Gold surges as risk of 1979-style oil shock rises

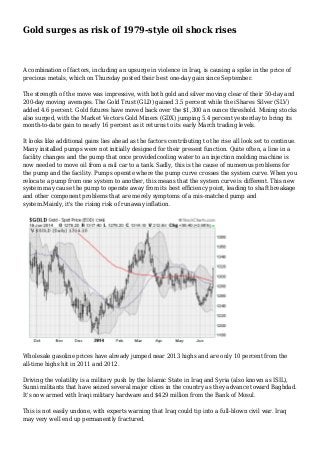

- 1. Gold surges as risk of 1979-style oil shock rises A combination of factors, including an upsurge in violence in Iraq, is causing a spike in the price of precious metals, which on Thursday posted their best one-day gain since September. The strength of the move was impressive, with both gold and silver moving clear of their 50-day and 200-day moving averages. The Gold Trust (GLD) gained 3.5 percent while the iShares Silver (SLV) added 4.6 percent. Gold futures have moved back over the $1,300 an ounce threshold. Mining stocks also surged, with the Market Vectors Gold Miners (GDX) jumping 5.4 percent yesterday to bring its month-to-date gain to nearly 16 percent as it returns to its early March trading levels. It looks like additional gains lies ahead as the factors contributing to the rise all look set to continue. Many installed pumps were not initially designed for their present function. Quite often, a line in a facility changes and the pump that once providedcooling water to an injection molding machine is now needed to move oil from a rail car to a tank. Sadly, this is the cause of numerous problems for the pump and the facility. Pumps operate where the pump curve crosses the system curve. When you relocate a pump from one system to another, this means that the system curve is different. This new system may cause the pump to operate away from its best efficiency point, leading to shaft breakage and other component problems that are merely symptoms of a mis-matched pump and system.Mainly, it's the rising risk of runaway inflation. Wholesale gasoline prices have already jumped near 2013 highs and are only 10 percent from the all-time highs hit in 2011 and 2012. Driving the volatility is a military push by the Islamic State in Iraq and Syria (also known as ISIL), Sunni militants that have seized several major cities in the country as they advance toward Baghdad. It's now armed with Iraqi military hardware and $429 million from the Bank of Mosul. This is not easily undone, with experts warning that Iraq could tip into a full-blown civil war. Iraq may very well end up permanently fractured.

- 2. For the West, this is the worst-of-all-possible outcomes and risks a repeat of the oil shock of 1979 that led to a surge of inflation, twin recessions and 20-percent-plus interest rates. Politicians aren't exactly helping with talk of a new 12 cent increase to the federal gas tax. The situation in Iraq is putting into play the one thing that central bankers -- who've been busily juicing the economy with cheap-money stimulus -- fear most: an energy-price- fueled spike in inflation. A near trebling of pentair pumps crude-oil prices between early 2007 and the middle of 2008 is now widely seen as one of the main catalysts that popped the housing bubble and threw the economy into recession. A similar, less-dramatic situation played out during the Arab Spring uprisings of 2011, with crude oil prices rising 50 percent. That forced the Federal Reserve to pull the plug on its bond-buying program, putting a lid on stock-market gains that year as the promise of more cheap money dried up. Play Video MoneyWatch Crisis in Iraq pushes oil prices to 6-year high Thanks in part to the crisis in Iraq, crude oil prices are now the highest they've been since 2008. Also, Mattel unveils a version of Barbie read... It's a big deal because higher energy prices not only hit consumers at an already vulnerable time, but could also force a quicker-than-expected hike in short-term interest rates. Federal Chair Janet Yellen would be stuck between her twin mandates of full employment and price stability. She would need to try to engineer a painful downturn in lower energy demand and bring prices back down.

- 3. Given Wednesday's dovish Fed policy announcement and press conference -- in which Yellen essentially dismissed the recent rise in consumer price inflation to a 2.1 percent annual rate as "noisy" -- it's clear they will wait until inflation gets much worse before taking any anti-inflation action. Given the lags inherent in the transmission of monetary policy, by the time the Fed reacts to the rise in energy prices, it may be too late. That means the inflation rate is likely to move toward three percent in the months to come, and perhaps as high as four percent in 2015. The result would be what economists call "stagflation," or the combination of economic stagnation and inflation. Japan is suffering a bout of this right now, which is why the Bank of Japan, which has been the most aggressive major central bank in its cheap-money injections, is whispering that it's looking to exit its stimulus policies. It stresses the imagination to envision the outcome of this scenario amid a record national debt, swollen corporate-debt levels, fragile household finances, ultra-low bond yields and a frothy stock market.

- 4. This was also the nightmare scenario the U.S. suffered through in the 1970s under Federal Reserve chairmen Arthur Burns and George Miller. That irrigation pumps and motors was the last time the Fed pushed real interest rates down as far as we've seen them lately (as shown in the chart above). A series of oil price shocks in 1973 and 1979 unleashed double-digit inflation and growing unemployment amid the flood of money. The 1979 crisis was connected to the Iranian revolution, the rise of an extreme Islamic militia within a major oil-producing country, and a mere four percent drop in global oil supply. Replace Ayatollah Khomeini with ISIL leader Abu Bakr al-Baghdadi, and the setup is pretty similar. The moral of the story: Cheap money stimulus is all fun and games until the Middle East blows up. The situation on the ground in Iraq remains in flux with conflicting reports about who controls Iraq's huge Baiji refinery north of Baghdad -- with 310,000 daily barrels of refining capacity -- which has been shut down amid security threats. Western oil companies are also evacuating workers from southern oil fields, potentially crimping the flow of crude into the Persian Gulf. Play Video CBS Evening News Iraq in danger of split as divisions grow Kurdish fighters north of Kirkuk are disciplined and well-equipped, but their goal is to protect their own region in the Northeast, not drive ISI... Further gains in energy prices are likely that could soon start trickling into the inflation-rate data. Other infrastructure at risk includes the large Iraq-Turkey oil pipeline (ITP) that runs north and has been shut for maintenance and repair, as well as another large oil refinery, the Daura facility, in the disputed region with a capacity of 300,000 barrels per day. Overall in April, Iraq produced 3.34 million barrels per day, versus a sustainable production capacity of 3.65 million barrels, according to Deutsche Bank. For now, I continue to recommend investors protect themselves by moving into attractively valued precious metals stocks and trade low-yielding fixed-income exposure for the inflation protection of gold and silver. The ETFs mentioned at the start of this article would be good picks for conservative investors. For the more aggressive, consider stocks like SilverCrest Mines (SVLC), which gained seven percent today and is up nearly 20 percent since I recommended it to clients last week. Another example is NovaGold (NG), which is up nearly 23 percent since being added to my Edge Letter Sample Portfolio on June 5.

- 5. Disclosure: Anthony has recommended SLV, GLD, GDX, SVLC, and NG to his clients. © 2014 CBS Interactive Inc.. All Rights Reserved.