CPT Accounts - Company Accounts Unit1 - Concept Sheet and Imp MCQs

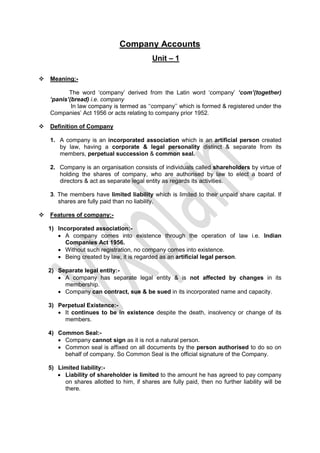

- 1. Company Accounts Unit – 1 Meaning:- The word ‘company’ derived from the Latin word ‘company’ ‘com’(together) ‘panis’(bread) i.e. company In law company is termed as ‘‘company’’ which is formed & registered under the Companies’ Act 1956 or acts relating to company prior 1952. Definition of Company 1. A company is an incorporated association which is an artificial person created by law, having a corporate & legal personality distinct & separate from its members, perpetual succession & common seal. 2. Company is an organisation consists of individuals called shareholders by virtue of holding the shares of company, who are authorised by law to elect a board of directors & act as separate legal entity as regards its activities. 3. The members have limited liability which is limited to their unpaid share capital. If shares are fully paid than no liability. Features of company:- 1) Incorporated association:- A company comes into existence through the operation of law i.e. Indian Companies Act 1956. Without such registration, no company comes into existence. Being created by law, it is regarded as an artificial legal person. 2) Separate legal entity:- A company has separate legal entity & is not affected by changes in its membership. Company can contract, sue & be sued in its incorporated name and capacity. 3) Perpetual Existence:- It continues to be in existence despite the death, insolvency or change of its members. 4) Common Seal:- Company cannot sign as it is not a natural person. Common seal is affixed on all documents by the person authorised to do so on behalf of company. So Common Seal is the official signature of the Company. 5) Limited liability:- Liability of shareholder is limited to the amount he has agreed to pay company on shares allotted to him, if shares are fully paid, then no further liability will be there.

- 2. 6) Distinction between Ownership and Management:- Large numbers of shareholder are distributed at different geographical location. So difference of ownership and management is required for day – to- day operation of business. Ownership is in hand of shareholders and Management is in hands of Board of Directors elected representative of the shareholders. 7) Transferability of shares:- Shares are transferable except in case of Private Limited Company which may have certain restrictions. 8) Maintenance of books:- A limited company is required to keep prescribed account books, required by law, failure to which attracts penalties. 9) Periodic audit:- Company has to get its accounts periodically audited by Chartered Accountants (in practise) for the purpose of shareholders. 10) Rights to access information:- Shareholders have rights to seek information from directors by participating in meetings of company and through periodic review. Types of Company Company Statutory Government Foreign Holding and Registered Company Company Company Subsidiary Company Company Limited Unlimited Company Company Public Private Public Private Company Company Company Company 1) Statutory Company : Companies which operate under the special act passed by the state legislature or parliament are called Statutory Company for e.g. Reserve Bank of India, Unit trust of India, Life Insurance Corporation etc. 2) Government company: According to section 617 of companies act 1956, “a Government company means any company in which not less than 51% of the paid – up capital is held by central government or by any state government jointly or separately.

- 3. 3) Foreign Company:- A foreign company is incorporated outside India but has place of business or business operations in India. 4) Holding Company:- Under section 4(4) of Companies’ Act 1956 a company becomes a subsidiary company when other company controls 51% or more paid up. Share capital or the total voting power of the other company. 5) Subsidiary Company: According to Section 4(1), if i. That other company controls the composition of its board of directors & if holding company has the right to appoint or remove any person from Board of Directors. ii. Other company holds more than half of its nominal value of its equity share capital. iii. That other company is subsidiary of any company which is that other’s subsidiary for e.g. B is subsidiary of A, C is subsidiary of B. Automatically C becomes the subsidiary of A. iv. If a company operating in India is subsidiary of foreign company, it will be treated as Subsidiary Company irrespective of the fact whether in India, as if it fulfils condition (i), (ii) and (iii) listed above or not. 6) Registered Company:- All companies registered under Indian Companies Act 1956, are Registered Companies. 7) Limited Liability Company:- A company in which liability of shareholder is restricted to the amount of unpaid calls on shares is known as Limited Liability Company. 8) Unlimited Liability Company:- A company in which liability of shareholder is not restricted to the amount of unpaid calls on shares is known as Unlimited Liability Company 9) Public Company:- According to section 3(1) (iv) of the act ‘public company’ means a company which: i. is not a private company ii. Has a minimum paid-up capital of Rs. 5 Lakhs or higher than it. iii. Public companies invite the public at large to participate & subscribe for the shares in, or debentures of the company & there are no restriction on transfer of shares. iv. Must have at least 3 directors and minimum 7 members and there is no maximum limit for membership. 10) Private Company: i. According to section 3(i)(iii) a private company is a company which has minimum paid up capital of Rs. 1,00,000/- ii. Restricts the rights of member to transfer its share iii. Limits number of its member to 50. (Excluding present and past employees). iv. Must have at least two directors. v. Prohibits invitation to public for subscription of shares or debentures.

- 4. vi. Prohibits any invitation or acceptance of deposits from person other than its member, directors or relatives. 11) Listed Company: A listed company is a public company which has any of its securities listed in any recognised stock exchange. 12) Unlisted company: It is a company whose securities are not listed in recognised stock exchange. Note: In case of Private Limited Company shares are not listed in any stock exchange. Preparation Of Financial Statements: (a) Balance sheet as on end of the year. (b) Profit & loss A/c for the period. In case of company not carrying business for profit, than an income & expenditure account is to be prepared. Balance sheet can be prepared in horizontal or vertical form, under is given main heads in prescribed manner: Liabilities Assets Share Capital Fixed Assets Reserves & Surplus Investment Secured Loans Current Assets Unsecured Loans Loans & Advances Current Liabilities & Provisions a. Current Assets a. Current Liabilities b. Loans & Advances b. Provisions Miscellaneous expenses / Profit & Loss A/c. Related MCQ: 1 The following list of accounts with their balances was taken from the general ledger of D Ltd. As on March 31, 2006: Particulars Rs. Discount on issue of debentures 8,500 Cash 73,500 Equity share capital of Rs.100 each 6, 80,000 General reserve 2, 31,500 Security premium 3, 95,000 Dividend Payable 22,000 Profit and loss appropriation account 80,000 10% debentures Rs.100 each 1,00,000 Shareholders’ equity as on March 31, 2006 is: a. 13,78,000 b. 13,86,500 c. 14,00,000 d. 14,08,500 Answer: a.13, 78,000

- 5. Reason: Shareholders equity means share capital invested by shareholders and all the shares in the profit like. General reserve, Profit and loss A/c, Security premium and Debit balance of profit if any, and unwritten off expenses like Discount on issue of Debentures should be deducted from their equity. Shareholders’ equity Equity share capital of Rs.100 each 6,80,000 (+)General reserve 2, 31,500 (+)Security premium 3, 95,000 (+)Profit and loss appropriation account 80,000 (-)Discount on issue of debentures 8,500 Shareholders’ equity 13, 78,000 Note: Cash, Dividend Payable, 10% debentures Rs.100 each are not part of Shareholders equity. 2 Which of the following statement is not a feature of a Company? (a) Separate legal entity (b) Common Seal (c) Perpetual Succession (d) Members have unlimited liability Answer: (d) Members have unlimited liability Reason: The members (Shareholder) of a company have limited liability till the unpaid amount of shares allotted to them. 3 In a Government Company, the holding of the Central Government in paid- up capital should not be less than (a) 25% (b) 50 % (c) 51% (d) 75% Answer: (c) 51% Reason: Holding company must have more than 50% of shares than subsidiary company.

- 6. 4 Which of the following statement is true in case of a Foreign Company? (a) A Company incorporated in India and has place of business outside India. (b) A Company incorporated outside India and has a place of business in India. (c) A Company incorporated in India and has a place of business in India. (d) A Company incorporated outside India and also has a place of business outside India Answer: (b) A Company incorporated outside India and has a place of business in India. Reason: Meaning of foreign company: A Company incorporated outside India and has a place of business in India. 5 Public Companies should have a minimum paid-up capital of (a) Rs. 5 lakhs (b) Rs. 10 lakhs (c) Rs. 15 lakhs (d) Rs. 50 lakhs Answer: (a) Rs. 5 lakhs 6 Private Company should have a minimum paid-up capital of (a) Rs. 1 lakhs (b) Rs. 5 lakhs (c) Rs. 10 lakhs (d) Rs. 50 lakhs Answer: (a) Rs. 1 lakhs 7 Which of the following statements is not a feature of a private company? (a) Restricts the rights of members to transfer its shares (b) Prohibits any invitation to the public to subscribe its shares or debentures (c) Do not involve participation of public in general (d) Do not restrict on the number of its members to any limit. ANSWER: (d) Do not restrict on the number of its members to any limit. Reason: There are restrictions on the number of members in private company. It can be maximum 50.