David cindric services coverage - 201505

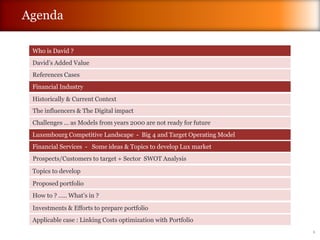

- 1. 1 1 Agenda Who is David ? References Cases Historically & Current Context The influencers & The Digital impact Challenges ... as Models from years 2000 are not ready for future Prospects/Customers to target + Sector SWOT Analysis David’s Added Value Financial Industry Financial Services - Some ideas & Topics to develop Lux market Topics to develop Proposed portfolio How to ? ….. What’s in ? Applicable case : Linking Costs optimization with Portfolio Investments & Efforts to prepare portfolio Luxembourg Competitive Landscape - Big 4 and Target Operating Model

- 2. 2 2 PERSONAL INFORMATION - Nationality: Belgian + Croatian - Marital status: Cohabitant - 2 Kids: Marijela (7Y) & Adrijan (5Y) - Born in Brussels, 7/09/1971 (43Y) LANGUAGES - English : Fluent - French : Mother Tongue - Dutch : Bilingual - Serbo-Croatian : Bilingual - Luxembourgish, German : Intermediate understanding - Spanish : Intermediate understanding PEOLE MANAGEMENT CAPABILITIES - Coaching, Mentoring, Team spirit - Analytical Skills, Empathy - Interpersonal Skills, Change Management - Respectful, Open-minded, Empowering people SOFT SKILLS - Strong Negotiation capabilities - Problem Solving (able to understand real root cause) - Figures sensibility (revenue, margins, turn over, etc.) - Leader, Creative, Rigorous, self-educated - People Motivator, Good Communicator - Objective Oriented, Determined EDUCATION - 1999: Marketing Communication 3rd post-academic cycle - with honors at ICHEC - 1998: Sales & Marketing Management 3rd post-academic cycle - with honors at ICHEC - 1994: Bachelor in Commercial Sciences FUNCTIONS EVOLUTIONS - Enterprise Account Manager - Department Manager : Consulting & Managed Services - Managing Director - Senior Consultant (free-lance, owner : Advise & Optimise SA) TRAININGS - People Management, Talent Motivation & Coaching - PSF Good Practices / Compliancy, Boardroom selling, etc. - Methodologies : IT/ Business Alignment (Agile, etc.), ITIL, Etc. INDUSTRY KNOWLEDGE - Banking : BCEE, BDL, BEI, BGL, Bil, ING, CA, KBL, SGBT - Fund : Alter Domus, BP2S, Caceis, Clearstream, Fideuram, HSBC, Mizuho, Natixis, Nomura, RBC, Schroders, State Street - Other financial : ADTS, BCL, Cetrel, CSSF, Kneip - Insurance : Axa, Bâloise, CLV, Lombard, Swiss Life, Swiss RE - Others : ArcelorMittal, Cactus, Champ, Ferrero, Hellef Doheem, Luxair, SES Astra, SNCT IT SKILLS - Operating System : Windows 8.1 - Mac OSX - Android - MS Office 2013 (Word, PowerPoint, Excel, Outlook), Lotus Notes - CRM & HR Systems : Siebel, SAP, Microsoft Dynamics - Project Management tools : Clarity, MS Project - Cloud technologies : Google, Microsoft, Dropbox - Others : Visio, Mindmap, Lync, Sametime PERSONALITY - Positive, enjoyable, humorous, passionate, eager to learn…& Geeek Who is David ?

- 3. 3 3 David’s Added Value - Large knowledge of IT Landscape/Organisations (How it must work,..) - Bringing IT as Business enabler (ex: the branch of the future, …) - Passionate by Projects with Business Value : Analytics, BI, Digital, Cloud, ECM, etc. IT Transformation/ Operations optimization General Knowledge in Financial Industry (FA, TA, Retail, …) Cost Efficiency PSDC / Legal Archiving / ECM Analytics (BI, BSC)/ Data Management Digital / Social Media Cloud Services / Service Catalogue Program Management BCP / DRP BPM / Business Rules / Desktop Publishing Contracts & Purchase Optimization Business & IT Alignment IT Strategy General knowledge in Risk / Compliance / Legal & Security David Sales Coaching Business Development Services Company Support From Strategy to Operations Governance Organization Optimization

- 4. 4 4 BGL, BP2S, Cardif (All 14 Lux entities) 1st BNP Paribas Territory Project • Outsourcing of All Service Desk, +/- 9.000 End-Users Devices (Desktops, printers, Mobiles, etc.) and Packaging activities • Aligning Governance (New Territory Team), Processes, SLA, KPI, Resource Units, Delivery Models, Tooling, etc. • TCV (5 years) : From 14 millions to 9,7 millions • Delivery Team : 30-35 people David’s role : • Write RFP • Organize qualification meetings (market scan) to define which provider will receive RFP, based on their capacities and added-value to deliver activities • Participate to requirements workshops (Processes review) with main entities and alignment between them • Drive complete Business Case study covering all entities • Build Competition Matrix for provider selection • Prepare all information for Audit department (incl. security) due to outsourced activities and for legal/compliance to respect internal/ external regulations (CSSF) • Project Management + P&L follow up • Deliverables definition on provider side + writing internal documentation (when processes or some activities were missing or not up to date) • Writing Frame contract including 15 schedules (KPI/SLA, Penalties, etc.) • Help within negotiation process : giving information to pressure prices + terms and conditions (text review) BCEE Re-writing the Core banking application • All functional domains existing at BCEE were covered: credit cards, loans, investments, private banking,etc. … • Workload : Up to 54 developers (Off-shore) • Duration : 1 year David’s role : • Write Proposal + workloads review • Participate to all qualification meetings before selection • Participate in negotiation process • Once selected, participate to requirements workshops • Preparing complete "testing" proposal (UAT) + POC implementation follow up (manual Vs automated based on mercury tooling) • Deliverables validation • P&L follow up + Gaps as project in fixed price Kneip Transforming the complete IT landscape (OS, Collaborative tooling, Back-end systems including monitoring) • 4 on-site consultants • 250 users : +/- 650 K David’s role : • Write Proposal + workloads review • Participate to requirements workshops • Documentation & Deliverables validation • Project Management + P&L follow up BGL BNP Paribas Program Management : Neos Migration (incl. Compatibility Application testing) • Project size : +/- 3.000 man/days • Scope including different providers to manage • Duration : 2 years IT Transformation - Reference Cases 1/2

- 5. 5 5 Natixis Transforming the complete IT landscape (OS, Users privileges, Back-end systems) • 4 on-site consultants • Duration : 8 months David’s role : • Write Proposal + workloads review • Participate to requirements workshops • Documentation & Deliverables validation • Project Management + P&L follow up BGL BNP Paribas Program "Fold in" : Integrating Business Units coming from BNPP within BGL BNP Paribas (impact on systems, apps, etc.) • Functional coverage : all businesses except Fund & TA activities • Managing directly 3 Project Managers + 1 service delivery Manager - complete team : 18 people David’s role : • Program Management (2 meetings/Week with Customer due to program size and large number of activities) • Deliverables validation Zurich Implementing all Lux IT environment Based on Group Decision • Team of architects, system engineers • Duration : 6 months (starting from scratch) David’s role : • Project Management + P&L follow up • Technology provider : Dell Alter Domus Transforming partly the IT landscape to implement new “standards”, IT base for company expansion • Implement IT infrastructure within new acquired subsidiaries (Netherlands, Singapore) • Team of architects, system engineers • Duration : +/- 2 years with several projects between 3 to 6 months BGL BNP Paribas Complete infrastructure redesign due to ESB (Websphere) implementation enabling better processes urbanization (covering web Banking transactions, etc.) • Duration : 3 years • Team of architects, system engineers, developers (to support applications changes due to major migration) • Value : +/- 2,4 millions David’s role : • Project Management + P&L follow up IT Transformation - Reference Cases 2/2

- 6. 6 6 Analytics (BI,...) / Data Mgt - Reference Cases 1/2 Bil + RBC 1 Program to cover different topics: • Budgeting/Planning for Bil and 50 Subsidiaries (incl. RBC) • IFRS • Basel II • Cross-Business Units Customer profitability (Private Bank, Funds, Retail, etc.) • Deal size : 750 - 950 K (Services)….. In parallel, creation of the BI Competence Center (BICC) at Bil On Bil side + RBC side : • Write Proposals + workloads review • Participate to all qualification meetings before selection + functionalities demo related to latest essbase version 6.3 (data traceability needed to comply Basel 2) • Participate in negotiation process with purchase • Participate in negotiation process with IBM(supporting Bil) • Once selected, participate to requirements workshops (how IFRS rules will be implemented within application) • Documentation & Deliverables validation • Project management + P&L follow up SGBT Finance Department : • Controlling and ad-hoc reporting on financial data (costs, margins, by activity, etc..) • Budgeting/planning, cross-charging and Consolidation Private Banking (Customer Profitability Analysis), Custody activities • For all those activities, automated reporting, ad-hoc and simulation/analysis tools were put in place (incl. alerting on KPI) • 5-7 on-site consultants • Deal size : 380 - 500 K David’s role : • Write Proposal + workloads review • Participate to a limited number of requirements workshops • Deliverables validation • Project Management + P&L follow up TrefilArbed For Trefilarbed, Worldwide Sales Forecast • “What if analysis“ enabling Sales & acquisition prices based on Iron stock exchanges evolution, local market prices, types of customers, volumes ordered, etc. • In scope were also covered following financial elements : order (capacity) management, invoicing treatments, costs of logistics, stock management, budgets and margins calculations. • Deal size : 750K David’s role : • Write Proposals + workloads review • Participate to all qualification meetings before selection • Building POC to validate project by Management and Business teams • Participate in negotiation process • Participate in some requirements workshops • Project management + P&L follow up Odyssey Odyssey Asset management (Triple A reporting) : Sub-contracting for all Private Banking customers (BGL BNP Paribas, Banque Cantonale Vaudoise, etc.) Arcelor For ArcelorMittal Corporate, Consulting activities to review all budgetary processes (including International standards in terms of accountancy)

- 7. 7 7 Analytics (BI,...) / Data Mgt - Reference Cases 2/2 BGL BI Competence Center implementation : Governance, Processes, technology roadmap to cover topics such as : • Basel II, Basel III • Funds value (NAV)/lifecycle • All Business Units reporting needs • All financial reporting BICC : Team of 20 FTE (internal + external) Regarding the BI Competence Center : • Conducting and preparing all workshops/meetings related to Governance, organization, processes to build with business departments (request/change management process, etc.) Regarding activities to perform : • Mix between customer staff and on-site consultants • 50% of staff for change/delivery + BAU - Other 50% for new projects implementation • For new projects : functional workshops based on other projects implemented at other Customers (regulatory, Customers profitability, etc.), sharing best practices, products evolution to prepare future technical migrations Lombard Reporting Implementation related to Customers, funds, portfolio, etc. Automated and ad-hoc reporting as Lombard decided to migrate core system Application • 5-7 on-site consultants • Deal size : +/- 500 K (services) David’s role : • Write Proposal + workloads review • Participate to a limited number of requirements workshops • Deliverables validation • Project Management + P&L follow up Caceis Audit and review of the complete fund process chain (end-to-end analysis to guarantee NAV delivery on time) • Team size : 5-7 people on-site David’s role : • Write Proposals + workloads review • Project management (during the complete delivery, 2 steerings/week with CIO at 9PM as they had some issues in terms of NAV delivery) + P&L follow up • Deliverables presented directly to the CEO ADTS Financial Capacity Planning, Activity Based Costing and Business Units cross-charging (RBC, Dexia Banque Belgique, Bil, etc.) Deal size : 300K (Services) RBC Building the team related to mass « reporting » (NAV, etc.) B Reporting on Lips-Gross to supervise and follow-up all system payments based on Custody Operations Luxai Capacity Planning Project and Balance Score Card covering : Optimizing : Route planning, flights filling rates, fuel consumption, link between costs, revenues, margins, etc. • 3-5 on-site consultants • Deal size : 500 K David’s role : • Write Proposal + workloads review regarding SAP BW implementation and BO reporting creation • Participate to some requirements workshops • Deliverables validation • P&L follow up

- 8. 8 8 BGL LCM Octopus Project: at BGL BNP Paribas, Outsourcing of the complete legal archiving environment & Publishing department David’s role : • As a 1st objective, define if there was a business case by outsourcing bank’s legal archiving to a PSDC company; All this in a phased approach (on several years) as there were several environments with different technologies (some out of date) Topics such as hardware, software, people take-over where also included within discussions and estimates • Creation of the RFP and document with qualifying questions to enable Provider selection • Deep work done on the Contract template, KPI/SLA definitions, penalties and elements to guarantee the delivery and close collaboration with legal/compliance departments (retention period, etc.) • Different visits with bank members were organized to validate working environments (physical security, validate scope of the provided cloud application, Q&A sessions, etc.) • Complete Scope : outsourcing covering the take over of : +/- 40 people (including "Print shop" teams) BCEE Cost and ROI study to "digitalize" all (historical) bank papers to decrease physical storage AXA For all insurance activities (life, fire, diverse risks, accidents, claims, etc.), reviewing all Business Processes to cover them in a dematerialized way. Therefore time to operate contracts (linked to customers surveys) were usually done in a few days with a customer satisfaction rate above 85%. This also helped AXA to better manage its capacity planning in terms of staffing (activities allocation) and complexity topics to manage (split between teams and people). • Access to the implemented applications was also provided to external partners (brokers). • Number of employees : 150 • Value : 450 K David’s role : • Write Proposals + workloads review • Participate to requirements workshops (Processes review) with Life + IARD entities and alignment with Legal department • Deliverables validation • Project Management + P&L follow up PWC New intranet implementation at PWC Luxembourg based on Microsoft SharePoint. The main objective was to provide a centralized area for information/documents collaboration to all 2400 PWC employees. All types of information was covered : from legal information (connected to Documentum) to facilities, hotels addresses, news, etc.. To optimize collaboration between people and within Business Units (tax, audit, etc.), functionalities such wiki, blogs and discussion boards were enabled. • Team between 2-5 people • The project took +/- 10 months BGL New intranet implementation at BGL BNP Paribas Luxembourg based on Microsoft SharePoint. The main objective was to provide a centralized area for information/documents collaboration and request services to all BGL BNP Paribas employees with a phased approach enabling: • In a 1st phase for IT teams (400 people) of all types of information: service catalogue, all cross-charge costs to business units, audit reports, documentation, etc. • In a 2nd phase, implement processes to accept a maximum of users requests through the portal (request equipment, forms input for different businesses, meeting room booking, etc.) • Team between 4-7 people (based on roles and responsibilities) • The project took +/- 7 months David’s role : • Write Proposals + workloads review • Participate to requirements workshops • Deliverables validation • Project Management + P&L follow up PSDC / Legal Archiving / ECM - Reference Cases 1/2

- 9. 9 9 BCEE Study to review internal processes to define Pros/Cons between centralized scanning organization/Operations and decentralized, Main objectives were : • Validating efficiency and people workloads for the complete scanning process (ex : when a new customer was giving its documents for scanning) • Validating the Pros/Cons and costing elements between a centralized and decentralized way of working as decentralized pushed all the complexity to the branches. AXA Cost and TCO study to "digitalize" all (historical) Company papers to decrease physical storage and review all potential internal impacts in terms of organization, processes, costs, team to work, etc. (Linked to the 1st versions of the PSDC text regulations) • Discuss assumptions to dematerialize company papers based on coming law and taking care of Axa's internal processes David’s role : • Work on TCO study • Deliverables validation • P&L follow up Luxair Cost and TCO study to "digitalize" all (historical) Company papers • Decrease physical storage and reuse physical space or for internal needs or to rent them Mizuho • Writing RFP for Mizuho and defining their needs in terms of legal archiving : - Software solution - Archiving back-end solution - Integration Partner - Replace (some) physical archives by electronic archives - Decreasing future physical archives (i.e. paper documents, box, rooms). - Archives internal & external data flows to be kept, on low cost, but secure and reliable, medias - Manage retention periods of archived documents - Provide search facility - Replace the existing DMS solution (Document Management System = G.E.D.) David’s role : • Write Proposals + workloads review • Help Company define requirements • Deliverables validation • Delivery + P&L follow up • Team size : 1-2 people on-site PSDC / Legal Archiving / ECM - Reference Cases 2/2

- 10. 10 10 BGL BNP Paribas TCO and Cost study to migrate 500 Blackberry users to iPhones • Analyze Blackberry consumptions and types of behaviors (call, SMS, data) and Define future usage levels, types of profiles and their related budgets/quotas • Study included devices, consumptions, technical environments (Mobile Iron) and people to manage them • Results : Management accepted a total budget increase of 10% as : iPhones cost 3 times more, Telco contract renegotiated with +/- 50% decrease, pooling and new policies in place David’s role : • Drive Complete TCO study • Define profiles and their packages (volumes, roaming, etc.) • Define new Bank's usage Policy Writing RFP to challenge Telco providers • Doing all financial simulations based on subscribed contracts (roaming, data, voice, etc.) • Do part of the negotiation process for the Customer Kneip Cost and TCO study to better manage licensing contracts with Microsoft • Financial simulations linked to architecture evolutions and future migrations Cardif Managed Services contract Review and Optimization • The contract, +/- 6 million €/year, was pending since several years with BP2S who manages almost all the IT production for CLV. • I had to elaborate a new version, which will be used as the “reference” between both companies. Main objectives were to find an agreement between parties, decrease pressure between both companies and protect CLV interests, as a lot of elements were missing : • Governance and related organization (steering committees for BAU activities, projects, etc.) • Service Catalogue completeness (Resource Unit for activities, server capacity, storage, etc.) • Operational processes description (who, what, when, etc.) • Contract terms and obligations such as Reversibility, Hand-over, Documentation, Contract termination, etc. • KPI (Key Performance Agreements), SLA (Service Level Agreements) and Penalties aspects • Legal issues and alignment with BNP Paribas group Compliancy David’s role : • Rewrite part of the new contract or make proposals to be validated by legal department • Challenge content (Resource Units, SLA, KPI, etc.) • Challenge Governance and quality of delivery + clarify some scope of activities, processes, etc. • Challenge responsibilities (RACI tables, etc.) Alter Domus Cost and TCO study to better manage licensing contracts with Microsoft • Financial simulations linked to architecture evolutions and future migrations Costs Efficiency / Purchase - Reference Cases 1/2

- 11. 11 11 BGL BNP Paribas TCO Study related to Printing costs and New printing policy definition. • Bank Targets : min. -50% individual printers / -25% in branches • Results : -74% printers (MFP usage) , 400 K economy/year ArcelorMitta Several workshops to simplify and optimize IT landscape costs were organized to bring best practices to ArcelorMittal In parallel, We sold : • 100.000 pc (lifecycle on 5 years) • HP software to standardize IT Management tooling (service desk, etc.) BCEE Cost and TCO study to better manage and predict contracts with IBM • Scope : licenses, hardware, software and mainframe usage linked to architecture evolution BGL BNP Paribas Contracts Optimization and Providers costs decrease Review of local major value contracts related to Services, Maintenance, Software and Hardware. • Case by case, or launch of RFPs with a limited number of companies or direct renegotiation with suppliers (quick wins) Ex: -200 K€/Year for maintenance contract for network equipment, same for security equipment, etc. • On the other hand, sourcing strategy was defined to go from a « best effort » mode to a « committed » fixed price approach BGL BNP Paribas Within a team writing an RFP related the Bank’s BCP, I brought input/elements to focus on quality, cost control and guarantees • Objective : a flat budget during contract duration without bad “financial” surprises Trefi For a WW project at Trefilarbed, TCO study between BI platforms before vendor selection (BO vs Cognos) BGL BNP Paribas Cost and TCO study to better manage licensing contracts with Microsoft • Financial simulations linked to architecture evolutions and future migrations Cham Cost and TCO study to better manage licensing contracts with Microsoft • Financial simulations linked to architecture evolutions and future migrations BGL, BP2S, Cardif (All 14 Lux entities) 1st BNP Paribas Territory Project • Outsourcing of All Service Desk, +/- 9.000 End-Users Devices (Desktops, printers, Mobiles, etc.) and Packaging activities • Aligning Governance (New Territory Team), Processes, SLA, KPI, Resource Units, Delivery Models, Tooling, etc. • TCV (5 years) : From 14 millions to 9,7 millions • Delivery Team : 30-35 people David’s role : • Write RFP • Organize qualification meetings (market scan) to define which provider will receive RFP, based on their capacities and added-value to deliver activities • Participate to requirements workshops (Processes review) with main entities and alignment between them • Drive complete Business Case study covering all entities • Build Competition Matrix for provider selection • Prepare all information for Audit department (incl. security) due to outsourced activities and for legal/compliance to respect internal/ external regulations (CSSF) • Project Management + P&L follow up • Deliverables definition on provider side + writing internal documentation (when processes or some activities were missing or not up to date) • Writing Frame contract including 15 schedules (KPI/SLA, Penalties, etc.) • Help within negotiation process : giving information to pressure prices + terms and conditions (text review) Costs Efficiency / Purchase - Reference Cases 2/2

- 12. 12 12 BC Expertise - Security audit on virtualized environments (infrastructure, applications, access controls, etc) BC Expertise - Audit to review all applications deployment processes (to avoid production issues during deployments) Od Expertise - Security audit on network and accesses, with a special focus on Wi-Fi Cactus Expertise - Security audit on new network environments (infrastructure, applications, access controls, etc) PW Expertise - Based on different .Net Framework, help PWC to define its internal development framework which will be used during several years as base for all applications developments ING ING conducted brainstorming sessions to think about : • Its strategy for the coming years • How being an attractive employer especially with the coming "Y" Generation • Define competitive landscape including companies like Google • To enable such positioning and evolution supported by the implementation of NWOW concept, the 1st brick was covering the BYOD approach. This was the 1st Mobile Iron Implementation in Luxembourg to enable such innovative approach. • BYOD had to support 300 smartphones users and in a second phase up to 900 users for the tablets (as the idea was to migrate from fix desktop to tablets which enables you to work everywhere within ING premises) David’s role : • Define “Vision” and roadmap related to NWOW concept to be implemented (taking care of new ING Building) • Drive Complete Security & Compliancy validation (ING teams and Mobile Iron Representatives were involved) • Support ING to drive its TCO study • Help defining restrictions to enable cost control (through MDM platform and Telco provider) BGL • As Digital working is a world wide group initiative at BNP Paribas group, the idea was to provide mobility and access to social media in a phased approach. • The 1st initiative was to bring a broader usage of smartphones and some tablets to specific users. • To support the initiative, firstly a TCO study was conducted to migrate 500 Blackberries to iPhones. Based on the study, different types of profiles were defined (incl. budgets & volumes) and a usage policy was written. AS iPhones were 3 times more expensive than Blackberries, an RFP and contract renegotiation process with Telco providers was launched to guarantee to the Management a limited financial impact . The deployment was done in a smooth way to guarantee a smooth change • In parallel, within new Building CBK2 at Kirchberg and existing one (CBK1) some ideas coming from New World of Work (NWOW) concept were implemented (Wi-Fi areas, library with tablets, etc.) to support the mobility initiative David’s role : • Drive Complete TCO study • Define profiles and their packages (volumes, roaming, etc.) • Help defining restrictions to enable cost control (through MDM platform and Telco provider) • Define new Bank's usage Policy Digital Working - Expertise/Audit - Reference Cases Digital Working Expertise - Audit

- 13. 13 13 BCL Implementation of full HR ERP to cover : • Administration and people management • Compensation and Benefits • Career path and management • Recruitments (automated workflow and processes) • Competence management and Trainings • Absence & illness • Dynamic organigram Management • Dashboarding & reporting for all performed activities (Age Pyramid, salaries evolution, illness, trainings costs, etc.) David’s role : • Write Proposal + workloads review • Participate to requirements workshops • Project Management + P&L follow up • 2 internal consultants + Software provider expertise to implement SES AStra Implementation of full HR ERP PeopleSoft • Optimize the administration of HR processes • Improve business processes through web technology • Reduce non-value adding tasks • Reduce the use of excel stand alone applications in order to increase collaboration and being able to share one version of non-redundant data • Centralize employee and job data to support the maximum of reporting queries • Implement a collaborative application • Leverage in-house PeopleSoft Technology knowledge David’s role : • Write Proposal + workloads review • Participate to Some of the business requirements workshops • Project Management + P&L follow up • 4 internal consultants Hellef Doheem Implementation of full HR ERP to cover : • Administration and people management • Compensation and Benefits • Career path and management • Recruitments (automated workflow and processes) • Competence management and Trainings • Absence & illness • Dynamic organigram Management • Dashboarding & reporting for all performed activities (Age Pyramid, salaries evolution, illness, trainings costs, etc.) David’s role : • Write Proposal + workloads review • Participate to requirements workshops • Project Management + P&L follow up • 3 internal consultants + Software provider support (on-demand) Human Capital - Reference Cases

- 15. 15 15 Financial Industry - HISTORICALLY • Activities usually with higher margins • Mainly driven by turnover (Sales figures) • Customer retention was in focus, therefore some costs not enough managed : o Services given for free, Personalization in terms of reporting, etc. • Usually without tracking in terms of costs allocations (mainly per BU, product) • Reporting mainly done “a posteriori” or to respect regulations… predictive/ proactive aspects, mainly not in mindsets • Sometimes real tariff policy was missing • Strong Sales Management missing regarding Sales force (Customer makes mainly effort) • Last but not least, organizations in silos

- 16. 16 16 • COMPETITIVE POSITIONING - Competition is fierce, global (Private Bank) Ex: UBS, HSBC scandals… - New Competitors….in payments Ex: Apple Pay, Amazon Credit Cards, PayPal, Facebook - New Competitors….in Direct banking Ex: Hello Bank, ING Direct, - Need to differenciate with innovative services and high added-value - Need to adapt offering and distribution channels Vs online players (less costs) • MARKET TRENDS - Development of Passive investments (« trackers ») and less risky products - Customers pressure on prices - Global Number of market Transactions decreased - Online players putting pressure on classical institutions - Products standardization and electronic - Margins decrease on investment products (savings) • REGULATORY IMPACTS - Regulatory pressure to pay the real services value - Regulatory Pressure and its Evolution Ex: FATCA, Basel III, MiFID, etc.. Requirement to « block » equity, etc. Impact on liquidity costs - Costs to implement and run reporting/ control infrastructures - Increase in Collateral/guarantees needs - Pressure on savings products and related Tax • INTERNAL CONSIDERATIONS - People, Culture, Talents retention, Age Pyramid Average Age in Banking in France : 46 years - Central services not ready for cross-channel distribution (Big Data, Social Media, Digital..) - Administration Time Vs Commercial Time - Asset Mgt portfolio review for more coherence - Need to activate underutilized portfolios - Improvement in: quality Customer relationship with more proactivity - ICT landscape evolutions / automation Ex: New Business Apps, manual tasks, etc. Financial Industry - CURRENT CONTEXT Margins are descreasing… (Transactions) Costs are increasing… 31 2 4

- 17. 17 17 Financial Industry - THE“ INFLUENCERS ” REGULATORY - AIFMD - Basel III / CRD IV - BEPS - EMIR - FATCA - MiFID 2 - SOLVENCY II - UCITS IV And next ones… TECHNOLOGY TRENDS DEMOGRAPHY EVOLUTIONS

- 18. 18 18 Optimizing The Customer experience - More interactivity and Services continuity (on-line portfolio performance follow up, orders through the web, …) - Usage simplification - More disintermediation (no need to lose time through intermediates, Customer negotiates things by himself to speed up process, etc.) - Seeking ultime personalization Operational processes transformation - Process Automation & integration/ data extraction with third parties (Social Media) - Dematerialization and non-materialization - Intelligent Data exploitation (Big Data & Analytics) - Seeking ultime personalization Modification of Organisations and internal Modus Operandi - Information sharing (Instant messaging, blogs,...) - Home shoring, Humanoid intelligence, etc. - Co-creation, Digital Marketing - Open Data and Open API - New types of organizations, Capacity planning,… Financial Industry - THE DIGITAL IMPACT

- 19. 19 19 IT - Transform landscape to enable multi-channel interactions - Integration of new technological tools : • Social Media • Analytics / Data Mgt • Cloud services • Mobility Industrialization + automation to reach: - Intelligent and “self-learning” information system (with business rules) - Efficiency in front-to-back processes - Cyber and information security SALES / PRODUCTS - Re-think : Customers portfolio & portfolio segmentation based on Profitability - Re-think : Scoping of provided services and related tariff policy - Re-think : Relationship model for more proximity (+by distance) - Re-think : Commercial methodologies and standards ex Sales people Advisers - Coach / help (channel) partners, ecosystem to manage “changes” and impacts on their side (end-to- end) STRATEGY / ORGANIZATION - Review Company Strategy and positioning (ABC/budget allocate) - Re-think Distribution organization to support new relational models - Re-think : Production organization to better bridge “front to back” - Re-think : Governance, Roles & Responsibilities, format and workforce (incl. branches if Banks) - Enable “Orchestration” in terms of Customer-Fin. Institution relation - Think on how organization may absorb future regulations in a smooth way (seen as simple change) HR - Prepare and support whole organization for cultural change - Train people on new ways of working (Tools, interactions,..) - Review Comp & Ben Model - Talents acquisition & Retention - Transform HR teams to recruit new types of profiles (digital marketing, Big Data specialist, etc) - Re-think salary grid and job types as new profiles (simulate cost impact on organization and salary evolutions on existing profiles and people to “transform”) Financial Industry - CHALLENGES Models “2K Years” not ready for future…Change is Mandatory Main Customers evolutions Financial Industry : Challenges Main Customers expectations - “Mass Affluents” emergence (between retail and Private Banking) - Rejuvenation of Customers with financial capacities - Customers financial competences are increasing - Trust in financial institutions, lack of credibility in Asset Managers/ Representatives - Increase usage of Multi-channel and internet - Assets/ Goods spread over different institutions - Multichannel and internet usage increase - Need for diversified types of investments - More transparency and autonomy (credibility) - Simplified products to better understand them (Trackers) - Proactive personalized advice and proposals - Capabilities to receive services and interact by distance (mobile) - Help Customers to increase their competences

- 21. 21 21 Some ideas to develop financial market 1/8 ASSUMPTIONS - PROSPECTS/CUSTOMERS TO TARGET 1 2 3 4 PROPOSED SEGMENTATION FOR PROSPECTS/CUSTOMERS (to be discussed) CUSTOMERS TIERING APPROACH MIX OF HUNTING & FARMING - Retail Banking: >300 employees (TBD: 150-300 employees ?) - Wealth & Investment Mgt: Based on number of assets/Value under administration - Insurance : >100 employees - If Other ? : Let’s define it together - Segmentation will also be based on Customers financial capabilities (ex: smaller companies with bigger revenues/ margins, etc.) - Tier 1 : Best Customers (almost blind consumption or open to implement new/trendy concepts) - Tier 2 : Correct/Good commercial relationship but cyclic (need to strengthen relationship on long term) - Tier 3 : Greenfield (everything must be build) Due to relationships, some Customers expect more or less time to be developed. The objective is to balance invested time Vs results. DEFINE COMPANIES TO DEVELOP FIRST STAKEHOLDERS TO MEET (to define per Prospect/Customer) For each domain : - Retail Banking - Wealth & Investment Mgt - Insurance (life & non-life) In the next slides are proposed : - A list of companies (ranking) to develop - A SWOT analysis related to their respective sectors - CxO level, all Board members/executives, HR Director - Main Functions Representatives : Investment/Wealth Mgt, Retail Banking, Corporate Banking, Life Insurance - Business Units Managers : Compliance Manager, FA, TA, Risk, Credit, Audit, BCP, … As each organization empowers people differently, approach will vary from one company to another one.

- 22. 22 22 Some ideas to develop financial market 2/8 WEALTH & INVESTMENT MANAGEMENT Strengths Weaknesses Strong professionalism of the local workforce Stabled legal framework Solid experience in Fund Migration Enviable reputation The Fund industry is the backbone of the country, hence constantly being supported by the government Highly motivated workers. Thanks to the high salaries and the quality of life that Luxembourg offers Strong RI Funds Market (28 % of RI Funds in EU – EUR 129 billion ) Increasing Product Demand Strong influence in neighboring domestic markets (50% of funds are Lux based) Overlap among financial regulators (EU) Frequently changing rules – making planning difficult ( EU Directives) Underdeveloped Fund Management sector The university of Luxembourg cannot meet demand for the skillset needed for the Fund Industry The industry relies on foreign workers Opportunities Threats Strong demand for servicing Onshore funds in Luxembourg- a new phenomenon Asset Management opportunities – Law and incentives to support this exists Islamic funds being absorbed by the UCIT structure Mergers and takeovers on the increase Regulatory convergence – information sharing AIFMD to boost alternative Funds in Luxembourg New Business wins from Swiss - Swiss-based funds lack EU distribution Migration of fund families ( Swiss based funds) The drive for efficiency leading to consolidation UCIT EU passport will provide more flexibility for non-Luxembourg Management UCITS from abroad, hence increasing competition. Outsourcing back office work on the increase. Watch out for Lithuania and Poland. New regulation on IT systems following the Bank systems failure in the UK (2012) Rivalry with Ireland The outcome of the current EURO zone crisis could change the fund landscape in Luxembourg Watch out for massive redemptions when the opting out of Greece is closer to reality (Source : Monterey Insight (previously Lipper Thomson Reuters)

- 23. 23 23 Some ideas to develop financial market 3/8 BANKING COMPANIES RANKING 2011 (Source : KPMG) Strengths Weaknesses Banks have increased their provisions for general banking and financial risks Luxembourg banks that are Subsidiaries' are sometimes doing better than their mother house Overlap among financial regulators (EU) Frequently changing rules – making planning difficult ( EU Directives) Underdeveloped Fund Management sector The university of Luxembourg cannot meet demand for the skillset needed for the Fund Industry The industry relies on foreign workers Opportunities Threats The solidarity of the state (ex-Dexia BIL and ex-Fortis) -political and legal stability Legal evolutions on secrecy World competition

- 24. 24 24 Some ideas to develop financial market 4/8 INSURANCE COMPANIES - RANKING 2013 Strengths Weaknesses European insurance passport Luxembourg as a hub to distribute life insurance products among the EU High product expertise Investment flexibility Life insurers can thus offer numerous sophisticated products Exemplary market stability (political, economic and social), together with an attractive legal base For international pension funds, and thus performing pension funds for European investors. Neutral tax environment No tax in Luxembourg neither insurance premiums, nor capital gains realized on the surrender or maturity of the contract, nor death proceeds paid to beneficiaries. In the context of units of account linked to Luxembourg life assurance policies, interest, dividends and gains are reinvested gross of any tax Narrow and already highly penetrated domestic insurance market 11th country in the world in terms of volume direct insurance especially in non-life insurance business. Local insurers mostly branches of international groups, and thus having low decision-making possibilities. Opportunities Threats « PSA » status Likely to increase flexibility and to bring about a better work organisation and optimisation of overheads Strengthening of legal and tax environment abroad An additional motivation for international investors to be interested in Luxembourg insurance products Ongoing pension reform Domestic wealth growth Population still growing together with salary indexation mechanism High costs coming from Solvency II implementation constraints + and its pending uncertainties Cross-border life insurance business linked to financial markets Sensitive and likely to be hit again by financial crisis Deterioration of local legal and tax environment Scenario where Euro-zone ceases to exist Insurers are important owners of European sovereign bonds + depend a lot from interest rates level On life insurance side, mainly single premiums Thus business having to be renewed every year Compagnies / Primes émises en euros Total encaissement Non-Vie Total Vie Total CARDIF LUX VIE 2 350 456 209 - 2 350 456 209 LOMBARD INTERNATIONAL ASSURANCE S.A. 2 266 509 131 - 2 266 509 131 LA MONDIALE EUROPARTNER S.A. 2 202 511 173 - 2 202 511 173 SWISS LIFE (LUXEMBOURG) S.A. 1 961 141 716 - 1 961 141 716 SOGELIFE S.A. 1 740 966 745 - 1 740 966 745 CALI EUROPE 1 562 246 413 - 1 562 246 413 ALLIANZ LIFE LUXEMBOURG S.A. 1 087 886 086 - 1 087 886 086 SWISS RE INTERNATIONAL S.E. 1 087 880 447 1 087 880 447 - BALOISE VIE LUXEMBOURG S.A. 874 805 768 - 874 805 768 R + V LUXEMBOURG LEBENSVERSICHERUNG S.A. 791 124 092 - 791 124 092 NATIXIS LIFE S.A. 697 370 742 - 697 370 742 ZURICH EUROLIFE S.A. 621 411 481 - 621 411 481 PRIVATE ESTATE LIFE S.A. 380 608 476 - 380 608 476 FOYER INTERNATIONAL S.A. 354 828 788 - 354 828 788 IWI - INTERNATIONAL WEALTH INSURER 353 667 180 - 353 667 180 FOYER ASSURANCES S.A. 310 068 938 310 068 938 - SKANDIA LIFE S.A. 299 041 064 - 299 041 064 GENERALI LUXEMBOURG S.A. 259 366 872 - 259 366 872 LA LUXEMBOURGEOISE S.A. 223 027 152 223 027 152 - VORSORGE LUXEMBURG S.A. 210 324 270 - 210 324 270 SWISS LIFE PRODUCTS (LUXEMBOURG) S.A. 203 985 359 - 203 985 359 ABN AMRO LIFE S.A. 203 858 654 - 203 858 654 THE SHIPOWNERS MUTUAL PROTECTION AND INDEMNITY ASSOCIATION 177 994 072 177 994 072 - FOYER VIE S.A. 152 589 963 - 152 589 963 CAMCA ASSURANCE S.A. 150 868 287 150 868 287 - ING LIFE LUXEMBOURG S.A. 150 287 532 - 150 287 532 THE WEST OF ENGLAND SHIPOWNERS MUTUAL INSURANCE ASSOCIATION (LUXEMBOURG) 148 499 744 148 499 744 - VITIS LIFE S.A. 136 629 293 - 136 629 293 LA LUXEMBOURGEOISE VIE 132 865 759 - 132 865 759 ATLANTICLUX LEBENSVERSICHERUNG S.A. 129 536 009 - 129 536 009 ALTRAPLAN LUXEMBOURG S.A. 119 377 965 - 119 377 965 AXA ASSURANCES VIE LUXEMBOURG S.A. 111 823 692 - 111 823 692 AXA ASSURANCES LUXEMBOURG S.A. 102 372 573 102 372 573 - Total 22 265 705 687 2 654 250 708 19 611 454 978 (Source : ACA - Association des Compagnies d’Assurance)

- 25. 25 25 ASSUMPTIONS - TOPICS TO DEVELOP Big Data (Predictive) Analytics Crowd investing Social Media Cloud Smart Banking (Mobile) Humanoid intelligence HR Transformation Why ? 3 simple reasons : 1) Optimize existing financial models (cost allocation, margins, etc.) and implement an automated system to treat data more precisely 2) Time to prepare data for reporting systems will cost more and more (today regulatory represents ~50% of all projects); Big data enables usage of raw data 3) How to be digital, use cloud, social media, etc. if your systems are not ready to treat information in efficient way ? Why ? 3 simple reasons : 1° Based on algorythms, different types of paterns, Anaylitcal solutions help to predict which may be very important, by example, in financial risks analysis (predit credit risk, solvency risk, etc..) 2) Predictability may be use in every domains : people turn- over in company, regulatory risks, risks of bankrupcy, asset managers efficiency, balanced score cards, etc.. Why ? 2 simple reasons : 1) Like cowdfunding, alternative channels to classical banks/ investors are created; therefore 2 possibilities: Or existing players are leading this trend Or they leave this to other players (impact on their revenue to be estimated) 2) Certainly some advisory to be proposed in this field Why ? 3 simple reasons : 1) Interactive, social media help to discover information, to share, to communicate and bring some proximity between people. 2) Companies will capitalize a lot on social media to segment types of customers, prospects as there are a lot of existing communities 3) Within companies, it will facilitate new comers integration by giving them the possibility to build new relations, discover life within company, etc.. Why ? 3 simple reasons : 1) IT Resources are shared and payed based on consumtions (so capacity is not paid when not used) 2) Enables to work anywhere, anyplace with different types of applications where access may be distributed in a few seconds(soft.catalogue) 3) For some activities, no need to have a dedicated team to maintain some types of environments, and/or applications Why ? 3 simple reasons : 1) Access your account anywhere 2) Check your balance before paying somewhere 3) No need to go to branch Why ? 3 simple reasons : 1) Contsant quality of work : mood doesn’t change, works based on business rules, always on time , (or battery issue),… 2) Opening a lot of new considerations : working hours, more than 15 languages in 1 body, always connected therefore real-time information, etc. 3) Artificial Intelligence may do a lot (scanning and analyzing people reactions, treat a lot of information) May help to optimize payroll costs Why ? 3 simple reasons : 1) Shock of cultures / generations (C/Z) may be quite hard as technologies will expand the gap 2) Companies will certainly need exernal help to structure all coming changes; or they prepare the change or they will face a tsunami 3) Let’s use those internal changes to promote this service within financial institutions (usually tackling subjects a couple of years later tahn other sectors) Some ideas to develop financial market 5/8 Topic Asset Management Banking incl.branches Insurance Comment Big data X X X Big Data & Analytics Topics to cover together as strength comes when they are used togetherPredictive Analytics X X X Mobility / Smart Banking X X X Information/Content must intelligently thought to be present on any type of device Cloud/ external providers X X X Service approach is key; therefore if provided internally or externally, most important is : secure, reliable and cost efficient Humanoid Intelligence X Mainly used for contact facing needs Holographic Displays X Optional today, may be a must have tomorrow to interact … ex: tablets

- 26. 26 26 - Company Strategy and departmental - Governance & Organization Optimization - Business & IT alignment - IT Transformation - Risk & Security - Cost efficiency - Contracts & Purchase Optimization - Core Application implementation - Business Process optimization - Operations optimization - Program & Project Management - RFP writing - PSDC / Legal archiving / ECM Some ideas to develop financial market 6/8 - Big Data - (Predictive) Analytics / Data Management - Crowd investing - Digital - Social Media - Cloud Services / Service Catalogue - Smart Banking (Mobile) - Humanoid intelligence - HR Consulting REGULATORY - AIFMD - Basel III, CRD IV - BEPS - EMIR - FATCA - MiFID 2 - SOLVENCY II - UCITS IV And next ones… “ CUSTOMERS ” - CEO - CFO - COO - CIO - HR Director - Legal & Risk - BU Managers, etc.. EXTERNAL CUSTOMERS : - Channel Partners - Customers Value Scale From “Common services” to Added-value “Digital Services” BASE SERVICES STRUCTURING SERVICES DIGITAL SERVICES PORTFOLIO - 3 Pillars: 1) Digital Services 2) Structuring Services 3) Base Services

- 27. 27 27 Some ideas to develop financial market 7/8 ASSUMPTIONS - HOW TO ? …. WHAT’S IN ? Design - Build Content (Concept +Bricks) - Build Demo environment / functional POC (if ok) - Facts & Figures : ROI, TCO, Quick wins, etc.. - Define Approach to sell - Define approach to implement /Deploy (elements to consider) Assess « The Concept » & Portfolio Bricks to address understanded results Building the Case : Show the Concept (+ Bricks) in internal Presentations - Estimate Target Operating Model - Estimate workloads and investments to build solutions + Returns (potential earnings, image, market coverage, etc.) - Team building up : Who to train, how to increase people knowledge, type of profiles to deliver - Needs to support the initiative (technology, environment, etc.) Understanding - Market Trends - Customers needs - New Services needs requested - Competition Evolution Deploy at Customers with Monitoring (metrics to reuse to other customers) Promote on the Market Test internally with people on the bench (if feasible) 1-4 days 3-5 weeks 1-5 weeks TBD per Topic 16-24 weeks Operate & Review Confirm Business Case and ROI or TCO 8-16 weeks Strategy Processes People Technology Programme & Change Delivery David will drive and orchestrate complete process : Internaly - Organisation : Market & Trends follow up, Preparation, building competence center, etc. - Orchestrate people in the delivery : Bid Mgt, proposals writing, project delivery, etc. - Financials : building cases, investments, etc. - Mapping business issues with IT solutions Externaly - Promote to market/Customers - Manage projects - Drive our teams

- 28. 28 28 Some ideas to develop financial market 8/8 ASSUMPTIONS - INVESTMENTS & EFFORTS TO PREPARE PORTFOLIO Big Data (Predictive) Analytics Crowd investing Social Media Technologies to Benchmark : Usability, management, ease to use, ease to integrate, security, TCO, quality of support, etc. Big Data OpenSource Platform: Hortonworks, Cloudera, MAPR Flume, Sqoop, Hive, Pig, Tajo, Spark, Hadoop Open source : R, Knime, Mathlab, Proprietary : SPSS, Stata, SAS, Mathematica, Specific to Customer environment 2 approaches : - Based on existing ones - For enterprises (yammer, tibbr, zyncro, etc - Public : linkedin, Facebook, etc. - Tracking raising players and their capabilities Types of profiles needed Solution Architect (apps landscape) Solution Architect (IT) Technical profiles (sys. Engineers, data mgt experts, ETL developers, Business Line experts, asset managers representatives, Solution Architect (apps landscape) Solution Architect (IT) Technical profiles (API integrators, developers, security specialists, etc) Efforts +/- 5 weeks Team : 4-5 people (Depending scope: multiple sources, data treatment, volumes, etc.) +/- 5 weeks Team : 4-5 people (depending scope: type of expect results, type of analysis to drive, number of sources, etc.) To validate with experts (based on complexity, type of products, technologies to use and integrate, targeted markets, etc.) +/- 5 weeks Team : 4-5 people (depending scope: depending ) Cloud Smart Banking (Mobile) Humanoid intelligence HR Transformation Technologies to Benchmark : Usability, management, ease to use, ease to integrate, security, TCO, quality of support, etc. Global : Amazon, Google, IBM, Microsoft, HP, EMC/VMWare, Salesforce, Rackspace, Citrix, Global open source : Cloudera, Red Hat, Joyent, Zoho, Puppet,etc. Local : Post, Telindus, Specific to Customer environment See what is existing on the market Ex: Pepper Robot Customers tools Provider / Market tools Types of profiles needed Solution Architect (apps landscape) Solution Architect (IT) Technical profiles (sys. Engineers, network & security engineers, developers, API integrators, …) Solution Architect (apps landscape) Solution Architect (IT) Technical profiles (API integrators, developers, security specialists, etc) Business Analysts/ Business experts Solution Architect (apps landscape) Solution Architect (IT) Technical profiles (API integrators, developers, security specialists, etc) Business Analysts and experts Specialits per area : - Payroll - Compensation & Benefits - HR director - All other HR profile necessary Efforts +/- 5 weeks Team : 4-5 people (depending scope) +/- 5 weeks Team : 4-5 people (depending scope) enough for a correct prototype Define integration possibilities with Customer’s environment +/- 5 weeks Team : 2-3 people (depending scope) CONSIDERATIONS - As technologies are evolving (too) fast, choice must be done on « Market/ Open standards » (XML, XBRL, web services, html5, etc.) - One of the objectives is to use « plug&play » technologies , meaning replace provider/solution whenever you want in « a click » - Ideally, a lab based on Cloud technologies will be created to show the Case

- 29. 29 29 Internal direct Costs Direct costs engaged by the Operations to manage Customers and their Operations Activities to Manage Cost per Team and their allocation by Customer Analysis related to all directs costs to manage provided services to Customers Front Office Operations Transverses Functions (IT, Finance, RH, legal) Market Costs / Stakeholders External treatment costs for the Operations • Customer Relationship Management (call, meeting, …) • Services & Products Sale (Research, investments ideas, products structuration, pitch, roadshows, conferences, …) • Representation Costs • Events Costs • Commercial discount • Execution Costs (Stock Exchange, market places, Broker, …) • Operations «Normal» lifecycle handling (booking, confirmation, Securities transactions, payments, closing) • Anomalies handling (Customers relaunch, analysis, corrections) • Exceptions handling (specific reporting, non standard channels, …) • Specific handling (IT : connectivity, developments, reporting, Legal: assembly, ad-hoc documentation , …) • Dedicated Marketing Costs • Generally insignificant • N/A • Compensation/ Clearing costs • Settlement/Delivery costs (Custodian, Swift…) • Costs related to collateral (Cash, Custody, …) Financial Markets - Asset Mgt - Approach in 2 Phases Costs identification via Business process reviews with Strong Management implication • MarketData costs (Terminals, specific subscriptions per product, …) • General resources costs/Overheads (Offices, …) • IT Costs (Infrastructure, Operations, Developments, …) • Central functions costs (Legal, HR, Finance, Control, Compliance, …) Reallocate indirect costs via key allocations Indirect Costs General operating expenses 1 2

- 30. 30 30 Financial Markets - Asset Mgt - Approach in 2 Phases Costs identification via Business process reviews with Strong Management implication • Achievements on short term: o Identify hidden costs o Spotlight Manual tasks, exception management, bottle necks, … o Underline abnormal market costs o Performing Modalities related to customers, o Pinpoint wrong focus in terms Commercial / marketing efforts (customers allocation and segmentation) • Achievements on mid-long term: o Better adjustments in terms of Mix Product/Price/Customer o Identify deep transformation programs to drive (organization, process, systems) to enable costs decrease and expected benefits o Correctly invoice Customers with real costs of services (and related performed activities) o Simulate potential impacts due to new tariff policies or organization changes

- 31. Common issues (Banking, Asset Mgt, Insurance) Common solutions Solutions Portfolio Need to automate processes and decrease manual tasks Objective 1 : lower cost of transaction or cost of product This also may be used for internal control / compliancy as all information/data is logged, automated and tracked Dematerialization & non-materialization Result 1a : Productivity gain Result 1b : Better granularity in terms of Costs allocation Result 1c : automated reporting for compliancy needs (to internal and external authorities) BPM, ECM, PSDC Big Data & Analytics to automate some intelligent treatments and controls If end-to-end « electronic » processes, Objective 1 : optimize interactions with internal and/or external Customers/ Partners (asset managers, etc..) Objective 2 : Provide tooling for New Way of working (NWOW) Objective 3 : manage fraud Publishing solutions based on business Rules Result 1 : Personalized content (based on risk, product, profitability, Customers with more interactions, etc.) Result 2 : Digital working (mobile devices, digital signature, etc.) Individualized Publishing(Editique) based on business rules Mobile & Cloud Based on all internal/external information/data, Objective 1 : rate customer value/profitability, product value, etc. Objective 2 : define product lifecycle / create new products Objective 3 : Sales performance/ asset managers performance (margin generation, cost per contact, customers retention) Restructuring Portfolio, Customers to focus on Validate real margins, refund value, etc. Compare our treatment costs with competition/market Big Data & (Predictive) Analytics Smart & algorythmic banking Asset Management Case: Linking Costs optimizations with Portfolio 1/3 Internal direct Costs Direct costs engaged by the Operations to manage Customers and their Operations Activities to Manage Cost per Team and their allocation by Customer Front Office Market Costs / Stakeholders External treatment costs for the Operations • Customer Relationship Management (call, meeting, …) • Services & Products Sale (Research, investments ideas, products structuration, pitch, roadshows, conferences, …) • Representation Costs • Events Costs • Commercial discount • Execution Costs (Stock Exchange, market places, Broker, …)

- 32. Common issues (Banking, Asset Mgt, Insurance) Common solutions Solutions Portfolio Try to automate and standardize all operations including anomalies or custom activities / exceptions to decrease operational costs and avoid manual treatment (potential errors) Objective 1 : treat as much as possible to decrease the cost of a product, service or transaction Dematerialization & non-materialization Result 1a : Productivity gain Result 1b : Better granularity in terms of Costs allocation Result 1c : treat anomalies / exception in automated way based on business rules BPM, ECM, PSDC Big Data & Analytics to automate some intelligent treatments and controls Objective 2 : based on regulatory rules, guarantee that liquidity and credits are well managed to avoid payment defects; also include all the tax aspects Result 2 : this covers all measures in terms of regulations (Basel, Solvency, Mifid, Fatca, etc.) Same as objective 1 Internal direct Costs Direct costs engaged by the Operations to manage Customers and their Operations Activities to Manage Cost per Team and their allocation by Customer Operations Market Costs / Stakeholders External treatment costs for the Operations • Operations «Normal» lifecycle handling (booking, confirmation, Securities transactions, payments, closing) • Anomalies handling (Customers relaunch, analysis, corrections) • Exceptions handling (specific reporting, non standard channels, …) • Generally insignificant • Compensation/ Clearing costs • Settlement/Delivery costs (Custodian, Swift…) • Coût du collateral (Cash, Custody, …) Asset Management Case: Linking Costs optimizations with Portfolio 2/3

- 33. Common issues (Banking, Asset Mgt, Insurance) Common solutions Solutions Portfolio Objective 1 : HR : Employee performance Trend analysis, turno-over, process automation, end-to-end tasks (from job description up to evaluations), simulations, pyramid age, etc. Objective 2 : IT as a Business facilitator Result 1a : Employee profitability Result 1b : Talents retention Result 1 c: alignment between resources vs company strategy and what to deliver Result 2 : provide all necessary tooling to business and internal people to maximize automation, reduction time in tasks, enable anywhere any place Business & IT Alignment Cloud / Mobile BPM, ECM PSDC Analytics/ ECM Social Media Internal direct Costs Direct costs engaged by the Operations to manage Customers and their Operations Activities to Manage Cost per Team and their allocation by Customer Transverses Functions (IT, Finance, RH, legal) Market Costs / Stakeholders External treatment costs for the Operations • Specific handling (IT : connectivity, developments, reporting, Legal: assembly, ad-hoc documentation , …) • Dedicated Marketing Costs • N/A Asset Management Case: Linking Costs optimizations with Portfolio 3/3 All optimizations are normally applicable for transverse functions

- 34. 34 34 Sector Sub-Sector Main topic Sub-Topic Finance All financial companies (Bank, Insurance) Legal, Regulatory & Compliance (Basel, Solvency, IFRS,etc) Risk Mgt Credit Risk & Scoring Liquidity Risk Data Loss Prevention Basel 3 / Solvency 2 Stress Test Simulation Audit - Compliance Log correlation Fraud Mgt + Trend Analysis Quality Transactions - Fraud Payment Insurance - Fraud related to contracts/ damages Private banking Portfolio (evolution) simulation Fund Investments Time for NAV calculation optimization Fund performance Providers performance Funds evolution simulation Margins optimization Matrix - Some ideas to position Analytics 1/4

- 35. 35 35 Sector Sub-Sector Main topic Sub-Topic Matrix - Some ideas to position Analytics 2/4 Cross-IndustriesCustomers Management Customer segmentation Customer Risks for unpayment Front-end apps customization based on profiling People behaviour & trend analysis Usage of social media and mobile data to have targeted customer approach (marketing, sales, etc.) Customer value and ranking Products Portfolio Optimization Product Optimization Transverse to companiesPerformance Management Company profitability optimization Activity Based Costing Projects efficiency Cross-charging Cost models optimization and base of its calculation Real time What if analysis Business Rules editic reporting/analysis Text mining to enable digital working --> show concept of NWOW ! Internal teams composition and adequation linked to sales figures and costs Data Governance, Data Classification & Data Management Finance & Admin Costs & Budgests simulations

- 36. 36 36 Sector Sub-Sector Main topic Sub-Topic Matrix - Some ideas to position Analytics 3/4 Public Sector Finance - Tax DepartmentFraud Mgt + Trend Analysis Tax declaration optimization (Based on Big data --> info related to taxed people) Hospitals - Health Care Customer Risks for unpayment Social Security Sejourn optimization Capacity Planning Fraud Mgt + Trend Analysis Fraud Payment/ Costs Reimbursment Illness trends Cost Management & organization efficiency Police People behaviour & trend analysis Usage of social media and mobile data to have efficient Police activities Risk & Threat management Stats Eurostat - Statec Luxembourg - ILRES - Other companies using statistics Ministries Stats Cost cutting / Costs Optimization

- 37. 37 37 Sector Sub-Sector Main topic Sub-Topic Matrix - Some ideas to position Analytics 4/4 HR - Cross Industries People efficiency & Productivity People turn over optimization People motivation degree Seek & Search People optimization Telecom Churn Coverage and bandwidth optimization - Capacity planning Campaign marketing optimization Fraud behavior& Usage web Sales - FMCG Customer and product adequation Amazon, iTunes, eBay, Gaming companies, other Post & TransportRoute Optimization Supply Chain Capacity planning & forecasting Employee efficiency