Colliers na office_2014_q3_final

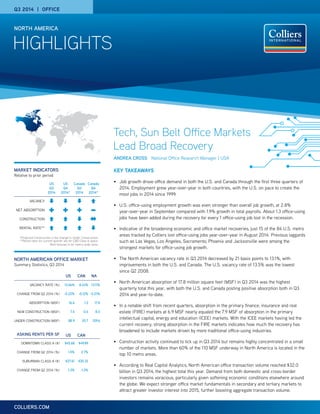

- 1. HIGHLIGHTS NORTH AMERICA COLLIERS.COM Q3 2014 | OFFICE MARKET INDICATORS Relative to prior period NORTH AMERICAN OFFICE MARKET Summary Statistics, Q3 2014 US Q3 2014 US Q4 2014* Canada Q3 2014 Canada Q4 2014* VACANCY NET ABSORPTION CONSTRUCTION RENTAL RATE** *Projected Construction is the change in Under Construction. **Rental rates for current quarter are for CBD Class A space. Rent forecast is for metro-wide rents. US CAN NA VACANCY RATE (%) 13.46% 8.43% 13.11% CHANGE FROM Q2 2014 (%) -0.22% -0.12% -0.21% ABSORPTION (MSF) 16.6 1.2 17.8 NEW CONSTRUCTION (MSF) 7.4 0.6 8.0 UNDER CONSTRUCTION (MSF) 88.9 20.7 109.6 ASKING RENTS PER SF US CAN DOWNTOWN CLASS A ($) $45.68 $49.89 CHANGE FROM Q2 2014 (%) 1.5% 2.7% SUBURBAN CLASS A ($) $27.61 $30.32 CHANGE FROM Q2 2014 (%) 1.3% -1.3% Tech, Sun Belt Office Markets Lead Broad Recovery ANDREA CROSS National Office Research Manager | USA KEY TAKEAWAYS • Job growth drove office demand in both the U.S. and Canada through the first three quarters of 2014. Employment grew year-over-year in both countries, with the U.S. on pace to create the most jobs in 2014 since 1999. • U.S. office-using employment growth was even stronger than overall job growth, at 2.8% year-over-year in September compared with 1.9% growth in total payrolls. About 1.3 office-using jobs have been added during the recovery for every 1 office-using job lost in the recession. • Indicative of the broadening economic and office market recoveries, just 15 of the 84 U.S. metro areas tracked by Colliers lost office-using jobs year-over-year in August 2014. Previous laggards such as Las Vegas, Los Angeles, Sacramento, Phoenix and Jacksonville were among the strongest markets for office-using job growth. • The North American vacancy rate in Q3 2014 decreased by 21 basis points to 13.1%, with improvements in both the U.S. and Canada. The U.S. vacancy rate of 13.5% was the lowest since Q2 2008. • North American absorption of 17.8 million square feet (MSF) in Q3 2014 was the highest quarterly total this year, with both the U.S. and Canada posting positive absorption both in Q3 2014 and year-to-date. • In a notable shift from recent quarters, absorption in the primary finance, insurance and real estate (FIRE) markets at 6.9 MSF nearly equaled the 7.9 MSF of absorption in the primary intellectual capital, energy and education (ICEE) markets. With the ICEE markets having led the current recovery, strong absorption in the FIRE markets indicates how much the recovery has broadened to include markets driven by more traditional office-using industries. • Construction activity continued to tick up in Q3 2014 but remains highly concentrated in a small number of markets. More than 60% of the 110 MSF underway in North America is located in the top 10 metro areas. • According to Real Capital Analytics, North American office transaction volume reached $32.0 billion in Q3 2014, the highest total this year. Demand from both domestic and cross-border investors remains voracious, particularly given softening economic conditions elsewhere around the globe. We expect stronger office market fundamentals in secondary and tertiary markets to attract greater investor interest into 2015, further boosting aggregate transaction volume.

- 2. P. 2 | COLLIERS INTERNATIONAL HIGHLIGHTS | Q3 2014 | OFFICE | NORTH AMERICA U.S. ECONOMIC TRENDS The U.S. economic recovery continued at a healthy clip through Q3 2014. Year-to-date through September, U.S. employers added more than 2 million positions, putting the economy on pace to add the most jobs this year since 1999. Unlike earlier in the cycle, where industries such as tech, energy, education and healthcare drove growth, job gains in recent months have been broad-based, with even the lagging government sector increasing slowly in recent months. The story has been even more positive for office-using employment. Growth in the primary office-using employment sectors (professional and business services, financial activities and information services) continues to track ahead of the recovery in overall employment, with 2.8% year- over-year growth in office-using jobs in September compared with 1.9% growth in overall payrolls. The U.S. economy has added approximately 1.3 office-using jobs for every 1 job lost during the recession, compared with 1.1 jobs added in all sectors for every 1 lost during the recession. Office- using employment surpassed 30 million jobs for the first time in September and now stands about 727,000 positions more than the prerecession peak in July 2007. SF by Region Absorption by Market (SF) Q2 2014 to Q3 2014 2,300,000 1,150,000 230,000 -230,000 -1,150,000 -2,300,000 2 billion 1 billion 200 million Occupied SF Vacant SF 13.0% vac. OFFICE VACANCY, INVENTORY & ABSORPTION | Q3 2014 | NORTH AMERICA The economic recovery has also broadened geographically. Of the 84 U.S. metro areas tracked by Colliers, just 15 of them lost office-using jobs between August 2013 and August 2014. Also, more than half of the metro areas have recovered all of the office-using jobs lost during the recession. No longer is the list dominated by intellectual capital, energy and education (ICEE) markets; among the strongest markets for office-using job growth in August were Jacksonville, Las Vegas, Los Angeles, Sacramento, Orlando, Phoenix and the Inland Empire (Calif.) -- metro areas that all were hit particularly hard by the housing and financial crises. The professional and business services sector remains the most significant driver of office-using employment growth, but financial activities continues to improve at a moderate pace, with growth concentrated in lower-cost Sun Belt and Midwest metro areas such as St. Louis, Phoenix, Jacksonville, Nashville, Raleigh and multiple Texas metro areas. Traditional higher-cost financial centers such as Nassau- Suffolk, Hartford, Bridgeport, Chicago, Los Angeles, Newark and Orange County have been among the slowest to recover jobs in the financial activities sector. Firms including Deutsche Bank, UBS, Charles Schwab and Goldman Sachs have been moving operations to lower-cost areas in recent years, driving this trend.

- 3. HIGHLIGHTS | Q3 2014 | OFFICE | NORTH AMERICA COLLIERS INTERNATIONAL | P. 3 Looking forward, we expect the economic recovery to continue at a similar pace through 2015. IHS Global Insight projects an addition of nearly 2.5 million jobs in 2014, increasing slightly to nearly 2.6 million jobs in 2015. This would amount to four consecutive years of net job gains exceeding 2 million — the longest such stretch since the 1997-2000 period. GDP should also reflect these positive economic trends. Due to poor weather conditions early in the year, IHS predicts only a small improvement in GDP growth: 2.29% in 2014, up slightly from 2.22% in 2013. However, growth is projected to accelerate to 2.74% in 2015. CHANGE IN EMPLOYMENT FROM CYCLICAL PEAK | US Total Employment Office-Using Employment Professional & Business Services Financial Activities MONTHS -12% -10% -8% -6% -4% -2% 0% 2% 4% 6% 8% 10% 0 3 6 9 12 15 18 21 24 27 30 33 36 39 42 45 48 51 54 57 60 63 66 69 72 75 78 81 84 87 90 93 Note: Latest data as of September 2014; x-axis indicates number of months elapsed since each sector’s previous cyclical employment peak; office-using employment sectors include professional and business services, financial activities and information services; information services not displayed separately because sector peaked in 2001. | Sources: Bureau of Labor Statistics, Colliers International. - 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 0.0 5.0 10.0 15.0 20.0 25.0 Vacancy% Absorption MSF Completions MSF Vac Rate (%) 14.73 14.63 14.49 14.45 14.15 14.00 13.93 13.69 13.46 Q3 2012 Q4 Q1 2013 Q2 Q3 Q4 Q1 2014 Q2 Q3 OFFICE MARKET | Q3 2012–Q3 2014 | US Source: Colliers International. MSA % CHANGE MSA % CHANGE St. Louis 400.0% Phoenix 141.4% Dallas-Fort Worth 360.2% Jacksonville 131.1% Nashville 338.9% Raleigh 121.4% Omaha 266.7% Cincinnati 118.4% Austin 265.5% Birmingham 117.9% Pittsburgh 213.6% Houston 109.1% Richmond 145.7% UNITED STATES 41.1% Note: All data are seasonally adjusted as of August 2014; Includes markets tracked by Colliers with at least 25,000 financial activities jobs as of August 2014. Sources: Bureau of Labor Statistics, Federal Reserve Bank of St. Louis, Colliers International. MARKETS WITH FINANCIAL ACTIVITIES EMPLOYMENT AT OR ABOVE PRERECESSION PEAK | AUGUST 2014 | US MSA PERCENT RECOVERED MSA PERCENT RECOVERED Austin 496.1% Columbus 170.3% Raleigh 362.6% Charlotte 169.9% Nashville 333.1% St. Louis 168.6% San Francisco 280.0% Baltimore 162.1% Pittsburgh 244.3% Denver 161.0% San Jose 243.9% Jacksonville 152.5% Dallas-Fort Worth 243.6% Atlanta 147.7% Houston 230.9% Boston 137.6% Omaha 191.8% Minneapolis 131.2% Indianapolis 173.5% Seattle 130.6% UNITED STATES 125.6% Note: All data are seasonally adjusted as of August 2014; Includes markets tracked by Colliers with at least 100,000 office-using jobs as of August 2014. Sources: Bureau of Labor Statistics, Federal Reserve Bank of St. Louis, Colliers International. TOP 20 MARKETS FOR OFFICE-USING JOBS RECOVERED | AUGUST 2014 | US MSA % CHANGE MSA % CHANGE Raleigh 8.7% Orlando 3.6% Nashville 6.2% Phoenix 3.6% Jacksonville 5.3% Inland Empire 3.5% Austin 5.2% San Jose 3.4% Dallas-Fort Worth 5.1% Atlanta 3.3% Las Vegas 4.7% Houston 3.2% San Francisco 4.0% Miami 3.2% Charlotte 3.8% Memphis 3.0% Los Angeles 3.7% St. Louis 2.9% Sacramento 3.6% Seattle 2.7% UNITED STATES 2.6% Note: All data are seasonally adjusted as of August 2014; Includes markets tracked by Colliers with at least 100,000 office-using jobs as of August 2014. Sources: Bureau of Labor Statistics, Federal Reserve Bank of St. Louis, Colliers International. FASTEST OFFICE-USING EMPLOYMENT GROWTH | AUG. 2013-2014 | US

- 4. P. 4 | COLLIERS INTERNATIONAL HIGHLIGHTS | Q3 2014 | OFFICE | NORTH AMERICA CANADA ECONOMIC TRENDS The Canadian economy continues to expand at a moderate pace, buoyed by growth in the U.S. but restrained by government cutbacks and private-sector caution regarding investment. Like the U.S. economy, growth has rebounded from the weather-impacted Q1 2014 period, but job creation has been choppy, with alternating gains and losses in employment each month this year through September. Nonetheless, the overall trend has been positive, with approximately 157,600 jobs added year-to-date 2014, up from 106,200 jobs added year-over-year but down from more than 200,000 jobs added during the first nine months in each of the prior three years. Despite the aforementioned headwinds, the Canadian economy should continue to grow through the remainder of 2014 and 2015, benefiting from the ongoing recovery of the U.S. economy, energy sector growth and expansion of the professional, scientific and technical services sector -- an important driver of demand for office space in markets including Vancouver and Toronto, and an economic bright spot in the Canadian economy. The Conference Board of Canada expects employment growth to slow to 1.0% in 2014 -- the weakest reading since Canada’s brief recession -- but accelerate thereafter to 1.8% in 2015. Real GDP is projected to increase by 2.0% in 2014, which is on par with the 2013 growth rate, and to accelerate to 2.7% in 2015. At the local level, Edmonton and Calgary are projected to remain among the fastest growing markets in terms of real GDP in 2014 and through the Conference Board’s forecast period from 2015 to 2018 due to continued growth in the energy industry and its spillover effect on other sectors. Vancouver is forecast to be the fastest-growing metro area with job gains in virtually every sector through 2018. MARKET VACANCY (%) MARKET VACANCY (%) Toronto, ON 6.62% New York, NY - Midtown South Manhattan 8.46% Montréal, QC 7.31% Saskatoon, SK 8.66% Bakersfield, CA 7.39% Calgary, AB 8.68% San Francisco, CA 7.46% Portland, OR 8.95% Nashville, TN 7.93% Indianapolis, IN 9.43% NORTH AMERICA 13.11% LOWEST OVERALL VACANCY RATES | Q3 2014 | NA 2.1% 1.9% 1.7% 1.6% 1.6% 1.4% 1.4% 1.3% 1.1% 0.9% 0.9% 0.8% 0.3% 2.1% 1.9% 1.7% 1.6% 1.6% 1.4% 1.4% 1.3% 1.1% 0.9% 0.9% 0.8% 0.3% -6% -4% -2% 0% 2% 4% 6% 8% 10% Quebec City Toronto Calgary W innipeg Regina Halifax Saskatoon Ham ilton Ottaw a-Gatineau Vancouver Victoria M ontreal Edm onton 2014f 2015-2018 (CAGR) CANADA OFFICE EMPLOYMENT GROWTH CITY 2015F-2018F CITY 2015F-2018F Vancouver 3.1% Saskatoon 2.5% Edmonton 3.0% Montreal 2.3% Calgary 3.0% Hamilton 2.3% Toronto 2.9% Ottawa 2.1% Halifax 2.6% Victoria 2.1% Winnipeg 2.6% Quebec City 2.1% Regina 2.5% CANADA 2.3% Source: The Conference Board of Canada. CANADA AVERAGE ANNUAL FORECASTED REAL GDP GROWTH % Source: Colliers International. Source: The Conference Board of Canada. “~157,600 jobs added in Canada year-to- date 2014”

- 5. HIGHLIGHTS | Q3 2014 | OFFICE | NORTH AMERICA COLLIERS INTERNATIONAL | P. 5 North American Downtown Markets: Excluding renewals, of the leases signed this quarter in your CBD/downtown, did most tenants...? Hold Steady 58.4% Expand 19.5% Contract 14.3% North American Downtown Markets: What was the trend in Free Rent (in months) offered by CBD landlords this quarter? Same 68.8% Less 18.2% More 6.5% North American Downtown Markets: What was the trend for tenant improvement allowances offered by CBD landlords this quarter? Same 77.9% Less 9.1% More 6.5% North American Suburban Markets: Excluding renewals, of the leases signed this quarter in your suburban market, did most tenants...? Hold Steady 52.2% Expand 30.4% Contract 17.4% Note: Charts above reflect % of markets reporting OFFICE OUTLOOK 2014 BEHIND THE STATISTICS BEYOND THE BASICS Scope of Colliers’ Office Outlook Report: Colliers’ office space universe encompasses 87 markets in the U.S. and Canada, with a combined total of more than 6.4 billion square feet (BSF). The 75 U.S. markets account for most of this space, with nearly 6.0 BSF of tracked inventory and the remaining 449 MSF in Canada. Our coverage includes 21 markets with more than 100 MSF of space, with a combined total of 3.8 BSF or nearly 60% of our office market inventory. The largest U.S. markets are New York, Washington, D.C., Chicago, Dallas and Atlanta. Toronto is the only Canadian market with more than 100 MSF of space. Vacancy The North American vacancy rate decreased again in Q3 2014, falling by 21 basis points to 13.1%. Unlike in recent quarters, this improvement was not confined to the U.S. office market; the Canadian vacancy rate decreased as well, as construction completions slowed from recent quarters. Canadian vacancy dipped below 8.5%, landing at 8.4% in Q3 2014 and remaining nearly five percentage points below the U.S. vacancy rate. In the U.S., broader economic improvements contributed to a 22 basis-point decrease in the vacancy rate to 13.5%, the lowest rate since Q2 2008. Both the CBD and suburban vacancy rates decreased, reaching their lowest respective levels since 2008 as well. Of the 81 markets reporting both Q2 2014 and Q3 2014 vacancy rates, 57 markets (more than 70%) posted vacancy rate decreases in Q3, which reflected widespread improvement in office market conditions. ICEE and Canadian markets continued to dominate the list of markets with the lowest vacancy rates. These include Toronto, Montreal, San Francisco, Midtown South Manhattan and Calgary. However, more markets are benefiting from the recovery, including markets adjacent to ICEE metro areas that are experiencing more spillover demand from tech and energy tenants, as well as increases in demand from traditional office tenants such as business services, finance and insurance companies. In New York, Downtown Manhattan and Midtown Manhattan were among the top markets for vacancy rate decrease in Q3, as demand spread beyond the hot Midtown South Manhattan market. In the San Francisco Bay Area, both San Francisco and Silicon Valley once again ranked among the top markets for vacancy rate decrease, as did lagging Oakland. Although San Francisco and Silicon Valley remain the preferred locations for many tech tenants, Oakland is starting to see demand from tenants priced out of these areas. Other markets that have lagged behind in the economic and office market recoveries also saw significant improvements in vacancy in Q3 2014, including Stockton, Los Angeles and Stamford. MARKET VACANCY RATE Q2 2014 VACANCY RATE Q3 2014 BASIS-POINT CHANGE Stockton, CA 15.66% 14.12% -155 Montréal, QC 8.68% 7.31% -137 New York, NY - Downtown Manhattan 13.35% 12.20% -115 Greenville, SC 17.72% 16.68% -103 San Jose - Silicon Valley 10.70% 9.77% -94 Los Angeles, CA 17.97% 17.07% -90 Stamford, CT 20.97% 20.11% -86 San Francisco, CA 8.28% 7.46% -82 New York, NY - Midtown Manhattan 11.39% 10.57% -82 Kansas City, MO 12.37% 11.60% -77 NORTH AMERICA 13.33% 13.11% -22 LARGEST QUARTER-OVER-QUARTER DECREASE IN OVERALL VACANCY RATE | NA Source: Colliers International. 0% 5% 10% 15% 20% -40 -20 0 20 40 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Sq. Ft., Mil. Absorption (left-axis) US Vacancy Rate (right-axis) CBD Vacancy Rate (right-axis) Suburban Vacancy Rate (right-axis) U.S. OFFICE VACANCY Note: Latest data as of Q3 2014. Source: Colliers International.

- 6. P. 6 | COLLIERS INTERNATIONAL HIGHLIGHTS | Q3 2014 | OFFICE | NORTH AMERICA Tenant Demand and Leasing Activity ICEE tenant leasing activity remained robust in 2014, with tenants seeking markets and properties that enable them to attract and retain top-flight talent. Technology companies continue to expand in, relocate to or open satellite offices in both well-established and emerging tech clusters in order to reap the benefits of these clusters, such as knowledge-sharing, access to specialized services and capital, and an established talent pool. Recent examples include Arkansas-based software company Acxiom, which announced in Q3 2014 plans to open an Austin office, and e-commerce titan Alibaba, which recently opened an office in Silicon Valley on the heels of its US IPO and will open a second office in Downtown Seattle near rival Amazon’s planned 4.1 million-square-foot campus. Boston area-based healthcare technology firm athenahealth is expanding into Austin and Atlanta, and is also relocating Bay Area employees from the suburban San Mateo submarket to San Francisco’s SoMa submarket, citing the strategic advantage of locating in SoMa in terms of attracting talent and engaging with clients. Also in San Francisco, Bloomberg announced plans this quarter to open an RD office, citing the region’s deep talent pool in data science and analysis. Google continues its astounding rate of expansion in Silicon Valley, recently purchasing six buildings at Redwood City’s Pacific Shores Center, which is adjacent to the CalTrain commuter rail, and leasing all of the 1.9 MSF of space under development at Sunnyvale’s Moffett Place. The company also purchased 188 Embarcadero and leased 250,000 SF at One Market’s Spear Tower in San Francisco in Q3 2014, underscoring the symbiotic technology industry growth occurring in suburban Silicon Valley and urban San Francisco. The clustering trend is occurring in other industries as well. In Houston, energy companies and supporting firms continue to expand in and relocate to the market. For example, Boston area-based Doble Engineering recently opened its first Houston office and oil lab, seeking proximity to its energy industry clients. Although downtown markets like San Francisco and New York have been among the fastest-growing areas for tech tenants, other markets that offer some of the same urban amenities have been benefiting from this growth as well. Atlanta, which posted the sixth-highest absorption year-to-date through Q3 2014, has experienced significant growth in its tech sector, especially submarkets such as Midtown and Buckhead that offer significant amenities and are transit-accessible. In addition to athenahealth, Twitter and Amazon have been expanding operations in the Atlanta area as well. Absorption North American absorption totaled 17.8 MSF in Q3 2014, up from 16.9 MSF in Q2 2014 and 13.5 MSF in Q1 2014. Both the U.S. and Canada posted positive absorption during the quarter as well as year to date. In the U.S., absorption totaled 16.6 MSF, the sixth straight quarter in which absorption was above 14 MSF, and all but 18 of the 72 markets reporting Q3 data posted positive absorption. Dallas ranked first in quarterly absorption (2.2 MSF), followed by Midtown Manhattan (1.9 MSF), Downtown Manhattan (1.3 MSF) and Phoenix (1.2 MSF). In Canada, five of the nine markets reporting Q3 data posted positive absorption, led by Montreal (1.1 MSF), Calgary (449,000 SF) and Ottawa (253,000 SF). In previous reports, we highlighted the dominance of ICEE markets during the current recovery. Indeed, this trend continued through the first half of 2014. During the first two quarters of the year, absorption in the primary ICEE markets totaled 15.1 MSF, roughly two-thirds higher than the 9.2 MSF of absorption in the primary FIRE markets. However, in Q3 2014, absorption in the primary FIRE markets totaled 6.9 MSF, nearing the ICEE market total of 7.9 MSF. In fact, all of the primary FIRE markets that Colliers tracks posted positive absorption year-to-date, and all but two posted positive absorption in Q3 2014. This is a noteworthy shift in market dynamics and reflects the contributions to office demand from a greater number of industries and sectors rather than the handful that dominated earlier in the cycle. Construction Activity As the market has improved, office construction activity has increased in recent quarters but remains low overall and focused on the strongest cities. Further along in both the economic and office market cycles, Canada is ahead of the U.S. in terms of new supply. As of Q3 2014, 20.7 MSF were under construction in the Canadian markets tracked by Colliers, amounting to 4.6% of existing inventory. In the U.S. markets tracked by Colliers, 88.9 MSF were underway, representing just 1.5% of existing inventory. Although still trailing the Canadian office market, development activity in the U.S. has been rising. The amount of space underway in Q3 2014 was the highest since Q4 2008 and was up nearly 40% from Q3 2013. Construction activity is occurring in a greater number of U.S. markets; as of Q3 2014, 23 markets had no construction underway, down from 31 one year earlier. Despite the increase in construction activity, development remains highly concentrated in a small number of markets. The top 10 U.S. markets accounted for 60.2 MSF under construction or about 68% of total square footage underway, the same percentage as one year earlier. Houston alone accounts for about 16% of North American office space underway and nearly 20% of U.S. office space under construction. Leading tech markets San Francisco, Silicon Valley, Boston, Seattle and Midtown South Manhattan, most of which have vacancy rates below 10%, account for more than 27 MSF underway or more than 30% of all U.S. office space under construction. Tech and energy companies continue to aggressively pursue large blocks of space in new buildings in the most desirable markets and submarkets in anticipation of future growth, as well as due to a lack of available existing space in many of these markets. Also, many REITs are disposing of existing assets and using the proceeds on their development pipelines in the hottest markets where pricing is nearing or exceeding replacement costs. As an example of both of these trends, Kilroy Realty Corporation recently inked a lease with cloud file management provider Box MARKET ABSORPTION (MSF) MARKET ABSORPTION (MSF) Dallas, TX 2.21 Boston, MA 1.08 NYC - Midtown Manhattan 1.88 Chicago, IL 0.96 NYC - Downtown Manhattan 1.27 San Francisco, CA 0.78 Phoenix, AZ 1.24 Los Angeles, CA 0.77 Montréal, QC 1.10 NYC - Midtown South Manhattan 0.77 YTD NORTH AMERICA ABSORPTION: 17.8 MSF TOP MARKETS FOR METRO OFFICE ABSORPTION | YTD | NA Source: Colliers International.

- 7. P. 7 | COLLIERS INTERNATIONAL HIGHLIGHTS | Q3 2014 | OFFICE | NORTH AMERICA Los Angeles County. A lack of large blocks of space, a low overall vacancy rate compared with the overall Los Angeles market and the revitalization of the area through mixed-use, residential and entertainment projects in recent years have been driving investor confidence in the submarket. Still-low levels of development activity in most markets illustrate the measured approach to development that developers continue to take during the current recovery. The ratio of absorption to new supply -- one of the key metrics that we use to gauge the supply-demand balance of the CRE markets -- was 2.2:1.0 in Q3 2014, indicating that office users absorbed more than twice the amount of space that was delivered to the market during the quarter. Indeed, absorption has outpaced new supply in all but one quarter since Q3 2010. Based on current construction levels and positive absorption trends, we expect this trend to persist into 2015. In addition to overall low levels of construction activity, residential conversions continue to remove office space from the market, particularly in dense urban areas favored by the Millennial generation. This trend is occurring in traditional urban residential markets such as New York, where Claremont Group recently announced plans to convert a 100,000-square- foot Financial District office building to luxury condos. However, conversions are also occurring in historically less popular residential downtown areas in the South and Midwest in response to demand from young residents. For example, multiple conversions are planned for or underway in Downtown Milwaukee, including Vangard Group’s recently announced redevelopment of the Germania Building. Also, in Downtown Kansas City, much of the office space in the underused Commerce Tower was removed from the market in Q3 2014 to be redeveloped into apartments. The ongoing maturation of a Millennial cohort that is expected to account for 50% of the workforce by 2020, coupled with an improving economy that is enabling more young adults to form households, should drive this trend for the foreseeable future. CAPITAL MARKETS TRANSACTION ACTIVITY Interest rates continue to defy expectations, remaining near historically low levels despite the end of the Federal Reserve’s bond-buying programs in October and anticipated interest rate hikes beginning in 2015. Amid geopolitical turmoil and economic weakness in many regions across the globe including Europe and Asia, investors continue to pile into safe U.S. Treasuries, suppressing yields. These fears also continue to drive demand for both U.S. and Canadian real estate, with both countries viewed as bright spots globally, especially in light of the positive economic trends highlighted in this report. In particular, improving office market fundamentals are attracting greater interest in the property type. A number of REITs are capitalizing on strong demand for office assets by disposing of non-core assets. These trends boosted aggregate transaction volume in the U.S. and Canada to $32.0 billion in Q3 2014, the highest quarterly total this year according to Real Capital Analytics. Also, 12-month trailing transaction volume reached $126.1 billion through Q3 2014, the highest 12-month trailing total since Q1 2008. Average cap rates have decreased to the high end of the 6% range in the U.S. and the mid-5% range in Canada, but these figures vary wildly by MSA CONSTRUCTION (MSF) Houston, TX 17.28 San Jose - Silicon Valley 8.26 Toronto, ON 6.80 Dallas, TX 5.36 Seattle/Puget Sound, WA 5.18 Boston, MA 5.11 San Francisco, CA 4.97 Washington DC 4.74 Calgary, AB 4.63 New York, NY - Midtown South Manhattan 3.60 TOP MARKETS FOR OFFICE SPACE UNDER CONSTRUCTION - Q3 2014 - NA Note: Rankings are based on the 87 U.S. and Canadian markets tracked by Colliers International. Source: Colliers International. for the entire Crossing/900 development under construction in Redwood City on San Francisco’s Peninsula. Development is also occurring in submarkets where demand is stronger than in the overall metropolitan area. Tishman Speyer broke ground in Q3 2014 on the 500,000 square-foot Three Alliance Center, a speculative office tower in Atlanta’s Buckhead submarket, which has one of the lowest vacancy rates in the Atlanta metro area. In Kansas City, a lack of Class A options in Johnson County prompted Block Real Estate Services to announce groundbreaking on Pinnacle Corporate Centre V in September. In Los Angeles’ Hollywood submarket, which has successfully attracted tech, entertainment and other creative tenants in recent years, Hudson Pacific Properties broke ground in Q3 2014 on 405,000 SF of office space at Sunset Bronson Studios, bringing the total square footage underway in that submarket to 1.1 MSF, accounting for 44% of all construction underway in MARKET SQUARE FEET UNDERWAY % OF EXISTING INVENTORY San Jose - Silicon Valley 8,258,649 11.30% Edmonton, AB 2,287,893 8.58% Houston, TX 17,277,411 8.18% Calgary, AB 4,633,348 6.98% Vancouver, BC 3,208,682 5.88% San Francisco, CA 4,965,035 5.56% Toronto, ON 6,801,189 4.91% Regina, SK 221,000 4.89% Seattle/Puget Sound, WA 5,184,094 4.62% Boston, MA 5,108,261 2.91% NORTH AMERICA 109,556,173 1.71% CONSTRUCTION AS % OF EXISTING INVENTORY - Q3 2014 - NA Note: Rankings are based on the 87 U.S. and Canadian markets tracked by Colliers International. Source: Colliers International

- 8. P. 8 | COLLIERS INTERNATIONAL HIGHLIGHTS | Q3 2014 | OFFICE | NORTH AMERICA region and asset type. Top-tier properties in gateway markets such as San Francisco and New York have been trading in the 3% to 4% range, while cap rates for recent transactions in Sacramento and Cincinnati were in the 9.0% to 9.5% range. According to Real Capital Analytics, the average cap rate in the six major U.S. metros (Boston, Chicago, Washington, D.C., Los Angeles, New York and San Francisco) decreased to 4.1%, the lowest rate on record, in Q3 2014, as demand for gateway assets from both domestic and foreign capital sources remained voracious. Growth in foreign investment in North American office properties has been even stronger than overall investment growth. Year-to-date through October, cross-border investment into the U.S. and Canada totaled $17.9 billion, exceeding the full-year total for 2013 and reaching the highest level since 2007. In fact, cross-border volume is approaching the previous cyclical peak of $21.6 billion in 2006, in contrast with overall transaction volume which has recovered only to about half of its the previous peak. After Canada, Norway is now the largest cross-border investor in the U.S. as its government pension fund aggressively pursues assets in gateway markets including New York, Boston, Washington, D.C., and San Francisco. Asian countries remain a major source of capital for U.S. office properties, with Hong Kong, South Korea, Singapore, China and Japan all ranking among the top countries for cross-border flows year-to-date. Like domestic investors, foreign investors are increasingly considering secondary markets. In September, German fund Union Investment Real Estate purchased Target-anchored 50 South 10th Street in Minneapolis for $330 per square foot, well above the metro average of $113 in Q3 2014 according to Real Capital Analytics data. Although interest rates have remained low to this point, expectations for higher interest rates in 2015, particularly following the Fed’s confirmation of the end of its bond-buying program, should drive a growing amount of investor interest to geographies that have been less favored up to this point in the cycle, boosting transaction volume and narrowing cap rate-to- Treasury spreads in those areas. In particular, suburban assets, especially those that are accessible to transit options, provide on-site and nearby amenities, and offer flexible, open floorplans that enable denser employee configurations, should benefit from growing demand. Secondary and tertiary markets that have been lagging in the recovery but are starting to experience stronger employment growth and absorption also should post stronger transaction activity. In addition, secondary markets with concentrations of ICEE industries, such as Portland, Pittsburgh, Nashville and Raleigh-Durham, will likely see greater investor interest as investors respond to organic growth as well as tenant relocations -- both ICEE firms and otherwise -- from higher-cost markets such as New York and San Francisco. MOODY’S/RCA COMMERCIAL PROPERTY PRICE INDICES - US OFFICE 0 50 100 150 200 250 300 Major Market-CBD Non-Major Market-CBD Major Market-Sub Non-Major Market-Sub 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Pricing Recovery From Recession Q3 2014 Office Major Market—CBD 134.9% Non-Major Market—CBD 89.4% Major Market Suburban 60.7% Non-Major Market Suburban 45.6% Note: Latest data as of Q3 2014. Sources: Moody’s Investor Service, Real Capital Analytics, Colliers International. CROSS-BORDER INVESTMENT - NORTH AMERICA $0 $5 $10 $15 $20 $25 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Bil. United States Canada Note: Latest data as of Q3 2014. Sources: Real Capital Analytics, Colliers International. -100% -50% 0% 50% 100% 150% 200% $0 $50 $100 $150 $200 $250 $300 2007 2008 2009 2010 2011 2012 2013 2014 Bil. 12-Month Trailing Volume (left-axis) Year-Over-Year % Change (right-axis) OFFICE TRANSACTION VOLUME | Q3 2014 | NA Note: Latest data as of Q3 2014; all data are 12-month trailing. Sources: Real Capital Analytics; Colliers International.

- 9. HIGHLIGHTS | Q3 2014 | OFFICE | NORTH AMERICA COLLIERS INTERNATIONAL | P. 9 UNITED STATES | DOWNTOWN OFFICE | ALL INVENTORY MARKET EXISTING INVENTORY (SF) SEP 30, 2014 NEW SUPPLY Q3 2014 (SF) YTD NEW SUPPLY 2014 (SF) UNDER CONSTRUCTION (SF) VACANCY RATE JUNE 30, 2014 VACANCY RATE SEP 30, 2014 ABSORPTION Q3 2014 (SF) YTD ABSORPTION 2014 (SF) NORTHEAST Baltimore, MD 28,529,527 0 45,000 0 12.87% 12.91% -11,291 -341,284 Boston, MA 62,834,701 0 1,050,000 2,415,827 12.38% 11.12% 787,562 1,462,013 Hartford, CT 9,971,800 0 0 0 13.45% 14.95% -149,721 -129,795 New York, NY - Downtown Manhattan 110,938,458 0 2,861,402 2,800,000 13.35% 12.20% 1,274,979 3,722,582 New York, NY - Midtown Manhattan 230,068,701 0 0 0 11.39% 10.57% 1,877,166 1,509,964 New York, NY - Midtown South Manhattan 162,245,367 0 894,672 3,600,000 8.93% 8.46% 771,943 2,077,793 Philadelphia, PA 42,663,439 0 0 0 11.38% 11.45% -29,567 54,485 Pittsburgh, PA* 32,091,162 0 0 1,560,643 10.28% 9.64% 43,805 38,023 Stamford, CT 18,742,064 0 0 0 20.97% 20.11% 161,374 152,004 Washington DC 144,221,640 168,769 1,032,510 1,529,345 10.73% 10.98% -352,413 -536,525 White Plains, NY 7,672,399 0 0 0 15.79% 14.74% 80,415 -10,214 Northeast Total 849,979,258 168,769 5,883,584 11,905,815 11.42% 10.88% 4,454,252 7,999,046 SOUTH Atlanta, GA 50,200,536 557,122 557,122 0 15.69% 16.54% 42,603 562,228 Birmingham, AL 4,895,917 0 0 0 21.83% 21.28% 27,062 340,476 Charleston, SC 2,252,548 0 0 21,000 8.52% 8.52% 22 14,903 Charlotte, NC 22,671,115 0 0 0 9.62% 8.68% 213,217 153,203 Columbia, SC 4,678,427 0 0 0 10.82% 10.50% 14,960 24,552 Dallas, TX 32,699,541 0 0 450,000 24.55% 21.99% 837,665 866,064 Ft. Lauderdale-Broward, FL 8,119,105 0 0 0 11.30% 10.72% 46,642 212,622 Ft. Worth, TX 10,195,293 75,971 75,971 0 15.66% 15.64% 66,873 217,851 Greenville, SC 3,317,131 0 0 0 18.38% 16.53% 61,250 54,372 Houston, TX 42,600,630 0 0 1,464,268 11.10% 10.97% 57,502 380,877 Jacksonville, FL 15,572,544 0 0 0 14.19% 15.48% -201,043 -334,528 Little Rock, AR* 6,482,552 0 0 0 10.79% 10.62% 27,815 3,330 Louisville, KY 43,865,629 130,000 429,483 0 10.49% 10.70% 25,146 385,480 Memphis, TN 5,403,149 0 0 0 14.80% 15.03% -12,285 167,036 Miami-Dade, FL 18,730,654 0 0 146,580 17.29% 16.79% 91,992 193,326 Nashville, TN 13,158,325 0 0 209,000 11.56% 11.27% 47,772 170,599 Orlando, FL 12,189,989 0 0 17,124 13.22% 12.87% 42,512 -117,620 Raleigh/Durham/ Chapel Hill, NC 14,274,712 186,000 574,279 242,969 5.91% 5.70% 204,894 496,113 Richmond, VA 16,586,757 0 1,066,662 321,500 11.19% 10.82% 62,562 257,074 Savannah, GA 803,516 0 0 0 11.61% 13.46% -14,921 3,521 Tampa Bay, FL 6,780,530 0 0 0 15.21% 14.62% 40,183 77,047 West Palm Beach/ Palm Beach County, FL 10,182,688 0 0 0 15.09% 14.76% 33,372 94,696 South Total 345,661,288 949,093 2,703,517 2,872,441 13.81% 13.56% 1,715,795 4,223,222 * - Q2-14 data used for Boise, Little Rock and Pittsburgh.

- 10. P. 10 | COLLIERS INTERNATIONAL HIGHLIGHTS | Q3 2014 | OFFICE | NORTH AMERICA UNITED STATES | DOWNTOWN OFFICE | ALL INVENTORY MARKET EXISTING INVENTORY (SF) SEP 30, 2014 NEW SUPPLY Q3 2014 (SF) YTD NEW SUPPLY 2014 (SF) UNDER CONSTRUCTION (SF) VACANCY RATE JUNE 30, 2014 VACANCY RATE SEP 30, 2014 ABSORPTION Q3 2014 (SF) YTD ABSORPTION 2014 (SF) MIDWEST Chicago, IL 157,653,431 0 0 1,073,100 12.43% 12.08% 548,703 860,394 Cincinnati, OH 18,749,613 0 0 600,000 15.16% 15.39% -43,484 -30,831 Cleveland, OH 32,537,011 0 0 0 17.47% 17.21% 84,626 146,384 Columbus, OH 19,452,521 0 0 490,000 9.97% 9.51% 91,079 337,908 Detroit, MI 26,415,460 0 0 0 16.78% 17.00% 187,058 383,966 Grand Rapids, MI 5,314,801 0 0 135,000 16.00% 15.64% 18,805 100,936 Indianapolis, IN 22,548,402 0 0 0 9.22% 9.62% -90,006 -96,533 Kansas City, MO 34,485,082 0 0 0 14.65% 13.40% 234,559 381,542 Milwaukee, WI 18,668,691 42,000 42,000 358,000 12.40% 12.54% 10,870 112,053 Minneapolis, MN 31,521,645 0 0 1,400,000 12.49% 12.34% 48,131 218,335 Omaha, NE 6,454,376 0 0 0 7.04% 6.93% 12,592 885 St. Louis, MO 23,216,158 0 0 0 19.77% 19.49% 65,551 -321,211 St. Paul, MN 11,730,218 0 0 0 13.65% 13.51% 17,400 -78,354 Midwest Total 408,747,409 42,000 42,000 4,056,100 13.55% 13.28% 1,185,884 2,015,474 WEST Albuquerque, NM 3,191,080 0 0 0 27.00% 26.12% 27,867 68,433 Bakersfield, CA 3,305,484 59,242 72,283 0 8.74% 8.44% 66,528 69,271 Boise, ID* 4,177,362 0 252,347 466,022 8.69% 11.34% -110,776 -104,324 Denver, CO 34,423,244 205,158 317,710 75,102 11.98% 11.09% 488,325 682,512 Fresno, CA 3,288,944 0 0 0 11.10% 11.21% -3,851 -55,162 Honolulu, HI 7,164,686 0 0 0 14.22% 14.70% -34,359 -74,014 Las Vegas, NV 5,043,161 0 49,200 129,000 10.72% 10.93% -10,557 143,064 Los Angeles, CA 32,566,100 0 0 464,340 19.68% 19.95% -148,500 -285,900 Oakland, CA 17,255,313 0 0 0 11.22% 11.05% 29,456 88,244 Phoenix, AZ 20,181,280 0 0 0 21.26% 21.03% 46,734 104,182 Portland, OR 34,785,989 0 0 221,380 9.18% 9.02% 57,637 253,300 Reno, NV 3,337,018 0 0 0 14.41% 13.99% 13,981 14,289 Sacramento, CA 13,571,910 0 0 0 14.33% 14.70% -50,987 -9,566 San Diego, CA 10,172,525 0 0 320,000 19.36% 18.82% 54,760 -44,306 San Francisco, CA 89,303,236 55,756 1,250,161 4,965,035 8.28% 7.46% 781,565 2,554,546 San Jose - Silicon Valley 8,024,606 0 0 0 16.72% 15.48% 81,629 219,043 Seattle/Puget Sound, WA 55,719,584 0 0 3,830,394 10.95% 10.77% 103,372 548,575 Stockton, CA 8,221,819 0 0 0 15.66% 14.12% 127,185 169,007 Walnut Creek, CA 12,359,536 0 0 0 14.88% 16.28% -172,926 -34,192 West Total 366,092,877 320,156 1,941,701 10,471,273 12.50% 12.19% 1,347,083 4,307,002 U.S. TOTALS 1,970,480,832 1,480,018 10,570,802 29,305,629 12.48% 12.09% 8,703,014 18,544,744 (continued) * - Q2-14 data used for Boise, Little Rock and Pittsburgh.

- 11. HIGHLIGHTS | Q3 2014 | OFFICE | NORTH AMERICA COLLIERS INTERNATIONAL | P. 11 UNITED STATES | DOWNTOWN OFFICE | CLASS A MARKET EXISTING INVENTORY (SF) SEP 30, 2014 AVG ANNUAL QUOTED RENT (USD PSF) SEP 30, 2014 VACANCY RATE JUNE 30, 2014 VACANCY RATE SEP 30, 2014 ABSORPTION Q3 2014 (SF) YTD ABSORPTION 2014 (SF) QUARTERLY CHANGE IN RENT (%) ANNUAL CHANGE IN RENT (%) NORTHEAST Baltimore, MD 12,819,952 21.41 11.61% 11.76% -19,754 208,262 -0.3% -8.3% Boston, MA 43,884,537 50.32 14.01% 12.47% 672,430 1,220,845 1.2% 3.0% Hartford, CT 6,771,455 20.73 13.48% 16.49% -203,601 -283,808 -8.3% -8.5% NYC - Downtown Manhattan 80,463,304 53.93 14.98% 13.53% 1,166,740 3,322,352 5.8% 10.0% NYC - Midtown Manhattan 197,217,338 77.66 11.86% 10.98% 1,736,011 1,628,415 2.2% 9.7% NYC - Midtown South Manhattan 34,311,898 66.03 9.43% 8.40% 353,945 1,413,240 -1.7% 3.6% Philadelphia, PA 30,273,405 28.31 11.41% 11.34% 21,377 64,757 2.5% 7.0% Pittsburgh, PA* 18,367,184 25.65 8.14% 7.72% 96,262 -43,468 -0.7% 4.0% Stamford, CT 13,314,999 38.81 21.82% 20.59% 163,532 161,912 1.3% 0.4% Washington DC 89,657,675 54.56 11.48% 11.91% -238,737 552,766 0.0% 6.8% White Plains, NY 4,887,732 31.49 17.90% 16.65% 61,016 19,283 0.0% 2.2% Northeast Total 531,969,479 59.09 12.45% 11.77% 3,809,221 8,264,556 1.9% 7.7% SOUTH Atlanta, GA 30,953,804 21.81 17.45% 18.81% 39,851 484,028 0.8% -5.0% Birmingham, AL 3,939,806 21.02 16.58% 15.88% 27,492 356,458 0.1% 0.8% Charleston, SC 1,009,994 32.81 8.68% 7.70% 9,832 16,395 -3.4% 2.1% Charlotte, NC 16,138,434 24.94 9.68% 8.95% 117,305 189,501 -0.8% -1.2% Columbia, SC 2,131,068 21.15 10.68% 10.74% -1,418 -40,209 3.9% 2.6% Dallas, TX 22,640,149 22.90 26.29% 23.03% 737,541 726,425 -0.2% 2.2% Ft. Lauderdale-Broward, FL 4,498,009 34.10 14.77% 13.78% 44,780 207,616 3.2% 8.0% Ft. Worth, TX 5,906,763 28.90 17.07% 17.33% 47,331 68,544 0.0% 2.7% Greenville, SC 2,045,167 22.16 18.36% 16.11% 46,039 20,287 3.3% 11.9% Houston, TX 30,778,455 42.52 9.86% 9.81% 15,178 219,585 4.9% 14.3% Jacksonville, FL 6,846,824 20.17 16.50% 18.76% -154,429 -369,671 1.0% 1.3% Little Rock, AR* 2,635,440 17.30 10.71% 10.69% 681 4,555 4.4% 6.1% Louisville, KY 10,836,604 20.55 10.61% 10.95% 79,384 334,005 0.6% -0.3% Memphis, TN 2,009,825 17.17 20.64% 22.65% -40,481 93,462 0.3% 0.3% Miami-Dade, FL 9,817,567 40.65 17.49% 17.28% 20,513 129,154 1.2% 4.3% Nashville, TN 3,750,462 24.08 9.98% 10.36% 16,831 60,714 1.3% 10.7% Orlando, FL 5,779,283 24.23 14.28% 14.08% 11,807 -89,405 -3.0% -1.0% Raleigh/Durham/Chapel Hill, NC 7,230,215 26.51 6.69% 5.97% 225,647 239,231 1.8% 10.3% Richmond, VA 6,355,704 24.52 8.09% 7.79% 18,861 138,351 -1.4% 5.6% Savannah, GA 645,713 21.06 6.82% 7.97% -7,471 7,324 0.7% 2.3% Tampa Bay, FL 4,999,570 25.08 13.26% 12.86% 19,876 45,125 3.5% 8.3% West Palm Beach/ Palm Beach County, FL 3,601,185 34.17 17.83% 16.85% 35,312 79,675 -3.9% -2.1% South Total 184,550,041 27.72 14.74% 14.49% 1,310,462 2,921,150 1.4% 4.3% * - Q2-14 data used for Boise, Little Rock and Pittsburgh.

- 12. P. 12 | COLLIERS INTERNATIONAL HIGHLIGHTS | Q3 2014 | OFFICE | NORTH AMERICA UNITED STATES | DOWNTOWN OFFICE | CLASS A MARKET EXISTING INVENTORY (SF) SEP 30, 2014 AVG ANNUAL QUOTED RENT (USD PSF) SEP 30, 2014 VACANCY RATE JUNE 30, 2014 VACANCY RATE SEP 30, 2014 ABSORPTION Q3 2014 (SF) YTD ABSORPTION 2014 (SF) QUARTERLY CHANGE IN RENT (%) ANNUAL CHANGE IN RENT (%) MIDWEST Chicago, IL 60,958,919 40.02 12.43% 12.22% 127,776 283,621 2.3% 6.7% Cincinnati, OH 7,392,484 23.28 17.42% 17.44% -1,455 101,843 2.5% 2.1% Cleveland, OH 10,512,842 21.57 14.80% 14.70% 11,160 34,262 1.1% 1.8% Columbus, OH 8,377,149 19.65 11.21% 10.95% 21,927 128,830 -0.5% 1.8% Detroit, MI 7,200,294 22.98 12.96% 13.12% -11,696 187,496 0.0% 0.2% Grand Rapids, MI 1,461,047 20.24 21.66% 20.22% 21,130 63,477 9.5% 4.5% Indianapolis, IN 9,501,787 18.95 12.07% 12.44% -35,513 -93,961 0.0% 0.3% Kansas City, MO 10,518,171 18.93 20.33% 19.88% 47,715 105,921 -0.5% 0.3% Milwaukee, WI 5,106,083 27.05 9.03% 9.35% -16,810 -16,007 0.0% -1.5% Minneapolis, MN 13,618,828 17.81 10.85% 10.37% 65,453 118,221 3.7% 5.9% Omaha, NE 3,492,762 20.25 3.38% 3.40% -690 32,909 0.0% 0.6% St. Louis, MO 9,558,798 17.83 19.76% 19.22% 51,123 -456,932 -1.3% -0.9% St. Paul, MN 2,773,960 14.48 13.51% 12.86% 17,878 -91,230 0.2% 1.8% Midwest Total 150,473,124 28.17 13.44% 13.24% 297,998 398,450 1.6% 4.6% WEST Albuquerque, NM 575,047 20.14 26.55% 23.60% 16,977 16,977 0.0% 1.9% Bakersfield, CA 788,282 17.40 6.35% 5.80% 59,826 46,583 0.0% 0.0% Boise, ID* 1,941,427 20.75 4.40% 11.52% -93,934 -56,044 8.0% 9.0% Denver, CO 21,580,654 32.72 12.82% 13.23% 38,882 218,938 0.3% 6.6% Fresno, CA 1,026,046 24.60 6.11% 7.40% -13,149 -12,340 0.0% 0.0% Honolulu, HI 4,966,720 35.38 12.32% 13.64% -7,546 -38,331 -0.4% 1.7% Las Vegas, NV 1,103,341 31.56 13.10% 13.60% -5,495 -6,160 -5.4% 0.4% Los Angeles, CA 18,098,100 39.72 18.75% 19.42% -132,400 -185,400 6.4% 8.3% Oakland, CA 10,562,045 34.56 9.64% 9.35% 30,808 -6,757 1.1% 9.5% Phoenix, AZ 9,474,646 23.34 22.75% 23.07% -29,809 -70,771 1.7% 1.3% Portland, OR 13,286,545 26.26 9.86% 9.68% 24,014 -81,429 0.0% 3.5% Reno, NV 583,955 24.16 13.42% 13.60% -1,027 -1,838 2.8% 0.4% Sacramento, CA 6,032,189 31.20 16.14% 16.85% -42,766 -75,544 -0.8% -2.3% San Diego, CA 7,257,266 29.76 18.60% 17.85% 54,316 -53,231 2.5% 6.0% San Francisco, CA 57,499,486 59.98 8.75% 7.87% 499,358 1,957,374 0.4% 13.2% San Jose - Silicon Valley 3,494,393 36.60 17.57% 14.11% 89,595 166,303 -0.3% 11.7% Seattle/Puget Sound, WA 32,299,750 33.48 11.22% 11.15% 21,983 234,442 -1.7% 3.8% Stockton, CA 2,790,574 18.60 19.49% 19.01% 13,540 32,189 -4.3% -7.7% Walnut Creek, CA 8,188,282 28.08 13.76% 16.31% -208,788 -84,599 0.0% 1.7% West Total 201,548,748 39.79 12.45% 12.41% 314,385 2,000,362 0.6% 8.5% U.S. TOTALS 1,068,541,392 45.68 12.99% 12.57% 5,732,066 13,584,518 1.5% 7.4% (continued) * - Q2-14 data used for Boise, Little Rock and Pittsburgh.

- 13. HIGHLIGHTS | Q3 2014 | OFFICE | NORTH AMERICA COLLIERS INTERNATIONAL | P. 13 UNITED STATES | SUBURBAN OFFICE | ALL INVENTORY MARKET EXISTING INVENTORY (SF) SEP 30, 2014 NEW SUPPLY Q3 2014 (SF) YTD NEW SUPPLY 2014 (SF) UNDER CONSTRUCTION (SF) VACANCY RATE JUNE 30, 2014 VACANCY RATE SEP 30, 2014 ABSORPTION Q3 2014 (SF) YTD ABSORPTION 2014 (SF) NORTHEAST Baltimore, MD 88,313,613 23,000 817,452 0 12.09% 12.47% -83,651 1,279,490 Boston, MA 112,676,513 110,000 110,000 2,692,434 17.75% 18.26% 290,925 1,205,573 Fairfield County, CT 39,763,516 0 0 0 12.96% 13.90% 48,204 419,091 Hartford, CT 12,784,662 0 0 0 11.86% 13.11% -44,310 374,973 Long Island, NY 74,884,709 80,000 80,000 20,000 10.12% 10.23% -63,544 -115,183 New Jersey - Central 129,118,877 0 100,826 1,298,674 14.53% 14.74% 285,158 960,371 New Jersey - Northern 163,981,980 519,108 594,595 0 15.66% 15.33% 541,457 1,000,459 Philadelphia, PA 110,247,204 0 605,631 746,000 15.05% 14.74% 294,983 625,492 Pittsburgh, PA* 91,138,395 208,981 444,605 1,347,989 7.55% 7.22% -38,625 -84,678 Washington DC 289,209,866 498,270 2,454,672 3,211,891 17.26% 15.03% -303,325 -955,877 Westchester County, NY 37,680,319 0 0 0 13.41% 14.27% -322,760 -463,982 Northeast Total 1,149,799,654 1,439,359 5,207,781 9,316,988 14.60% 14.12% 604,512 4,245,729 SOUTH Atlanta, GA 171,738,942 0 0 2,111,298 16.06% 17.15% 486,282 1,780,861 Birmingham, AL 14,676,855 0 0 0 14.19% 13.43% -20,555 -25,355 Charleston, SC 9,823,256 0 114,880 215,000 12.19% 12.11% 66,355 -7,722 Charlotte, NC 62,494,903 124,770 366,005 348,258 11.69% 13.31% 301,291 1,005,814 Columbia, SC 4,966,961 0 0 0 22.66% 25.52% 50,732 101,523 Dallas, TX 239,606,702 1,032,193 2,492,897 4,914,028 14.82% 15.18% 1,367,537 3,552,932 Ft. Lauderdale- Broward, FL 43,324,188 0 0 515,000 14.14% 14.69% 35,120 199,099 Ft. Worth, TX 21,429,937 20,000 213,285 839,712 11.43% 8.77% 64,605 209,774 Greenville, SC 4,783,806 0 0 0 17.26% 19.58% 22,264 120,634 Houston, TX 168,568,052 1,271,979 4,813,119 15,813,143 11.74% 12.26% 291,216 3,944,635 Jacksonville, FL 46,170,943 13,000 25,151 234,041 11.28% 12.24% 26,680 556,421 Little Rock, AR* 7,551,255 0 0 0 12.59% 13.50% 39,299 68,375 Memphis, TN 27,219,396 0 0 248,464 14.60% 15.21% -40,749 154,422 Miami-Dade, FL 65,127,192 0 80,000 351,054 10.72% 11.68% 180,901 683,185 Nashville, TN 15,556,763 0 0 260,000 4.86% 5.93% -64,633 444,696 Orlando, FL 54,388,480 0 315,599 90,000 14.01% 13.93% 10,359 119,235 Raleigh/Durham/ Chapel Hill, NC 65,625,256 349,152 627,000 1,478,632 12.19% 12.11% 411,914 643,845 Richmond, VA 34,880,897 28,000 101,000 203,413 11.35% 11.41% 88,830 46,449 Savannah, GA 1,461,838 0 0 0 19.21% 18.98% -47,396 -46,135 Tampa Bay, FL 57,612,308 0 110,000 18,000 17.80% 18.22% 277,776 494,383 West Palm Beach/Palm Beach County, FL 28,415,947 0 0 119,681 17.37% 18.33% 64,871 347,833 South Total 1,145,423,877 2,839,094 9,258,936 27,759,724 13.71% 14.25% 3,612,699 14,394,904 * - Q2-14 data used for Boise, Little Rock and Pittsburgh.

- 14. P. 14 | COLLIERS INTERNATIONAL HIGHLIGHTS | Q3 2014 | OFFICE | NORTH AMERICA UNITED STATES | SUBURBAN OFFICE | ALL INVENTORY MARKET EXISTING INVENTORY (SF) SEP 30, 2014 NEW SUPPLY Q3 2014 (SF) YTD NEW SUPPLY 2014 (SF) UNDER CONSTRUCTION (SF) VACANCY RATE JUNE 30, 2014 VACANCY RATE SEP 30, 2014 ABSORPTION Q3 2014 (SF) YTD ABSORPTION 2014 (SF) MIDWEST Chicago, IL 155,310,600 0 155,475 180,000 17.40% 16.94% 413,250 -121,880 Cincinnati, OH 46,509,893 0 135,576 750,000 15.65% 15.94% 164,361 436,751 Cleveland, OH 48,013,270 0 57,000 55,753 11.33% 11.28% 59,588 27,265 Columbus, OH 44,027,261 0 0 424,840 10.49% 10.80% 96,464 132,924 Detroit, MI 138,475,957 62,820 86,852 405,544 17.40% 18.83% -706,316 172,086 Grand Rapids, MI 12,625,071 120,000 140,593 0 20.64% 18.41% 21,822 69,497 Indianapolis, IN 43,397,174 132,991 132,991 0 9.37% 9.63% 135,912 245,999 Kansas City, MO 59,137,945 240,000 371,200 438,500 11.03% 11.98% 495,013 1,083,461 Milwaukee, WI 33,277,753 0 0 0 11.97% 12.67% -71,905 146,267 Minneapolis, MN 78,842,024 0 598,400 1,050,900 13.39% 13.87% 623,141 1,501,975 Omaha, NE 21,528,082 60,000 344,489 100,000 10.19% 12.12% -59,578 448,854 St. Louis, MO 55,394,777 0 183,000 435,000 9.19% 9.23% -167,102 -49,298 Midwest Total 736,539,807 615,811 2,205,576 3,840,537 14.05% 14.45% 1,004,650 4,093,901 WEST Albuquerque, NM 10,877,999 0 0 0 19.09% 16.71% -114,683 -421,091 Bakersfield, CA 6,079,388 8,984 17,968 122,910 7.24% 7.27% 34,188 34,222 Boise, ID* 17,158,432 3,576 24,142 153,048 12.42% 15.60% -87,145 -334,958 Denver, CO 106,783,645 0 91,537 759,590 12.72% 13.02% 49,672 648,125 Fairfield, CA 4,982,086 0 0 30,000 19.76% 21.72% 32,868 45,083 Fresno, CA 17,562,156 0 20,000 60,000 13.34% 14.04% -1,609 144,860 Honolulu, HI 7,730,394 0 0 0 12.93% 11.10% 55,361 -48,963 Las Vegas, NV 37,623,868 12,000 59,000 628,444 20.79% 22.93% 47,183 526,731 Los Angeles - Inland Empire, CA 20,516,142 0 94,891 58,000 18.46% 19.48% 52,400 214,800 Los Angeles, CA 166,199,199 0 152,300 2,043,570 17.64% 18.17% 922,500 2,312,000 Oakland, CA 16,271,372 0 0 0 19.03% 19.71% 214,004 367,603 Orange County, CA 81,334,154 326,121 814,817 456,000 14.98% 14.74% -153,262 1,317,301 Phoenix, AZ 111,733,311 574,261 792,593 2,720,977 18.11% 19.31% 1,198,011 2,143,975 Pleasanton/ Tri-Valley, CA 27,644,063 0 0 0 12.48% 10.44% -661,197 -870,034 Portland, OR 43,699,653 0 45,521 201,976 8.99% 9.81% 42,980 390,849 Reno, NV 9,666,712 0 0 0 14.76% 14.44% 18,639 -41,072 Sacramento, CA 52,186,729 0 47,776 55,140 18.58% 19.44% 175,355 588,093 San Diego, CA 71,901,725 45,917 587,052 920,416 12.79% 12.82% 154,798 847,920 San Francisco Peninsula 35,209,871 0 30,893 835,346 11.11% 12.89% 80,102 75,267 San Jose - Silicon Valley 65,065,266 70,802 782,085 8,258,649 9.95% 10.43% 401,872 923,771 Seattle/Puget Sound, WA 56,542,807 0 0 1,353,700 9.32% 10.52% 328,792 535,369 Walnut Creek, CA 5,408,617 0 0 0 16.68% 17.35% -99,519 -80,189 West Total 972,177,589 1,041,661 3,560,575 18,657,766 14.74% 15.32% 2,691,310 9,319,662 U.S. TOTALS 4,003,940,927 5,935,925 20,232,868 59,575,015 14.28% 14.51% 7,913,171 32,054,196 (continued) * - Q2-14 data used for Boise, Little Rock and Pittsburgh.

- 15. HIGHLIGHTS | Q3 2014 | OFFICE | NORTH AMERICA COLLIERS INTERNATIONAL | P. 15 * - Q2-14 data used for Boise, Little Rock and Pittsburgh. UNITED STATES | SUBURBAN OFFICE | CLASS A MARKET EXISTING INVENTORY (SF) SEP 30, 2014 AVG ANNUAL QUOTED RENT (USD PSF) SEP 30, 2014 VACANCY RATE JUNE 30, 2014 VACANCY RATE SEP 30, 2014 ABSORPTION Q3 2014 (SF) YTD ABSORPTION 2014 (SF) QUARTERLY CHANGE IN RENT (%) ANNUAL CHANGE IN RENT (%) NORTHEAST Baltimore, MD 31,966,789 24.23 12.50% 12.72% -69,362 1,056,243 -0.3% -1.8% Boston, MA 48,321,025 27.35 16.06% 16.45% -135,272 257,729 5.1% 8.3% Fairfield County, CT 17,928,352 39.14 12.38% 12.45% -13,054 55,691 -0.5% -0.1% Hartford, CT 7,123,495 20.96 11.46% 11.92% -32,402 215,819 -0.2% -1.0% Long Island, NY 25,513,593 30.48 10.55% 10.99% -38,797 -161,321 -0.2% 0.9% New Jersey - Central 61,705,302 26.40 15.34% 14.61% 730,733 1,294,780 -0.3% 1.5% New Jersey - Northern 88,628,188 27.99 18.24% 18.29% 373,535 301,992 -0.1% 4.9% Philadelphia, PA 67,631,527 25.56 13.24% 13.06% 118,812 870,497 -0.3% 1.1% Pittsburgh, PA* 16,920,743 25.92 7.11% 8.69% -72,242 -138,548 17.1% 15.7% Washington DC 139,612,570 31.85 17.68% 17.97% 151,516 151,953 0.3% -1.5% Westchester County, NY 17,710,956 27.87 15.76% 17.71% -346,337 -383,238 0.6% 4.0% Northeast Total 523,062,540 28.57 15.44% 15.61% 667,130 3,521,597 0.8% 1.8% SOUTH Atlanta, GA 81,369,217 23.85 14.32% 13.58% 601,238 960,304 4.2% 7.0% Birmingham, AL 9,276,993 20.82 9.55% 10.59% -96,484 7,291 0.1% 3.6% Charleston, SC 3,698,398 25.62 7.68% 7.66% 765 -56,012 1.3% 4.6% Charlotte, NC 20,518,259 23.49 11.99% 10.98% 273,703 777,193 -0.1% 1.8% Columbia, SC 1,001,769 16.78 19.51% 16.35% 31,649 11,136 -1.6% 1.5% Dallas, TX 98,354,589 25.00 13.99% 13.73% 711,652 1,796,978 0.4% 6.2% Ft. Lauderdale-Broward, FL 10,529,078 27.59 15.26% 14.53% 76,394 227,794 0.4% 1.8% Ft. Worth, TX 3,601,516 24.35 3.49% 2.59% 32,397 40,947 0.2% 0.4% Greenville, SC 2,458,553 18.67 9.23% 9.64% -10,191 95,818 -0.2% 5.2% Houston, TX 76,086,722 31.80 8.92% 9.58% 635,953 3,810,469 -0.9% 4.0% Jacksonville, FL 9,183,817 20.28 7.42% 6.50% 84,946 313,058 3.5% 2.3% Little Rock, AR* 2,843,202 19.74 17.26% 16.82% 8,982 28,407 7.0% 3.2% Memphis, TN 8,309,170 21.08 8.07% 8.22% -12,439 23,839 0.5% -0.3% Miami-Dade, FL 16,196,644 33.57 14.41% 13.66% 120,522 326,446 1.2% 5.8% Nashville, TN 8,213,488 25.10 4.98% 4.70% -4,495 436,543 -5.3% 2.7% Orlando, FL 16,897,279 21.15 17.55% 17.09% 77,635 -554 0.6% 0.2% Raleigh/Durham/Chapel Hill, NC 25,294,098 22.56 9.90% 9.98% 272,702 466,043 5.3% 10.0% Richmond, VA 13,760,678 18.88 11.22% 11.30% -10,591 -107,759 1.0% 3.9% Savannah, GA 490,035 22.12 16.05% 19.28% -15,837 -16,603 0.2% -5.2% Tampa Bay, FL 19,111,994 23.78 16.64% 16.05% 111,416 307,097 0.8% 2.5% West Palm Beach/Palm Beach County, FL 9,136,988 31.88 16.95% 17.16% -19,451 205,151 1.8% 4.8% South Total 436,332,487 25.53 12.49% 12.25% 2,870,466 9,653,586 1.1% 5.1%

- 16. P. 16 | COLLIERS INTERNATIONAL HIGHLIGHTS | Q3 2014 | OFFICE | NORTH AMERICA UNITED STATES | SUBURBAN OFFICE | CLASS A MARKET EXISTING INVENTORY (SF) SEP 30, 2014 AVG ANNUAL QUOTED RENT (USD PSF) SEP 30, 2014 VACANCY RATE JUNE 30, 2014 VACANCY RATE SEP 30, 2014 ABSORPTION Q3 2014 (SF) YTD ABSORPTION 2014 (SF) QUARTERLY CHANGE IN RENT (%) ANNUAL CHANGE IN RENT (%) MIDWEST Chicago, IL 78,112,351 27.39 18.78% 18.38% 314,054 -403,954 0.2% 0.1% Cincinnati, OH 18,266,220 20.18 17.66% 17.38% 49,622 215,849 -0.8% 3.2% Cleveland, OH 9,373,555 21.35 11.20% 10.92% 26,603 57,124 0.9% 0.6% Columbus, OH 18,337,079 19.48 8.91% 8.61% 54,901 132,677 -1.0% 0.8% Detroit, MI 34,435,261 20.42 14.94% 16.04% -247,491 -195,231 1.3% 5.5% Grand Rapids, MI 937,115 13.31 17.76% 16.78% 9,230 91,026 -23.9% -23.9% Indianapolis, IN 12,589,324 18.85 11.49% 11.34% 136,473 280,671 0.3% 2.7% Kansas City, MO 16,799,970 20.74 9.82% 9.36% 293,661 381,332 1.1% 0.9% Milwaukee, WI 6,085,173 18.65 10.85% 11.47% -37,507 88,583 -1.1% -7.9% Minneapolis, MN 26,377,731 14.26 14.88% 14.25% 195,775 1,272,235 -2.5% 3.0% Omaha, NE 5,345,490 25.94 2.41% 3.79% -31,736 292,941 -1.6% 3.6% St. Louis, MO 26,374,431 21.72 8.30% 9.38% -284,806 15,456 -0.6% -1.6% Midwest Total 253,033,700 22.00 14.19% 14.21% 478,779 2,228,709 -0.1% 1.0% WEST Albuquerque, NM 811,008 21.30 4.69% 4.69% 0 -3,057 0.0% 2.2% Bakersfield, CA 2,776,404 24.00 6.50% 5.20% 36,081 17,748 0.0% 0.0% Boise, ID* 5,826,036 15.75 15.38% 16.36% -57,080 -96,211 1.5% 4.3% Denver, CO 35,812,428 25.01 11.67% 11.91% -87,803 -31,570 -0.1% 4.3% Fairfield, CA 1,950,606 25.96 19.74% 18.21% 29,694 42,692 1.4% 0.5% Fresno, CA 3,973,324 25.80 17.49% 16.59% 35,784 30,273 0.0% 0.0% Las Vegas, NV 4,792,696 30.84 28.95% 29.36% 10,971 215,639 2.8% 5.8% Los Angeles - Inland Empire, CA 5,019,438 25.68 19.93% 18.90% 38,000 113,200 0.5% 4.4% Los Angeles, CA 102,831,030 35.88 16.37% 14.74% 1,094,100 1,797,400 2.4% 3.8% Oakland, CA 3,682,927 31.68 23.66% 17.71% 219,078 214,270 7.8% 18.4% Orange County, CA 33,050,966 27.12 15.48% 16.68% -375,695 105,900 2.3% 6.1% Phoenix, AZ 31,181,235 24.43 17.45% 16.74% 465,178 867,843 1.1% 2.9% Pleasanton/Tri-Valley, CA 15,526,039 31.44 10.82% 15.99% -802,048 -988,648 8.3% 11.5% Portland, OR 11,405,889 23.86 10.37% 10.51% -16,013 30,371 0.7% 1.4% Reno, NV 965,364 19.67 16.92% 14.92% 19,296 1,292 -5.4% 0.7% Sacramento, CA 14,297,881 22.32 17.58% 15.70% 268,513 398,088 0.0% 2.2% San Diego, CA 24,117,278 35.64 12.32% 11.86% 112,509 516,724 1.0% 5.7% San Francisco Peninsula 22,729,746 46.68 10.51% 11.11% -27,596 35,985 2.1% 8.1% San Jose - Silicon Valley 33,523,127 46.56 12.18% 10.82% 374,323 960,281 7.8% 5.7% Seattle/Puget Sound, WA 20,752,875 30.43 9.08% 7.18% 393,752 439,111 2.3% -8.0% Walnut Creek, CA 737,964 28.32 19.51% 19.63% -940 -10,703 -0.8% -15.1% West Total 375,764,261 32.46 14.38% 13.85% 1,730,104 4,656,628 2.8% 4.5% U.S. TOTALS 1,588,192,988 27.61 14.18% 14.05% 5,746,479 20,060,520 1.3% 3.3% (continued) * - Q2-14 data used for Boise, Little Rock and Pittsburgh.

- 17. HIGHLIGHTS | Q3 2014 | OFFICE | NORTH AMERICA COLLIERS INTERNATIONAL | P. 17 CANADA | DOWNTOWN OFFICE | ALL INVENTORY MARKET EXISTING INVENTORY (SF) SEP 30, 2014 NEW SUPPLY Q3 2014 (SF) YTD NEW SUPPLY 2014 (SF) UNDER CONSTRUCTION (SF) VACANCY RATE JUNE 30, 2014 VACANCY RATE SEP 30, 2014 ABSORPTION Q3 2014 (SF) YTD ABSORPTION 2014 (SF) Calgary, AB 40,447,480 0 841,064 3,359,000 8.23% 7.70% 217,727 605,135 Edmonton, AB 17,256,559 0 0 2,090,493 8.66% 9.03% -33,176 -43,132 Halifax, NS* 4,547,627 0 17,000 463,900 12.41% 12.41% -159,741 -159,741 Montréal, QC 49,610,579 0 279,476 653,498 5.94% 6.13% -94,902 -129,832 Ottawa, ON 15,995,156 0 0 0 9.10% 9.89% -28,914 -69,550 Regina, SK 3,714,792 0 0 160,000 10.71% 10.50% 7,697 -57,303 Saskatoon, SK 2,442,182 0 0 0 6.86% 8.66% -33,000 -52,000 Toronto, ON 70,479,113 0 40,000 5,190,400 3.61% 3.46% 107,423 469,697 Vancouver, BC 24,474,251 0 81,770 2,150,490 5.78% 6.00% -53,534 -106,936 Victoria, BC* 4,902,931 0 0 29,000 9.85% 9.85% 0 -36,664 Waterloo Region, ON 3,938,504 0 25,586 43,280 12.69% 14.06% -54,266 -45,487 Winnipeg, MB* 11,944,204 0 0 70,000 8.26% 8.26% 0 46,911 CANADA TOTAL 249,753,378 0 1,284,896 14,210,061 6.52% 6.56% -124,686 421,098 CANADA | DOWNTOWN OFFICE | CLASS A MARKET EXISTING INVENTORY (SF) SEP 30, 2014 AVG ANNUAL QUOTED RENT (CAD PSF) SEP 30, 2014 VACANCY RATE JUNE 30, 2014 VACANCY RATE SEP 30, 2014 ABSORPTION Q3 2014 (SF) YTD ABSORPTION 2014 (SF) QUARTERLY CHANGE IN RENT (%) ANNUAL CHANGE IN RENT (%) Calgary, AB 27,568,453 58.00 7.01% 6.51% 139,871 769,997 0.0% -1.7% Edmonton, AB 8,550,473 22.00 6.34% 7.50% -69,546 -8,923 2.3% -45.7% Halifax, NS* 1,951,103 16.90 9.42% 9.42% 9,991 9,991 0.0% -0.6% Montréal, QC 23,073,808 45.00 7.69% 7.55% 31,395 -130,780 0.0% 0.0% Ottawa, ON 10,004,044 47.50 7.45% 7.24% 20,470 20,470 29.3% -5.0% Regina, SK 1,392,816 34.97 6.11% 4.33% 24,892 -31,231 0.0% -20.5% Saskatoon, SK 570,571 43.00 6.88% 8.11% -6,987 -13,500 0.0% 0.0% Toronto, ON 39,391,697 57.11 4.56% 4.26% 126,516 327,623 2.0% 6.2% Vancouver, BC 10,094,997 54.35 5.43% 5.36% 7,304 45,222 2.5% -2.1% Victoria, BC* 513,808 35.00 2.33% 2.33% 0 8,969 0.0% 0.0% Waterloo Region, ON 1,561,288 24.67 10.60% 11.22% -9,637 -9,269 -0.7% -3.8% Winnipeg, MB* 2,619,428 33.75 4.50% 4.50% 0 -13,347 0.0% 0.0% CANADA TOTAL 127,292,486 49.89 6.24% 6.06% 274,269 975,222 2.7% -1.5% * - Halifax, Victoria and Winnipeg report data semi-annually. Q2-14 data shown.

- 18. P. 18 | COLLIERS INTERNATIONAL HIGHLIGHTS | Q3 2014 | OFFICE | NORTH AMERICA CANADA | SUBURBAN OFFICE | ALL INVENTORY MARKET EXISTING INVENTORY (SF) SEP 30, 2014 NEW SUPPLY Q3 2014 (SF) YTD NEW SUPPLY 2014 (SF) UNDER CONSTRUCTION (SF) VACANCY RATE JUNE 30, 2014 VACANCY RATE SEP 30, 2014 ABSORPTION Q3 2014 (SF) YTD ABSORPTION 2014 (SF) Calgary, AB 25,913,952 80,000 207,600 1,274,348 10.62% 9.43% 231,712 227,516 Edmonton, AB 9,408,644 40,000 318,631 197,400 12.50% 11.87% -8,670 105,292 Halifax, NS* 3,282,082 0 34,000 0 9.42% 22.43% 56,960 56,960 Montréal, QC 25,731,403 66,500 724,084 1,450,556 13.99% 10.20% 1,191,291 1,006,584 Ottawa, ON 21,305,074 11,700 222,904 581,300 11.44% 9.64% 282,184 262,651 Regina, SK 801,929 0 31,122 61,000 6.20% 3.74% 0 -35,000 Toronto, ON 67,905,171 109,573 582,547 1,610,789 9.08% 7.90% -527,305 -700,422 Vancouver, BC 30,138,814 153,000 769,000 1,058,192 12.23% 10.64% 71,987 286,232 Victoria, BC* 3,717,151 0 0 99,600 10.03% 11.33% 0 -5,849 Waterloo Region, ON 7,535,589 140,982 176,168 62,283 17.94% 9.81% -21,818 -500,836 Winnipeg, MB* 3,386,471 0 0 70,000 6.36% 12.09% 0 73,840 CANADA TOTAL 199,126,280 601,755 3,066,056 6,465,468 11.10% 9.61% 1,276,341 776,968 CANADA | SUBURBAN OFFICE | CLASS A MARKET EXISTING INVENTORY (SF) SEP 30, 2014 AVG ANNUAL QUOTED RENT (CAD PSF) SEP 30, 2014 VACANCY RATE JUNE 30, 2014 VACANCY RATE SEP 30, 2014 ABSORPTION Q3 2014 (SF) YTD ABSORPTION 2014 (SF) QUARTERLY CHANGE IN RENT (%) ANNUAL CHANGE IN RENT (%) Calgary, AB 12,822,152 43.00 9.85% 9.84% 98,490 142,950 0.0% -2.3% Halifax, NS* 1,478,125 28.56 10.54% 10.54% 44,328 44,328 0.0% 0.2% Montréal, QC 14,557,822 31.00 14.62% 9.09% 862,355 722,998 6.9% 10.7% Ottawa, ON 12,250,530 29.50 11.58% 9.93% 202,812 256,452 -7.8% -3.5% Regina, SK 141,122 29.00 0.00% 0.00% 0 -31,122 0.0% 0.0% Toronto, ON 32,713,369 29.12 9.60% 10.41% -237,740 -290,851 -6.4% -5.8% Vancouver, BC 15,485,892 23.76 13.07% 13.66% 40,521 386,600 7.8% 10.0% Victoria, BC* 808,145 40.00 17.15% 17.15% 0 -5,031 0.0% 5.3% Waterloo Region, ON 3,833,091 23.41 16.98% 19.04% 26,067 -102,178 6.0% 3.2% CANADA TOTAL 94,090,248 30.32 11.60% 11.00% 1,036,833 1,124,146 -1.3% -0.2% * - Halifax and Victoria report data semi-annually. Q2-14 data shown. 0.0 0.0 0.0 0.0 0.1 0.2 0.5 0.7 2.1 2.2 3.4 5.2 0.0 1.0 2.0 3.0 4.0 5.0 6.0 Ottawa, ON Saskatoon, SK Victoria, BC* Waterloo Region, ON Winnipeg, MB* Regina, SK Halifax, NS* Montréal, QC Edmonton, AB Vancouver, BC Calgary, AB Toronto, ON SF (Millions) CBD OFFICE UNDER CONSTRUCTION BY MARKET | Q3 2014 | CANADA * - Halifax, Victoria and Winnipeg report data semi-annually. Q2-14 data shown. SF (Thousands) -159.7 -94.9 -54.3 -53.5 -33.2 -33.0 -28.9 0.0 0.0 7.7 107.4 217.7 -200.0 -150.0 -100.0 -50.0 0.0 50.0 100.0 150.0 200.0 250.0 Halifax, NS Montréal, QC Waterloo Region, ON Vancouver, BC Edmonton, AB Saskatoon, SK Ottawa, ON Victoria, BC Winnipeg, MB Regina, SK Toronto, ON Calgary, AB CBD OFFICE ABSORPTION BY MARKET | Q3 2014 | CANADA

- 19. HIGHLIGHTS | Q3 2014 | OFFICE | NORTH AMERICA COLLIERS INTERNATIONAL | P. 19 UNITED STATES | OFFICE INVESTMENT MARKET CBD SALES PRICE (USD PSF) CBD CAP RATE (%) SUBURBAN SALES PRICE (USD PSF) SUBURBAN CAP RATE (%) Albuquerque, NM 145.00 9.00 175.00 8.00 Atlanta, GA 165.00 7.00 169.00 8.20 Bakersfield, CA 155.00 Baltimore, MD 53.57 6.72 158.86 6.70 Boston, MA 559.00 5.70 136.00 5.20 Chicago, IL 350.00 5.50 200.00 7.50 Cincinnati, OH 125.00 9.75 135.00 9.25 Dallas, TX 181.00 7.00 Denver, CO 380.96 5.60 223.78 7.35 Detroit, MI 246.00 6.81 Fairfield County, CT 139.00 7.80 Fresno, CA 125.00 8.50 160.00 8.00 Ft. Lauderdale-Broward, FL 294.00 147.00 6.92 Ft. Worth, TX 205.00 170.00 7.80 Hartford, CT 58.55 7.50 117.81 7.50 Indianapolis, IN 170.00 8.00 15.00 7.25 Jacksonville, FL 74.00 5.00 119.00 8.00 Las Vegas, NV 130.65 8.52 Little Rock, AR* 88.00 9.00 117.00 9.00 Long Island, NY 111.00 7.95 Los Angeles - Inland Empire, CA 158.00 7.50 Los Angeles, CA 310.00 5.25 315.00 5.80 Miami-Dade, FL 270.00 186.00 6.49 Milwaukee, WI 120.00 8.50 110.00 8.75 Minneapolis, MN 131.00 6.60 75.00 7.30 New Jersey - Central 242.44 7.10 New Jersey - Northern 122.80 6.90 NYC - Downtown Manhattan 486.00 6.50 NYC - Midtown Manhattan 857.00 4.50 NYC- Midtown South Manhattan 518.00 4.75 UNITED STATES | OFFICE INVESTMENT (continued) MARKET CBD SALES PRICE (USD PSF) CBD CAP RATE (%) SUBURBAN SALES PRICE (USD PSF) SUBURBAN CAP RATE (%) Oakland, CA 275.00 7.00 180.00 7.75 Orange County, CA 197.00 6.10 Orlando, FL 220.00 7.30 Philadelphia, PA 172.19 5.30 191.34 6.43 Phoenix, AZ 44.00 7.50 114.00 7.00 Pittsburgh, PA* 90.00 8.25 115.00 8.50 Portland, OR 182.56 6.86 76.67 8.25 Richmond, VA 127.00 Sacramento, CA 164.71 6.50 74.61 7.04 San Diego, CA 141.50 6.75 San Francisco Peninsula 350.00 7.45 San Francisco, CA 571.00 4.28 San Jose - Silicon Valley 371.00 5.65 Savannah, GA 160.00 9.25 120.00 9.50 Seattle/Puget Sound, WA 209.15 5.50 212.08 6.75 St. Louis, MO 90.00 9.50 135.00 8.50 Stamford, CT 186.00 8.00 Tampa Bay, FL 168.00 8.00 166.49 8.00 Walnut Creek, CA 270.00 5.50 180.00 8.00 Washington DC 540.00 5.68 249.00 7.68 West Palm Beach/Palm Beach County, FL 242.00 175.00 6.44 Westchester County, NY 179.00 7.60 White Plains, NY 283.73 8.00 U.S. AVERAGES** 243.81 6.94 164.78 7.45 * - Q2-14 data used for Boise, Little Rock and Pittsburgh. ** - Straight averages used Source: Colliers International. CANADA | OFFICE INVESTMENT MARKET CBD SALES PRICE (CAD PSF) CBD CAP RATE (%) SUBURBAN SALES PRICE (CAD PSF) SUBURBAN CAP RATE (%) Calgary, AB 450.00 6.00 Montréal, QC 270.00 6.50 185.00 7.25 Regina, SK 280.00 6.75 200.00 7.25 Saskatoon, SK 306.00 6.50 Vancouver, BC 550.00 4.50 375.00 6.25 Victoria, BC* 300.00 6.25 280.00 6.50 Waterloo Region, ON 117.00 7.50 102.00 7.50 Winnipeg, MB* 150.00 7.25 140.00 7.25 CANADA AVERAGES** 281.86 6.46 247.43 6.86 * - Victoria and Winnipeg report data semi-annually. Q2-14 data shown. ** - Straight averages used Source: Colliers International.

- 20. P. 20 | COLLIERS INTERNATIONAL HIGHLIGHTS | Q3 2014 | OFFICE | NORTH AMERICA Glossary Inventory — Includes all existing multi- or single-tenant leased and owner-occupied office properties greater than or equal to 10,000 square feet (net rentable area). In some larger markets this minimum size threshold may vary up to 50,000 square feet. Does not include medical or government buildings. Vacancy Rate — Percentage of total inventory physically vacant as of the survey date, including direct vacant and sublease space. Absorption — Net change in physically occupied space over a given period of time. New Supply — Includes completed speculative and build-to-suit construction. New supply quoted on a net basis after any demolitions or conversions. Annual Quoted Rent — Includes all costs associated with occupying a full floor in the mid-rise portion of a Class A building, inclusive of taxes, insurance, maintenance, janitorial and utilities (electricity surcharges added where applicable). All office rents in this report are quoted on an annual, gross per square foot basis. Rent calculations do not include sublease space. Cap Rate — (Or going-in cap rate) Capitalization rates in this survey are based on multi-tenant institutional grade buildings fully leased at market rents. Cap rates are calculated by dividing net operating income (NOI) by purchase price. NOTE: SF = square feet MSF = million square feet PSF = per square foot CBD = central business district COLLIERS INTERNATIONAL 601 Union Street, Suite 4800 Seattle, WA 98101 TEL +1 206 695 4200 FOR MORE INFORMATION Andrea B. Cross Office Research Manager | USA TEL +1 415 288 7892 EMAIL andrea.cross@colliers.com CONTRIBUTORS Jeff Simonson Senior Research Analyst | USA Cliff Plank National Director | GIS Mapping 485 offices in 63 countries on 6 continents United States: 146 Canada: 44 Latin America: 25 Asia Pacific: 186 EMEA: 84 • $2.1 billion in annual revenue • 15,800 professionals and staff • 1.46 billion square feet under management • $75 billion in total transaction value Copyright © 2014 Colliers International. The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult their professional advisors prior to acting on any of the material contained in this report. Accelerating success. VACANCY RATES 13.46 8.43 60% of the 110 MSF underway in North America is located in the top 10 metro areas