Abacus Weath Partners Investment slideshow

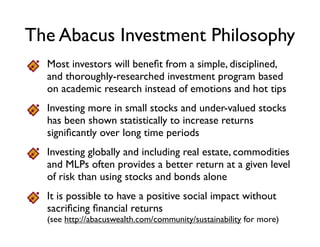

- 1. The Abacus Investment Approach Investing globally and including real estate potentially provides a higher more stable return than using stocks and bonds alone It is possible for an investment portfolio to create positive social and environmental impact without sacrificing financial returns Include low cost, diversified strategies (like index funds, only better) Invest more in small stocks and under-valued stocks, because both have been shown to increase returns over time Build a disciplined and thoroughly researched investment program based on Nobel-Prize-winning academic research instead of emotions and hot tips

- 2. The striped areas show how many funds were still in business. During the ten year period, only 52% of funds survived. Even worse, the blue box is the number of funds that both survived and beat their benchmark, only 19% over the ten year period. So, how do you identify one of the 19%? So you agree that avoiding hot tips makes sense. How do you choose an investment manager? This chart shows that over time, it’s very difficult to pick a manager that stays in business and outperforms their benchmark. The grey boxes represent the total mutual fund population that existed one, five, and ten years prior to 12/31/13. The first question is, how many of these funds were still around at the end of 2013? Find a good money manager! Beginning sample includes funds as of the beginning of the one-, five-, and 10-year periods ending in 2013. The number of beginners is indicated below the period label. Survivors are funds that were still in existence as of December 2013. Non-survivors include funds that were either liquidated or merged. Outperformers (winners) are funds that survived and beat their respective benchmarks over the period. Past performance is no guarantee of future results. See Data appendix for more information. US-domiciled mutual fund data is from the CRSP Survivor-Bias-Free US Mutual Fund Database, provided by the Center for Research in Security Prices, University of Chicago.

- 3. Pick a past winner! Many Wall Street experts proclaim that ten years is long enough to get rid of the lucky managers and leave only those with great skill.We looked at the best equity funds over a three, five and seven-year period and picked those that beat their benchmarks.Then we looked at how those past winners did over the next three years. Across the board, only a quarter of the winning funds continued to beat their benchmarks in the subsequent three-year period (2011–2013), regardless of how many years they had won in the past.That kind of drop would turn the 17% number from the prior slide to less than 7%. So, in summary, the research shows that most managers aren’t any better than a simple index, and you can’t find the 7% that will end up doing better by looking at past performance. The sample includes funds at the beginning of the three-, five-, and seven-year periods, ending in December 2010. The graph shows the proportion of funds that outperformed and underperformed their respective benchmarks (i.e., winners and losers) during the initial periods. Winning funds were re-evaluated in the subsequent period from 2011 to 2013, with the graph showing the proportion of outperformance and underperformance among past winners. (Fund counts and percentages may not correspond due to rounding.) Past performance is no guarantee of future results. See Data appendix for more information. US-domiciled mutual fund data is from the CRSP Survivor-Bias-Free US Mutual Fund Database, provided by the Center for Research in Security Prices, University of Chicago.

- 4. October 1987: Stock Market Crash August 1989: US Savings and Loan Crisis September 1998: Asian Contagion Russian Crisis March 2000: Dot-Com Crash September 2001: Terrorist Attack September 2008: Bankruptcy of Lehman Brothers When things get bad, get out! 44% 84% 55% 51%52% 61% 9% 42% -2% 25% 15% 37% 6% -3% 3% 20% -1% 21% After 1 year After 3 years After 5 years Balanced Strategy: 7.5% each S&P 500 Index, CRSP 6-10 Index, US Small Value Index, US Large Value Index; 15% each International Value Index, International Small Index; 40% BofA Merrill Lynch One-Year US Treasury Note Index. The S&P data are provided by Standard & Poor’s Index Services Group. The Merrill Lynch Indices are used with permission; copyright 2014 Merrill Lynch, Pierce, Fenner & Smith Incorporated; all rights reserved. CRSP data provided by the Center for Research in Security Prices, University of Chicago. US Small Value Index and US Large Value Index provided by Fama/French. International Value Index provided by Fama/French. International Small Cap Index compiled by Dimensional from StyleResearch securities data; includes securities of MSCI EAFE countries in the bottom 10% of market capitalization, excluding the bottom 1%; market-cap weighted; each country capped at 50%; rebalanced semiannually. Indexes are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Not to be construed as investment advice. Returns of model portfolios are based on back-tested model allocation mixes designed with the benefit of hindsight and do not represent actual investment performance. If we can’t find a good manager, at least we should be able to predict that when bad things happen in the world, we should stay away from the markets. Or maybe we can’t. We looked at six of the worst world events in the past 25 years to see what effect they had on the market. We found short term drops with pretty amazing five year performance after the event. Here’s the punchline: If your emotions tell you to run away from the market, ignore them. Performance of a Normal Balanced Strategy: 60% Stocks, 40% Bonds - Cumulative Total Return

- 5. If we can’t trust past performance or our emotions, how do we create a portfolio? We found Nobel Prize winning research that identifies four factors that affect the majority of stock performance. 1. Relative price as measured by the price-to-book ratio; value stocks are those with lower price-to-book ratios. Company Size Small cap premium – small vs large companies Market Equity premium – stocks vs bonds Relative Price1 Value premium – value vs growth companies Expected Profitability Profitability premium – high vs low profitability companies Most of the investment management industry exists to say,“hire us and we’ll pick stocks better than the other guy.” The overwhelming evidence is that this activity is an economic waste of time because any financial return from this activity pales in comparison to the effect of these four factors. Sometimes two of the factors above are described more colorfully as Small (company size) andValue (relative price). Structure Determines Performance 3.46% 1927-2014 8.40% 1927-2014 4.85% 1927-2014 4.09% 1964-2014

- 6. Structure Determines Performance 1. Beta: A quantitative measure of the co-movement of a given stock, mutual fund, or portfolio with the overall market. 2. Price-to-Book Ratio: A company's capitalization divided by its book value. It compares the market's valuation of a company to the value of that company as indicated on its financial statements. 3. Direct Profitability: A measure of a company’s current profits. We define this as operating income before depreciation and amortization minus interest expense, scaled by book equity. By carefully structuring portfolios to take advantage of these dimensions, you can tilt toward the Small, Value and Profitability dimensions that can increase your expected returns.

- 7. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. Actual returns may be lower. See “Index Descriptions” in the appendix for descriptions of Dimensional and Fama/French index data. Eugene Fama and Ken French are members of the Board of Directors for and provide consulting services to Dimensional Fund Advisors LP. The S&P data are provided by Standard & Poor’s Index Services Group. MSCI data © MSCI 2015, all rights reserved. Dimensions of Expected Returns Illustrative index performance: Annualized compound returns (%) in US dollars #17867-1011 HIGH RelativePriceProfitabilitySize 1928–2014 1996–2014 1975–2014 EMERGING MARKETS STOCKSUS STOCKS DEVELOPED EX US MARKETS STOCKS 12.22 9.82 S&P 500 Index Dimensional US Small Cap Index Fama/French International Growth Index Fama/French International Value Index Dimensional Emerging Markets High Profitability Index Dimensional Emerging Markets Low Profitability Index SMALL LARGE SMALL LARGE SMALL LARGE LOW HIGH LOW LOW HIGH LOW HIGH HIGH LOWHIGH LOW 1928–2014 Fama/French US Growth Index Fama/French US Value Index 1970–2014 MSCI World ex USA Index (gross div.) Dimensional Intl. Small Cap Index 1964–2014 Dimensional US High Profitability Index Dimensional US Low Profitability Index MSCI Emerging Markets Index (gross div.) Dimensional Emerging Markets Small Cap Index 1989–2014 1992–2014 Dimensional International High Profitability Index Dimensional International Low Profitability Index 1989–2014 Fama/French Emerging Markets Growth Index Fama/French Emerging Markets Value Index 14.56 9.73 12.41 10.58 12.68 9.04 14.52 8.82 14.28 9.80 13.03 8.29 8.45 2.79 10.64 3.53 Factors Around the World Here are the numbers to prove the story. Small, value and profitable stocks have provided higher returns in most historical periods. For example, the blue bars to the far left show the results for US companies across each dimension. For example, the S&P 500’s annualized return (unreduced by any fees or costs) was 9.82% from 1927-2014. If one allocated to small stocks, one earned 12.22%, or 2.4% more per year. This effect has been persistent in other countries as well. Value Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Indices are not available for direct investment.Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment.Actual returns may be lower. See “Index Descriptions” in the appendix for descriptions of Dimensional and Fama/French index data. Eugene Fama and Ken French are members of the Board of Directors for and provide consulting services to Dimensional Fund Advisors LP.The S&P data are provided by Standard & Poor’s Index Services Group. MSCI data © MSCI 2015, all rights reserved.

- 8. World Stock Market Capitalization As of December 31, 2014 Market cap data is free-float adjusted from Bloomberg securities data. Many nations not displayed. Total may not equal 100% due to rounding. For educational purposes; should not be used as investment advice. China market capitalization excludes A-shares, which are generally only available to mainland China investors. Abacus diversifies client assets across most of the world’s stock markets, often owning thousands of stocks in a typical portfolio.We currently allocate 40% of total stocks to foreign companies.

- 9. Other 16% Non Agency MBS 12% Corporate 27% Agency MBS 12% US Govt Direct 33% Mortgage 28% TIPS 20% US Investment Grade 40% International 12% Bonds - The Ballast of your Portfolio Allocation Credit Quality Abacus aims to earn clients a healthy yield from bonds while not taking on excessive credit risk from companies or governments with a poor future outlook, or excessive interest rate risk by investing in long term bonds. We diversify our bond allocation in an attempt to provide protection from inflation as well as declines in individual sectors of the bond market.

- 10. DFA Global Real Estate: REITs around the globe provide core exposure to real estate. We also offer private real estate investments to accredited clients. Oppenheimer SteelPath MLP: MLPs earn income by owning the means of transportation for natural gas and oil (pipelines, shipping, trucking). A Sample Portfolio U.S. Stocks 30% International Stocks - 20% Alternatives - 10% Bonds - 40% DFA US Sustainability Core I (DFSIX) O'Shaughnessy All Cap Core I (OFAIX) DFA US Targeted Value I (DFFVX) DFA Global Real Estate Securities I (DFGEX) Oppenheimer SteelPath MLP Select 40 Y(MLPTX) DFA Intl Sustainability Core 1 (DFSPX) DFA International Small Cap Value I (DISVX) DFA Emerging Markets Core Equity I (DFCEX) DFA Investment Grade I (DFAPX) DFA Two-Year Global Fixed-Income I (DFGFX) PIMCO Income Instl (PIMIX) DoubleLine Total Return Bond I (DBLTX) DFA Short-Duration Real Return Instl (DFAIX) 20% 5% 5% 7% 3% 10% 3% 7% 8% 8% 8% 8% 8% 40% 20%30% 10% Abacus offers a variety of portfolios tailored to each client’s required rate of return, ability to accept risk, social values, and current income needs. DFA US Sustainability: A broad exposure to the US stock market with innovative environmental screening. O'Shaughnessy All Cap: A multi-factor value fund with a unique approach to capturing the momentum factor. DFA US Targeted Value: Owns many of the smallest and lowest-priced (“value”) companies in the U.S. This is how we capture the Small &Value premiums. DFA Intl. Sustainability: A broad exposure to the stock markets of developed countries around the world with the same environmental screens as the U.S. fund. DFA Intl. Small Cap Value: Captures the Small and Value premiums in developed countries. DFA Emerging Markets Core: Exposure to stocks in emerging economies around the world. These investments have higher volatility but a significantly higher expected return than US stocks. DFA Investment Grade, DFA Two- Year Global & PIMCO Income: These three funds offer broad exposure to the government and corporate bond markets with a focus on credit quality and low duration. Doubleline Total Return: Exposure to the vast real estate debt market, with its different investment characteristics than other bonds. DFA Short Duration Real Return: A short-term corporate bond fund that protects from rising inflation.

- 11. DISCLOSURES The figures above reflect the hypothetical past performance of model portfolios. These model portfolios are similar to those used currently by Abacus for its clients. However, these particular models have not always been used by Abacus. The models used may change without notice at any time. The model portfolios were developed in part by examining past risk and return relationships, and may benefit from hindsight. The figures shown do not represent past performance of any actual portfolios, including those of Abacus clients. Neither Abacus nor its predecessor firms were in business for the full time period shown above. Abacus and its predecessors may have used different models with clients during the time periods shown. Different clients may have followed different models. Clients following the same model may have had different actual holdings and different performance. These model results do not reflect any impact that material economic or market factors might have had on the adviser’s decision making if the adviser were actually managing clients’ money. These performance figures are shown net of mutual fund expense ratios (where mutual funds were used), but include no such costs where index returns were used. The figures are net of an assumed 1.2% per year reduction to cover trading costs, custodial costs, and Abacus management fees. The effect of taxes is not reflected in these results, and inclusion of tax costs would reduce the illustrated returns. The figures shown are not intended to represent potential future performance of actual or hypothetical clients, portfolios, models, or asset classes. Future results may vary substantially from past results, due to a wide variety of uncontrollable and unpredictable factors. These factors may include market changes, military or political events, economic or societal changes, and many others. The performance statistics assume annual rebalancing at the end of each year, whereas actual client accounts may be rebalanced at irregular times based upon a number of factors. Actual client portfolios may never exactly match these models nor any models used in the future to guide their construction. The historical model performance illustrated derives from a number of assumptions. Asset classes were included in each model according to the percentages shown above. Annual rebalancing is assumed, along with immediate reinvestment of all income and capital gains. Asset class returns were measured using mutual fund returns where available (i.e. about 10-15 years for most stock funds), and index returns where mutual fund returns were not available (i.e. earlier years). The performance results reflect the specific mutual funds and indices we selected. Other indices or funds may be available to measure returns in one or more asset classes. Index returns do not include actual costs of investment. Actual portfolios or models used by Abacus from time to time may have included more, fewer, or different asset classes or funds. Each of the model portfolios includes an allocation to equity, real estate, and other securities purchased with an emphasis on capital appreciation rather than primarily seeking income. The various underlying funds and asset classes may fluctuate dramatically, and this variation in individual asset class returns is not visible in the aggregate results presented here. The model portfolios include allocations to small capitalization stocks,“value” stocks, international stocks (including those issued in countries considered to be emerging markets), and other asset classes which may exhibit significant volatility in returns when each is examined in isolation. The performance for Abacus Model Portfolios is illustrated along with the performance of selected indices, for comparison purposes. The composition, returns, and volatility of these indices vary widely from that of the model portfolios. The indices were chosen to illustrate the performance of individual asset classes within the US securities markets, and because the Abacus Model Portfolios are comprised of multiple asset classes, results are not directly comparable. Index returns do not include the actual costs of investment or taxes, and including these costs would reduce the returns shown for the indices.

- 12. Data Appendix Research conducted by Dimensional Fund Advisors LP. Mutual fund data is from the CRSP Mutual Fund Database, provided by the Center for Research in Security Prices, University of Chicago. Certain types of equity and fixed income funds were excluded from the performance study. For equities, sector funds and funds with a narrow investment focus, such as real estate and gold, were excluded. Money market funds, municipal bond funds, and asset-backed security funds were excluded from fixed income. Funds are identified using Lipper fund classification codes and are matched to their respective benchmarks at the beginning of the sample periods. Winner funds are those whose cumulative return over the period exceeded that of their respective benchmark. Loser funds are funds that did not survive the period or whose cumulative return did not exceed their respective benchmark. Expense ratio ranges — The ranges of expense ratios for equity funds over the one-, five-, and 10-year periods are 0.02% to 4.95%, 0.01% to 4.47%, and 0.02% to 4.43%, respectively. For fixed income funds, ranges over the same periods are 0.02% to 2.61%, 0.03% to 2.56%, and 0.10% to 2.32%, respectively. Portfolio turnover ranges — Ranges for equity fund turnover over the one-, five-, and 10-year periods are 1% to 1,135%, 1% to 5,062%, and 1% to 2,447%, respectively. Benchmark data provided by Barclays, MSCI, and Russell. Barclays data provided by Barclays Bank PLC. MSCI data copyright MSCI 2013, all rights reserved. Russell data copyright © Russell Investment Group 1995−2013, all rights reserved. Benchmark indices are not available for direct investment.Their performance does not reflect the expenses associated with the management of an actual portfolio. Mutual fund investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost. Diversification neither assures a profit nor guarantees against a loss in a declining market. Past performance is no guarantee of future results. In US dollars. Indices are not available for direct investment.Their performance does not reflect the expenses associated with the management of an actual portfolio. Market, value, and size premiums (1927-2014) provided by Fama/French. Profitability premium computed by Dimensional using CRSP and Compustat data. Profitability is measured as operating income before depreciation and amortization minus interest expense, scaled by book.The annual profitability premium is computed as the average annual return on six high profitability groups of stocks (Large High Book-to- Market High Profitability, Large Medium Book-to-Market High Profitability, Large Low Book-to-Market High Profitability, Small High Book-to-Market High Profitability, Small Medium Book-to-Market High Profitability, and Small Low Book-to-Market High Profitability) minus the average annual return on six low profitability groups of stocks (Large High Book-to-Market Low Profitability, Large Medium Book-to-Market Low Profitability, Large Low Book-to-Market Low Profitability, Small High Book-to-Market Low Profitability, Small Medium Book-to-Market Low Profitability, and Small Low Book-to-Market Low Profitability).