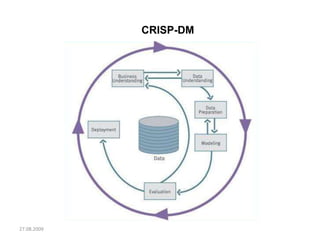

Crisp Dm

- 2. 27.08.2009 Agenda Business Understanding 1.1 Business Objectives 1.2 Assess the Situation Data Understanding Data Preparation 3.1 Filters 3.2 Population 3.3 Flow Modeling Evaluation Deployment v

- 3. 27.08.2009 1.1 Business Understanding – Business Objectives Yıldız portföyde yer alan müşterilerden terketme ve uyarıya geçme eğiliminde olan müşterilerin önceden tahmin edilerek müşterinin kalmasını sağlamak amacıyla aksiyon alınması xxxx ile yapılan görüşme

- 4. 27.08.2009 1.1 Business Understanding – Business Objectives İş Hedefi Yıldız Müşterileri Tutundurma “Bireysel Müşteri” ye dönüşen veya “Uyarı” statüsüne geçen Yıldız müşteri sayısını azaltmak Model Hedefi Mevcut datayı kullanarak “Açık” statüsünden “Uyarı” statüsüne ve “Uyarı” statüsünden “Bireysele” dönüşen müşterileri kullanarak, Yıldız müşteriler arasından gitmeye eğilimli müşterileri yüksek güven düzeyinde tahmin etmek amacıyla Retention Modeli geliştirmek

- 6. 27.08.2009 3. Veri Hazırlama Popülasyon Filtreler Veri Seti Datamart Değişkenler Exclude target dependent variables Değişken Seçimi Hipotez testleri (ANOVA) Korelasyon ( yüksek olanlar çıkarılacak) Multiplot, İstatistikler Ay1, Çeyrek1 Karar Ağacı (Largest) (EM) Değişken Seçimi (EM)

- 7. 27.08.2009 3.1 Data Hazırlama - Filtreler

- 8. 27.08.2009 3.2 Data Preparation - Population 2008 Q3 2008 Q4 Model Veri Seti Periyodu Hedef Belirleme Periyodu Q3’de Otomatik Ödemeye sahip olmayan Q4’de Otomatik Ödemeye sahip müşteriler hedef:1 olarak tanımlanmıştır (Kasım’da sahip olmayan Aralık’da sahip olanlar ile daha küçük bir hedef listesi olşuyor 2794 kişi) Model kitlesinin (860,634 müşteri); % 99.12 ’si (853,036 müşteri) hedef:0 % 0.88 ’i (7,598 müşteri)hedef:1 Oversampling?

- 9. 27.08.2009 3.3 Data Preparation - Flow HEDEF SETI MODEL_DATA_SET VERI SETI Haciz Kaydı Yok Takip Kaydı Yok Yaşayan Müşteri KK statüsü “K”, “I” olmayan filtreleri uygulanıyor Dönemi Verileri Türetilen değişkenler

- 10. 27.08.2009 4. Modeling Modelleme Tekniğinin Seçilmesi Lojistik Regresyon Karar Ağacı Generate Test Design Train, Validation, Test Sets Use 80%, 10%,10 % distribution Build Model SAS EM Assess Model

- 11. 27.08.2009 5. Evaluation Compare Models Choose at least two model Prepare Analysis based on models Extract Rules, Variables Summarize Model Performance Define Cutoffs Evaluate whether model achieves business objectives Apply Model Score to available data( according to your target deifnition) Select Model

- 12. 27.08.2009 6. Deployment Score Customers (with model filters) Integration with Oracle, BO

- 13. 27.08.2009 Monitoring When to renew

- 15. 27.08.2009 Zaman Planı ?

- 16. 27.08.2009 bacs Direct Debit Case

- 17. 27.08.2009 Resource: bacsR:ireysel pazarlamaustomer InsightropensityTOMATIK ODEMEesourcesustomer profiles.htm Different customers have different reasons to buy in to Direct Debit. And they fall into four clear groups: preferers, selectives, reluctants and will nots/cannots. The first three groups are well worth targeting. Using the right motivational messages can change their mindset and behaviour, and they can be converted to Direct Debit. For example, preferrers are defined as likely to be aged between 25 and 44, ABC1C2s with younger children or older ones who have left home. For them, convenience is the best feature of Direct Debit, so that’s the best message to use to convince them to sign up to Direct Debit. Simple! As the name suggests, will nots are ardent cash and cheque payers and will not convert. Cannots do not have appropriate bank accounts, so your marketing materials will be wasted on them

- 18. 27.08.2009 Resources- Customer profile - Preferers R:ireysel pazarlamaustomer InsightropensityTOMATIK ODEMEesourcesreferer.htm Definition : Choose to pay the majority of their regular commitments by Direct Debit. Generalised portrait : Equal male/female split , Aged 25-44 , ABC1C2s ,The better off the more likely they are to be preferers than people on lower incomes ,Tend to be home owners with a mortgage, followed closely by those owning a home outright and ones being bought/part rented ,Less likely to live in the South East with a relatively even split over other UK regions ,More likely to be in full time employment than self employed or retired. Assumptions :Actively preferring to pay by this method and generally opt to do so if it is offered as an option. Reasons for preferring Direct Debit:Find it a convenient, quick and hassle free form of payment ,Have the time to be very well organised financially. Payment attitudes :Prefer regular, convenient methods for paying bills.

- 19. 27.08.2009 Resources- Customer profile - Selectives R:ireysel pazarlamaustomer InsightropensityTOMATIK ODEMEesourceselectives.htm Definition :Pay some of their regular commitments by Direct Debit, but are selective which ones. Generalised portrait :Equal male/female split ,Tend to be slightly older, 45+ with highest proportion being 65+ , They are more likely to be ABC1s who have older children that no longer live at home , A slightly higher percentage come from lower income households this could be due to the high proportion of 65+ people who may be retired,Living in privately rented properties or homes they own outright, Higher proportion live in East Anglia, London, South East and Wales than other UK regions, They are less likely to be students with a relatively equally split across other employment status classifications. Assumptions :Their decision is usually influenced by their level of trust in the organisation collecting the payment or where there is no option, all payments have to be made by Direct Debit. Reasons for being selective: Concerns about the safety aspect of automated payments, Don’t trust some organisations to administer Direct Debit correctly , Have time to manage financial matters and may be stuck in their ways in terms of how they make their payments. For example, they like paying bills in full where possible ,Fear losing control of their finances when too many bills are paid by Direct Debit. Payment attitudes :Like to pay some regular, necessary payments by Direct Debit but have concerns over security and safety of automated payments. So they like to remain in control and will opt to pay by other methods such as cash or cheque.

- 20. 27.08.2009 Resources- Customer profiles – ReluctantsR:ireysel pazarlamaustomer InsightropensityTOMATIK ODEMEesourceseluctants.htm Definition: Will only use Direct Debit if there is no other option, reticent to use an automated payment for financial commitments. Generalised portrait: Equal male/female split, Predominately falling into two age brackets 16-24 and 55-64 , With a high proportion being lower social grades (D and E) , From lower income households , More likely to live in Eastern areas of the UK, from the North East down to the South East , Mainly living in being bought /part rented houses ,Students are likely to be reluctants with house sharing and low income levels most likely influencing their current reluctance to Direct Debit. Assumptions; General lack of education and understanding about automated payments is the key issue. Loss of control is their main fear. Irregular and limited income means this audience may believe Direct Debit is not for them. Direct Debit can appeal if it seen to enhance control of finances not threaten this and show that they are in control of the situation – not the bank or the biller. Reasons for reluctance: The fear of losing control of their bank account/balance , Concerns about banks and organisations collecting Direct Debit payments making mistakes , Assumption that companies can dip into their account and take money whenever they want , Don’t trust themselves to save enough money or have the required funds when the Direct Debit is collected ,Concerns over bank charges, which could cause havoc with their budgeting, if they miss a Direct Debit payment. Payment attitudes: They feel the ‘pay as you go’ approach suits their needs and behaviour better than Direct Debit. They tend to opt for payment cards, cash and cheque, preferring to pay for bills over the counter so they know they have been paid.

- 21. 27.08.2009 Models developed by bacs The first set of models predicts an individual’s propensity to pay a particular bill type by Direct Debit. Separate models have been created for all major bill types including Council Tax, Utility, Credit Card and TV Licensing bills. The second set calculates an individual’s reasons for using Direct Debit and their main drivers, for example saving time, helping them manage their finances more effectively, or capitalising on financial discounts. Our Data mining goal : is to develop one model (regardless of bill type)

- 22. 27.08.2009 CRISP - DM

- 23. 27.08.2009

- 24. 27.08.2009 CRISP - DM DATA UNDERSTANDING DEPLOYMENT BUSINESS UNDERSTANDING MODELING DATA PREPARATION EVALUATION

- 26. 27.08.2009 Data Understanding Collect Initial Data SAS Datamart Bilgi Talep - MIS ( Fatura türünde bir hedef olmadığı için gerek yok) Describe Data O.Ödeme sahibi olan müşteriler/ olmayan müşteriler Otomatik Ödeme Sahipliği herhangi –bir- faturanın tanımlanması ile etkinleşiyor Explore Data Otomatik Ödeme sahibi müşteriler Ürün sahiplikleri AUM, RISK, TV, NCI Demografik verileri, Segment Dağılımları Verify Data

- 27. 27.08.2009 Data Preparation Sample (Haciz Yok, Takip Kaydı Yok, KK Ekstre Statu Not in K,I, İşkolu,Portföy, Yaşayan filtreleri ile) İki farklı kitle tanımı yapıldı ( Slayt 16, Slayt 17) Veri Seti Datamart Değişkenler Exclude target dependent variables Değişken Seçimi Initial Hypothesis Testing ( ANOVA) Correlations ( yüksek olanlar çıkarılacak) Multiplots, Statistics Month1, Q1 Decision Tree (Largest) (EM) Variable Selection Node of EM

- 28. 27.08.2009 Data Preparation Clean data Missing Imputation No need, but can be controlled Construct Data Transformation For regression normality asssumption must be hold Integrate Data Business Knowledge Derive new variables if possible Format Data Selection of Scales ( for EM)

- 29. 27.08.2009 MODELING Select the Modeling Technique Regression (Logistic) Decision Tree Generate Test Design Train, Validation, Test Sets Use 80%, 10%,10 % distribution Build Model SAS EM Assess Model

- 30. 27.08.2009 EVALUATION Compare Models Choose at least two model Prepare Analysis based on models Extract Rules, Variables Summarize Model Performance Define Cutoffs Evaluate whether model achieves business objectives Apply Model Score to available data( according to your target deifnition) Select Model

- 31. 27.08.2009 DEPLOYMENT Score Customers (with model filters) Integration with Oracle, BO

- 32. 27.08.2009 O.Ödeme sahibi olan müşteriler/ olmayan müşteriler Otomatik Ödeme Sahipliği herhangi –bir- faturanın tanımlanması ile etkinleşiyor Explore Data Otomatik Ödeme sahibi müşteriler Ürün sahiplikleri AUM, RISK, TV, NCI Demografik verileri, Segment Dağılımları