NEPT Roth Target Increase

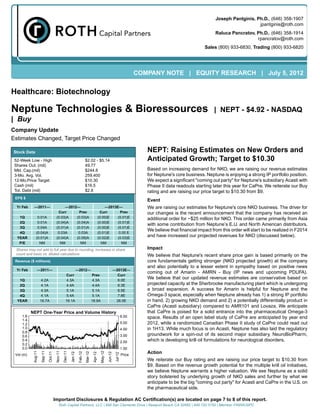

- 1. Joseph Pantginis, Ph.D., (646) 358-1907 jpantginis@roth.com Raluca Pancratov, Ph.D., (646) 358-1914 rpancratov@roth.com Sales (800) 933-6830, Trading (800) 933-6820 COMPANY NOTE | EQUITY RESEARCH | July 5, 2012 Healthcare: Biotechnology Neptune Technologies & Bioressources | NEPT - $4.92 - NASDAQ | Buy Company Update Estimates Changed, Target Price Changed Stock Data NEPT: Raising Estimates on New Orders and 52-Week Low - High $2.02 - $5.14 Anticipated Growth; Target to $10.30 Shares Out. (mil) 49.77 Mkt. Cap.(mil) $244.8 Based on increasing demand for NKO, we are raising our revenue estimates 3-Mo. Avg. Vol. 259,400 for Neptune's core business. Neptune is enjoying a strong IP portfolio position. 12-Mo.Price Target $10.30 We expect a significant "coming out party" for Neptune's subsidiary Acasti with Cash (mil) $16.5 Phase II data readouts starting later this year for CaPre. We reiterate our Buy Tot. Debt (mil) $2.8 rating and are raising our price target to $10.30 from $9. EPS $ Event Yr Feb —2011— —2012— —2013E— We are raising our estimates for Neptune's core NKO business. The driver for Curr Prev Curr Prev our changes is the recent announcement that the company has received an 1Q 0.01A (0.03)A (0.03)A (0.00)E (0.01)E additional order for ~$25 million for NKO. This order came primarily from Asia 2Q 0.01A (0.04)A (0.04)A (0.00)E (0.01)E with some contribution from Neptune’s E.U. and North American distributors. 3Q 0.04A (0.01)A (0.01)A (0.00)E (0.01)E We believe that financial impact from this order will start to be realized in F2014 4Q (0.04)A 0.03A 0.03A (0.01)E 0.00 E YEAR (0.01)A (0.04)A (0.09)A (0.02)E (0.03)E and have increased our projected revenues for NKO (discussed below). P/E NM NM NM NM NM Shares may not add to full year due to rounding, increases in share Impact count and basic vs. diluted calculations We believe that Neptune's recent share price gain is based primarily on the Revenue ($ millions) core fundamentals getting stronger (NKO projected growth) at the company and also potentially to a lesser extent in sympathy based on positive news Yr Feb —2011— —2012— —2013E— coming out of Amarin - AMRN - Buy (IP news and upcoming PDUFA). Curr Prev Curr 1Q 4.2A 4.3A 4.3A 6.0E We believe that our updated revenue estimates are conservative based on 2Q 4.1A 4.4A 4.4A 6.3E projected capacity at the Sherbrooke manufacturing plant which is undergoing 3Q 4.3A 5.1A 5.1A 6.5E a broad expansion. A success for Amarin is helpful for Neptune and the 4Q 4.1A 5.4A 5.1A 7.8E Omega-3 space, especially when Neptune already has 1) a strong IP portfolio YEAR 16.7A 19.1A 18.9A 26.5E in hand, 2) growing NKO demand and 2) a potentially differentially product in CaPre (Acasti subsidiary) compared to AMR101 and Lovaza. We anticipate NEPT One-Year Price and Volume History that CaPre is poised for a solid entrance into the pharmaceutical Omega-3 1.6 6.00 space. Results of an open label study of CaPre are anticipated by year end 1.4 1.2 5.00 2012, while a randomized Canadian Phase II study of CaPre could read out 1.0 4.00 in 1H13. While much focus is on Acasti, Neptune has also laid the regulatory 0.8 0.6 3.00 groundwork for a spin-out of its second major subsidiary, NeuroBioPharm, 0.4 2.00 which is developing krill oil formulations for neurological disorders. 0.2 0.0 1.00 Action Aug-11 Sep-11 Nov-11 Dec-11 May-12 Feb-12 Mar-12 Oct-11 Jan-12 Jun-12 Apr-12 Jul-12 Vol (m) Price We reiterate our Buy rating and are raising our price target to $10.30 from $9. Based on the revenue growth potential for the multiple krill oil initiatives, we believe Neptune warrants a higher valuation. We see Neptune as a solid story bolstered by underlying growth of NKO sales and further by what we anticipate to be the big "coming out party" for Acasti and CaPre in the U.S. on the pharmaceutical side. Important Disclosures & Regulation AC Certification(s) are located on page 7 to 8 of this report. Roth Capital Partners, LLC | 888 San Clemente Drive | Newport Beach CA 92660 | 949 720 5700 | Member FINRA/SIPC

- 2. NEPTUNE TECHNOLOGIES & BIORESSOURCES Company Note - July 5, 2012 Raising estimates on Neptune’s Core Business (NKO Growth) We are raising our estimates for Neptune, which also impacts our valuation (discussed below) to the upside. The driver for our changes is the recent announcement that the company has received an additional order for ~$25 million for NKO. This order came primarily from Asia with some contribution from Neptune’s E.U. and North American distributors. We believe that financial impact from this order will start to be realized in F2014. For F2013, we believe that Neptune’s core operations will run just around break even and cut its loss in half from F2012; ($0.04) to ($0.02) based on current projected NKO revenue growth (excluding the recent $25 million additional order). Manufacturing capacity is projected, by management, to be able to support ~$80 million in NKO revenue in 2014. Taking into account the additional order from Asia (excludes SKFC potential) and the expected growth from current supplier initiatives we are adjusting our revenue estimates in the following manner: • 2014 - $34.61 million raised to $39.59 million • 2015 - $37.31 million raised to $44.34 million • 2016 - $42.72 million raised to $55.43 million We believe our estimates could be conservative based on the anticipated additional capacity, and look forward to Neptune’s ability to hit a strong stride in strengthening its NKO franchise. There are two key areas of specific potential upside 1. Inclusion of revenues from the SKFC collaboration in China. We are not including revenue estimates from this broad collaboration currently and look toward further visibility of manufacturing buildout. 2. We are conservative in our current NKO revenue estimates, in our belief, taking into consideration that they do not approach full capacity estimates for the Sherbrooke plant as well as the overall competitive landscape for Omega-3 products. From a valuation perspective, our revenue changes impact our EPS estimates. We still value Neptune’s core business based on projected 2016 EPS however have raised our estimate from $0.22 to $0.30 ($2.55 per share contribution raised to $3.80 per share contribution to our valuation). Our new $3.80 per share portion of our valuation is based on a 20x multiple on projected 2016 EPS of $0.30 discounted at 20%. The remainder of our valuation contributing to our new $10.30 price target (increased from $9) comes from the Acasti subsidiary and the potential for CaPre (discussed below). Acasti Neptune’s subsidiary Acasti has received feedback following discussions with the FDA for CaPre (pharmaceutical grade krill oil). The agency recommended the addition of a 4 gm dose in hypertriglyceridemia, and Acasti has included a treatment arm for the 4 gm dose for the ongoing open label, dose escalation Canadian study of CaPre in patients with moderate to high triglycerides (TGs). Results of this study are anticipated by year end 2012, while a randomized Canadian Phase II study of CaPre could read out in early 2013. Management has noted that enrollment is progressing well for both studies, and we believe PK/PD as well as clinical data from these studies may support the smooth transition to the planned U.S. clinical program. Phase II Open Label Study (ongoing) The primary endpoint of the study is to test the dose-dependent effect of increasing doses of CaPre on fasting plasma triglycerides in patients with hypertriglyceridemia (TG >2.28 and <10 nmol/L or 200-877 mg/dL). It is an open label prospective study testing doses of 0.5, 1, 2 and 4 gm per day for 8 weeks and will be compared to current standards. The first patient enrolled in the study in December 2011 and will enroll ~276 patients, each followed for 8 weeks. Page 2 of 8

- 3. NEPTUNE TECHNOLOGIES & BIORESSOURCES Company Note - July 5, 2012 Phase II Randomized Study (ongoing) The primary endpoint of this study is to test the dose-dependent effect on fasting triglycerides per day as compared to placebo in patients with hypertriglyceridemia. It is a blinded prospective, randomized study testing doses of 1 and 2 gm per day compared to placebo (patients with 200-877 mg/dL TGs at baseline). The first patient was enrolled in the study in October 2011 and will enroll ~429 patients, each followed for 12 weeks. The main focus for Acasti now is to move the CaPre program quickly into the U.S. To this end, the company has the following objectives in F2013: • Product development o Molecular characterization o Pilot GMP production plant design and development • IND-enabling studies o Complete preclinical studies for U.S. IND filing • Clinical Trials o Report data from the randomized Phase II Canadian study o Report data from the open label Phase II Canadian study o Select and hire a CRO to manage the planned U.S. Phase III o Recruit Principal Investigator for planned Phase III • Regulatory o GMP validations of process and packaging o Prepare IND package for U.S.; including drug master file, CMC optimization and Phase II results • Business Development meetings ongoing From a corporate standpoint, Acasti is also looking to list on the Nasdaq in the U.S. as well as secure financing for the planned Phase III study. NeuroBioPharm NeuroBioPharm is Neptune’s other major subsidiary, along with Acasti. Recently the company has made significant progress in navigating the regulatory filing process with SEDAR in Canada regarding the planned spin-out of the company. In short, a final prospectus has been filed defining the framework of the terms to Neptune investors. ~2 million “units” will be distributed to Neptune shareholders. One “unit” equals 24.9 Neptune shares under the current framework. The unit will be defined as 1 share of NeuroBioPharm and 2 warrants. One warrant has a strike price of $0.40 per share, which is attributable to NeuroBioPharm and the second warrant has a strike price of $0.35 per share and is attributable to Neptune. Neptune will still own approximately 76% of NeuroBioPharm after the anticipated spin- out. NeuroBioPharm is developing omega-3 products based on data to date from different groups which have shown initial promise in neurological disorders. The business model is a bit of hybrid between Neptune and Acasti (described below) in that the company is looking at both functional food (OTC) formulations of omega-3 as well as prescription pharmaceutical grade omega-3. The subsidiary is looking to 1) grow short term revenues through the sales of medical foods and OTC products, 2) successfully develop the pharmaceutical grade product and initiate a Phase II study, 3) achieve regulatory approval for a Phase III clinical trial towards an NDA for the treatment of neurodegenerative disorders and 4) within one to two years, apply to list its Class A Shares on the TSX Venture Exchange. Page 3 of 8

- 4. NEPTUNE TECHNOLOGIES & BIORESSOURCES Company Note - July 5, 2012 VALUATION We reiterate our Buy rating and are raising our price target to $10.30 from $9.00. Our valuation of Neptune is based on a sum of the parts analysis: s Probability weighted clinical net present value (NPV) model of the pharmaceutical, CaPre, initial cardiovascular opportunity with Neptune’s Acasti subsidiary. s A discounted earnings valuation on Neptune’s core revenue and earnings on the sale of bulk krill oil (primarily NKO currently). Factors that could impede shares of Neptune from reaching our price target include negative data readouts from ongoing clinical studies, any perceived delays in the CaPre regulatory path as well as Neptune's ability to continue to fund its operations and monetize its expansion plans for NKO manufacturing. RISKS s Capacity expansion. Neptune is currently at or near full capacity in the manufacturing of NKO. The company is now in the expansion phase for its Sherbrooke Canada facility with the goal of taking the current capacity of 130,000 kg per year to >400,000 kg per year in 2014 and approximately doubled over the next year. In line with this capacity expansion is the expectation for increased revenue growth. Any potential delays in the timelines in building out the expansion could have a deleterious effect on the company’s business model. s Time behind the competition. The medical benefits of omega-3’s, specifically pharmaceutical grade formulations (Lovaza, AMR101, CaPre) have been shown in multiple clinical trials. Drugs such as Lovaza have laid important groundwork as the market prepares for additional and differentiated products. To this end, AMR101 has the potential to significantly impact Lovaza’s market share, in our belief. Neptune/Acasti’s CaPre is entering a large Phase II study in high triglyceride patients. Therefore the product is several years behind AMR101 for potential commercialization. s Market perception and education for differentiated profile of krill oil (NKO/CaPre). While potential CaPre pharmaceutical sales should be driven by physician prescribing habits for patients with high triglycerides, we believe patients still need to be educated about the differentiation of krill oil compared to the multitude of omega-3 products available both off the shelf and through Lovaza and potentially AMR101 prescriptions. While we do not believe this is a large risk for the company, Neptune/Acasti will need to be cognizant of addressing the market properly. s Financing and clinical trial risks. As with all drug development companies the need to continually fund drug development exists. Should Neptune not be able to secure sufficient funding to grow its underlying business, it could significantly impact the valuation of the shares. The company does have the potential to offset this risk by having a revenue stream which is expected to grow from the sale of bulk krill oil to distributors and subsidiaries. Additionally the pharmaceutical development pathway being pursued by Acasti and NeuroBioPharm are critical to Neptune's success. Any failed or inconclusive clinical trials could significantly impact Neptune's shares. COMPANY DESCRIPTION Neptune Technologies & Bioressources Inc. researches, develops and commercializes proprietary bioactive ingredients and products with the goal of superior added-value and clinically proven health benefits. The Company extracts a range of bioactive ingredients such as novel proprietary omega-3 phospholipids from abundant yet underexploited marine biomass including Krill, a cold deep water zooplankton. Neptune’s first commercially available product is Neptune Krill Oil (NKO®), which represents marine based omega-3 phospholipids with potential in cardiovascular, cognitive and anti-inflammatory disorders. Neptune is pursuing market opportunities in the nutraceutical market including dietary supplements and functional foods. The Company is also pursuing opportunities in the pharmaceutical market through its pharmaceutical subsidiaries, Acasti and NeuroBioPharm (including medical food, over-the-counter and prescription drug applications). Page 4 of 8

- 5. NEPTUNE TECHNOLOGIES & BIORESSOURCES Company Note - July 5, 2012 (Cdn$ in millions except per share data) - February fiscal year Profit & Loss 2010A 2011A 2012A 2013E 2014E 2015E 2016E License and milestone 0.0 0.0 0.0 1.0 1.8 4.5 8.2 Contract manufacturing 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Product and royalty 12.7 16.6 19.1 25.5 39.6 44.3 55.4 Other revenues 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Revenues 12.7 16.6 19.1 26.5 41.4 48.8 63.6 CoGS 11.2 7.4 9.1 13.0 19.8 22.2 27.7 Gross Profit 1.5 9.2 10.1 13.5 21.6 26.7 35.9 Gross margin 12% 56% 53% 51% 52% 55% 56% G&A 0.0 8.1 11.9 12.1 12.4 12.7 13.0 R&D 2.7 2.8 3.9 4.1 4.2 4.4 4.7 Other op ex 1.9 0.0 0.0 0.0 0.0 0.0 0.0 EBIT (3.1) (1.6) (5.7) (2.7) 5.1 9.6 18.2 EBIT margin nm nm nm nm 12% 20% 29% EBITDA (3.1) (1.6) (5.7) (2.7) 5.1 9.6 18.2 EBITDA margin nm nm nm nm 12% 20% 29% Non operating expenses 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Net Interest Income/Other 2.3 1.8 3.2 2.0 0.4 0.6 1.1 Interest expense 0.7 0.6 0.4 0.4 0.2 0.2 0.2 EBT (1.5) (0.4) (2.9) (1.1) 5.3 9.9 19.1 EBT margin nm nm nm nm 13% 20% 30% Provision for taxes 0.0 0.0 (1.0) 0.0 0.0 0.0 1.0 Net Income (1.5) (0.4) (1.9) (1.1) 5.3 9.9 18.1 Participation of preffered stock (0.0) (0.0) (0.0) 0.0 0.0 0.0 0.0 Net Income to common (1.5) (0.4) (1.9) (1.1) 5.3 9.9 18.1 net margin nm nm nm nm 13% 20% 29% NoSH -basic 37.9 40.5 48.2 49.0 50.5 55.0 55.5 NoSH-diluted 37.9 40.5 48.2 49.0 53.5 59.0 60.0 EPS - basic (0.04) (0.01) (0.04) (0.02) 0.10 0.18 0.33 EPS - diluted (0.04) (0.01) (0.04) (0.02) 0.10 0.17 0.30 Source: Company documents and ROTH Capital Partners estimates Page 5 of 8

- 6. NEPTUNE TECHNOLOGIES & BIORESSOURCES Company Note - July 5, 2012 Quarterly P&L May Aug Nov Feb May Aug Nov Feb February fiscal year (Cdn$) Q1'12A Q2'12A H1'12A Q3'12A 9M'12A Q4'12A FY'12A Q1'13E Q2'13E H1'13E Q3'13E 9M'13E Q4'13E FY'13E License and milestone 0.00 0.00 0.00 0.00 0.00 0.00 0.0 0.00 0.00 0.00 0.50 0.50 0.50 1.0 Contract manufacturing 0.00 0.00 0.00 0.00 0.00 0.00 0.0 0.00 0.00 0.00 0.00 0.00 0.00 0.0 Product and royalty 4.28 4.35 8.64 5.12 13.76 5.37 19.1 6.00 6.25 12.25 6.48 18.73 6.81 25.5 Other revenues 0.00 0.00 0.00 0.00 0.00 0.00 0.0 0.00 0.00 0.00 0.00 0.00 0.00 0.0 Revenues 4.28 4.35 8.64 5.12 13.76 5.37 19.1 6.00 6.25 12.25 6.98 19.23 7.31 26.5 CoGS 2.06 2.13 4.19 2.39 6.58 2.48 9.1 3.00 3.10 6.10 3.25 9.35 3.65 13.0 Gross Profit 2.22 2.22 4.45 2.73 7.17 2.89 10.1 3.00 3.15 6.15 3.73 9.88 3.66 13.5 Gross margin 52% 51% 51% 53% 52% 54% 53% 50% 50% 50% 53% 51% 50% 51% G&A 2.46 2.75 5.21 2.88 8.09 3.80 11.9 2.94 2.99 5.93 3.06 8.99 3.14 12.1 R&D 0.74 1.50 2.23 1.71 3.94 -0.03 3.9 0.78 0.90 1.68 1.15 2.83 1.27 4.1 Other op ex -0.01 0.00 -0.01 0.00 -0.01 0.01 0.0 0.00 0.00 0.00 0.00 0.00 0.00 0.0 EBITDA (1.0) (2.0) (3.0) (1.9) (4.8) (0.9) (5.7) (0.7) (0.7) (1.5) (0.5) (1.9) (0.8) (2.7) EBITDA margin nm nm Non operating expenses 0.00 0.00 0.00 0.00 0.00 0.00 0.0 0.00 0.00 0.00 0.00 0.00 0.00 0.0 Net Interest Income/Other 0.14 0.25 0.40 1.36 1.75 1.44 3.2 0.50 0.50 1.00 0.50 1.50 0.50 2.0 Interest expense 0.44 0.00 0.44 0.00 0.44 (0.06) 0.4 0.00 0.00 0.00 0.00 0.00 0.40 0.4 EBT (1.3) (1.8) (3.0) (0.5) (3.5) 0.6 (2.9) (0.2) (0.2) (0.5) 0.0 (0.4) (0.7) (1.1) EBT margin nm nm Provision for taxes 0.00 0.00 0.00 0.00 0.00 (1.00) (1.0) 0.00 0.00 0.00 0.00 0.00 0.00 0.0 Participation of preferred stock Net Income to common (1.3) (1.8) (3.0) (0.5) (3.5) 1.6 (1.9) (0.2) (0.2) (0.5) 0.0 (0.4) (0.7) (1.1) net margin nm nm NoSH-basic 48.3 49.0 48.69 49.58 48.99 49.10 48.21 50.0 50.0 50.00 50.00 50.00 50.00 49.00 NoSH-diluted 48.3 49.0 48.69 49.58 48.99 50.00 48.21 52.0 52.0 52.00 52.00 52.00 52.00 49.00 EPS - basic (0.03) (0.04) (0.06) (0.01) (0.07) 0.03 (0.04) (0.00) (0.00) (0.01) 0.00 (0.01) (0.01) (0.02) EPS - diluted (0.03) (0.04) (0.06) (0.01) (0.07) 0.03 (0.04) (0.00) (0.00) (0.01) 0.00 (0.01) (0.01) (0.02) Source: Company documents and ROTH Capital Partners estimates Joseph Pantginis, Ph.D. jpantginis@roth.com Page 6 of 8

- 7. NEPTUNE TECHNOLOGIES & BIORESSOURCES Company Note - July 5, 2012 Regulation Analyst Certification ("Reg AC"): The research analyst primarily responsible for the content of this report certifies the following under Reg AC: I hereby certify that all views expressed in this report accurately reflect my personal views about the subject company or companies and its or their securities. I also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Disclosures: ROTH makes a market in shares of Neptune Technologies & Bioressources and as such, buys and sells from customers on a principal basis. On September 28, 2010, ROTH changed its rating system in order to replace the Hold rating with Neutral. On May 26, 2011, ROTH changed its rating system in order to incorporate coverage that is Under Review. Each box on the Rating and Price Target History chart above represents a date on which an analyst made a change to a rating or price target, except for the first box, which may only represent the first note written during the past three years. Distribution Ratings/IB Services shows the number of companies in each rating category from which Roth or an affiliate received compensation for investment banking services in the past 12 month. Distribution of IB Services Firmwide IB Serv./Past 12 Mos. as of 07/05/12 Rating Count Percent Count Percent Buy [B] 206 72.28 72 34.95 Neutral [N] 66 23.16 5 7.58 Sell [S] 2 0.70 0 0 Under Review [UR] 10 3.51 5 50.00 Our rating system attempts to incorporate industry, company and/or overall market risk and volatility. Consequently, at any given point in time, our investment rating on a stock and its implied price movement may not correspond to the stated 12- month price target. Ratings System Definitions - ROTH employs a rating system based on the following: Buy: A rating, which at the time it is instituted and or reiterated, that indicates an expectation of a total return of at least 10% over the next 12 months. Neutral: A rating, which at the time it is instituted and or reiterated, that indicates an expectation of a total return between negative 10% and 10% over the next 12 months. Sell: A rating, which at the time it is instituted and or reiterated, that indicates an expectation that the price will depreciate by more than 10% over the next 12 months. Under Review [UR]: A rating, which at the time it is instituted and or reiterated, indicates the temporary removal of the prior rating, price target and estimates for the security. Prior rating, price target and estimates should no longer be relied upon for UR-rated securities. Not Covered [NC]: ROTH does not publish research or have an opinion about this security. Page 7 of 8

- 8. NEPTUNE TECHNOLOGIES & BIORESSOURCES Company Note - July 5, 2012 ROTH Capital Partners, LLC expects to receive or intends to seek compensation for investment banking or other business relationships with the covered companies mentioned in this report in the next three months. The material, information and facts discussed in this report other than the information regarding ROTH Capital Partners, LLC and its affiliates, are from sources believed to be reliable, but are in no way guaranteed to be complete or accurate. This report should not be used as a complete analysis of the company, industry or security discussed in the report. Additional information is available upon request. This is not, however, an offer or solicitation of the securities discussed. Any opinions or estimates in this report are subject to change without notice. An investment in the stock may involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. Additionally, an investment in the stock may involve a high degree of risk and may not be suitable for all investors. No part of this report may be reproduced in any form without the express written permission of ROTH. Copyright 2012. Member: FINRA/SIPC. Page 8 of 8