Income tax rates

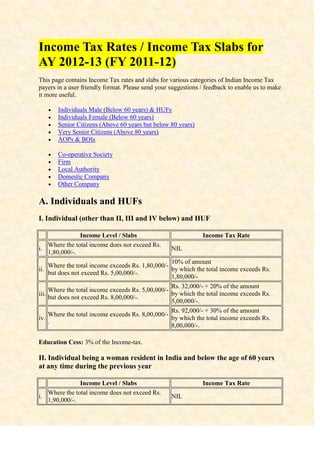

- 1. Income Tax Rates / Income Tax Slabs for AY 2012-13 (FY 2011-12) This page contains Income Tax rates and slabs for various categories of Indian Income Tax payers in a user friendly format. Please send your suggestions / feedback to enable us to make it more useful. Individuals Male (Below 60 years) & HUFs Individuals Female (Below 60 years) Senior Citizens (Above 60 years but below 80 years) Very Senior Citizens (Above 80 years) AOPs & BOIs Co-operative Society Firm Local Authority Domestic Company Other Company A. Individuals and HUFs I. Individual (other than II, III and IV below) and HUF Income Level / Slabs Income Tax Rate Where the total income does not exceed Rs. i. NIL 1,80,000/-. 10% of amount Where the total income exceeds Rs. 1,80,000/- ii. by which the total income exceeds Rs. but does not exceed Rs. 5,00,000/-. 1,80,000/- Rs. 32,000/- + 20% of the amount Where the total income exceeds Rs. 5,00,000/- iii. by which the total income exceeds Rs. but does not exceed Rs. 8,00,000/-. 5,00,000/-. Rs. 92,000/- + 30% of the amount Where the total income exceeds Rs. 8,00,000/- iv. by which the total income exceeds Rs. . 8,00,000/-. Education Cess: 3% of the Income-tax. II. Individual being a woman resident in India and below the age of 60 years at any time during the previous year Income Level / Slabs Income Tax Rate Where the total income does not exceed Rs. i. NIL 1,90,000/-.

- 2. 10% of the amount Where total income exceeds Rs. 1,90,000/- ii. by which the total income exceeds Rs. but does not exceed Rs. 5,00,000/-. 1,90,000/-. Rs. 31,000- + 20% of the amount Where the total income exceeds Rs. 5,00,000/- iii. by which the total income exceeds Rs. but does not exceed Rs. 8,00,000/-. 5,00,000/-. Rs. 91,000/- + 30% of the amount iv. Where the total income exceeds Rs. 8,00,000/- by which the total income exceeds Rs. 8,00,000/-. Education Cess: 3% of the Income-tax. III. Individual resident who is of the age of 60 years or more but below the age of 80 years at any time during the previous year Income Level / Slabs Income Tax Rate Where the total income does not exceed Rs. i. NIL 2,50,000/-. 10% of the amount Where the total income exceeds Rs. 2,50,000/- ii. by which the total income exceeds Rs. but does not exceed Rs. 5,00,000/- 2,50,000/-. Rs. 25,000/- + 20% of the amount Where the total income exceeds Rs. 5,00,000/- iii. by which the total income exceeds Rs. but does not exceed Rs. 8,00,000/- 5,00,000/-. Rs. 85,000/- + 30% of the amount iv. Where the total income exceeds Rs. 8,00,000/- by which the total income exceeds Rs. 8,00,000/-. Education Cess: 3% of the Income-tax. IV. Individual resident who is of the age of 80 years or more at any time during the previous year Income Level / Slabs Income Tax Rate Where the total income does not exceed Rs. i. NIL 5,00,000/-. 20% of the amount Where the total income exceeds Rs. 5,00,000/- ii. by which the total income exceeds Rs. but does not exceed Rs. 8,00,000/- 5,00,000/-. Rs. 60,000/- + 30% of the amount iii. Where the total income exceeds Rs. 8,00,000/- by which the total income exceeds Rs. 8,00,000/-. Education Cess: 3% of the Income-tax.

- 3. B. Association of Persons (AOP) and Body of Individuals (BOI) i. Income-tax: Income Level / Slabs Income Tax Rate Where the total income does not exceed Rs. i. NIL 1,80,000/-. 10% of amount Where the total income exceeds Rs. 1,80,000/- ii. by which the total income exceeds Rs. but does not exceed Rs. 5,00,000/-. 1,80,000/- Rs. 32,000/- + 20% of the amount Where the total income exceeds Rs. 5,00,000/- iii. by which the total income exceeds Rs. but does not exceed Rs. 8,00,000/-. 5,00,000/-. Rs. 92,000/- + 30% of the amount Where the total income exceeds Rs. 8,00,000/- iv. by which the total income exceeds Rs. . 8,00,000/-. ii. Education Cess: 3% of the Income-tax. C. Co-operative Society i. Income-tax: Income Level / Slabs Income Tax Rate Where the total income does not exceed i. 10% of the income. Rs. 10,000/-. Where the total income exceeds Rs. Rs. 1,000/- + 20% of income in excess of Rs. ii. 10,000/- 10,000/-. but does not exceed Rs. 20,000/-. Where the total income exceeds Rs. Rs. 3.000/- + 30% of the amount iii. 20,000/- by which the total income exceeds Rs. 20,000/-. ii. Surcharge: Nil iii. Education Cess: 3% of the Income-tax. D. Firm i. Income-tax: 30% of total income. ii. Surcharge: Nil iii. Education Cess: 3% of the total of Income-tax and Surcharge.

- 4. E. Local Authority i. Income-tax: 30% of total income. ii. Surcharge: Nil iii. Education Cess: 3% of Income-tax. F. Domestic Company i. Income-tax: 30% of total income. ii. Surcharge: The amount of income tax as computed in accordance with above rates, and after being reduced by the amount of tax rebate shall be increased by a surcharge at the rate of 5% of such income tax, provided that the total income exceeds Rs. 1 crore. iii. Education Cess: 3% of the total of Income-tax and Surcharge. G. Company other than a Domestic Company i. Income-tax: @ 50% of on so much of the total income as consist of (a) royalties received from Government or an Indian concern in pursuance of an agreement made by it with the Government or the Indian concern after the 31st day of March, 1961 but before the 1st day of April, 1976; or (b) fees for rendering technical services received from Government or an Indian concern in pursuance of an agreement made by it with the Government or the Indian concern after the 29th day of February, 1964 but before the 1st day of April, 1976, and where such agreement has, in either case, been approved by the Central Government. @ 40% of the balance ii. Surcharge: The amount of income tax as computed in accordance with above rates, and after being reduced by the amount of tax rebate shall be increased by a surcharge at the rate of 2.5% of such income tax, provided that the total income exceeds Rs. 1 crore. iii. Education Cess: 3% of the total of Income-tax and Surcharge.

- 5. TDS Rates and Returns for Assessment Year 2013-14 (Financial Year 2012-13) TDS Rate on Payment of Salary and Wages Section 192 Payment of Salary and Wages TDS is deducted if the estimated income of the employee is taxable. Employer must not deduct tax on non-taxable allowances like conveyance Criterion of allowance, rent allowance, medical allowance and deductible investments under Deduction sections like 80C, 80CC, 80D, 80DD, 80DDB, 80E, 80GG and 80U. No tax is required to be deducted at source if the estimated total income of the employee is less than the minimum taxable income. As per Income Tax and Education Cess at the applicable rate on the estimated TDS Rate income of employee for the year. TDS Rates on Payments other than Salary and Wages Criterion Payment to Section Total Payment For Payment of Individual No. During the Other Year or HUF From 01.04.2012 to 30.06.2012 More than Rs. 2500/- 193 Interest on Debentures 10% 10% From 01.07.2012 More than Rs. 5000/- 194 Deemed Dividend - 10% 10% More than Rs. 194 A Interest by banks or others 10% 10% 10000/- More than Rs. 194 B Winnings from Lotteries / Puzzle / Game 30% 30% 10000/- More than Rs. 194 BB Winnings from Horse Race 30% 30% 5000/- 194 C More than Rs. Payment to Contractors 1% 2% (1) 30000/-

- 6. 194 C Payment to Sub-Contractors / for More than Rs. 1% 2% (2) Advertisements 30000/- More than Rs. 194 D Payment of Insurance Commission 10% 10% 20000/- More than Rs. 194 EE Out of deposits under NSS 20% NA 2500/- More than Rs. 194 F Repurchase of units by Mutual Funds / UTI 20% 20% 1000/- More than Rs. 194 G Commission ons Sale of Lottery tickets 10% 10% 1000/- More than Rs. 194 H Commission or Brokerage 10% 10% 5000/- More than Rs. 194 I Rent of Land, Building or Furniture 10% 10% 180000/- More than Rs. 194 I Rent of Plant & Machinery 2% 2% 180000/- More than Rs. 194 J Professional / technical services, royalty 10% 10% 30000/- 194 J Remuneration / commission to director of - 10% 10% (1) the company w.e.f. 01.07.2012 194 J Any remuneration / fees / commission to a - 10% 10% (ba) director of a company, other than those on which tax is deductible under section 192. Compensation on acquisition of Capital More than Rs. 194 L 10% 10% Asset 100000/- From 01.04.2012 to 30.06.2012 More than Rs. Compensation on acquisition of certain 194 LA 100000/- 10% 10% immovable property From 01.07.2012 More than Rs. 200000/- Notes: 1. No education cess is deductible / collectible at source on payments made to residents {Individuals / HUF / Society / AOP / Firm / Domestic Company) on payment of incomes other than salary or wages. Education cess @ 3% is deductible when such payments are made to non residents and foreign companies. 2. TDS at higher rate of 20% has to be deducted if the deductee does not provide PAN to the deductor.(section 206AA) 3. Surcharge is not deductible if payment is made to a dowmwstic company. However, surcharge is deductible @ 2%, if payment is made to a company other than a domestic

- 7. company and the total of payment made / to be made during the year exceeds Rs. 1 Crore. All persons who are required to deduct tax at source or collect tax at source on behalf of Income Tax Department are required to apply for and obtain Tax Deduction or Tax Collection Account Number (TAN). Issue of TDS Certificate 1. Section 192 (TDS on Salary) : The certificate on Form No. 16 should be issued by the deductor by 31st day of May of the financial year immediately following the financial year in which the income was paid and tax deducted. 2. In all other cases : The certificate on Form No. 16A should be issued within fifteen days from the due date for furnishing the "statement of TDS" under rule 31A. Forms for submitting Quarterly Statements of Tax Deducted at Source (Rule 31A) (a) Statement of deduction of tax under section 192 in Form No. 24Q (b) Statement of deduction of tax under sections 193 to 196D in : 1. Form No. 27Q in respect of the deductee who is a non-resident not being a company or a foreign company or resident but not ordinarily resident; and 2. Form No. 26Q in respect of all other deductees. Due Dates for submitting Quarterly Statements of Tax Deducted at Source (Rule 31A) Date of ending of Due date,if deductor is an office the quarter of the Due Date for others of the Government financial year 30th June 31st July of the financial year 15th July of the financial year 30th September 31st October of the financial year 15th October of the financial year 31st December 31st January of the financial year 15th January of the financial year 15th May of the financial year 15th May of the financial year immediately following the immediately following the 31st March financial year in which deduction financial year in which deduction is made is made.

- 8. Allowable Deductions from Gross Total Income Deductions Allowable under various sections of Chapter VIA of Income Tax Act : Section 80C (Various investments) Section 80CCC (Premium for Annuity plans) Section 80CCD (Contribution to Pension Account) Section 80CCF (Investment in Infrastructure Bonds) Section 80CCG Rajiv Gandhi Equity Saving Scheme (RGESS) Section 80D (Medical/ Health Insurance) Section 80DD (Rehabilitation of Handicapped Dependent Relative) Section 80DDB (Medical Expenditure on Self or Dependent Relative) Section 80E (Interest on Loan for Higher Studies) Section 80G (Various Donations) Section 80GG (House Rent Paid) Section 80U (Employee suffering from Physical Disability) Section 80RRB (Royalty of a Patent) Section 80TTA (Interest on Savings Bank) Section 80C: This section has been introduced by the Finance Act 2005. Broadly speaking, this section provides deduction from total income in respect of various investments/ expenditures/payments in respect of which tax rebate u/s 88 was earlier available. The total deduction under this section (alongwith section 80CCC and 80CCD) is limited to Rs. 1 lakh only. Life Insurance Premium For individual, policy must be in self or spouse's or any child's name. For HUF, it may be on life of any member of HUF. Sum paid under contract for deferred annuity For individual, on life of self, spouse or any child . Sum deducted from salary payable to Govt. Servant for securing deferred annuity for self-spouse or child Payment limited to 20% of salary. Contribution made under Employee's Provident Fund Scheme. Contribution to PPF For individual, can be in the name of self/spouse, any child & for HUF, it can be in the name of any member of the family. Contribution by employee to a Recognised Provident Fund. Sum deposited in 10 year/15 year account of Post Office Saving Bank Subscription to any notified securities/notified deposits scheme. e.g. NSS Subscription to any notified savings certificate, Unit Linked Savings certificates. e.g. NSC VIII issue. Contribution to Unit Linked Insurance Plan of LIC Mutual Fund e.g. Dhanrakhsa 1989

- 9. Contribution to notified deposit scheme/Pension fund set up by the National Housing Scheme. Certain payment made by way of instalment or part payment of loan taken for purchase/construction of residential house property. Condition has been laid that in case the property is transferred before the expiry of 5 years from the end of the financial year in which possession of such property is obtained by him, the aggregate amount of deduction of income so allowed for various years shall be liable to tax in that year. Contribution to notified annuity Plan of LIC(e.g. Jeevan Dhara) or Units of UTI/notified Mutual Fund. If in respect of such contribution, deduction u/s 80CCC has been availed of rebate u/s 88 would not be allowable. Subscription to units of a Mutual Fund notified u/s 10(23D). Subscription to deposit scheme of a public sector, company engaged in providing housing finance. Subscription to equity shares/ debentures forming part of any approved eligible issue of capital made by a public company or public financial institutions. Tuition fees paid at the time of admission or otherwise to any school, college, university or other educational institution situated within India for the purpose of full time education of any two children. Available in respect of any two children Section 80CCC: Deduction in respect of Premium Paid for Annuity Plan of LIC or Other Insurer Payment of premium for annuity plan of LIC or any other insurer Deduction is available upto a maximum of Rs. 100,000/-. (This limit has been increased from Rs. 10,000/- to Rs. 1,00,000/- w.e.f. 01.04.2007). The premium must be deposited to keep in force a contract for an annuity plan of the LIC or any other insurer for receiving pension from the fund. Note: The limit for maximum deduction available under Sections 80C, 80CCC and 80CCD (combined together) is Rs. 1,00,000/- (Rs. one lac only). An additional deduction upto a maximum of Rs. 20,000/- will be available from Assessment Year 2011-12 (FY 2010-11) for investment in Infrastructure Bonds. Section 80CCD: Deduction in respect of Contribution to Pension Account Deposit made by a Central government servant in his pension account to the extent of 10% of his salary. Where the Central Government makes any contribution to the pension account, deduction of such contribution to the extent of 10% of salary shall be allowed. Further, in any year where any amount is received from the pension account such amount shall be charged to tax as income of that previous year. Section 80CCF: Investment in Long Term Infrastructure Bonds Investments in Long Term Infrastructure Bonds issued by Industrial Finance Corporation of India, LIC, Infrastructure Development Finance Company Limited or a Non-Banking Finance Company classified as an Infrastructure Finance Company by RBI with a minimum tenure of

- 10. 10 years and Lock in period of 5 years. Maximum amount of deduction available is Rs. 20,000/- The deduction is over and above the combined deduction of Rs. 100,000/- available under section 80C, 80CCC and 80DDD. The benefits under this section were extended by one year in the Budget 2011 but the same has not been done in Budget. Therefore, the deduction under this section shall not be available for AY 2013-14. Section 80CCG: Rajiv Gandhi Equity Saving Scheme (RGESS) As per the Budget 2012 anouncements, a new scheme Rajiv Gandhi Equity Saving Scheme (RGESS) will be launched. Those investors whose annual income is less than Rs. 10 lakh can invest in this scheme up to Rs. 50,000 and get a deduction of 50% of the investment. So if you invest Rs. 50,000 (maximum amount you can invest), you can claim a tax deduction of Rs. 25,000 (50% of Rs. 50,000). The details of the scheme are yet awaited. Section 80D: Deduction in respect of Medical Insurance Deduction is available upto Rs. 20,000/- for senior citizens and upto Rs. 15,000/ in other cases for insurance of self, spouse and dependent children. Additionally, a deduction for insurance of parents (father or mother or both) is available to the extent of Rs. 20,000/- if parents are senior Citizen and Rs. 15,000/- in other cases. Therefore, the maximum deduction available under this section is to the extent of Rs. 40,000/-. From AY 2013-14, within the existing limit a deduction of upto Rs. 5,000 for preventive health check-up is available. Section 80DD: Deduction in respect of Rehabilitation of Handicapped Dependent Relative Deduction of Rs. 50,000/- w.e.f. 01.04.2004 in respect of 1. Expenditure incurred on medical treatment, (including nursing), training and rehabilitation of handicapped dependent relative. 2. Payment or deposit to specified scheme for maintenance of dependent handicapped relative. Further, if the defendant is a person with severe disability a deduction of Rs. 100,000/- shall be available under this section. The handicapped dependent should be a dependent relative suffering from a permanent disability (including blindness) or mentally retarded, as certified by a specified physician or psychiatrist. Note: A person with 'severe disability' means a person with 80% or more of one or more disabilities as outlined in section 56(4) of the 'Persons with disabilities (Equal opportunities, protection of rights and full participation)' Act. Section 80DDB: Deduction in respect of Medical Expenditure on Self or Dependent Relative A deduction to the extent of Rs. 40,000/- or the amount actually paid, whichever is less is available for expenditure actually incurred by resident assessee on himself or dependent relative for medical treatment of specified disease or ailment. The diseases have been

- 11. specified in Rule 11DD. A certificate in form 10 I is to be furnished by the assessee from any Registered Doctor. Section 80E: Deduction in respect of Interest on Loan for Higher Studies Deduction in respect of interest on loan taken for pursuing higher education. The deduction is also available for the purpose of higher education of a relative w.e.f. A.Y. 2008-09. Section 80G: Deduction in respect of Various Donations The various donations specified in Sec. 80G are eligible for deduction upto either 100% or 50% with or without restriction as provided in Sec. 80G Section 80GG: Deduction in respect of House Rent Paid Deduction available is the least of 1. Rent paid less 10% of total income 2. Rs. 2000/- per month 3. 25% of total income, provided o Assessee or his spouse or minor child should not own residential accommodation at the place of employment. o He should not be in receipt of house rent allowance. o He should not have self occupied residential premises in any other place. Section 80U: Deduction in respect of Person suffering from Physical Disability Deduction of Rs. 50,000/- to an individual who suffers from a physical disability(including blindness) or mental retardation. Further, if the individual is a person with severe disability, deduction of Rs. 100,000/- shall be available u/s 80U. Certificate should be obtained from a Govt. Doctor. The relevant rule is Rule 11D. Section 80RRB: Deduction in respect of any Income by way of Royalty of a Patent Deduction in respect of any income by way of royalty is respect of a patent registered on or after 01.04.2003 under the Patents Act 1970 shall be available upto Rs. 3 lacs or the income received, whichever is less. The assessee must be an individual resident of India who is a patentee. The assessee must furnish a certificate in the prescribed form duly signed by the prescribed authority. Section 80 TTA: Deduction from gross total income in respect of any Income by way of Interest on Savings account Deduction from gross total income of an individual or HUF, upto a maximum of Rs. 10,000/-, in respect of interest on deposits in savings account ( not time deposits ) with a bank, co-operative society or post office, is allowable w.e.f. 01.04.2012 (Assessment Year 2013-14).

- 12. Deductions Allowable under Section 24 of Income Tax Act : Where a housing property has been acquired / constructed / repaired / renewed with borrowed capital, the amount of interest payable yearly on such capital is allowed as deduction under Section 24 of Income Tax Act, subject to the limits stated below. Penal interest on housing loan is not eligible for deduction. If a fresh loan has been raised to repay the original loan and the new loan has been used only for the purpose of repaying the original loan then, the interest accrued on such fresh loan is allowed for deduction. 1. If the property is acquired or constructed with the capital borrowed on or after 01-04- 1999 and such acquisition or construction is completed within 3 years of the end of the financial year in which capital was borrowed then the actual interest payable is allowed as deduction subject to a maximum Rs. 1,50,000/-. 2. In other case interest up to maximum Rs.30,000/- is deductible. 3. The ceiling of Rs.1,50,000/- or Rs. 30,000/- is only in case the property is self occupied. There is no limit on deduction of interest if the property is let out. Exempt Incomes and Allowances Information of Section 10 of I T Act relating to Individuals and HUFs. Following incomes shall not be included in computing the total taxable income: 1. Agricultural Income {Section 10(1)] 2. Subject to the provisions of sub-section (2) of section 64, any sum received by an individual as a member of a Hindu undivided family, where such sum has been paid out of the income of the family, or, in the case of any impartible estate, where such sum has been paid out of the income of the estate belonging to the family. {Section 10(2)] 3. In the case of a partner of a firm, who is separately assessed as such, his share in the total income of the firm shall not be included. {Section 10(2A)] 4. Any income by way of interest on moneys in a Non-Resident (External) Account in any bank in India in accordance with the Foreign Exchange Regulation Act, 1973 (46 of 1973), and the rules made thereunder, provided such individual accruing to a person resident outside India as defined in clause (q) of section 282 of the said Act or is a person who has been permitted by the Reserve Bank of India to maintain the aforesaid Account. {Section 10(4)(ii)] 5. The sum received (including the bonus) under a life insurance policy (other than any sum received under sub-section (3) of section 80DDA or under a Keyman insurance policy).{Section (10)(10)(D)] 6. The value of any travel concession or assistance received by, or due to a person, from his employer for himself and his family, in connection with his proceeding on leave to any place in India or from his employer or former employer for himself and his family, in connection with his proceeding to any place in India after retirement from service or after the termination of his service, subject to such conditions as may be

- 13. prescribed (including conditions as to number of journeys and the amount which shall be exempt per head) having regard to the travel concession or assistance granted to the employees of the Central Government. The amount exempt under this clause shall in no case exceed the amount of expenses actually incurred for the purpose of such travel.{Section 10(5)] 7. Any allowances or perquisites paid or allowed as such outside India by the Government to a citizen of India for rendering service outside India. {Section 10(7)] 8. View Exemptions available on Retirement benefits. 9. Any special allowance or benefit, not being in the nature of a perquisite within the meaning of clause (2) of section 17, specifically granted to meet expenses wholly, necessarily and exclusively incurred in the performance of the duties of an office or employment , to the extent to which such expenses are actually incurred for that purpose. {Section 10(13A)] 10. Income by way of interest, premium on redemption or other payment on such securities, bonds, annuity certificates, savings certificates, other certificates issued by the Central Government and deposits as the Central Government may, by notification in the Official Gazette, specify in this behalf, subject to such conditions and limits as may be specified in the said notifications.{Section 10(15)] 11. Scholarships granted to meet the cost of education.{Section 10(16)] 12. Any income to the extent such income does not exceed one thousand five hundred rupees in respect of each minor child whose income is so includible. {Section 10(32)] 13. Any income arising from the transfer of a capital asset, being a unit of the Unit Scheme, 1964. {Section 10(33)] 14. Any income by way of dividends referred to in section 115-O. {Section 10(34)] 15. Any income by way of (a) income received in respect of the units of a Mutual Fund specified under clause (23D); or (b) income received in respect of units from the Administrator of the specified undertaking; or (c) income received in respect of units from the specified company The Exemptions under this section are subjected to the conditions listed under the section. (Section 10(35)] 16. Any income arising from the transfer of a long-term capital asset, being an eligible equity share in a company purchased on or after the 1st day of March, 2003 and before the 1st day of March, 2004 and held for a period of twelve months or more. {Section 10(36)] 17. Any income chargeable under the head Capital gains to an individual or a Hindu undivided family arising from the transfer of agricultural land , where (i) such land is situate in any area referred to in item (a) or item (b) of sub-clause (iii) of clause (14) of section 2; (ii) such land, during the period of two years immediately preceding the date of transfer, was being used for agricultural purposes by such Hindu undivided family or individual or a parent of his;

- 14. (iii) such transfer is by way of compulsory acquisition under any law, or a transfer the consideration for which is determined or approved by the Central Government or the Reserve Bank of India; (iv) such income has arisen from the compensation or consideration for such transfer received by such assessee on or after the 1st day of April, 2004. {Section 10(37)] 18. Any income arising from the transfer of a long-term capital asset, being an equity share in a company or a unit of an equity oriented fund where such transaction is chargeable to securities transaction tax. {Section 10(38)] Saving Bank Interest (Section 80 TTA) : From Assessment year 2013-14, the interest earned on Savings Bank accounts upto a limit of Rs. 10,000/- is exempt from inclusion in Gross Total Income for the purpose of Income Tax. Taxability of Retirement Benefits Gratuity Commutation of Pension Leave Encashment Retrenchment Compensation Compensation on Voluntary Retirement Payment from Provident Fund Payment from Superannuation Fund On retirement, an employee normally receives certain retirement benefits. Such benefits are taxable under the head 'Salaries' as 'profits in lieu of Salaries' as provided in section 17(3). However, in respect of some of them, exemption from taxation is granted u/s 10 of the Income Tax Act, either wholly or partly. These exemptions are described below:- Gratuity {Section 10(10)]: 1. Any death cum retirement gratuity received by Central and State Govt. employees, Defense employees and employees in Local authority shall be exempt. 2. Any gratuity received by persons covered under the Payment of Gratuity Act, 1972 shall be exempt subject to following limits:- o For every completed year of service or part thereof, gratuity shall be paid at the rate of fifteen days wages based on the rate of wages last drawn by the concerned employee. o The amount of gratuity as calculated above shall not exceed Rs. 3,50,000/- (w.e.f. 24.9.97). 3. In case of any other employee, gratuity received shall be exempt, subject to the following exemptions o Exemption shall be limited to half month salary (based on last 10 months average) for each completed year of service or Rs. 3.5 Lakhs whichever is less.

- 15. o Where the gratuity was received in any one or more earlier previous years also and any exemption was allowed for the same, then the exemption to be allowed during the year gets reduced to the extent of exemption already allowed, the overall limit being Rs. 3.5. Lakhs. The exemption in respect of gratuity is permissible even in cases of termination of employment due to resignation. The taxable portion of gratuity will quality for relief u/s 89(1). Gratuity payment to a widow or other legal heirs of any employee who dies in active service shall be exempt from income tax. Commutation of Pension {Section 10(10A)]: 1. In case of employees of Central & State Govt., Local Authority, Defense Services and corporations established under Central or State Acts, the entire commuted value of pension is exempt. 2. In case of any other employee, if the employee receives gratuity, the commuted value of 1/3 of the pension is exempt, otherwise, the commuted value of ½ of the pension is exempt. Note: 1. Where any such payments are received by an employee from more than one employer in the same previous year, the aggregate amount exempt from income-tax shall not exceed the limit i.e. Rs. 350000/-. 2. Where any such payment or payments was or were received in any one or more earlier previous years also and the whole or any part of the amount of such payment or payments was or were not included in the total income of the assessee of such previous year or years, the aggregate amount exempt from income-tax shall not exceed the limit of Rs. 350000/-. Leave Encashment{Section 10(10AA)]: 1. Leave Encashment during service is fully taxable in all cases, relief u/s 89(1), if applicable, may be claimed for the same. 2. Payment by way of leave encashment received by Central & State Govt. employees at the time of retirement in respect of the period of earned leave at credit is fully exempt. 3. In case of other employees, the exemption is to be limited to a maximum of 10 months of leave encashment, based on last 10 months average salary. This is further subject to a limit of Rs. 3,00,000/-. 4. Leave salary paid to legal heirs of a deceased employee in respect of privilege leave standing to the credit of such employee at the time of death is not taxable. 5. Provided that where any such payments are received by an employee from more than one employer in the same previous year, the aggregate amount exempt from income- tax under sub-clause 42 shall not exceed the specified limit i.e. Rs. 300000/-. For the purpose of Section 10(10AA), the term 'Superannuation or otherwise' covers resignation.

- 16. Retrenchment Compensation (Sec. 10(10B): Retrenchment compensation received by a workman under the Industrial Dispute Act 1947 or any other Act or Rules is exempt subject to following limits: 1. Compensation calculated @ fifteen days average pay for every completed year of continuous service or part there of in excess of 6 months. 2. The above is further subject to an overall limit of Rs. 5,00,000/- for retrenchment on or after 1.1.1997. Compensation on Voluntary Retirement or 'Golden Handshake' {Sec. 10(10C)]: 1. Payment received by an employee of the following at the time of voluntary retirement, or termination of service is exempt to the extent of Rs. 5 Lakh: o Public Sector Company. o Any other company. o Authority establishment under State, Central or provincial Act. o Local Authority. o Co-operative Societies, Universities, IITs and Notified Institutes of Management. o Any State Government or the Central Government. 2. The voluntary retirement Scheme under which the payment is being made must be framed in accordance with the guidelines prescribed in Rule 2BA of Income Tax Rules. In case of a company other than a public sector company and a co-operative society, such scheme must be approved by the Chief Commissioner/ Director General of Income-tax. However, such approval is not necessary from A.Y. 2001-2002 onwards. 3. Where exemption has been allowed under above section for any assessment year, no exemption shall be allowed in relation to any other assessment year. Payment from Provident Fund{Sec. 10(11), Sec.10(12)]: Any payment received from a Statutory Provident Fund, (i.e. to which the Provident Fund Act, 1925 applies) is exempt. Any payment from any other provident fund notified by the Central Govt. is also exempt. The Public Provident Fund (PPF) established under the PPF Scheme, 1968 has been notified for this purpose. Besides the above, the accumulated balance due and becoming payable to an employee participating in a Recognized Provident Fund is also exempt to the extent provided in Rule 8 of Part A of the Fourth Schedule of the Income Tax Act. Payment from Superannuation Fund{Sec.10(13)]: Payment from an Approved Superannuation Fund will be exempt provided the payment is made in the circumstances specified in the section viz. death, retirement and incapacitation.

- 17. Exempt Incomes and Allowances Information of Section 10 of I T Act relating to Individuals and HUFs. Following incomes shall not be included in computing the total taxable income: 1. Agricultural Income {Section 10(1)] 2. Subject to the provisions of sub-section (2) of section 64, any sum received by an individual as a member of a Hindu undivided family, where such sum has been paid out of the income of the family, or, in the case of any impartible estate, where such sum has been paid out of the income of the estate belonging to the family. {Section 10(2)] 3. In the case of a partner of a firm, who is separately assessed as such, his share in the total income of the firm shall not be included. {Section 10(2A)] 4. Any income by way of interest on moneys in a Non-Resident (External) Account in any bank in India in accordance with the Foreign Exchange Regulation Act, 1973 (46 of 1973), and the rules made thereunder, provided such individual accruing to a person resident outside India as defined in clause (q) of section 282 of the said Act or is a person who has been permitted by the Reserve Bank of India to maintain the aforesaid Account. {Section 10(4)(ii)] 5. The sum received (including the bonus) under a life insurance policy (other than any sum received under sub-section (3) of section 80DDA or under a Keyman insurance policy).{Section (10)(10)(D)] 6. The value of any travel concession or assistance received by, or due to a person, from his employer for himself and his family, in connection with his proceeding on leave to any place in India or from his employer or former employer for himself and his family, in connection with his proceeding to any place in India after retirement from service or after the termination of his service, subject to such conditions as may be prescribed (including conditions as to number of journeys and the amount which shall be exempt per head) having regard to the travel concession or assistance granted to the employees of the Central Government. The amount exempt under this clause shall in no case exceed the amount of expenses actually incurred for the purpose of such travel.{Section 10(5)] 7. Any allowances or perquisites paid or allowed as such outside India by the Government to a citizen of India for rendering service outside India. {Section 10(7)] 8. View Exemptions available on Retirement benefits. 9. Any special allowance or benefit, not being in the nature of a perquisite within the meaning of clause (2) of section 17, specifically granted to meet expenses wholly, necessarily and exclusively incurred in the performance of the duties of an office or employment , to the extent to which such expenses are actually incurred for that purpose. {Section 10(13A)] 10. Income by way of interest, premium on redemption or other payment on such securities, bonds, annuity certificates, savings certificates, other certificates issued by the Central Government and deposits as the Central Government may, by notification in the Official Gazette, specify in this behalf, subject to such conditions and limits as may be specified in the said notifications.{Section 10(15)] 11. Scholarships granted to meet the cost of education.{Section 10(16)]

- 18. 12. Any income to the extent such income does not exceed one thousand five hundred rupees in respect of each minor child whose income is so includible. {Section 10(32)] 13. Any income arising from the transfer of a capital asset, being a unit of the Unit Scheme, 1964. {Section 10(33)] 14. Any income by way of dividends referred to in section 115-O. {Section 10(34)] 15. Any income by way of (a) income received in respect of the units of a Mutual Fund specified under clause (23D); or (b) income received in respect of units from the Administrator of the specified undertaking; or (c) income received in respect of units from the specified company The Exemptions under this section are subjected to the conditions listed under the section. (Section 10(35)] 16. Any income arising from the transfer of a long-term capital asset, being an eligible equity share in a company purchased on or after the 1st day of March, 2003 and before the 1st day of March, 2004 and held for a period of twelve months or more. {Section 10(36)] 17. Any income chargeable under the head Capital gains to an individual or a Hindu undivided family arising from the transfer of agricultural land , where (i) such land is situate in any area referred to in item (a) or item (b) of sub-clause (iii) of clause (14) of section 2; (ii) such land, during the period of two years immediately preceding the date of transfer, was being used for agricultural purposes by such Hindu undivided family or individual or a parent of his; (iii) such transfer is by way of compulsory acquisition under any law, or a transfer the consideration for which is determined or approved by the Central Government or the Reserve Bank of India; (iv) such income has arisen from the compensation or consideration for such transfer received by such assessee on or after the 1st day of April, 2004. {Section 10(37)] 18. Any income arising from the transfer of a long-term capital asset, being an equity share in a company or a unit of an equity oriented fund where such transaction is chargeable to securities transaction tax. {Section 10(38)] Saving Bank Interest (Section 80 TTA) : From Assessment year 2013-14, the interest earned on Savings Bank accounts upto a limit of Rs. 10,000/- is exempt from inclusion in Gross Total Income for the purpose of Income Tax.