2009 Denver Market Reports - 3rd Quarter

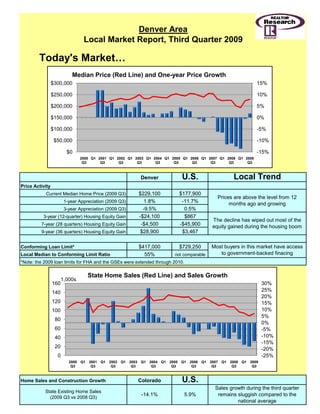

- 1. Denver Area Local Market Report, Third Quarter 2009 Today's Market… Median Price (Red Line) and One-year Price Growth $300,000 15% $250,000 10% $200,000 5% $150,000 0% $100,000 -5% $50,000 -10% $0 -15% 2000 Q1 2001 Q1 2002 Q1 2003 Q1 2004 Q1 2005 Q1 2006 Q1 2007 Q1 2008 Q1 2009 Q3 Q3 Q3 Q3 Q3 Q3 Q3 Q3 Q3 Q3 Denver U.S. Local Trend Price Activity Current Median Home Price (2009 Q3) $229,100 $177,900 Prices are above the level from 12 1-year Appreciation (2009 Q3) 1.8% -11.7% g g months ago and growing g 3-year Appreciation (2009 Q3) -9.5% 9 5% 0.5% 0 5% 3-year (12-quarter) Housing Equity Gain -$24,100 $867 The decline has wiped out most of the 7-year (28 quarters) Housing Equity Gain -$4,500 -$45,900 equity gained during the housing boom 9-year (36 quarters) Housing Equity Gain $28,900 $3,467 Conforming Loan Limit* $417,000 $729,250 Most buyers in this market have access Local Median to Conforming Limit Ratio 55% not comparable to government-backed finacing *Note: the 2009 loan limits for FHA and the GSEs were extended through 2010. State Home Sales (Red Line) and Sales Growth 1,000s 160 30% 140 25% 20% 120 15% 100 10% 5% 80 0% 60 -5% 40 -10% -15% 20 -20% 0 -25% 2000 Q1 2001 Q1 2002 Q1 2003 Q1 2004 Q1 2005 Q1 2006 Q1 2007 Q1 2008 Q1 2009 Q3 Q3 Q3 Q3 Q3 Q3 Q3 Q3 Q3 Q3 Home Sales and Construction Growth Colorado U.S. Sales growth during the third quarter State Existing Home Sales -14.1% 5.9% remains sluggish compared to the ( (2009 Q3 vs 2008 Q3)) national average

- 2. Drivers of Local Supply and Demand… Local Economic Outlook Denver U.S. Not 1-year Job Change (Sep) -51,700 Job losses are a problem and will weigh Comparable on demand, but layoffs are declining Not 1-year Job Change (Aug) -53,000 which could help buyer confidence Comparable Not Unemployment has risen since the same 3-year Job Change (Sep) -26,400 Comparable period last year, but Denver's labor Current Unemployment Rate (Sep) 7.1% 9.8% market has been more resilient than the Year-ago Unemployment Rate 5.0% 6.2% national average 1-year (12 month) Job Growth Rate -4.1% -3.1% Weak compared to other markets State Economic Activity Index Colorado U.S. The economy of Colorado is weaker than 12-month change (2009 - Sep) -4.3% -3.2% the rest of the nation, but improved 36-month change (2009 - Sep) -0.3% -1.1% modestly from last month Local Fundamentals Denver U.S. 12-month Sum of 1-unit Building Permits through The current level of construction is 85.8% 2,603 not comparable Sep 2009 (1,000s) below the long-term average Excess supply reduction could result in Long-term average for 12-month Sum of 1-Unit price escalation over the longer-term if, in 18,314 , not comparable p Building Permits (1,000s) (1 000s) the future there is rapid and robust future, increase in demand Single-Family Housing Permits (Sep 2009) Low construction will help to maintain a -45.5% -34.9% 12-month sum vs. a year ago tight supply and to stabilize prices Construction: 12-month Sum of Local Housing Permits (Historical Average Shown in Red Dashed Line) 40,000 35,000 30,000 25,000 20,000 15,000 10,000 5,000 0

- 3. Affordability Affordability - Local Mortgage Servicing Cost-to-Income (Historical Average Shown in Red Dashed Line) 20% 18% 16% 14% 12% 10% 8% 6% 4% 2% 0% 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 Monthly Mortgage Payment to Income Denver U.S. Ratio for 2008 12.7% 19.5% Historically strong, but weaker than the Ratio for 2009 Q3 12.1% 15.6% second quarter of this year Historical Average 15.5% 23.2% Good relative to the nation Recent Trend - Local Mortgage Servicing Cost to Income (Historical Average Shown in Red Dashed Line) 18% 16% 14% 12% 10% 8% 6% 4% 2% 0% 2007 Q4 2008 Q1 2008 Q2 2008 Q3 2008 Q4 2009 Q1 2009 Q2 2009 Q3

- 4. Median Home Price to Income Denver U.S. Ratio for 2008 4.6 7.1 Local affordability conditions have Ratio for 2009 Q3 4.8 6.2 weakened relative to local history Historical Average 5.0 7.2 Affordable compared to most markets Ratio of Local Median Home Price to Local Average Income (Historical Average shown in Red Dashed Line) 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 The Mortgage Market 30-year Fixed Mortgage Rate and Treasury Bond Yield (%) 3.0 7.0 6.5 2.5 6.0 2.0 5.5 5.0 1.5 4.5 4.0 1.0 3.5 0.5 3.0 2.5 0.0 2.0 2004 Q3 Q1 2005 Q3 Q1 2006 Q3 Q1 2007 Q3 Q1 2008 Q3 Q1 2009 Q3 Spread (left axis) 30-Year FRM (Right axis) 10-Year Treasury Bond (Right Axis) The spread between the 30-year fixed rate mortgage and the 10-year Treasury bond fell again in the third quarter and stands close to the historic average. This decline of the spread suggests that the financial markets view the risk on mortgage debt as close to a "normal" state and that the private sector will buy up excess demand if yields rise. Consequently, the Fed is likely to phase out its program of buying up mortgages in the secondary market to keep rates low, leaving the private sector to fill the void. Mortgage rates are likely to rise in first or second quarter of 2010 as the Fed exits the mortgage market.

- 5. Looking Deeper…. State Total Foreclosure Rate vs. U.S Average (U.S. Average in Blue Dashed Line) 5.0% 4.5% 4.0% 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% 0.5% 0.0% Source: Mortgage Bankers' Association Monthly Market Data - August 2009 Denver U.S. 12.3 12.3 The D Th Denver market has a lower share of k th l h f Market Share: % % 87.7% 87.7% subprime loans than the average market, Prime (blue) vs. 87.7 87.7 but rising prime foreclosures are Subprime + Alt-A % % becoming a problem 12.3% 12.3% There was a substantial increase versus 1.6 1.6% 2.3% PRIME: 1.4 2.3% July of this year % 1.7% Foreclosure + REO % Rate Compared to the national average, 1.4% 1.7% Jul-09 Aug-09 Jul-09 Aug-09 today's local rate is low There has been little change locally 13.3% 18.0% SUBPRIME: 13.6 18.8 compared to July % 13.3 % 18.0 Foreclosure + REO % % Rate Locally, today's foreclosure rate is low 13.6% 18.8% Jul-09 Aug-09 Jul-09 Aug-09 relative to the national average Relatively little local change versus July 7.5% 14.5% ALT-A: 14.5 of this year 7.5% 12.1 % Foreclosure + REO 6.9% % Rate The August rate for Denver is low 6.9% 12.1% Jul-09 Aug-09 Jul-09 Aug-09 compared to the national average The "foreclosure + REO rate" is the number of mortgages, by metro area, that are either in the foreclosure process or have completed the foreclosure process and are owned by banks divided by the total number of mortgages for that area. Source: First American CoreLogic, LoanPerformance data