Countrywide Subprime - 8-16-2006

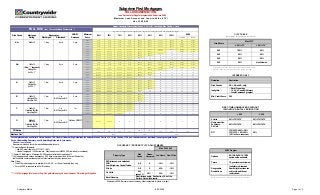

- 1. Subprime First Mortgages Loan Amounts for Regular programs and Subprime 80/20 Risk Grade Mortgage NOD/FC Minimum As of 08/16/06 Owner-Occupied Primary Residence: SFR, PUD, Low-/High-Rise Condo, 2 Units Rating Discharged Dismissed Released Score Combined 2nd Lien 700+ $1M $1M $1M $1M $850k $750k $700k $1M $200k AA+ 0x30x12 1 day 2 yrs 3 yrs 680 $1M $1M $1M $1M $850k $750k $700k $650k $1M $200k 640 $1M $1M $1M $1M $850k $750k $700k $850k $170k 620 $1M $1M $1M $900k $850k $750k $650k $850k $170k 600 $1M $1M $1M $900k $800k $750k $600k $750k $150k 580 $850k $850k $850k $800k $750k $650k $550k $650k $130k 560 $750k $750k $750k $700k $650k $600k $500k na na 540 $700k $700k $700k $700k $650k $550k na na na 520 $700k $700k $700k $650k $550k na na na na 500 $700k $700k $700k $650k na na na na na na 660 $1M $1M $1M $1M $850k $650k $650k $850k $170k $600k $600k 90% na na $600k AA 1x30x12 1 day 2 yrs 3 yrs 640 $1M $1M $1M $1M $850k $650k $600k $600k $850k $170k (See **** footnote) 600 $1M $1M $850k $850k $750k $650k $600k1 $600k1 $750k $150k Rolling 30s 580 $850k $850k $850k $850k $750k $650k $550k1 na na 100% 1 95% 1 SFRs, PUDs and condo. Owner-occupied, primary residences only. 2 Secondary financing not allowed with LTVs greater than 90%. na 6x30 = 15 560 $750k $750k $750k $700k $650k $600k na na na na na 540 $700k $700k $700k $650k $650k $550k na na na 520 $700k $700k $700k $650k $550k na na na na 500 $700k $700k $700k $650k na na na na na 620 $850k $850k $850k $750k $750k $600k na na na na na A- 2x30x12 1 day 2 yrs 3 yrs 600 $750k $750k $750k $750k $750k $600k na na na na Rolling 30s 580 $750k $750k $750k $650k $650k $600k na na na na 6x30 = 15 560 $650k $650k $650k $650k $650k $600k na na na na 540 $650k $650k $650k $600k $600k $550k na na na na 520 $650k $650k $650k $600k $550k na na na na na 500 $650k $650k $650k $600k na na na na na na 600 $650k $650k $650k $600k $600k na na na na na B 1x60x12 1 day 1 yr 2 yrs 580 $650k $650k $650k $600k $550k na na na na na Unlimited 30s BK 13 buyout OK 560 $600k $600k $600k $550k $550k na na na na na No rolling 60s5 520 $600k $600k $600k $550k $550k na na na na na 500 $600k $600k $600k $550k na na na na na na 600 $600k $600k $600k $550k na na na na na 580 $600k $600k $550k $550k na na na na na na C 1x90x12 1 day 1 yr 1 yr 560 $550k $550k $550k $500k na na na na na na Unlimited 30s/60s BK 13 buyout OK 540 $550k $550k $550k $450k na na na na na No rolling 90s 500 $550k $550k $550k na na na na na na C- 2x90x12 1 day 1 yr No Open NOD/FC No 120's BK 13 buyout OK Unlimited 30s/60s No rolling 90s 500 $500k $500k na na na na DTI Ratios 55% 55% 55% 55% 55%2 55%2 50% Max Cash Out 4 For complete details, see Seller's Guide: Section 18.6, General Underwriting Guidelines for Subprime Loans, Section 19.1, Risk Grades, LTVs, and Loan Amounts or individual loan program guidelines. For an Underwriting Summary, see Underwriting Notes tab in this matrix. 1 Cash-out is not allowed. 2 Borrowers must have twice the required disposable income. 3 12 months Bank Statements: ─ Min. 600 credit score for LTV/CLTV > 90%. ─ Non-self employed / W-2 borrowers: Max loan amount of $500,000 (individual or combined). 4 Chapter 13 BK Buyouts: Maximum $5,000 cash out after bankruptcy payoff. Misc. Notes: ─ Credit Comeback program is available for 40-, 30-, or 15-year fixed-rate loan only. **** If 1x30 mortgage late is not rolling, AA+ guidelines may be used; however, AA pricing still applies. OCCUPANCY / PROPERTY LTV ADJUSTMENTS Risk Grade 2nd Home Non-O/Occ All, -10% -10% except C- -10% * N/A -15% INTEREST-ONLY Guideline Restriction ─ Rural Properties ─ 10, 20, 25, and 40/40 terms ─ Credit Comeback program 560 Ineligible Refer to Sections 20.3, Subprime 80/20 Program for details. 2 Units Property Type Owner- Occupied All 0 80/15/5, 80/10/10, 75/25 options also available. 3-4 Units Rural Housing 0 95% LTV/CLTV Restrictions apply. See Section 18.4 of the Seller's Guide, for details. * Maximum $500K. Borrower cannot own any other real estate in whole or in part. 80/20 Program Terms 10-year term not allowed. Max $500,000 90% LTV/CLTV 5 If a mortgage shows serious delinquency (120 days or more past due in the last 36 months), the file should contain evidence that no foreclosure activity has taken place. Options na na na na ─ Form 4506-T is required on all Full Doc loans. Geographic Restrictions N/A -10% SFR (attached and detached) PUD Low & High-rise Condo/Twnhs All Ineligible in Arkansas. Some eligible states are subject to additional restrictions. ≥ 620 Non-owner Occ. 2nd Home 3-4 Unit 80% LTV/CLTV 85% LTV/CLTV DTI LTV/CLTV ≤ 95%: 50% LTV/CLTV > 95%: 45% (50% w/2 mo. reserves) 50% 2 Units Not Allowed < 620 Risk Grades Min. Credit Score AA+, AA and A- only. FIRST-TIME HOMEBUYERS WITHOUT 12 MONTHS' RENTAL VERIFICATION 520 500 90% 90% 90% Bankruptcy 100% $700k CLTV TABLE (Countrywide only purchases the first lien) Max CLTV 85% na 90% Credit Score ≤ 80% LTV > 80% LTV 2 560 540 na Maximum Loan Amount and Loan-to-Value (LTV) 65% 70% 75% 90% 80% 95% 80-20 FULL DOCUMENTATION (For other Occupancy and Property types, refer to "Occupancy/Property LTV Adjustment" table) FULL DOC (incl. 12 months Bank Statements 3 ) $650k na na na na 50% 50% $500k $150k $100k Subprime Matrix 8/15/2006 Page 1 of 5

- 2. Loan Amounts for Regular programs and Subprime 80/20 Risk Grade Mortgage NOD/FC Minimum 65% 70% 75% 80% 85% 90% 95% 100%2 Rating Discharged Dismissed Released Score Combined 2nd Lien 700+ $1M $1M $1M $1M $850k $750k $700k $700k $1M $200k 680 $1M $1M $1M $1M $850k $750k $700k $650k $1M $200k 640 $1M $1M $1M $1M $850k $600k $600k $550k $850k $170k 620 $1M $1M $1M $900k $850k $600k $550k na na na 600 $1M $1M $900k $750k $650k $600k na na na na AA+ 0x30x12 1 day 2 yrs 3 yrs 580 $850k $850 $800k $650k $600k $550k na na na na 560 $750k $750k $700k $600k $550k na na na na na 540 $700k $700k $650k $600k $550k na na na na na 520 $700k $700k $650k $550k $450k na na na na na 500 $700k $700k $650k $550k na na na na na na 640 $1M $1M $900k $800k $700k $550k na na na na 600 $1M $1M $800k $700k $600k $550k na na na na 1x30x12 580 $850k $850k $800k $700k $600k $550k na na na na (See **** footnote) 1 day 2 yrs 3 yrs 560 $750k $750k $700k $600k $550k na na na na na Refer to Sections 20.3, Subprime 80/20 Program for details. Max CLTV Rolling 30s 540 $700k $700k $650k $550k $550k na na na na na 2 Secondary financing not allowed with LTVs greater than 90%. 6x30 = 14 520 $700k $700k $650k $550k na na na na na na 500 $700k $700k $650k na na na na na na na 620 $850k $800k $700k $600k $600k na na na na na 600 $750k $700k $600k $600k $600k na na na na na A- 2x30x12 1 day 2 yrs 3 yrs 580 $750k $700k $600k $550k $550k na na na na na Rolling 30s 560 $650k $600k $550k $550k $550k na na na na na 6x30 = 14 520 $650k $600k $550k $500k na na na na na na 500 $650k $600k $550k na na na na na na na 580 $550k $500k $500k na na na na na na na 500 $500k $500k $500k na na na na na na na C 1x90x12 Unlimited 30s/60s No rolling 90s 1 day 1 yr BK Buyout OK 1 yr 500 $400k $350k na na na na na na na na Min. Credit Score 55% 55% 55% 55% 55%1 55%1 50% 50% Max Cash Out 3 For complete details, see Seller's Guide: Section 18.6, General Underwriting Guidelines for Subprime Loans, Section 19.1, Risk Grades, LTVs, and Loan Amounts or individual loan program guidelines. For an Underwriting Summary, see Underwriting Notes tab in this matrix. 0 Property Type Risk Grade Max $500,000 All 0 N/A N/A 560 Max. LTV/CLTV 95% (80/20 program: 100% CLTV) DTI 80/20 program: 45% FIRST-TIME HOMEBUYERS WITHOUT 12 MONTHS' RENTAL VERIFICATION 85% LTV/CLTV All -10% 1 N/A 50% Non-O/Occupied 2nd Home 3-4 Unit Non- O/Occ SFR (attached and detached) PUD Low & High-rise Condo/Twnhs ≥ 660 < 660 2nd 2 Units 90% LTV/CLTV 95% LTV/CLTV Home 1 DTI Ratios: Borrowers must have twice the required disposable income. Non-owner occupied properties eligible to maximum 50%. 3 Chapter 13 BK Buyouts: Maximum $5,000 cash out after bakruptcy payoff. 4 If a mortgage shows serious delinquency (120 days or more past due in the last 36 months), the file should contain evidence that no foreclosure activity has taken place. -10% -10% 2 80% LTV/CLTV Misc. Notes: ─ Credit Comeback program is available for 40-, 30-, or 15-year fixed-rate loan only. 2 Units All Guideline Restriction Risk Grades AA+, AA and A- only ─ Rural Properties ─ Investment Properties ─ 10, 20, 25, and 40/40 terms ─ Credit Comeback program LTV/CLTV ≤ 95%: 50% LTV/CLTV > 95%: 45% (50% w/2 mo. reserves) DTI Bankruptcy AA 50% Subprime First Mortgages STATED DOCUMENTATION (Self-employed) Maximum Loan Amount and Loan-to-Value (LTV) 80-20% As of 08/16/06 STATED DOC: Self-Employed Owner-Occupied Primary Residence: SFR, PUD, Low-/High-Rise Condo, 2 Units (For other Occupancy and Property types please see Occupancy/Property LTV Adjustment Matrix.) $250k $150k $100k 2 Reserves required for first-time homebuyers. See Underwriting Notes page for details. OCCUPANCY / PROPERTY LTV ADJUSTMENTS N/A Owner- Occupied 3-4 Units Credit Score CLTV TABLE (Countrywide only purchases the first lien) ≤ 80% LTV > 80% LTV 2 560 100% 1 90% 540 95% 90% 520 90% 90% 500 90% Not Allowed 1 SFRs, PUDs and condo. Owner-occupied, primary residences only. INTEREST-ONLY B 1x60x12 Ineligible Unlimited 30s 1 day 1 yr No rolling 60s BK Buyout OK 2 yrs 80/20 PROGRAM Options 80/15/5, 80/10/10, 75/25 options also available. Terms 10-, 20-, 25- year terms not allowed. Geographic Restrictions Ineligible in Arkansas. Some eligible states are subject to additional restrictions. **** If 1x30 mortgage late is not rolling, AA+ guidelines may be used; however, AA pricing still applies. Rural Housing Restrictions apply. See Section 18.4 of the Seller's Guide for details. 1 Maximum $500K. Borrower cannot own any other real estate in whole or in part 2 Eligible subject to the following restrictions: ─ AA+ risk grade only. ─ 620 minimum credit score. ─ Interest-only option is not allowed. ─ Credit Comeback program is not allowed. ─ Borrowers who own five or more properties, including subject property, are not allowed. Subprime Matrix 8/15/2006 Page 2 of 5

- 3. Subprime First Mortgages STATED DOCUMENTATION (Non-self Employed / W-2) Loan Amounts for Regular programs and Subprime 80/20 As of 08/16/06 Risk Grade Mortgage NOD/FC Minimum 65% 70% 75% 80% 85% 90% 95% 100% Rating Discharged Dismissed Released Score Combined 2nd lien 680+ $1M $1M $1M $1M $850k $600k na na $1M $200k 640 $1M $1M $1M $1M $850k $600k na na $850k $170k 620 $1M $1M $1M $900k $850k $600k na na na na 600 $1M $1M $900k $750k $650k $600k na na na na AA+ 0x30x12 1 day 2 yrs 3 yrs 580 $850k $850k $800k $650k $600k $550k na na na na 560 $750k $750k $700k $600k $550k na na na na na 540 $700k $700k $650k $600k $550k na na na na na 520 $700k $700k $650k $550k $450k na na na na na 500 $700k $700k $650k $550k na na na na na na 640 $1M $1M $900k $800k $700k $550k na na na na 620 $1M $1M $800k $700k $600k $550k na na na na 1x30x12 600 $1M $1M $800k $700k $600k na na na na na AA (See **** footnote) 1 day 2 yrs 3 yrs 580 $850k $850k $800k $650k $600k na na na na na Rolling 30s 560 $750k $750k $700k $600k $550k na na na na na 6x30 = 13 540 $700k $700k $650k $550k $550k na na na na na Credit Score Max CLTV ≤ 80% LTV 80% LTV 2 560 100% 1 90% 540 95% 90% 520 90% 90% 520 $700k $700k $650k $550k na na na na na na 2 Secondary financing not allowed with LTVs greater than 90%. 500 $700k $700k $650k na na na na na na na 620 $850k $800k $700k $600k na na na na na na 600 $750k $700k $600k $600k na na na na na na A- 2x30x12 1 day 2 yrs 3 yrs 580 $750k $700k $600k $550k na na na na na na Rolling 30s 560 $650k $600k $550k $550k na na na na na na 6x30 = 13 520 $650k $600k $550k $500k na na na na na na 500 $650k $600k $550k na na na na na na na 580 $550k $500k $500k na na na na na na na B 1 day 2 yrs 500 $500k $500k $500k na na na na na na na C 1 day 1 yr BK 13 Buyout OK 1 yr Min. Credit Score 620 for all borrowers na na na DTI Ratios 55% 55% 55% 55% 55%1 55%1 50% 50% Max Cash Out 2 50% For complete details, see Seller's Guide: Section 18.6, General Underwriting Guidelines for Subprime Loans, Section 19.1, Risk Grades, LTVs, and Loan Amounts or individual loan program guidelines. Property Types For an Underwriting Summary, see Underwriting Notes tab in this matrix. Occupancy All 0 -10% All 0 N/A N/A FIRST-TIME HOMEBUYERS WITHOUT 12 MONTHS' RENTAL VERIFICATION 2 Units 90% LTV/CLTV 95% LTV/CLTV DTI LTV/CLTV ≤ 95%: 50% LTV/CLTV 95%: 45% (50% w/2 mo. reserves) 1 DTI Ratios: Borrowers must have twice the required disposable income. Non-owner occupied properties eligible to maximum 50%. 2 Chapter 13 BK Buyouts: Maximum $5,000 cash out after bankruptcy payoff Max. LTV/CLTV 90% (80/20 program: 100% CLTV) 50% Non-O/O 2nd Home 3-4 Unit 80% LTV/CLTV 85% LTV/CLTV $250k $150k INTEREST-ONLY Guideline Restriction Risk Grades AA+ and AA only na na na 500 90% Not Allowed 1 SFRs, PUDs, and condo. Owner-occupied, primary residences only. 500 1x90x12 Unlimited 30s/60s No rolling 90s 80/20 PROGRAM Options 80/15/5, 80/10/10, 75/25 options also available. Terms 10-, 20-, 25- year terms not allowed. Geographic Restrictions Ineligible in Arkansas. Some eligible states are subject to additional restrictions. CLTV TABLE (Countrywide only purchases the first lien) STATED DOC: Non-Self Employed / W2 Owner-Occupied Primary Residence: SFR, PUD, Low-/High-Rise Condo, 2 Units (For other Occupancy and Property types please see Occupancy/Property LTV Adjustment Matrix.) Bankruptcy 80/20 $100k 80/20 program: 45% 1x60x12 Unlimited 30s No rolling 60s3 1 yr BK 13 Buyout OK SFR, PUD, and low-rise condo only DTI ─ Rural Properties ─ Investment Properties ─ 10, 20, 25, and 40/40 terms ─ 3-4 units ─ Credit Comeback program Ineligible $400k $350k na na OCCUPANCY / PROPERTY LTV ADJUSTMENTS Max $500,000 Property Type Risk Grade Owner- Occupied 2nd Home Non- O/O SFR (attached and detached) PUD Low High-rise Condo/Twnhs 3 If a mortgage shows serious delinquency (120 days or more past due in the last 36 months), the file should contain evidence that no foreclosure activity has taken place. Misc. Notes: ─ Credit Comeback program is available for 40-, 30-, or 15-year fixed-rate loan only. Owner-occupied primary residences only 1 Maximum $500K. Borrower cannot own any other real estate in whole or in part 2 Eligible subject to the following restrictions: ─ AA+ risk grade only. ─ 620 minimum credit score. ─ Interest-only option is not allowed. ─ Credit Comebak program is not allowed. ─ Borrowers who own five or more properties, including subject property, are not allowed. -10% 2 2 Units 3-4 Units All -10% 1 N/A N/A **** If 1x30 mortgage late is not rolling, AA+ guidelines may be used; however, AA pricing still applies Refer to Sections 20.3, Subprime 80/20 Program for details. Rural Housing Restrictions apply. See Section 18.4 of the Seller's Guide for details. 660 ≥ 660 Subprime Matrix 8/15/2006 Page 3 of 5

- 4. Subprime Second Mortgages (Guidelines for second lien mortgages delivered for purchase in stand-alone transactions) As of 08/16/06 CLOSED-END FIXED RATE SECONDS (Stand-alone Transactions) Owner-Occupied Primary Residence Mortgage NOD/FC Rating Discharged Filed/Dismissed Released Maximum Loan Amt: $100,000 (Maximum 1st Loan Amt = $400K; maximum combined loan amt = $500K) (NOTE: Subprime 80/20 second lien subject to different maximum loan amount guidelines) Min Credit Score Max CLTV AA+ 0x30x12 2 yrs 2 yrs 3 yrs SFRs, PUDs, Low-rise Condos, Row Houses 90% 600 580 560 80% 85% Min Credit Score Max CLTV 1x30x12 AA (See **** footnote) 2 yrs 2 yrs 3 yrs SFRs, PUDs, Rolling 30s Low-rise Condos, 6x30 = 1 Row Houses 600 90% 580 85% Min Credit Score Max CLTV 2 yrs A- 2x30x12 2 yrs 3 yrs SFRs, PUDs, If filed, discharge Rolling 30s Low-rise Condos, 6x30 = 1 Row Houses 560 85% 80% Min Credit Score Max CLTV is required 1x60x12 18 mos 18 mos 2 yrs SFRs, PUDs, 560 80% Rolling 30s BK 13 buyout OK Low-rise Condos, No rolling 60s Row Houses Min Credit Score Max CLTV 1x90x12 1 yr 1 yr 1 yr SFRs, PUDs, 560 70% Rolling 30s/60s BK 13 buyout OK Low-rise Condos, No rolling 90s Row Houses Owner-Occupied Primary Residence Bankruptcy /Chapter7/13 Mortgage NOD/FC B C Risk Grade Rating Discharged Filed/Dismissed Released Property Type (Maximum 1st Loan Amt = $400K; maximum combined loan amt = $500K) Min Credit Score Max CLTV 600 600 90% AA+ 0x30x12 2 yrs 2 yrs 3 yrs Detached SFRs/PUDs 580 85% Min Credit Score Max CLTV 1x30x12 (See **** footnote) 2 yrs 2 yrs 3 yrs Detached SFRs/PUDs 600 90% Rolling 30s 6x30 = 1 Min Credit Score Max CLTV 2 yrs AA A- 2x30x12 2 yrs 3 yrs Detached SFRs/PUDs 580 85% Rolling 30s 6x30 = 1 If filed, discharge is required Credit Notes for Closed-end Fixed Rate and HELOCs: Maximum debt-to-income (DTI) ratios: 50% **** If 1x30 mortgage late is not rolling, AA+ guidelines may be used; however, AA pricing still applies. 580 85% FULL DOC Only Risk Grade Bankruptcy /Chapter7/13 Maximum Line Amt: $100,000 Subprime HELOCs FULL DOC Only (12 months bank statements not allowed) Subprime HELOC (Stand-alone Transactions) 560 Property Type 80% 580 Subprime Matrix 8/15/2006 Page 4 of 5

- 5. Subprime Underwriting Notes As of 08/16/06 For complete details, refer to Seller's Guide Section 18.6, General Underwriting Guidelines for Subprime Loans. PRODUCT INFORMATION CENTER: (800) 669-6680 (EXT 4801) Platinum Website: https://cld.countrywide.com Platinum HELP Desk: (877) 425-3463 DOCUMENTATION REQUIREMENTS APPRAISAL REQUIREMENTS An appraisal review performed by LandSafe's® ValuefinderSM or LandSafe's Appraisal Review Analysis (LARA) is required for any of the following: ─ LTVs over 90%. ─ 3-4 unit properties. ─ Second home and non-owner occupied transactions. ─ Non-arms length, For Sale By Owner, and gift equity transactions. ─ Loan amounts $350,000 and ≤ $500,000. ─ High-rise condos. ─ C and C- risk grade loans. ─ Contract-for-deed transactions. ─ Lease option (option to purchase) transactions. ─ Loans submitted under the 80/20 program. For combined loan amounts $500,000: Review appraisal required in addition to one full appraisal for the following: ─ CA, CO, CT, MA, NJ, NY, WA: 2055 (SFRs or PUDs) or 1075/466 (condominiums) from LandSafe Services, Inc. OR second full appraisal from Countrywide-approved company. ─ All other states: Second full appraisal from Countrywide-approved company. ADDITIONAL NOTES CREDIT To be considered a valid and usable credit score, the credit report must reflect two or three scores. ─ If there is one or no score reported on the credit report, refer to Valid/Usable Credit Score in the Seller's Guide, Section 18.6A, Subprime Credit-Score Underwriting, for more information. Judgments, Collections/Charge-offs and Tax Liens: See Treatment of Major Adverse Credit in Section 18.6, General Underwriting Guidelines for Subprime Loans for details. Multiple Unrelated Bankruptcies: The use of the filing date is not allowed. ─ If the primary borrower contributes less than 75% of the total reported income, all co-borrowers with contributing income must have a minimum credit score of 500. ─ Rate and term refinances allow incidental cash back equal to the lesser of 2% of the new principal mortgage amount or $2,000. Debt consolidation is considered cash out. ─ 2 months proposed housing expense (PITI plus HOA) are required and must be verified with source or seasoned for 60 days for the following: ° First-lien loan amounts greater than $650,000, regardless of LTV. ─ This requirement may be waived with Full documentation and proof of two years’ income. (paystub plus two years’ W-2s for wage-earners; two years’ tax returns for self-employed.) See Salaried Borrowers or Self-Employed Borrowers in Section 18.6, General Underwriting Guidelines for Subprime Loans, for additional details. Bank Statements are not allowed. ° First-time homebuyers with Stated Documentation and LTV 95%. ° First-time homebuyers with all of the following: ─ No rental verification. ─ LTV/CLTV 95%. ─ DTI 45%. ─ Credit Score 620 (Full doc) or 660 (Stated doc). ─ Properties identifed in the appraisal as declining property values, over supply of housing, or marketing time over six months are considered on a case-by-case basis. ─ Disposable income requirements: 1 person.......$550 3 persons.........$900 2 persons.....$700 4 persons.......$1,000 FULL: Complete verification and documentation of income is required. 12 Months Bank Statements: Allowed as Full Doc subject to the following additional requirements: ─ LTVs/CLTV 90%: Minimum credit score of 600 for Self-employed borrowers. Must have a verified 2-year history of self-employment. ─ Non-self employed / W-2: Not allowed on individual or combined loan amounts $500k. ─ Subprime HELOC programs are not allowed. ─ Owner-occupied 3-4 unit properties are not allowed. Salaried Borrowers (each borrower): Current year-to-date pay stub dated within 60 days of the Note and one of the following: ─ W-2 (1 year prior), OR ─ Tax Returns (1 year prior) AND 4506, OR ─ Fully executed VOE. Self-Employed Borrowers (each borrower): ─ Tax Returns (1 year prior-personal business) with signed YTD PL AND 4506, OR ─ 12 months personal and/or business bank statments with corresponding signed PL. STATED: Income on 1003 application is not verified; however, income must be reasonable for the borrower's profession and level of experience. Not available for fixed income, foreign or military borrowers. Salaried Borrowers (each borrower) ─ Verbal verification of employment. Self-Employed Borrowers (each borrower) ─ Disinterested third party verification of self-employment. Minimum 2 years verified history. ─ Form 4506 is not required. Verbal VOE is requirement on all transactions prior to closing. Blacked out documentation is considered altered and is not allowed. Subprime Matrix Page 5 of 5