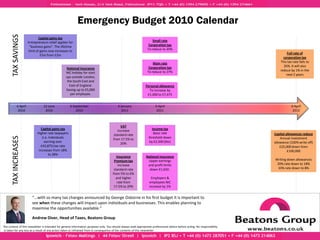

Emergency Budget Calendar V3[1]

- 1. Emergency Budget 2010 Calendar TAX SAVINGS Capital gains tax Entrepreneurs relief applies for Small rate “business gains”. The lifetime Corporation tax limit of gains now increases to To reduce to 20% Full rate of £5m from £2m corporation tax Main rate This tax rate falls to Corporation tax 26%. It will also National Insurance To reduce to 27% reduce by 1% in the NIC holiday for start next 2 years ups outside London, the South East and East of England. Personal allowance Saving up to £5,000 To increase by per employee. £1,000 to £7,475 6 April 22 June 6 September 4 January 6 April 6 April 2010 2010 2010 2011 2011 2012 VAT Capital gains tax Increase Income tax Higher rate taxpayers standard rate Basic rate Capital allowances reduce TAX INCREASES (i.e. Individuals from 17.5% to threshold down Annual investment earning over 20% by £2,500 (tbc) allowance (100% write off) £43,875) tax rate £25,000 down from increases from 18% £100,000 to 28% Insurance National Insurance Premium tax Upper earnings Writing down allowances Increase and profit limits 20% rate down to 18% standard rate down £1,650 . 10% rate down to 8% from 5% to 6% and higher Employers & rate from employees NIC 17.5% to 20% increase by 1% “...with so many tax changes announced by George Osborne in his first budget it is important to see when these changes will impact upon individuals and businesses. This enables planning to maximise the opportunities available.” Andrew Diver, Head of Taxes, Beatons Group The content of this newsletter is intended for general information purposes only. You should always seek appropriate professional advice before acting. No responsibility is taken for any loss as a result of any action taken or refrained from in consequence of the contents of this newsletter