Weitere ähnliche Inhalte

Ähnlich wie How Companies Estimate Cost of Capital

Ähnlich wie How Companies Estimate Cost of Capital (16)

How Companies Estimate Cost of Capital

- 1. FPA

& Financial Planning and Analysis AFP—Your Daily Resource

Spring 2011

Cost Uncertainty

s

Welcome to the spring edition of FP&A

newsletter. Since the Winter 2010 issue

we’ve been quite busy. We held two

financial planning and analysis webinars Ira Apfel

and one seminar, and I was privileged With a record $2 trillion in cash and short-term liquid assets on hand, U.S. businesses are

enough to host a number of roundtables poised to expand but they are unsure about which initiatives to fund. Furthermore, U.S. firms

in Chicago, Houston and Nashville.

lack confidence in the accuracy of the cost of capital projections that underpin their decisions.

These events were wonderful opportuni-

Those are two of the findings in the first Cost of Capital Survey by the Association of Financial

ties for FP&A professionals to discuss,

Professionals. Fully 55 percent of respondents believe their cost of capital estimates are off by

face to face, the critical issues confront-

ing their organizations and profession.

more than 50 basis points (see Figure 1), while only 17 percent believe their estimates are ac-

Just last week, we released Current curate within 25 basis points. Little wonder, then, that only 15 percent of businesses surveyed

Trends in Estimating and Applying the communicate their weighted average cost of capital estimates company-wide (see Figure 2).

Cost of Capital, a first-of-its-kind study. AFP conducted the Cost of Capital Survey in October 2010 and received answers from 309

This research provides unique insight chief financial officers, treasurers, vice presidents-finance and assistant treasurers. Their answers

into how companies around the country

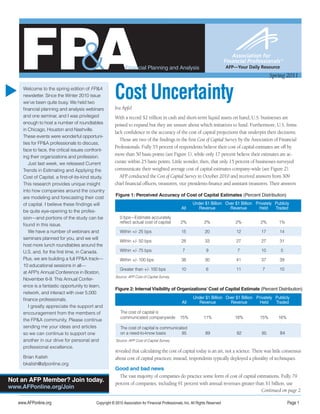

Figure 1: Perceived Accuracy of Cost of Capital Estimates (Percent Distribution)

are modeling and forecasting their cost

of capital. I believe these findings will Under $1 Billion Over $1 Billion Privately Publicly

All Revenue Revenue Held Traded

be quite eye-opening to the profes-

sion—and portions of the study can be 0 bps—Estimate accurately

reflect actual cost of capital 2% 2% 2% 2% 1%

found in this issue.

We have a number of webinars and Within +/- 25 bps 15 20 12 17 14

seminars planned for you, and we will

Within +/- 50 bps 28 33 27 27 31

host more lunch roundtables around the

U.S. and, for the first time, in Canada. Within +/- 75 bps 7 9 7 10 5

Plus, we are building a full FP&A track— Within +/- 100 bps 38 30 41 37 39

10 educational sessions in all—

Greater than +/- 100 bps 10 6 11 7 10

at AFP’s Annual Conference in Boston,

Source: AFP Cost of Capital Survey.

November 6-9. This Annual Confer-

ence is a fantastic opportunity to learn,

Figure 2: Internal Visibility of Organizations’ Cost of Capital Estimate (Percent Distribution)

network, and interact with over 5,000

finance professionals. Under $1 Billion Over $1 Billion Privately Publicly

All Revenue Revenue Held Traded

I greatly appreciate the support and

encouragement from the members of The cost of capital is

communicated companywide 15% 11% 18% 15% 16%

the FP&A community. Please continue

sending me your ideas and articles The cost of capital is communicated

so we can continue to support one on a need-to-know basis 85 89 82 85 84

another in our drive for personal and Source: AFP Cost of Capital Survey.

professional excellence.

revealed that calculating the cost of capital today is an art, not a science. There was little consensus

Brian Kalish about cost of capital practices; instead, respondents typically deployed a plurality of techniques.

bkalish@afponline.org

Good and bad news

The vast majority of companies do practice some form of cost of capital estimations. Fully 79

Not an AFP Member? Join today. percent of companies, including 91 percent with annual revenues greater than $1 billion, use

www.AFPonline.org/Join

Continued on page 2

www.AFPonline.org Copyright © 2010 Association for Financial Professionals, Inc. All Rights Reserved Page 1

- 2. Cost Uncertainity from page 1

A Corporate’s Perspective on Cost of Capital

discounted cash flow tech-

So how do treasury and finance professionals determine their cost of

niques. (One wonders what

capital? FP&A asked one executive, Mark W. Scott, CTP, Manager,

the remaining 9 percent with

2011 AFP Treasury, Corporate Finance for Verizon, for his insights.

annual revenues greater than Current Trends in Estimating

and Applying the Cost of Capital

Report of Survey Results

$1 billion do.) FP&A: Why did you undertake this survey?

There is less consistency, however, in how organizations Mark Scott: We thought that this was an important study to do because

estimate cash flows and determine the weighted average cost it provides treasury finance professionals and academics with valuable

of capital at which those cash flows are discounted. benchmarking information about how and when the CAPM is currently

Five years is the most common period over which orga- being used by practitioners, and which inputs they populate the model

nizations explicitly forecast the cash flows associated with a with. This is particularly pertinent when considering that one of the

project—a span cited by 46 percent of survey respondents. most critical issues owing the recent financial turmoil concerns asset

More than one-third of organizations forecast explicit cash prices, and the capital asset pricing model is one of the most widely

flows for the first 10 years of a project. used valuation models.

There is great diversity in how organizations determine FP&A: Looking at the results, what surprised you?

the value of cash flows for the remaining life of a project, i.e., Scott: I’m surprised that this study even occurred, considering the

terminal value. Only 46 percent use the perpetuity growth confidential nature of the information, the number of responses, and the

model, while 27 percent develop an explicit cash flow fore- broad array of the firms they represent.

cast for the entire life of a project. Fully 72 percent develop

FP&A: For many of the questions, there seems to be little consen-

multiple cash flow scenarios representing the expected out-

sus. How surprising did you find that and why?

come as well as best and worst-case outcomes, which are then Scott: Not surprising at all. It is no secret that applying the CAPM is as

discounted. A significant share of organizations (28 percent) much an art as financial science. However, two thoughts readily come

uses only a single cash flow scenario. to mind when thinking about the number of variations that are associ-

There is even greater diversity among organizations in ated with the CAPM.

the methods they use when estimating the weighted aver- First, despite the differences in model inputs, many of the final WACC

age cost of capital. In estimating the cost of equity, nearly estimates will still manage to fall within a reasonably close grouping.

nine of 10 organizations use the, which calculates the cost This occurs precisely because of the wide variety of inputs and inter-

of equity using a risk-free rate, beta factor, and a market pretations of the model.

risk premium, each of which introduces significant variabil- One practitioner might use the 1-year Treasury as their risk-free rate,

ity. While nearly half of organizations (46 percent) use the while others may use the 10 or 30-year. However, the practitioner using

10-year Treasury note to estimate the risk-free rate, the 1-year Treasury may also be using the higher Ibbotson long-term

16 percent use the 90-day Treasury bill, five-year Treasury market risk premium, while the others use a more recent lower valued risk

(12 percent), and even the 30-year Treasury bond. Given premium. So while there may be a significant disparity among the inputs

that the historical spread between 90-day Treasury bills that does not necessarily result in significant discrepancy in results.

and 30-year Treasury bonds is approximately 3 percent, The other thought is that the lack of consensus in CAPM interpreta-

this wide variation in choices for the risk-free rate will have tion actually supports healthy and efficient markets. It has been said

dramatic effects on project valuation. that a seller of stock sells with the belief that the value of that security is

There is also little consistency in the methods organiza- about to decline, to a buyer with an equal conviction that the stock will

tions use to estimate the cost of debt. More than go up. How can that be when the same information about the stock’s

underlying company and markets are available to both? It is because

one-third use either the current rate on their existing debt

the buyer and seller interpret that same information differently. The

(37 percent) or the forecasted rate for newly issued debt

same is true for the CAPM.

(34 percent). More than one in five reduces the volatility

of the cost of debt by using an average rate on outstanding FP&A: Was there any practice that you had never heard of before?

debt over some period of time. Results from the survey are Anything you will adopt?

more consistent for the tax rates that organizations apply Scott: While the survey provides fertile terrain for debate and further re-

to calculate the after-tax cost of debt. Fully 64 percent use search, in general, it appears that responses follow academic theory—

their effective tax rate, but 29 percent use the marginal tax albeit, the wide range of responses indicates different interpretations of

rate, and 7 percent use a target tax rate. s the theories. s

Page 2 Copyright © 2011 Association for Financial Professionals, Inc. All Rights Reserved Spring 2011

- 3. Developing Capital Structure Strategy

David Mallicoat, MBA, CMA, CFM FPA

&

One of FP&A’s primary functions is to facili- balance sheet and in cash flow related to financ- Published by the Association for

Financial Professionals, Inc.

tate the strategic planning process and help ing activities. Before assumptions related to

management develop goals, objectives and financing activities can be developed, it is neces- Editor

strategies for the organization. Typically, the sary to first deal with anticipated levels of cash Ira Apfel

lion’s share of attention during this process is flow from operating and investing activities.

Director, Finance Practice

devoted to operating strategy development. Clearly, whether external financing is required Brian Kalish

While this allocation is appropriate, a compre- or excess cash is available depends largely on

hensive strategic plan should also include a operating and capital spending assumptions. President and CEO

James A. Kaitz

well articulated capital structure strategy. From a modeling perspective, it is generally

Capital structure strategy should have advisable to reflect returns on planned capital Managing Director, Communications

two main objectives: align with the operat- investment at levels consistent with economic Elizabeth Johns

ing strategy; and maximize total shareholder value creation; that is, at or above the weighted Publications Specialist

returns (TSR). Too much leverage can lead average cost of capital (WACC). An updated Amy Cooley

to credit default and insolvency while too WACC analysis should, therefore, also be in-

Advertising

little may result in sub-optimal shareholder cluded in the strategic planning process. Advertise in FP&A to reach out to

value creation. Key components of the capital decision makers seeking new FP&A

Optimal debt levels technology. To reserve space

structure strategy include: today, contact the AFP Sales Team

At the heart of capital structure strategy is

• Capital spending and expected returns at 301.961.8833.

a fundamental question: how much debt is

• Optimal debt levels

too much, and how much is too little? Hold-

• Liquidity and cash balances Subscriptions

ing operating cash flows constant, enterprise

• Interest rate risk management www.AFPonline.org/newsletters

value is maximized where the after-tax WACC

• Dividend policy Copyright © 2011 Association for Financial Profession-

is minimized (figure 1). In a world where als, Inc. Copying and redistributing prohibited without

• Share repurchases and share-based permission of the publisher. This information is provided

interest (and lease) payments are tax deduct- with the understanding that the publisher is not engaged in

compensation. rendering legal, accounting or other professional services.

ible, the WACC benefits from each marginal If legal or other expert assistance is required, the services

of a competent professional person should be sought.

Capital spending and expected returns dollar of debt capital up to the point at which

Capital structure assumptions are reflected elevated default risk premiums are mani- Association for Financial

Professionals

in the “three statement model” primarily on the Continued on page 4 4520 East-West Highway

Suite 750

Bethesda, MD 20814

Figure 1: Optimal Capital Structure

Phone: 301.907.2862

Website: www.AFPonline.org

Email: AFP@AFPonline.org

Blog: http://blogs.afponline.org/FPA

Twitter: http://twitter.com/afponline

LinkedIn: http://www.linkedin.com/

companies/association-for-financial-

professionals

AFP’s FP&A resources are available

at www.AFPonline.org/FPA

Debt/Total Assets

www.AFPonline.org Copyright © 2010 Association for Financial Professionals, Inc. All Rights Reserved Page 3

- 4. Developing Capital Structure Strategy continued

fested. The precise amount of leverage that Interest rate risk management shareholders is by repurchasing shares.

represents is difficult to know, but, one thing If the firm anticipates including debt Share repurchase programs have become an

is certain: operating cash flow is anything but in the capital structure, interest rates and important way for firms to enhance share-

constant. One approach to estimating an ideal expense must be projected. This exercise holder returns by driving EPS accretion

debt level is to model minimum acceptable calls into question the firm’s strategy for through reduced share counts. Using an EPS

debt metrics (e.g., debt covenant cushions) interest rate risk management, which ideally accretion framework, share repurchases are

under downside or worst-case scenarios. This includes developing targets for fixed versus almost always favorable to debt reduction as

approach helps the firm balance default risk floating rate exposure. There are many a use of cash. There are a number of impor-

with the opportunity costs of over-weighting diverging views on interest rate risk manage- tant considerations in the share repurchase

equity in the capital structure mix. ment. Some CFOs and boards of directors, analysis, including issues related to share

It is also important to consider sources of may place a premium on certainty and seek price. If management is agnostic about share

debt capital. For instance, diversifying sources to minimize floating rate exposure. Others price when repurchasing shares, it risks the

of debt capital with a mixture of bank debt may adopt a more balanced approach to potential perception of over-paying. How-

and corporate bonds, as well as staggering hedging interest rate risk. ever, if the firm adopts a more opportunistic

debt maturities, may help reduce refinanc- approach, a lack of buybacks may signal the

ing risks should shocks occur in the credit Dividend policy market that management believes shares are

markets at inopportune times. In practice, dividend policy should be over-valued.

considered within the context of an overall Inextricably linked to the share repur-

Liquidity and cash balances investor strategy. It is important to consider chase strategy, is the firm’s strategy for share-

It is important to consider the adequacy how current and prospective investors view based compensation. On one hand, the firm

of available liquidity in the planning process. and value dividends. For instance, some dilutes the current shareholder base in order

Analysis should be developed to determine funds/portfolio managers may exclude non- to better align the interests of employees

peak working capital requirements based on dividend paying companies from consider- and owners. On the other, the firm uses a

a variety of scenarios. Liquidity requirements, ation while others may prefer the company portion of its excess cash to simply offset the

however, should be balanced against the to reinvest its cash. Competitive yield dilutive effects of share-based compensation.

prospect of holding excessive cash balances comparisons and expected growth rates are It is important in the capital structure strat-

idly on the balance sheet. Modeling the accu- also important factors to consider. egy development process to ensure these

mulation of cash on the balance sheet implies programs are philosophically aligned. s

the lack of a comprehensive capital structure Share repurchases and share-based

strategy (unless earmarked for some specific compensation David Mallicoat is Manager, FP&A at Cracker

purpose such as an acquisition). Another way of returning capital to Barrel Old Country Store

Current Trends in Estimating and

Applying the Cost of Capital

Report of Survey Results

More than 300 financial planning and analysis professionals provide

insight into practices currently being used in the profession to

deploy corporate capital.

2011 AFP g Visit www.AFPonline.org/FPA to read this unique survey.

ds in Estimatin

Current Treng the Cost of Capital

and Applyin Results

y rve

Report of Su

Page 4 Copyright © 2011 Association for Financial Professionals, Inc. All Rights Reserved Spring 2011

- 5. Metrics Matters individual metrics through all levels of the organization, while

other companies may establish a handful of key metrics that

drive the right collective behavior through the company.

David P Mann

. 3. Balance simplicity vs. perfection. Lean toward metrics that

The traditional role of financial planning and analysis (FP&A) is to can be readily understood and communicated easily vs. the

establish plans that ensure investments align with strategy to maxi- “perfect” metric that is difficult to grasp.

mize return on investment (ROI). However, FP&A increasingly is 4. Be data-driven. While you may be able to dream up many

relied on to play a strategic role in driving business operations. interesting metrics, the metric has no value if you cannot get

Why the transformation? data to track the metric.

Organizations increasingly recognize that FP&A brings a 5. Start with a baseline. When using metrics and setting tar-

holistic and unbiased view of the business, and is highly vested gets, always start with a baseline, whether through historical

to ensure operations are smart and efficient to drive financial trends or external benchmarking. This will give you a better

performance. FP&A also is in the unique position to bring a sense for patterns and proposed targets.

metric-centric view of the entire business that, if designed cor- 6. Communicate. Metrics should be communicated consis-

rectly, can ensure an organization is on track with its goals. tently, in various forums and with regularity.

Metrics are a key component of successful operations. There 7. Look to the future. Take a long-term view in managing

are three primary advantages for using metrics: metrics. Small blips up or down are fine, as long as the trend

1. Accountability. In a nutshell, metrics don’t lie. Metrics moves in the right direction.

force accountability to the agreed-upon goal. It is a much 8. Consider costs. When appropriate, it is valuable to factor

better approach than allowing people to “spin” how they cost into a metric. We have a large customer support team

talk about their respective areas. at Constant Contact and, being a customer-centric company,

2. Empowerment. It may seem counterintuitive, but if met- we focus on answering the phones quickly when custom-

rics are used appropriately, then they will serve to support ers call with questions. One way the management team can

an entrepreneurial culture, one that empowers people to ensure we answer the phones quickly is by overstaffing the

make their own decisions. With well-defined metrics, there organization. To manage this, we monitor the cost per call

is no need to micromanage. The goals are clear and people and look at the longer-term trend.

know how they will ultimately be measured, so they are 9. Don’t forget the customer. When feasible, incorporate

more willing to try new or creative approaches to solve a customer satisfaction as one of the metrics. In the example

problem, and also to take risks and move quickly. above, the customer support team can influence the cost per

3. Front Lines. By establishing a smart, collaborative ap- call by hiring less experienced folks with lower salaries who

proach for using metrics, FP&A teams move to the front may or may not be meeting the needs of the customer call-

lines and become key business partners in the organiza- ing in for support. That is why it is important for us to also

tion—consulting, collaborating and driving better and measure customer satisfaction, to ensure we are doing right

smarter decisions. by our customers.

Now that you understand the goals of a sound metrics-driven 10. Tie in compensation. It may be tricky to find the right

finance strategy, here are 10 strategies for making metrics work structure, but I have found that when you tie compensa-

within a company: tion to metrics, things get done. Always involve key stake-

1. Align with strategy. The first place any company should holders in the formulation of metrics to ensure you have

begin is by establishing a long-term vision and strategy and understanding and buy-in. Just imagine how you would

short-term goals that are aligned with the strategy. Once feel if someone established a metric for you to achieve your

these plans are crystallized, a set of complementary metrics bonus, one that you didn’t feel you could influence, and the

can be designed that align with this framework. company fell short of the metric. s

2. Be flexible in the use of metrics. Just like people, all

companies are different. There are numerous approaches David P Mann is Director of Finance and Assistant Treasurer for Constant Con-

.

to using metrics and you need to find a solution that works tact. David has more than 15 years experience in FP&A, treasury, M&A, and

well for your company. Some companies may choose to drive investment banking. Reach David at dmann@constantcontact.com.

www.AFPonline.org Copyright © 2011 Association for Financial Professionals, Inc. All Rights Reserved Page 5

- 6. Navigating the BI Selection Process

Michael Merrill

This article is the second of a series. Read the first here.

Understanding that the three major Business cross-department repository of BI expertise because they typically understand the

Intelligence (BI) players, Oracle, SAP and and experience is essential to the long-term challenges of the business users and the

IBM, have comparable solutions, it is now success of a company’s BI solution. Skills technical limitations faced by the tech-

time to choose a solution for your company. and functions incorporated into this body nology group. Members of this group can

be pulled from the Business Intelligence

Many companies have multiple BI solutions that have been Competency Center discussed above.

developed within silos across the organization with no ability Information Technology Specialists -

to share information across departments. Giving information technology specialists

a voice in the selection process will ensure

Create a foundation for success might include BI project assessment and that the BI solution provider does not

Start by surveying your company for exist- feasibility, BI design and development, proj- over-promise the abilities of the product.

ing BI solutions so that you can build on what ect management expertise, integration and It also allows the IT group the ability to

is working for your organization. This may data cleansing resources, support staff, and make sure they have the infrastructure and

seem like an obvious step, but many compa- a library of business best practices. staff in house to support the new software

nies have multiple BI solutions that have been product(s). Members of this group can be

developed within silos across the organization Product selection team pulled from the Business Intelligence Com-

with no ability to share information across de- When choosing the BI products, it is impor- petency Center discussed above.

partments. For example, if your company uses tant to put together the correct selection team.

Oracle Financials and bases all custom applica- The team needs to be comprised of executives, Product demo

tions on Oracle databases with an army of PL/ business users, power users and information It is important for your organization to

SQL developers on staff, then Oracle Business technology professionals. Without the support be an active driver of the product demo

Intelligence Enterprise Edition (OBIEE) would and buy-in of any of these groups, even the process rather than a passive participant. Be

be a natural fit. best software products being implemented prepared to provide the software company

Also, this type of organization-wide with the best plans will fail. a detailed list of business requirements

assessment can be the foundation for the Executives - The executives have their and functionality essential to the solution

creation of a Business Intelligence Compe- eyes on the direction of the company and implementation. During the demo keep

tency Center. An Aberdeen Group October will monitor the ROI of the BI imple- these things in mind:

2010 study suggests that a Business Intel- mentation. They need to know if the • Does the demonstrated functionality

ligence Competency Center that serves as a solution wins more customers, makes the meet the current business need(s)?

company more efficient, or reduces the • Which product(s) are being shown,

total cost of ownership. but more importantly which

product(s) are needed?

Business Users - The business users

• What will it take to implement the

will use the BI solution on a daily basis,

product?

so they need to feel that it makes their

• Does the product support an ability

job easier or offers more functionality.

to share information across organiza-

Typically, they are the ones affected the

tional silos?

most after the implementation, so their

• Don’t be afraid to ask detailed questions

opinion should carry the most weight.

• Don’t get side tracked by the “bells

Power Users - Power users are a great and whistles”

group to have in the selection process Continued on page 7

Page 6 Copyright © 2011 Association for Financial Professionals, Inc. All Rights Reserved Spring 2011

- 7. Navigating the BI Selection Process continued

Creating a product scorecard for the se- • effort to configure appropriate security Solution negotiation

lection team to fill out will help ensure that • existence of extensions or enhance- After the BI solution of choice has

the entire team’s voice is heard. Develop- ments to augment the out-of-the-box survived the selection team and POC, it

ing a good scorecard can be tricky; most pre-built solution. is time to negotiate acquiring the appro-

effective ones keep the measuring range The same Aberdeen Group study found priate product(s). Every BI company has

simple (scale of 1 to 4), limit the number of that firms using pre-built dashboards said that “street” prices for their products, but very

measurements to 15 key factors or less, and 36 percent of the key performance indica- few companies pay that price. The typical

allow for comments. After the demos are tors associated with strategy are represented in software discount is from 20-40 percent.

completed get the selection team together their dashboards. By comparison, 48 percent of Don’t forget to inquire about other contract

and review the scorecards. strategic KPIs are present in dashboards or orga- concessions that can be offered by the BI

nizations that pursue a custom built approach. companies. BI deals often include services

A word about out-of-the-box, at a discount. However, it is important to

pre-built solutions Proof-of-concept seek multiple client references in your field

It can be very easy during a product Once the selection committee has nar- to ensure that the services offered are what

demo to be swept away by out-of-the-box, rowed the field to the product believed you expect.

pre-built solutions. The Aberdeen Group to be the best fit, it is time to contact that When looking at the final BI solution

October 2010 study found that respondents company for a proof-of-concept (POC). package, pay close attention to the mainte-

who used pre-built dashboard solutions The typical POC takes a couple days to two nance. Make sure your team understands

were able to deploy their first dashboard weeks. Most companies will allow your or- how much annually the company will

project in 60 percent of the time required ganization 30-60 days to evaluate the POC. need to continue to spend to protect the

by organizations that were building custom The POC is the best and last chance to BI investment. Maintenance is based on

dashboard solutions. However, the study is make sure the product will meet the business the software sold, so if the deal includes

quick to point out that “there is still work needs. Run the POC like a mini-project. software and services, be sure to have the

to be done to complete the implementation Develop specific goals to be achieved by the software discounted as deeply as possible,

before the go-live date. When assessing pre- POC. Hold a kick-off meeting to make sure and pay more for the services. The timing

built solutions, consider the following: everybody knows what products are going of the deal is also very important. End of

• effort to integrate your source data into to be used and who has what responsibili- quarter or end of fiscal year deals can give

these pre-built solutions ties. Make sure the business users get enough your company more leverage. s

• effort to map and tailor the pre-built hands on experience with the product. Wrap

solution to your specific business needs up the POC with a presentation that shows Michael Merrill is a partner with Elire. Reach

and business processes how the product(s) will be used. him at michael.merrill@elire.com.

AFP Global ®

Corporate Treasurers Forum EXCHANGING

REAL IDEAS FOR

May 18-20, 2011 | The Ritz Carlton Chicago REAL RESULTS

Experience interactive roundtables, facilitated by highly-distinguished Exclusive Sponsor:

treasury and finance colleagues. Exclusively for executive-level

corporate practitioners.

Register early to save $300.

Visit www.AFPonline.org/Global

www.AFPonline.org Copyright © 2011 Association for Financial Professionals, Inc. All Rights Reserved Page 7

- 8. 3 Budgeting Challenges—and 6 Solutions

Jenny Okonkwo, MBA

Annual budgets are ideally based upon an agreed-upon business 3. Ownership and accountability

strategy. Group/head office management set subsequent targets Ideally, companies should strive for shared ownership and

around revenue, profit, operating expenses and headcount, using accountability of the business plan between finance and the rest

a set of assumptions. This leads to a business plan, from which of the organization. Finance has an active business partnering

the company budget for the coming year will be created. This all role to play in bringing potential risks and issues to the attention

sounds very straightforward, so what are some of the practical chal- of senior management. They can also be process owners in the

lenges that affect the budget cycle? task of flexing original budgets to reflect changes in the business

environment. A widely held opinion is that sales are responsible

1. Agreeing a set of assumptions for achieving revenue targets; equally, finance has a role to play in

I once worked for a prominent consumer electronics firm that monitoring company expenses, in line with sales trends, high-

changed the sales organization structure every year. It was auto- lighting any potential risks to meeting bottom line profit targets.

matic to ask “What will the new company structure be?” before Based on the above, here are some tips to improve the budget-

calculating the numbers. The challenge would then be how best to ing process:

break out the previous years numbers to provide sensible budget • Collectively agree a set of budget assumptions in advance

versus actual comparatives. • Identify and engage all potential stakeholders

When I worked for a food manufacturer, my key challenge was • Identify and document key interdependencies, risks and issues

agreeing to suitable standards for certain products that were subject to • Agree whether to centralize or decentralize the process of

wide price fluctuations. This was particularly challenging in the wake building the numbers

of unforeseen events, such as droughts or sudden freezes. • Agree to role boundaries between finance and budget holders

Competitive action within a sector often has a highly visible • Share accountability and ownership.

effect on company performance. Beer, in particular, may often be It is important to recognize that in most instances, budgeting

subject to brand switching as customers react to limited time pro- is an iterative process, and can go through several rounds prior to

motions. Competitive activity, outside specific periods, may often being approved.

be difficult to predict in advance. Once a company budget has been established, it needs to be

brought to life via a continuous performance review process. The

2. Non-involvement of budget stakeholders frequency of business performance reviews vary within companies

Company culture often dictates whether the budget is an annual (monthly, quarterly, etc). These reviews form the basis for produc-

chore left exclusively to the finance department, or whether it is ing a forecast, based on an actual versus budget comparison for a

viewed as a company-wide process with active engagement at all particular timeframe and flexing the original numbers for unfore-

levels. In environments where the process is centralized within seen changes, budgeting errors and risks.

finance, it becomes virtually impossible to implement an ongo- There should also be time set aside for an in-depth review of

ing business review process. The operative term is “these are not the past budget process, identifying lessons learned and ways to

my numbers.” Performance target setting processes are adversely improve the process for future cycles. This may involve a review of

impacted and accountability is unclear. the systems and tools used as well as gathering feedback from those

Treating the budget process as a finance exercise also results in involved in the process. s

key business interdependencies and risks being overlooked. In my

experience, what has worked best is a situation where the business Toronto-based Jenny Okonkwo, MBA, (CIMA Associate Member, UK),

builds their own budgets within group guidelines, with review, is finance manager for Transform Consulting. Email: okonkwoj@gmail.

coaching and assistance from finance throughout the process. com. Web: http://ca.linkedin.com/in/jennyokonkwo.

Page 8 Copyright © 2011 Association for Financial Professionals, Inc. All Rights Reserved Spring 2011

- 9. Collaboration Counts

Thomas W. Smith, CMA, MBA

Most experts are clear in their beliefs about the “The Gymnast”

importance of traditional financial skill sets as Be flexible, balanced, and precise. Flexibility in approach is critical. Balance financial

imperatives for entry into the FP&A ranks. and business priorities. Be precise when it counts. Know that constant precision can

But what are the keys to advanced FP&A wear on others.

success? Cross-functional collaboration and

other soft skills. “The Tailor”

Business leaders tend to value financial Work the seams. Find loose change in the pockets of opportunity that even

professionals who understand the business and the best business processes and change efforts leave. Be on the lookout for seam

contribute to operational success. Meanwhile, dwellers that need help.

finance leaders, faced with unique pressures

and influences, have different views about how “The Ambassador”

business support activities stack up in priority Build rapport and trust. Span the boundaries between Finance and other company units.

against closing the books, updating rolling Be the broker for solutions that engender organizational stability and forge process

forecasts, and building budgets. Largely a improvement.

matter of differing perceptions and compet-

“The Interpreter”

ing priorities, it is exactly within this gap—of

Remove the language barrier. Recognize that colleagues may see even the most basic

who thinks what is important—where FP&A

financial terminology as a foreign language. Assemble a vocabulary and desk-side

is squarely caught in the middle. Somewhat

manner that works.

paradoxically, this is also a golden road of op-

portunity for FP&A.

“The Educator”

FP&A professionals need collaborative and

Simplify and clarify. Help others to understand financial concepts and initiatives.

other soft skills to constantly reconcile this ap-

Invest in the power of financial education across the business. Make it easy for others

parent dichotomy and to seize the opportunity.

to support FP&A.

Moving beyond our traditional accounting and

finance skill sets is developmentally essential, as

“The Individualizer”

we look to improve ourselves and to help oth-

Adapt to differences among colleagues. Recognize the diversity of skills and talents

ers who look to us for leadership and mentor-

that exists in an organization. Modify approach and style to achieve the best results.

ing. This is not to suggest in any way, shape, or

form that functional excellence be cast aside or “The Integrator”

that technical knowledge, financial models, and Put the pieces together. Create a mosaic by assembling the seemingly disparate perspec-

analytical methods be replaced with glad-hand- tives and information that we encounter. Embrace the opportunity to unify.

ing, back-slapping, and an aversion to heavy

lifting. As financial professionals, we cannot “The Raconteur”

and should not forsake the very skills that got Tell the FP&A story. Be the soundtrack. Inject personality and enthusiasm. Be inter-

us to where we are. esting. Focus on a few overarching themes. Create a story that encourages others to

Rather than representing a single set of abso- want to work with us. s

lutes, the list that follows is intended to evoke

imagery and be an illustrative look at a very Thomas W. Smith is Director, FP&A, Home Systems Division, Legrand North America. Reach

important topic. him at Thomas.Smith@Legrand.us.

www.AFPonline.org Copyright © 2011 Association for Financial Professionals, Inc. All Rights Reserved Page 9

- 10. How to Get What You Want When You Want It

Kristin Castille, CTP

For FP&A professionals to succeed, they must work with multiple information. By knowing why you need the data, they can better

departments to gather information used in their financial and business allocate their time and resources to the request. For example,

analysis. The quality and timeliness of the work is paramount as the if you just need rough numbers for a back-of-the-envelope

analysis is relied upon by the senior leadership team including the calculation, communicating this might save needless hours as

President, Chief Financial Officer and the Board of Directors. someone attempts to gather exact numbers to the penny. To the

Data and information are required from numerous departments. contrary, when the information is being used for a public filing

For example, data may include the specific business volume from or board report, you will gain buy-in as your source will share in

the commercial team, or tax and depreciation estimates from the the excitement and importance of this work.

accounting department. Information includes the commercial

4. Recognize language differences.

outlook and reason for volume and price fluctuations from prior

While you know exactly what you want, your finance lan-

periods or strategic initiatives from the executive team.

guage might have a different meaning to a non-finance profes-

It is the responsibility of the FP&A team to verify the inputs.

sional. For example, something that is considered an expense

Here are a few pointers to help achieve this goal:

by the commercial team may not be an expense that hits the

1. Communicate clear and specific deadlines. income statement. Even though cash is going out the door, it

Information requests should be accompanied by an exact date could instead be classified as inventory and only impact the

and time. Avoid using the phrase ASAPas there is no agreed upon balance sheet. So exercise caution and ask plenty of questions to

meaning. While one person could interpret this to mean in the make sure everyone is on the same page when you’re trying to

next five minutes, someone else could understand this to be in get that income statement forecast right.

the next five days. By providing a deadline, you are better able to

5. Build personal relationships.

ensure your own deadlines will be met.

People prefer to say “yes” to individuals they know and like. It

2. Be detailed in your requests. may not take a PhD to figure this out, but one did: According to

You know exactly what you’re trying to do with the informa- Robert Cialdini, Professor Emeritus of Psychology and Marketing

tion, but others aren’t mind readers. Tell them exactly what you’re at Arizona State University and author of “Influence,” compliance

looking for. For example, asking the VP of Sales for “2010 vol- with requests is more likely to be achieved if people are familiar

umes” is too vague. Asking the following is much more helpful: with and have positive feelings towards the person making the

“Could you please provide me with volume by product line for request. So take the time to get to know your colleagues, and

2010 broken out by month, which ties to the summary number?” instead of eating at your desk, invite them out to lunch.

This eliminates precious time wasted All the technical knowledge and

with needless back-and-forth as you spreadsheet wizardry will not do

attempt to get exactly what you want. you a lick of good if you can’t get

An even more fool-proof method is accurate information in a timely

providing an Excel template in which manner from your coworkers. Fol-

the cells to be populated are high- lowing these five steps will put you

lighted. This visual guide will often on a path to success in meeting your

prove easier than verbal instructions. deadlines and endless reporting

requirements. s

3. Take a collaborative

approach. Kristin Castille, CTP, is Manager of

Share the reason for the request Financial Planning & Analysis for

with your coworker providing the SPT Inc.

Page 10 Copyright © 2011 Association for Financial Professionals, Inc. All Rights Reserved Spring 2011

- 11. Managing Liquidity in Tough Times

Rod Hewlett, CTP

Managing capital costs and capital structure ture cash flows (financial capital), right-sized access to affordable capital. What types of

is complicated, even in the best of economic physical capital, structural capital (processes, tools exist within treasury to do this type

times. Yet, the ability to access cash for capi- procedures, culture, customer relationships, of planning?

tal investments is not a mystery and can be supply chain, and reputation—as some have It is fundamental that all forms of capital

managed—even in challenging times. Three suggested, structural capital is the knowl- available to an organization receive effec-

critical planning steps that can help mitigate edge that resides in the organization when tive capital budgeting—all investments

cost of capital problems include: the employees leave at night), access to intel- should mitigate risk and enhance organi-

• Understanding the near and mid-term lectual capital, and well honed and aligned zational cash flow. Essentially, this form

external economic environment human capital. Smart investors want to see of holistic capital budgeting is part of a

• Tying a comprehensive enterprise risk the risk mitigation strategies. thoughtful risk management strategy. Trea-

management strategy to capital planning

• Focusing on markets and cash flow.

It is fundamental that all forms of capital available to

In February 2010, Richard Fisher, Presi-

dent of the Dallas Fed, shared that the Dallas an organization receive effective capital budgeting—

Fed pegged Federal unfunded liabilities at all investments should mitigate risk and enhance

$104 trillion, growing at $2-3 trillion per

year. Federal debt has climbed north of $14 organizational cash flow.

trillion. All told, debt in the United States

is now over $50 trillion. In short, there is Enterprise risk management tracks all sury must become adept at integrating ex-

tremendous pressure on capital markets and major risks that can impact the organization ternal market cues into capital and liquidity

there will be pressure for a protracted period. and uses an integrated, and systematic, ap- planning. Enterprise risk management must

Large government, consumer, and business proach to share or mitigate risks. Good risk be considered as a holistic management

borrowing will create real competition for strategies also include scanning strategies tool that links markets to cash flow. Risk

precious capital investments. At the same to identify and adapt to the “black swan.” management is more than insurance and

time, commodity prices continue to climb Ultimately, a solid risk management plan netting activities. One has to look no further

and the value of the U.S. dollar is under mitigates risk that affects the price of cash, than talent acquisition, management, and

tremendous pressure. Even with growth in or the cost of capital. retention in a knowledge-based business to

consumer and investment demand, there are All organizations face the hard reality understand that employee benefits and the

serious challenges—many of the fixes to the that their missions require cash—and that regulatory environment are important risk

debt issues will diminish consumer demand. also includes access to future cash. Good areas. If a knowledge-based business cannot

So, businesses that want to maintain access organizations manage liquidity holistically. attract knowledge talent, their access to and

to capital need a very clean balance sheet, They plan for current cash, future access to cost of capital will become prohibitive.

an effective value proposition for good and cash, and use this cash to shape the organi- The treasury group is the critical orga-

bad times, and a risk strategy that convinces zation to meet the market. Good businesses nizational player in liquidity management.

capital markets that your organization has a manage and make mid-course corrections Risks shapes value and value governs access

serious handle on risks. to manage to cash. Without cash, great to capital and cost of capital, which impacts

Smart companies have a comprehensive ideas die and capital is employed ineffec- liquidity. Twenty-first century economics has

risk management strategy that links opera- tively and eventually evaporates. Under- creating an expanded role for treasury. s

tional and strategic plans to markets and standing the organization value proposition

ultimately the value creating capital of the through market-capital-risk-cash flow Rod Hewlett, DA, CFM, CTP is Dean, College

,

organization. Capital includes current and fu- links is the critical element to ensure ready of Business, Bellevue University.

www.AFPonline.org Copyright © 2011 Association for Financial Professionals, Inc. All Rights Reserved Page 11