Q1 2016 Austin Office Market Research Report

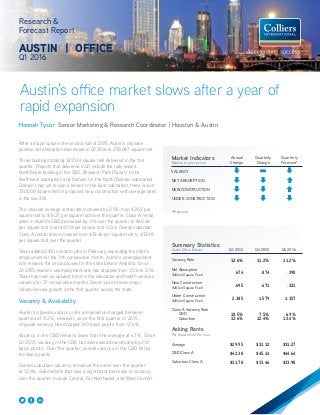

- 1. Austin’s office market slows after a year of rapid expansion Research & Forecast Report AUSTIN | OFFICE Q1 2016 Hannah Tysor Senior Marketing & Research Coordinator | Houston & Austin After a major spike in the second half of 2015, Austin’s citywide positive net absorption decreased in Q1 2016 to 290,047 square feet. Three buildings totaling 321,024 square feet delivered in the first quarter. Projects that delivered in Q1 include the fully leased NorthShore building in the CBD, Research Park Plaza V in the Northwest submarket, and Domain I in the North/Domain submarket. Domain I has yet to sign a tenant. In the East submarket, there is over 350,000 square feet of proposed new construction with average rates in the low 30s. The citywide average rental rate increased by 0.5% from $31.12 per square foot to $31.27 per square foot over the quarter. Class A rental rates in Austin’s CBD decreased by 1.1% over the quarter to $44.64 per square foot from $45.14 per square foot in Q4. Overall suburban Class A rental rates increased from $33.46 per square foot to $33.98 per square foot over the quarter. Texas added 2,100 nonfarm jobs in February, expanding the state’s employment for the 11th consecutive month. Austin’s unemployment rate remains the second lowest in the state behind Amarillo. Since Q1 2015, Austin’s unemployment rate has dropped from 3.5% to 3.1%. Texas has seen an upward trend in the education and health services industry for 37 consecutive months. Seven out of eleven major industries saw growth in the first quarter across the state. Vacancy & Availability Austin’s citywide vacancy rate remained unchanged between quarters at 11.2%. However, since the first quarter of 2015, citywide vacancy has dropped 140 basis points from 12.6%. Vacancy in the CBD remains lower than the average at 6.7%. Since Q1 2015, vacancy in the CBD has decreased dramatically by 210 basis points. Over the quarter, overall vacancy in the CBD fell by ten basis points. Overall suburban vacancy remained the same over the quarter at 12.4%. Submarkets that saw a significant decrease in vacancy over the quarter include Central, Far Northwest, and West Central. Summary Statistics Austin Office Market Q1 2015 Q4 2015 Q1 2016 Vacancy Rate 12.6% 11.2% 11.2% Net Absorption (Million Square Feet) .674 .874 .290 New Construction (Million Square Feet) .695 .671 .321 Under Construction (Million Square Feet) 2.385 1.579 1.357 Class A Vacancy Rate CBD Suburban 10.5% 13.6% 7.5% 12.4% 6.9% 12.4% Asking Rents Per Square Foot Per Year Average $29.95 $31.12 $31.27 CBD Class A $42.38 $45.14 $44.64 Suburban Class A $31.78 $33.46 $33.98 Market Indicators Relative to prior period Annual Change Quarterly Change Quarterly Forecast* VACANCY NET ABSORPTION NEW CONSTRUCTION UNDER CONSTRUCTION *Projected

- 2. 2 Austin Research & Forecast Report | Q1 2016 | Office | Colliers International Vacancy in the Far Northwest submarket in Class A properties dropped from 15.2% to 6.8% over the quarter. Submarkets that experienced increases in vacancy in Q1 include Northwest, and North/Domain. In the North/Domain submarket, Domain I, a 124,578 SF office building, delivered in January and remains completely vacant. Absorption, New Supply and Vacancy Absorption & Demand Austin’s office market posted 290,047 square feet of positive net absorption in Q1 2016, a dramatic decrease from the second half of 2015 which saw 1,889,284 square feet of positive net absorption. A majority of the positive net absorption in the first quarter can be attributed to the Far Northwest submarket’s Class A office space that saw 160,581 square feet of positive net absorption. LDR Spine USA, a medical manufacturing facility, moved into their 53,170 SF space in Aspen Lake One. The second highest positive net absorption occurred in Class A space in the CBD with 63,213 square feet in the first quarter, due in a large part to the delivery of the NorthShore building where Galvanize moved into 23,592 SF of space. NorthShore was 100% leased at completion. Citywide Class B space saw 42,442 SF of negative net absorption in the first quarter. Negative net absorption in Class B space occurred in the Northwest, South, Southwest and CBD submarkets. Rental Rates The citywide average rental rate increased over the quarter from $31.12 per square foot to $31.27 per square foot. The highest rates across the Austin market in the first quarter were in CBD Class A buildings where rental rates reached $44.64 per square foot. Although still higher than other submarkets, Class A rates in the CBD fell by 1.1% since Q4 2015. Rental rates were also high in the South submarket and West Central submarket where Class A rental rates reached $39.38 per square foot and $37.62 per square foot respectively. Citywide Class B rental rates rose slightly in the first quarter to $25.71 per square foot from $25.43 per square foot in Q4. Class B rates in the CBD rose by 4% over the quarter from $35.48 per square foot to $36.91 per square foot. Job Growth & Unemployment (not seasonally adjusted) UNEMPLOYMENT 1/15 1/16 AUSTIN 3.5% 3.1% TEXAS 4.4% 4.3% U.S. 5.8% 5.2% JOB GROWTH Annual Change # of Jobs Added AUSTIN 4.2% 39.8K TEXAS 1.5% 172.7K U.S. 2.0% 2.9M CBD vs. Suburban CLASS A OFFICE VACANCY CLASS A OFFICE RENTS

- 3. 33 Austin Research & Forecast Report | Q1 2016 | Office | Colliers International Q1 2016 Top Office Lease Transactions BUILDING NAME/ADDRESS SUBMARKET SF TENANT LEASE DATE Domain 4 North/Domain 400,000 Accruent Mar-16 5800 Airport Blvd Central 75,735 Netspend Jan-16 Lamar Central West Central 69,868 Unknown Feb-16 9600 N MoPac Expy Northwest 44,712 Oracle USA, Inc.1 Feb-16 Rollingwood Center Southwest 37,883 Unknown Feb-16 Riata Corporate Center Northwest 33,557 Unknown Feb-16 Research Park Plaza Northwest 25,937 Navitus Health Solutions Jan-16 13620 Ranch Road 620 N Cedar Park 22,285 CalAtlantic Homes Mar-16 The Park at Barton Creek Southwest 21,265 Unknown Feb-16 Lakeview Plaza Northwest 19,664 2Wire, Inc.1 Jan-16 816 Congress CBD 18,660 Unknown Mar-16 Capstar Plaza West Central 17,515 Jones Lang LaSalle Feb-16 Park Centre Northwest 16,228 Xplore Technologies Mar-16 Atrium Office Centre Central 16,146 The Community Care Collaborative Feb-16 Treemont Plaza Southwest 15,287 Mattersight Corporation Mar-16 Atrium Office Centre Central 15,893 Stewart Title Company Feb-16 Monterey Tech Center Southwest 14,400 Arrive Logistics Mar-16 1705 Guadalupe St. CBD 11,210 NeighborFavor Inc., DBA “Favor” Feb-16 Scarbrough Building CBD 10,536 ClearData Mar-16 Lamar Central West Central 10,288 AcademicWorks Feb-16 Leasing Activity Austin’s office leasing activity recorded 1,316,525 SF in Q1 2016. Major transactions this quarter included a new lease for Accruent at Domain 4 and a renewal for Oracle USA, Inc. 1 Renewal 2 Expansion 3 Sublease 4 Pre-lease/proposed or under construction Q1 2016 Significant Sales Transactions – (100,000 SF or greater) BUILDING NAME SUBMARKET RBA (SF) YEAR BUILT BUYER SELLER SALE PRICE $/SF CLOSED Parmer Office Park (6 Properties) Northwest 257,468 1999-2001 US Real Estate Invesment Fund, LLC & Eurus Capital REEF America LLC Undisclosed N/A Jan-16 9101 Burnet Rd. & 12710 Research Blvd North/Domain & Northwest 124,310 1984 Valor Capital Partners OakPoint and Haverford Management Undisclosed N/A Feb-16 University Park Central 206,657 2009 Lionstone Investments UP Austin Holdings LP $64,270,327 $311 Mar-16 316 W. 12th St. CBD 100,000 1950 Austin 316 LP Texas State Teachers Association Undisclosed N/A Mar-16 Sales Activity Austin’s office investment sales activity included four sales transactions (including two portfolio sales) with an average sale price of $294 per SF. Sources: CoStar and Real Capital Analytics *Part of a portfolio

- 4. 4 Austin Research & Forecast Report | Q1 2016 | Office | Colliers International Austin Office Market Summary (CBD, Suburban, & Overall) INVENTORY DIRECT VACANCY SUBLEASE VACANCY VACANCY VACANCY RATE (%) NET ABSORPTION (SF) RENTAL RATE CLASS # OF BLDGS. TOTAL (SF) (SF) RATE (%) (SF) RATE (%) TOTAL (SF) Q1-2016 Q4-2015 Q1-2016 Q4-2015 AVG ($/SF) CBD A 27 6,804,010 456,220 6.7% 14,667 0.2% 470,887 6.9% 7.5% 63,213 148,599 $44.64 B 31 2,322,311 131,980 5.7% 4,650 0.2% 136,630 5.9% 4.3% -35,671 -11,255 $36.91 C 9 470,243 22,000 4.7% 14800 3.1% 36,800 7.8% 8.4% 2,469 7,231 $25.33 Total 67 9,596,564 610,200 6.4% 34,117 0.4% 644,317 6.7% 6.8% 30,011 144,575 $42.56 SUBURBAN A 172 20,170,503 2,186,303 10.8% 327,464 1.6% 2,513,767 12.5% 12.5% 263,272 716,778 $33.98 B 315 15,735,784 1,999,494 12.7% 136,544 0.9% 2,136,038 13.6% 13.5% -6,771 -19,794 $24.85 C 55 2,857,430 140,928 4.9% 0 0.0% 140,928 4.9% 5.1% 3,535 33,075 $18.49 Total 542 38,763,717 4,326,725 11.2% 464,008 1.2% 4,790,733 12.4% 12.4% 260,036 730,059 $29.56 OVERALL A 199 26,974,513 2,642,523 9.8% 342,131 1.3% 2,984,654 11.1% 11.2% 326,485 865,377 $35.86 B 346 18,058,095 2,131,474 11.8% 141,194 0.8% 2,272,668 12.6% 12.4% -42,442 -31,049 $25.71 C 64 3,327,673 162,928 4.9% 14,800 0.4% 177,728 5.3% 5.5% 6,004 40,306 $19.03 Total 609 48,360,281 4,936,925 10.2% 498,125 1.0% 5,435,050 11.2% 11.2% 290,047 874,634 $31.27 INVENTORY DIRECT VACANCY SUBLEASE VACANCY VACANCY VACANCY RATE (%) NET ABSORPTION (SF) RENTAL RATE CLASS # OF BLDGS. TOTAL (SF) (SF) RATE (%) (SF) RATE (%) TOTAL (SF) Q1-2016 Q4-2015 Q1-2016 Q4-2015 AVG ($/SF) CEDAR PARK A 4 439,046 217,729 49.6% 0 0.0% 217,729 49.6% 49.6% 0 3,766 $26.80 B 3 142,622 0 0.0% 0 0.0% 0 0.0% 0.0% 0 0 $27.20 Total 7 581,668 217,729 37.4% 0 0.0% 217,729 37.4% 37.4% 0 3,766 $26.80 CENTRAL A 3 474,288 45,888 9.7% 0 0.0% 45,888 9.7% 15.6% 28,169 7,678 $33.01 B 34 1,901,761 186,932 9.8% 2,337 0.1% 189,269 10.0% 10.4% 9,077 12,890 $24.15 C 16 939,288 17,219 1.8% 0 0.0% 17,219 1.8% 2.8% 8,906 875 $19.58 Total 53 3,315,337 250,039 7.5% 2,337 0.1% 252,376 7.6% 9.0% 46,152 21,443 $24.72 EAST A 2 104,821 0 0.0% 0 0.0% 0 0.0% 0.0% 0 0 - B 12 1,021,495 450,666 44.1% 0 0.0% 450,666 44.1% 44.2% 1,279 292 $19.62 C 4 149,025 29,050 19.5% 0 0.0% 29,050 19.5% 19.5% 0 0 $19.98 Total 18 1,275,341 479,716 37.6% 0 0.0% 479,716 37.6% 37.7% 1,279 292 $19.64 FAR NORTHEAST B 1 23,408 0 0.0% 0 0.0% 0 0.0% 0.0% 0 0 - Total 1 23,408 0 0.0% 0 0.0% 0 0.0% 0.0% 0 0 - FAR NORTHWEST A 12 1,918,051 83,483 4.4% 47,877 2.5% 131,360 6.8% 15.2% 160,581 -11,664 $30.76 B 9 347,418 22,898 6.6% 0 0.0% 22,898 6.6% 8.8% 7,693 2,163 $26.43 C 1 21,964 0 0.0% 0 0.0% 0 0.0% 20.0% 4,400 -4,400 _ Total 22 2,287,433 106,381 4.7% 47,877 2.1% 154,258 6.7% 14.3% 172,674 -13,901 $29.37 Austin Suburban Office Market Summary

- 5. 5 Austin Research & Forecast Report | Q1 2016 | Office | Colliers International Austin Suburban Office Market Summary - Continued INVENTORY DIRECT VACANCY SUBLEASE VACANCY VACANCY VACANCY RATE (%) NET ABSORPTION (SF) RENTAL RATE CLASS # OF BLDGS. TOTAL (SF) (SF) RATE (%) (SF) RATE (%) TOTAL (SF) Q1-2016 Q4-2015 Q1-2016 Q4-2015 AVG ($/SF) NORTH/DOMAIN A 13 1,816,029 223,484 12.3% 5,162 0.3% 228,646 12.6% 7.4% 20,598 73,665 $36.48 B 28 1,625,709 94,534 5.8% 51,937 3.2% 146,471 9.0% 11.7% 44,483 -29,566 $27.24 C 1 24,759 0 0.0% 0 0.0% 0 0.0% 0.0% 0 0 $18.98 Total 42 3,466,497 318,018 9.2% 57,099 1.6% 375,117 10.8% 9.4% 65,079 44,099 $32.24 NORTHEAST A 4 375,146 108,892 29.0% 0 0.0% 108,892 29.0% 28.4% -2,267 2,296 $23.52 B 18 1,280,752 121,327 9.5% 12,657 1.0% 133,984 10.5% 11.0% 6,946 12,603 $18.47 C 7 214,114 58,220 27.2% 0 0.0% 58,220 27.2% 27.2% 0 38,241 $14.55 Total 29 1,870,012 288,439 15.4% 12,657 0.7% 301,096 16.1% 16.4% 4,679 53,140 $19.31 NORTHWEST A 73 6,964,561 630,682 9.1% 63,525 0.9% 694,207 10.0% 8.3% 45,671 204,809 $33.28 B 96 4,234,306 453,532 10.7% 42,177 1.0% 495,709 11.7% 10.6% -45,880 -53,392 $27.32 C 4 401,563 386 0.1% 0 0.0% 386 0.1% 0.1% 0 1,313 $33.19 Total 173 11,600,430 1,084,600 9.3% 105,702 0.9% 1,190,302 10.3% 8.9% -209 152,730 $30.62 ROUND ROCK A 2 282,721 28,086 9.9% 0 0.0% 28,086 9.9% 8.4% -4,417 0 $29.13 B 10 296,246 19,338 6.5% 2,743 0.9% 22,081 7.5% 9.4% 5,779 9,865 $19.94 C 3 147,466 0 0.0% 0 0.0% 0 0.0% 0.0% 0 0 Total 15 726,433 47,424 6.5% 2,743 0.4% 50,167 6.9% 7.1% 1,362 9,865 $21.70 SOUTH A 4 372,743 5,668 1.5% 0 0.0% 5,668 1.5% 3.9% 8,778 -1,887 $39.38 B 22 1,106,771 46,984 4.2% 0 0.0% 46,984 4.2% 3.3% -10,004 -6,958 $30.98 C 11 653,048 22,912 3.5% 0 0.0% 22,912 3.5% 3.4% -678 -8,165 $23.28 Total 37 2,132,562 75,564 3.5% 0 0.0% 75,564 3.5% 3.5% -1,904 -17,010 $31.33 SOUTHEAST B 9 989,009 428,662 43.3% 0 0.0% 428,662 43.3% 43.7% 3,704 10,678 $22.58 C 4 161,933 5,000 3.1% 0 0.0% 5,000 3.1% 0.0% -5,000 3,502 $17.98 Total 13 1,150,942 433,662 37.7% 0 0.0% 433,662 37.7% 37.6% -1,296 14,180 $21.38 SOUTHWEST A 51 6,785,342 714,784 10.5% 210,900 3.1% 925,684 13.6% 13.4% -14,770 327,720 $36.01 B 69 2,583,587 163,357 6.3% 24,693 1.0% 188,050 7.3% 6.0% -33,904 21,631 $28.27 C 3 94,138 5,433 5.8% 0 0.0% 5,433 5.8% 1.4% -4,093 4,417 $32.24 Total 123 9,463,067 883,574 9.3% 235,593 2.5% 1,119,167 11.8% 11.3% -52,767 353,768 $34.59 WEST CENTRAL A 4 637,755 127,607 20.0% 0 0.0% 127,607 20.0% 23.3% 20,931 110,395 $37.62 B 4 182,700 11,264 6.2% 0 0.0% 11,264 6.2% 8.4% 4,056 0 $33.43 C 1 50,132 2,708 5.4% 0 0.0% 2,708 5.4% 5.4% 0 -2,708 _ Total 9 870,587 141,579 16.3% 0 0.0% 141,579 16.3% 19.1% 24,987 80,532 $37.15

- 6. 6 Austin Research & Forecast Report | Q1 2016 | Office | Colliers International Office Development Pipeline 1.35 million square feet of office space was under construction during Q1 2016. Three buildings totaling 321,024 square feet delivered in Q1 including Domain I, a 5-story office building with ground level retail in the North/Domain submarket. Domain 11, a proposed 400,000 SF building, got the green light to begin construction. BUILDING NAME ADDRESS SUBMARKET SF PRE- LEASED DEVELOPER EST. DELIVERY Domain 5 11305 Alterra Pky North/Domain 74,804 0.0% Endeavor Real Estate Group Apr-16 5th & Colorado 201 W 5th St CBD 179,846 26.8% Lincoln Property Company Jun-16 2700 La Frontera Blvd 2700 La Frontera Blvd Round Rock 97,941 89.3% Unknown Jun-16 9811 Vikki Terrace 9811 Vikki Terrace Southwest 22,000 64.10% Unknown Jul-16 411 W Main St 411 W Main St Round Rock 33,634 14.0% 411 Partners, LLC Jul-16 Presidio I 11900 W Parmer Ln Round Rock 24,000 50.0% Riverside Resources Aug-16 Pioneer Bank Building 623 W 38th St Central 46,000 62.3% Pioneer Bank Sep-16 317 Grace Ln 317 Grace Ln Southwest 87,748 2.5% Equitable Commercial Realty Dec-16 Green Water Treatment Plant 500 W 2nd St CBD 500,512 41.2% Trammel Crow Co Jan-17 Domain 8 11601 Alterra Parkway North/Domain 291,058 0.0% Endeavor Real Estate Group Feb-17 QUOTED GROSS RENTAL RATES FOR EXISTING TOP PERFORMING OFFICE BUILDINGS BUILDING NAME ADDRESS SUBMARKET RBA (SF) YEAR BUILT % LEASED AVAIL. SF RENT ($/SF) OWNER Frost Bank Tower 401 Congress Ave. CBD 535,078 2003 98.50% 7,944 $56.97 CalSTRS One Eleven 111 Congress Ave. CBD 518,385 1985 90.20% 98,046 $55.31 Parkway Properties, Inc One American Center 600 Congress Ave. CBD 503,951 1984 97.40% 13,187 $48.91 CalSTRS 301 Congress 301 Congress Ave. CBD 418,338 1986 88.60% 75,877 $52.46 National Office Partners, LP 100 Congress 100 Congress Ave. CBD 411,536 1987 97.70% 27,991 $55.52 Metlife, Inc. 7700 W Parmer Ln - Bldg. B 7700 W Parmer Ln - Bldg. B Far Northwest 350,000 1999 90.60% 31,500 $38.20 Unknown 7700 W. Parmer Ln - Bldg. C 7700 W. Parmer Ln. - Bldg. C Far Northwest 282,000 1999 91.80% 23,693 $39.57 Unknown Two Barton Skyway 1601 S MoPac Southwest 195,639 2000 97.10% 5,639 $32.10 University Federal Credit Union Lamar Central 3800 N Lamar Blvd. CBD 168,752 2015 85.9% 93,654 $52.71 Lamar Village Shopping Center Note: Avail. SF includes direct and sublet space as well as any future available space listed. Source: CoStar Property

- 7. 7 <<region>> Research & Forecast Report | Quarter Year or Date | <<Location / Sector>> | Colliers International7 North American Research & Forecast Report | Q4 2014 | Office Market Outlook | Colliers International Copyright © 2015 Colliers International. The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult their professional advisors prior to acting on any of the material contained in this report. Colliers International | Market 000 Address, Suite # 000 Address, Suite # +1 000 000 0000 colliers.com/<<market>> 7 North American Research & Forecast Report | Q4 2014 | Office Market Outlook | Colliers International Copyright © 2015 Colliers International. The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult their professional advisors prior to acting on any of the material contained in this report. Colliers International | Austin 111 Congress Avenue, Suite 750 Austin, Texas 78701 +1 512 539 3000 colliers.com/texas/austin FOR MORE INFORMATION Hannah Tysor Senior Marketing & Research Coordinator | Houston & Austin +1 713 830 2192 hannah.tysor@colliers.com AS OF APRIL 1st, WE HAVE MOVED Our new address is: LEADING THE NATION Austin is ranked No. 1 for real estate development across all 75 markets surveyed in Emerging Trends in Real Estate, an annual report published by the Urban Land Institute and PwC LLP. Austin ranked second in the nation for overall real estate prospects. 8.0M SF 11.2% 290,047 SF VACANCY NET ABSORPTION CLASS A: 56% CLASS B: 37% CLASS C: 7% TOTAL INVENTORY BY CLASS -42.7% ANNUALLY -47.3% QUARTERLY CLASS A LEASING ACTIVITY CURRENT Q1 2015 1.0M SF Q2 2015 1.5M SF Q3 2015 1.7M SF Q4 2015 1.1M SF Q1 2016 598K SF 27M SF 18M SF 3M SF TOTAL OFFICE INVENTORY 48.4M SF UNDER CONSTRUCTION 1.36M SF DOWN FROM 1.57M SF IN Q4 2015 Q1 2016 Office Highlights