Kennedy Wilson JV 22 Mantena New York, NY 84.0 98 857,143 Equity Residential 23 Circa Green Lake Seattle, WA 83.1 199 417,550 TIAA-CREF 24 88 Lexington Avenue New York, NY 82.0 180 455,556 Westbrook Partners 25 Preserve at Travis Creek Austin, TX 79.5 608 130,757 Heitman Top 10 Portfolio Sales Transaction Location Inv Vol ($M)* Units PPU Buyer 1 Archstone Multiple $8,765.6† 67,962 242,783 Lehman Brothers Holdings Inc 2 Campus Acquisitions Merger Multiple 627.0 2,210 283,710 American Campus Communities 3 Kushner MD APT Portfolio '12 Multiple, MD 125.0† 5,517 90,629 Kushner Companies 4 UDR/DRA Advisors Apt Portfolio 2012 Multiple 431.0 4,454 106,870 DRA Advisors JV Milestone Group 5 Landmark Apt Portfolio 12 Multiple n/a 5,353 n/a Apartment Trust of America 6 35 Building Pinnacle Note Sale New York, NY 139.2 1,029 140,914 Heritage Realty JV Dune Capital Mgmt 7 Lynd JV Florida Value Partners CVI Portfolio Multiple 141.0 2,990 47,157 Lynd JV Florida Value Partners 8 State Street Development Apt Portfolio 2012 Multiple, MA 115.9 849 136,523 Preservation of Affordable Housing 9 Aires Portfolio New York, NY 51.0† 328 310,976 Vornado Realty Trust 10 Laurel Square I II Laurel, MD 102.0 982 103,870 Hampshire Properties * When prices are not known, estimated prices are used in the ranking but are not shown. In the case of partial interest deals, the pro-rated share of the property was used for the transaction price and the PPU/PPSF was based on the full 100% price. † Partial Interest ©2012 Real Capital Analytics, Inc. All rights reserved. Data believed to be accurate but not guaranteed; subject to future revision; based on properties portfolios $2.5m and greater. 7

- 8. ® third quarter 2012 top Apartment Brokers through Q3’12 top 25 By investment volume By Region* Garden Mid/high-rise All Apartment Mid-Atlantic CBRE 7,176,568,723 CBRE 2,055,429,604 CBRE 9,231,998,327 CBRE Apartment Realty Advisors 3,083,401,450 HFF 1,220,595,193 Apartment Realty Advisors 3,763,506,862 Apartment Realty Advisors Marcus Millichap 2,941,390,658 Eastdil Secured 987,086,801 Marcus Millichap 3,710,873,661 First Capital Realty Cushman Wakefield 1,690,450,425 Marcus Millichap 769,483,003 HFF 2,649,720,198 Moran Co HFF 1,429,125,005 Apartment Realty Advisors 680,105,412 Cushman Wakefield 2,254,441,767 Marcus Millichap Hendricks Ptnrs 1,194,421,846 Cushman Wakefield 563,991,342 Moran Co 1,524,728,841 Midwest Moran Co 1,077,826,506 Jones Lang LaSalle 497,975,000 Eastdil Secured 1,522,644,801 CBRE Jones Lang LaSalle 672,705,771 Massey Knakal 495,161,244 Hendricks Ptnrs 1,286,897,343 Marcus Millichap Eastdil Secured 535,558,000 Moran Co 446,902,335 Jones Lang LaSalle 1,170,680,771 HFF Colliers International 387,710,497 Rosewood Realty Group 444,573,500 Colliers International 584,576,497 Moran Co Transwestern 348,887,285 Prince Realty Advisors 280,000,000 Massey Knakal 519,661,244 Hendricks Ptnrs Engler Financial Group 289,425,000 Besen Associates 222,320,000 Engler Financial Group 454,275,000 Northeast First Capital Realty 279,550,500 Colliers International 196,866,000 Rosewood Realty Group 449,573,500 Eastdil Secured Grubb Ellis 183,749,968 Eastern Consolidated 177,706,876 Transwestern 348,887,285 CBRE Newmark Grubb Knight Frank 177,241,875 Engler Financial Group 164,850,000 First Capital Realty 341,420,500 Massey Knakal Lee Associates 121,600,000 Ariel Property Advisors 95,082,545 Prince Realty Advisors 280,000,000 HFF Rosewood Realty Group Friedman Integrated #REF! Portman Realty 95,000,000 Grubb Ellis 227,150,968 NAI Global 113,448,979 Hendricks Ptnrs 92,475,497 Besen Associates 222,320,000 Southeast Southeast Apartment Partners 101,181,000 Multi Investment Group 79,150,000 Newmark Grubb Knight Frank 194,291,875 CBRE Cassidy Turley 90,383,883 Arroyo Coates 75,801,750 Eastern Consolidated 177,706,876 Apartment Realty Advisors Cushman Wakefield Kidder Mathews 87,145,743 GFI Capital Resources 70,244,774 NAI Global 137,283,979 Jones Lang LaSalle Houston Income Properties 85,170,396 Alain Pinel 67,838,304 Rockwood RE Advisors 130,161,688 Engler Financial Group Kislak 83,520,420 First Capital Realty 61,870,000 Kidder Mathews 122,900,743 Sperry Van Ness 80,708,000 Studley 56,000,000 Lee Associates 121,600,000 Southwest CBRE Rockwood RE Advisors 76,850,000 Rockwood RE Advisors 53,311,688 Friedman Integrated #REF! Apartment Realty Advisors $0.0 $4.0 $8.0 $0.0 $1.0 $2.0 $0.0 $5.0 $10.0 HFF Billions Billions Billions Marcus Millichap Moran Co top 15 By number of Properties West Garden Mid/high-rise All Apartment Marcus Millichap CBRE CBRE 350 Marcus Millichap 71 CBRE 397 Cushman Wakefield Marcus Millichap 260 Massey Knakal 65 Marcus Millichap 331 Moran Co Apartment Realty Advisors 129 HFF 59 Apartment Realty Advisors 151 Hendricks Ptnrs Hendricks Ptnrs 108 CBRE 47 Hendricks Ptnrs 113 Cushman Wakefield 81 Rosewood Realty Group 47 HFF 109 *ranked by investment volume HFF 50 Besen Associates 28 Cushman Wakefield 101 Colliers International 33 Apartment Realty Advisors 22 Massey Knakal 66 Methodology Moran Co 33 Cushman Wakefield 20 Rosewood Realty Group 48 Full credit assigned to sellers’ Transwestern 30 Eastdil Secured 19 Jones Lang LaSalle 42 representative. When two brokers Jones Lang LaSalle 29 Eastern Consolidated 19 Colliers International 40 represent same seller, both sellers’ representatives assigned full NAI Global 26 Jones Lang LaSalle 13 Moran Co 40 credit. For partial-interest, rankings Grubb Ellis 24 HPNY 11 NAI Global 30 are based on the pro-rated share Newmark Grubb Knight Frank 18 Alain Pinel 10 Transwestern 30 of the total property or portfolio value. For more information Keller Williams 14 GFI Capital Resources 9 Eastdil Secured 29 on rankings please visit www. Brown Realty Advisors 10 Ariel Property Advisors 8 Besen Associates 28 rcanalytics.com/Misc/Brokers_ Ranking_Methodology.pdf 0 200 400 0 50 100 0 250 500 ©2012 Real Capital Analytics, Inc. All rights reserved. Data believed to be accurate but not guaranteed; subject to future revision; based on properties portfolios $2.5m and greater. 8

- 9. ® third quarter 2012 Selected investment Sales transactions Reported in the Past 45 Days Property Name Units Price Owner Address Year Built PPU Seller Location Notes Qualifier Broker Mid-Atlantic Mass Court 371 $168,383,333 TIAA-CREF from CBRE Global Investors 300 Massachusetts Ave Nw 2004 $453,863 by CBRE Washington, DC Mid/high-rise approximate Hamptons at Town Center 768 $90,250,000 AHC from Harbor Group Int'l by CBRE 19775 Crystal Rock 1982 $117,513 Germantown, MD Garden confirmed Chase Heritage 236 $42,500,000 Continental Realty by Cushman 1212 Chase Heritage Cir 1986 $180,085 Wakefield from Henderson Global Sterling, VA Garden approximate Investors by Cushman Wakefield Curren Terrace 318 $29,800,000 BET Investments from 1011 New Hope St 1970 $93,711 Home Properties by CBRE Norristown, PA Mid/high-rise approximate Midwest 1401 South State 278 $70,500,000 Marquette Cos JV American Realty 1401 S State St 2008 $253,597 Advisors JV Hunt from Lincoln Property Chicago, IL Mid/high-rise confirmed Co JV Equity Residential by HFF The Crossing at Barry Road 624 $54,775,000 GoldOller RE Invts from 7831 Nw Roanridge Rd 1997 $87,780 Creekstone Partners JV Wafra Investment Kansas City, MO Garden confirmed Advisory Group by CBRE Stadium Village Flats 120 $43,000,000 Harrison Street Real Estate 818 Washington Ave Se 2012 $358,333 Capital from Opus Minneapolis, MN Mid/high-rise approximate Northeast Mantena 98 $84,000,000 Equity Residential from Joy 433-439 W 37th St 2011 $857,143 Construction Corp by HFF New York, NY Mid/high-rise confirmed 425 Third Avenue 102 $44,000,000 Benchmark RE Group JV Western Heritable 425 3rd Ave 1967 $431,373 Investment from Midas Management New York, NY Mid/high-rise approximate Wellington Place 137 $40,058,750 McMorgan Co by CBRE from 34 Brainard Ave 2005 $292,400 Northwestern Mutual by CBRE Medford, MA Mid/high-rise confirmed Eagle Rock Advisors by Institutional Wintergreen of Westville 294 $39,500,000 Property Advisors - Marcus Millichap Company 400 Blake St 2008 $134,354 from US Bank NA by Institutional Property New Haven, CT Mid/high-rise confirmed Advisors - Marcus Millichap Company The 163 Washington Condominiums 49 $31,500,000 ARC NYRR from AE 163-171 Washington Ave 2010 $642,857 Real Estate Holdings Brooklyn, NY Mid/high-rise confirmed Southeast Windsor at Tryon Village 393 $54,000,000 Guardian Life Insurance Co from JP 2000 Crossroads Manor Ct 2007 $137,405 Morgan Asset Management by Engler Cary, NC Garden confirmed Financial Group The Province 235 $49,420,750 EdR from Edwards Companies 504 Boxelder Way 2010 $210,301 Greenville, NC Garden confirmed ©2012 Real Capital Analytics, Inc. All rights reserved. Data believed to be accurate but not guaranteed; subject to future revision; based on properties portfolios $2.5m and greater. 9

- 10. ® third quarter 2012 Selected investment Sales transactions Reported in the Past 45 Days Property Name Units Price Owner Address Year Built PPU Seller Location Notes Qualifier Broker Lost Creek Resort at Lakewood Ranch 272 $39,250,700 Inland Real Estate Corp from PAC Land 11140 Lost Creek Ter 2011 $144,304 Development Corp by HFF Bradenton, FL Garden confirmed Colonial Grand@Research Park 370 $38,000,000 Colonial Properties Trust from 400 Stone Lion Dr 2002 $102,703 Tuckerman Group Durham, NC Garden approximate Links at Windsor Park 280 $33,600,000 Catalyst Dev Ptnrs from TA Realty by 13700 Sutton Park Dr N 1994 $120,000 CBRE Jacksonville, FL Garden approximate Stoneridge Farms at the Hunt Club 364 $28,969,600 CRES Management from Flournoy 2325 Nashville Pike 2002 $79,587 Companies by Apartment Realty Advisors Gallatin, TN Garden approximate Southwest District on 5th 208 $67,000,000 EdR from Campus Apartments 550 N 5th Ave 2012 $322,115 Tucson, AZ Mid/high-rise approximate Prairie Creek 464 $52,500,000 Pure Multi-Family REIT from MA Real 3560 Alma Rd 1996 $113,147 Estate Richardson, TX Garden confirmed Calvera Point 276 $37,750,000 Waterton Associates from BRE 9100 Vance St 1994 $136,775 Properties by Cushman Wakefield Broomfield, CO Garden approximate Alexan Star Ranch 396 $36,630,000 Lincoln Property Co from Trammell 150 Klattenhoff Ln 2009 $92,500 Crow Residential (TCR) by CBRE Hutto, TX Garden confirmed Brookstone 528 $35,570,000 Bascom Group from Variable Annuity 4424 E Baseline Rd 1988 $67,367 Life Insurance Co. by Cushman Wakefield Phoenix, AZ Garden approximate West Waterfront at Pu'uloa 1,461 $311,000,000 Carmel Partners from Cirrus Asset 5105 Iroquois Ave 1965 $212,868 Managment Inc OBO Hunt by Eastdil Ewa Beach, HI Garden confirmed Secured Club Laguna 421 $120,800,000 Invesco RE from Shea Homes by HFF 350 The Club Dr 1988 $286,936 Laguna Beach, CA Garden approximate Circa Green Lake 199 $83,013,776 TIAA-CREF from Prudential RE 6900 E Green Lake Way N 2009 $417,155 Investors (PREI) JV Trammell Crow Seattle, WA Mid/high-rise confirmed by Cushman Wakefield Waterford Place 360 $58,410,000 Grosvenor from Archstone by 13305 NE 171st St 1989 $162,250 Cushman Wakefield Woodinville, WA Garden confirmed Archstone Venice on Rose 70 $56,200,000 Archstone by Institutional Property 512 Rose Avenue 2011 $802,857 Advisors - Marcus Millichap Company from Venice, CA Garden confirmed Gerding Edlen by Marcus Millichap Granite Point 384 $45,500,000 Matteson Cos from Northwestern 4500 Truxel Rd 2003 $118,490 Mutual by Colliers International Sacramento, CA Garden confirmed ©2012 Real Capital Analytics, Inc. All rights reserved. Data believed to be accurate but not guaranteed; subject to future revision; based on properties portfolios $2.5m and greater. 10